Global HPMC Market By Grade(Industrial Grade, Food Grade, Pharmaceutical Grade), By Viscosity(Low-Viscosity, Medium-Viscosity, High-Viscosity), By End-use(Construction, Pharmaceuticals, Food Industry, Others) and by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 12443

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

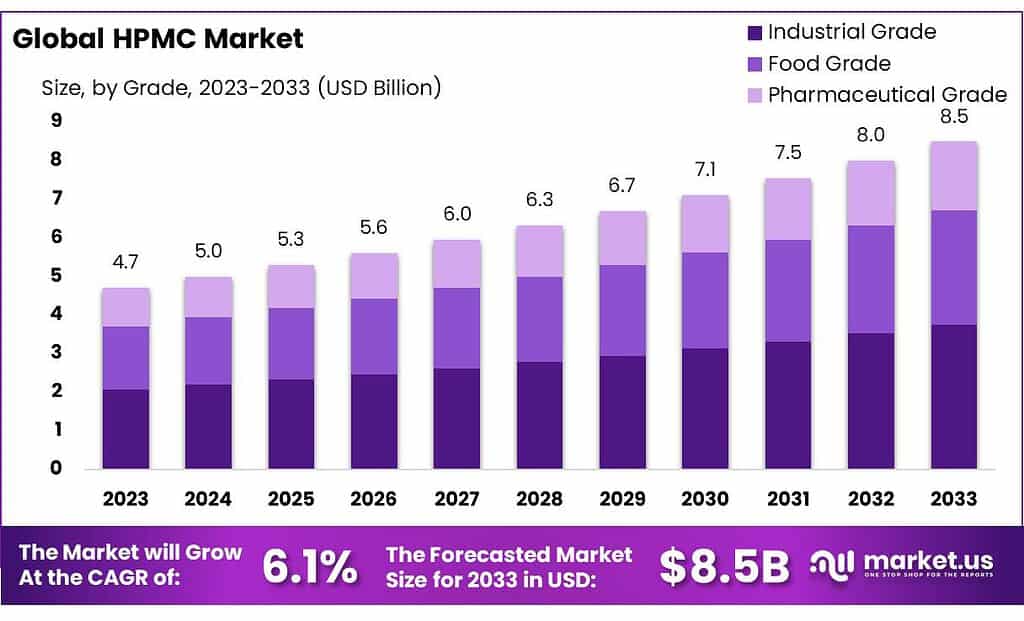

The global HPMC Market size is expected to be worth around USD 8.5 billion by 2033, from USD 4.7 billion in 2023, growing at a CAGR of 6.1% during the forecast period from 2023 to 2033.

The HPMC market refers to the global industry and sales of Hydroxypropyl Methylcellulose, a chemical made from plant fibers. HPMC is mainly used to make products thicker, help mix ingredients together, and keep them stable. It’s used across several industries.

In the pharmaceutical world, HPMC is crucial because it helps make tablets hold together and controls how medicine is released in our body, making sure it works over time rather than all at once. This is especially important for medications that need to act slowly throughout the day.

In the food industry, HPMC is used as a thickener and stabilizer. This means it helps give a consistent texture to foods like ice cream and sauces, preventing them from separating or becoming too runny. It’s also used in gluten-free baking to help doughs and batters hold together better, which is important for getting the right texture in bread and cakes without gluten.

HPMC also has a significant role in the construction industry. It’s added to cement and plaster to help them retain water and improve their workability. This makes it easier to apply and increases the durability of the materials once they are set.

Key Takeaways

- Projected Market Growth: The global HPMC market is projected to grow from USD 4.7 billion in 2023 to USD 8.5 billion by 2033, at a CAGR of 6.1%.

- Industrial Grade Dominance: In 2023, the Industrial Grade segment leads with over 44.3% market share, driven by its application in construction and textiles.

- Viscosity Insights: Medium-viscosity HPMC dominates with a 54.3% share in 2023, preferred for its balance of flow and stability in pharmaceuticals and food.

- End-use in Construction: The construction sector, using HPMC to enhance cement and plaster properties, held a 39.4% market share in 2023.

