Global Hazmat Packaging Market Size, Share, Growth Analysis By Product (Drums, Intermediate bulk containers (IBCs), Pails, Bottles, Others), By Material Type (Plastics, Metal, Corrugated), By End-User (Chemicals, Pharmaceuticals, Oil and Gas, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154777

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

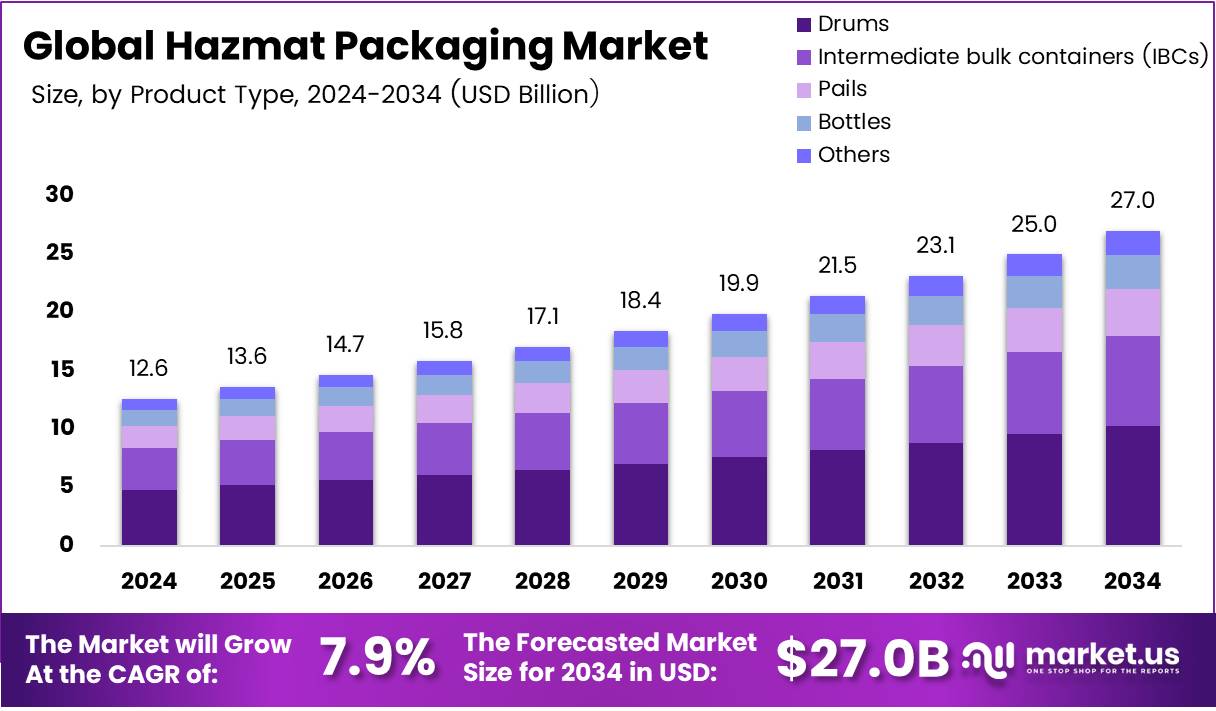

The Global Hazmat Packaging Market size is expected to be worth around USD 27.0 Billion by 2034, from USD 12.6 Billion in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034.

The Hazmat Packaging Market is a vital segment of the packaging industry, focused on the safe transportation and storage of hazardous materials. These materials include chemicals, flammable substances, and toxic goods that require special handling and packaging to prevent leaks, spills, or accidents. The market’s primary goal is ensuring safety while maintaining compliance with stringent regulations.

Growth in the Hazmat Packaging Market is largely driven by increasing global trade and the expanding chemical industry. As industries continue to globalize, the demand for secure and compliant packaging solutions for hazardous materials has surged. The market is expected to grow steadily as more industries adopt safer and more efficient packaging practices.

A significant opportunity within the market lies in the innovation of eco-friendly and sustainable packaging solutions. Manufacturers are increasingly exploring ways to reduce environmental impact without compromising safety standards. Eco-friendly hazmat packaging can meet rising consumer demand for sustainability, which is a growing concern among industries and consumers alike.

Government investment and regulations play a critical role in the development of the Hazmat Packaging Market. Strict safety standards and environmental laws are consistently evolving to address the risks associated with hazardous material transportation. Compliance with these regulations ensures that packaging solutions meet both safety and environmental protection criteria, creating opportunities for manufacturers in the market.

