Global Hospital Capacity Management Solution Market By Product Type (Asset Management (Bed Management, and Medical Equipment Management), Patient Flow Management Solutions, Nursing & Staff Scheduling Solutions (Workforce Management, and Leave and Absence Management), and Patient Care Management), By Delivery Mode (Web-based, Cloud-based, and On-premises), By Component (Software and Services), By End-user (Hospitals, ASCs, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159103

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

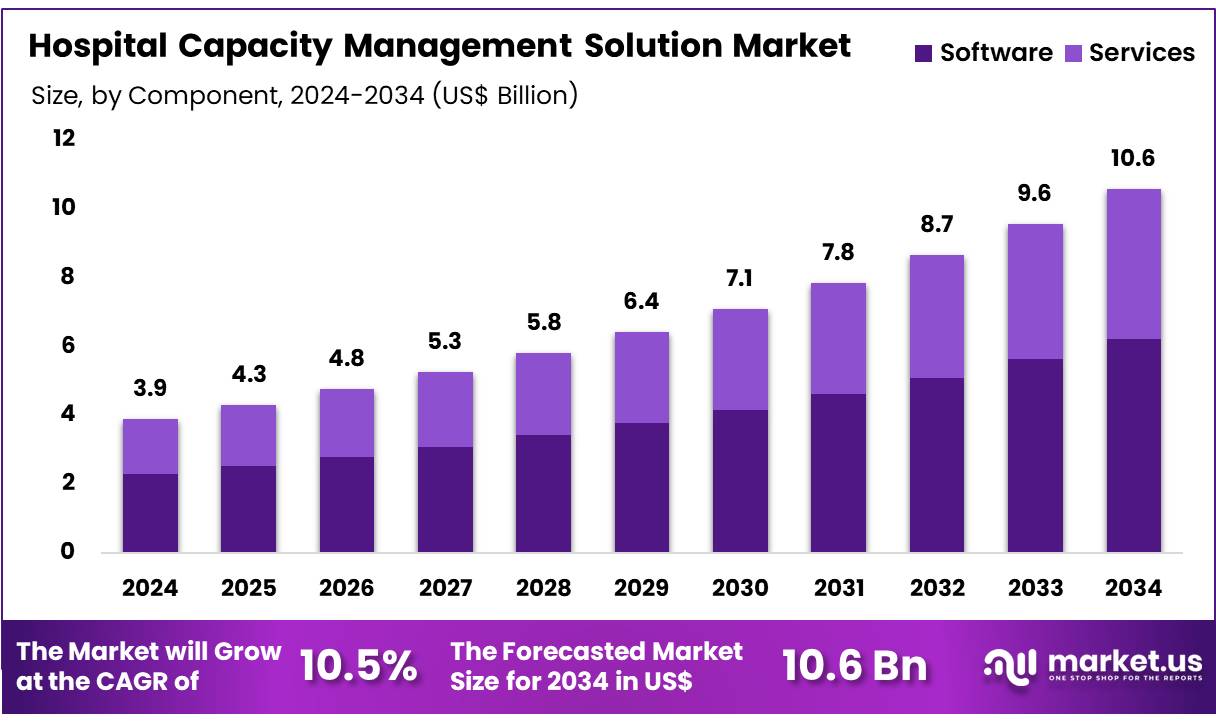

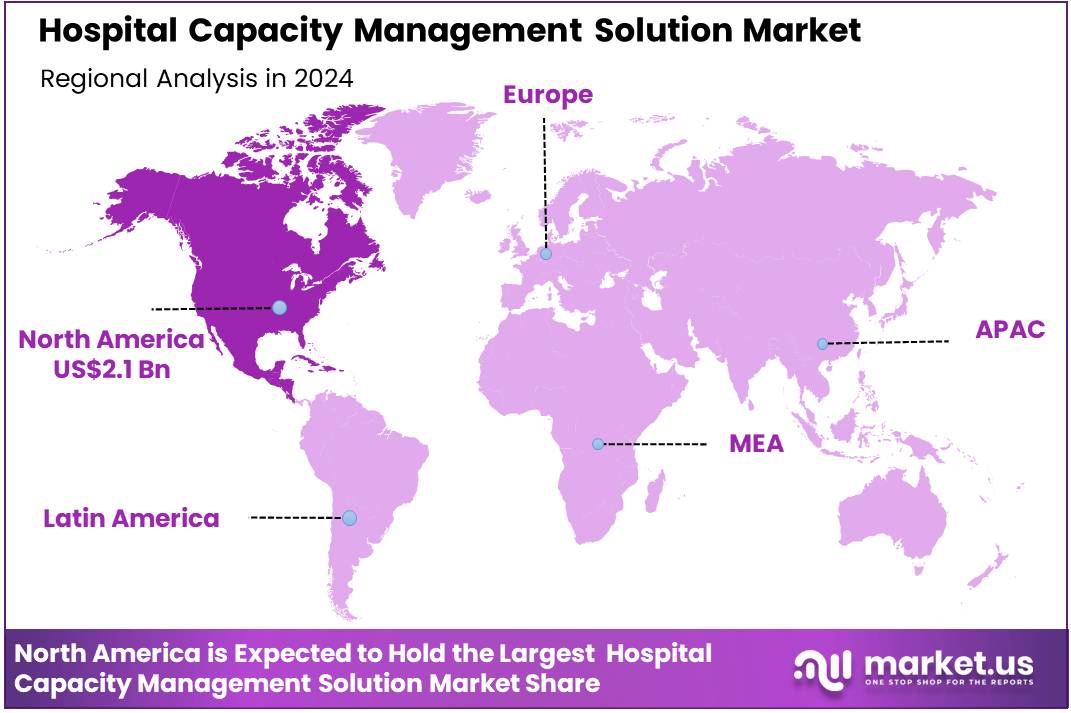

Global Hospital Capacity Management Solution Market size is expected to be worth around US$ 10.6 Billion by 2034 from US$ 3.9 Billion in 2024, growing at a CAGR of 10.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 53.3% share with a revenue of US$ 2.1 Billion.

The hospital capacity management solution market is experiencing significant growth as healthcare systems face increasing service demands. Challenges such as overcrowding and limited resources are pressing issues for administrators, and advanced solutions are being implemented to optimize hospital operations, particularly in bed allocation and patient admissions. These systems are designed to reduce emergency department wait times by up to 30%, leading to better patient experiences and more efficient care delivery.

As staffing shortages continue to impact hospital operations, the need for effective management solutions becomes even more critical. Software platforms are being used to streamline shift scheduling, ensuring optimal nurse-to-patient ratios, especially in high-acuity areas like critical care. These tools also support discharge planning, predict bed availability, and reduce delays in patient transitions. Coordination in surgical suites, especially for complex procedures like organ transplants, is another area where these solutions play a vital role, enhancing operational efficiency across clinical environments.

