Global HPC Data Management Market Size, Share and Analysis Report By Component (Solutions, Services), By Data Type (Structured Data, Unstructured Data, Semi-structured Data), By Deployment Model (On-premises, Cloud-based, Hybrid), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By End-User Industry (Academic & Government Research, Manufacturing & Engineering, Banking, Financial Services, and Insurance, Healthcare & Life Sciences, Media & Entertainment, Energy & Utilities, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 173568

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Insight Summary

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Component

- By Data Type

- By Deployment Model

- By Organization Size

- By End-User Industry

- By Region And Driver Comparison

- Investment Opportunities

- Business Benefits

- Regulatory Environment

- Emerging Trends

- Growth Factors

- Technology Enablement Analysis

- Technology Maturity Roadmap

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

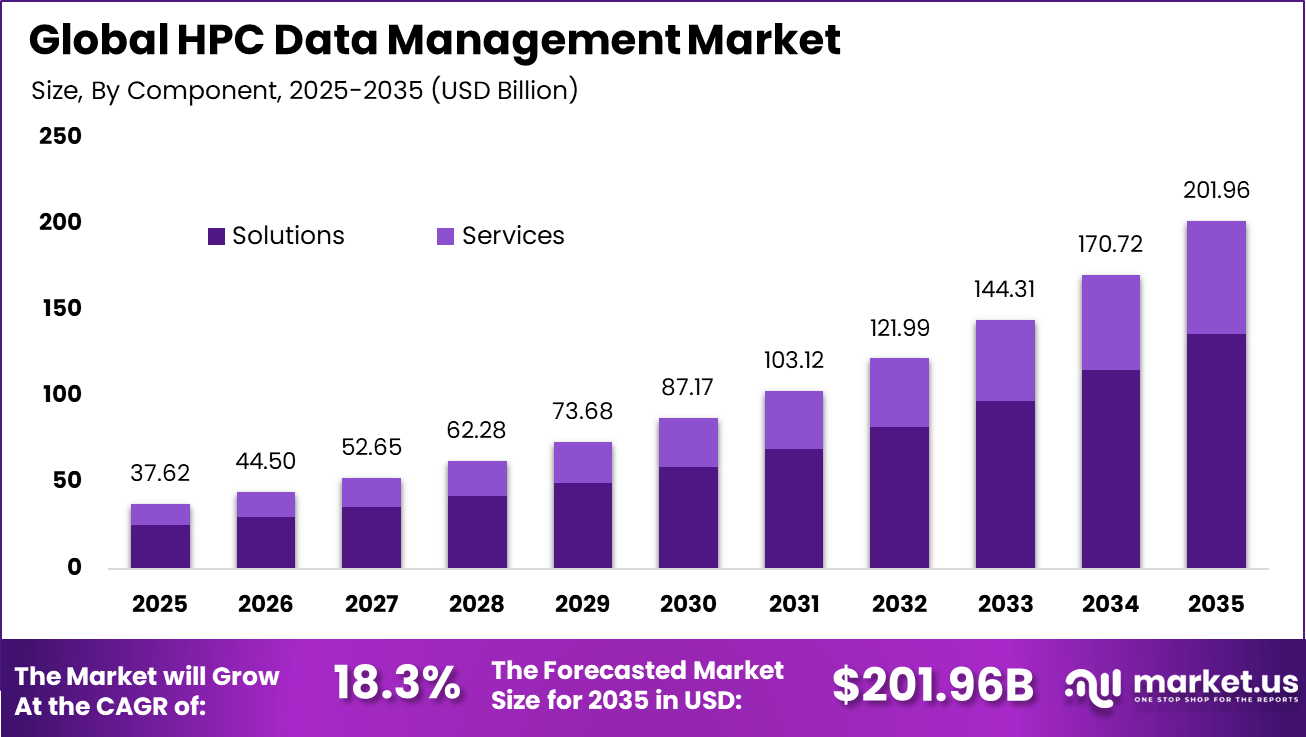

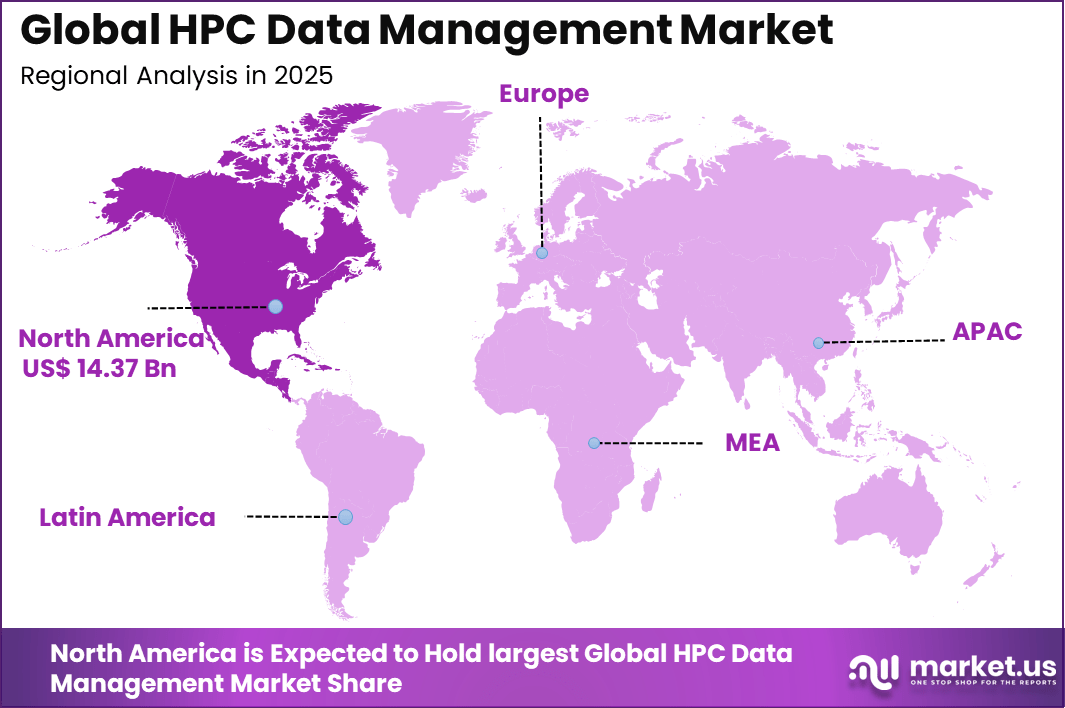

The Global HPC Data Management Market size is expected to be worth around USD 201.96 billion by 2035, from USD 37.62 billion in 2025, growing at a CAGR of 18.3% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 38.2% share, holding USD 14.37 billion in revenue.

The HPC data management market refers to software and platforms designed to store, organize, move, and manage large volumes of data generated by high performance computing environments. These solutions support data lifecycle activities such as ingestion, classification, tiering, archiving, and retrieval across compute clusters and storage systems. HPC data management is critical for workloads that generate massive datasets from simulations, modeling, and advanced analytics.

