Global Hearing Aids Market By Product Type (In-the-Ear Hearing Aids, Receiver in-the-Ear Hearing Aids, Canal Hearing Aids, Behind-the-Ear Hearing Aids, and Other Product Types), By Technology Type, By Distribution Channel(E-commerce, Government Purchases, and Retail Sales), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov 2024

- Report ID: 59116

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

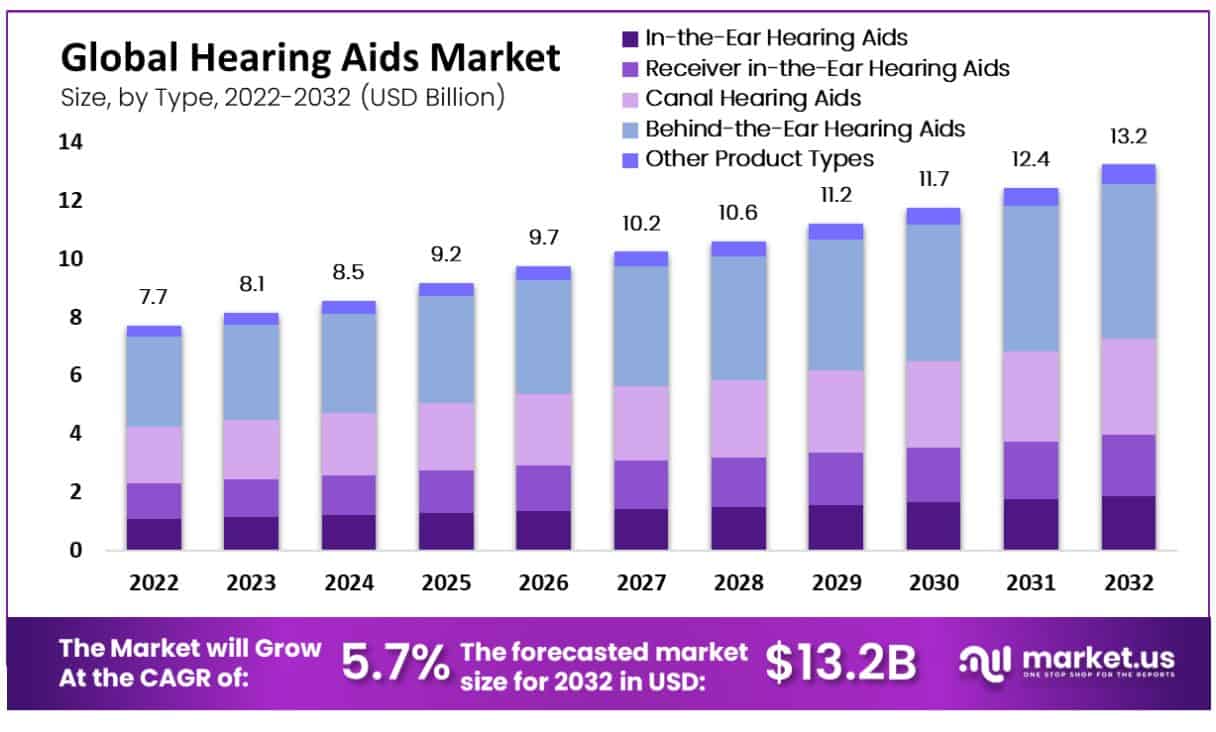

The Hearing Aids Market size is expected to be worth around USD 13.2 billion by 2032 from USD 7.7 billion in 2022, growing at a CAGR of 5.7% during the forecast period 2023 to 2032.

A hearing aid is a small electronic device that should be used by people who can’t hear. The microphone, amplifier, and speaker are the three fundamental components of a hearing aid. People who suffer from hearing loss as a result of damage to the tiny sensory cells in the inner ear, known as hair cells, can benefit most from hearing aids in terms of improving their ability to hear and speak. This is because these devices amplify the sound waves that enter the ear.

Key Takeaways

- Market Growth: The global Hearing Aids Market is projected to reach USD 13.2 billion by 2032, growing at a CAGR of 5.7% from USD 7.7 billion in 2022.

- Market Driver: High expansion of the elderly population, particularly susceptible to hearing loss, is driving market growth.

- Restraining Factor: Financial constraints and unwillingness to take hearing tests are restraining factors.

- COVID-19 Impact: The COVID-19 pandemic led to a decrease in hearing aid sales, with postponed cochlear implant procedures contributing to the decline.

- By Type Analysis: Behind-the-ear (BTE) hearing aids dominated the market in 2022, accounting for over 40% of revenue share. Canal hearing aids are expected to grow rapidly due to their discreet nature and appeal to young adults.

