Global High-pressure Protective Packaging Film Market Size, Share Analysis Report By Material Type (Polyethylene (PE), Polypropylene (PP), Polyamide (PA / Nylon), Bio based Polymers, and Others), By Packaging Type (Pouches /Bags, Sheets, Wraps And Rolls, Custom-Molded Inserts, and Others), By End-Use (Food And Beverage, Electronics And Electrical, E-Commerce and Retail, Automotive, Pharmaceuticals, Consumer Goods, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173165

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

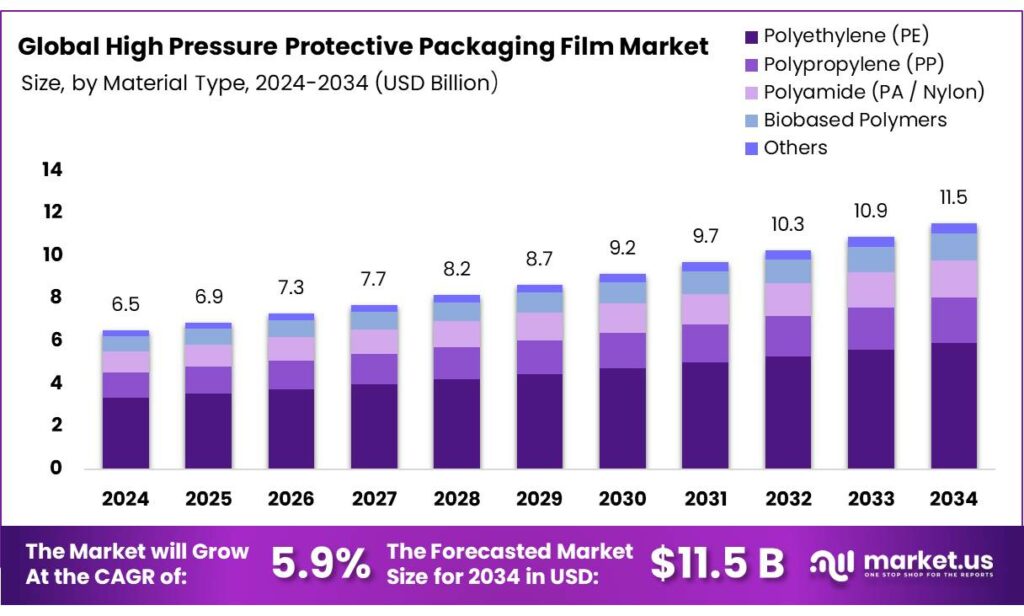

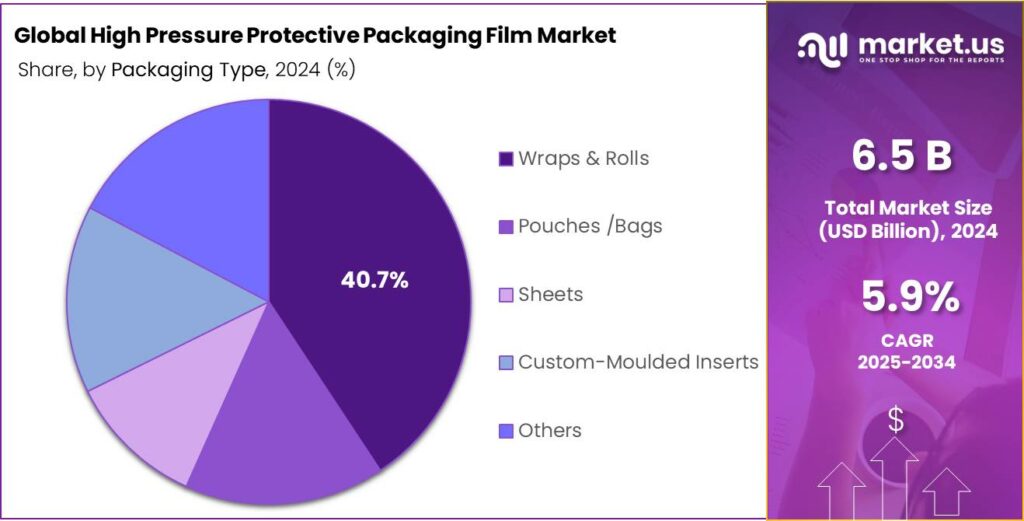

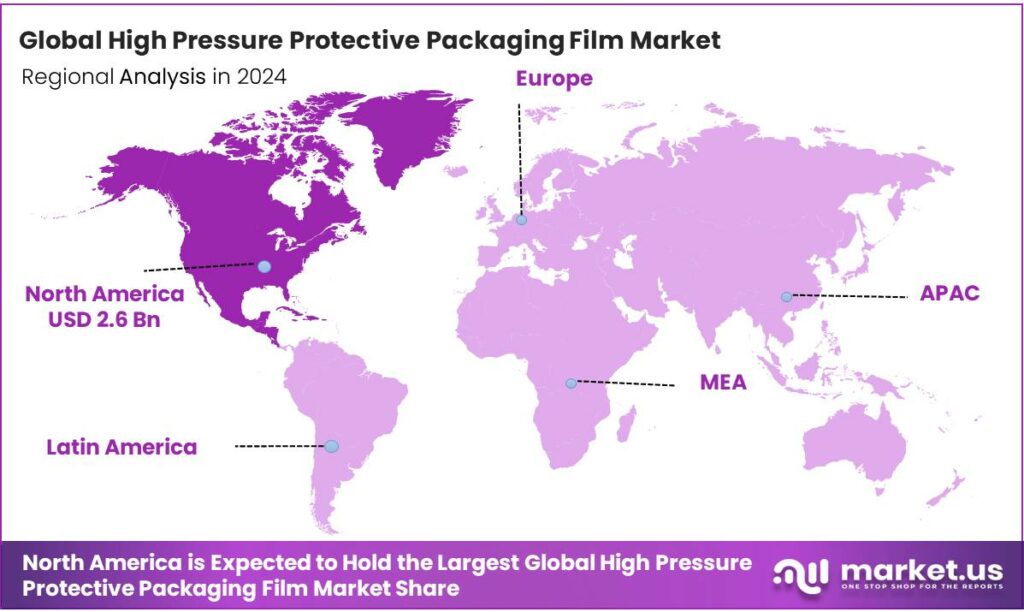

The Global High-Pressure Protective Packaging Film Market size is expected to be worth around USD 11.5 Billion by 2034, from USD 6.5 Billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 40.1% share, holding USD 2.6 Billion in revenue.

High-pressure protective packaging film is an advanced material, often layered polymers, engineered to resist extreme forces such as compression, punctures, and shock, safeguarding valuable goods during intense shipping, handling, or storage. The market is experiencing significant demand, primarily driven by industries such as electronics and electrical, where sensitive components require secure, durable packaging during transportation.