The market serves research institutions, enterprises, and public sector organizations using HPC systems. Market development has been shaped by the rapid growth in data intensive computing workloads. Traditional storage and file systems struggle to handle the scale and performance requirements of HPC environments. HPC data management solutions are designed to optimize throughput, reduce latency, and improve data accessibility. As HPC adoption expands, effective data management has become as important as compute performance.

One major driving factor of the HPC data management market is the exponential growth of data produced by simulations and analytics. Scientific research, climate modeling, genomics, and engineering simulations generate petabyte scale datasets. Managing this data efficiently is essential to avoid performance bottlenecks. HPC data management platforms address this challenge by enabling high speed data movement and structured storage.

For instance, in May 2023, Panasas launched ActiveStor Ultra Edge for portable HPC/AI storage at remote sites, supporting real-time decisions with lower entry costs. Though earlier, it remains relevant for edge data management expansion.

Parallel file systems and high throughput storage architectures are central to HPC data management adoption. These technologies allow simultaneous access to data by thousands of compute nodes. Improved scalability and performance support complex workloads. Continued innovation in storage architectures strengthens data management capabilities. Artificial intelligence and automation technologies are also influencing adoption.

Key Takeaway

- Solutions dominated the market with a 67.4% share, indicating strong preference for integrated data management platforms that support storage optimization, data movement, and performance monitoring in complex HPC environments.

- Unstructured data accounted for a leading 72.8% share, reflecting the growing volume of simulation outputs, sensor data, research files, and AI generated datasets handled by HPC systems.

- On premises deployment held 58.9% share, driven by strict data control requirements, security concerns, and the need for low latency access in research intensive workloads.

