Global Headwear Market Size, Share, Growth Analysis By Product (Caps, Beanies, Neckwear, Hats, Others), By Material (Cotton, Wool, Polyester, Nylon, Others), By End Use (Men, Women, Kids), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176605

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

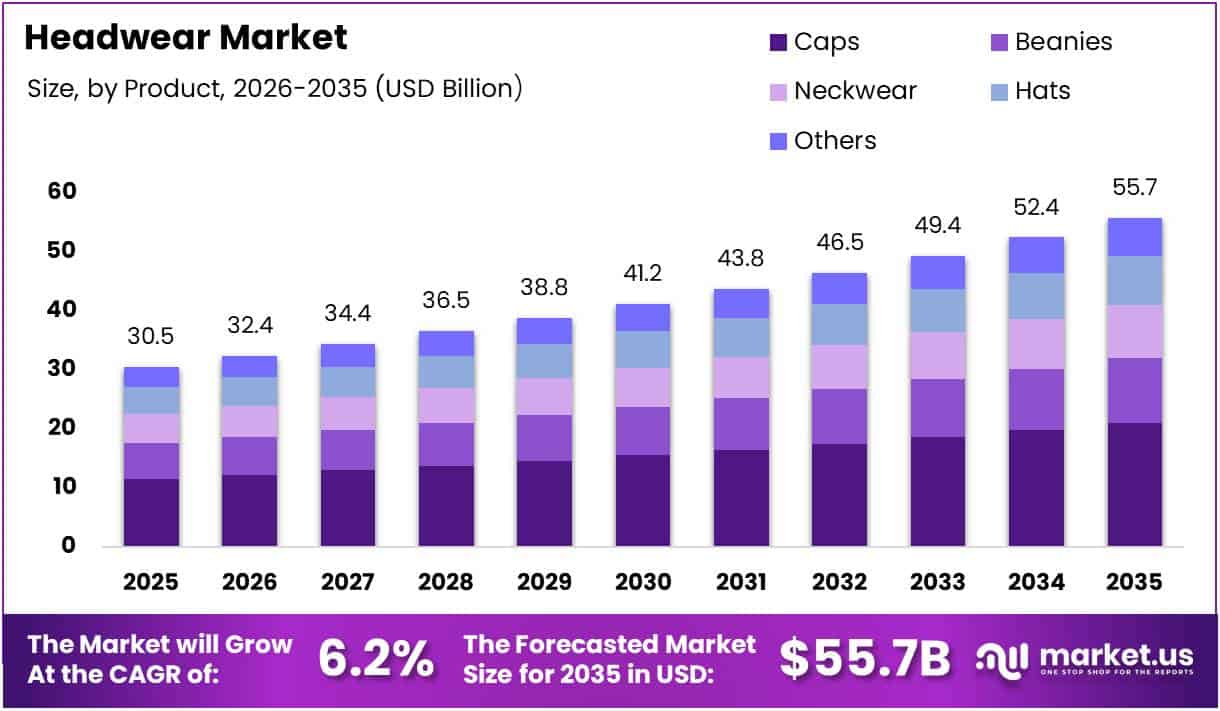

The Global Headwear Market size is expected to be worth around USD 55.7 Billion by 2035 from USD 30.5 Billion in 2025, growing at a CAGR of 6.2% during the forecast period 2026 to 2035.

The headwear market encompasses a diverse range of products including caps, hats, beanies, and neckwear designed for fashion, functionality, and protection. These products serve multiple purposes from sun protection to style statements across various demographics. Moreover, headwear has evolved beyond traditional uses to become an essential accessory in athleisure and sports culture.

The market continues to experience robust growth driven by increasing consumer awareness about sun protection and changing fashion preferences. Additionally, the integration of performance fabrics and sustainable materials is reshaping product development strategies. Consequently, brands are investing heavily in innovation to meet diverse consumer needs across different climates and occasions.

Rising disposable incomes and urbanization are fueling demand for premium and branded headwear products globally. Furthermore, the influence of sports leagues and celebrity endorsements significantly impacts purchasing decisions. Therefore, manufacturers are expanding their product portfolios to cater to both functional and fashion-oriented consumer segments.