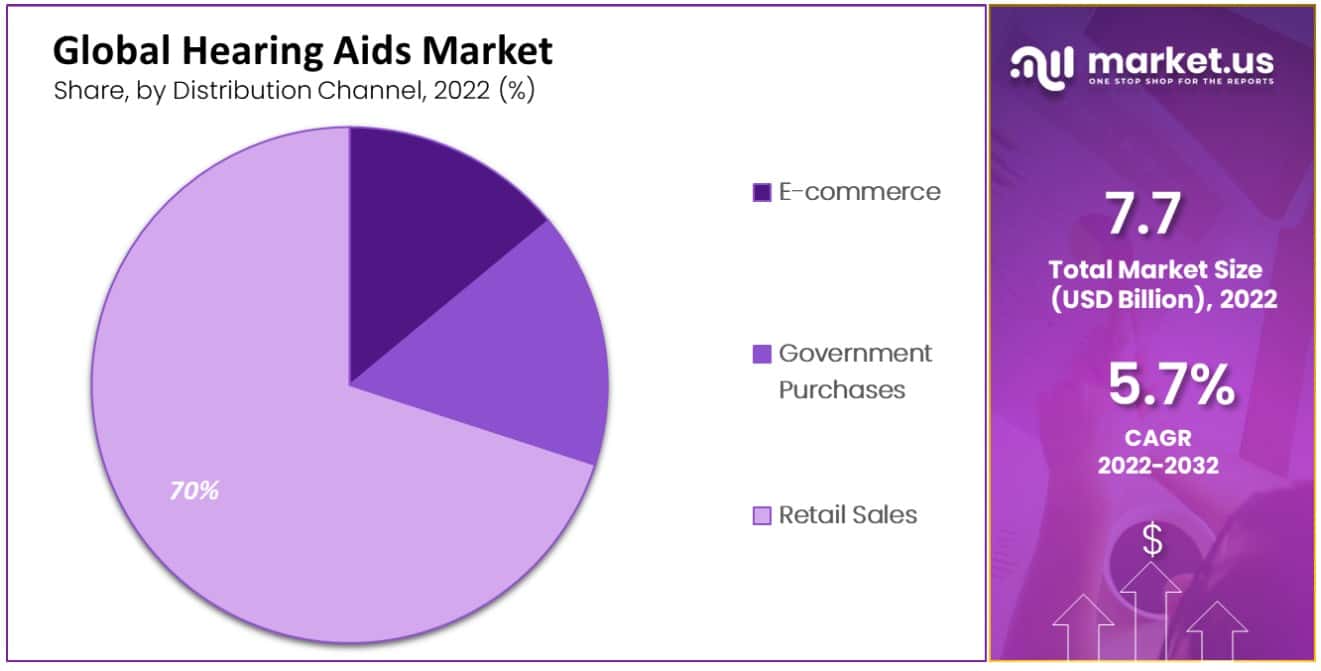

- By Distribution Channel Analysis: Retail sales, including over-the-counter hearing aids, had a revenue share of over 70% in 2022.

- Growth Opportunity: Emerging markets, driven by competitive prices, medical tourism, and healthcare infrastructure improvements, offer lucrative opportunities.

- Latest Trends: Manufacturers are increasingly focusing on securing raw materials at competitive prices and partnering with third-party suppliers.

Driving Factors

Increasing Noise Pollution and the Market for Hearing Aids to Drive Market Expansion

Estimates indicate that exposure to loud noises causes irreversible hearing loss in 17% of adults aged 20 to 69 and 12.5 percent of adolescents and children aged 6 to 19, roughly 26 million adults and 5.2 million children and adolescents. Hearing loss may be caused by damage to inner ear structures or nerve fibers that respond to sound.

Hearing loss can result from a single exposure to a mostly loud sound and blast, as can prolonged exposure to loud sounds. Approximately 118 thousand adults and 65 thousand children in the United States had their devices fixed. Extreme noise pollution and the expansion of the Hearing Aids Market applications are likely to drive the global market for hearing aids.

Due to the rising demand for hearing aids from older people, the market’s expansion is severely impacted by the high expansion of the elderly population. In addition, the aging population, which is susceptible to hearing loss due to changes in the auditory nerve and inner ear, congenital conditions, long-term exposure to loud noises, and other hearing conditions, will drive market growth over the forecast period.

According to the World Health Organization, the prevalence of deafness rises with age; More than 25% of people over the age of 60 have a hearing loss that makes them unable to communicate with others. Patients with hearing impairment who receive effective treatment may have fewer co-morbid conditions and incur lower healthcare costs.

Restraining Factors

Ignorance by Patients Due to Poverty

One of the primary causes of healthcare providers’ low financial standing is a lack of financial resources to invest in cutting-edge technologies, particularly in developing nations like Brazil and Mexico. A lot of work in research and development is needed to come up with cutting-edge hearing aids.

