Global Home Blood Testing Devices Market By Indication Type (Glucose testing, Bacterial infection testing, Heart condition testing, and Others), By Distribution Channel (Online Stores, Hospital Pharmacies, Drug Stores, and Retail Stores), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169112

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

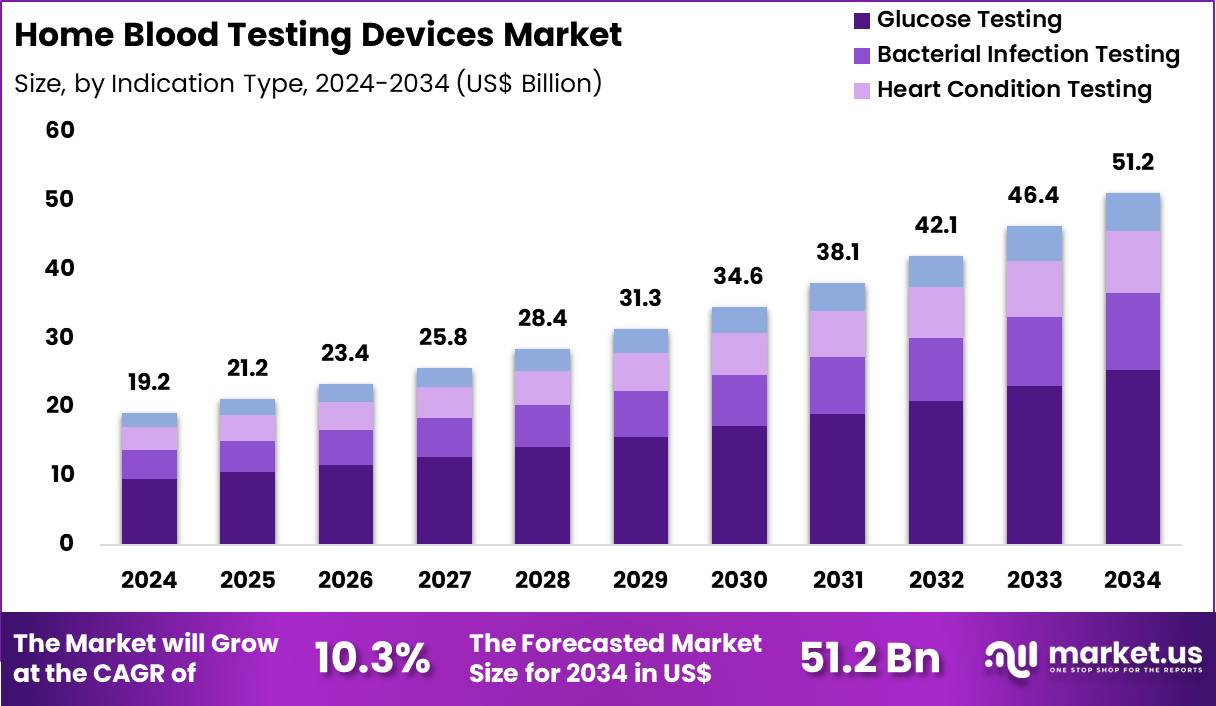

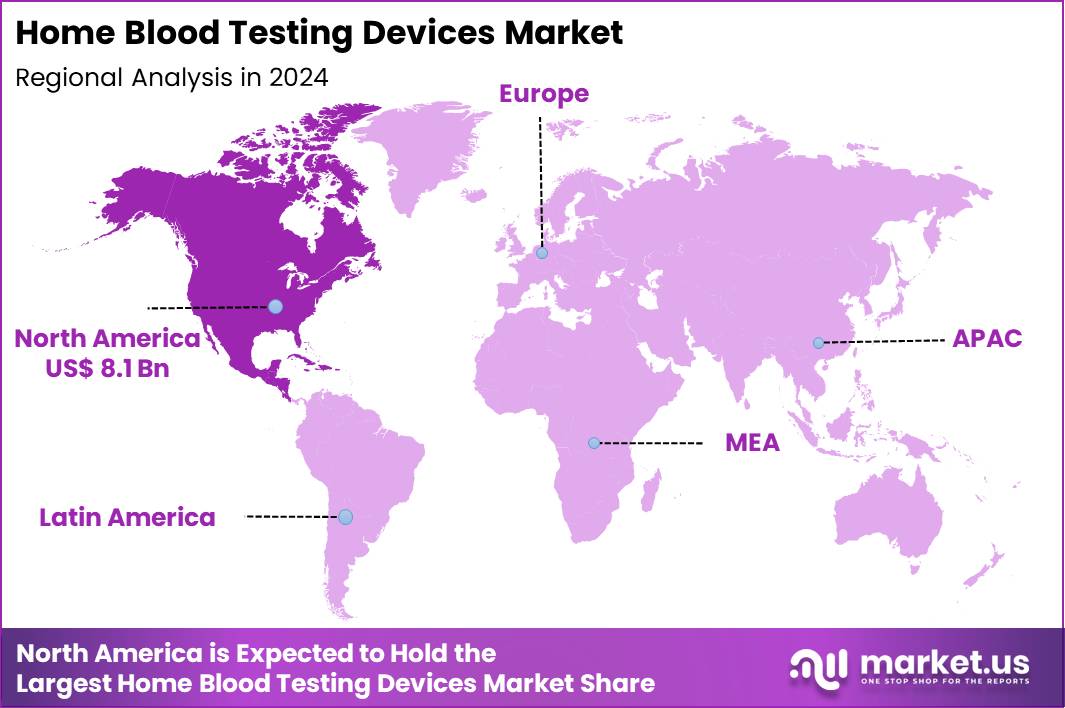

Global Home Blood Testing Devices Market size is expected to be worth around US$ 51.2 Billion by 2034 from US$ 19.2 Billion in 2024, growing at a CAGR of 10.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.3% share with a revenue of US$ 8.1 Billion.

Increasing consumer preference for self-monitoring chronic conditions propels the Home Blood Testing Devices market, as individuals embrace convenient tools that empower proactive health management without frequent clinical visits. Manufacturers innovate with compact analyzers that utilize fingerstick sampling for immediate biomarker quantification, enhancing user independence in daily wellness routines.

These devices support glucose monitoring for diabetes management through continuous trend tracking, lipid profile assessments for cardiovascular risk evaluation, coagulation checks for anticoagulant therapy adherence, and hemoglobin measurements for anemia surveillance. Validation studies create opportunities for regulatory endorsements that expand reimbursement coverage and integrate devices into telehealth ecosystems.