E-commerce platforms have emerged as crucial distribution channels, enabling brands to reach wider audiences and offer customization options. However, the market faces challenges from fragmentation and rapidly changing fashion trends. Nevertheless, strategic partnerships and limited-edition releases continue to drive brand visibility and consumer engagement.

Government regulations regarding workplace safety and sun protection standards are creating new opportunities in industrial and protective headwear segments. Additionally, growing environmental consciousness is pushing brands toward sustainable manufacturing practices. Therefore, eco-friendly materials and ethical sourcing are becoming key differentiators in the competitive landscape.

According to AYTM, 51% of hat wearers said they wear baseball caps regularly while 42% said they regularly wear knit or winter type hats. According to PMC research, 43.5% of young people aged 15-25 said they use a hat as a means of sun protection. According to ResearchGate, Wide-brimmed or bucket headwear was worn by a significantly higher share of children (45.1%) than adults (27.1%).

Key Takeaways

- Global Headwear Market is projected to reach USD 55.7 Billion by 2035 from USD 30.5 Billion in 2025, growing at a CAGR of 6.2%

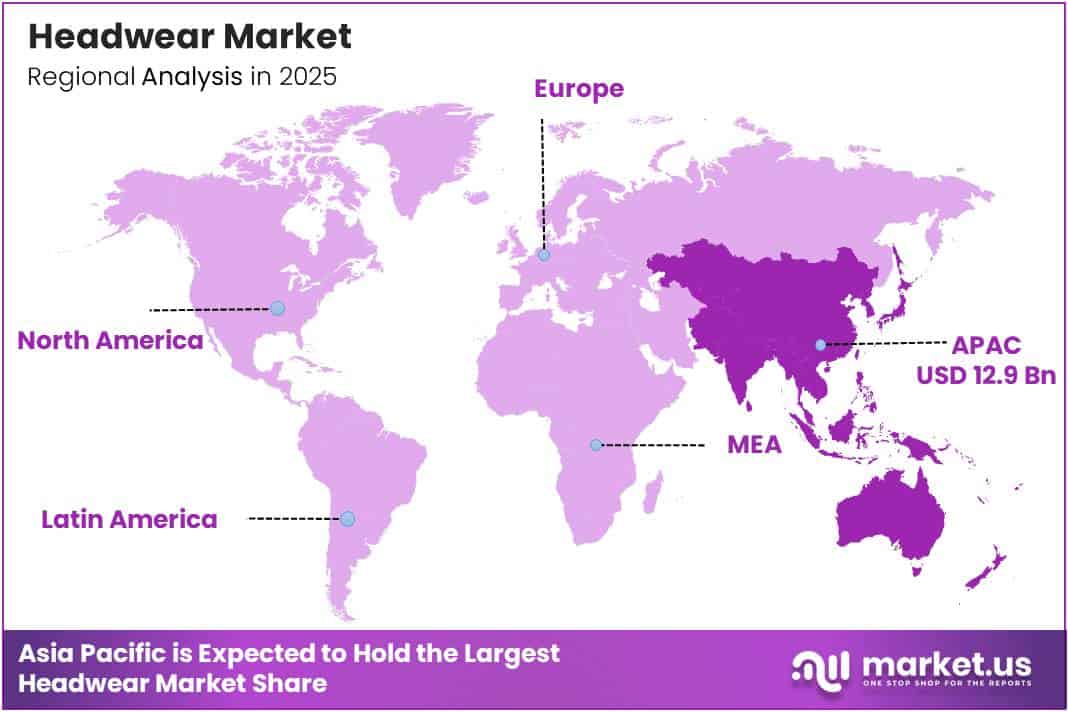

- Asia Pacific dominates the market with 42.50% share, valued at USD 12.9 Billion

