Global Healthcare Cleanroom Consumables Market Analysis By Product (Wipers, Cleanroom Apparel, Cleanroom Products, Cleanroom Stationery, Other Products), By End-User (Hospitals & Clinics, Research Laboratories, Medical Device Industry, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 83861

- Number of Pages: 201

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

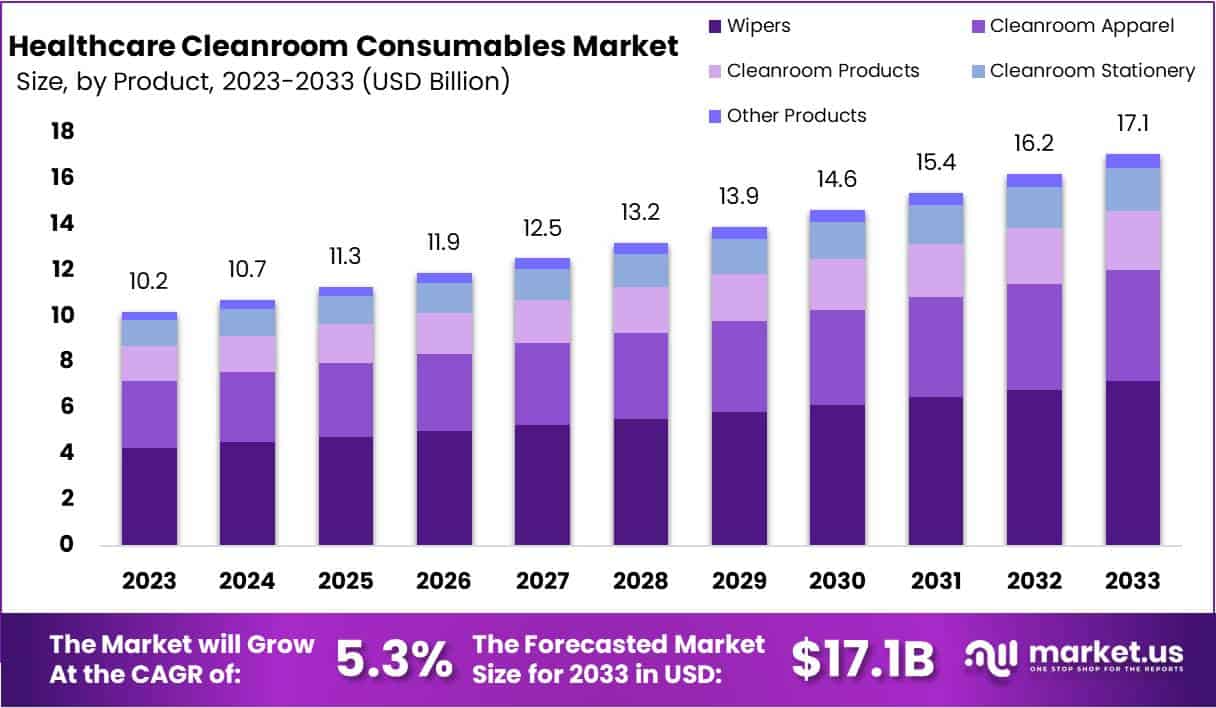

The Global Healthcare Cleanroom Consumables Market size is expected to be worth around USD 17.1 Billion by 2033, from USD 10.2 Billion in 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

Healthcare cleanroom consumables encompass a range of disposable products crucial for maintaining sterile and contamination-free environments in controlled healthcare settings. These settings are pivotal for the manufacturing of pharmaceuticals, medical devices, aseptically prepared drugs, and other sensitive healthcare products. Cleanroom consumables play a vital role in safeguarding the integrity and efficacy of these products by minimizing the risk of contamination during production, assembly, and storage processes.

In recent years, the market has witnessed notable developments, including significant investments, innovative product launches, strategic acquisitions, and partnerships. For instance, according Research, Inc., investments in expanding cleanroom manufacturing facilities, such as Avantor, Inc.’s €40 million investment in its facility in Limerick, Ireland, are indicative of the industry’s commitment to meeting growing demand and enhancing production capabilities.

Moreover, advancements in materials science have spurred the development of innovative cleanroom consumables with improved functionality and performance, as exemplified by DuPont Personal Protection’s introduction of a new line of cleanroom apparel made from bio-based materials. Additionally, strategic partnerships and acquisitions, such as Thermo Fisher Scientific’s acquisition of Phapros Systems, Inc., have enabled companies to broaden their product portfolios and strengthen their market presence.