In addition, the staff needs extensive training to effectively and safely handle bone-anchored systems and cochlear implants. As a result, both the final price paid by the customer and the cost of manufacturing will rise significantly.

Patients’ Unwillingness to Take a Hearing Test May Impede Growth.

Accepting that they have a hearing impairment is difficult for many people, so they never take a test. Additionally, many people are reluctant to use these products because of their social stigma. Approximately 92 percent of respondents acknowledge the importance of hearing in preserving one’s overall quality of life. However, only 37% of people have taken a hearing test in the past two years.

Type Analysis

According to the product type, the market is divided into Behind-the-Ear, In-The-Ear (ITE), Receiver-In-The Canal (RIC), Completely Inside the Canal (CIC), and others (invisible within the canal). The behind-the-ear (BTE), hearing aids segment had an over 40% revenue share in 2022.

A BTE hearing aid is a small, curvy case that fits behind the ear. These products can be modified by connecting them to external sound sources such as infrared hearing systems and auditory training equipment.

Market demand is driven by the availability of various BTE models compatible with Bluetooth, allowing for improved wireless connectivity. Cochlear implants and bone-anchored implants make up the segment of hearing implants. The major contributors to the substantial market expansion are incorporating newborn hearing screening tests into routine medical care and introducing new products.

Throughout the forecast period, it is anticipated that the canal hearing aids segment will emerge as the revenue segment with the fastest growth rate. One of the crucial factors in their rapid expansion is their discreet nature.

In addition, due to the stigma associated with wearing hearing aids, young adults favor canal devices over other options. These technologically advanced devices significantly reduce tinnitus and cancel out external voices. The growth of canal devices in the coming years is due to the factors above.

Distribution Channel Analysis

With a revenue share of over 70% in 2022, the retail sales segment is expected to expand fastest over the forecast period. Many retail sales can be attributed to the widespread use of over-the-counter hearing aids.

Over the forecast period, e-commerce and government purchases of these devices are expected to expand profitably. Many retail stores, increasing manufacturing companies entering the retail sales market, and a high sales margin all contribute to the retail sales sector’s expansion.

These products’ retail sales are further broken down into company-owned and independent stores. Due to their low entry barriers, high-profit margin, and high level of customer interaction, independent retail stores dominated the market. Walmart, Costco, and CVS are important independent retail sales players.

Key Market Segments

Based on Product Type

- In-the-Ear Hearing Aids

- Receiver in-the-Ear Hearing Aids

- Canal Hearing Aids

- Behind-the-Ear Hearing Aids

- Other Product Types

Based on the Technology Type

- Digital

- Analog

Based on the Distribution Channel

- E-commerce

- Government Purchases

- Retail Sales

Growth Opportunity

Emerging Markets Offer Lucrative Opportunities

The competitive prices offered by leading healthcare facilities for surgical procedures, including those involving cochlear implant implantations, are a major driver of medical tourism in developing countries. The expansion of medical tourism, rising healthcare costs, and better healthcare infrastructure are expected to drive the emerging market demand for hearing aids over the forecast period.

Latest Trends

Nowadays, manufacturers are more likely to purchase raw materials at competitive prices. Contracting with suppliers of raw materials on a long-term basis is necessary for raw material procurement. To sell their products, some independent manufacturers employ third-party suppliers. This market is currently experiencing such market key trends, which is increasing demand for these products.

