Global Homeopathic Products Market By Product Type (Dilutions, Tablets, Tincture, and Others), By Application (Analgesic & Antipyretic, Neurology, Respiratory, and Others), By Source (Plants, Animals, and Minerals), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145039

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

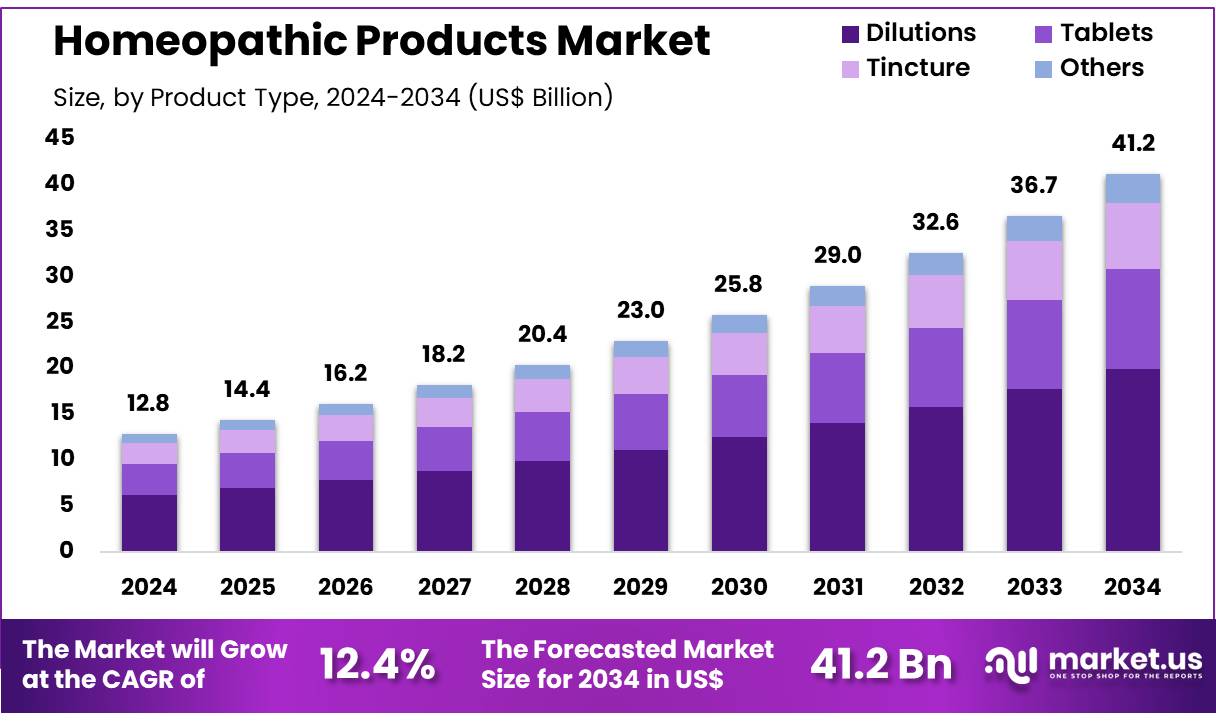

