Global Hoisin Sauce Market Size, Share, And Business Benefits By Nature (Conventional, Organic), By Type (Traditional Hoisin Sauce, Organic Hoisin Sauce, Gluten-Free Hoisin Sauce, Low-Sodium Hoisin Sauce), By Packaging (Glass Bottle, Plastic Bottle, Pouches and Sachets), By Application (Household, Food Service), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Grocery Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 158779

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

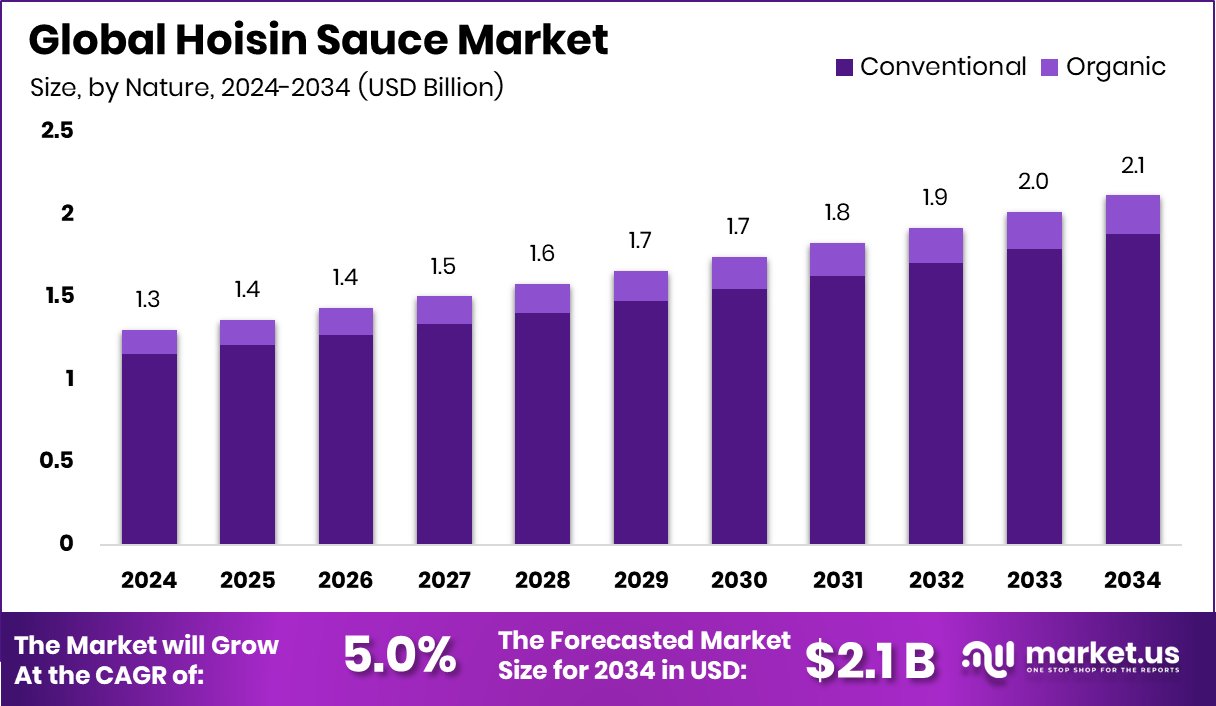

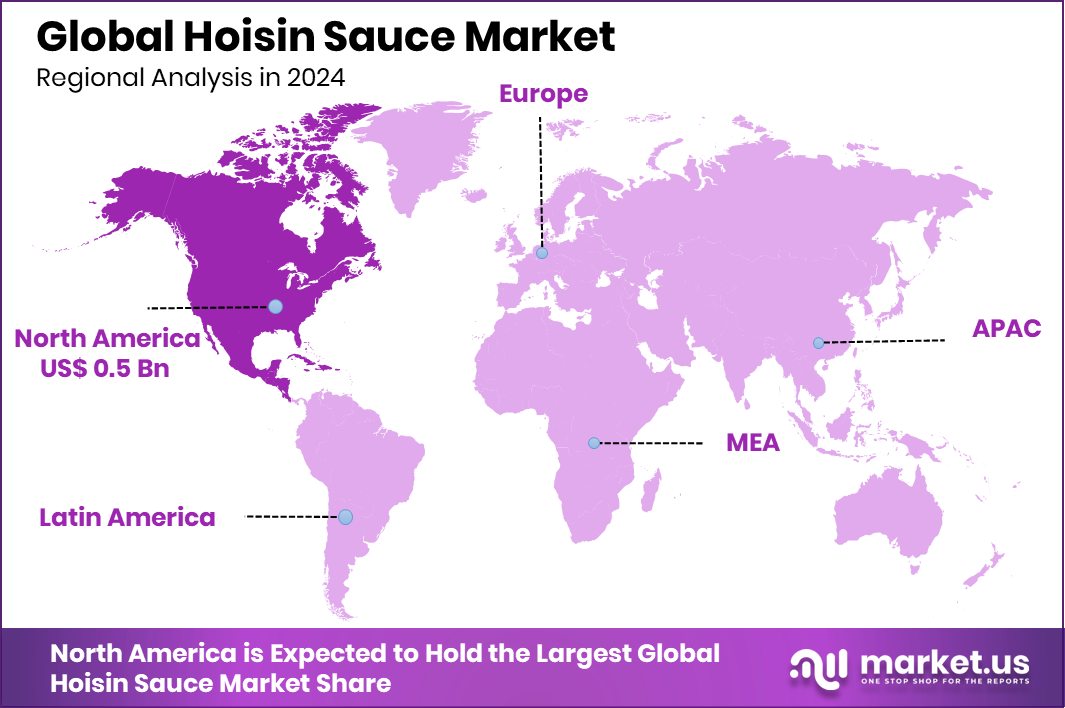

The Global Hoisin Sauce Market is expected to be worth around USD 2.1 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 5.0% from 2025 to 2034. The Hoisin Sauce Market in North America stood at 43.80%, totaling USD 0.5 Bn.

Hoisin sauce is a thick, dark, and flavorful condiment used widely in Asian cooking. It is made from soybeans, garlic, vinegar, sugar, and spices, giving it a sweet, salty, and slightly tangy taste. Known for its rich umami flavor, hoisin sauce is often used as a glaze, dipping sauce, or stir-fry seasoning, making it a staple in both home kitchens and restaurants worldwide.

The hoisin sauce market represents the trade and consumption of this condiment across regions. It has been steadily growing as global cuisines merge and consumers seek authentic Asian flavors. The market is supported by rising international food culture, the growth of packaged sauces in supermarkets, and increasing demand in both the household and foodservice sectors.

One of the key growth factors is the rising popularity of Asian cuisine across Western countries. As more people enjoy dishes like noodles, stir-fries, and grilled meats, hoisin sauce is gaining recognition as a versatile ingredient that elevates flavor. Its adaptability in both traditional and fusion dishes is driving consistent growth.

Looking at opportunities, the market has room for innovation in packaging and healthier formulations. Consumers are increasingly health-conscious, creating demand for options with lower sugar, organic ingredients, or preservative-free labels. Expanding into emerging markets with a strong interest in international flavors also presents significant growth potential.

Key Takeaways

- The Global Hoisin Sauce Market is expected to be worth around USD 2.1 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 5.0% from 2025 to 2034.

- The Hoisin Sauce Market is largely conventional, with an 88.9% share dominating consumer preference.

- Traditional Hoisin Sauce leads the type category, capturing 67.4% of overall market consumption globally.

- Glass bottles remain the most preferred packaging choice, holding a 46.7% share in the Hoisin Sauce Market.