- Large enterprises represented 83.5% of total adoption, supported by their scale of operations, higher data volumes, and sustained investments in advanced computing infrastructure.

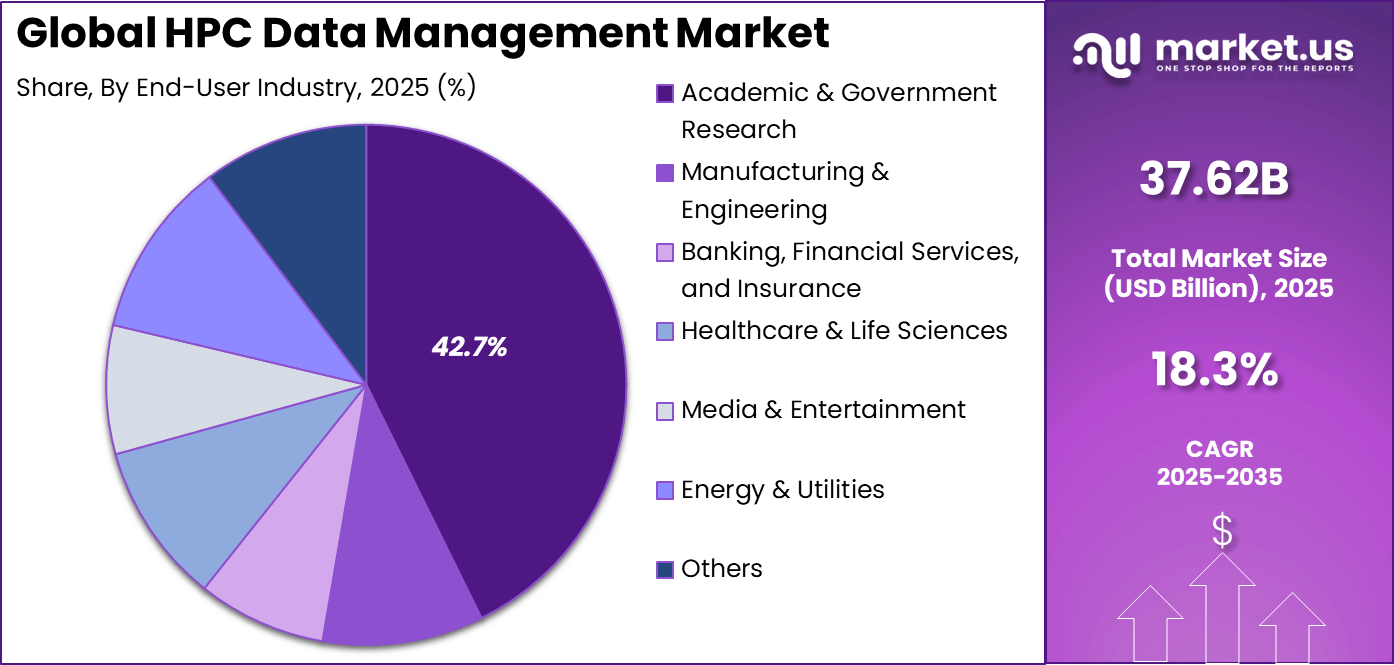

- Academic and government research emerged as the largest end user group with a 42.7% share, highlighting the critical role of HPC data management in scientific research, national laboratories, and public sector innovation.

- North America led the market with a 38.2% share, supported by strong research funding, mature HPC ecosystems, and early adoption of advanced data management technologies.