According to clsmith, 74% of consumers are willing to pay more for products with sustainable packaging. This shift in consumer preferences is influencing the hazmat packaging industry to prioritize environmentally friendly solutions. Moreover, regulatory bodies are also encouraging sustainable packaging practices, pushing companies to develop innovative packaging methods that are both secure and eco-friendly.

Additionally, 90% of consumers are more likely to purchase from brands with eco-friendly packaging, as per statistics. This growing trend is compelling companies to integrate sustainability into their hazmat packaging strategies. The focus on reducing carbon footprints and using recyclable materials aligns with the preferences of today’s environmentally conscious consumers.

Key Takeaways

- The global Hazmat Packaging Market is projected to reach USD 27.0 Billion by 2034, growing at a CAGR of 7.9% from 2025 to 2034.

- Drums accounted for the largest share of the market in 2024, with 38.2% due to their robustness, ease of handling, and cost-effectiveness.

- Plastics emerged as the leading material in 2024, holding 51.8% of the market share, due to their durability, lightweight nature, and chemical resistance.

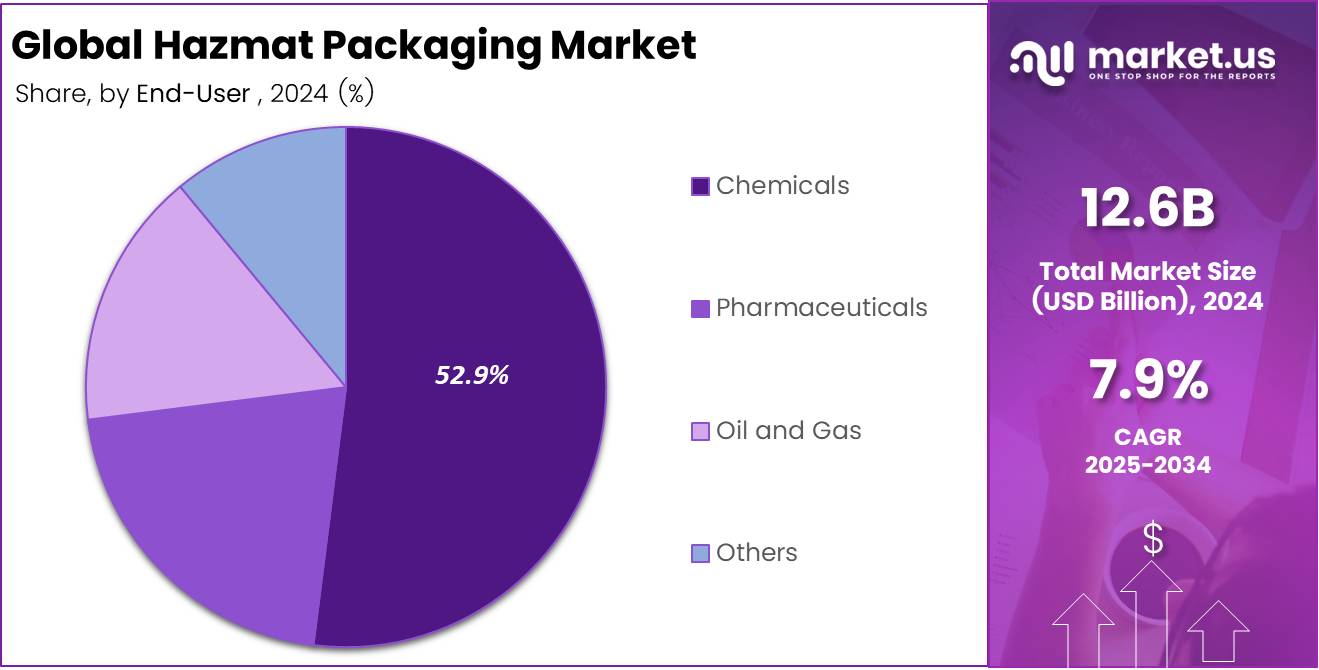

- The Chemicals industry held the largest share of 52.9% in 2024, driven by the need for secure packaging and regulatory compliance.