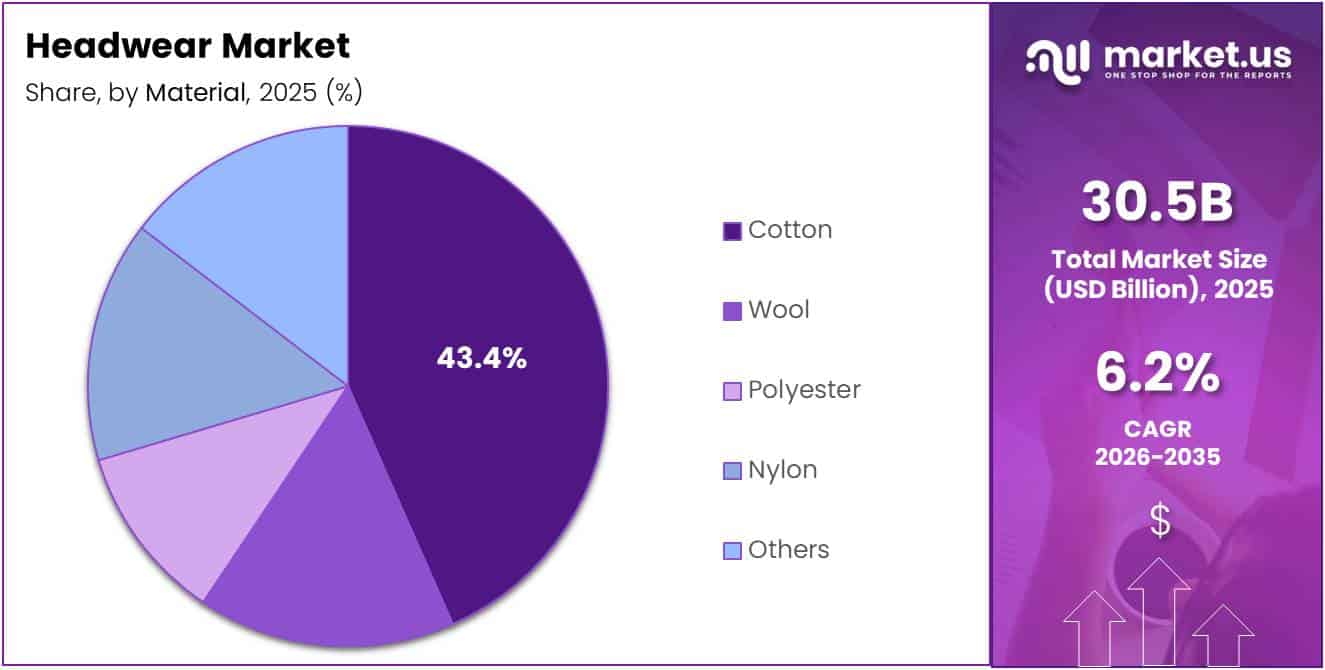

- Cotton material segment leads with 43.4% market share in the By Material segment

- Caps hold the largest share at 37.6% in the By Product segment

- Men segment dominates the By End Use category with 56.7% share

- Offline distribution channel commands 73.3% of the market share

Product Analysis

Caps dominate with 37.6% due to versatility and widespread adoption in sports and casual fashion.

In 2025, Caps held a dominant market position in the By Product segment of Headwear Market, with a 37.6% share. Caps remain the most popular headwear choice due to their versatility across sports, casual wear, and promotional merchandise. Baseball caps particularly drive significant revenue through team merchandise and branded collaborations.

Beanies represent a growing segment driven by winter fashion trends and year-round streetwear adoption. These products appeal to younger demographics seeking comfort and style. Moreover, sustainable knit materials are expanding the beanie market into premium segments with higher profit margins.

Neckwear serves niche applications in outdoor activities and extreme weather conditions, offering functional protection beyond traditional headwear. Additionally, multifunctional designs combining sun protection and breathability attract adventure sports enthusiasts. Therefore, innovation in moisture-wicking fabrics continues to drive this specialized segment forward.

Hats encompass wide-brimmed, fedora, and bucket styles that cater to both fashion-conscious consumers and sun protection needs. Furthermore, luxury brands are elevating hat designs into premium fashion accessories. Consequently, this segment benefits from both functional demand and high-end fashion positioning in the market.

