Global High-Performance Liquid Chromatography (HPLC) Market Analysis By Product (Instruments, Consumables & Accessories, Software), By Application (Clinical Research Applications, Diagnostic Applications), By End-User (Pharmaceutical And Biotechnology Companies, Academic And Research Institutions, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 12676

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

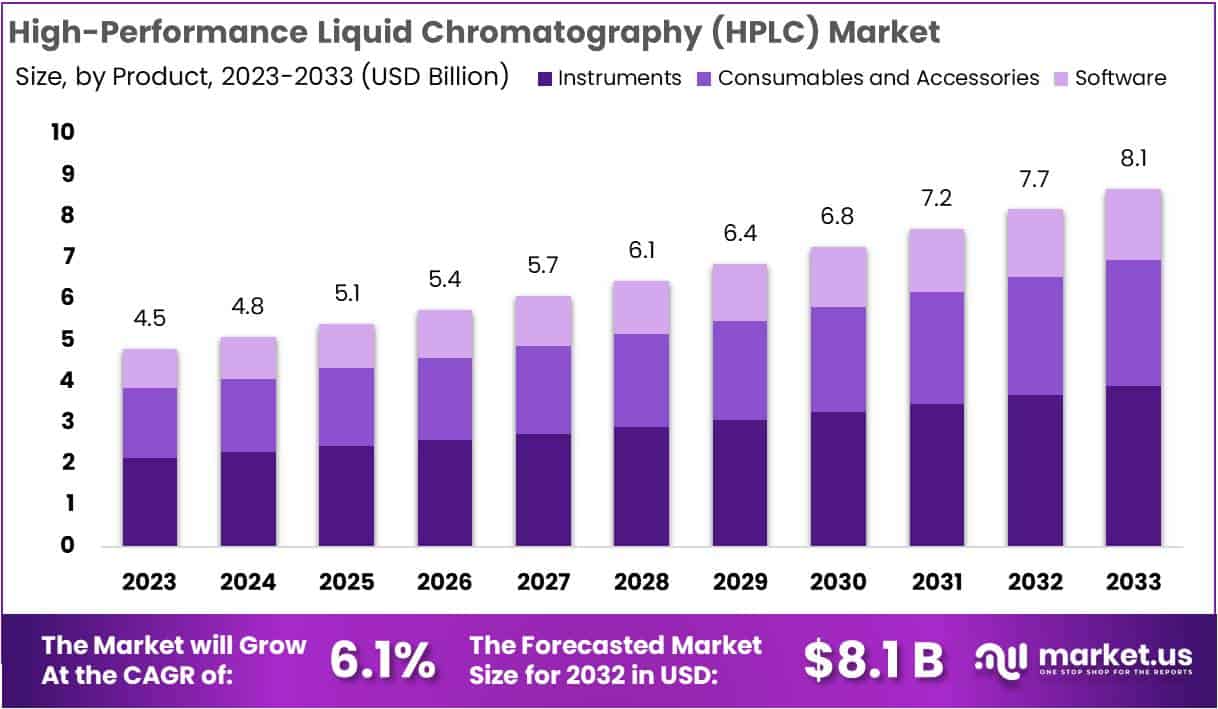

The High-performance Liquid Chromatography (HPLC) Market Size is anticipated to reach approximately USD 8.1 Billion by 2033, compared to its 2023 value of USD 4.5 Billion. This reflects a steady growth rate of 6.1% from 2024 to 2033, highlighting the expanding significance of HPLC technology in various industries.

*Note: Actual Numbers Might Vary In The Final Report

High-Performance Liquid Chromatography, or HPLC is a technique used to separate the different substances within a liquid sample. It works by pumping the sample mixture through a tube filled with solid particles. The different sample components stick to the particles for varied lengths of time as they travel through the tube. This causes them to exit the tube separately over time.

Detectors monitor the exiting liquids to identify and measure the amounts of each component. Compared to earlier methods, HPLC is faster and provides very clear separation between components. It is used widely for applications like pharmaceutical, environmental, and biochemical analysis. By adjusting the tube conditions, HPLC can separate and identify components ranging from small molecules to large proteins.

The High-Performance Liquid Chromatography (HPLC) market has witnessed consistent growth, driven by heightened demand for precise analytical methods in pharmaceuticals, biotechnology, and other sectors. Stringent industry regulations and the need for accurate quality control contribute to the widespread adoption of HPLC. Technological advancements, including enhanced column efficiency and detector sensitivity, further fuel market expansion.

