Hormone Replacement Therapy Market By Product Type (Estrogen & Progesterone Hormone Replacement Therapy, Thyroid Hormone Replacement Therapy, Human Growth Hormone Replacement Therapy, and Testosterone Hormone Replacement Therapy), By Route of Administration (Oral, Transdermal, Parenteral, and Others), By Application (Male Hypogonadism, Growth Hormone Deficiency, Menopause, Hypothyroidism, and Others), By Distribution Channel (Hospitals Pharmacies, Retail Pharmacies, and Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 131740

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Route of Administration Analysis

- Application Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Trends

- Regional Analysis

- Key Regions and Countries

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

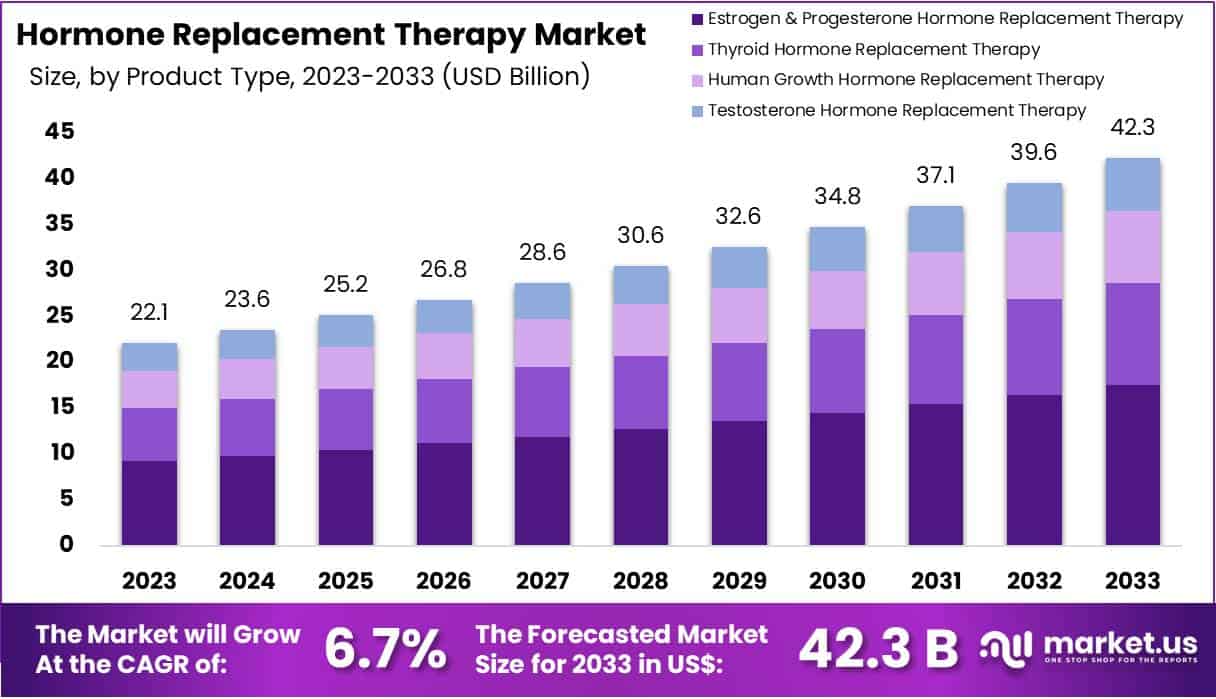

The Hormone Replacement Therapy Market Size is expected to be worth around US$ 42.3 billion by 2033 from US$ 22.1 billion in 2023, growing at a CAGR of 6.7% during the forecast period 2024 to 2033.

Growing demand for hormone replacement therapies (HRT) is driven by the increasing prevalence of hormonal imbalances due to aging, menopause, and growth disorders. HRT is widely used to treat conditions like menopause symptoms, hypothyroidism, and pediatric growth hormone deficiencies. In January 2022, Pfizer and OPKO Health received approval in Japan for NGENLA, a next-generation long-acting growth hormone injection requiring only a once-weekly dosage.

In June 2023, NGENLA received FDA approval for treating pediatric growth hormone deficiency, becoming available in the U.S. by August 2023. This innovation underscores the shift toward more convenient and effective hormone treatments. Opportunities in the market include advancements in bioidentical hormones and personalized therapies, addressing a broader range of endocrine disorders. Recent trends, such as the development of transdermal patches and gel formulations, are expanding the ways HRT can be delivered, improving patient compliance and outcomes.