Others encompass specialized headwear categories including visors, headbands, turbans, and novelty items serving niche applications. This segment addresses specific cultural, religious, and functional requirements not covered by mainstream categories. Additionally, safety helmets for cycling and industrial applications contribute to this diverse product grouping. Innovation in specialty designs continues expanding market reach across underserved consumer segments.

Material Analysis

Cotton dominates with 43.4% due to breathability, comfort, and natural fiber preferences.

In 2025, Cotton held a dominant market position in the By Material segment of Headwear Market, with a 43.4% share. Cotton remains the preferred material for headwear due to its natural breathability and soft texture. Additionally, organic cotton variants are gaining traction among environmentally conscious consumers seeking sustainable fashion choices.

Wool materials provide essential warmth for winter headwear products, particularly in cold climate regions. Moreover, merino wool and premium blends offer superior insulation with moisture management properties. Therefore, wool-based products command higher price points in the premium headwear market segment.

Polyester fabrics deliver durability and moisture-wicking performance crucial for athletic and outdoor headwear applications. Furthermore, recycled polyester options align with sustainability trends while maintaining technical performance. Consequently, synthetic materials continue gaining market share in performance-oriented product categories.

Nylon addresses technical requirements in outdoor and extreme sports applications. The material’s lightweight yet durable nature suits demanding athletic conditions. Consequently, water-resistant treatments and UV protection enhance functional benefits. Recycled nylon innovations support sustainability while maintaining performance standards.

Others include advanced synthetic blends, bamboo fibers, and specialty technical fabrics. These materials combine performance characteristics like antimicrobial properties and temperature regulation. Additionally, sustainable alternatives gain traction among environmentally conscious consumers. Material science innovations continue expanding headwear functionality across applications.

End Use Analysis

Men dominate with 56.7% due to higher sports merchandise consumption and workplace headwear usage.

In 2025, Men held a dominant market position in the By End Use segment of Headwear Market, with a 56.7% share. Men demonstrate stronger purchasing patterns for sports-related headwear and team merchandise across various leagues. Additionally, workplace safety requirements and outdoor occupations drive consistent demand in this demographic segment.

Women represent a rapidly growing segment driven by fashion-forward designs and sun protection awareness. Moreover, influencer marketing and social media trends significantly impact women’s headwear purchasing decisions. Therefore, brands are developing gender-specific collections with enhanced style variety and premium positioning.

Kids segment shows promising growth potential with increased parental awareness about sun protection for children. Furthermore, licensed character merchandise and school spirit wear contribute to steady demand. Consequently, brands are focusing on adjustable sizing and durable materials tailored for active young consumers.

Distribution Channel Analysis

Offline dominates with 73.3% due to tactile product evaluation and immediate purchase preferences.

In 2025, Offline held a dominant market position in the By Distribution Channel segment of Headwear Market, with a 73.3% share. Physical retail stores enable customers to try products for fit and style before purchasing. Additionally, sporting goods stores and specialty boutiques provide curated selections and expert assistance that enhance the shopping experience.

Online channels demonstrate accelerating growth through e-commerce platforms and direct-to-consumer brand websites. Moreover, virtual try-on technologies and detailed sizing guides are reducing return rates. Therefore, digital channels offer customization options and limited-edition releases that attract younger, tech-savvy consumers seeking convenience.

Key Market Segments

By Product

- Caps

- Beanies

- Neckwear

- Hats

- Others

By Material

- Cotton

- Wool

- Polyester

- Nylon

- Others

By End Use

- Men

- Women

- Kids

By Distribution Channel

- Offline

- Online

Drivers

Rising Athleisure Adoption Blending Functional Headwear with Everyday Fashion

The athleisure trend has transformed headwear from purely functional items into essential fashion accessories for daily wear. Consumers increasingly seek versatile products that transition seamlessly between workout sessions and casual social settings. Moreover, performance fabrics originally designed for sports now enhance comfort in everyday headwear applications.

Sports leagues and team-based merchandise sales generate substantial revenue through licensed headwear products across global markets. Additionally, fan engagement through branded caps and hats strengthens emotional connections with teams. Therefore, strategic partnerships between leagues and headwear manufacturers continue driving consistent demand growth.