- Asia Pacific Market Share: The Asia Pacific region accounted for 38.2% of the global HPMC market in 2023, driven by rapid industrialization and urbanization.

By Grade

In 2023, Industrial Grade held a dominant market position, capturing more than a 44.3% share. This segment leverages HPMC’s properties like water retention and viscosity to enhance products in the construction and textile industries. These applications drive its substantial market share.

Following closely, the Pharmaceutical Grade segment also plays a critical role. It uses HPMC to improve the effectiveness of medications, serving as a binder in tablets and controlling drug release in sustained-release formulations. Its demand is bolstered by the growing pharmaceutical industry’s need for excipients that ensure safety and efficiency.

The Food Grade segment, while smaller, is significant too. HPMC acts as a thickener, stabilizer, and emulsifier in food products like ice cream, sauces, and gluten-free baked goods. Its importance is increasing with the rise in demand for processed foods and dietary restrictions like gluten intolerance.

By Viscosity

In 2023, Medium-Viscosity HPMC held a dominant market position, capturing more than a 54.3% share. This segment is preferred for its balance between flow and stability, making it ideal for applications in the pharmaceutical and food industries where moderate viscosity is crucial for efficient processing and quality end products.

Low-viscosity HPMC, while holding a smaller market share, is essential in applications requiring rapid solubility and lower thickness, such as in coatings and personal care products. Its ability to quickly dissolve makes it suitable for formulations that need fast action and smooth textures.

High-viscosity HPMC is pivotal in industries that require thick, stable gels, such as in construction and some high-density food products. Its ability to create strong, durable bonds and maintain consistency under stress conditions supports its use in heavy-duty applications.

By End-use

In 2023, Construction held a dominant market position, capturing more than a 39.4% share. This sector relies heavily on HPMC for its water retention properties and workability enhancements in cement-based formulations, plasters, and adhesives. The demand in construction is driven by global infrastructure development and the need for improved building materials.

The Pharmaceuticals segment also plays a significant role in the HPMC market. It utilizes HPMC as a binder, film former, and controlled-release agent in tablet production, enhancing the stability and efficacy of medications. With increasing investment in drug development and generic medicines, the use of HPMC in pharmaceuticals continues to grow.

In the Food Industry, HPMC is valued for its thickening, stabilizing, and emulsifying properties, particularly in products like baked goods, sauces, and dairy alternatives. The shift towards processed and convenience foods, along with rising consumer awareness about food safety and quality, fuels its adoption in this sector.

Key Market Segmentation

By Grade

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

By Viscosity

- Low-Viscosity

- Medium-Viscosity

- High-Viscosity

By End-use

- Construction

- Pharmaceuticals

- Food Industry

- Others

Driving Factors

Increasing Demand for Gluten-Free and Vegan Products

One major driver for the Hydroxypropyl Methylcellulose (HPMC) market is the rising consumer demand for gluten-free and vegan products. As awareness about dietary restrictions and lifestyle choices continues to grow, more consumers are opting for gluten-free and vegan food options. This shift is largely influenced by health concerns, ethical considerations regarding animal welfare, and environmental sustainability. HPMC plays a critical role in this trend as it serves as an essential ingredient in gluten-free baking and vegan food formulations.

HPMC’s ability to mimic the texture and properties of gluten makes it an invaluable ingredient in gluten-free baked goods. It provides the necessary binding and structural properties that gluten typically offers in breads, cakes, and pastries. This allows for the creation of gluten-free products that do not compromise on texture or taste, making them appealing to both individuals with gluten intolerance and those choosing gluten-free options for other health reasons.

In the realm of vegan food production, HPMC is equally important. It acts as a plant-based gelatin substitute, which is crucial for producing a wide range of vegan-friendly products. From desserts like mousses and jellies to savory dishes such as vegan cheeses and meat substitutes, HPMC is used to achieve the desired consistency and mouthfeel that would typically rely on animal-based ingredients.

The functionality of HPMC extends beyond just being a substitute for gluten or gelatin; it also improves the shelf life and stability of food products. This is particularly important in the processed food industry, where longevity and consistency of products are key to consumer satisfaction and brand reliability. As a result, food manufacturers are increasingly incorporating HPMC into their products to meet the growing demand for high-quality gluten-free and vegan options.