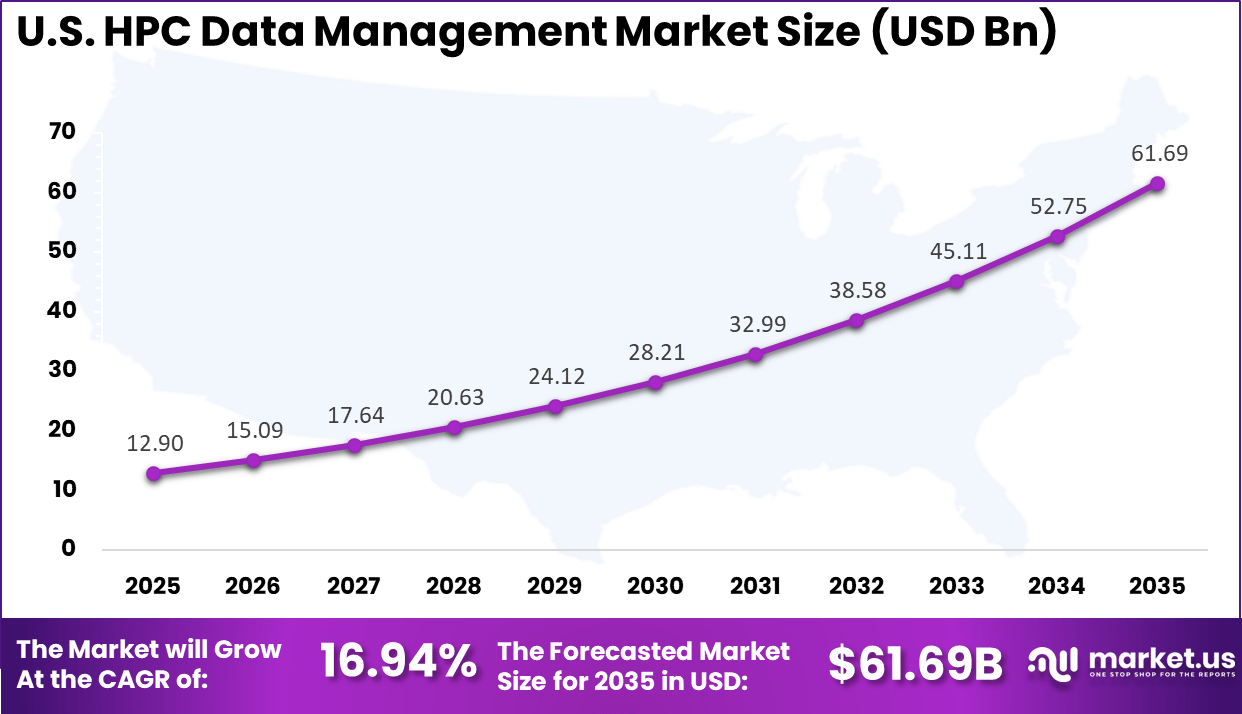

- The United States remained a central contributor, with market activity valued at USD 12.90 billion, reflecting high concentration of large scale research institutions and enterprise HPC deployments.

Key Insight Summary

HPC Data and Operational Insights

- Global high performance computing workloads handled more than 2.3 zettabytes of data in 2024, highlighting the rapid expansion of data intensive simulations, analytics, and artificial intelligence workloads across industries.

- Manufacturing accounted for around 40% of total HPC usage, driven mainly by digital twin modeling, advanced simulations, and supply chain optimization activities that require continuous high throughput computing.

- The government and defense sector represented 31.8% of overall usage, reflecting sustained investment in national security applications, large scale simulations, and advanced research programs.

- Life sciences continued to scale HPC demand, as genomic sequencing workloads processed close to 12 billion reads per week. This level of activity required reliable high speed compute and storage coordination.

Deployment and Architecture Trends

- Cloud based HPC led new deployments in 2024 with a 59% share, supported by faster provisioning and elastic capacity. At the same time, on premises systems retained a 52.7% share of total market value due to strict security, compliance, and latency requirements.

- Hybrid and multi cloud architectures became standard practice, with more than 90% of large enterprises adopting these models by early 2026. This approach allowed organizations to balance control with scalability.

Infrastructure and Efficiency Metrics

- Hardware investment remained central, accounting for 58.4% of total spending, as organizations prioritized advanced processors and accelerators such as GPUs to improve computational performance.

- Energy consumption at leading supercomputing facilities averaged around 23 MW, while adoption of liquid cooling technologies improved thermal efficiency by up to 31% by late 2025.

