Global HTCC and LTCC Substrate Market By Product Type(HTCC, Alumina (Al2O3) HTCC Substrates, Aluminum Nitride (AlN) HTCC Substrates, LTCC, Glass-Ceramic LTCC Substrates, Other Material-Based LTCC Substrates), By End-Use Industry(Automotive, Consumer Electronics, Aerospace and Defense, Telecommunications, Healthcare, Others), By Region, And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 63493

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

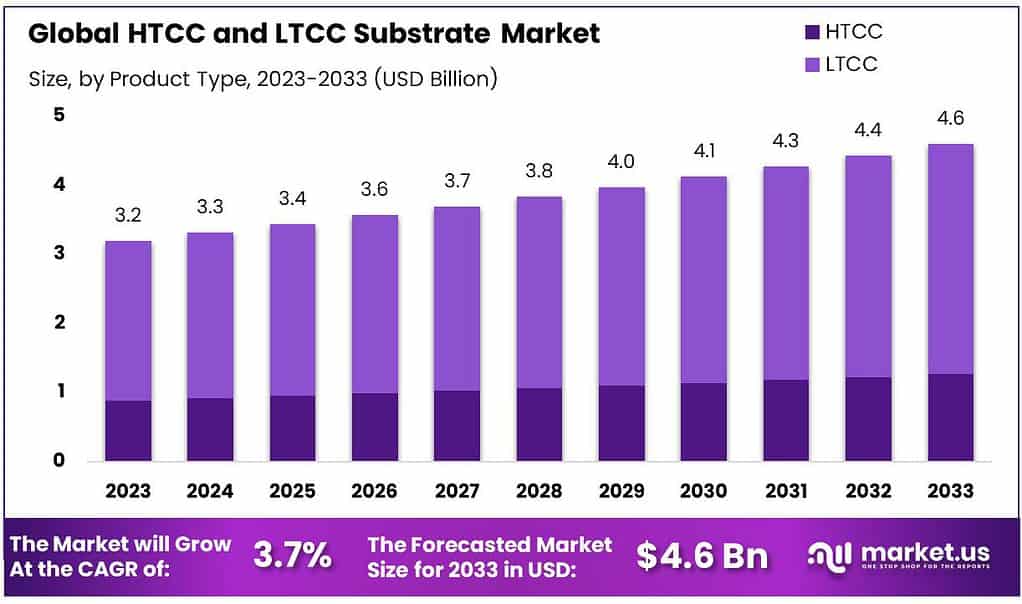

The global HTCC and LTCC Substrate Market size is expected to be worth around USD 4.6 billion by 2033, from USD 3.2 billion in 2023, growing at a CAGR of 3.7% during the forecast period from 2023 to 2033.

HTCC (High-Temperature Co-Fired Ceramic) and LTCC (Low-Temperature Co-Fired Ceramic) substrates are specialized materials used in electronics for packaging and interconnection purposes.

HTCC substrates are crafted using a co-firing process at high temperatures, typically above 1,600 degrees Celsius. These substrates offer excellent thermal conductivity, mechanical strength, and dimensional stability, making them suitable for high-temperature applications. HTCC substrates are commonly used in industries such as aerospace, automotive, and telecommunications.

On the other hand, LTCC substrates undergo co-firing at lower temperatures, generally below 1,000 degrees Celsius. LTCC substrates are known for their compatibility with low-cost materials, multilayer capabilities, and the integration of passive components during the co-firing process. These substrates find applications in various electronic devices, including sensors, antennas, and modules, where miniaturization and high-frequency performance are essential.

Key Takeaways

- Market Size and Growth: The HTCC and LTCC substrate market is projected to reach USD 4.6 billion by 2033, growing at a CAGR of 3.7% from USD 3.2 billion in 2023.

- LTCC Dominance: In 2023, LTCC claimed over 72.4% market share, showcasing its widespread influence in the substrate landscape.