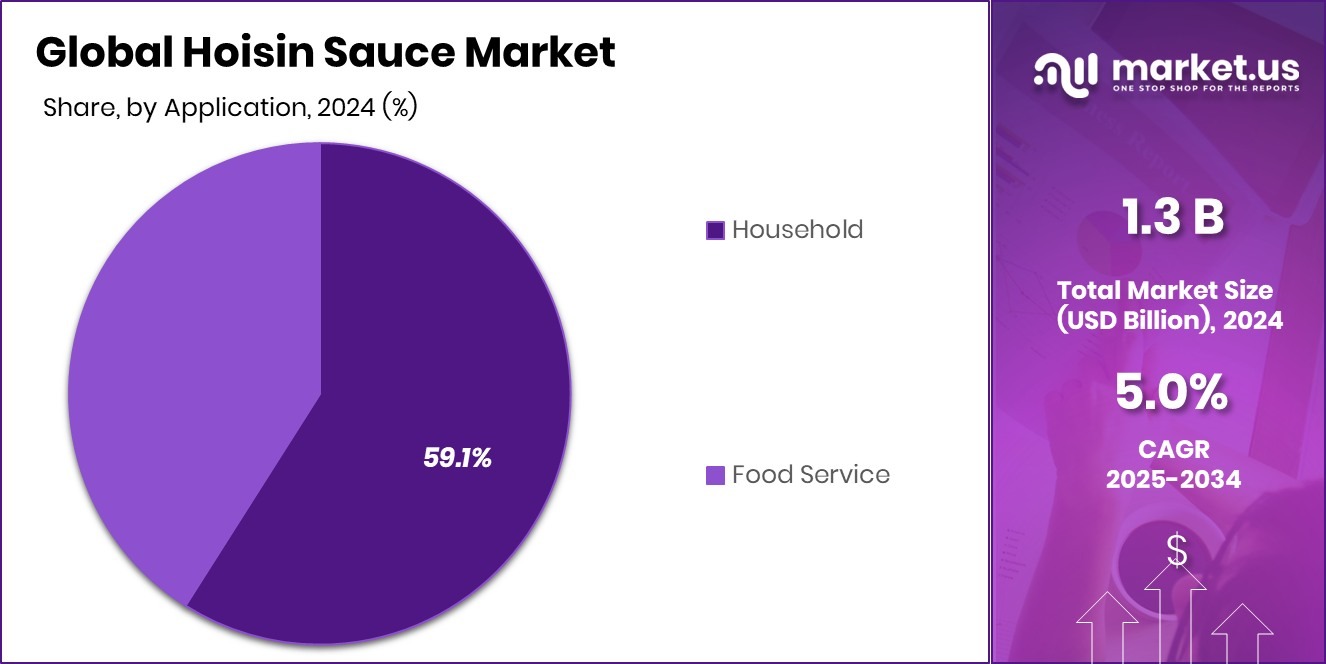

- Household applications dominate usage, accounting for 59.1% of the total hoisin sauce market demand.

- Supermarkets and hypermarkets drive distribution, contributing a 39.2% share in the overall Hoisin Sauce Market sales.

- North America, with a 43.80% share and USD 0.5 Bn value, reflects rising consumer demand.

By Nature Analysis

In 2024, Conventional held a dominant market position in the By Nature segment of the Hoisin Sauce Market, with an 88.9% share. This strong presence is mainly due to its wide availability, affordability, and established consumer preference across both household and foodservice channels. Conventional hoisin sauce is extensively distributed through supermarkets, grocery stores, and online platforms, making it the most accessible choice for consumers.

Its consistent flavor profile and suitability for traditional recipes further strengthen its adoption. With rising global demand for convenient and authentic Asian condiments, the conventional category continues to maintain market leadership, supported by large-scale production, stable supply chains, and its ability to meet the growing consumption needs across diverse regions.

By Type Analysis

In 2024, Traditional Hoisin Sauce held a dominant market position in the By Type segment of the Hoisin Sauce Market, with a 67.4% share. This leadership is driven by its authentic taste, deep-rooted cultural use, and preference in preparing classic Asian dishes. Traditional hoisin sauce continues to be the first choice for households and restaurants seeking genuine flavors that align with long-established cooking practices.

Its strong adoption is further supported by consistent demand in both domestic and international markets, where consumers associate it with authenticity and quality. With its established flavor profile and versatility across stir-fries, marinades, and dipping sauces, the traditional variant remains the backbone of market growth in 2024.

By Packaging Analysis

In 2024, Glass Bottle held a dominant market position in the By Packaging segment of the Hoisin Sauce Market, with a 46.7% share. The preference for glass packaging is largely due to its ability to preserve flavor, maintain product freshness, and offer a premium appeal to consumers.

Glass bottles are widely seen as a safe and sustainable option, reducing concerns about chemical interactions and enhancing shelf life. Their reusability and recyclability also align with growing consumer awareness of environmentally friendly packaging. Additionally, glass bottles are favored in both retail and foodservice settings as they provide a traditional and authentic presentation, reinforcing the product’s quality image and strengthening customer trust in the segment.