- Storage utilization levels stayed exceptionally high in research intensive environments, with leading HPC systems operating above 95% utilization, reflecting continuous workload demand and optimized resource management.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Growth of data intensive research Large scale simulations and scientific datasets ~4.8% North America, Europe Short to Mid Term Expansion of national supercomputing programs Government funded HPC infrastructure ~3.9% North America, Asia Pacific Mid Term Rising AI and ML workloads High throughput data ingestion and storage ~3.4% Global Short Term Transition to hybrid HPC environments On premise and cloud data orchestration ~3.1% Global Mid Term Need for data lifecycle optimization Cost control and performance efficiency ~2.6% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Storage cost escalation Rapid growth of unstructured data ~3.7% Global Short Term Data movement bottlenecks Network and I O limitations ~3.0% Global Mid Term Security and access control risks Sensitive research data protection ~2.6% Global Short to Mid Term Integration complexity Compatibility with diverse HPC stacks ~2.1% Global Mid Term Skills shortage Limited expertise in HPC data platforms ~1.7% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High deployment cost Capital intensive storage and networking ~4.2% Emerging Markets Short to Mid Term Legacy infrastructure Aging file systems and storage arrays ~3.4% Global Mid Term Limited budget flexibility Research funding constraints ~2.8% Academic institutions Short Term Data governance complexity Compliance and access management ~2.1% North America, Europe Long Term Vendor lock in Dependence on proprietary platforms ~1.6% Global Long Term By Component

Solutions account for 67.4%, showing that software platforms are central to HPC data management. These solutions handle data storage, movement, and access across high-performance computing environments. Organizations rely on solutions to manage large data volumes efficiently. Centralized platforms improve visibility and control over data workflows. Reliability and performance remain key requirements.

The dominance of solutions is driven by the complexity of HPC workloads. Users require tools that can manage data at scale without disruption. Solutions support automation and policy-based management. They also integrate with existing compute infrastructure. This sustains strong adoption of solution-based components.

By Data Type

Unstructured data holds 72.8%, making it the dominant data type in HPC environments. Research and simulations generate large volumes of files, images, and logs. Managing unstructured data requires specialized tools. Efficient handling improves processing speed and storage utilization. Data organization remains a challenge.

Growth in unstructured data is driven by advanced research activities. Scientific and technical workloads produce diverse data formats. HPC systems rely on data management platforms to organize and access this data. Improved data handling supports faster analysis. This keeps unstructured data management critical.

By Deployment Model

On-premises deployment accounts for 58.9%, reflecting preference for local control. HPC environments often require dedicated infrastructure for performance and security. On-premises systems provide predictable latency and bandwidth. Organizations maintain full ownership of data. Control remains a priority.

Adoption of on-premises deployment is driven by security and compliance needs. Sensitive research data is often stored locally. On-premises systems support customization based on workload requirements. Organizations prefer stable environments for long-term projects. This sustains strong on-premises usage.

By Organization Size

Large enterprises represent 83.5%, highlighting their dominance in the market. These organizations operate large-scale HPC systems. Managing massive data sets requires advanced platforms. Large enterprises invest in robust data management solutions. Scale increases demand for reliability.

Adoption among large enterprises is driven by research and innovation goals. These organizations handle complex simulations and analytics. Data management tools support operational efficiency. Integration across departments improves collaboration. This sustains strong enterprise participation.

By End-User Industry

Academic and government research accounts for 42.7%, making it the leading end-user segment. Research institutions rely heavily on HPC systems. Data management supports scientific discovery and analysis. Reliable access to data is essential. Performance and accuracy remain critical.

Industry Vertical Primary Use Case Adoption Share (%) Adoption Maturity Academic and government research Scientific simulations and modeling 42.7% Advanced Climate and environmental science Large scale data modeling 17.9% Advanced Healthcare and life sciences Genomics and drug discovery 15.4% Developing Manufacturing and engineering Product simulation and testing 13.1% Developing Energy and utilities Reservoir and grid analytics 10.9% Developing Growth in this segment is driven by research funding and data-intensive projects. Institutions generate large volumes of experimental data. HPC data management tools support long-term storage and retrieval. Collaboration across research teams benefits from organized data. This supports continued adoption.

By Region And Driver Comparison

North America accounts for 38.2%, supported by advanced research infrastructure. The region hosts numerous HPC facilities. Investment in computing and data systems remains strong. Digital research initiatives support market growth. The region remains a major contributor.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn, 2025) Adoption Maturity North America Federal research funding and AI workloads 38.2% USD 14.37 Bn Advanced Europe Collaborative scientific computing programs 27.4% USD 10.31 Bn Advanced Asia Pacific Expansion of national HPC centers 25.6% USD 9.63 Bn Developing to Advanced Latin America Academic HPC modernization 5.1% USD 1.92 Bn Developing Middle East and Africa Early stage research infrastructure 3.7% USD 1.39 Bn Early For instance, in November 2025, Seagate Technology plc, advanced HAMR-based Mozaic platform with 36TB Exos M HDD shipments ramping, targeting AI/HPC needs with plans for 60TB models. These drives provide cost-effective, high-capacity storage essential for massive datasets in North American data centers.