- The global trade expanded by about USD 500 billion in the first half of 2025, despite volatility, policy shifts, and persistent geopolitical tensions. As international trade and e-commerce grow, the demand for secure packaging solutions has intensified, with companies focusing on innovations in high-performance films to meet evolving demands.

Polyethylene (PE) is the material of choice due to its flexibility, moisture resistance, and cost-effectiveness, offering superior protection for fragile items. While other sectors, such as food & beverage, automotive, and pharmaceuticals, use protective packaging, the electronics sector sees the most extensive utilization due to the delicate nature of its products, such as semiconductors and circuit boards.

Key Takeaways

- The global high-pressure protective packaging film market was valued at USD 6.5 billion in 2024.

- The global high-pressure protective packaging film market is projected to grow at a CAGR of 5.9% and is estimated to reach USD 11.5 billion by 2034.

- Based on the types of materials, polyethylene (PE) dominated the high-pressure protective packaging film market, with a substantial market share of around 51.5%.

- Based on packaging type, the high-pressure protective packaging film market is dominated by wraps & rolls, comprising 40.7% share of the total market.

- Among the end-uses of high-pressure protective packaging film, the electronics & electrical sectors held a major share in the market, 35.9% of the market share.

- In 2024, North America was the most dominant region in the high-pressure protective packaging film market, accounting for around 40.1% of the total global consumption.