Key Takeaways

- In 2023, the market for hormone replacement therapy generated a revenue of US$ 22.1 billion, with a CAGR of 6.7%, and is expected to reach US$ 42.3 billion by the year 2033.

- The product type segment is divided into estrogen & progesterone hormone replacement therapy, thyroid hormone replacement therapy, human growth hormone replacement therapy, and testosterone hormone replacement therapy, with estrogen & progesterone hormone replacement therapy taking the lead in 2023 with a market share of 41.6%.

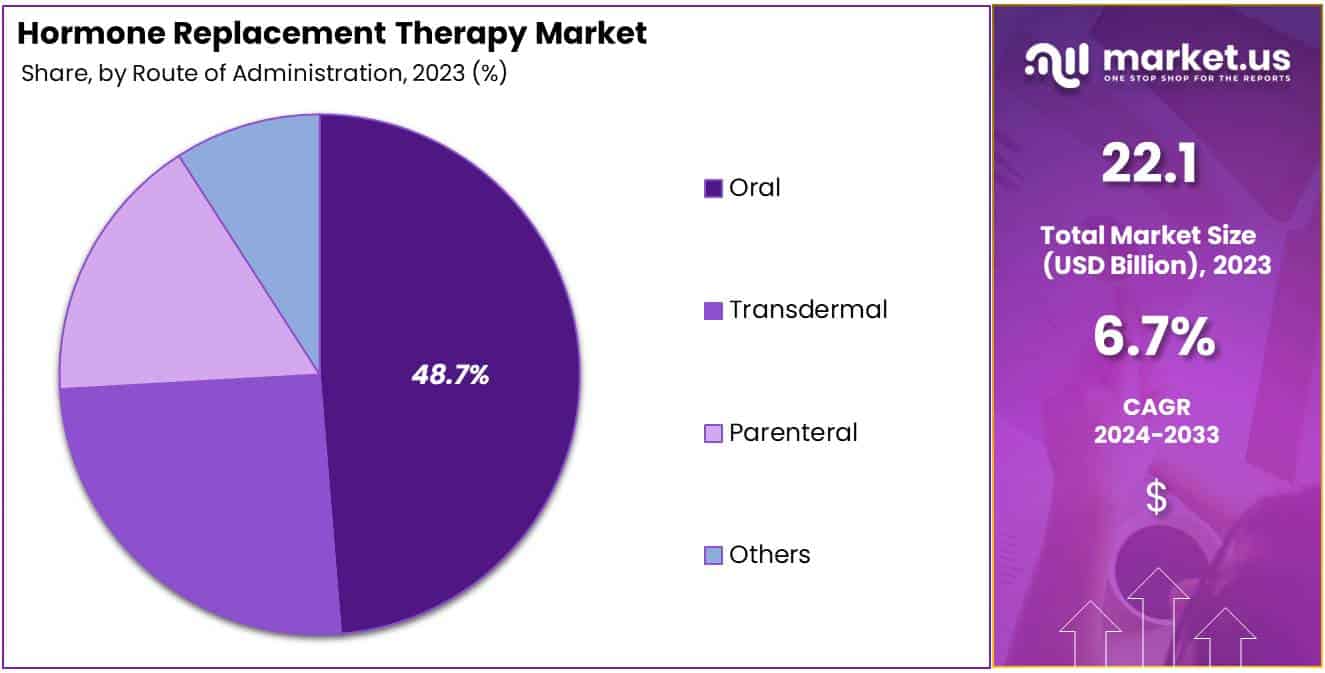

- Considering route of administration, the market is divided into oral, transdermal, parenteral, and others. Among these, oral held a significant share of 48.7%.

- Furthermore, concerning the application segment, the market is segregated into male hypogonadism, growth hormone deficiency, menopause, hypothyroidism, and others. The menopause sector stands out as the dominant player, holding the largest revenue share of 37.5% in the hormone replacement therapy market.

- The distribution channel segment is segregated into hospitals pharmacies, retail pharmacies, and online pharmacies, with the hospitals pharmacies segment leading the market, holding a revenue share of 52.8%.