Major players such as Agilent Technologies, Waters Corporation, and Thermo Fisher Scientific dominate the competitive landscape, engaging in innovation and strategic partnerships. The HPLC market spans diverse applications, from drug development to environmental monitoring, with regional variations in growth. Challenges include initial high costs and operator training, while the future outlook remains positive with continuous technological progress and increasing demand for analytical techniques.

Key Takeaways

- Market Growth Projection: Anticipated HPLC market size of USD 8.1 Billion by 2033, growing at a steady rate of 6.1% annually from 2024.

- Dominant Product Segment: Instruments segment led in 2023 with over 45% market share, driven by demand for sophisticated HPLC instruments.

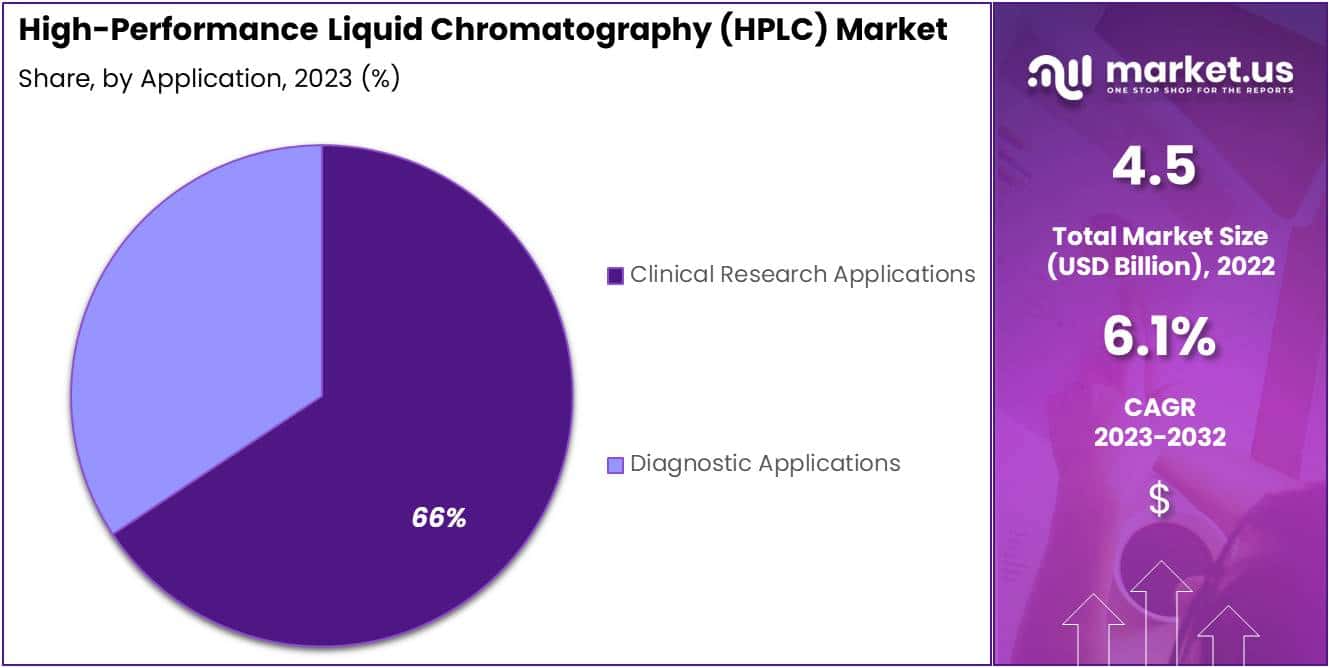

- Application Leadership: Clinical Research Applications dominated, capturing 65.7% market share, emphasizing HPLC’s role in advancing medical understanding.

- End-User Market Share: Pharmaceutical and Biotechnology Companies held a dominant position with a 40.3% market share.