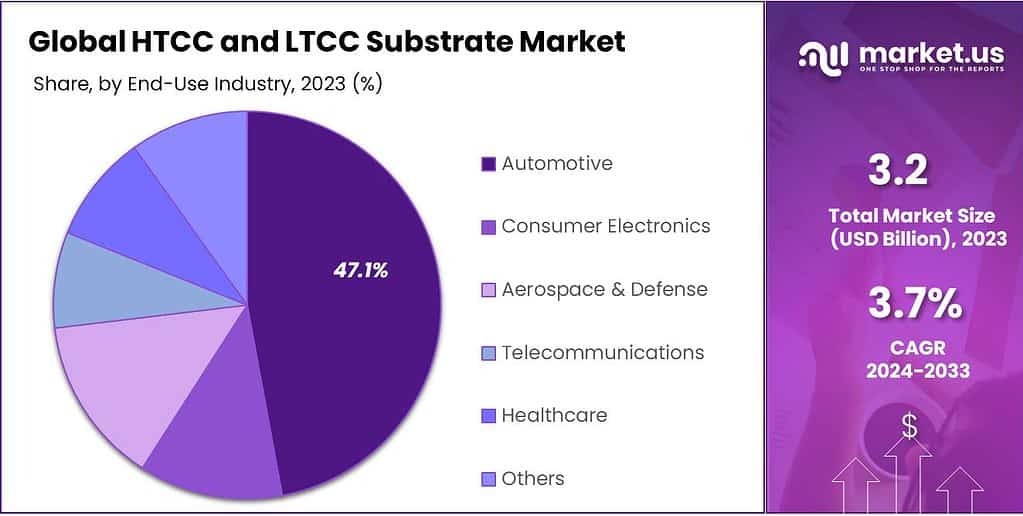

- End-Use Industry Impact: Automotive held a significant 47.1% market share in 2023, underlining the industry’s reliance on HTCC and LTCC substrates.

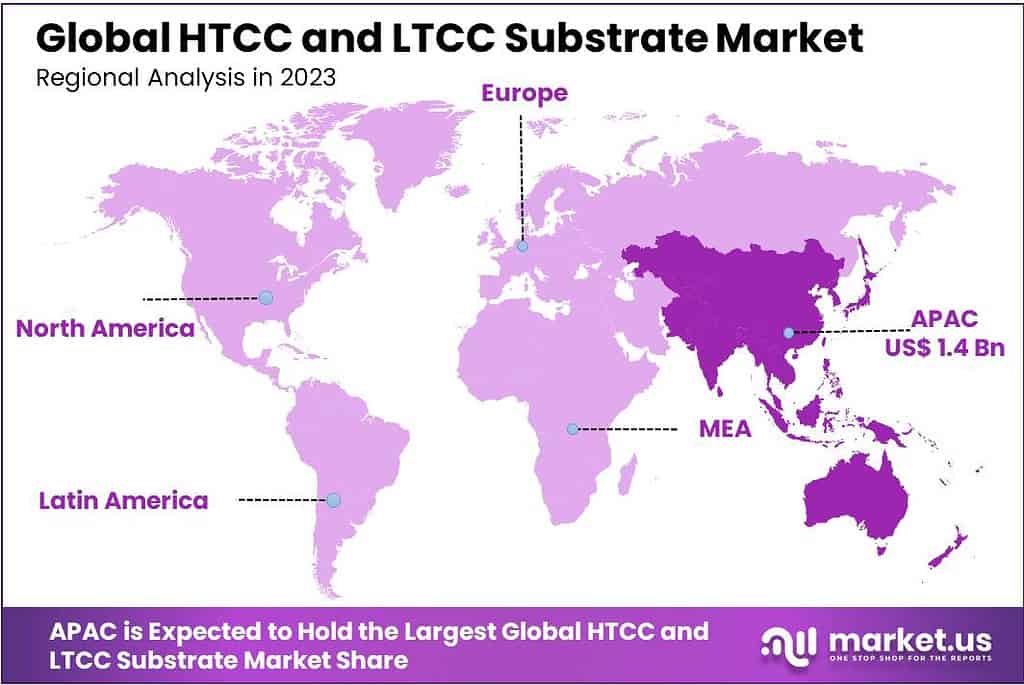

- Regional Dominance: In 2023, the Asia-Pacific region secured over 45.6% market share, driven by robust demand for substrates in electronics, telecommunications, and automotive industries.

By Product Type

In 2023, LTCC (Low-Temperature Co-Fired Ceramic) took the lead, securing over 72.4% of the market, showcasing its widespread influence in the substrate landscape.

Alumina (Al2O3) HTCC Substrates: Alumina-based HTCC substrates emerged as a strong contender, renowned for outstanding thermal conductivity and mechanical strength. Industries requiring robust performance in high-temperature environments favored these substrates.