BD and Babson Diagnostics released compelling study results in March 2025, demonstrating that fingerstick-based tests achieve comparable accuracy to venous draws, thereby bolstering confidence in small-volume home collection methods. This evidence accelerates adoption of user-friendly platforms designed for reliable at-home diagnostics.

Growing integration of digital health ecosystems accelerates the Home Blood Testing Devices market, as providers connect devices to mobile apps for seamless data sharing and virtual consultations that optimize care delivery. Technology firms develop Bluetooth-enabled meters that sync results with electronic health records, facilitating real-time clinician oversight and personalized recommendations.

Applications encompass hormone level testing for thyroid disorder tracking, electrolyte panels for hydration status in athletes, vitamin D assays for bone health maintenance, and inflammatory marker evaluations for early arthritis detection. App-based analytics open avenues for predictive alerts on potential health deviations and subscription models for recurring test supplies. Pharmaceutical companies increasingly partner with device makers to bundle monitoring tools with medication programs, enhancing patient engagement and outcomes.

Rising advancements in microfluidic biosensors invigorates the Home Blood Testing Devices market, as innovators miniaturize lab-grade capabilities into portable units that deliver multiplexed results from minimal samples. Engineers embed AI algorithms into analyzers that interpret complex patterns and flag anomalies for immediate action.