Growing awareness about skin cancer prevention and UV exposure risks is driving demand for protective headwear solutions. Furthermore, climate change concerns motivate consumers to invest in sun-protective accessories for outdoor activities. Consequently, brands are developing technologically advanced fabrics with enhanced UPF ratings to meet evolving safety standards and consumer expectations.

Restraints

High Market Fragmentation Limiting Brand Differentiation and Pricing Power

Intense competition from numerous local and international players creates challenges in establishing strong brand differentiation. Additionally, low entry barriers enable new competitors to enter the market with similar product offerings. Therefore, pricing pressure and promotional activities reduce profit margins across the industry.

Rapidly changing fashion trends and seasonal variations create short product life cycles that complicate inventory management. Moreover, consumer preferences shift quickly influenced by social media and celebrity endorsements. Consequently, brands face increased risks of obsolete inventory and markdowns that impact profitability.

The fragmented retail landscape with multiple distribution channels makes it difficult to maintain consistent brand positioning. Furthermore, counterfeit products and unauthorized sellers undermine brand equity in online marketplaces. Therefore, manufacturers invest heavily in brand protection and authentication technologies to preserve market share and premium positioning.

Growth Factors

Emerging Demand for Sustainable and Eco-Friendly Headwear Materials Drives Innovation

Environmental consciousness among consumers is driving demand for headwear made from organic, recycled, and biodegradable materials. Additionally, brands adopting circular economy principles attract environmentally aware younger demographics. Moreover, certifications like GOTS and Fair Trade provide competitive advantages in premium market segments.

Personalization and customization services enable consumers to create unique headwear reflecting individual style preferences and identities. Furthermore, digital printing technologies make small-batch custom production economically viable. Therefore, brands offering bespoke designs capture higher margins and foster stronger customer loyalty.

Industrial safety regulations and workplace requirements create untapped opportunities in protective headwear categories beyond fashion applications. Additionally, construction, manufacturing, and outdoor industries demand durable, compliant headwear solutions. Consequently, manufacturers developing specialized products for occupational safety markets diversify revenue streams and reduce dependence on fashion cycles.

Emerging Trends

Integration of Smart Features and Performance Fabrics Transforms Traditional Headwear Categories

Advanced textile technologies incorporating moisture-wicking, antimicrobial, and temperature-regulating properties elevate headwear functionality significantly. Additionally, some manufacturers integrate sensors and connectivity features for fitness tracking applications. Moreover, performance fabrics originally developed for athletic wear now enhance comfort across casual headwear product lines.

Gender-neutral designs and inclusive sizing strategies respond to evolving consumer expectations for diversity and representation. Furthermore, unisex collections simplify inventory management while appealing to broader demographic segments. Therefore, brands adopting inclusive design philosophies strengthen market positioning among socially conscious consumers.

Limited-edition releases and strategic collaborations create urgency and exclusivity that drive brand engagement and premium pricing. Additionally, partnerships with artists, athletes, and influencers generate buzz on social media platforms. Consequently, drop culture marketing strategies prove highly effective in attracting younger consumers and maintaining brand relevance in competitive markets.

Regional Analysis

Asia Pacific Dominates the Headwear Market with a Market Share of 42.50%, Valued at USD 12.9 Billion

Asia Pacific leads the global headwear market with a 42.50% share, valued at USD 12.9 Billion, driven by large populations and rising disposable incomes. Moreover, manufacturing capabilities in countries like China and Bangladesh support both domestic consumption and export activities. Additionally, growing fashion consciousness and urbanization fuel demand for diverse headwear styles across the region.

North America Headwear Market Trends

North America demonstrates strong demand driven by established sports culture and team merchandise consumption patterns. Furthermore, outdoor recreation activities and sun protection awareness sustain consistent market growth. Additionally, premium and sustainable headwear segments gain traction among environmentally conscious consumers seeking quality products.