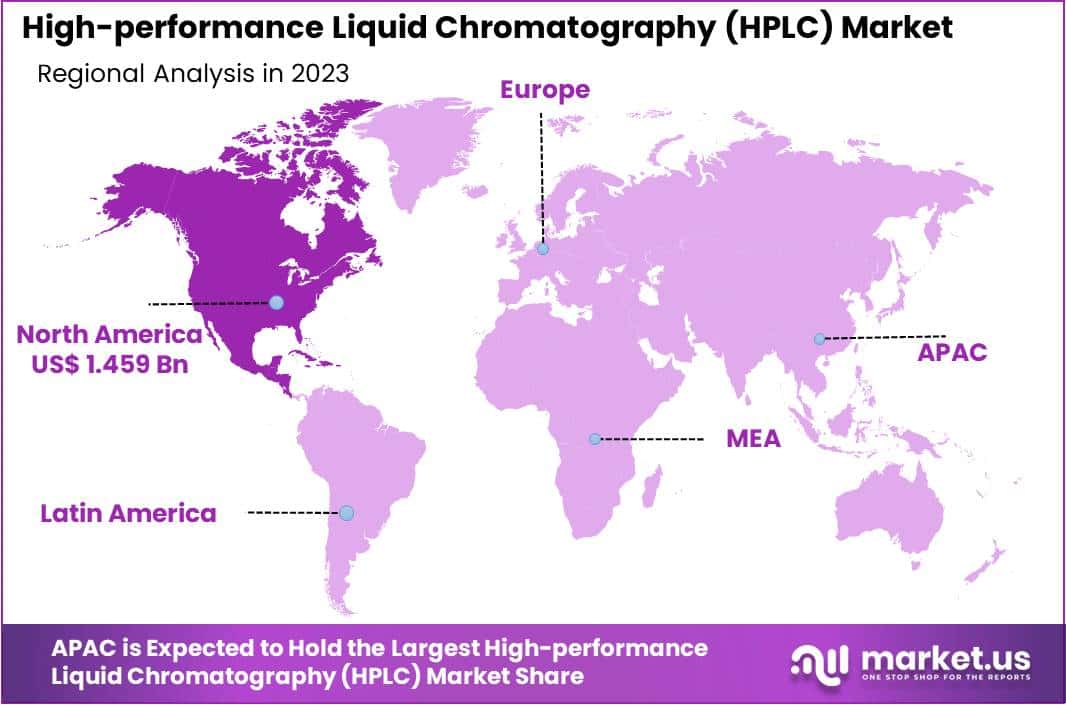

- Regional Dominance: North America contributed 30.4% to the global HPLC market in 2023, driven by the United States’ strong presence.

- Adoption Trends: UHPLC adoption is rising, green chromatography is a sustainable trend, and demand for miniaturized HPLC systems is growing.

- Opportunities in Emerging Markets: Emerging economies offer growth potential, with industrialization and research activities driving demand for advanced analytical solutions.

- Challenges Faced: Initial HPLC system costs pose a barrier, and a shortage of skilled professionals can hinder market growth.

- Competitive Landscape: Major players, including Agilent Technologies and Thermo Fisher Scientific, dominate the market, engaging in innovation and strategic partnerships.

- Positive Future Outlook: Despite challenges, the HPLC market has a positive outlook with continuous technological progress and increasing demand for analytical techniques.

Product Analysis

In 2023, the High-performance Liquid Chromatography (HPLC) market showcased a robust landscape, with distinct segments playing pivotal roles in shaping its dynamics. Among these, the Instruments segment emerged as a frontrunner, asserting its dominance by securing over a 45% share of the market.

The Instruments segment encompasses the tangible hardware crucial for HPLC processes. These instruments, ranging from pumps and detectors to columns, form the backbone of chromatographic analyses. Their pivotal role in ensuring precise and efficient separation of components in a mixture solidified their prominence in the market landscape.

This commanding position can be attributed to the increasing demand for advanced and technologically sophisticated HPLC instruments. Researchers and analysts, in various industries, are increasingly relying on cutting-edge instruments to enhance the accuracy and speed of their chromatographic experiments. The Instruments segment’s strong foothold is further strengthened by ongoing innovations, driving the adoption of HPLC techniques across diverse applications.

Looking forward, this segment is expected to maintain its momentum, fueled by continuous advancements in instrument functionalities, user-friendly interfaces, and enhanced capabilities. As the HPLC market continues to evolve, the Instruments segment stands poised to retain its leadership, reflecting the ongoing commitment to technological excellence and precision in chromatographic analyses.

Application Analysis

In 2023, the High-performance Liquid Chromatography (HPLC) market showcased a remarkable landscape, with the Clinical Research Applications segment emerging as a frontrunner. Capturing an impressive 65.7% share, this segment dominated the market scene.