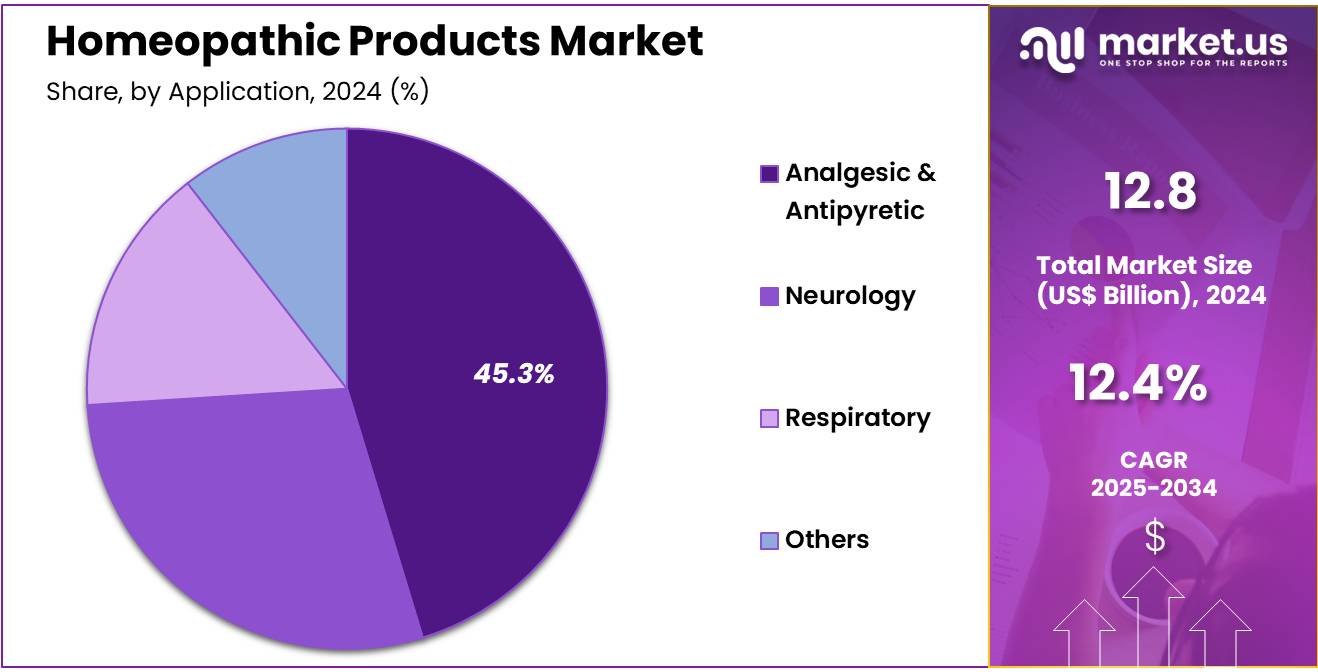

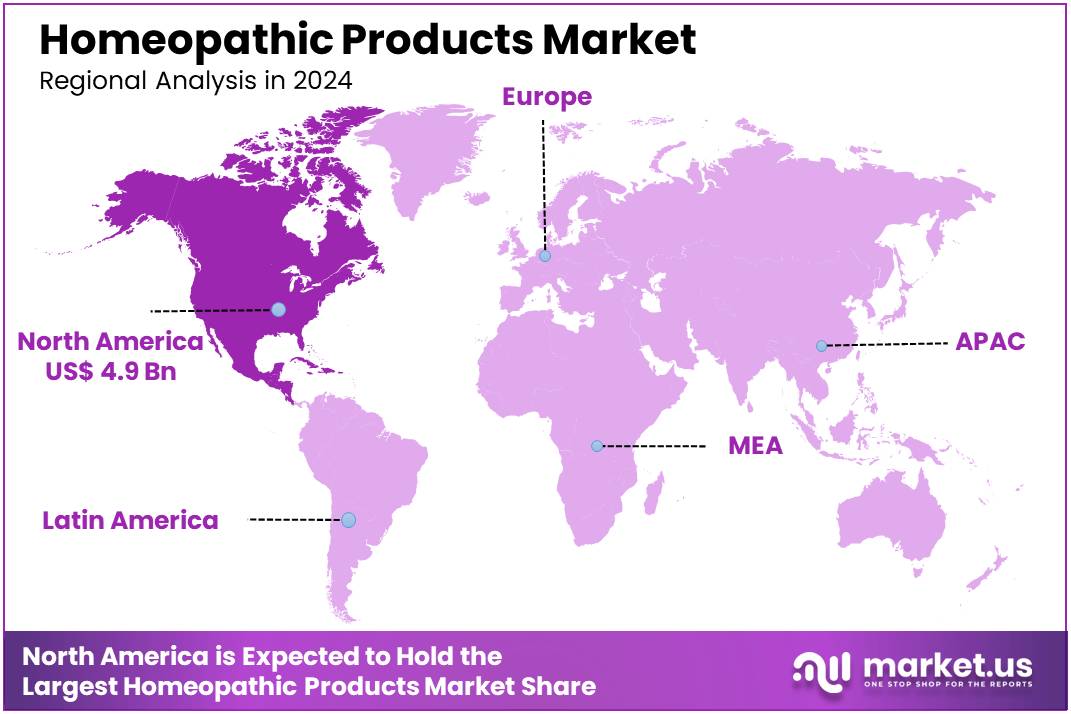

Global Homeopathic Products Market Size is expected to be worth around US$ 41.2 billion by 2034 from US$ 12.8 billion in 2024, growing at a CAGR of 12.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.2% share with a revenue of US$ 4.9 Billion.