Furthermore, the global rise in health-conscious consumers who are reducing their gluten intake as part of a healthier lifestyle choice rather than due to celiac disease is also propelling the demand for HPMC. These consumers are looking for food products that are not only safe and healthy but also provide sensory satisfaction similar to their traditional counterparts. HPMC’s versatility and safety profile make it an attractive option for food manufacturers aiming to cater to this broad customer base.

Restraining Factors

Volatility in Raw Material Prices

One significant restraint affecting the Hydroxypropyl Methylcellulose (HPMC) market is the volatility in raw material prices. HPMC is derived from cellulose, which is sourced from plants. The cost and availability of these plant materials can fluctuate widely due to a variety of factors, including agricultural production levels, changes in weather patterns, and geopolitical issues that may affect supply chains. These fluctuations can lead to unpredictable raw material costs for manufacturers of HPMC, impacting their production budgets and pricing strategies.

The price instability of key raw materials not only affects the cost structure of HPMC production but also poses a challenge for consistent supply chain management. For industries that rely heavily on stable ingredient pricing to manage their production costs, such as the pharmaceutical and food industries, sudden increases in HPMC prices can lead to higher product prices or a search for alternative ingredients, potentially reducing the demand for HPMC.

Furthermore, agricultural policies and trade restrictions in various countries can significantly influence the availability and cost of cellulose. For example, if a major cellulose-producing country decides to impose export restrictions or if there is a subsidy change that affects farming practices, it can disrupt the entire supply chain. This could lead to a shortage of cellulose, driving up the cost of raw materials and, consequently, HPMC.

Environmental factors also play a critical role in the volatility of raw material prices. Extreme weather conditions such as droughts or floods can severely impact agricultural output, affecting the supply of cellulose. This unpredictability in supply levels can lead to price spikes, making it difficult for HPMC producers to plan their production cycles efficiently.

Additionally, the push towards more sustainable and eco-friendly manufacturing processes and raw materials can further complicate the economic landscape for HPMC manufacturers. As regulatory pressures increase and consumers demand more environmentally friendly products, manufacturers may need to invest in alternative, possibly more expensive, sources of cellulose or adapt their production processes to meet these new standards, which can increase costs.

Growth Opportunities

Expansion into Emerging Markets

A major opportunity for the Hydroxypropyl Methylcellulose (HPMC) market lies in its expansion into emerging markets. As economies in regions like Asia, Africa, and Latin America continue to grow, so does the demand for various products that utilize HPMC, such as pharmaceuticals, food, and construction materials. These markets offer a new frontier for growth due to their increasing population, rising middle class, and urbanization trends.

In the pharmaceutical sector, emerging markets are witnessing rapid growth in healthcare infrastructure and access, accompanied by a surge in demand for generic medications and controlled-release drugs, both of which often require HPMC as a key ingredient. As these regions invest more in healthcare and regulatory frameworks, the demand for high-quality, consistent pharmaceutical excipients like HPMC is expected to rise significantly. This presents a lucrative opportunity for HPMC manufacturers to establish partnerships and expand their footprint in these growing markets.

The construction industry in these emerging economies is another critical area of potential growth. Urbanization is driving the demand for new construction projects, from residential to commercial buildings, all of which require modern, durable building materials. HPMC is integral in construction applications, particularly in cement formulations and plasters, where it improves workability, water retention, and durability. The booming construction sector in these regions could drive significant demand for HPMC, providing a substantial market for manufacturers to tap into.

Additionally, the food industry in emerging markets is experiencing a transformation driven by changing consumer preferences towards processed and convenience foods, which often require stabilizers, thickeners, and emulsifiers like HPMC. As diets evolve and the middle class expands, there is a growing preference for high-quality food products that offer health benefits, such as gluten-free and vegan options. HPMC’s role in food applications, especially in meeting these new consumer demands, positions it well for growth in these markets.