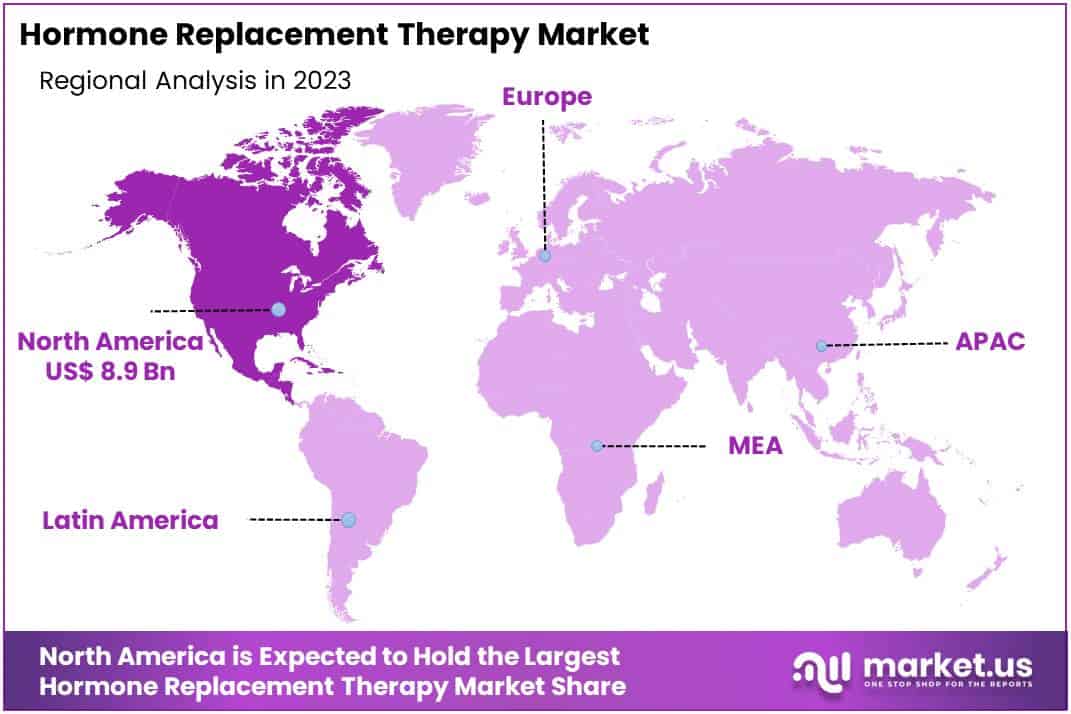

- North America led the market by securing a market share of 40.1% in 2023.

Product Type Analysis

The estrogen & progesterone hormone replacement therapy segment led in 2023, claiming a market share of 41.6% owing to the increasing prevalence of menopause and associated symptoms in women. Estrogen and progesterone therapies are anticipated to remain in high demand because they effectively manage symptoms such as hot flashes, night sweats, and osteoporosis prevention.

The rising awareness about the benefits of hormone replacement in improving the quality of life for postmenopausal women is expected to further drive growth. Additionally, advancements in combination therapies and their availability in various formulations are likely to enhance the segment’s expansion. The growing aging female population worldwide is also anticipated to fuel demand for these therapies.

Route of Administration Analysis

The oral held a significant share of 48.7% due to the convenience and ease of administration associated with oral formulations. Many patients prefer oral hormone replacement therapies as they offer a non-invasive route, which is likely to drive demand in this segment. The availability of a wide range of oral dosage forms, including tablets and capsules, is expected to further support growth.

Additionally, advancements in drug formulation technologies that improve the efficacy and bioavailability of oral hormone therapies are projected to contribute to the segment’s expansion. Increasing patient adherence to oral therapies, compared to other routes, also supports this trend.

Application Analysis

The menopause segment had a tremendous growth rate, with a revenue share of 37.5% owing to the rising number of women experiencing menopause and related symptoms. As awareness about menopause management increases, more women are likely to seek hormone replacement therapy to alleviate symptoms such as mood swings, hot flashes, and sleep disturbances.

The growing emphasis on women’s health, coupled with increased healthcare accessibility, is expected to further drive demand in this segment. Additionally, advancements in treatment options and personalized therapies are anticipated to support the adoption of hormone replacement therapies specifically for menopause, contributing to the segment’s growth.

Distribution Channel Analysis

The hospitals pharmacies segment grew at a substantial rate, generating a revenue portion of 52.8% due to the increasing number of hospital visits for hormone-related health issues and the availability of specialized care. Hospital pharmacies are likely to see rising demand as they provide access to both standard and advanced hormone replacement therapies, ensuring proper management of treatment by healthcare professionals.

The ability to offer patient counseling and monitor hormone therapy progress is anticipated to support the expansion of this segment. Additionally, the growing preference for hospital-based treatments, especially for complex hormone disorders, is projected to further boost the role of hospital pharmacies in this market.