By Application Analysis

In 2024, Household held a dominant market position in the By Application segment of the Hoisin Sauce Market, with a 59.1% share. This dominance is attributed to the rising popularity of home cooking, where consumers increasingly use hoisin sauce to replicate restaurant-style Asian dishes in their kitchens. Its versatility in enhancing stir-fries, noodles, marinades, and dipping sauces has made it a staple in everyday meals.

Growing interest in international flavors, coupled with the convenience of ready-to-use condiments, has further boosted household adoption. The availability of hoisin sauce in supermarkets, grocery outlets, and online channels also makes it easily accessible, ensuring consistent demand and strengthening its leading role within the household consumption category.

By Distribution Channel Analysis

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of the Hoisin Sauce Market, with a 39.2% share. This leadership stems from their extensive product variety, competitive pricing, and strong consumer trust in organized retail formats. Supermarkets and hypermarkets provide greater visibility and accessibility for hoisin sauce, often featuring dedicated sections for international condiments that attract a wide customer base.

Promotional campaigns, in-store sampling, and attractive discounts further encourage purchases. Additionally, the convenience of one-stop shopping makes these outlets the preferred choice for households seeking authentic sauces. Their established supply chains and ability to maintain consistent product availability continue to reinforce their dominance in this segment.

Key Market Segments

By Nature

- Conventional

- Organic

By Type

- Traditional Hoisin Sauce

- Organic Hoisin Sauce

- Gluten-Free Hoisin Sauce

- Low-Sodium Hoisin Sauce

By Packaging

- Glass Bottle

- Plastic Bottle

- Pouches and Sachets

By Application

- Household

- Food Service

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Grocery Stores

- Online

- Others

Driving Factors

Government Support for Food Processing Industry Growth

One of the key driving factors for the Hoisin Sauce Market is the increasing government funding and support for the food processing industry. Many governments across Asia, Europe, and North America have launched initiatives and allocated funds to improve food processing infrastructure, promote exports, and encourage value-added food products.

For example, funding programs that support modern food processing units, packaging innovations, and international trade fairs indirectly boost the reach of condiments like hoisin sauce. These initiatives make it easier for manufacturers to expand production, ensure better quality, and meet growing consumer demand globally. Government-backed schemes also strengthen supply chains and open export opportunities, helping sauces such as hoisin gain stronger recognition in global markets.

Restraining Factors

Limited Government Funding for Small Food Producers

A major restraining factor in the Hoisin Sauce Market is the limited government funding available for small and medium-sized food producers. While larger food processing projects often receive substantial support, smaller manufacturers sometimes face challenges in accessing these funds. Government programs and grants are often designed with strict eligibility requirements, making it difficult for smaller players to benefit from subsidies or incentives.

This lack of equal financial support limits their ability to modernize facilities, invest in advanced packaging, or expand into international markets. As a result, small producers struggle to compete with larger companies that can leverage government-backed funds, creating an uneven playing field and slowing down overall market inclusivity and growth.

Growth Opportunity

Government Incentives Boosting Export Opportunities for Sauces

A key growth opportunity for the Hoisin Sauce Market lies in government incentives that promote food exports. Many countries are offering financial support, subsidies, and tax benefits to encourage food manufacturers to expand their products into global markets. Such funding programs help companies cover costs related to international certifications, participation in trade fairs, and setting up modern facilities that meet export standards.

For hoisin sauce, this creates a chance to reach new consumers in regions where Asian cuisine is gaining popularity. By leveraging these government-backed opportunities, producers can scale their operations, improve quality, and establish stronger global distribution networks, ultimately driving higher demand and long-term growth for the market.

Latest Trends

Government Funding Encouraging Sustainable Food Production Practices

One of the latest trends in the Hoisin Sauce Market is the focus on sustainability, strongly supported by government funding programs. Governments worldwide are investing in eco-friendly food production initiatives, such as reducing carbon emissions, promoting renewable energy use in factories, and encouraging recyclable packaging. These funds are helping sauce producers, including hoisin sauce makers, adopt greener manufacturing methods and sustainable sourcing of raw materials.