Clinical Research Applications took center stage due to its pivotal role in advancing medical understanding and treatment methodologies. Its high market share signifies the widespread adoption of HPLC techniques in the field, emphasizing the critical role played by chromatography in clinical research.

On the diagnostic front, the market displayed a dynamic scenario with Diagnostic Applications carving out its niche. While not surpassing the dominance of Clinical Research Applications, Diagnostic Applications held a substantial share, contributing significantly to the overall market dynamics.

The strategic utilization of HPLC in diagnostic applications has proven instrumental in enhancing precision and efficiency in various healthcare processes. This segment’s presence in the market highlights the versatile applications of HPLC technology in the diagnostic realm, fostering advancements in medical diagnostics and patient care.

As the HPLC market continues to evolve, these segmented dynamics underscore the pivotal contributions of Clinical Research and Diagnostic Applications, providing a comprehensive snapshot of the industry’s current landscape.

*Note: Actual Numbers Might Vary In The Final Report

End-user Analysis

In 2023, the High-performance Liquid Chromatography (HPLC) market showcased a remarkable landscape, with the Pharmaceutical and Biotechnology Companies segment emerging as the frontrunner, securing a dominant market position by capturing over 40.3% share.

Pharmaceutical and Biotechnology Companies led the way in adopting HPLC technologies, driven by their imperative need for precise and efficient separation and analysis of complex compounds. This segment’s robust hold on the market is attributed to the growing demand for advanced chromatography solutions in drug development, quality control, and research processes.

Academic and Research Institutions constituted another significant segment, contributing to the diverse HPLC market. With a focus on academic excellence and scientific exploration, these institutions accounted for a substantial market share. Their adoption of HPLC technologies reflects a broader trend towards enhancing analytical capabilities in academic research and fostering innovation.

Furthermore, the market dynamics were influenced by other segments, such as government laboratories, contract research organizations, and more, collectively categorized as “Others.” While each segment played a crucial role, the versatility of HPLC applications contributed to the widespread adoption across diverse end-users.

Looking ahead, the HPLC market is poised for continued growth, fueled by advancements in technology, increasing research and development activities, and the ongoing quest for precision in various scientific domains. As the landscape evolves, the interplay between these segments will likely shape the trajectory of the HPLC market in the coming years.

Key Market Segments

Product

- Instruments

- Consumables & Accessories

- Software

Application

- Clinical Research Applications

- Diagnostic Applications

End-User

- Pharmaceutical And Biotechnology Companies

- Academic And Research Institutions

- Others

Drivers

Increased Pharmaceutical R&D Spending and Drug Development Activities

Companies are spending more money on researching and developing new medicines. This creates a higher demand for HPLC as it helps in analyzing and separating different compounds in drugs.

Growing Food Safety and Environmental Testing

As concerns about food safety and the environment increase, there’s a need for accurate analysis. HPLC plays a crucial role in separating and analyzing substances in food and environmental samples.

Emergence of Ultra-High-Pressure Chromatography Systems

Newer chromatography systems can work at extremely high pressures. This allows for quicker and more detailed separation of substances. HPLC benefits from this, making it more efficient.

Expanding Applications in Forensic Sciences, Drug Discovery, Biotechnology, and Polymer Analysis

HPLC is finding more uses in various fields like solving crimes (forensic sciences), discovering new drugs, working with biotechnology, and analyzing polymers. This expanded utility is driving the demand for HPLC systems.

Restraints

High Initial Costs

The initial investment required for acquiring HPLC systems, including instruments and associated accessories, can be a significant barrier for smaller laboratories and companies, limiting their adoption.

Lack of Skilled Professionals

The effective use of HPLC systems requires skilled professionals. The shortage of trained personnel capable of operating and maintaining these sophisticated instruments can hinder market growth.

Competition from Alternative Technologies

The market faces competition from alternative analytical technologies, such as mass spectrometry and capillary electrophoresis, which offer different advantages. This competition may impact the widespread adoption of HPLC systems.

Limited Accessibility in Developing Regions

The availability and accessibility of HPLC systems are limited in developing regions due to factors such as infrastructure constraints, economic challenges, and a lack of awareness about the benefits of advanced analytical techniques.

Opportunities

Expansion in Emerging Markets

There is a substantial growth opportunity in expanding the market presence of HPLC systems in emerging economies, where increased industrialization and research activities are creating a demand for advanced analytical solutions.

