Global HBsAg Testing Market By Kits (Cassettes/Cards and Strips), By Sample (Serum, Plasma and Whole Blood), By End-user (Hospitals & Clinics, Diagnostic Centres, Home Care and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171247

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

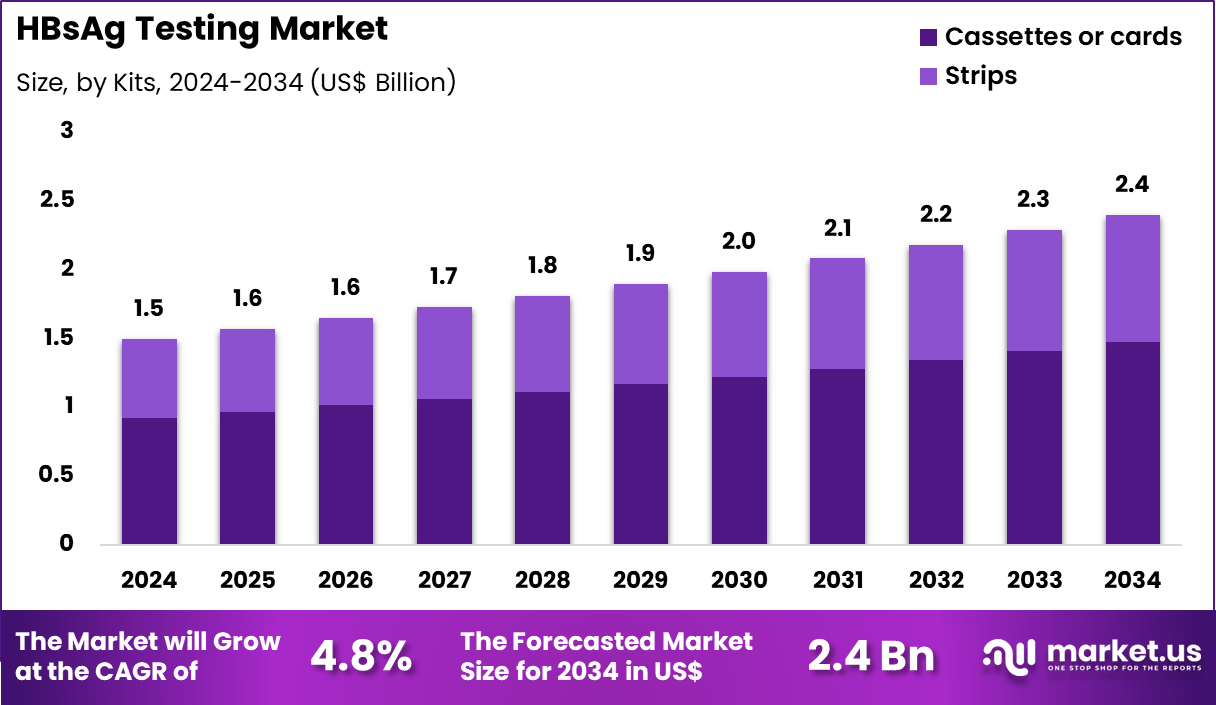

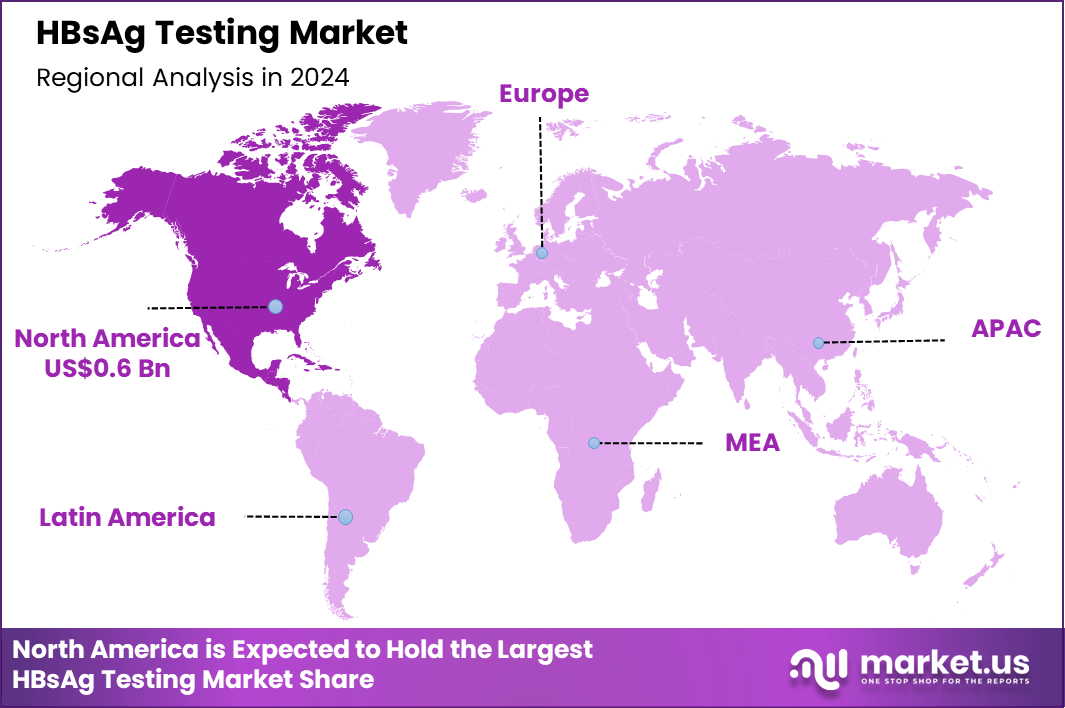

The Global HBsAg Testing Market size is expected to be worth around US$ 2.4 billion by 2034 from US$ 1.5 billion in 2024, growing at a CAGR of 4.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.2% share with a revenue of US$ 0.6 Billion.

Increasing prevalence of hepatitis B infections drives the HBsAg Testing market, as healthcare providers prioritize sensitive assays to identify surface antigen carriers and prevent transmission through timely interventions. Diagnostic manufacturers refine enzyme immunoassays and chemiluminescent platforms that detect HBsAg at picogram levels from serum or plasma samples.

These tests enable routine blood donor screening to ensure transfusion safety, prenatal evaluations to guide antiviral prophylaxis in pregnant carriers, occupational health assessments for healthcare workers post-exposure, and pre-vaccination immunity checks to avoid unnecessary immunization. Collaborative innovations create opportunities for enhanced assay specificity that reduces false positives in low-prevalence settings.