Material Type Analysis

Polyethylene (PE) is a Prominent Segment in the High-pressure Protective Packaging Film Market.

The high-pressure protective packaging film market is segmented based on material type as polyethylene (PE), polypropylene (PP), polyamide (PA / Nylon), biobased polymers, and others. The polyethylene (PE) dominated the market, comprising around 51.5% of the market share, due to its unique combination of flexibility, durability, and cost-effectiveness. Unlike polypropylene (PP) and polyamide (PA), PE offers superior resistance to moisture, chemicals, and external pressures, making it ideal for protecting sensitive items during transportation and storage.

Additionally, PE is lightweight and strong, providing a balance between strength and ease of handling. In addition, it has a lower production cost compared to other polymers, such as PA or biobased options, which can be more expensive to source and manufacture. While biobased polymers are gaining traction due to sustainability concerns, PE remains the preferred choice due to its established performance and lower overall cost for mass production, making it more accessible for a variety of industries.

Packaging Type Analysis

Wraps & Rolls Dominated the High-pressure Protective Packaging Film Market.

Based on packaging type, the high-pressure protective packaging film market is segmented into pouches /bags, sheets, wraps & rolls, custom-molded inserts, and others. The wraps & rolls dominated the market, comprising around 40.7% of the market share. Wraps and rolls of high-pressure packaging, such as bubble wrap, air pillows, or stretch film, are preferred due to their cost-effectiveness, versatility, storage efficiency, and ability to adapt to various product shapes, unlike rigid inserts or pre-formed pouches, offering superior protection for diverse items in automated systems.

In addition, wraps & rolls take up significantly less space than bulky, pre-filled pouches or custom inserts, lowering storage and transport costs. Similarly, the bulk rolls reduce material cost and allow automated machinery to create custom-sized packaging on demand, minimizing waste.

End-Use Analysis

The Electronics & Electrical Sector was the Most Used Technology for High-pressure Protective Packaging Film.

Based on the end-use of high-pressure protective packaging film, the market is divided into food & beverage, electronics & electrical, e-commerce and retail, automotive, pharmaceuticals, consumer goods, and others. The electronics & electrical sectors dominated the market, with a market share of 35.9%, due to the sensitive nature of the products involved. Electronic components, such as semiconductors, circuit boards, and display panels, are highly susceptible to damage from moisture, static, and physical impact during shipping and storage.

High-pressure films provide an effective barrier against these risks, ensuring the integrity of delicate items. While other sectors, such as food & beverage, e-commerce, and automotive, use protective packaging, the level of fragility in electronics makes the demand for such specialized films more critical. Additionally, the rapid growth in consumer electronics, including smartphones and computers, has driven substantial demand for these packaging solutions, further reinforcing their primary use in this sector over others.

Key Market Segments

By Material Type

- Polyethylene (PE)

- LDPE (Low-Density Polyethylene)

- LLDPE (Linear Low-Density Polyethylene)

- HDPE (High-Density Polyethylene)

- Polypropylene (PP)

- Polyamide (PA / Nylon)

- Biobased Polymers

- Others

By Packaging Type

- Pouches /Bags

- Sheets

- Wraps & Rolls

- Custom-Molded Inserts

- Others

By End-Use

- Food & Beverage

- Electronics & Electrical

- E-Commerce and Retail

- Automotive

- Pharmaceuticals

- Consumer Goods

- Others

Drivers

Booming Electronics & Electrical Industry Drives the High-pressure Protective Packaging Film Market.

The booming electronics and electrical industry has significantly contributed to the expansion of the high-pressure protective packaging film market. As technological advancements accelerate, the demand for sensitive electronic components, such as semiconductors, circuit boards, and fragile sensors, has increased, necessitating robust protective solutions. High-pressure protective packaging films offer superior durability and resistance to external pressures, moisture, and contaminants, ensuring the safe transport and storage of these delicate items.

- The surge in consumer electronics production, particularly smartphones, laptops, and gaming consoles, requires innovative packaging materials to prevent damage during transit. In the third quarter of 2025, computer shipments grew by over 8% from the third quarter of 2024, with global volumes reaching approximately 76 million units.