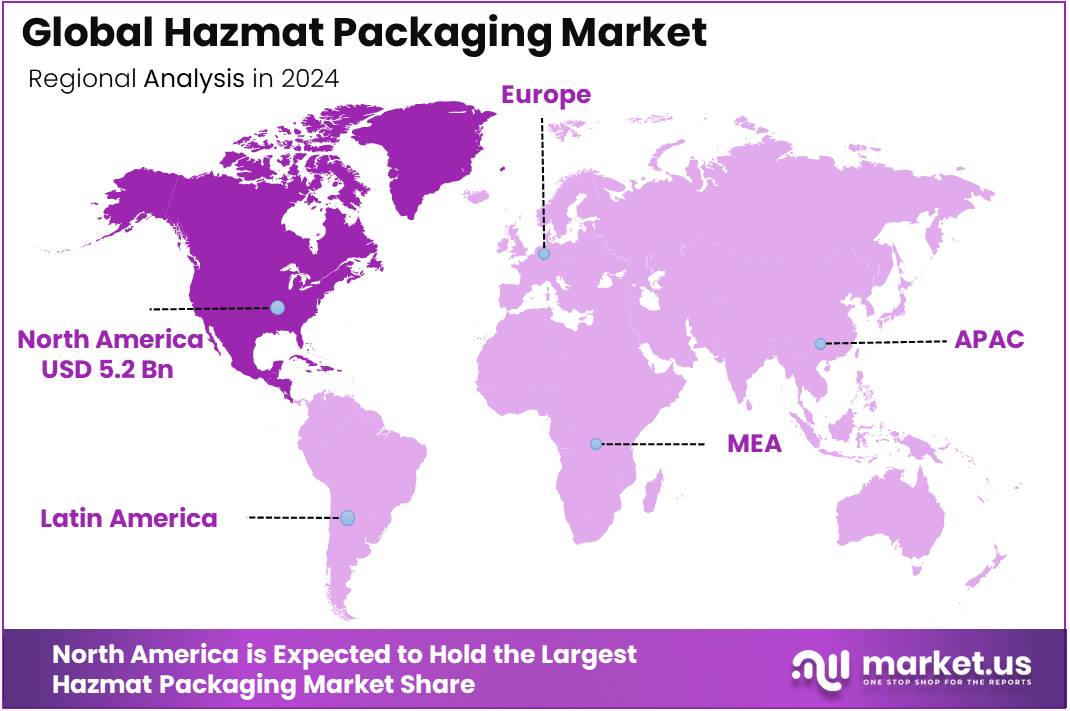

- North America leads the Hazmat Packaging Market with a share of 41.9%, valued at USD 5.2 billion, benefiting from stringent regulations and demand for safety.

Product Type Analysis

Drums lead with a 38.2% share, maintaining a dominant position in the Hazmat Packaging Market in 2024.

In 2024, Drums accounted for the largest share of the Hazmat Packaging Market, with a significant 38.2% share. The widespread use of drums for hazardous materials due to their robustness, ease of handling, and cost-effectiveness has bolstered their market position. Drums are designed to handle large volumes of hazardous substances, making them a popular choice across various industries.

Intermediate Bulk Containers (IBCs) follow, holding a notable share of the market. Their ability to store and transport large quantities of hazardous materials efficiently contributes to their market penetration. Pails, Bottles, and Other packaging types also play a role in the market but hold a smaller share in comparison to Drums and IBCs. These packaging solutions are often used for specific smaller-scale needs, catering to particular product requirements.

The strong preference for Drums in handling hazardous materials, coupled with the global demand for secure and reliable packaging, has kept this product type at the forefront of the Hazmat Packaging Market.

Material Type Analysis

Plastics dominate the Hazmat Packaging Market with a 51.8% share in 2024.

In 2024, Plastics emerged as the leading material type in the Hazmat Packaging Market, with a commanding 51.8% market share. The significant adoption of plastics in packaging is driven by their durability, lightweight nature, and flexibility, making them ideal for a wide range of hazardous materials. Plastics offer superior protection and are resistant to many chemicals, which further strengthens their position in the market.

Metal and Corrugated materials follow in importance, but their market shares remain smaller compared to Plastics. Metal is favored in certain high-risk industries for its strength and security, while Corrugated materials are typically used for specific packaging needs, offering cost-effective solutions for less hazardous products.

The dominance of Plastics in the Hazmat Packaging Market is likely to continue, as it remains the material of choice for companies seeking reliable, efficient, and cost-effective packaging solutions for hazardous materials.

End-User Analysis

Chemicals lead the Hazmat Packaging Market with a 52.9% share in 2024.