With consumers becoming more conscious about the environmental impact of their food choices, government-backed programs provide both financial relief and motivation for companies to innovate responsibly. This trend not only aligns with global sustainability goals but also strengthens consumer trust, creating new pathways for long-term market growth.

Regional Analysis

In 2024, North America captured 43.80% of the Hoisin Sauce Market, worth USD 0.5 Bn.

The Hoisin Sauce Market shows varied growth across regions, shaped by evolving food preferences and cultural acceptance of Asian flavors. In 2024, North America emerged as the leading region, holding a dominant 43.80% share of the market, valued at USD 0.5 billion. This strong position is driven by rising consumer interest in international cuisines, the growing popularity of Asian restaurants, and the adoption of convenient sauces for home cooking. The presence of well-structured retail channels, including supermarkets, hypermarkets, and online platforms, further supports easy accessibility for consumers.

Europe and the Asia Pacific are also witnessing a steady uptake of hoisin sauce, driven by cultural exchange, urban lifestyles, and increasing demand for authentic condiments in household kitchens. Meanwhile, regions such as the Middle East & Africa and Latin America are gradually expanding their consumption base, supported by urban migration, tourism, and exposure to global cuisines.

However, it is North America that continues to dominate the global market landscape, benefiting from strong demand for packaged sauces and a growing shift toward diverse culinary experiences. With its significant market share, North America remains the central hub for growth, reinforcing its leadership position in the global hoisin sauce industry.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Lee Kum Kee continues to be a benchmark brand, widely recognized for making hoisin sauce a household name internationally. Its strong heritage, coupled with modern production capabilities, has enabled it to maintain consumer trust while scaling into diverse markets. By ensuring product quality and leveraging wide retail and foodservice networks, Lee Kum Kee sustains its leadership role.

HADAY, known for its innovation in sauces and condiments, strengthens the hoisin sauce segment through large-scale production and distribution strength, particularly across Asian and emerging global markets. The company’s ability to combine traditional taste with industrial efficiency has enhanced its market contribution, supporting the rising global demand for authentic Asian flavors.

Koon Chun Sauce Factory Hong Kong, with its longstanding heritage, plays a vital role by focusing on traditional formulations and catering to both domestic and international consumers who value authenticity. Its niche yet trusted presence ensures continued relevance in the market.

Top Key Players in the Market

- Lee Kum Kee

- HADAY

- Koon Chun Sauce Factory Hong Kong

- Ka-me

- San-J

- Iron Chef

- Ty Ling

- Hormel Foods LLC

- Laoganma Special Flavour Foodstuffs Company

- Huy Fong Foods, Inc.

Recent Developments

- In August 2025, Koon Chun (USA), a branch of Koon Chun Sauce Factory, announced it would invest about USD 70 million to build a new food manufacturing plant in Gainesville, Georgia. This facility will serve as their U.S. manufacturing headquarters and aims to help them better serve American customers. It is expected to create multiple jobs in production, logistics, quality control, and support functions.

- In June 2025, HADAY (under their parent company) successfully completed a large IPO in Hong Kong as part of an A+H dual-share listing. They raised about USD 1.29 billion (≈ HKD 12.9 billion) to help expand production capacity, improve technology, and optimize supply chains. While this is broader than hoisin sauce alone, increased capacity and tech upgrades will likely affect their condiment lines, including hoisin.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.1 Billion CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Conventional, Organic), By Type (Traditional Hoisin Sauce, Organic Hoisin Sauce, Gluten-Free Hoisin Sauce, Low-Sodium Hoisin Sauce), By Packaging (Glass Bottle, Plastic Bottle, Pouches and Sachets), By Application (Household, Food Service), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Grocery Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Lee Kum Kee, HADAY, Koon Chun Sauce Factory Hong Kong, Ka-me, San-J, Iron Chef, Ty Ling, Hormel Foods LLC, Laoganma Special Flavour Foodstuffs Company, Huy Fong Foods, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Lee Kum Kee

- HADAY

- Koon Chun Sauce Factory Hong Kong

- Ka-me

- San-J

- Iron Chef

- Ty Ling

- Hormel Foods LLC

- Laoganma Special Flavour Foodstuffs Company

- Huy Fong Foods, Inc.