The growing incorporation of artificial intelligence (AI) is providing new opportunities in this sector. AI-powered tools are increasingly used to predict patient admissions, enabling healthcare providers to allocate resources more effectively, particularly in outpatient clinics. For example, LeanTaaS launched its iQueue Autopilot in June 2023, a generative AI solution that optimizes patient flow and staffing in inpatient settings.

AI also helps maximize the use of diagnostic equipment, such as MRI and CT scanners, improving efficiency. Platforms that use AI for workforce analytics help predict staffing needs, especially in high-demand areas like pediatric care during peak periods. With the American Hospital Association projecting a shortage of 100,000 healthcare workers by 2028, AI-driven solutions are set to revolutionize resource management in healthcare.

Recent trends show a clear movement toward AI integration and strategic partnerships to enhance operational flexibility. For instance, ShiftMed partnered with Hennepin Healthcare in September 2023 to implement on-demand W-2 workforce solutions, improving staffing efficiency. In April 2024, ShiftMed also collaborated with Children’s Minnesota to address staffing gaps in pediatric care. These collaborations highlight the growing demand for flexible staffing solutions in specialized healthcare settings and demonstrate the shift toward intelligent, patient-focused systems that improve both hospital operations and patient outcomes.

Key Takeaways

- In 2024, the market generated a revenue of US$ 3.9 Billion, with a CAGR of 10.5%, and is expected to reach US$ 10.6 Billion by the year 2034.

- The product type segment is divided into asset management, patient flow management solutions, nursing & staff scheduling solutions, and patient care management, with asset management taking the lead in 2023 with a market share of 28.3%.

- Considering delivery mode, the market is divided into web-based, cloud-based, and on-premises. Among these, web-based held a significant share of 39.2%.

- Furthermore, concerning the component segment, the market is segregated into software and services. The software sector stands out as the dominant player, holding the largest revenue share of 58.7% in the market.