In addition, industries such as automotive, where electronic systems are becoming more integrated into vehicles, drive the demand for such protective films. With the global trend of miniaturization and increased demand for high-precision components, the demand for effective packaging materials has grown, positioning high-pressure protective packaging films as a critical part of the logistics and supply chain processes.

Restraints

Recycling of Multilayer Films Might Delay the Growth of the High-pressure Protective Packaging Film Market.

The recycling of multilayer films presents a significant challenge to the growth of the high-pressure protective packaging film market. Multilayer films, commonly used in protective packaging, often consist of various polymer materials that are difficult to separate during the recycling process. As sustainability efforts intensify, the pressure on industries to reduce plastic waste and improve recyclability has increased. For instance, multilayer films, which provide enhanced protection, pose a challenge related to their environmental impact. The complexity of recycling these films often increases operational costs and limits the efficiency of the recycling systems, leading to slower adoption rates.

- According to a report by Plastics Europe on a study conducted in the region, in 2022, 37.8% of post-consumer plastic packaging waste was recycled, 44.9% was used for energy recovery, and 17.3% was landfilled, which is a decline from 2020, when post-consumer plastic packaging waste sent to recycling reached 46%.

Additionally, the lack of widely available infrastructure for the proper recycling of multilayer films further complicates their end-of-life management. As regulatory standards around plastic waste tighten, manufacturers may face higher compliance costs or be forced to seek alternative materials that are more recyclable, potentially delaying the widespread use of high-pressure protective packaging films in the long term.

Opportunity

Expansion of International Trade Creates Opportunities in the High-pressure Protective Packaging Film Market.

The expansion of international trade and the rapid growth of e-commerce have created significant opportunities for the high-pressure protective packaging film market. According to the World Trade Organization, as of 2024, world trade volume and value have expanded 4% and 5% respectively on average since 1995. As global trade volumes continue to increase, particularly in sectors such as electronics, consumer goods, and pharmaceuticals, the demand for secure packaging solutions has become more pronounced.

The rise of e-commerce and the growing demand for fast, secure delivery of goods have contributed to the market’s growth. This expansion in trade and e-commerce drives demand for high-pressure protective packaging films and encourages innovation to meet the evolving needs of fast-paced, international logistics.

Trends

Shift Towards Biodegradable High-pressure Protective Packaging Film.

The shift towards biodegradable high-pressure protective packaging films is a prominent and ongoing trend in the market, driven by growing environmental concerns and regulatory pressures. As industries across the globe move towards sustainability, there is a significant push to replace traditional plastic-based films with biodegradable alternatives. For instance, materials such as plant-based polyesters, polylactic acid (PLA), and polyhydroxyalkanoates (PHA) are gaining traction due to their ability to break down naturally without causing long-term environmental harm.

- The number of consumers who consider the environment while making a purchase has increased to around 83%, and approximately 88% of the customers reported that they would support sustainability initiatives by the companies.

The rise of eco-conscious consumers and stringent waste management regulations has prompted companies to adopt these materials. Leading e-commerce companies, which are increasingly responsible for large quantities of packaging waste, are exploring biodegradable options to meet sustainability goals. For instance, in Germany, Otto Group and Tchibo, along with the government, launched a project to try out different kinds of reusable packaging.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the High-pressure Protective Packaging Film Market by Disrupting the Essential Supply Chains in the Market.

The geopolitical tensions have had a significant impact on the high-pressure protective packaging film market. Increased trade barriers, supply chain disruptions, and economic uncertainty due to conflicts, such as the Russia-Ukraine war, have forced businesses to rethink their outsourcing strategies. For instance, global supply chains for raw materials such as polyethylene, polypropylene, and other polymers used in protective packaging films were heavily disrupted due to conflicts in the South China Sea and the restrictions on Chinese imports, as China is the largest exporter of these polymers.

These tensions have led to extended lead times for the raw materials, impacting the packaging market. Consequently, many players diversify their procurement channels by seeking out suppliers from regions that are less prone to conflicts, such as Latin America, India, or Turkey. Furthermore, some major players have funded startups and R&D for sustainable alternatives to buffer against conventional plastic market volatility.