These sophisticated tools enable cancer biomarker screening via circulating tumor DNA detection, infectious disease antibody confirmation for post-vaccination immunity, kidney function assessments through creatinine clearance estimates, and liver enzyme profiling for medication side-effect monitoring. Biosensor refinements create opportunities for non-invasive adaptations and global supply chain efficiencies in kit production. Collaborative research initiatives actively validate these devices against traditional lab standards to expedite market entry and clinical trust.

Key Takeaways

- In 2024, the market generated a revenue of US$ 19.2 Billion, with a CAGR of 10.3%, and is expected to reach US$ 51.2 Billion by the year 2034.

- The indication type segment is divided into glucose testing, bacterial infection testing, heart condition testing, others, with glucose testing taking the lead in 2024 with a market share of 49.8%.

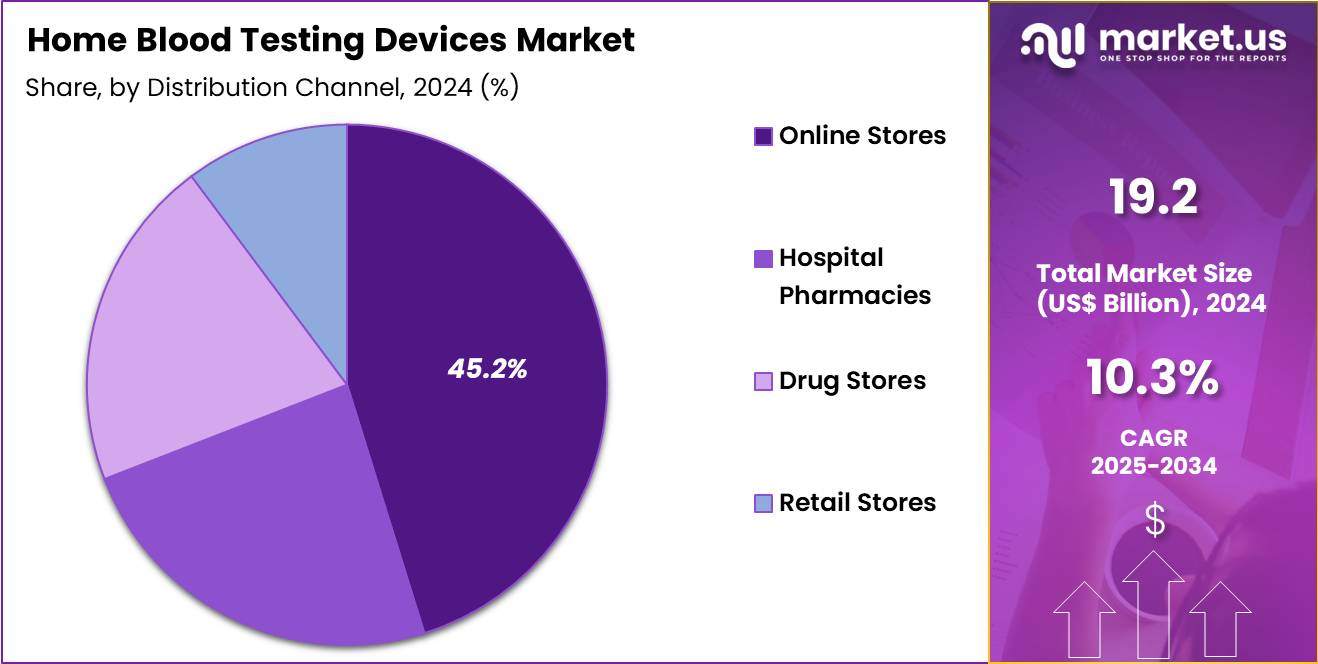

- Considering distribution channel, the market is divided into online stores, hospital pharmacies, drug stores, retail stores. Among these, online stores held a significant share of 45.2%.

- North America led the market by securing a market share of 42.3% in 2024.