Overall, the healthcare cleanroom consumables market is poised for significant growth, driven by technological advancements, increasing regulatory scrutiny, and the growing demand for sterile products across various healthcare sectors. As stakeholders continue to invest in research and development and forge strategic collaborations, the market is expected to witness sustained expansion in the coming years.

Key Takeaways

- Market Growth: Expected market value of USD 17.1 billion by 2033, growing at a 5.3% CAGR from 2024 to 2033.

- Product Dominance: Wipers segment held over 42% market share in 2023, followed by cleanroom apparel and cleanroom products.

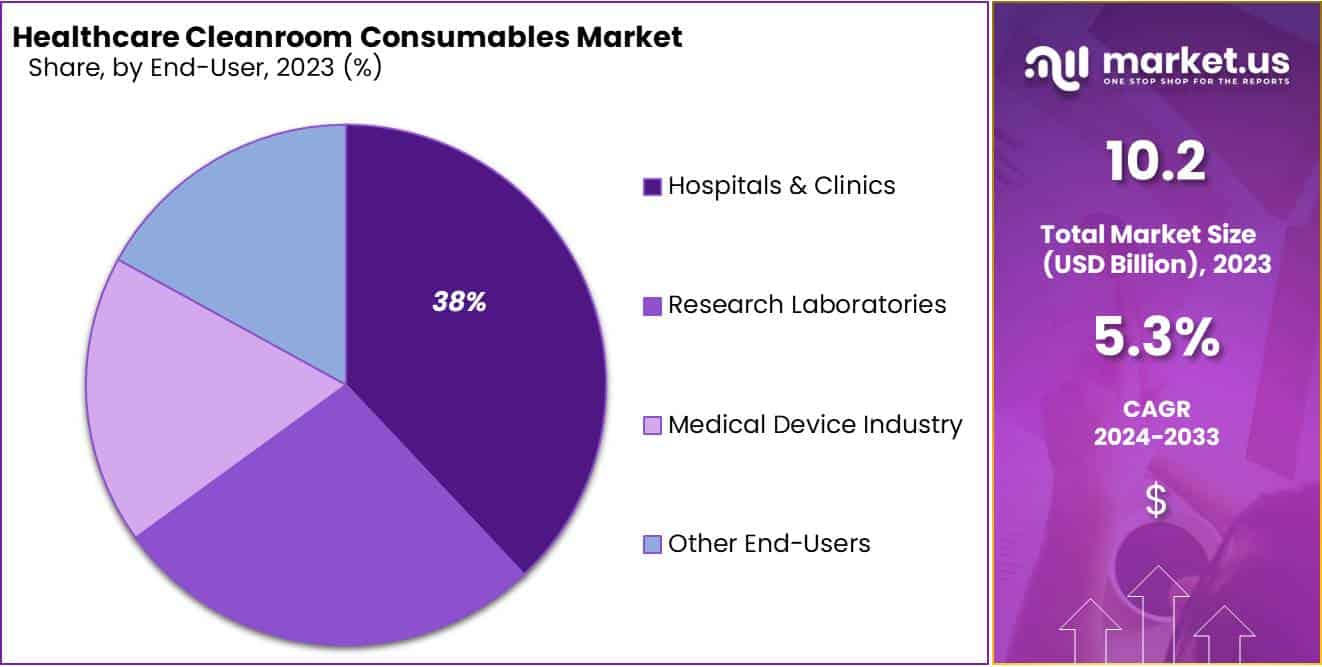

- End-User Importance: Hospitals, segment held a strong position with over 42% of the market share and clinics, and research labs are major consumers, driven by infection prevention and research needs.

- Cost Restraints: High initial and maintenance expenses hinder adoption, particularly among smaller healthcare organizations.

- Technological Opportunities: Rising adoption of advanced healthcare tech fuels demand for cleanroom consumables.

- Disposable Trends: Increasing preference for single-use products driven by infection control concerns and regulatory compliance.