Customized Solutions

Offering customized HPLC solutions to cater to specific industry needs, such as pharmaceuticals, biotechnology, and environmental testing, presents a growth avenue. Tailoring systems to meet unique requirements enhances market competitiveness.

Integration of Data Analytics

Incorporating data analytics capabilities into HPLC systems can provide valuable insights and improve analytical efficiency. This integration opens up opportunities for market players to offer comprehensive solutions.

Partnerships and Collaborations

Forming strategic partnerships with research institutions, pharmaceutical companies, and other stakeholders can facilitate the development of innovative HPLC technologies and broaden market reach.

Trends

Increasing Adoption of UHPLC

There is a noticeable trend towards the adoption of Ultra-High-Performance Liquid Chromatography (UHPLC), characterized by higher speed and resolution. This trend reflects the industry’s pursuit of faster and more efficient analytical processes.

Growing Focus on Green Chromatography

The industry is witnessing a shift towards environmentally friendly practices, with an emphasis on reducing solvent consumption and waste generation in chromatographic processes. Green chromatography is gaining traction as a sustainable trend.

Rise in Demand for Miniaturized HPLC Systems

Miniaturization of HPLC systems is gaining popularity, especially in point-of-care applications and portable analytical devices. This trend aligns with the need for compact and portable solutions in various industries.

Integration of Automation

The integration of automation features in HPLC systems, such as autosamplers and robotic sample handling, is a notable trend. This move towards automation enhances efficiency, reduces human errors, and streamlines analytical workflows.

Regional Analysis

In 2023, North America asserted its dominant position in the High-performance Liquid Chromatography (HPLC) market, securing a substantial market share of over 30.4%. The regional market’s robust performance was reflected in its impressive market value, reaching USD 1.5 billion for the year. Several factors contributed to North America’s prominent standing in the HPLC market, making it a key player in driving advancements and innovation within the industry.

The United States emerged as a pivotal contributor to North America’s HPLC market dominance, propelled by a well-established research and development infrastructure, technological expertise, and a burgeoning pharmaceutical and biotechnology sector. The region’s emphasis on cutting-edge analytical techniques and stringent quality control standards further fueled the adoption of HPLC technologies across various industries, solidifying North America’s lead.

Additionally, the increasing demand for HPLC in pharmaceutical and clinical research applications played a pivotal role in North America’s market dominance. The region’s focus on precision medicine, drug discovery, and development of novel therapeutic compounds underscored the indispensable role of HPLC in ensuring accurate and reliable analytical results. This heightened demand was met by a robust presence of leading HPLC manufacturers and suppliers, further fortifying North America’s position in the global market.

While North America maintained its stronghold, it is essential to acknowledge the dynamic nature of the global HPLC market. The region’s dominance is not only attributed to its historical contributions but also to its continuous efforts in research, development, and implementation of HPLC technologies across diverse sectors. As the HPLC market evolves, North America remains a pivotal force, shaping the trajectory of advancements and contributing significantly to the overall growth and innovation within the global HPLC landscape.

*Note: Actual Numbers Might Vary In The Final Report

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the High-performance Liquid Chromatography (HPLC) market, several key players play pivotal roles in shaping its trajectory. Waters Corporation, with its innovative solutions, stands out as a frontrunner in chromatography technologies. Their commitment to research and development positions them as a key influencer in driving advancements within the HPLC sector.

Thermo Fisher Scientific Inc., another major player, contributes significantly to the market’s growth with its comprehensive range of HPLC instruments and consumables. The company’s global presence and emphasis on technological excellence make it a key contributor to the expanding applications of liquid chromatography.

Agilent Technologies Inc. brings its expertise to the HPLC market with a focus on precision and reliability. The company’s chromatography solutions cater to diverse industry needs, contributing to the overall competitiveness and efficiency of HPLC systems.

Shimadzu Corporation, a stalwart in analytical instrumentation, is instrumental in advancing HPLC technologies. With a legacy of innovation, Shimadzu plays a crucial role in setting benchmarks for performance and reliability in liquid chromatography.

Beyond these key players, there are several other contributors shaping the HPLC market. Each brings its unique strengths, whether it be technological innovation, global reach, or a focus on specific applications. Together, these players create a vibrant ecosystem that drives continuous evolution and improvement within the High-performance Liquid Chromatography market.