The opportunity extends to the increasing environmental consciousness in these regions. As more consumers and governments in emerging markets become aware of environmental issues, the demand for sustainable and eco-friendly products increases. HPMC is non-toxic and biodegradable, characteristics that make it attractive in the context of environmental sustainability. Manufacturers can leverage this aspect to cater to the green market segment, promoting HPMC as an environmentally friendly alternative to synthetic chemicals in various applications.

By focusing on market expansion strategies, such as forming local partnerships, adapting products to regional needs, and navigating regulatory landscapes effectively, companies in the HPMC market can capitalize on these opportunities. The combination of growing industrial sectors, shifting consumer patterns, and an increasing focus on sustainability makes emerging markets fertile ground for expanding the HPMC business. This strategic move not only diversifies the market presence of HPMC manufacturers but also aligns them with long-term global growth trends.

Latest Trends

Growing Utilization in Nutraceutical Products

A significant trend shaping the Hydroxypropyl Methylcellulose (HPMC) market is its increasing utilization in nutraceutical products. This trend is driven by the growing consumer focus on health and wellness, which has heightened the demand for dietary supplements and functional foods that promote health benefits beyond basic nutrition. HPMC is playing a crucial role in this sector due to its functional properties as a vegetarian capsule material and as a stabilizer in various health-oriented food products.

The preference for vegetarian and clean-label products has surged, particularly among health-conscious consumers who are also often environmentally conscious. These consumers are looking for products that are not only beneficial to their health but also produced in a way that is sustainable and ethical. HPMC fits perfectly into this niche as it is derived from plant cellulose and serves as an excellent alternative to gelatin capsules, which are animal-derived. This makes HPMC capsules a preferred choice for the encapsulation of dietary supplements, appealing to the vegan and vegetarian markets as well as those avoiding animal products for ethical or health reasons.

In the realm of functional foods, HPMC’s properties as a thickener and emulsifier allow it to enhance the texture and stability of products such as dairy-free yogurts, gluten-free baked goods, and other specialty diet foods. Its ability to maintain product integrity and improve mouthfeel without compromising the clean label requirements is particularly valued. As the nutraceutical market expands to include more specialized products aimed at specific health concerns and dietary needs, the versatility of HPMC can be leveraged to meet these sophisticated consumer demands.

Moreover, the global health crisis has prompted an increased interest in immune-boosting and health-maintenance supplements, further propelling the demand for HPMC in nutraceutical formulations. Manufacturers are exploring new ways to incorporate HPMC to not only encapsulate active ingredients but also to stabilize novel formulations that may include a wide range of natural extracts and vitamins, which are sensitive to processing conditions.

Additionally, the technological advancements in capsule production and food processing techniques are enabling more precise and efficient use of HPMC. These advancements help in creating more effective delivery systems for nutraceuticals, ensuring that the active ingredients are protected until they reach the targeted area of absorption within the body, thereby increasing their efficacy.

Regional Analysis

In 2023, Asia Pacific held a significant position in the global Hydroxypropyl Methylcellulose (HPMC) market, accounting for around 38.2% due to rapid industrialization and urbanization across the region. This region has experienced considerable growth in sectors that are major consumers of HPMC, such as pharmaceuticals, construction, and food industries.

This surge is propelled by the expanding middle-class population and increasing urbanization. Notably, countries like China have emerged as key exporters of HPMC products, addressing demands globally.

Countries in the Asia Pacific, including Japan, India, and South Korea, are witnessing rapid infrastructure development, which requires substantial amounts of construction materials, including HPMC for use in cement additives and coatings. Additionally, the high population density in countries like China and India translates into a vast consumer base for HPMC-enhanced products.

There is also an increasing preference for packaged goods and modern retail formats, boosting the demand for HPMC as a food additive in packaging materials. The Asia Pacific has established itself as a hub for HPMC production, backed by significant investments in manufacturing facilities. The availability of raw materials and relatively lower production costs further fuel the growth of the market. The dominance of the Asia Pacific in the HPMC market reflects its dynamic economic landscape and its critical role in the global supply chain for HPMC and related products.