Indication Type Analysis

Glucose testing, holding 49.8%, is expected to dominate due to rising global prevalence of diabetes and increased adoption of routine self-monitoring practices. Patients rely on compact glucometers and test strips to track daily glucose trends for better glycemic control. Manufacturers introduce app-connected glucose meters that support digital logging and remote monitoring, increasing usability. Growing awareness of early detection of prediabetes strengthens home-testing adoption among at-risk populations.

Public-health campaigns emphasize regular glucose checks, expanding user participation. Subscription-based glucose test-strip delivery services enhance convenience. Advancements in sensor accuracy improve trust in home-based readings. Busy lifestyles encourage self-testing rather than frequent clinical visits. These factors keep glucose testing anticipated to remain the leading indication segment.

Distribution Channel Analysis

Online stores, holding 45.2%, are anticipated to dominate as consumers increasingly prefer digital purchasing channels for home blood testing devices. E-commerce platforms offer broad product choices, competitive pricing, and doorstep delivery, improving accessibility. Online retailers provide subscription models for test strips, lancets, and cartridges, supporting recurring purchases. User reviews and product comparisons help consumers make informed buying decisions.

Growing comfort with digital health tools strengthens online adoption. Manufacturers partner with e-commerce platforms to expand reach in urban and remote regions. Online promotions and discounts drive higher sales volumes. Digital channels also support seamless access to advanced smart devices integrated with mobile applications. These drivers keep online stores projected to remain the most influential distribution channel in the home blood testing devices market.

Key Market Segments

By Indication Type

- Glucose testing

- Bacterial infection testing

- Heart condition testing

- Others

By Distribution Channel

- Online Stores

- Hospital Pharmacies

- Drug Stores

- Retail Stores

Drivers

Rising Prevalence of Chronic Diseases is Driving the Market

The increasing prevalence of chronic diseases among adults has become a primary driver for the home blood testing devices market, as these conditions require frequent monitoring of biomarkers like glucose and cholesterol to manage health effectively. This demographic shift, influenced by lifestyle factors and aging populations, prompts consumers to seek convenient, self-administered devices for daily tracking without clinical visits.

Healthcare providers are recommending home testing to empower patients, integrating results into virtual care plans for better adherence and outcomes. Manufacturers are responding with user-friendly devices featuring app connectivity for data visualization and alerts. Regulatory agencies validate these tools for over-the-counter use, ensuring safety for non-professional operation. Public health campaigns emphasize the role of home testing in preventing complications, fostering consumer awareness and adoption.

The economic advantages, including reduced clinic loads and lower long-term costs, justify expanded insurance coverage for devices. Professional guidelines support home monitoring for high-risk groups, embedding it in disease management protocols. This driver accelerates innovation in multi-parameter devices, allowing simultaneous tests for multiple markers. Educational resources from health organizations guide users on accurate self-testing, promoting confidence and regular use. In 2023, 76.4% of U.S. adults, representing 194 million individuals, reported having at least one chronic condition.

Restraints

Accuracy and Reliability Concerns are Restraining the Market

Concerns regarding the accuracy and reliability of home blood testing devices continue to serve as a significant restraint, as variations in user technique can lead to erroneous readings and misguided health decisions. Devices like glucose meters must meet stringent performance standards, yet real-world factors such as improper calibration or environmental interference compromise results. This issue erodes user trust, limiting adoption among those reliant on precise data for medication adjustments.

Regulatory bodies impose rigorous testing requirements, delaying approvals for new models and increasing development costs. Manufacturers face challenges in designing foolproof interfaces for diverse users, including the elderly or those with dexterity issues. The restraint perpetuates skepticism from clinicians, who often advise confirmatory lab tests, reducing standalone device utility.

Policy discussions highlight the need for standardized user training, but implementation remains inconsistent. These limitations exacerbate health disparities, as low-literacy groups struggle with device operation. The overall effect tempers market growth, favoring professional diagnostics over home alternatives. Mitigation efforts focus on AI-enhanced error detection, though widespread integration is nascent. The U.S. Food and Drug Administration requires blood glucose meters to be accurate within 15–20% of the actual reading.

