Global Human Insulin Market by Type (Analogue Human Insulin and Traditional Human Insulin), By Application (Type 1 Diabetes and Type 2 Diabetes), By Distribution Channel (Hospital Pharmacy &Retail and Online Pharmacy), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 28643

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

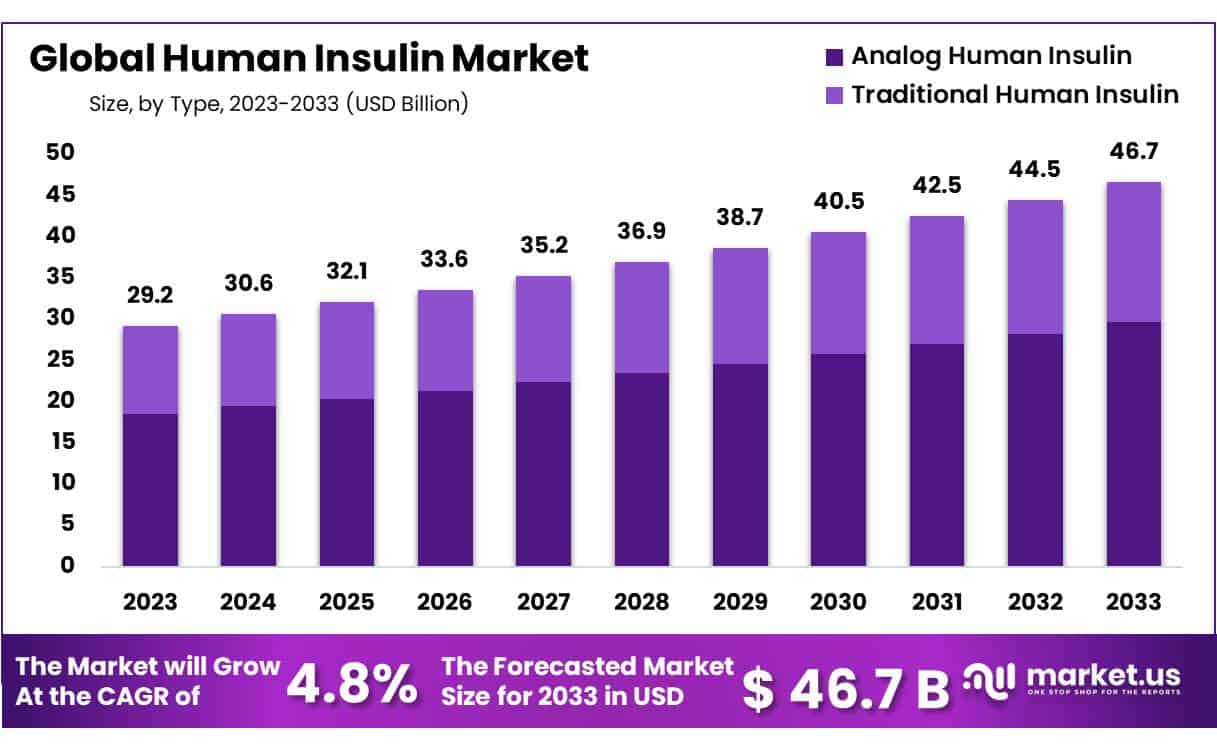

Global Human Insulin Market size is expected to be worth around USD 46.7 Billion by 2033 from USD 29.2 Billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033.

Insulin is the peptide hormone produced by beta cells in the pancreas. Insulin helps to absorb glucose from blood and regulation throughout the body. It is used especially in patients with damaged blood tissue and other health complications like diabetic retinopathy and diabetic nephropathy. When the body cannot control glucose and other problems, they require insulin daily.

Human insulin refers to synthetic insulin produced in a laboratory to closely resemble that found naturally within humans. It’s created by cultivating insulin proteins within Escherichia coli bacteria in a laboratory setting, with two variations available – fast-acting (regular) and medium-acting (NPH). Human insulin was designed for cost-effective large-scale production; administration can take place either orally or via delivery devices such as syringes, pumps or injection pens, designed specifically to ensure timely and consistent insulin administration.