Aluminum Nitride (AlN) HTCC Substrates: HTCC substrates featuring Aluminum Nitride gained traction, offering enhanced thermal conductivity and reliability. Sectors with demands for efficient heat dissipation, like aerospace and automotive, found these substrates highly beneficial.

Glass-Ceramic LTCC Substrates: Glass-ceramic LTCC substrates demonstrated versatility and adaptability. Their ability to seamlessly integrate various passive components during the co-firing process made them indispensable in electronic devices, including sensors and antennas.

Other Material-Based LTCC Substrates: LTCC substrates based on diverse materials emerged as a dynamic segment. The flexibility in material compatibility, coupled with multilayer capabilities, contributed to their popularity across a spectrum of electronic applications.

By End-Use Industry

In 2023, Automotive claimed a significant market share of over 47.1%, establishing itself as a key player in the HTCC and LTCC substrate market.

Automotive: Held a dominant position, emphasizing the industry’s reliance on HTCC and LTCC substrates for applications demanding high thermal conductivity and mechanical strength. The substrates contribute to the innovation and efficiency of automotive electronics.

Consumer Electronics: Emerged as a notable segment, with HTCC and LTCC substrates playing a crucial role in compact and high-performance electronic components. The substrates enable the development of sleek and efficient devices, meeting consumer electronics demands.

Aerospace & Defense: Significantly utilized HTCC and LTCC substrates for their reliability and adaptability in extreme conditions. These substrates contribute to the creation of advanced electronic systems, enhancing the aerospace and defense industry’s technological capabilities.

Telecommunications: Demonstrated a growing reliance on HTCC and LTCC substrates for their ability to support high-frequency applications. These substrates contribute to the development of efficient and reliable communication systems, meeting the evolving needs of the telecommunications sector.

Healthcare: Found increasing applications in healthcare electronics, benefiting from the substrates’ precision and compatibility in medical devices. HTCC and LTCC substrates play a crucial role in the advancement of electronic components used in diagnostic and treatment equipment.

Key Маrkеt Ѕеgmеntѕ

By Product Type

- HTCC

- Alumina (Al2O3) HTCC Substrates

- Aluminum Nitride (AlN) HTCC Substrates

- LTCC

- Glass-Ceramic LTCC Substrates

- Other Material-Based LTCC Substrates

By End-Use Industry

- Automotive

- Consumer Electronics

- Aerospace & Defense

- Telecommunications

- Healthcare

- Others

Market Drivers

Growing Demand for Miniaturized Electronics:

The increasing consumer preference for compact and lightweight electronic devices is a key driver for the rapid growth of the HTCC and LTCC substrate market. These substrates enable the miniaturization of electronic components, meeting the demand for smaller and more portable devices.

Industries such as consumer electronics, healthcare, and telecommunications are witnessing a surge in demand for smaller and more powerful electronic products. HTCC and LTCC substrates, with their high-density capabilities and efficient thermal management, play a crucial role in fulfilling this demand.

Rising Adoption in Automotive Electronics:

The automotive sector’s expanding reliance on advanced electronics and the demand for high-performance components contribute significantly to the market’s growth. HTCC and LTCC substrates offer exceptional thermal conductivity and mechanical strength, addressing the rigorous requirements of automotive applications.

As the automotive industry continues to integrate electronic systems for safety, connectivity, and autonomous functionalities, the demand for reliable and efficient substrates like HTCC and LTCC is expected to escalate, further propelling the market growth.

Market Restraints

High Initial Investment and Operating Costs:

One of the primary challenges faced by the rapid HTCC and LTCC substrate market is the high initial investment required for setting up manufacturing facilities and acquiring specialized equipment. The sophisticated technologies involved in the production of these substrates contribute to the significant upfront costs.

Operating costs, including maintenance and skilled personnel, further add to the financial challenges, especially for smaller players in the market. This barrier to entry may limit the adoption of HTCC and LTCC substrates, particularly among small and medium-sized enterprises (SMEs).

Technical Limitations and Material Challenges:

Despite their advantages, HTCC and LTCC substrates face technical limitations, primarily related to the range of materials that can be effectively used. Ongoing research is expanding this range, but current restrictions on material properties, such as durability under various conditions and compatibility with different chemicals, pose challenges.

Overcoming these material challenges is crucial for broader adoption, especially in industries with stringent requirements for specific material properties, such as aerospace and healthcare.