On March 10, 2024, BD Biosciences announced a collaboration with GSK Bio to develop a next-generation HBsAg diagnostic platform, leveraging combined expertise to advance early screening and optimize hepatitis B management strategies. This partnership directly elevates detection capabilities and supports proactive disease control across diverse clinical applications.

Growing adoption of point-of-care HBsAg testing accelerates the HBsAg Testing market, as clinicians deploy rapid lateral flow devices to deliver results in under 20 minutes for immediate patient counseling and linkage to care. Biotechnology firms optimize gold nanoparticle conjugates that visualize antigen-antibody complexes without instrumentation.

Applications encompass emergency department triage for acute jaundice cases to differentiate viral etiologies, dialysis unit admissions to enforce infection control protocols, tattoo parlor pre-procedure verifications for client safety, and refugee health screenings to initiate vaccination series promptly.

Portable formats open avenues for community outreach programs that bridge gaps in laboratory access. Pharmaceutical developers increasingly incorporate these tests into clinical trials for novel nucleoside analogs, confirming baseline infectivity status. This decentralization trend empowers frontline providers and expands testing reach in varied healthcare scenarios.

Rising integration of multiplex viral hepatitis panels invigorates the HBsAg Testing market, as laboratories consolidate assays to simultaneously detect HBsAg, anti-HCV, and HIV antigens from single specimens. Technology providers launch automated analyzers with barcode-enabled workflows that minimize manual handling and ensure traceability.