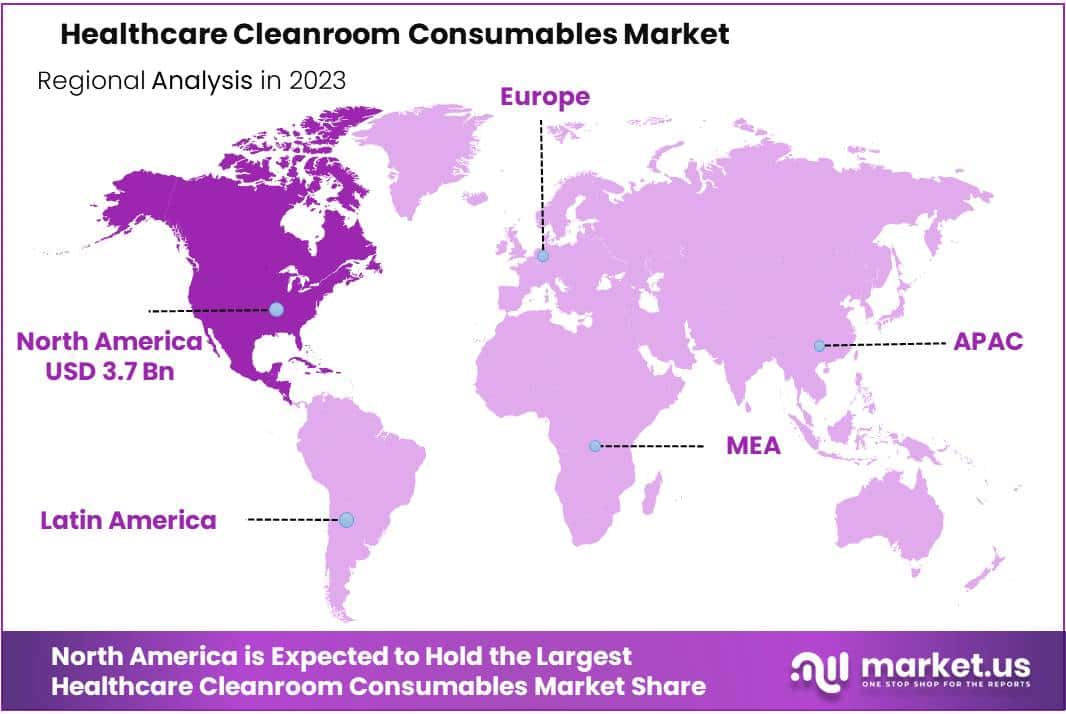

- Regional Dominance: North America led with over 36.6% market share in 2023, driven by strong healthcare infrastructure and industry.

Product Analysis

In 2023, the Healthcare Cleanroom Consumables Market saw a significant dominance of the Wipers segment, capturing over 42% of the market share. Wipers are crucial for maintaining cleanliness and sterility in healthcare cleanrooms by wiping surfaces, equipment, and instruments to prevent contamination and meet regulatory standards.

Cleanroom Apparel, including coveralls, gowns, masks, and gloves, also gained traction due to the need for protective clothing to minimize contamination risks in healthcare settings.

Cleanroom Products, such as disinfectants, sterilization supplies, swabs, and mops, constituted a substantial share, driven by the focus on infection prevention in healthcare facilities.

Cleanroom Stationery emerged as a notable segment, featuring specialized items like notebooks and pens designed for cleanroom use to reduce particle generation and contamination risks.

Other Products, like adhesive mats, shoe covers, and packaging materials, played a crucial role in maintaining cleanliness and compliance with regulations in healthcare cleanrooms.

Overall, the diverse range of products in the Healthcare Cleanroom Consumables Market caters to specific cleanliness and sterility requirements in healthcare facilities. With growing emphasis on infection control and regulatory compliance, the market is expected to witness continued growth, offering opportunities for market players across all segments.

End-User Analysis

In 2023, the healthcare cleanroom consumables market saw significant activity, particularly in the wipers segment, which held a strong position with over 42% of the market share. This dominance was largely due to the critical need for cleanliness in healthcare facilities, such as hospitals, clinics, and research labs, where wipers are essential for maintaining sterile environments.

Following closely behind, hospitals and clinics emerged as the main users of healthcare cleanroom consumables. Their growth was driven by a heightened focus on preventing infections and ensuring patient safety, requiring strict adherence to cleanroom protocols.

Research laboratories also played a substantial role in driving demand for cleanroom consumables. These facilities, pivotal for scientific breakthroughs and medical advancements, rely heavily on such products to maintain pristine environments conducive to sensitive research activities.

The medical device industry was another significant consumer of cleanroom consumables, driven by stringent regulatory standards mandating cleanliness throughout the manufacturing process to ensure product quality and safety.

Additionally, pharmaceutical manufacturers, biotech firms, and compounding pharmacies contributed to the diverse landscape of cleanroom consumables usage. These entities prioritize cleanliness to maintain product integrity, comply with regulations, and protect patient health.

