Global Hemophilia Market By Type (Hemophilia A and Hemophilia B), By Treatment Type (On-Demand and Prophylaxis), By Therapy (Factor Replacement Therapy, Gene Therapy and Non-Factor Replacement Therapy), By Distribution Channel (Specialty Treatment Centers, Hospitals, Retail Pharmacies and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174531

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

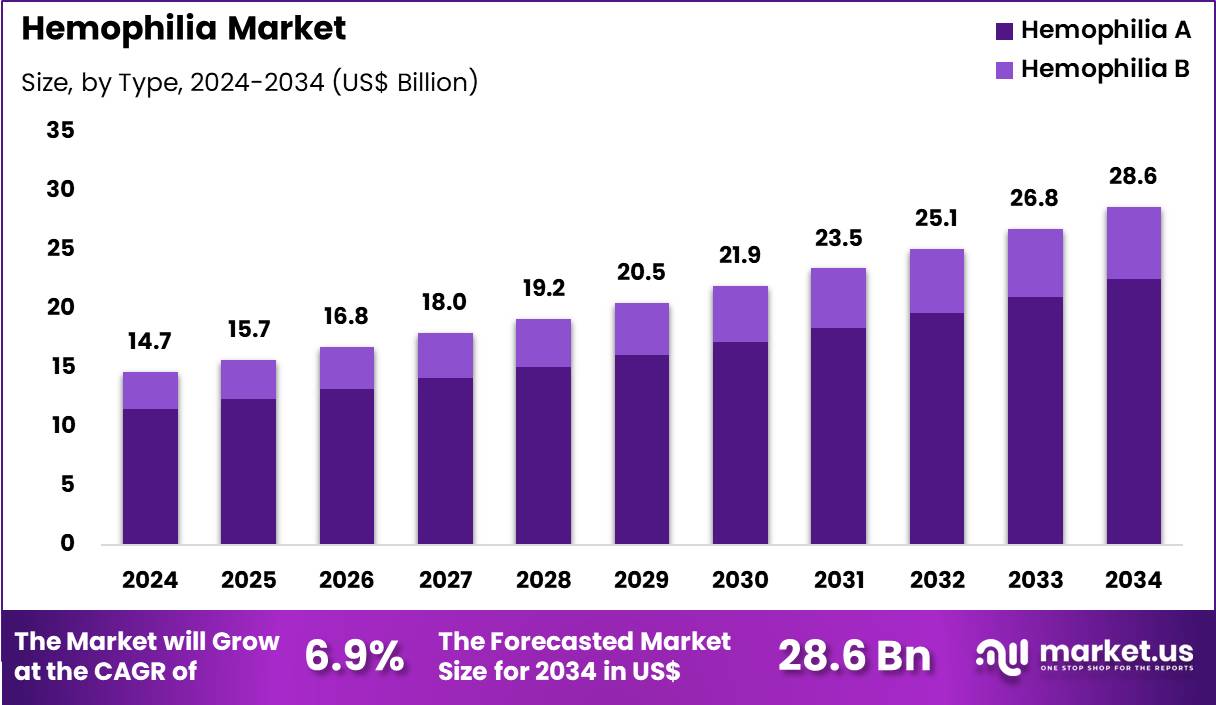

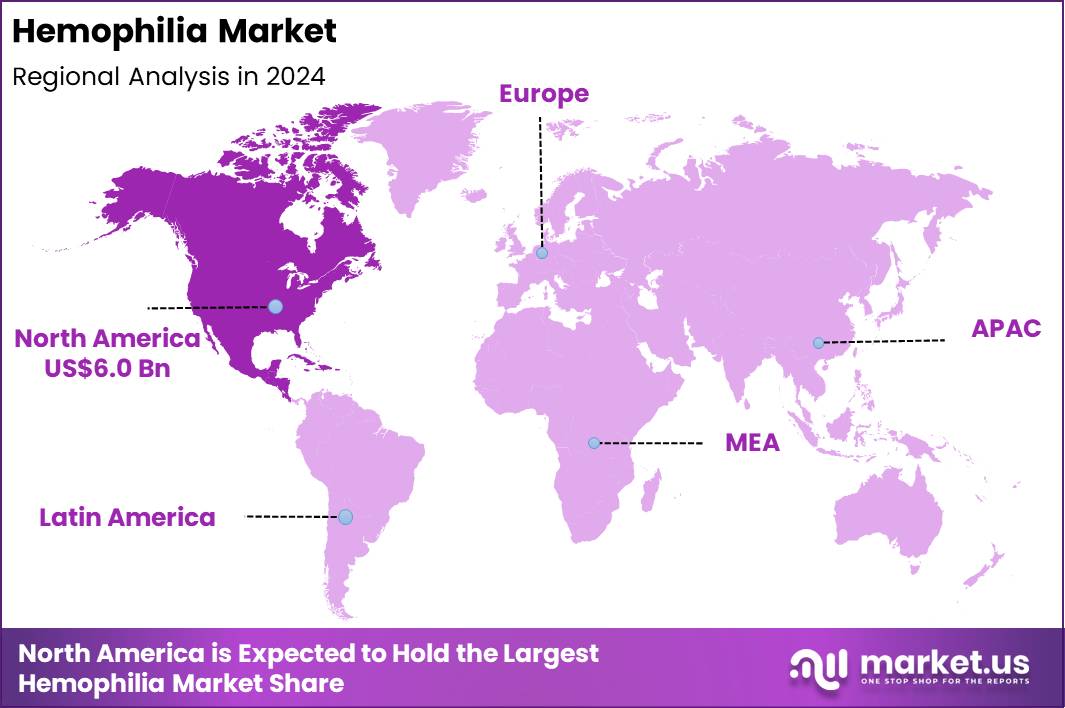

The Global Hemophilia Market size is expected to be worth around US$ 28.6 Billion by 2034 from US$ 14.7 Billion in 2024, growing at a CAGR of 6.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.7% share with a revenue of US$ 6.0 Billion.

Rising prevalence of hemophilia A and B, coupled with improved diagnostic capabilities, drives demand for advanced therapies that prevent spontaneous bleeding and enable normal physical activity. Hematologists increasingly prescribe recombinant factor VIII concentrates for routine prophylaxis in hemophilia A patients, maintaining trough levels that minimize joint damage and improve quality of life. These products support on-demand treatment during acute bleeds, arresting hemorrhage in joints, muscles, or soft tissues to prevent long-term disability.

Clinicians administer extended half-life factor IX therapies for hemophilia B, reducing infusion frequency while sustaining protective factor levels during daily activities and minor trauma. Patients with inhibitors utilize bypassing agents to achieve hemostasis when standard replacement therapy fails, facilitating surgical interventions and trauma management.

In February 2023, the US FDA granted approval to ALTUVIIIO, previously known as efanesoctocog alfa, marking the introduction of a novel recombinant Factor VIII therapy. Designed as an Fc VWF XTEN fusion protein, the treatment delivers sustained Factor VIII activity over an extended period, representing a significant advancement in prophylactic care for individuals living with Hemophilia A.

Manufacturers pursue opportunities to develop gene therapies that restore endogenous factor production, offering potential one-time cures for severe hemophilia A and B. Developers advance subcutaneous non-factor therapies that inhibit anticoagulant pathways, providing convenient prophylaxis for patients with or without inhibitors. These innovations facilitate immune tolerance induction protocols, enabling successful factor replacement in previously refractory cases.

Opportunities emerge in personalized dosing algorithms that optimize trough levels based on individual pharmacokinetics, enhancing outcomes in pediatric and adult populations. Companies invest in bispecific antibodies that mimic factor VIII function, expanding options for inhibitor patients requiring frequent bypassing agents. Firms explore combination approaches that integrate extended half-life concentrates with emerging non-replacement strategies, creating comprehensive management plans for complex bleeding phenotypes.