These comprehensive panels support pre-operative risk assessments to prevent nosocomial spread, organ donor evaluations for transplant viability, intravenous drug user harm reduction programs through combined serology, and longitudinal cohort studies tracking co-infection dynamics. Multi-target capabilities create opportunities for cost-effective screening bundles in high-risk cohorts. Research institutions actively validate these systems against gold-standard methods to refine diagnostic algorithms. This synergistic approach positions HBsAg testing as a foundational element in broad-spectrum viral diagnostics.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.5 billion, with a CAGR of 4.8%, and is expected to reach US$ 2.4 billion by the year 2034.

- The kits segment is divided into cassettes/cards and strips, with cassettes/cards taking the lead in 2023 with a market share of 61.5%.

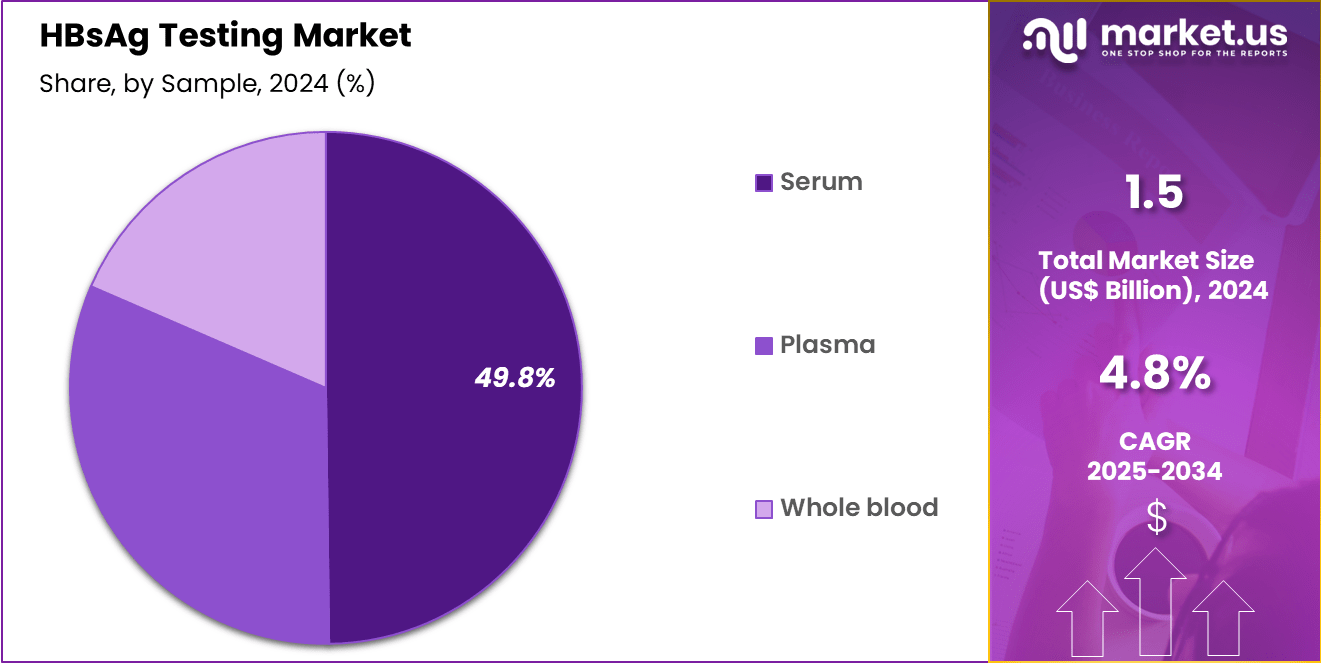

- Considering sample, the market is divided into serum, plasma and whole blood. Among these, serum held a significant share of 49.8%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & clinics, diagnostic centres, home care and others. The hospitals & clinics sector stands out as the dominant player, holding the largest revenue share of 53.4% in the market.

- North America led the market by securing a market share of 42.2% in 2024.

Kits Analysis

Cassettes or cards, holding 61.5%, are expected to dominate because they provide faster results and simple visual interpretation for hepatitis B surface antigen detection. Primary healthcare facilities rely on cassette-based rapid tests to support early screening and immediate clinical decisions, especially in areas with limited laboratory access. The rising prevalence of hepatitis B in low-resource countries strengthens demand for affordable point-of-care solutions.