Key Market Segments

By Product Type

- Estrogen & Progesterone Hormone Replacement Therapy

- Thyroid Hormone Replacement Therapy

- Human Growth Hormone Replacement Therapy

- Testosterone Hormone Replacement Therapy

By Route of Administration

- Oral

- Transdermal

- Parenteral

- Others

By Application

- Male Hypogonadism

- Growth Hormone Deficiency

- Menopause

- Hypothyroidism

- Others

By Distribution Channel

- Hospitals Pharmacies

- Retail Pharmacies

- Online Pharmacies

Drivers

Rising Number Of Patients With Menopause

Rising numbers of patients entering menopause are expected to drive the hormone replacement therapy market. As more women reach the menopausal stage, the demand for treatments that alleviate symptoms such as hot flashes, night sweats, and mood swings increases. According to the American Congress of Obstetricians and Gynecologists, approximately 6,000 women in the U.S. reach menopause daily, creating a large and consistent demand for hormone-related treatments.

Hormone replacement therapy offers a solution to manage the decline in estrogen and progesterone levels that accompanies menopause, improving the quality of life for many women. As the global population ages and more women enter this life stage, the market is projected to expand steadily.

Restraints

Rising Cost Of Treatments

Rising costs of treatment are anticipated to hamper the growth of the hormone replacement therapy market. The financial burden for patients is significant, with oral hormone therapies costing between USD 130 and 240 per month, resulting in annual expenses of USD 1,560 to 2,440.

Injectable therapies are even more expensive, with insured individuals paying between USD 288 to 1,440 annually, while uninsured individuals face costs ranging from USD 480 to 4,800 depending on the frequency of injections, which can range from 52 to 156 per year.

These high costs limit access to treatment, particularly for uninsured or underinsured individuals, creating a barrier to the broader adoption of hormone replacement therapies. As a result, price sensitivity continues to restrain the market, especially in regions with limited healthcare coverage.

Opportunities

Growing Trend Of Online Pharmacies

Growing popularity of online pharmacies presents a significant opportunity for the hormone replacement therapy market. The rise of digital healthcare platforms allows patients easier access to prescription medications, particularly for long-term treatments like hormone therapy. According to a June 2021 article by Invest India, there are approximately 50 online pharmacies in India, indicating a growing shift towards digital solutions in healthcare.

This opportunity not only enhances convenience for patients but also helps reduce the stigma associated with purchasing sensitive treatments like hormone therapy. As more individuals embrace online pharmacy platforms, especially in developing regions, the hormone replacement therapy market is projected to grow due to the increased accessibility and competitive pricing that these digital platforms offer.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions and geopolitical factors significantly influence the hormone replacement therapy market. Rising inflation and healthcare costs increase treatment expenses, making access to therapies challenging in price-sensitive regions. Economic downturns limit healthcare budgets and reduce the purchasing power of consumers, affecting demand.

Geopolitical instability and trade restrictions disrupt the supply chain, delaying the availability of critical medications and therapeutic devices. However, increasing healthcare investments in both developed and emerging economies positively impact the market, driving greater accessibility to therapies. Growing awareness of aging populations and the need for effective treatments fuel demand for hormone-related therapies. As governments prioritize healthcare improvements, the market for hormone replacement therapy is expected to experience sustained growth driven by both innovation and increasing patient demand.

Trends

Rising Approval Cases

Rising approval cases by government entities are anticipated to drive the growth of the hormone replacement therapy market. In April 2023, Novo Nordisk received FDA approval for an additional indication of Sogroya, targeting children over 2.5 years old with growth failure due to insufficient hormone secretion.

Similarly, in August 2021, Ascendis Pharma A/S gained FDA approval for SKYTROFA, a treatment for pediatric patients aged one year and older suffering from growth hormone deficiency, developed using TransCon technology. These approvals reflect the increasing regulatory support for innovative hormone therapies, improving patient access to critical treatments.

Growing governmental endorsements for new indications and therapies are projected to accelerate market expansion, benefiting patients and stimulating further research and development in hormone-related treatments.

Regional Analysis

North America is leading the Hormone Replacement Therapy Market

North America dominated the market with the highest revenue share of 40.1% owing to rising awareness and diagnosis of hormonal imbalances, including thyroid-related conditions. The increasing prevalence of thyroid disorders has played a key role in this market’s expansion. According to the American Thyroid Association, about 12% of the U.S. population is expected to suffer from thyroid issues during their lifetime, and approximately 20 million Americans are currently living with some form of thyroid disease.