Increasing interest in natural and alternative therapies is driving the growth of the homeopathic products market. Consumers are becoming more aware of the benefits of homeopathy for managing a range of health conditions, including chronic ailments, stress, and minor injuries. The shift toward natural remedies has led to a growing demand for homeopathic medicines as safe, non-toxic alternatives to conventional pharmaceuticals.

Homeopathic products offer an individualized treatment approach, focusing on stimulating the body’s healing process by addressing underlying causes rather than just symptoms. In September 2021, a clinical study published in the Complementary Medical Research Journal explored the efficacy of homeopathic treatments for SARS-CoV-2. The study, which included five patients, found that homeopathy contributed to significant improvements in symptoms, particularly when traditional treatments had limited success.

This demonstrates the potential of homeopathy in addressing health challenges that conventional medicine may not fully manage. As interest in holistic health continues to rise, there is a growing opportunity for companies to expand their homeopathic product offerings, especially in preventive and wellness applications. Recent trends show an increase in the use of homeopathic remedies for stress management, immunity boosting, and lifestyle-related disorders, all of which are expected to support continued market growth.

Key Takeaways

- In 2023, the market for homeopathic products generated a revenue of US$ 12.8 billion, with a CAGR of 12.4%, and is expected to reach US$ 41.2 billion by the year 2033.

- The product type segment is divided into dilutions, tablets, tincture, and others, with dilutions taking the lead in 2023 with a market share of 48.3%.

- Considering application, the market is divided into analgesic & antipyretic, neurology, respiratory, and others. Among these, analgesic & antipyretic held a significant share of 45.3%.

- Furthermore, concerning the source segment, the market is segregated into plants, animals, and minerals. The plants sector stands out as the dominant player, holding the largest revenue share of 58.7% in the homeopathic products market.

- North America led the market by securing a market share of 38.2% in 2023.

Product Type Analysis

The dilutions segment led in 2023, claiming a market share of 48.3% owing to their widespread use and growing popularity among individuals seeking natural remedies. Dilutions, which are prepared by repeatedly diluting substances in water or alcohol, are considered an essential component of homeopathic treatments.

The increasing interest in holistic and alternative medicine is anticipated to drive the demand for homeopathic dilutions, especially as more people seek non-invasive treatments for various conditions. Additionally, the growing number of homeopathic practitioners and the rise of personalized healthcare options are likely to contribute to the expansion of the dilutions segment, making it a central aspect of the homeopathic market.

Application Analysis

The analgesic & antipyretic held a significant share of 45.3% as consumers increasingly turn to natural and non-pharmaceutical options for pain and fever relief. Homeopathic analgesic and antipyretic products, which are used to manage pain and reduce fever, are expected to see rising demand due to their perceived safety and minimal side effects compared to conventional drugs.

The increasing preference for holistic health solutions and growing awareness of the potential risks associated with over-the-counter medications are likely to drive this segment’s growth. Furthermore, as people become more proactive in managing their health, especially in terms of pain management and fever control, the analgesic & antipyretic segment is anticipated to expand significantly.

Source Analysis

The plants segment had a tremendous growth rate, with a revenue share of 58.7% owing to the rising preference for plant-based remedies in alternative and natural health practices. Plant-based ingredients are fundamental to homeopathic formulations, offering a wide range of healing properties without the risk of harmful side effects. As consumers increasingly seek sustainable, organic, and eco-friendly alternatives to synthetic medications, the demand for plant-derived homeopathic products is projected to rise.

Additionally, the growing trend toward integrating herbal and plant-based treatments into everyday healthcare routines is likely to contribute to the continued growth of the plants segment in the homeopathic products market. As more research supports the efficacy of plant-based remedies, this segment is expected to gain further traction among consumers.

Key Market Segments

By Product Type

- Dilutions

- Tablets

- Tincture

- Others

By Application

- Analgesic & Antipyretic

- Neurology

- Respiratory

- Others

By Source

- Plants

- Animals

- Minerals

Drivers

Growing Consumer Preference for Natural Remedies is Driving the Market

The increasing consumer preference for natural and holistic remedies is a major driver for the homeopathic products market. According to the National Center for Complementary and Integrative Health (NCCIH), nearly 38% of adults in the US used complementary health approaches, including homeopathy, in 2022. This shift is driven by rising awareness of the potential side effects of conventional medicines and a growing emphasis on preventive healthcare.