Key Takeaways

- In 2024, the market generated a revenue of US$ 14.7 Billion, with a CAGR of 6.9%, and is expected to reach US$ 28.6 Billion by the year 2034.

- The type segment is divided into hemophilia A and hemophilia B, with hemophilia A taking the lead with a market share of 78.6%.

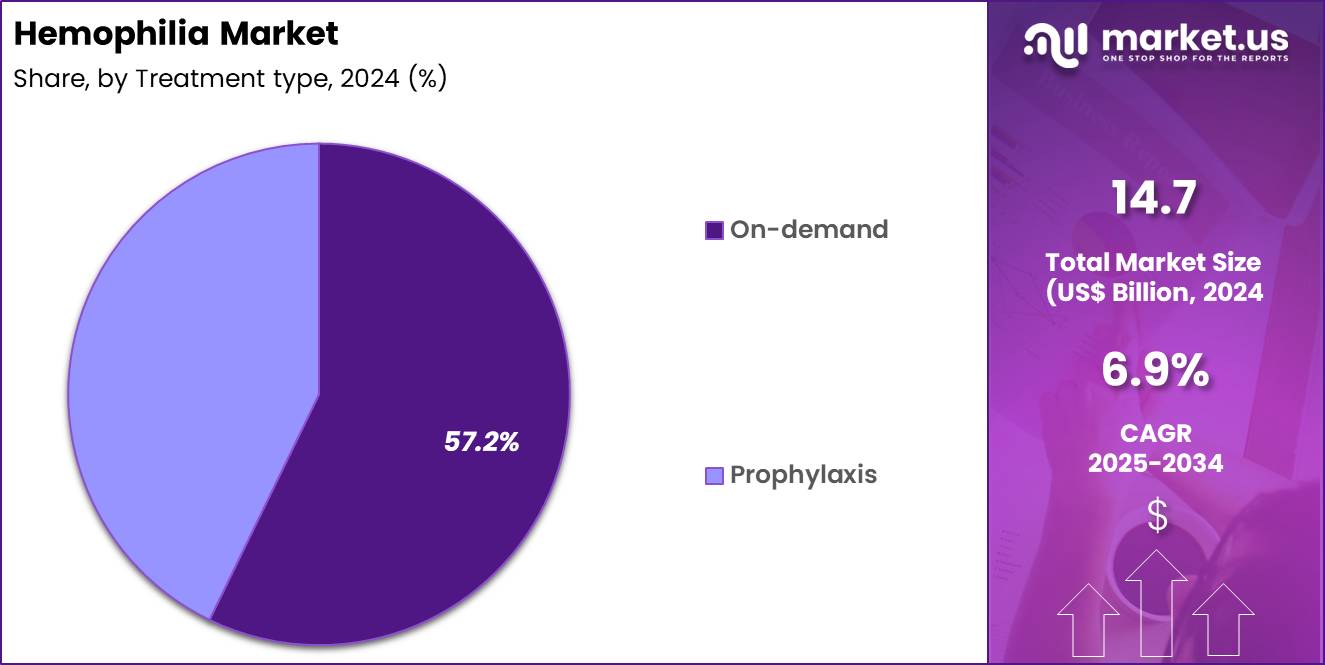

- Considering treatment type, the market is divided into on-demand and prophylaxis. Among these, on-demand held a significant share of 57.2%.

- Furthermore, concerning the therapy segment, the market is segregated into factor replacement therapy, gene therapy and non-factor replacement therapy. The factor replacement therapy sector stands out as the dominant player, holding the largest revenue share of 61.9% in the market.

- The distribution channel segment is segregated into specialty treatment centers, hospitals, retail pharmacies and others, with the specialty treatment centers segment leading the market, holding a revenue share of 49.5%.

- North America led the market by securing a market share of 40.7%.