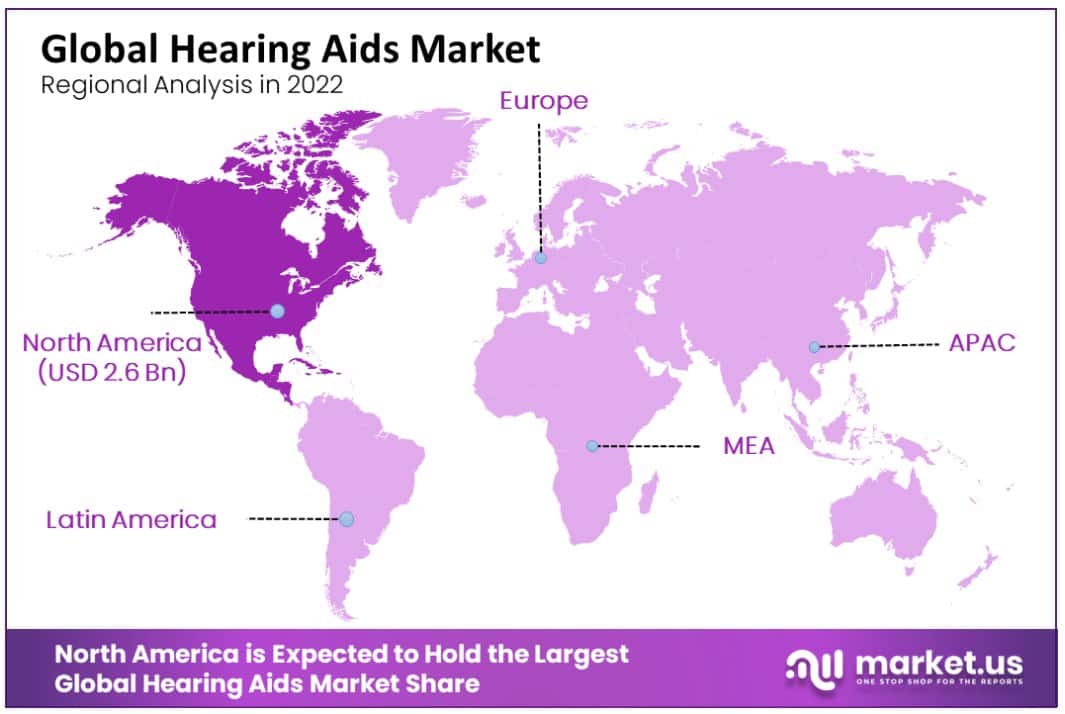

Regional Analysis

In 2022, North America held a dominant market position, capturing more than a 33.7% share and holds US$ 2.6 Billion market value for the year. The North American market is dominating the Global Hearing Aids Market. The strong adoption of smaller devices to increase aesthetic appeal, new product launches, and a growing market volume for hearing aids are some of the main factors contributing to the region’s prominence in the global market due to increased research into the development of advanced hearing aids and strong government support.

Europe is anticipated to be the second-largest region in terms of share. Additionally, it is expected that the strategic presence of several businesses in the region, including GN Store Nord A/S, Senovo, Demant A/S, and WS Audiology, will boost growth.

Due to the growing number of people using hearing implants and the ever-increasing number of people who are getting older, Asia-Pacific is expected to grow at the highest CAGR over the forecast period. Nearly 3.6 million Australians have hearing loss. This number is expected to rise to 7.8 million by 2060, boosting the country’s growing market.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Sonova Holding AG has more than 80% market share and is the major hearing brand. Sonova Holding AG has completed the March 2022 purchase of Sennheiser Electronic GmbH & Co. KG’s Consumer Division. This acquisition will expand Sonova’s client network and product portfolio. GN Store Nord A/S introduced the brand-new ReSound Key in February 2021.

The extensive range of hearing aids now opens up new opportunities for people all over the globe to have access to advanced hearing technology. The company will be able to reach more customers and expand its product range with this launch.

Listed below are some of the most prominent players in the hearing aid industry.

Market Key Players

- Sonova Group

- Demant A/S

- GN Store Nord A/S

- WS Audiology

- Starkey

- MED-EL (Medical Electronics)

- Cochlear Ltd

- RION Co., Ltd

- SeboTek Hearing System LLC

- Widex USA, Inc

- Sivantos Pte LTD

- Phonak Hearing Systems

- Other Key Players

Recent Developments

- In May 2022: Signia, a W/S Audiology brand, announced the availability of its feature enhancements to its groundbreaking Augmented Xperience (AX) hearing aid platform -HandsFree, Auto EchoShield, and Own Voice Processing (OVP) 2.0 – which work together to improve hearing performance in a variety of situations

- In February 2022: Phonak, a member of Sonova group, a manufacturer of hearing aids across the globe, announced the new Virto Paradise line of custom-made hearing aids. These include the highly anticipated Virto P Black – the fully connected in-the-ear (ITE) hearing aid that resembles a modern headphone, and the super-discreet Virto PTitanium – the world’s only custom titanium hearing aid.

Report Scope

Report Features Description Market Value (2022) US$ 7.7 Bn Forecast Revenue (2032) US$ 13.2 Bn CAGR (2023-2032) 5.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on Product Type- In-the-Ear Hearing Aids, Receiver in-the-Ear Hearing Aids, Canal Hearing Aids, Behind-the-Ear Hearing Aids, and Other Product Types; Based on Technology Type- Digital and Analog; Based on Distribution Channel- E-commerce, Government Purchases, and Retail Sales Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Sonova Group, Demant A/S., GN Store Nord A/S, WS Audiology, Starkey, MED-EL (Medical Electronics), Phonak Hearing Systems, Cochlear Ltd., RION Co., Ltd., SeboTek Hearing System LLC, Widex USA, Inc., Sivantos Pte LTD, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sonova Group

- Demant A/S

- GN Store Nord A/S

- WS Audiology

- Starkey

- MED-EL (Medical Electronics)

- Cochlear Ltd

- RION Co., Ltd

- SeboTek Hearing System LLC

- Widex USA, Inc

- Sivantos Pte LTD

- Phonak Hearing Systems

- Other Key Players