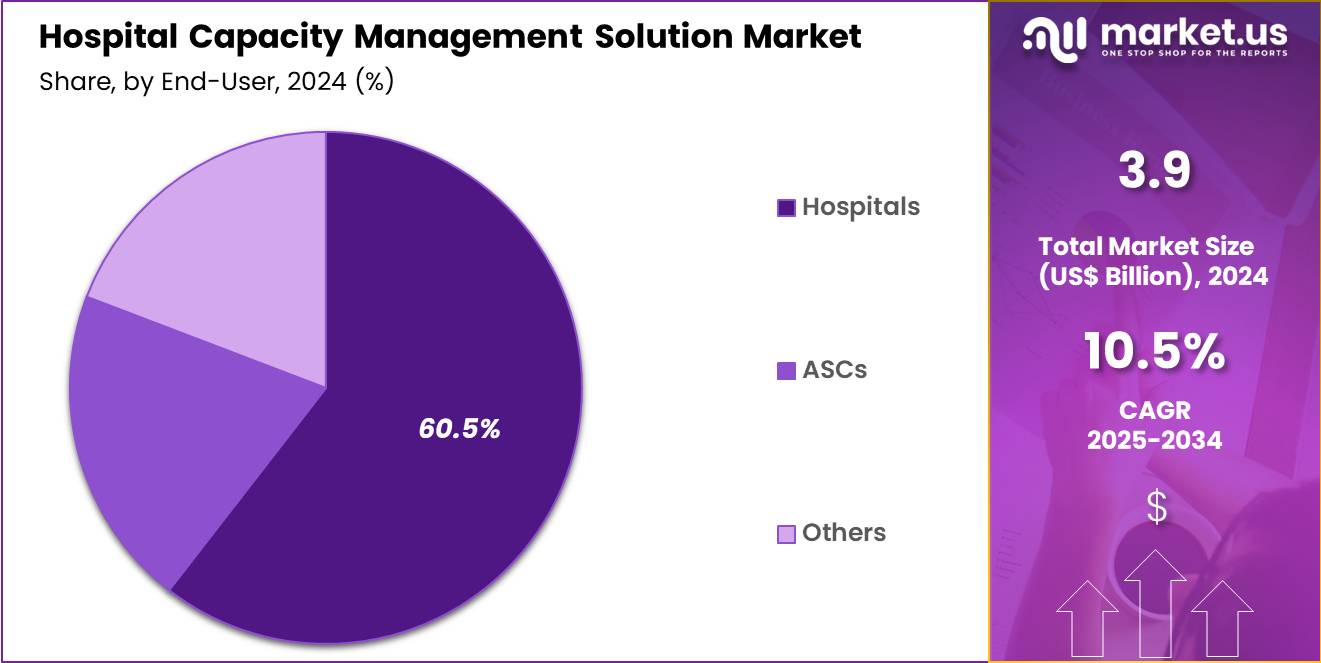

- The end-user segment is segregated into hospitals, ASCs, and others, with the hospitals segment leading the market, holding a revenue share of 60.5%.

- North America led the market by securing a market share of 53.3% in 2023.

Product Type Analysis

Asset management holds the largest share in the product type segment at 28.3%. This segment’s growth is driven by the increasing need for healthcare facilities to track, manage, and optimize their assets, including medical equipment and physical resources. With the complexity of modern healthcare, hospitals require more sophisticated asset management systems to ensure the availability of critical equipment when needed, minimize downtime, and reduce overall operational costs.

As the healthcare industry embraces the Internet of Things (IoT) and artificial intelligence (AI), these technologies enable predictive maintenance, real-time asset tracking, and streamlined operations, making asset management systems more efficient and cost-effective. The growing pressure to improve resource management, combined with increasing patient care demands, is driving the expansion of asset management solutions across healthcare facilities, which will likely continue to dominate the market.

Delivery Mode Analysis

Web-based solutions account for 39.2% of the delivery mode segment. The preference for web-based systems has grown significantly due to their flexibility, scalability, and ease of use. These solutions enable healthcare professionals to access hospital capacity management tools from virtually any location, providing greater operational flexibility. This is especially critical for healthcare systems with multiple locations or decentralized operations.

Web-based systems also offer real-time data exchange, easy integration with existing hospital information systems, and more frequent updates without requiring costly infrastructure changes. As hospitals and healthcare providers continue to adopt digital technologies to streamline operations, web-based delivery models are expected to remain highly popular. The flexibility and reduced maintenance costs associated with web-based systems make them particularly attractive to healthcare institutions, ensuring their continued dominance in the market.