Europe Headwear Market Trends

Europe shows steady growth with emphasis on fashion-forward designs and sustainable manufacturing practices across major markets. Moreover, luxury brands and heritage manufacturers maintain strong positions in premium headwear categories. Additionally, regulatory standards for workplace safety and environmental compliance influence product development strategies throughout the region.

Latin America Headwear Market Trends

Latin America presents emerging opportunities driven by expanding middle class populations and increasing fashion awareness. Furthermore, tropical climates create consistent demand for sun-protective headwear products year-round. Additionally, local manufacturing capabilities support affordable pricing strategies that appeal to price-sensitive consumer segments.

Middle East & Africa Headwear Market Trends

Middle East and Africa region demonstrates growing potential with rising disposable incomes and modernization trends. Moreover, extreme weather conditions drive demand for both sun-protective and climate-adaptive headwear solutions. Additionally, cultural preferences and traditional headwear styles create unique market dynamics requiring localized product strategies.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Intersport maintains a significant presence in the global headwear market through extensive retail networks across Europe and emerging markets. The company leverages its multi-brand strategy to offer diverse headwear options catering to sports enthusiasts and casual consumers. Moreover, Intersport’s strong supply chain capabilities enable competitive pricing while maintaining quality standards. Additionally, partnerships with leading brands enhance product variety and customer appeal across different price segments.

H&M capitalizes on fast fashion trends to deliver affordable headwear collections aligned with current style preferences and seasonal demands. The retailer’s global footprint and efficient inventory management systems enable rapid product turnover and trend responsiveness. Furthermore, H&M’s sustainability initiatives in materials sourcing attract environmentally conscious consumers. Therefore, the company effectively balances affordability with growing demand for responsible fashion practices in headwear categories.

Zalando dominates European online headwear distribution through comprehensive digital platforms and seamless customer experiences. The company’s data-driven approach to consumer preferences enables targeted marketing and personalized product recommendations. Moreover, Zalando’s extensive brand partnerships provide customers with diverse headwear options from budget to premium segments. Additionally, efficient logistics networks ensure fast delivery that strengthens customer loyalty and repeat purchases.

Inditex leverages its portfolio of brands including Zara to capture diverse headwear market segments with differentiated product strategies. The company’s vertically integrated supply chain enables rapid design-to-market cycles that capitalize on emerging fashion trends. Furthermore, Inditex’s global retail presence ensures consistent brand visibility and accessibility across major markets. Consequently, the company maintains competitive advantages through agility and trend-responsive product development capabilities.

Key players

- Intersport

- H&M

- Zalando

- Inditex

- Dick’s Sporting Goods

- Lululemon

- Skechers

- New Balance

- Columbia Sportswear

- Lidl

- Hoka

Recent Developments

- January 2026 – Imperial Headwear announced the acquisition of Winston Collection to significantly expand its premium golf portfolio and strengthen market positioning in the luxury sports headwear segment.

- November 2025 – FC Barcelona partnered with New Era to launch an official headwear collection, combining iconic team branding with premium quality to engage global football fans.

- November 2025 – NCAA established a strategic partnership with Zephyr for championship headwear, creating exclusive licensed products celebrating collegiate sports achievements and team spirit.

- September 2025 – Liverpool Football Club announced New Era as its official headwear collaborator, introducing innovative designs that blend traditional club heritage with contemporary fashion trends.

- August 2025 – Bioworld expanded its market reach through the acquisition of Portland Accessories, enhancing its licensed headwear portfolio and distribution capabilities across North American markets.

Report Scope

Report Features Description Market Value (2025) USD 30.5 Billion Forecast Revenue (2035) USD 55.7 Billion CAGR (2026-2035) 6.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Caps, Beanies, Neckwear, Hats, Others), By Material (Cotton, Wool, Polyester, Nylon, Others), By End Use (Men, Women, Kids), By Distribution Channel (Offline, Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Intersport, H&M, Zalando, Inditex, Dick’s Sporting Goods, Lululemon, Skechers, New Balance, Columbia Sportswear, Lidl, Hoka Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Intersport

- H&M

- Zalando

- Inditex

- Dick's Sporting Goods

- Lululemon

- Skechers

- New Balance

- Columbia Sportswear

- Lidl

- Hoka