Regional Analysis

North America Held the Largest Share of the Global High-pressure Protective Packaging Film Market.

In 2024, North America dominated the global high-pressure protective packaging film market, holding about 40.1% of the total global consumption. The region has consistently held the largest share of the market, driven by its advanced manufacturing capabilities, strong e-commerce sector, and increasing demand for protective packaging in industries such as electronics, automotive, and healthcare. The region benefits from a robust logistics infrastructure and a well-established network of packaging manufacturers, particularly in the United States, which support the growth of industries requiring high-performance packaging solutions.

In addition, the focus of the region on innovation, along with increasing regulatory requirements for sustainable packaging, has spurred investments in eco-friendly high-pressure films. Moreover, major players in the e-commerce space, such as Amazon and Walmart, heavily rely on high-pressure protective films to ensure the safe delivery of goods, further reinforcing the dominance of the region in this market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The companies invest in product innovation, developing films with enhanced durability, better moisture resistance, and eco-friendly properties, such as biodegradable options, to meet the growing demand for sustainable packaging. Additionally, the players focus on strengthening their supply chains to ensure reliable and timely delivery, reducing lead times, and minimizing production disruptions. Furthermore, players emphasize expanding into emerging markets, where industries such as electronics and e-commerce are rapidly growing. Moreover, the companies form strategic partnerships with major players in sectors such as electronics, automotive, and pharmaceuticals, to tap into larger, more consistent customer bases.

The Major Players in The Industry

- Sealed Air Corporation

- Amcor plc

- Pregis LLC

- Uflex Limited

- Dow Packaging and Specialty Plastics

- Supreme Industries Limited

- Intertape Polymer Group Inc.

- Mondi plc

- Coveris Holdings S.A.

- Winpak Ltd.

- Fruth Custom Plastics Inc.

- iVEX Protective Packaging Inc.

- Abco Kovex Ltd.

- CDF Corporation

- Automated Packaging Systems Inc.

- Other Key Players

Key Development

- In June 2023, Pregis introduced Pregis AirSpeed Hybrid Cushioning (HC) Renew PCR, the high-pressure air cushioning film made with 80% post-consumer recycled (PCR) content.

- In May 2025, IPG, a prominent provider of high-performance tapes and films, announced the introduction of its Polyethylene Surface Protection Film Tape (PESP). This low-tack, clean-removal polyethylene tape is engineered to protect a wide range of smooth and rough surfaces across various industries.

Report Scope:

Report Features Description Market Value (2024) USD 6.5 Bn Forecast Revenue (2034) USD 11.5 Bn CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Polyethylene (PE), Polypropylene (PP), Polyamide (PA / Nylon), Biobased Polymers, and Others), By Packaging Type (Pouches /Bags, Sheets, Wraps & Rolls, Custom-Moulded Inserts, and Others), By End-Use (Food & Beverage, Electronics & Electrical, E-Commerce and Retail, Automotive, Pharmaceuticals, Consumer Goods, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Sealed Air Corporation, Amcor plc, Pregis LLC, Uflex Limited, Dow Packaging and Specialty Plastics, Supreme Industries Limited, Intertape, Polymer Group Inc., Mondi plc, Coveris Holdings S.A., Winpak Ltd., Fruth Custom Plastics Inc., iVEX Protective Packaging Inc., Abco Kovex Ltd., CDF Corporation, Automated Packaging Systems Inc., and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  High-pressure Protective Packaging Film MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

High-pressure Protective Packaging Film MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Sealed Air Corporation

- Amcor plc

- Pregis LLC

- Uflex Limited

- Dow Packaging and Specialty Plastics

- Supreme Industries Limited

- Intertape Polymer Group Inc.

- Mondi plc

- Coveris Holdings S.A.

- Winpak Ltd.

- Fruth Custom Plastics Inc.

- iVEX Protective Packaging Inc.

- Abco Kovex Ltd.

- CDF Corporation

- Automated Packaging Systems Inc.

- Other Key Players