The increase in the number of diabetes patients affecting the demand for analog diabetic insulins is expected to drive the market over the forecast period

Key Takeaways

- Market Size: Human Insulin Market size is expected to be worth around USD 46.7 Billion by 2033 from USD 29.2 Billion in 2023.

- Market Growth: The market growing at a CAGR of 4.8% during the forecast period from 2024 to 2033.

- Type Analysis: Analog human insulin dominates the segment by 63.5% as compared to traditional human insulin.

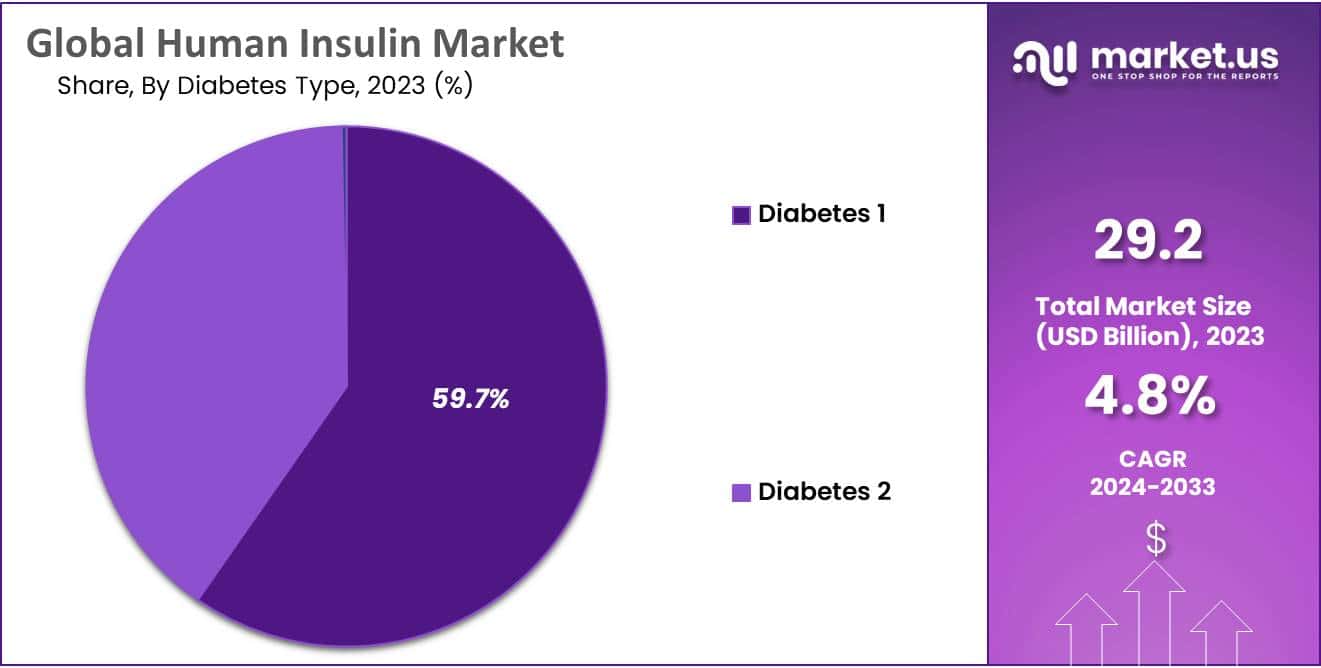

- Application Analysis: The Diabetes 1 segment dominate 59.7% market share in 2023.

- Distribution Channel Analysis: Hospital pharmacies play a pivotal role in making insulin products, accounting for 60.5% market share.