Market Opportunities

Expansion into Emerging Industries:

The rapid HTCC and LTCC substrate market presents significant opportunities for expansion into emerging industries beyond traditional applications. Sectors such as renewable energy, the Internet of Things (IoT), and smart manufacturing are increasingly exploring the use of these substrates.

In renewable energy, HTCC and LTCC substrates can contribute to the development of efficient and compact components for solar inverters, wind turbines, and energy storage systems. The adaptability of these substrates positions them as enablers of innovation in emerging industries.

Advancements in Material Science:

Ongoing advancements in material science offer tremendous opportunities for the HTCC and LTCC substrate market. The development of new materials with enhanced properties, such as increased thermal conductivity, flexibility, or biocompatibility, can open up new applications.

Materials that are more resistant to environmental conditions can extend the use of HTCC and LTCC substrates in outdoor applications, while biocompatible materials can expand their use in medical implants and devices. These advancements are critical for broadening the scope and appeal of HTCC and LTCC technologies.

Market Trends

Integration with 5G Technology:

A notable trend in the rapid HTCC and LTCC substrate market is the integration of these substrates with 5G technology. The advent of 5G has led to increased demand for high-frequency electronic components, and HTCC and LTCC substrates are well-suited for these applications.

The substrates’ ability to support high-frequency signals without significant signal loss makes them crucial in the development of 5G-enabled devices, including smartphones, base stations, and IoT devices. This trend aligns with the global rollout of 5G networks and the surge in connected devices.

Focus on Sustainable Manufacturing Practices:

Sustainability is emerging as a key trend in the HTCC and LTCC substrate market, with a growing emphasis on eco-friendly and energy-efficient manufacturing processes. Manufacturers are adopting practices that reduce the environmental impact of substrate production.

The trend towards sustainability involves the use of recyclable materials, energy-efficient manufacturing technologies, and the development of substrates with longer lifecycles. This aligns with the broader industry shift towards environmentally conscious practices.

Geopolitical and Recession Impact Analysis

Geopolitical Impact Analysis:

- Trade Import and Tariff Restrictions: Geopolitical tensions may trigger tariffs and import restrictions on HTCC and LTCC substrates, disrupting the supply chain. This can escalate production costs and, subsequently, raise prices for consumers, impacting market dynamics.

- Supply Chain Disruptions: Political instability in key regions for HTCC and LTCC substrate production can disrupt the global supply chain. Interruptions in raw material flow or manufacturing processes may cause production delays, affecting substrate availability.

- Market Access Challenges: Geopolitical tensions can create barriers for HTCC and LTCC substrate manufacturers entering new markets. Restrictions on market access or unfavorable trade policies may impede expansion efforts, limiting growth in specific regions.

- Currency Exchange Rate Fluctuations: Geopolitical events can induce currency exchange rate fluctuations, affecting HTCC and LTCC substrate raw material costs. These shifts may impact global competitiveness, influencing both domestic sales and international trade dynamics.

Recession Impact Analysis:

- Reduced Demand in Electronics: Economic downturns typically lead to reduced demand for electronics, impacting HTCC and LTCC substrate applications. The decline in manufacturing activities affects the demand for substrates used in electronic components, leading to reduced sales and production.

- Constraints on Industrial Spending: During recessions, industries may limit spending, affecting projects involving HTCC and LTCC substrates. Cutbacks in manufacturing or infrastructure projects can result in delayed or reduced demand for substrates in various applications.

- Cost-Reduction Strategies: HTCC and LTCC substrate manufacturers may implement cost-cutting measures in response to economic downturns. Workforce reductions or scaled-down production could impact substrate availability and variety in the market.

- Emphasis on Innovation: Recessions may drive innovation in the HTCC and LTCC substrate market. Manufacturers may focus on developing more cost-effective and sustainable solutions to align with changing preferences. This innovation drive may lead to the introduction of novel substrate formulations or applications to remain competitive.

Regional Analysis

In 2023, the Asia-Pacific (APAC) region emerged as a dominant player in the HTCC and LTCC Substrate markets, securing a significant market share of over 45.6%. The market’s value reached USD 6.04 billion, showcasing remarkable growth driven by the region’s robust demand for HTCC and LTCC substrates.

This dominance highlights the substantial interest and utilization of HTCC and LTCC substrates across diverse industries in the APAC region. The flourishing industrial sector, particularly in areas like electronics, telecommunications, and automotive, played a pivotal role in driving the notable demand for HTCC and LTCC substrates, contributing significantly to the market’s expansion.