Manufacturers continue to develop compact formats requiring minimal operator expertise, increasing practical adoption in mass screening programs. Increasing public health campaigns focused on identifying undiagnosed hepatitis infections further support cassette usage. These factors keep cassettes or cards projected to remain the leading kit type in this market.

Sample Analysis

Serum, holding 49.8%, is anticipated to dominate because serum-based samples provide higher detection accuracy for HBsAg testing. Clinicians strongly prefer serum testing due to reduced interference from hemolysis or cellular contamination, improving clinical decision confidence. High testing volumes from hospital laboratories and diagnostic centres support the consistent use of serum collection.

Growing awareness of hepatitis B complications, including cirrhosis and hepatocellular carcinoma, drives early diagnosis and monitoring, which relies heavily on serum testing. Standardized protocols for serum handling and storage strengthen assay performance benchmarks. These drivers keep serum expected to remain the dominant sample type in the HBsAg testing market.

End-User Analysis

Hospitals and clinics, holding 53.4%, are projected to dominate because they remain the primary points where patients undergo hepatitis B diagnostic evaluation and ongoing monitoring. Increasing hospital admissions for liver-related disorders encourages clinicians to perform HBsAg screening routinely. Pediatric vaccination programs and antenatal care protocols frequently include hospital-based hepatitis testing to prevent perinatal transmission.

Hospitals adopt both rapid testing kits and laboratory-based immunoassays, expanding diagnostic capacity. Rising healthcare expenditure improves hepatitis screening infrastructure globally. Continuous follow-up testing for treatment response further boosts test demand within clinical settings. These factors keep hospitals and clinics expected to remain the dominant end-user segment in this market.

Key Market Segments

By Kits

- Cassettes/Cards

- Strips

By Sample

- Serum

- Plasma

- Whole Blood

By End-user

- Hospitals & Clinics

- Diagnostic Centres

- Home Care

- Others

Drivers

Endemic burden of chronic hepatitis B infections is driving the market

The persistent high prevalence of chronic hepatitis B virus infections worldwide continues to necessitate widespread HBsAg testing as the primary screening tool for active infection. According to the World Health Organization’s Global Hepatitis Report 2024, an estimated 254 million people were living with chronic hepatitis B at the end of 2022, with 1.2 million new infections occurring that year. This substantial disease reservoir underscores the critical role of HBsAg assays in identifying cases for timely intervention and preventing transmission.

Regional disparities exacerbate the need, particularly in the WHO African and Western Pacific regions, which account for 65% of global cases. Blood banks and healthcare facilities rely on these tests to ensure transfusion safety, as undetected infections pose risks to recipients. The integration of HBsAg screening into routine prenatal care further amplifies demand, given the high vertical transmission rates in endemic areas.

Public health strategies emphasize universal screening to achieve elimination targets by 2030, driving procurement of reliable diagnostic kits. Advancements in assay formats, from enzyme-linked immunosorbent to chemiluminescent methods, enhance detection accuracy and throughput. Collaborative efforts by international agencies support capacity building in low-resource settings, where testing volumes are surging. Collectively, this driver sustains momentum in the HBsAg testing market, aligning diagnostic expansion with global health equity goals.

Restraints

Low diagnostic coverage rates are restraining the market

Despite the availability of effective HBsAg tests, diagnostic coverage remains critically low, hindering comprehensive screening efforts and market scalability. The World Health Organization reported that only 13% of the 254 million individuals living with chronic hepatitis B had been diagnosed by the end of 2022.

This gap stems from infrastructural limitations in remote and underserved regions, where laboratory access is restricted. Stigma associated with hepatitis B discourages testing uptake, particularly among at-risk populations like migrants and key populations.

Inconsistent supply chains for reagents and equipment further impede routine implementation in resource-constrained environments. Variability in test sensitivity across different populations and viral genotypes complicates standardization and trust in results. Funding shortfalls for viral hepatitis programs divert resources from diagnostics to treatment priorities in many countries.