Type Analysis

Hemophilia A accounted for 78.6% of growth within the type category and represents the largest patient population in the Hemophilia market. Higher prevalence compared to hemophilia B expands diagnosis volumes globally. Clinical pathways and guidelines primarily focus on factor VIII deficiency management. Established diagnostic assays support early and accurate identification. Pediatric diagnosis rates increase with improved newborn screening and family history awareness.

Long-term disease management drives sustained therapy demand. Treatment familiarity among clinicians improves prescribing confidence. Expanded access programs increase treatment initiation in emerging regions. Patient registries strengthen disease tracking and continuity of care. Improved survival rates increase lifetime treatment exposure.

Bleeding episode frequency in untreated patients reinforces therapy reliance. Standardized care protocols improve outcomes and adherence. Innovation in extended half-life products supports continued utilization. Education initiatives increase patient engagement and monitoring. Caregiver training improves home-based administration. Reimbursement structures more frequently support hemophilia A therapies.

Global advocacy increases awareness and diagnosis rates. Clinical trial activity remains concentrated in hemophilia A populations. The segment is projected to retain dominance due to prevalence and established treatment pathways. Overall growth reflects disease burden and long-term care requirements.

Treatment type Analysis

On-demand treatment represented 57.2% of growth within the treatment type category and remains a widely used management approach in the Hemophilia market. Many patients rely on episodic treatment to control acute bleeding events. Cost considerations influence therapy selection in several regions. On-demand therapy suits patients with lower bleed frequency. Healthcare systems in developing markets emphasize episodic care models. Patient preference for reduced infusion burden supports adoption.

Treatment initiation occurs quickly during bleeding episodes. Emergency management protocols reinforce on-demand usage. Limited access to prophylaxis sustains on-demand reliance. Adult patients often transition to on-demand regimens. Clinicians tailor therapy intensity based on disease severity. On-demand therapy supports flexible care pathways.

Hospitals frequently initiate treatment in acute settings. Short-term factor usage reduces inventory requirements. Education programs teach rapid response to bleeds. On-demand therapy integrates with home infusion models. Insurance coverage variability influences regimen selection. Lower monitoring requirements simplify management. The segment is anticipated to remain dominant due to accessibility and flexibility. Overall growth reflects real-world practice patterns and resource considerations.

Therapy Analysis

Factor replacement therapy accounted for 61.9% of growth within the therapy category and continues to anchor hemophilia treatment standards. Decades of clinical use establish strong safety and efficacy confidence. Immediate correction of clotting deficiency supports acute bleed control. Prophylactic and on-demand regimens rely heavily on factor concentrates. Manufacturing advancements improve purity and viral safety. Extended half-life formulations improve dosing convenience.

Clinical guidelines continue to recommend factor therapy as first-line care. Broad availability across regions supports high utilization. Pediatric treatment protocols emphasize early factor initiation. Surgical procedures depend on factor replacement for bleed prevention. Patient training supports home infusion practices. Stable supply chains reinforce therapy continuity.

Physicians prefer predictable pharmacokinetics for individualized dosing. Real-world outcomes reinforce clinical trust. New product launches maintain competitive innovation. Reimbursement frameworks widely recognize factor therapies.

Transition care programs sustain long-term usage. Combination strategies integrate factor therapy with newer options. The segment is projected to retain leadership due to clinical reliability and entrenched practice. Overall growth reflects standard-of-care status and widespread access.

Distribution channel Analysis

Specialty treatment centers represented 49.5% of growth within the distribution channel category and dominate hemophilia care delivery. Comprehensive care models improve patient outcomes and adherence. Multidisciplinary teams coordinate hematology, physiotherapy, and counseling services. Centers maintain expertise in individualized treatment planning. Regular monitoring supports optimal dosing and bleed prevention. Patient education programs improve self-management skills.