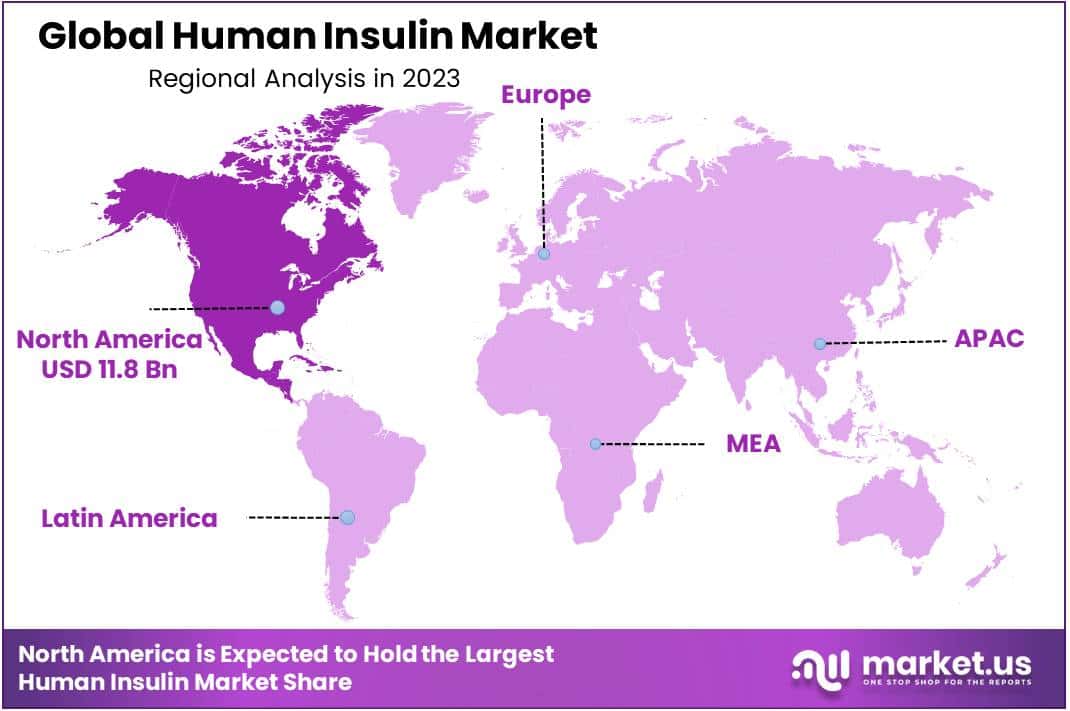

- Regional Analysis: North America dominates the market share by 40.7% and held USD 11.8 billion market revenue in the human insulin market.

- Rising Prevalence of Diabetes: Due to rising global prevalence, human insulin market continues to experience strong growth as more individuals are diagnosed with diabetes and demand increases for both short and long-acting forms.

- Biologics Dominance: Human insulin, which is a biologic medication, dominates the insulin market due to its efficacy and reduced risk of immunogenicity compared to animal-derived insulins.

- Attracting Biologic Similars: Market trends show a move toward biosimilar insulins as lower-cost alternatives to brand name products gain momentum, particularly among emerging markets.

Type Analysis

Analogue Human Insulin Dominates the Product Segment

Based on Product type analysis, the market is segmented into analog and traditional human insulin. Analog human insulin dominates the segment by 63.5% as compared to traditional human insulin. Analog insulin has a better observance treatment and glycemic control. It does not occur a high risk of hypoglycemia compared to traditional insulin. Also, analog insulin is a quickly and consistently acting type of diabetes insulin.

Hence analog insulin has observed a higher demand in form past few years. The recent launch of novel insulin is also expected to grow in the analog insulin market. Traditional human insulin is expected to grow at less CAGR than analog insulin due to less adaption rate go the drug type.

Application Analysis

Type 1 Diabetes grows by increasing the Prevalence of Diabetes

Based on the application segment, the market is segmented into two types Diabetes 1 and Diabetes 2. The Diabetes 1 segment dominate 59.7% market share to the increasing frequency of diabetes and the daily need for insulin injections to control blood glucose levels in Diabetes 1 patients. The Diabetes 2 segment is expected to grow slower than Diabetes 2 patients.