The United States reached USD 12.90 Billion with a CAGR of 16.94%, reflecting strong expansion. Growth is driven by increased HPC adoption across sectors. Research and enterprise use continue to rise. Data management remains a priority. Market momentum stays positive.

For instance, in December 2025, Hewlett Packard Enterprise (HPE) expanded its NVIDIA AI Computing portfolio with new secure, scalable AI factory solutions and launched the first AI Factory Lab in the EU for sovereign AI testing. These innovations deliver full-stack AI infrastructure for diverse workloads, including HPC data management, reinforcing U.S. leadership in high-performance computing.

Investment Opportunities

Investment opportunities in the HPC data management market exist in software platforms that integrate storage, networking, and compute orchestration. Solutions that simplify management across hybrid and multi site HPC environments are gaining attention. Scalability and interoperability are key value drivers. These platforms align with growing complexity in HPC deployments.

Another opportunity lies in cloud integrated HPC data management solutions. Organizations increasingly combine on premises HPC with cloud resources. Data management tools that support seamless data movement between environments are in demand. Investment in hybrid data management capabilities offers strong growth potential.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Academic and government research bodies Very High ~42.7% Large scale scientific data handling Long term infrastructure funding National laboratories High ~24% Mission critical simulations Capital intensive investment Cloud service providers High ~16% Hybrid HPC data services Platform expansion Large enterprises Moderate ~11% AI and analytics workloads Selective adoption Research consortia Low to Moderate ~6% Shared computing resources Grant driven programs Business Benefits

Adoption of HPC data management solutions improves operational efficiency and system utilization. Optimized data workflows reduce idle compute time and resource waste. Organizations can complete workloads faster and at lower cost. These benefits improve overall HPC economics.

HPC data management also supports long term data value creation. Properly managed datasets can be reused for future research and analysis. This reduces duplication of effort and storage inefficiencies. Long term benefits include improved research outcomes and cost control.

Regulatory Environment

The regulatory environment for the HPC data management market is influenced by data protection and data sovereignty requirements. Many HPC workloads involve sensitive scientific, defense, or personal data. Organizations must ensure compliance with regional data handling laws. Secure data management is essential for regulatory adherence.

Industry specific regulations also affect adoption in healthcare, finance, and government sectors. Requirements for auditability, access control, and data retention must be met. HPC data management platforms support compliance through logging and governance features. Alignment with regulatory standards supports trust and sustained market growth.

Emerging Trends

In the high-performance computing data management market, one trend is the integration of scalable storage systems designed to support very large datasets. Organisations using HPC infrastructures are increasingly linking high-capacity storage with fast retrieval capabilities so that simulations, analyses, and real-time modelling can access needed information without delay. This shift helps maintain computational performance as data volumes expand.

Another emerging trend is the adoption of unified data management frameworks that bridge traditional file systems, object storage, and parallel file access. These systems allow HPC applications to read and write data efficiently without requiring specialised handling for different storage types. The result is smoother data workflows and improved consistency across analytical processes.

Growth Factors

A key growth factor in this market is the continued increase in data generated by scientific research and engineering applications. Fields such as genomics, climate modelling, material science, and particle physics produce massive datasets that must be organised, stored, and retrieved effectively. As the demand for processing larger data volumes grows, so do needs for robust HPC data management solutions.

Another important factor supporting growth is the expansion of data-driven industries that depend on rapid analysis and simulation results. Sectors such as automotive engineering, aerospace design, finance, and energy use HPC systems to model scenarios and assess outcomes quickly. Effective data management makes it possible for these industries to handle complex inputs and outputs without bottlenecks.

Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status Parallel file systems High throughput data access ~5.2% Mature High performance storage Fast read write for simulations ~4.1% Growing Data orchestration software Automated data placement and movement ~3.3% Growing Cloud data gateways Hybrid HPC data access ~2.9% Developing AI driven data optimization Predictive tiering and caching ~2.8% Developing Technology Maturity Roadmap

Technology Stage Key Focus Area Adoption Level (%) Timeframe Mature Traditional HPC file systems 41% Current Growth Scalable object and parallel storage 29% Short Term Emerging AI assisted data lifecycle management 18% Mid Term Early Fully automated data fabrics 8% Mid to Long Term Experimental Autonomous HPC data ecosystems 4% Long Term Key Market Segments

By Component

- Solutions

- File & Object Storage Systems

- Hierarchical Storage Management

- Data Integration & Movement Tools

- Metadata & Catalog Management

- Others

- Services

- Professional Services

- Managed Services

- Support & Maintenance

- Others

By Data Type

- Structured Data

- Unstructured Data

- Semi-structured Data

By Deployment Model

- On-premises

- Cloud-based

- Hybrid

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By End-User Industry

- Academic & Government Research

- Manufacturing & Engineering

- Banking, Financial Services, and Insurance

- Healthcare & Life Sciences

- Media & Entertainment

- Energy & Utilities

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Hewlett Packard Enterprise Company, Dell Technologies, Inc., and International Business Machines Corporation lead the HPC data management market by delivering high performance storage, data orchestration, and scalable infrastructure for compute intensive workloads. Their solutions support large scale simulations, AI training, and scientific research environments. These companies focus on low latency access, parallel file systems, and reliability.

NetApp, Inc., Hitachi, Ltd., Fujitsu Limited, DDN Storage, and Panasas, Inc. strengthen the market with advanced data management platforms optimized for HPC and AI workloads. Their offerings enable fast data ingestion, intelligent tiering, and efficient data movement across clusters. These providers emphasize performance optimization and scalability. Rising data volumes in research and enterprise HPC environments support wider adoption.

Seagate Technology plc, Western Digital Corporation, Pure Storage, Inc., Qumulo, Inc., and Microsoft Corporation expand the landscape with high density storage, flash based systems, and cloud integrated data management solutions. Their technologies support hybrid HPC models and data intensive analytics. These companies focus on flexibility and cost efficiency. Increasing convergence of HPC, AI, and cloud computing continues to drive steady growth in the HPC data management market.

Top Key Players in the Market

- Hewlett Packard Enterprise Company

- Dell Technologies, Inc.

- International Business Machines Corporation

- NetApp, Inc.

- Hitachi, Ltd.

- Fujitsu Limited

- DDN Storage

- Panasas, Inc.

- Datalight, Inc.

- Seagate Technology plc

- Western Digital Corporation

- Pure Storage, Inc.

- Qumulo, Inc.

- Axiado Corporation

- Microsoft Corporation

- Others

Recent Developments

- In November 2025, Dell was named a 2025 market and innovation leader for file and object storage tailored for AI and HPC. PowerScale platforms deliver massive throughput and low-latency access, scaling from terabytes to exabytes with energy-efficient designs that keep GPUs fully utilized in demanding workloads.

- In October 2025, IBM enhanced its Spectrum Scale for HPC data management, integrating AI-driven analytics to streamline petabyte-scale data handling. Recent deployments emphasize hybrid cloud support and real-time processing, positioning IBM as a go-to for complex scientific simulations.

Report Scope

Report Features Description Market Value (2025) USD 37.6 Bn Forecast Revenue (2035) USD 201.9 Bn CAGR(2025-2035) 18.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions, Services), By Data Type (Structured Data, Unstructured Data, Semi-structured Data), By Deployment Model (On-premises, Cloud-based, Hybrid), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By End-User Industry (Academic & Government Research, Manufacturing & Engineering, Banking, Financial Services, and Insurance, Healthcare & Life Sciences, Media & Entertainment, Energy & Utilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Hewlett Packard Enterprise Company, Dell Technologies, Inc., International Business Machines Corporation, NetApp, Inc., Hitachi, Ltd., Fujitsu Limited, DDN Storage, Panasas, Inc., Datalight, Inc., Seagate Technology plc, Western Digital Corporation, Pure Storage, Inc., Qumulo, Inc., Axiado Corporation, Microsoft Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  HPC Data Management MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

HPC Data Management MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Hewlett Packard Enterprise Company

- Dell Technologies, Inc.

- International Business Machines Corporation

- NetApp, Inc.

- Hitachi, Ltd.

- Fujitsu Limited

- DDN Storage

- Panasas, Inc.

- Datalight, Inc.

- Seagate Technology plc

- Western Digital Corporation

- Pure Storage, Inc.

- Qumulo, Inc.

- Axiado Corporation

- Microsoft Corporation

- Others