Opportunities

Expansion of Telehealth Services is Creating Growth Opportunities

The rapid expansion of telehealth services is generating substantial growth opportunities for the home blood testing devices market, as remote consultations demand reliable patient-generated data for virtual assessments. This integration allows clinicians to review home test results in real-time, enabling informed adjustments to treatment plans without in-person visits. Opportunities arise in developing devices with seamless data transmission to telehealth platforms, enhancing interoperability for electronic health records.

Regulatory extensions of telehealth reimbursements cover device purchases, incentivizing provider recommendations. Partnerships between device makers and telehealth providers facilitate bundled offerings, streamlining consumer access. The model reduces barriers in rural areas, where home testing bridges geographic gaps in care. Economic analyses demonstrate cost savings from fewer office visits, appealing to insurers for broader coverage.

Global telehealth adoption in emerging markets amplifies demand for affordable, durable devices. These developments diversify revenue through subscription models for ongoing support and analytics. Sustained clinical validations will solidify telehealth-device synergies for chronic management. In the last quarter of 2023, over 12.6% of Medicare beneficiaries received a telehealth service.

Impact of Macroeconomic / Geopolitical Factors

Economic fluctuations and persistent inflation erode consumer confidence, prompting households to postpone purchases of home blood testing devices in price-sensitive segments. Expanding telemedicine services and wellness tracking apps, however, stimulate demand as patients seek convenient monitoring tools for chronic conditions like diabetes. Geopolitical instabilities in supply-critical areas such as Eastern Europe and the Middle East interrupt component shipments from overseas vendors, raising logistics fees and causing inventory shortfalls for manufacturers.

These instabilities, in contrast, compel companies to cultivate alternative supplier relationships in stable regions, which enhances chain diversity and long-term security. Current U.S. tariffs, featuring a universal 10% levy on all imports since April 2025 and up to 25% on Chinese-origin medical devices under Section 301 with select exclusions extended to 2026, amplify production expenses for importers and challenge retail pricing strategies.

Firms adapt resourcefully by ramping up U.S.-based assembly and exploring exemption avenues through trade pacts, preserving market access. At its core, these influences require vigilant monitoring yet inspire operational optimizations. The home blood testing devices market emerges more innovative and patient-focused, leveraging such forces to deliver affordable, reliable self-care solutions that empower healthier lifestyles globally.

Latest Trends

FDA Clearance for Non-Invasive Blood Testing Devices is a Recent Trend

The U.S. Food and Drug Administration’s clearance of non-invasive blood testing devices has emerged as a prominent trend in 2024, shifting focus toward painless, needle-free alternatives for glucose and vital sign monitoring. This innovation utilizes optical sensors and spectroscopy to estimate blood parameters without skin penetration, appealing to needle-phobic users. The trend prioritizes integration with wearables, enabling continuous tracking synced to smartphones for trend analysis.

Developers are refining algorithms to match invasive accuracy, addressing regulatory scrutiny on equivalence. This evolution supports diabetes management by facilitating frequent checks without discomfort. Adoption in consumer health apps surges, where cleared devices inform lifestyle interventions. Competitive advancements include multi-analyte capabilities for cholesterol alongside glucose. Broader implications encompass applications in pediatric care, adapting technology for young users.

The trend fosters global alignments, harmonizing standards for international clearances. Ethical guidelines emphasize data privacy in connected ecosystems. On February 21, 2024, the U.S. Food and Drug Administration issued a safety communication warning against using smartwatches or smart rings for blood glucose measurement due to inaccuracy, highlighting the push for validated non-invasive options.

Regional Analysis

North America is leading the Home Blood Testing Devices Market

North America accounted for 42.3% of the overall market in 2024, and the region recorded strong growth as consumers adopted self-testing tools for chronic-disease monitoring, preventive health, and remote-care programs. Households increased use of glucose, lipid, and HbA1c test kits as clinicians encouraged home monitoring to reduce clinic visits for stable patients. Telehealth platforms integrated app-connected devices that enabled seamless data sharing with physicians, improving long-term disease management.