Type 2 diabetes patients have been prescribed human insulin only when any previous treatment has not affected the patients. Therefore, rising risk of developing type 2 diabetes globally. Hence type 2 diabetes will experience constant growth during the forecast period.

Distribution Channel Analysis

Hospital and Retail Pharmacy Segment Dominate the Segment

Hospital pharmacies play a pivotal role in making insulin products accessible to patients in the Human Insulin Market, accounting for 60.5% market share. They serve as key access points for insulin therapy patients by offering various formulations of the therapy while fulfilling healthcare professionals’ recommendations.

Online Pharmacy channels have also grown increasingly popular over time. As more patients turn to shopping online for insulin products, this channel has emerged as an efficient and accessible way for individuals to order their necessary supplies – often including home delivery!

Key Market Segments

Based on Type

- Analogue Human Insulin

- Long-acting

- Fast-acting

- Premix

- Traditional Human Insulin

- Long-acting

- Fast-acting

- Slow-acting

- Premix

By Diabetes Type

- Diabetes 1

- Diabetes 2

Based on Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Others

Drivers

Launch of Novel Insulin Products to Stimulate the Market Growth

The geriatric population of diabetes patients has been rising significantly in the recent pandemic and is estimated to grow significantly in the coming years. A large number of the population suffers from type 1 diabetes. Insulin is essential for type 1 diabetes patients due to the daily requirement for glycemic control.

The increase in requests for human insulin universally helps drive the market growth during the forecast period. The insulin market is witnessing a significant number of new products across the globe. The companies are concentrating on developing novel insulin drugs to gain higher market shares in the human insulin market.

Restraints

Lack of Health Funding and Diagnosis Restrict the Growth of the Market.

During the COVID-19 Pandemic, insulin accounted for significant demand growth owing to new product adoption and advanced technologies. However, the lack of funding in emerging and developing regions restricted the market growth. Also, expensive diagnostics treatment hampers the growth market. Due to the presence of low-income people, they cannot afford the treatment and demand low-cost treatment.

The refund encourages the people to give the treatment and diagnosis, but lack of the refund and diagnosed cases of diabetes limits the demand for human insulin worldwide and declines the market growth during the forecast period.

Opportunity

Increasing investments and Healthcare Facilities

The human insulin industry is also boosted due to growing healthcare industries in several emerging economies such as Brazil, India, South Africa, and China. The rapidly increasing geriatric population, rising per capita incomes, high patient volumes, and spiking awareness among individuals drive the need to enhance these nations’ healthcare industries.

Therefore, the governments in these economies are increasing their investments to improve healthcare facilities & infrastructure. Owing to the high number of applications of human insulin products in healthcare industries, the rising investment in this industry is expected to offer growth opportunities in the market.

Trends

Improvement in Research and Healthcare Facilities Drive the Market Growth

The increase in the frequency of diabetes due to choosing a poor lifestyle, unhealthy diets, and high-stress levels are the major factors that help to increase the demand for human insulin across the globe. However, the increasing geriatric population, which is more susceptible to such products, helps provide market growth.

The key players are introducing pen devices and safety pen needles to manage human insulin in the body. It helps to reduce the risk of infection and injuries and minimize discomfort. Also, growing public awareness about the benefits of using insulin and individuals’ health consciousness is driving the market.

Regional Analysis

North America Dominate the Largest Shares in the Human Insulin Market

North America dominates the market share by 40.7% and held USD 11.8 billion market revenue in the human insulin market. The presence of robust major insulin manufacturers, the strong competition between companies, and the increasing frequency of diabetes 1 and diabetes 2 insulin are the major factors to drive the insulin market’s growth in North America. Europe is the second largest region in the human insulin market due to the growth of this region and the increasing prevalence of key players in this region. Asia Pacific is anticipated to grow at the highest CAGR during the forecast period. It is applicable due to the presence of high-risk diabetes patients in this region.