As hormone therapies are essential for managing conditions like hypothyroidism and menopause, demand has surged. Furthermore, advancements in personalized HRT solutions and growing healthcare accessibility have supported market growth, particularly as more patients seek effective treatments for hormonal deficiencies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the increasing prevalence of menopause-related symptoms and growing awareness of HRT’s benefits. A study published by the North American Menopause Society in May 2022 indicated that vasomotor symptoms related to menopause, such as hot flashes and night sweats, affect 43% to 83% of women in East Asian countries.

This widespread prevalence is likely to fuel demand for HRT as more women seek relief from these symptoms. Additionally, improving healthcare infrastructure, expanding access to medical treatments, and the rising focus on women’s health in countries like China, Japan, and India are anticipated to further propel the adoption of hormone therapies across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the hormone replacement therapy market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the hormone replacement therapy market focus on developing personalized treatments that cater to the specific needs of patients, improving both efficacy and safety.

They invest in research and development to introduce new formulations and delivery methods, such as transdermal patches and gels, to enhance patient convenience. Collaborating with healthcare providers helps them raise awareness about treatment options and expand their patient base. Companies also target emerging markets by offering affordable solutions to address the growing demand for menopausal and hormonal health management. Additionally, they focus on gaining regulatory approvals and conducting clinical trials to ensure the effectiveness of their products.

Top Key Players in the Hormone Replacement Therapy Market

- TherapeuticsMD, Inc.

- Theramex

- Teva Pharmaceuticals

- Pfizer Inc.

- Myovant Sciences GmbH

- Mithra Pharmaceuticals

- Merck KGaA

- Halozyme

- Bayer AG

- Ascendis Pharma

Recent Developments

- In June 2023: Pfizer Inc. reintroduced DUAVEE, a hormone therapy for menopause containing conjugated estrogens and bazedoxifene, with enhanced packaging. This relaunch is relevant to the growth of the hormone replacement therapy (HRT) market as it reflects continued demand for menopause treatments and highlights efforts to improve product accessibility and user experience through better packaging.

- In June 2022: Halozyme announced the launch of Testosterone undecanoate (Tlando), an oral testosterone replacement therapy for men with hypogonadism, in the U.S. market. This introduction contributes to the HRT market’s growth by providing a convenient, oral option for testosterone replacement, addressing the needs of men with testosterone deficiencies.

- In January 2022: Ascendis Pharma A/S received market authorization from the European Commission for SKYTROFA, a treatment for growth hormone disorders in children and adolescents. This approval strengthens the HRT market by expanding available treatments for pediatric endocrine disorders, addressing a critical segment of the patient population.

- In October 2021: Theramex introduced Bijuva/Bijuve, the first body-identical hormone therapy for estrogen deficiency symptoms in post-menopausal women. This launch is significant for the HRT market as it provides a natural hormone therapy option, addressing the demand for more body-identical treatments for menopause symptoms.

- In May 2021: Myovant Sciences GmbH received approval from the U.S. FDA for Myfembree, a hormone therapy for uterine fibroid bleeding. This drug, with its dosing advantage, competes directly with existing treatments and bolsters the HRT market by offering new therapeutic options for women with uterine fibroids.

- In April 2021: TherapeuticsMD, Inc. and Theramex received regulatory approval for BIJUVE in the UK and Belgium. This approval supports the HRT market’s growth by expanding access to hormone replacement therapies for post-menopausal women, particularly with the introduction of body-identical hormone formulations.

Report Scope

Report Features Description Market Value (2023) US$ 22.1 Billion Forecast Revenue (2033) US$ 42.3 Billion CAGR (2024-2033) 6.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Estrogen & Progesterone Hormone Replacement Therapy, Thyroid Hormone Replacement Therapy, Human Growth Hormone Replacement Therapy, and Testosterone Hormone Replacement Therapy), By Route of Administration (Oral, Transdermal, Parenteral, and Others), By Application (Male Hypogonadism, Growth Hormone Deficiency, Menopause, Hypothyroidism, and Others), By Distribution Channel (Hospitals Pharmacies, Retail Pharmacies, and Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape TherapeuticsMD, Inc., Theramex , Teva Pharmaceuticals, Pfizer Inc. , Myovant Sciences GmbH , Mithra Pharmaceuticals, Merck KGaA, Halozyme , Bayer AG, and Ascendis Pharma. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hormone Replacement Therapy MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Hormone Replacement Therapy MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- TherapeuticsMD, Inc.

- Theramex

- Teva Pharmaceuticals

- Pfizer Inc.

- Myovant Sciences GmbH

- Mithra Pharmaceuticals

- Merck KGaA

- Halozyme

- Bayer AG

- Ascendis Pharma