Key Market Segments

Product

- Wipers

- Cleanroom Apparel

- Cleanroom Products

- Cleanroom Stationery

- Other Products

End-User

- Hospitals & Clinics

- Research Laboratories

- Medical Device Industry

- Other End-Users

Drivers

Stringent Regulatory Standards

Stringent regulatory standards play a pivotal role in driving the demand for healthcare cleanroom consumables. These standards, set forth by regulatory bodies such as the FDA (Food and Drug Administration) and CDC (Centers for Disease Control and Prevention), mandate strict cleanliness and contamination control measures in healthcare facilities to safeguard patient health and prevent infections.

For instance, the CDC estimates that each year in the United States, approximately 1 in 31 hospital patients acquires at least one healthcare-associated infection (HAI). Compliance with these regulations necessitates the use of cleanroom consumables, including gloves, apparel, wipes, and disinfectants, to maintain sterile environments and minimize the risk of cross-contamination. Consequently, healthcare providers are compelled to invest in high-quality cleanroom products to adhere to regulatory requirements, thereby driving the growth of the healthcare cleanroom consumables market.

Restraints

High Initial Investment and Maintenance Costs

The high initial investment and ongoing maintenance costs associated with establishing and sustaining cleanroom facilities pose a significant restraint on the adoption of healthcare cleanroom consumables. According to data from leading healthcare organizations, the initial investment for constructing a cleanroom can range from $100,000 to over $1 million, depending on the size and complexity of the facility.

Additionally, annual operational expenses for cleanroom maintenance, including HVAC systems, filtration, and monitoring equipment, can exceed $50,000 per year per cleanroom. For smaller or resource-constrained healthcare facilities, these costs represent a considerable financial burden, often leading to hesitancy in adopting cleanroom technologies and consumables.

Moreover, ongoing training of personnel to adhere to stringent cleanroom protocols adds to operational costs. Consequently, despite the critical importance of contamination control in healthcare settings, the barrier of high upfront and maintenance expenses constrains the widespread adoption of cleanroom consumables, particularly among smaller healthcare organizations.

Opportunities

Rising Adoption of Advanced Healthcare Technologies

The rising adoption of advanced healthcare technologies, including biotechnology, pharmaceuticals, and medical devices, presents a compelling opportunity for the healthcare cleanroom consumables market. As per the Healthcare Information and Management Systems Society (HIMSS), the global healthcare technology market is projected to reach $674.5 billion by 2025, indicating a substantial growth trajectory. These innovative technologies often necessitate stringent contamination control measures to safeguard product integrity and patient well-being.

Consequently, healthcare facilities are increasingly investing in manufacturing capabilities and cleanroom environments to meet regulatory standards and industry best practices. This surge in technological advancements and facility expansions is driving the demand for cleanroom consumables, such as gloves, apparel, wipes, and disinfectants. Manufacturers and suppliers in this market stand to benefit significantly from the expanding adoption of advanced healthcare technologies, with opportunities for growth and market penetration on the horizon.

Trends

Shift towards Single-Use and Disposable Products

The healthcare cleanroom consumables market is witnessing a pronounced trend towards single-use and disposable products, driven by heightened concerns over infection control and patient safety. According to a report by the World Health Organization (WHO), approximately 7% of hospitalized patients in developed countries acquire at least one healthcare-associated infection (HAI) during their stay, emphasizing the critical need for stringent contamination control measures.

As a result, healthcare facilities are increasingly opting for disposable gloves, masks, gowns, wipes, and other consumables to mitigate the risk of cross-contamination and enhance infection prevention protocols. This shift is underscored by the efficiency and convenience offered by single-use products, which not only streamline compliance with regulatory standards but also reduce operational complexities associated with sterilization and reprocessing.

Regional Analysis

In 2023, North America dominated the Healthcare Cleanroom Consumables Market, accounting for over 36.6% of the market share and reaching a value of USD 3.7 billion. This was mainly due to factors such as the region’s strong healthcare infrastructure, strict regulatory standards governing cleanroom practices, and the thriving pharmaceutical and biotechnology industry.

The United States played a crucial role in driving market growth within North America. With its leadership in healthcare innovation and technology adoption, coupled with substantial investments in research and development, the country saw high demand for cleanroom consumables, especially in pharmaceutical manufacturing and medical device production.

Although Canada’s market size is smaller compared to the US, it made significant contributions to North America’s leadership position. Canada’s advanced medical facilities and emphasis on patient safety and infection control fueled the demand for cleanroom consumables across various healthcare settings.