The need for confirmatory testing post-HBsAg positivity adds logistical burdens, delaying linkage to care. Educational barriers among healthcare providers lead to underutilization of screening guidelines. Overall, these restraints perpetuate undiagnosed cases, constraining broader market penetration and innovation incentives.

Opportunities

Advancements in point-of-care HBsAg assays are creating growth opportunities

The evolution of point-of-care HBsAg tests offers transformative potential for decentralized screening, bridging gaps in traditional laboratory-dependent diagnostics. These portable assays enable rapid results in community settings, facilitating immediate referral and treatment initiation. The U.S. Food and Drug Administration’s collaboration with initiatives in 2024 to accelerate validation and commercialization of innovative point-of-care HBsAg detection tools highlights regulatory support for such technologies.

High sensitivity levels, such as 0.1 IU/mL achieved by certain rapid lateral flow tests, ensure reliable detection in field conditions. Integration into mobile health units and primary care outreach programs expands reach to high-burden, low-access areas. Cost-effectiveness analyses demonstrate that these tools reduce long-term healthcare expenditures by enabling early intervention.

Multiplex capabilities, combining HBsAg with other markers, streamline workflows for comprehensive viral hepatitis assessment. Partnerships between governments and diagnostic developers are scaling production for low- and middle-income countries. Training modules for non-specialist users enhance feasibility and adoption rates. In aggregate, these opportunities position point-of-care innovations as catalysts for equitable diagnostic access and market diversification.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic trends invigorate the HBsAg testing market as escalating healthcare investments and persistent Hepatitis B prevalence compel clinics worldwide to deploy rapid immunoassay kits for early detection and vaccination monitoring. Manufacturers boldly innovate with point-of-care devices and multiplex panels, harnessing the momentum from global immunization drives and chronic disease management to expand reach in emerging economies.

Stubborn inflation and erratic economic recoveries, however, constrict diagnostic budgets for hospitals and public health programs, prompting providers to scale back routine screenings and prolong equipment lifecycles in cost-conscious areas. Geopolitical frictions, particularly U.S.-China trade disputes and regional instabilities, routinely sever supplies of vital antibodies and plastic consumables, igniting shortages and price swings that burden international kit producers.

Current U.S. tariffs impose substantial duties on imported diagnostic reagents and instruments, elevating procurement expenses for American labs and eroding competitiveness against local alternatives. These tariffs incite reciprocal barriers in overseas territories that obstruct U.S. exports of advanced HBsAg tests and stall joint epidemiological studies. Yet the escalating pressures catalyze strategic shifts toward domestic sourcing and enhanced R&D incentives, nurturing a more robust supply infrastructure that will unlock greater innovation and market stability for the future.

Latest Trends

FDA reclassification of HBsAg assays to Class II devices is a recent trend

In September 2024, the U.S. Food and Drug Administration proposed reclassifying certain antigen, antibody, and nucleic acid-based hepatitis B virus assays, including HBsAg tests, from Class III to Class II medical devices. This regulatory shift acknowledges the established safety and effectiveness profiles of these diagnostics, streamlining future approvals. The proposal, detailed in the Federal Register, includes special controls to ensure performance standards like sensitivity and specificity.

As of June 2024, the FDA documented 4 Class III recalls and 12 Class II recalls for these devices, informing the risk-based reclassification. This move facilitates innovation by reducing premarket review burdens for low-risk modifications. Manufacturers can now pursue 510(k) pathways more efficiently, accelerating product iterations. The trend aligns with broader efforts to modernize oversight for mature in vitro diagnostics.

It complements the February 2024 FDA approval of Roche’s Elecsys HBsAg II and II Auto Confirm assays, enhancing automated screening options. Public comments on the proposal closed in November 2024, paving the way for final implementation. This 2024 development signals a maturing regulatory landscape, fostering sustained advancements in HBsAg testing accessibility.

Regional Analysis

North America is leading the HBsAg Testing Market

North America accounted for 42.2% of the overall market in 2024, and the region experienced solid growth as healthcare providers intensified screening for hepatitis B among high-risk groups, including people undergoing immunosuppressive therapy, pregnant women, and individuals with a history of injectable drug use. Hospitals and diagnostic laboratories increased adoption of automated surface antigen assays to support early detection and reduction of transmission risk.