Component Analysis

Software dominates the component segment with a significant share of 58.7%. As healthcare continues to adopt digital solutions to improve efficiency and patient outcomes, the demand for comprehensive software platforms that manage various aspects of hospital capacity is increasing. These software solutions enable healthcare providers to manage patient flow, track medical assets, and optimize staffing and operational workflows.

Additionally, the integration of artificial intelligence and machine learning algorithms into these software systems allows for data-driven decision-making, predictive analytics, and enhanced resource allocation. The shift toward cloud-based solutions further drives the adoption of software, offering hospitals a more scalable, cost-efficient, and flexible approach to capacity management. As hospitals and healthcare organizations increasingly focus on improving operational efficiencies and patient care, software solutions are expected to continue playing a central role in hospital capacity management, ensuring their market share remains strong.

End-User Analysis

Hospitals represent the largest share in the end-user segment with 60.5%. This dominance can be attributed to the increasing reliance of hospitals on digital tools to optimize operations and improve patient care. Hospital capacity management solutions are essential for managing patient flow, staff scheduling, and medical equipment availability, especially during times of peak demand. As hospitals continue to face challenges such as resource constraints and increasing patient volumes, the adoption of these solutions is critical to improving patient outcomes and operational efficiency.

The ability to make real-time decisions, optimize resource utilization, and streamline clinical workflows is a key factor in the growth of this segment. Hospitals are expected to continue investing in these solutions to meet the growing demand for healthcare services, enhance collaboration among medical professionals, and provide timely, quality care to their patients. As the healthcare sector places more emphasis on digital transformation, hospitals will continue to be the primary end-users of capacity management solutions, contributing to the segment’s sustained growth.

Key Market Segments

By Product Type

- Asset Management

- Bed Management

- Medical Equipment Management

- Patient Flow Management Solutions

- Nursing & Staff Scheduling Solutions

- Workforce Management

- Leave and Absence Management

- Patient Care Management

By Delivery Mode

- Web-based

- Cloud-based

- On-premises

By Component

- Software

- Services

By End-user

- Hospitals

- ASCs

- Others

Drivers

The rising demand for healthcare services is driving the market.

The market for hospital capacity management solutions is being driven by the increasing strain on hospital resources, which has been exacerbated by rising patient volumes, an aging population, and staffing shortages. Hospitals are facing immense pressure to optimize their operations to improve patient throughput, reduce wait times, and enhance the overall quality of care.

Capacity management software provides the tools to address these challenges by offering real-time visibility into bed availability, staff assignments, and patient flow across various departments, from the emergency room to inpatient wards. This enables hospital administrators to make data-driven decisions that can improve efficiency and prevent bottlenecks.

The necessity for these solutions is underscored by the reality of hospital utilization. A 2024 analysis of hospital data found that national hospital occupancy remained at an average of over 75% throughout 2023, a persistently elevated level that places significant stress on existing resources and drives the need for more efficient management tools.

Restraints

High costs and complexity of integration are restraining the market.

A significant restraint on the hospital capacity management solution market is the high cost of implementation and the complexity of integrating these solutions into a hospital’s legacy IT infrastructure. Many hospitals operate with a fragmented and outdated mix of information systems, including electronic health records (EHRs), patient portals, and lab systems. Integrating a new capacity management solution with these disparate systems is a major technical and financial challenge.

It often requires significant customization, extensive data migration, and a lengthy implementation period that can disrupt daily operations. For smaller hospitals or those with limited IT budgets, the capital expenditure and the risk of a failed integration are often too high to justify the investment.

A 2023 report from a key industry player, Oracle Health, indicated that its services revenue, which includes complex implementation and support for its hospital management solutions, was a major component of its overall financial performance. The complexity of these projects is a key part of the value proposition for the company, but also a barrier for many potential customers who are not able to bear the associated costs.

Opportunities

The shift to value-based care is creating growth opportunities.

A key growth opportunity for the hospital capacity management solution market lies in the healthcare industry’s shift toward value-based care models. Under this model, providers are reimbursed based on patient outcomes and care quality rather than the volume of services they provide. This transition creates a powerful incentive for hospitals to improve their operational efficiency, reduce preventable readmissions, and enhance patient satisfaction all of which can be directly improved by effective capacity management..