Centers manage complex cases including inhibitors and comorbidities. Access to advanced diagnostics supports precise care. Clinical trial participation concentrates within specialty centers. Data collection improves long-term disease management. Treatment centers streamline access to high-cost therapies. Emergency bleed management occurs efficiently in specialized settings.

Pediatric transition programs improve continuity into adulthood. Centralized care improves treatment consistency. Reimbursement processes operate more smoothly through specialty centers. Home infusion training often begins at these centers. Advocacy and support services enhance patient engagement. Referral networks direct patients to specialized care hubs. Capacity expansion increases patient reach. The segment is expected to remain dominant due to expertise concentration and comprehensive care delivery.

Key Market Segments

By Type

- Hemophilia A

- Hemophilia B

By Treatment Type

- On-demand

- Prophylaxis

By Therapy

- Factor replacement therapy

- Gene therapy

- Non-factor replacement therapy

By Distribution Channel

- Specialty treatment centers

- Hospitals

- Retail pharmacies

- Others

Drivers

Rising prevalence of cardiovascular diseases is driving the market

The cardiovascular ultrasound market continues to expand primarily because of the growing incidence of heart-related conditions across the world, creating a strong need for non-invasive methods to detect and track these disorders. Clinicians depend on echocardiography and related imaging techniques to evaluate heart chambers, valve performance, and blood flow patterns with precision.

Health authorities worldwide advocate for broader use of ultrasound in routine cardiac evaluations to help lower the overall impact of these diseases on public health systems. Device manufacturers respond to this demand by developing equipment with superior resolution and portability suitable for various clinical environments. Standard care pathways in hospitals and outpatient clinics now routinely include ultrasound as an initial assessment tool.

International recommendations consistently endorse its application in managing hypertension, coronary issues, and structural abnormalities. Ongoing investigations reinforce its value in decreasing long-term mortality through reliable early findings. Handheld and compact systems have extended access to ultrasound in settings with limited resources.

The considerable societal and financial consequences of unrecognized cardiac problems reinforce the urgency of diagnostic advancement. Cardiovascular diseases remain among the principal causes of death worldwide, highlighting the essential function of ultrasound in contemporary clinical practice.

Restraints

High costs of advanced ultrasound systems are restraining the market

The cardiovascular ultrasound market encounters significant limitations due to the substantial expense of sophisticated equipment, especially systems equipped with advanced imaging capabilities and analytical software. Producers bear considerable costs related to research, regulatory approval, and quality verification, resulting in elevated prices for healthcare institutions. Facilities with restricted budgets, particularly in smaller or rural locations, frequently find it difficult to justify acquiring top-tier systems.

Ongoing requirements for calibration, software maintenance, and staff training generate persistent financial commitments. Reimbursement structures in numerous areas fall short of covering the full expense of premium ultrasound technology, creating additional disincentives. Budgetary restrictions within public and private healthcare organizations often lead to preference for simpler, less expensive alternatives.

Disparities in funding between wealthier and less affluent regions widen the divide in access to modern diagnostic tools. Long-term economic assessments indicate that without meaningful price adjustments, expansion will remain limited in certain segments. Providers must balance the initial investment against potential improvements in diagnostic reliability and workflow. The combination of these financial obstacles continues to restrict the widespread implementation of cutting-edge cardiovascular ultrasound technology.

Opportunities

Advancements in AI-integrated ultrasound systems is creating growth opportunities

Considerable potential exists in the cardiovascular ultrasound market due to continuous progress in incorporating artificial intelligence, which improves diagnostic reliability and streamlines operational processes for various cardiac conditions. Equipment developers are able to embed automated functions that perform routine calculations, identify irregularities, and provide initial assessments, thereby lessening reliance on individual expertise.

Regulatory authorities have started to approve AI-enhanced equipment more readily when supported by solid performance evidence. Clinicians receive meaningful assistance in demanding environments, where AI aids in detailed evaluations such as ventricular function and strain measurements. Alliances between technology providers and medical institutions speed up the improvement of AI features for practical application.