Public-health initiatives emphasized universal prenatal screening, expanding test volumes across maternity units. The Centers for Disease Control and Prevention (CDC) estimates that 880,000 to 1.89 million people in the United States are living with chronic hepatitis B as of 2023 (CDC – Viral Hepatitis Surveillance Data), and this substantial burden continued to drive clinical testing demand. Growing availability of point-of-care tests and improved reimbursement frameworks further strengthened market expansion across the region in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to record strong growth during the forecast period as national hepatitis-control programs advance mandatory screening policies and increase public awareness across high-prevalence populations. Hospitals incorporate surface antigen testing into routine care to prevent liver complications through early diagnosis and linkage to antiviral treatment.

Diagnostic laboratories expand molecular and immunoassay platforms to accommodate higher testing volumes in community clinics. Governments strengthen screening in blood-banking services and maternal-health programs to reduce mother-to-child transmission.

The World Health Organization reports that the Western Pacific region accounts for roughly 116 million people living with chronic hepatitis B in 2023 (WHO – Global Hepatitis Data Update), underscoring the urgent need for expanded diagnostic services. These improvements in diagnostic coverage and healthcare infrastructure position Asia Pacific for sustained and accelerated market growth ahead.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading companies in HBsAg testing drive growth by advancing high-sensitivity immunoassays that detect early and low-viral-load infections, which strengthens adoption in hospital screening and blood-safety programs. They expand global access by partnering with public-health bodies and distributors in regions with significant hepatitis-B burden, ensuring steady testing demand. Product teams integrate automation to improve throughput and standardization so large clinical laboratories process high sample volumes with consistent quality.

Commercial units reinforce value by linking test solutions with confirmatory assays and monitoring panels to support full hepatitis-B care pathways. They invest in educational outreach and compliance support to help healthcare providers align with vaccination and screening initiatives, driving recurring utilization.

Abbott Laboratories exemplifies this strategy through its extensive infectious-disease diagnostics portfolio, global manufacturing and service infrastructure, and strong presence in viral hepatitis screening, which positions the company as a trusted partner for healthcare systems focused on early detection and ongoing management of hepatitis B.

Top Key Players

- Siemens Healthineers AG

- F. Hoffmann-La Roche Ltd.

- Abbott Laboratories

- Bio-Rad Laboratories, Inc.

- CTK Biotech, Inc.

- Biopanda Reagents Ltd.

- Avecon Healthcare Pvt. Ltd.

- Elabscience Bionovation Inc.

Recent Developments

- On April 15, 2024, Thermo Fisher Scientific Inc. rolled out the TaqMan™ HBsAg Assay, designed to deliver improved accuracy in hepatitis B surface antigen detection. The assay supports clinicians with more reliable and sensitive results, reflecting growing demand for high-precision hepatitis B diagnostics.

- In February 2024, Danaher Corporation introduced a new CLIA-based HBsAg Detection Kit that incorporates advanced chemiluminescent technology. The solution is engineered to raise testing productivity and support a wide range of laboratory environments, from major reference centers to decentralized diagnostic facilities.

Report Scope

Report Features Description Market Value (2024) US$ 1.5 Billion Forecast Revenue (2034) US$ 2.4 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Kits (Cassettes/Cards and Strips), By Sample (Serum, Plasma and Whole Blood), By End-user (Hospitals & Clinics, Diagnostic Centres, Home Care and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens Healthineers AG, F. Hoffmann-La Roche Ltd., Abbott Laboratories, Bio-Rad Laboratories, Inc., CTK Biotech, Inc., Biopanda Reagents Ltd., Avecon Healthcare Pvt. Ltd., Elabscience Bionovation Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Siemens Healthineers AG

- F. Hoffmann-La Roche Ltd.

- Abbott Laboratories

- Bio-Rad Laboratories, Inc.

- CTK Biotech, Inc.

- Biopanda Reagents Ltd.

- Avecon Healthcare Pvt. Ltd.

- Elabscience Bionovation Inc.