By ensuring timely access to beds, reducing emergency department wait times, and streamlining discharge planning, hospitals can improve their performance metrics and secure higher reimbursements. This opportunity is supported by strong government initiatives. According to the Centers for Medicare & Medicaid Services (CMS), there were 480 Accountable Care Organizations (ACOs) taking part in the Medicare Shared Savings Program as of January 2024. The program, which aims to improve care quality and lower costs, provides a clear financial incentive for hospitals to adopt technologies that help them manage their capacity and improve patient flow.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly shape the hospital capacity management market, presenting both challenges and opportunities for strategic adaptation. Persistent global inflation erodes healthcare providers’ budgets, compelling executives to defer investments in AI-enhanced platforms that optimize bed occupancy and staff scheduling. Economic slowdowns in emerging regions like Asia-Pacific restrict funding for cloud-based solutions integrating emergency workflows.

Geopolitical tensions, including U.S.-China trade frictions and Red Sea shipping disruptions, elevate costs for processors and secure networking components essential to these systems. These pressures delay software updates and complicate HIPAA compliance efforts. However, the rising prevalence of chronic diseases and increasing patient volumes intensify demand for efficient resource orchestration, driving market expansion. Vendors respond by developing hybrid architectures and partnering with stable suppliers in regions like Ireland to mitigate risks. These initiatives enhance operational resilience and patient throughput.

Current U.S. tariffs reshape the hospital capacity management market by intensifying cost pressures while fostering domestic innovation. The April 2025 baseline 10% tariff on all imports, coupled with up to 145% duties on Chinese electronics, inflates expenses for servers and IoT devices critical to real-time analytics, compressing margins for vendors like Epic Systems. Health systems postpone platform upgrades, perpetuating inefficiencies in surgical queue management.

Retaliatory measures from trading partners disrupt firmware deliveries, delaying rural implementations. Nevertheless, these policies accelerate U.S. onshoring, with firms expanding facilities to leverage CHIPS Act subsidies and create specialized jobs. Collaborative efforts with domestic tech providers expedite secure, modular deployments. By negotiating exemptions for core components, the industry transforms challenges into catalysts for efficiency and sustained growth.

Latest Trends

The integration of predictive analytics and AI is a recent trend.

A major trend in the hospital capacity management solution market in 2024 is the integration of predictive analytics and artificial intelligence (AI) to optimize patient flow and resource allocation. While earlier solutions provided real-time visibility, the new generation of platforms leverages AI to forecast patient demand based on historical data, seasonal trends, and even real-time weather events. These tools can predict bed needs for the coming hours or days, optimize staff scheduling, and automate discharge planning to prevent bottlenecks before they occur. This moves the technology from a reactive to a proactive tool. This trend is demonstrated by the rapid growth of AI-related patents.

An analysis of patenting statistics from the U.S. Patent and Trademark Office (USPTO) in 2024 showed a significant increase in patents for AI-driven medical technologies, with a strong focus on hospital operations and management. This surge in innovation reflects a clear strategic shift by technology companies toward creating more intelligent and proactive solutions for the healthcare sector.

Regional Analysis

North America is leading the Hospital Capacity Management Solution Market

In 2024, North America held a 53.3% share of the global hospital capacity management solution market, driven by persistent healthcare workforce shortages and rising patient volumes that necessitated advanced tools for optimizing bed utilization and patient throughput. Hospitals increasingly implemented real-time location systems and predictive analytics to mitigate emergency department overcrowding, enabling faster discharges and reducing average length of stay in high-acuity units.

Regulatory pressures from bodies like the Centers for Medicare & Medicaid Services emphasized value-based care, prompting investments in integrated platforms that forecast demand and allocate resources efficiently across networked facilities. The surge in chronic disease management post-pandemic further accelerated adoption, as solutions incorporating remote monitoring alleviated inpatient burdens by shifting care to outpatient settings.

Academic health systems collaborated with vendors to customize dashboards for interdisciplinary teams, enhancing operational resilience during seasonal flu spikes and unexpected surges. Economic incentives, including federal grants for digital infrastructure, supported mid-tier hospitals in transitioning to cloud-based systems without prohibitive upfront costs. This strategic emphasis on data-driven decision-making solidified the region’s dominance in streamlining workflows and improving financial outcomes.

According to the National Center for Biotechnology Information, there was a 40.2% increase in the number of hospitals offering remote patient monitoring services from 2018 to 2022, rising from 33.0% to 46.3%. Additionally, the Centers for Medicare & Medicaid Services reported outlays of approximately US$1,516 billion in fiscal year 2024, net of offsetting receipts and payments to healthcare trust funds, underscoring substantial federal support for capacity-enhancing initiatives.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project the Asia Pacific hospital capacity management solution sector to expand substantially during the 2024-2030 forecast period, propelled by escalating urbanization and aging demographics that strain existing infrastructure in populous nations. Regional authorities prioritize digital upgrades in public facilities, compelling administrators to integrate bed-tracking software for real-time occupancy optimization amid chronic bed shortages. Biopharmaceutical collaborators anticipate partnering with local tech firms to embed AI forecasting models, expediting resource allocation during infectious disease outbreaks.