The increase in high-risk diabetes patients due to poor diet and unhealthy lifestyle. These unhealthy diets and lifestyles include smoking, lack of exercise, unhealthy food, etc. The market in Latin America and Middle East Africa is expected to grow at a slow rate compared to the other regions. The demand for insulin in countries of Latin America, such as Mexico, Brazil, and others, is expected to drive the market in this country.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Emerging key players are focused on various strategic policies to develop their respective businesses in foreign markets. Several human insulin market companies are concentrating on expanding their existing operations and R&D facilities.

Furthermore, businesses in the human insulin market are developing new products and portfolio expansion strategies through investments, mergers, and acquisitions. In addition, several key players are now focusing on different marketing strategies, such as spreading awareness about natural ingredients, which is boosting the target products’ growth.

Market Key Players

With many local and regional players, the market for human insulin is fragmented. Market players are subject to intense competition from top market players, particularly those with strong brand recognition and high distribution networks. Companies have gained various expansion strategies, such as partnerships and product launches, to stay on top of the market.

Listed below are some of the most prominent human insulin market players

- Novo Nordisk N\S

- Eli Lilly and Company

- Sanofi

- BIOCON

- Tonghua Dongbao Pharmaceuticals Ltd.

- Julphar

- Wockhardt

- Other key players

Recent Developments

- March 2023: Eli Lilly and Company Reduced the list price of its Humalog and Humalog U-500 human insulin in the US due to pricing pressure.

- April 2023: Novo Nordisk N\S Partnered with the International Diabetes Federation to increase access to affordable insulin in low- and middle-income countries.

- June 2023: Sanofi Capped the monthly price of its Lantus insulin at USD 35 for uninsured Americans, addressing affordability concerns.

- Dec 2022: BIOCON Received WHO prequalification for its insulin glargine, enabling supply to various UN agencies and humanitarian organizations.

Report Scope

Report Features Description Market Value (2023) USD 29.2 Billion Forecast Revenue (2033) USD 46.7 Billion CAGR (2024-2033) 4.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Analogue Human Insulin and Traditional Human Insulin), By Application (Type 1 Diabetes and Type 2 Diabetes), By Distribution Channel (Hospital Pharmacy &Retail and Online Pharmacy) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Novo Nordisk N\S, Eli Lilly and Company, Sanofi, BIOCON, Tonghua Dongbao Pharmaceuticals Ltd., Julphar, Wockhardt, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is human insulin?Human insulin refers to synthetic insulin produced to mimic the insulin found in humans. It is grown in a laboratory and is a crucial treatment for individuals with diabetes.

How big is the Human Insulin Market?The global Human Insulin Market size was estimated at USD 29.2 Billion in 2023 and is expected to reach USD 46.7 Billion in 2033.

What is the Human Insulin Market growth?The global Human Insulin Market is expected to grow at a compound annual growth rate of 4.8%. From 2024 To 2033

Who are the key companies/players in the Human Insulin Market?Some of the key players in the Human Insulin Markets are Novo Nordisk N\S, Eli Lilly and Company, Sanofi, BIOCON, Tonghua Dongbao Pharmaceuticals Ltd., Julphar, Wockhardt, Other key players.

How is human insulin produced?Human insulin is created by cultivating insulin proteins within Escherichia coli (E-coli) bacteria in a laboratory setting.

Why was human insulin developed?Human insulin was developed to enable cost-effective, large-scale production, ensuring its availability to a wide range of patients.

How is human insulin administered?Human insulin can be administered orally or through various insulin infusion devices, including syringes, insulin pumps, and injection pens.

What distribution channels are common for human insulin products?Hospital Pharmacies dominate the distribution of human insulin, accounting for 60.5% of the market, while Online Pharmacies provide a convenient alternative for purchasing insulin products.

-

-

- Novo Nordisk N\S

- Eli Lilly and Company

- Sanofi

- BIOCON

- Tonghua Dongbao Pharmaceuticals Ltd.

- Julphar

- Wockhardt

- Other key players