Looking ahead, North America is expected to maintain its dominance in the Healthcare Cleanroom Consumables Market. Ongoing advancements in medical technology, increased investments in healthcare infrastructure, and a growing focus on maintaining sterile environments in healthcare facilities will likely drive market growth in the region.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The healthcare cleanroom consumables market is characterized by the strong presence of global leaders such as Thermo Fisher Scientific Inc. and DuPont. These companies are recognized for their extensive portfolios of contamination control products and sterile solutions. Their continued investment in R&D and expansion into emerging markets have reinforced their dominance. The growth of their cleanroom consumables segment is supported by increased demand for advanced pharmaceutical manufacturing and biotechnology processes, where high standards of cleanliness and contamination control are critical.

Berkshire Corporation and Valutek Inc. are significant contributors to the market, offering a broad range of specialized cleanroom products such as wipes, apparel, and gloves. Their focus on developing innovative, lint-free, and antistatic materials has positioned them as preferred suppliers in the healthcare sector. Through continuous technological upgrades and adherence to stringent industry standards, these companies ensure product reliability and compatibility with healthcare and pharmaceutical cleanroom environments, which enhances operational efficiency and compliance.

KM Purely and Illinois Tool Works Inc. have been expanding their market footprint by offering cost-effective, high-quality cleanroom consumables. Their growth strategy is primarily centered on innovation, operational excellence, and regional expansion, particularly in Asia-Pacific and North America. Illinois Tool Works, with its diversified industrial base, leverages its manufacturing capabilities to deliver precision-engineered consumables that meet evolving healthcare requirements. KM Purely’s product quality and targeted distribution networks have further strengthened its presence in global cleanroom markets.

Steris, Kimberly-Clark Corporation, and Contec Inc. play essential roles in driving innovation and sustainability in cleanroom consumables. Their focus lies in developing eco-friendly, sterilized, and reusable cleanroom products aligned with healthcare safety regulations. Steris leads in sterilization and infection prevention solutions, while Kimberly-Clark offers superior protective apparel and wipers. Contec’s specialization in contamination control products tailored for pharmaceutical and biotechnology applications further supports the sector’s growth. Together, these players contribute to the technological and operational advancement of the healthcare cleanroom consumables market.

Market Key Players

- Thermo Fisher Scientific Inc.

- DuPont

- Berkshire Corporation

- Valutek Inc.

- KM Purely

- Illinois Tool Works Inc.

- Valutek Inc.

- Steris

- Kimberly-Clark Corporation

- Contec Inc.

- Other Key Players

Recent Developments

- In January 2024, Alcon has acquired Transcend Therapeutics for $1.75 billion. This move allows Alcon to broaden its product range in ophthalmic surgery by incorporating Transcend’s microfluidics technology, enhancing surgical procedures. The acquisition also opens avenues for developing new cleanroom consumables to aid drug delivery and surgery monitoring.

- In October 2023, Carl Zeiss Meditec AG and Johnson & Johnson Surgical Vision joined forces to pioneer next-generation surgical microscopes. By leveraging Zeiss’s optics prowess and J&J’s surgical instrument expertise, the collaboration aims to enhance surgical efficiency. This could potentially integrate advanced cleanroom consumables with the microscopes, further optimizing surgical procedures.

- In December 2023, Maxigen Biotech Inc. introduced a new line of environmentally friendly cleanroom wipes. These wipes, crafted from plant-based materials, uphold the same rigorous standards as traditional synthetic wipes, prioritizing sustainability within the cleanroom consumables market.

- In November 2023, CIMA Technology Inc. disclosed a strategic partnership with a top sterile filtration product manufacturer. This collaboration seeks to broaden CIMA’s offerings in the sterile filtration market, vital for cleanroom air and liquid purification. The partnership may yield innovative filtration consumables for diverse cleanroom applications.

Report Scope

Report Features Description Market Value (2023) USD 10.2 Bn Forecast Revenue (2033) USD 17.1 Bn CAGR (2024-2033) 5.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Wipers, Cleanroom Apparel, Cleanroom Products, Cleanroom Stationery, Other Products), By End-User (Hospitals & Clinics, Research Laboratories, Medical Device Industry, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., DuPont, Berkshire Corporation, Valutek Inc., KM Purely, Illinois Tool Works Inc., Valutek Inc., Steris, Kimberly-Clark Corporation, Contec Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Healthcare Cleanroom Consumables MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Healthcare Cleanroom Consumables MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Kimberly-Clark Worldwide Inc.

- Valutek Inc.

- KM

- Texwipe

- Berkshire

- Cantel Medical

- and Contec Inc.

- DuPont de Nemours Inc.

- Micronclean

- and Ansell Ltd.

- among others.