In 2024, the Chemicals industry holds the largest share of the Hazmat Packaging Market, with a strong 52.9% share. The chemical sector’s demand for secure packaging solutions for hazardous substances has significantly driven this growth. The need to comply with stringent safety regulations and ensure the safe transportation and storage of chemicals reinforces the importance of specialized packaging.

Pharmaceuticals, Oil and Gas, and Other industries also contribute to the Hazmat Packaging Market but with relatively smaller shares compared to Chemicals. The pharmaceutical sector requires specialized packaging for hazardous pharmaceutical ingredients, while the Oil and Gas industry demands packaging solutions that withstand harsh environments.

Given the size and scope of the Chemicals sector, it is expected to continue its dominance in the Hazmat Packaging Market, driven by global demand for chemical products and the ever-growing need for secure packaging solutions.

Key Market Segments

By Product

- Drums

- Intermediate bulk containers (IBCs)

- Pails

- Bottles

- Others

By Material Type

- Plastics

- Metal

- Corrugated

By End-User

- Chemicals

- Pharmaceuticals

- Oil and Gas

- Others

Drivers

Stringent Government Regulations on Hazardous Materials Handling Drives Hazmat Packaging Market Growth

The hazardous materials (hazmat) packaging market is significantly influenced by stringent government regulations surrounding the handling and transportation of dangerous goods. Governments across the globe have enforced strict rules to ensure safety during the transportation and storage of hazardous materials. These regulations require manufacturers to adopt packaging that meets specific safety standards, thus driving demand for high-quality, compliant packaging solutions.

As industries continue to grow, particularly in sectors like chemicals, pharmaceuticals, and manufacturing, the need for secure and safe packaging increases. Adhering to these regulations is not just a legal requirement but a necessity to minimize environmental and human health risks. Therefore, the need for hazmat packaging that meets these standards becomes more prominent in the market, encouraging manufacturers to invest in packaging solutions that ensure compliance.

Restraints

Complex Compliance and Certification Processes Pose Challenges for Hazmat Packaging Market

Despite the growth in the hazmat packaging market, one of the key restraints is the complex compliance and certification processes. Packaging materials must undergo rigorous testing and certification to meet regulatory standards. These processes can be time-consuming and costly for manufacturers, which may limit the growth of the market, particularly for small and medium-sized enterprises.

Additionally, some markets face a lack of standardized packaging solutions, which further complicates compliance and increases the cost of production. Manufacturers often have to adapt their packaging to meet specific regional or national regulations, which can be a significant barrier for companies trying to expand internationally.

Growth Factors

Expansion of E-commerce and Online Retailing Drives Hazmat Packaging Market Growth

One of the key growth opportunities in the hazmat packaging market lies in the expansion of e-commerce and online retailing for hazardous goods. As more businesses and consumers engage in online shopping, the demand for safe and reliable packaging solutions for hazardous materials has risen. E-commerce platforms require robust, tamper-proof packaging that ensures hazardous goods are safely transported.

Furthermore, as online sales grow, so does the need for packaging solutions that meet the unique requirements of hazardous products. This creates significant opportunities for manufacturers to innovate and develop new packaging solutions that cater specifically to the e-commerce sector.

Emerging Trends

Adoption of Smart Packaging Technologies and Digital Solutions Drives Hazmat Packaging Trends

In the hazmat packaging market, one of the emerging trends is the adoption of smart packaging technologies. These technologies offer enhanced safety features such as temperature monitoring, real-time tracking, and sensor integration. The integration of artificial intelligence in packaging design is helping to improve safety and efficiency, making hazardous material handling more secure.

Another important trend is the rising focus on the circular economy, with companies exploring ways to reuse packaging materials. This shift toward sustainability is driven by growing environmental concerns.

Additionally, the increasing use of digital labeling and tracking solutions enhances the ability to trace hazardous materials during transportation, improving safety standards. These trends suggest a significant shift toward more innovative, safer, and sustainable packaging solutions in the hazmat sector.

Regional Analysis

North America Dominates the Hazmat Packaging Market with a Market Share of 41.9%, Valued at USD 5.2 Billion

North America leads the global hazmat packaging market with a significant share of 41.9%, valued at USD 5.2 billion. This region benefits from stringent regulatory standards, a high demand for safety, and the presence of key players in industries like chemicals, pharmaceuticals, and manufacturing. The growing focus on environmentally friendly packaging solutions and advancements in packaging technologies further drive market growth.