Pharmacies expanded availability of FDA-cleared home kits, strengthening access for elderly and rural populations. The CDC reported 38.4 million people living with diabetes in the United States in 2022 (CDC – “National Diabetes Statistics Report 2022”), and this large chronic-disease base significantly increased demand for home blood-testing tools. Insurers broadened coverage for remote monitoring, which encouraged wider device adoption. These combined factors supported strong regional market expansion in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to experience sustained growth during the forecast period as healthcare systems prioritize early detection of lifestyle-related diseases and expand digital-health adoption across major urban centers. Consumers increasingly rely on home kits for glucose, anemia, and cholesterol screening due to rising awareness of preventive health practices. Governments promote self-monitoring for high-risk groups, including elderly individuals and patients with metabolic disorders.

Diagnostic chains strengthen last-mile delivery of home-testing devices, improving accessibility across India, Japan, and Southeast Asia. Smartphone connectivity accelerates device adoption among younger consumers seeking real-time health insights. The Japan Ministry of Health, Labour and Welfare reported around 10 million people with diabetes in 2022, highlighting a strong need for routine monitoring tools. Research institutions enhance digital-health collaborations, encouraging broader uptake of home-based diagnostics. These developments collectively position Asia Pacific for robust growth over the forecast horizon.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading companies in at-home blood test devices drive expansion by designing user-friendly kits that deliver lab-grade results for cholesterol, glucose, and other biomarkers, thereby appealing to health-conscious consumers seeking convenience. They expand market reach by developing companion mobile apps and data-tracking platforms that permit users to monitor trends and share results with healthcare providers, boosting long-term engagement.

They scale distribution through e-commerce channels and partnerships with pharmacies and wellness retailers to penetrate urban and semi-urban markets. They invest in regulatory approvals and quality certifications to build credibility and support integration with telemedicine and remote-care services. They target emerging economies by offering region-specific pricing, multilingual instructions, and local customer support to ensure broader adoption. One major firm, Abbott Laboratories, leverages its global manufacturing footprint, broad diagnostics and medical-device portfolio, and established brand reputation to deliver reliable at-home blood testing solutions and support growth across diverse geographies.

Top Key Players

- Abbott Laboratories

- Roche Diagnostics

- Becton Dickinson & Co.

- ARKRAY, Inc.

- Nova Biomedical Corp.

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- i-SENS, Inc.

Recent Developments

- On August 26, 2024, Dexcom introduced the Stelo Glucose Biosensor System, the first continuous glucose monitor cleared by the FDA for over-the-counter use. The product aims to broaden access to at-home glucose tracking, particularly for people with Type 2 diabetes who are not on insulin and for individuals monitoring wellness-related glucose trends.

- In December 2024, BD and Babson Diagnostics expanded their partnership to advance fingertip-based blood collection and testing. Their joint effort focuses on bringing validated micro-sample technologies into settings such as primary care clinics and urgent care centers, helping make accurate, low-volume testing more widely accessible.

Report Scope

Report Features Description Market Value (2024) US$ 19.2 Billion Forecast Revenue (2034) US$ 51.2 Billion CAGR (2025-2034) 10.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Indication Type (Glucose testing, Bacterial infection testing, Heart condition testing, and Others), By Distribution Channel (Online Stores, Hospital Pharmacies, Drug Stores, and Retail Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, Roche Diagnostics, Becton Dickinson & Co., ARKRAY, Inc., Nova Biomedical Corp., Bio-Rad Laboratories, Inc., bioMérieux SA, i-SENS, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Home Blood Testing Devices MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Home Blood Testing Devices MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- Roche Diagnostics

- Becton Dickinson & Co.

- ARKRAY, Inc.

- Nova Biomedical Corp.

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- i-SENS, Inc.