Investigations examine the role of AI in remote evaluation and virtual cardiac consultations. Developing healthcare regions are gradually incorporating AI-capable equipment as digital systems become more widespread. Training programs are being updated to equip sonographers and cardiologists with skills for working alongside AI-generated insights.

Individuals gain from earlier and more dependable identification of heart abnormalities. The combination of greater diagnostic confidence and operational efficiency establishes AI-enhanced ultrasound as an important direction for future market development.

Impact of Macroeconomic / Geopolitical Factors

Global economic stability enhances funding for rare disease therapies, propelling the hemophilia market forward as governments and insurers prioritize access to clotting factor treatments and gene therapies. Businesses align with population growth trends in emerging regions, which increases patient registries and drives consistent demand for prophylaxis regimens.

Despite these advantages, fluctuating currency values amid economic downturns raise operational expenses, compelling pharmaceutical firms to adapt pricing in unstable financial landscapes. Political instabilities in Europe and the Middle East compromise plasma collection networks, leading to shortages that affect production schedules for international suppliers.

Decision-makers counter such vulnerabilities by establishing redundant collection centers in secure locations, which improves resource allocation and supports uninterrupted patient care. Current US tariffs impose elevated duties on imported branded biologics from key markets like Europe, intensifying cost structures for companies reliant on global sourcing.

U.S.-focused entities respond by deepening investments in local bioreactors, which enhances manufacturing agility and aligns with national health priorities. Evolving partnerships in recombinant technologies ultimately solidify the market’s foundation, enabling broader treatment equity and sustained value for healthcare ecosystems.

Latest Trends

Integration of artificial intelligence in cardiovascular ultrasound is a recent trend

The cardiovascular ultrasound market has displayed a noticeable shift in recent years toward extensive incorporation of artificial intelligence, which simplifies image evaluation and promotes more uniform diagnostic conclusions. Equipment producers are embedding AI functions that automatically recognize critical anatomical features and measure essential parameters during live examinations.

Cardiologists observe that AI shortens the duration of standard procedures while preserving high levels of precision. Regulatory authorities have released guidance that supports the verification and authorization of AI-supported ultrasound capabilities. Current clinical assessments are confirming the advantages of AI in recognizing subtle irregularities that might escape manual examination.

Training institutions are updating their programs to prepare future sonographers and physicians for effective collaboration with AI tools. International partnerships are working to establish consistent AI performance across different ultrasound systems and clinical contexts.

Individuals experience the advantages of more dependable results and potentially shorter diagnostic timelines. Ethical standards are being established to guarantee openness and fairness in AI-supported ultrasound reporting. The movement indicates a wider transition in medical imaging toward intelligent, data-supported approaches that complement clinical judgment.

Regional Analysis

North America is leading the Hemophilia Market

In 2024, North America held a 40.7% share of the global hemophilia market, driven by advancements in gene therapy and extended half-life clotting factors that have enhanced treatment efficacy and reduced infusion frequency for patients with hemophilia A and B, thereby improving adherence in long-term management protocols. Hematologists increasingly adopted prophylactic regimens to prevent joint damage in pediatric and adult cohorts, supported by comprehensive patient registries that facilitate personalized dosing amid rising awareness campaigns.

Regulatory approvals expedited access to novel recombinant products, addressing unmet needs in inhibitor management for severe cases. Demographic factors, including improved newborn screening, amplified diagnosed populations, prompting integrated multidisciplinary clinics for comprehensive care. Pharmaceutical innovations focused on subcutaneous alternatives to intravenous options, optimizing convenience for home-based therapies.

Collaborative surveillance monitored bleeding episodes, fostering confidence in emerging bispecific antibodies. Supply enhancements ensured biologic stability compliant with stringent standards in specialty centers. The Centers for Disease Control and Prevention estimates that as many as 33,000 males in the United States are living with hemophilia.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders project notable escalation in hemophilia therapies across Asia Pacific during the forecast period, propelled by intensifying diagnostic efforts and healthcare infrastructure upgrades that confront underreporting amid genetic predispositions. Clinicians incorporate recombinant factors into routine prophylaxis for young patients, adapting strategies to curb arthropathy in high-fertility nations.