Innovation centers in Australia and Singapore foster scalable platforms that synchronize with national electronic records, empowering rural hospitals to manage transfers without delays. India’s expanding universal health schemes expect to harness cloud analytics for workforce scheduling, addressing disparities in specialist availability across states. China’s centralized reforms likely accelerate deployment of unified dashboards in tiered hospitals, facilitating proactive surge planning for seasonal demands.

Japan anticipates leveraging IoT-enabled tools to enhance elderly care coordination, minimizing unnecessary admissions through home-based monitoring. These concerted efforts establish the region as a frontrunner in resilient, tech-infused healthcare delivery. In 2022–23, health expenditure on hospitals in Australia increased by US$4.8 billion, representing a 4.7% rise in real terms compared to the previous year. Furthermore, state and territory governments in Australia contributed US$77.3 billion to overall health funding in 2022–23, marking a 5.9% increase from the prior year.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the hospital capacity management market drive growth by acquiring smaller firms to expand their technology offerings and gain larger market shares. They launch innovative products with AI and machine learning, enabling hospitals to optimize bed usage and predict patient demand accurately. These companies form partnerships with hospitals and tech firms to deliver customized solutions, speeding up adoption and creating shared value. They invest heavily in research to enhance platforms with predictive analytics and compatibility with existing systems.

Expansion into growing markets like Asia-Pacific and Latin America helps them adapt to local needs and regulations, strengthening their competitive edge. Additionally, they offer training programs and analytics services to build customer loyalty and ensure steady revenue through subscriptions.

Epic Systems Corporation, founded in 1979 and headquartered in Verona, Wisconsin, develops integrated software for healthcare providers, supporting patient care and operational efficiency for hospitals globally. Its platforms serve over 250 million patients yearly, helping clinicians and administrators streamline tasks and improve care quality. Epic focuses on innovations like telehealth and population health tools while prioritizing data security and ease of use.

Led by CEO Judy Faulkner, the employee-owned company emphasizes stability and long-term growth. Epic employs thousands in development and support roles, operating from a unique campus designed to foster collaboration. The firm continues to advance healthcare technology through customer-focused solutions.

Top Key Players

- WellSky

- ORTEC

- Oracle

- LeanTaaS

- IQVIA

- Infosys Limited

- Flatworld Solutions

- Epic Systems Corporation

- Dedalus

- Alcidion

Recent Developments

- In February 2025, WellSky introduced Resource Manager, a centralized workforce management platform designed to enhance home health and hospice care operations. By optimizing patient scheduling, clinician capacity, and routing, this platform streamlines resource allocation, contributing to growth in the Hospital Capacity Management Solution market by improving operational efficiency and patient care delivery.

- In July 2024, Qventus launched its third-generation Inpatient Solution, integrated directly into EHR workflows to improve hospital discharge planning and automate care coordination. This innovation enhances patient flow and optimizes hospital operations, driving the Hospital Capacity Management Solution market by improving discharge efficiency and reducing bottlenecks in inpatient care.

- In January 2023, LeanTaaS acquired Hospital IQ, merging their AI-driven capabilities to optimize capacity and workflows across U.S. health systems. This acquisition strengthens the Hospital Capacity Management Solution market by providing more advanced tools to address staffing shortages and improve resource allocation across healthcare settings.

Report Scope

Report Features Description Market Value (2024) US$ 3.9 Billion Forecast Revenue (2034) US$ 10.6 Billion CAGR (2025-2034) 10.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Asset Management (Bed Management, and Medical Equipment Management), Patient Flow Management Solutions, Nursing & Staff Scheduling Solutions (Workforce Management, and Leave and Absence Management), and Patient Care Management), By Delivery Mode (Web-based, Cloud-based, and On-premises), By Component (Software and Services), By End-user (Hospitals, ASCs, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape WellSky, ORTEC, Oracle, LeanTaaS, IQVIA, Infosys Limited, Flatworld Solutions, Epic Systems Corporation, Dedalus, Alcidion. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hospital Capacity Management Solution MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Hospital Capacity Management Solution MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- WellSky

- ORTEC

- Oracle

- LeanTaaS

- IQVIA

- Infosys Limited

- Flatworld Solutions

- Epic Systems Corporation

- Dedalus

- Alcidion