The region’s economic prosperity, coupled with extensive infrastructural development and a surge in manufacturing activities, propelled the consumption of HTCC and LTCC substrates. Moreover, the rising population and the expanding middle-class demographic further fueled the demand for electronic devices, communication systems, and automotive components – all of which extensively incorporate HTCC and LTCC substrates in their production processes.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

In the rapidly evolving landscape of the HTCC and LTCC substrate market, several key players play instrumental roles in shaping the industry’s trajectory. Notably, Kyocera Corporation stands out as a leading force, leveraging its advanced ceramic technologies to provide high-performance substrates for diverse applications, particularly in electronics and telecommunications.

Murata Manufacturing Co., Ltd. is another prominent player, distinguished for its focus on innovation and technological excellence in the development of HTCC and LTCC substrates. MARUWA Co., Ltd. has also made significant contributions, recognized globally for its commitment to delivering quality and reliable substrates, catering to industries such as automotive, healthcare, and telecommunications.

Micro Systems Technologies Management AG (MST) is a key contributor, specializing in high-density interconnect solutions and pushing the boundaries of miniaturization in the LTCC substrate segment. ECRIM Co., Ltd., known for its expertise in electronic ceramics, addresses the industry’s demands for advanced HTCC and LTCC substrates, particularly in telecommunications and aerospace.

Top Key Рlауеrѕ

- KYOCERA Corporation

- DowDuPont Inc.

- Murata Manufacturing Co., Ltd.

- KOA Corporation

- Hitachi Metals

- NGK Spark Plug Co., Ltd.

- Yokowo Co., Ltd.

- NIKKO COMPANY

- MARUWA CO., LTD.

- Micro Systems Technologies

- ECRI Microelectronics

- Selmic Oy

- American Technical Ceramics Corp.

- NEO Tech

- Advanced Substrate Microtechnology Corporation

Recent Developments

2023 KYOCERA Corporation: Focused on developing high-performance HTCC and LTCC substrates for 5G applications.

2023 DowDuPont Continued to invest in R&D for advanced LTCC materials.

Report Scope

Report Features Description Market Value (2023) USD 3.2 Bn Forecast Revenue (2033) USD 4.6 Bn CAGR (2024-2033) 3.7% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(HTCC, Alumina (Al2O3) HTCC Substrates, Aluminum Nitride (AlN) HTCC Substrates, LTCC, Glass-Ceramic LTCC Substrates, Other Material-Based LTCC Substrates), By End-Use Industry(Automotive, Consumer Electronics, Aerospace & Defense, Telecommunications, Healthcare, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape KYOCERA Corporation, DowDuPont Inc., Murata Manufacturing, KOA Corporation, Hitachi Metals, NGK Spark Plug Co., Ltd., Yokowo, NIKKO COMPANY, MARUWA, Micro Systems Technologies, ECRI Microelectronics, Selmic Oy, American Technical Ceramics Corp., NEO Tech, Advanced Substrate Microtechnology Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of HTCC and LTCC Substrate Market?HTCC and LTCC Substrate Market size is expected to be worth around USD 4.6 billion by 2033, from USD 3.2 billion in 2023

What is the HTCC and LTCC Substrate Market growth?The global HTCC and LTCC Substrate Market is expected to grow at a compound annual growth rate of 3.7%. From 2024 to 2033.Who are the key players in the HTCC and LTCC Substrate Market?KYOCERA Corporation, DowDuPont Inc. , Murata Manufacturing Co., Ltd. , KOA Corporation, Hitachi Metals, NGK Spark Plug Co., Ltd., Yokowo Co., Ltd., NIKKO COMPANY, MARUWA CO., LTD., Micro Systems Technologies, ECRI Microelectronics, Selmic Oy, American Technical Ceramics Corp., NEO Tech, Advanced Substrate Microtechnology Corporation

HTCC and LTCC Substrate MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

HTCC and LTCC Substrate MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- KYOCERA Corporation

- DowDuPont Inc.

- Murata Manufacturing Co., Ltd.

- KOA Corporation

- Hitachi Metals

- NGK Spark Plug Co., Ltd.

- Yokowo Co., Ltd.

- NIKKO COMPANY

- MARUWA CO., LTD.

- Micro Systems Technologies

- ECRI Microelectronics

- Selmic Oy

- American Technical Ceramics Corp.

- NEO Tech

- Advanced Substrate Microtechnology Corporation