Key players like Boiron and Hyland’s have reported steady revenue growth, with Boiron’s global sales reaching approximately US$ 650 million in 2022. The demand for homeopathic remedies is particularly strong in Europe, where countries like Germany and France have a long-standing tradition of using these products. This trend is expected to continue as consumers increasingly seek safer and more natural alternatives for managing their health.

Restraints

Lack of Scientific Validation and Regulatory Challenges are Restraining the Market

The lack of robust scientific validation and regulatory challenges are significant restraints for the homeopathic products market. Many health authorities, including the US Food and Drug Administration (FDA), have raised concerns about the efficacy of these remedies, leading to stricter regulations. In 2023, the FDA issued new guidelines requiring homeopathic products to meet the same safety and efficacy standards as conventional drugs.

This has increased compliance costs for manufacturers and limited the availability of certain products. Additionally, skepticism among healthcare professionals and consumers in regions like North America has hindered market growth. For instance, a 2022 survey by the Pew Research Center found that only 15% of Americans believe homeopathic treatments are effective. These factors have created barriers to widespread adoption, particularly in scientifically driven markets.

Opportunities

Expansion into Emerging Markets is Creating Growth Opportunities

The expansion into emerging markets presents significant growth opportunities for the homeopathic products industry. Countries like India and Brazil have a strong cultural acceptance of homeopathy, with India accounting for over 70% of global demand in 2022. The Indian government’s Ministry of AYUSH reported that the homeopathy sector grew by 12% in 2023, driven by increasing government support and public awareness campaigns.

Similarly, Brazil’s growing middle class and rising healthcare expenditure have fueled demand for affordable and natural remedies. Companies like Schwabe Group and SBL Pvt. Ltd. are investing heavily in these regions to capitalize on the growing demand. The untapped potential in emerging markets, combined with increasing disposable incomes, offers a lucrative opportunity for market players to expand their footprint and drive revenue growth.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors are significantly influencing the homeopathic products market. Rising disposable incomes in emerging economies and increasing healthcare expenditure in developed regions are driving demand for natural remedies. For instance, India’s AYUSH Ministry allocated US$ 500 million in 2023 to promote traditional medicine systems, including homeopathy. However, geopolitical tensions and trade disruptions have impacted the supply chain, leading to shortages of raw materials and increased production costs.

Inflation in key markets like Europe and North America has also affected consumer spending on non-essential health products. Despite these challenges, the growing global focus on preventive healthcare and the cultural acceptance of homeopathy in regions like Asia and Latin America are creating a positive outlook. Companies are leveraging these opportunities by expanding their product portfolios and investing in marketing campaigns, ensuring sustained market growth.

Latest Trends

Rising Demand for Personalized Homeopathic Solutions is a Recent Trend

The rising demand for personalized homeopathic solutions is a recent trend shaping the market. Consumers are increasingly seeking tailored remedies that address their specific health concerns, driving innovation in product offerings. In 2023, companies like Boiron and Heel introduced personalized homeopathic kits that cater to individual needs, such as stress management or immune support.

This trend aligns with the broader shift towards personalized medicine, which has gained traction globally. According to a 2022 report by the European Committee for Homeopathy, over 60% of homeopathic practitioners in Europe now offer customized treatment plans. The integration of digital tools, such as AI-driven diagnostic platforms, is further enhancing the ability to deliver personalized solutions. This trend is expected to drive consumer engagement and boost market growth in the coming years.

Regional Analysis

North America is leading the Homeopathic products Market

North America dominated the market with the highest revenue share of 38.2% owing to increasing consumer preference for natural and alternative healthcare solutions. The National Center for Complementary and Integrative Health (NCCIH) reported that nearly 40% of adults in the US used complementary health approaches, including homeopathy, in 2023, reflecting a steady rise since 2022. This trend is fueled by growing awareness of the potential side effects of conventional medications and a shift toward holistic wellness practices.

The US Food and Drug Administration (FDA) has also streamlined regulations for over-the-counter homeopathic remedies, making them more accessible to consumers. Retail giants like Walmart and CVS have expanded their homeopathic product offerings, with sales increasing by 18% year-on-year in 2023. The COVID-19 pandemic has further accelerated demand, as consumers sought immune-boosting and preventive remedies.