National programs subsidize inhibitor eradication regimens through public insurance, equipping urban hospitals to manage severe bleeding episodes effectively. Biotech developers customize extended-half-life variants with local manufacturing, tailoring them to ethnic hemostatic profiles in polycystic kidney-associated cases.

Cross-regional alliances validate gene therapy pilots through trials, enhancing accessibility for underserved ethnic minorities. Pharmaceutical entities localize bispecific antibody production, ensuring affordability for rural hemophilia centers. Policy frameworks promote awareness drives on inheritance patterns, empowering families in peripheral areas facing stigma. The World Federation of Hemophilia reported 36,209 identified hemophilia patients in China in 2024.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Hemophilia market drive growth by expanding long-acting factor therapies, non-factor treatments, and gene-based solutions that reduce bleeding frequency and treatment burden. Companies strengthen adoption through deep engagement with hematologists and treatment centers to integrate advanced therapies into individualized care plans.

Commercial strategies emphasize patient support programs, home-infusion enablement, and payer alignment to improve adherence and lifetime therapy continuity. Innovation priorities focus on durability of response, inhibitor management, and simplified dosing schedules that enhance quality of life.

Market expansion targets regions improving rare-disease diagnosis, reimbursement access, and specialty care infrastructure. Roche operates as a leading participant by leveraging its strong hematology portfolio, global clinical development capabilities, and patient-centric approach to delivering innovative therapies that redefine long-term management of bleeding disorders.

Top Key Players

- Bayer AG

- Pfizer Inc.

- Novo Nordisk A/S

- Takeda Pharmaceutical Company Limited

- Bioverativ (Sanofi)

- Sobi (Swedish Orphan Biovitrum AB)

- CSL Behring

- Octapharma AG

- Grifols, S.A.

- Shire (now part of Takeda)

Recent Developments

- In May 2024, the US FDA revised the prescribing information for ALTUVIIIO to incorporate detailed findings from the Phase 3 XTEND Kids clinical study. The updated label reflects evidence that a once weekly dosing regimen delivers strong and consistent bleeding control in pediatric patients with Hemophilia A, reinforcing confidence in extended interval prophylaxis for children.

- In December 2024, researchers in India reported a milestone outcome in which gene therapy was successfully administered to a patient with severe Hemophilia A. Conducted under a clinical trial led by Alok Srivastava at the Centre for Stem Cell Research, Christian Medical College Vellore, and supported by India’s Union Department of Biotechnology, the study demonstrated the potential of genetic correction to address the root cause of recurrent and life threatening bleeding episodes.

Report Scope

Report Features Description Market Value (2024) US$ 14.7 Billion Forecast Revenue (2034) US$ 28.6 Billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Hemophilia A and Hemophilia B), By Treatment Type (On-Demand and Prophylaxis), By Therapy (Factor Replacement Therapy, Gene Therapy and Non-Factor Replacement Therapy), By Distribution Channel (Specialty Treatment Centers, Hospitals, Retail Pharmacies and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bayer AG, Pfizer Inc., Novo Nordisk A/S, Takeda Pharmaceutical Company Limited, Bioverativ (Sanofi), Sobi (Swedish Orphan Biovitrum AB), CSL Behring, Octapharma AG, Grifols, S.A., Shire (now part of Takeda) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bayer AG

- Pfizer Inc.

- Novo Nordisk A/S

- Takeda Pharmaceutical Company Limited

- Bioverativ (Sanofi)

- Sobi (Swedish Orphan Biovitrum AB)

- CSL Behring

- Octapharma AG

- Grifols, S.A.

- Shire (now part of Takeda)