Following Asia Pacific, North America, particularly the United States, maintains a strong industrial and manufacturing sector that demands high volumes of HPMC for various applications, including pharmaceutical excipients, construction materials, and food products. The region’s emphasis on technological advancements in manufacturing processes also leads to enhanced efficiency and quality in HPMC products, strengthening its market position.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- India

- Japan

- South Korea

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Key Players Analysis

The Hydroxypropyl Methylcellulose (HPMC) market features several key players who significantly influence its dynamics through innovation, production capacity, and regional outreach. Among these, Dow Chemical Company and Ashland Inc. are prominent leaders, known for their extensive product portfolios and robust distribution networks. These companies have excelled in leveraging advanced technologies to produce high-quality HPMC that meets diverse industrial requirements, particularly in pharmaceuticals and construction.

Market Key Players

- Celotech Chemicals Co., Ltd.

- Changzhou Guoyu Environmental S&T Co., Ltd.

- Chemcolloid Limited

- CP Kelco U.S., Inc.

- Dow Chemical

- DuPont de Nemours, Inc.

- Gemez Chemical

- Hebei Yibang Building Materials Co., Ltd.

- Henan Tiansheng Chemical Industry

- Hercules-Tianpu

- Hopetop Pharmaceutical

- Samsung Fine Chemicals

- Shandong Guangda Technology

- Shijiazhuang Ruixin

- Shin-Etsu Chemical Co., Ltd.

- Tai’an Ruitai

- Xinjiang Su nok cotton Industry

- Zhejiang Haishen New Materials limited

- Zhejiang Kehong Chemical

- Zouping Fuhai Technology Development

Recent Developments

Celotech Chemical Co., Ltd. has established itself as a prominent player in the HPMC sector by focusing on the development and production of cellulose ethers, primarily serving the construction, paint, pharmaceutical, and food industries.

Dow’s efforts in this area reflect its broader commitment to developing specialized solutions that support pharmaceutical manufacturers in overcoming formulation challenges

Report Scope

Report Features Description Market Value (2023) US$ 4.7 Bn Forecast Revenue (2033) US$ 8.5 Bn CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Grade(Industrial Grade, Food Grade, Pharmaceutical Grade), By Viscosity(Low-Viscosity, Medium-Viscosity, High-Viscosity), By End-use(Construction, Pharmaceuticals, Food Industry, Others) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, India, Japan, South Korea, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, and Rest of Middle East & Africa. Competitive Landscape Celotech Chemicals Co., Ltd., Changzhou Guoyu Environmental S&T Co., Ltd., Chemcolloid Limited, CP Kelco U.S., Inc., Dow Chemical, DuPont de Nemours, Inc., Gemez Chemical, Hebei Yibang Building Materials Co., Ltd., Henan Tiansheng Chemical Industry, Hercules-Tianpu, Hopetop Pharmaceutical, Samsung Fine Chemicals, Shandong Guangda Technology, Shijiazhuang Ruixin, Shin-Etsu Chemical Co., Ltd., Tai’an Ruitai, Xinjiang Su nok cotton Industry, Zhejiang Haishen New Materials limited, Zhejiang Kehong Chemical, Zouping Fuhai Technology Development Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of HPMC Market?HPMC Market size is expected to be worth around USD 8.5 billion by 2033, from USD 4.7 billion in 2023

What CAGR is projected for the Hpmc Market?The Hpmc Market is expected to grow at 6.1% CAGR (2024-2033).

-

-

- Celotech Chemicals Co., Ltd.

- Changzhou Guoyu Environmental S&T Co., Ltd.

- Chemcolloid Limited

- CP Kelco U.S., Inc.

- Dow Chemical

- DuPont de Nemours, Inc.

- Gemez Chemical

- Hebei Yibang Building Materials Co., Ltd.

- Henan Tiansheng Chemical Industry

- Hercules-Tianpu

- Hopetop Pharmaceutical

- Samsung Fine Chemicals

- Shandong Guangda Technology

- Shijiazhuang Ruixin

- Shin-Etsu Chemical Co., Ltd.

- Tai’an Ruitai

- Xinjiang Su nok cotton Industry

- Zhejiang Haishen New Materials limited

- Zhejiang Kehong Chemical

- Zouping Fuhai Technology Development