According to the American Association of Homeopathic Pharmacists, the number of registered homeopathic practitioners in the US grew by 12% between 2022 and 2024. Additionally, the aging population and rising healthcare costs have encouraged individuals to explore cost-effective alternatives. Homeopathic manufacturers like Boiron and Hyland’s have reported a 22% increase in revenue during this period, attributing it to strong consumer demand.

Government initiatives promoting integrative medicine, such as the NCCIH’s research grants, have also supported market growth. The Canadian government’s approval of homeopathic products as part of its Natural Health Products Regulations has further bolstered the market in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR. The World Health Organization (WHO) estimates that over 500 million people in the region rely on traditional and complementary medicine, including homeopathy, for primary healthcare. India, a key market, is expected to lead this growth, with the Ministry of AYUSH reporting a 20% increase in the number of registered homeopathic practitioners between 2022 and 2024.

The Indian government’s investment in AYUSH healthcare infrastructure, including homeopathy, is projected to drive further adoption. In China, the National Administration of Traditional Chinese Medicine has integrated homeopathy into its broader traditional medicine framework, with usage rates increasing by 15% during the same period. Japan’s aging population is likely to contribute to demand, as the Ministry of Health, Labour, and Welfare emphasizes preventive and alternative healthcare.

Australia’s Therapeutic Goods Administration (TGA) has also approved a growing number of homeopathic products, with over 30% of households now using complementary medicines, according to the Australian Bureau of Statistics. Manufacturers like SBL and Dr. Reckeweg are expected to expand their presence in the region, with sales in Southeast Asia growing by 25% in 2023-2024.

Rising disposable incomes and increasing awareness of natural remedies are anticipated to further fuel market growth. Government campaigns promoting homeopathy, such as those in India and Malaysia, are likely to enhance consumer trust and adoption. The region’s cultural affinity for traditional medicine, combined with regulatory support, is expected to sustain this upward trend.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the homeopathic products market focus on expanding their product range, increasing consumer awareness, and enhancing distribution networks to drive growth. They invest in developing natural, safe, and effective remedies that cater to various health conditions, positioning themselves as alternatives to conventional pharmaceuticals.

Companies also engage in digital marketing and influencer partnerships to build brand trust and reach a wider audience. Strategic collaborations with healthcare providers and wellness centers help expand market access. Additionally, increasing their presence in emerging markets with rising interest in alternative medicine supports further growth opportunities.

Boiron, headquartered in Lyon, France, is a leading global manufacturer of homeopathic medicines. The company offers a wide range of homeopathic remedies, including treatments for common ailments such as colds, allergies, and stress. Boiron focuses on quality and innovation, ensuring its products meet stringent regulatory standards. The company has a strong international presence, with products available in over 50 countries, and continues to expand its market footprint through education and partnerships with health professionals. Boiron remains committed to providing natural, holistic healthcare solutions to consumers worldwide.

Top Key Players

- SBL

- Mediral International Inc

- Homeocaninc

- Hahnemann Laboratories

- Batra’s Clinic

- BioIndiaPharma

- Arnicare

- A Nelson & Co Ltd

Recent Developments

- In July 2023, Arnicare launched a new homeopathic cream designed to provide temporary relief for individuals suffering from arthritis-related discomfort, including joint stiffness and muscle pain. The product caters to those aged 12 and above, offering an alternative for pain management through homeopathic principles.

- In April 2022, Dr. Batra’s Clinic outlined its strategy to broaden its reach by opening 225 new homeopathy clinics in smaller towns and cities. This expansion aims to make homeopathic treatments more accessible to a larger population, particularly in underserved areas, thus contributing to the growing demand for alternative healthcare options in the market.

Report Scope

Report Features Description Market Value (2024) US$ 12.8 billion Forecast Revenue (2034) US$ 41.2 billion CAGR (2025-2034) 12.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Dilutions, Tablets, Tincture, and Others), By Application (Analgesic & Antipyretic, Neurology, Respiratory, and Others), By Source (Plants, Animals, and Minerals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SBL, Mediral International Inc, Homeocaninc, Hahnemann Laboratories, Dr. Batra’s Clinic, BioIndiaPharma, Arnicare, and A Nelson & Co Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Homeopathic Products MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Homeopathic Products MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SBL

- Mediral International Inc

- Homeocaninc

- Hahnemann Laboratories

- Batra's Clinic

- BioIndiaPharma

- Arnicare

- A Nelson & Co Ltd