Market Key Players

- Waters Corporation

- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- Shimadzu Corporation

- Sartorius AG

- PerkinElmer Inc.

- Bio-Rad Laboratories Inc.

- Merck KGaA

- Tosoh Bioscience GmbH

- Gilson Inc.

- Danaher Corporation

Recent Developments

- In October 2023, Agilent Technologies made a significant move by acquiring Rigaku for a whopping $1.6 billion. Rigaku, a prominent player in analytical and industrial X-ray technologies, will bring valuable additions to Agilent’s HPLC instrument and solution portfolio. This strategic move is expected to propel Agilent’s growth in both the life sciences and materials science markets.

- In September 2023, Shimadzu unveiled its latest innovation, the Nexera X2 UHPLC system. This cutting-edge system boasts notable advancements in speed, sensitivity, and resolution compared to its predecessor. Designed to cater to diverse applications such as pharmaceutical research, food analysis, and environmental monitoring, the Nexera X2 marks a significant step forward for Shimadzu.

- In August 2023, Waters Corporation made waves in the industry, with its acquisition of CHROMSPEC, a notable provider of chromatography supplies and consumables. This strategic move is set to broaden Waters’ range of HPLC products and services, offering customers a more extensive selection for their chromatography needs.

- In July 2023, Thermo Fisher Scientific introduced the Vanquish Neo UHPLC system. Crafted for high-throughput applications, the Vanquish Neo comes equipped with features tailored for demanding tasks, including a high-speed gradient pump and a low-dispersion flow path. This launch solidifies Thermo Fisher Scientific’s commitment to meeting the evolving needs of scientific research and analysis.

Report Scope

Report Features Description Market Value (2023) USD 4.5 Bn Forecast Revenue (2033) USD 8.1 Bn CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Instruments, Consumables & Accessories, Software), By Application (Clinical Research Applications, Diagnostic Applications), By End-User (Pharmaceutical And Biotechnology Companies, Academic And Research Institutions, Others Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Waters Corporation, Thermo Fisher Scientific Inc., Agilent Technologies Inc., Shimadzu Corporation, Sartorius AG, PerkinElmer Inc., Bio-Rad Laboratories Inc., Merck KGaA, Tosoh Bioscience GmbH, Gilson Inc., Danaher Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the high-performance liquid chromatography (hplc) market in 2023?The high-performance liquid chromatography (hplc) market size is USD 4.5 billion in 2023.

What is the projected CAGR at which the high-performance liquid chromatography (hplc) market is expected to grow at?The high-performance liquid chromatography (hplc) market is expected to grow at a CAGR of 6.1% (2024-2033).

List the segments encompassed in this report on the high-performance liquid chromatography (hplc) market?Market.US has segmented the high-performance liquid chromatography (hplc) market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product the market has been segmented into Instruments, Consumables & Accessories, Software. By Application the market has been segmented into Clinical Research Applications, Diagnostic Applications. By End-User the market has been segmented into Pharmaceutical And Biotechnology Companies, Academic And Research Institutions, Others.

List the key industry players of the high-performance liquid chromatography (hplc) market?Waters Corporation, Thermo Fisher Scientific Inc., Agilent Technologies Inc., Shimadzu Corporation, Sartorius AG, PerkinElmer Inc., Bio-Rad Laboratories Inc., Merck KGaA, Tosoh Bioscience GmbH, Gilson Inc., Danaher Corporation and other Key players.

Which region is more appealing for vendors employed in the high-performance liquid chromatography (hplc) market?North America is expected to account for the highest revenue share of 30.4% and boasting an impressive market value of USD 1.5 billion. Therefore, the high-performance liquid chromatography (hplc) industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for high-performance liquid chromatography (hplc)?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the high-performance liquid chromatography (hplc) Market.

Which segment accounts for the greatest market share in the high-performance liquid chromatography (hplc) industry?With respect to the high-performance liquid chromatography (hplc) industry, vendors can expect to leverage greater prospective business opportunities through the pharmaceutical segment, as this area of interest accounts for the largest market share.

High-performance Liquid Chromatography (HPLC) MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample

High-performance Liquid Chromatography (HPLC) MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Waters Corporation

- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- Shimadzu Corporation

- Sartorius AG

- PerkinElmer Inc.

- Bio-Rad Laboratories Inc.

- Merck KGaA

- Tosoh Bioscience GmbH

- Gilson Inc.

- Danaher Corporation