Europe Hazmat Packaging Market Trends

Europe holds a strong position in the hazmat packaging market, driven by regulatory compliance and the increasing need for secure transportation of hazardous goods. The region’s robust industrial base, coupled with government initiatives aimed at improving safety standards, supports significant market demand. Furthermore, the rise of e-commerce and logistics services is contributing to the growth of hazmat packaging solutions.

Asia Pacific Hazmat Packaging Market Outlook

Asia Pacific is experiencing substantial growth in the hazmat packaging market, fueled by rapid industrialization, urbanization, and an expanding chemical sector. The increasing focus on safety and environmental regulations in countries like China and India is contributing to the rising demand for hazardous materials packaging. The market is also benefitting from the growing need for logistics services across the region, particularly in the transportation of chemicals and hazardous goods.

Middle East and Africa Hazmat Packaging Market Dynamics

The Middle East and Africa region is witnessing moderate growth in the hazmat packaging market due to an expanding industrial sector and the rising demand for safe packaging solutions in the oil and gas industry. Key markets in the region are focused on adhering to international packaging standards, which helps to bolster the market for hazmat packaging. Increased infrastructure development and trade activities are also key drivers for market growth.

Latin America Hazmat Packaging Market Developments

Latin America’s hazmat packaging market is evolving, supported by growing chemical industries and stricter safety regulations. Countries like Brazil and Mexico are leading the market due to their expanding manufacturing sectors and trade in hazardous goods. The region’s ongoing efforts to align with international safety and environmental standards are anticipated to drive the demand for more advanced and compliant packaging solutions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Hazmat Packaging Company Insights

The global Hazmat Packaging Market in 2024 continues to see innovation and strategic growth driven by leading industry players. Balmer Lawrie & Co. Ltd., with its long-established presence in the market, offers a wide range of high-quality packaging solutions, ensuring safe and compliant transport of hazardous materials. Their expertise in manufacturing steel drums and other containment systems strengthens their market position.

Clouds Drums Dubai stands out for its focus on providing durable and efficient packaging for hazardous materials, particularly in the Middle Eastern and African regions. The company is known for its comprehensive service that includes packaging design, compliance, and logistics, making it a key player in the sector.

Eagle Manufacturing is recognized for its advanced product lines in the hazardous materials packaging space. The company emphasizes safety, environmental responsibility, and durability, offering a diverse portfolio of products such as safety cans and containment solutions, which cater to a wide range of industries requiring hazmat packaging.

Fibrestar Drums Limited specializes in providing fiberboard drums that are ideal for safely packaging hazardous materials. With a strong focus on sustainability, the company offers lightweight, cost-effective, and secure packaging solutions, allowing it to capture a significant share of the market, particularly for chemical and pharmaceutical sectors.

Top Key Players in the Market

- Balmer Lawrie & Co. Ltd.

- Clouds Drums Dubai

- Eagle Manufacturing

- Fibrestar Drums Limited

- Hoover Ferguson

- Mauser Group

- Meyer Steel Drum

- Patrick J. Kelly Drums

- Peninsula Drums

- Schutz Container Systems

Recent Developments

- In July 2025, Bambrew secured $10.3 million in funding to accelerate its growth in the eco-friendly packaging sector, aiming to expand its product offerings and enhance sustainability practices.

- In July 2025, sustainable packaging startup Bambrew raised Rs 90 crore to further its mission of providing innovative and environmentally friendly packaging solutions, with plans for scaling operations and increasing market share.

- In December 2024, Movopack raised $2.5 million in funding to enhance its sustainable ecommerce packaging solutions, focusing on reducing environmental impact and expanding its reach within the e-commerce sector.

Report Scope

Report Features Description Market Value (2024) USD 12.6 Billion Forecast Revenue (2034) USD 27.0 Billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Drums, Intermediate bulk containers (IBCs), Pails, Bottles, Others), By Material Type (Plastics, Metal, Corrugated), By End-User (Chemicals, Pharmaceuticals, Oil and Gas, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Balmer Lawrie & Co. Ltd., Clouds Drums Dubai, Eagle Manufacturing, Fibrestar Drums Limited, Hoover Ferguson, Mauser Group, Meyer Steel Drum, Patrick J. Kelly Drums, Peninsula Drums, Schutz Container Systems Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Balmer Lawrie & Co. Ltd.

- Clouds Drums Dubai

- Eagle Manufacturing

- Fibrestar Drums Limited

- Hoover Ferguson

- Mauser Group

- Meyer Steel Drum

- Patrick J. Kelly Drums

- Peninsula Drums

- Schutz Container Systems