Global Hardware in The Loop (HIL) Market By Loop Type (Open Loop HIL and Closed Loop HIL), By End-User (Automobile, Aerospace and Defense, Electronic Power, Scientific Research and Education, and Other End-User), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Jan. 2024

- Report ID: 105849

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

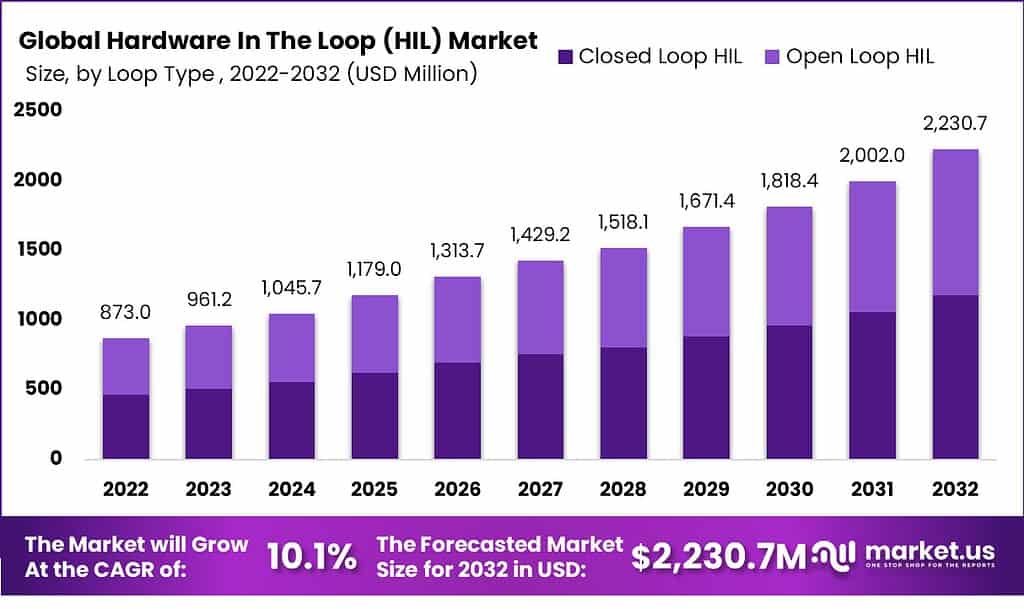

The Global Hardware in The Loop (HIL) Market Size Recorded Sales of USD 961.2.0 Mn in 2023. The Market experienced a CAGR of 10.1% year-on-year growth. It is anticipated to achieve revenues of USD 2,230.7 Mn by 2032.

In HIL testing, the physical hardware components are interfaced with a computer-based simulation model that represents the rest of the system. This simulation model generates real-time responses and stimuli to mimic the behavior of the actual system under test. By connecting the hardware and simulation together, engineers can simulate complex scenarios, evaluate system performance, and identify potential issues before deploying the system in real-world environments.

In the context of the market, the Hardware in the Loop (HIL) sector is experiencing significant growth, driven by the increasing complexity of embedded systems and the need for more effective testing methodologies. This growth is further fueled by advancements in industries such as automotive, aerospace, defense, and energy, where the demand for reliable and efficient systems is paramount. The HIL market is characterized by a proliferation of solutions tailored to specific industry needs, incorporating advancements in computing power, simulation fidelity, and real-time testing capabilities.

Note: Actual Numbers Might Vary In The Final Report

Key players in the market are focusing on innovation and the development of more integrated, user-friendly, and scalable HIL platforms. This market dynamic indicates a trend towards more comprehensive testing solutions, integral to the lifecycle of complex systems. The future prospects of the HIL market seem promising, with potential expansion into new application areas and the continuous evolution of technology driving further growth.

Key Takeaways

- Market Growth and Size: The Hardware in The Loop (HIL) market is expected to experience a CAGR of 10.1% and reach a value of USD 2,230.7 million by 2032, from USD 961.2 million in 2023.

- Definition and Methodology: HIL testing involves evaluating and confirming the operational efficacy of devices or systems within simulated environments that replicate authentic operational circumstances. This helps in identifying discrepancies in design and other complications that could be disregarded in alternative testing approaches.

- Loop Type Analysis: Closed-loop HIL accounts for the largest market share at 53.0%, offering greater reliability and stability in detecting and correcting errors. Open-loop HIL is gaining traction for its simplicity in design and cost-effectiveness in manufacturing processes.

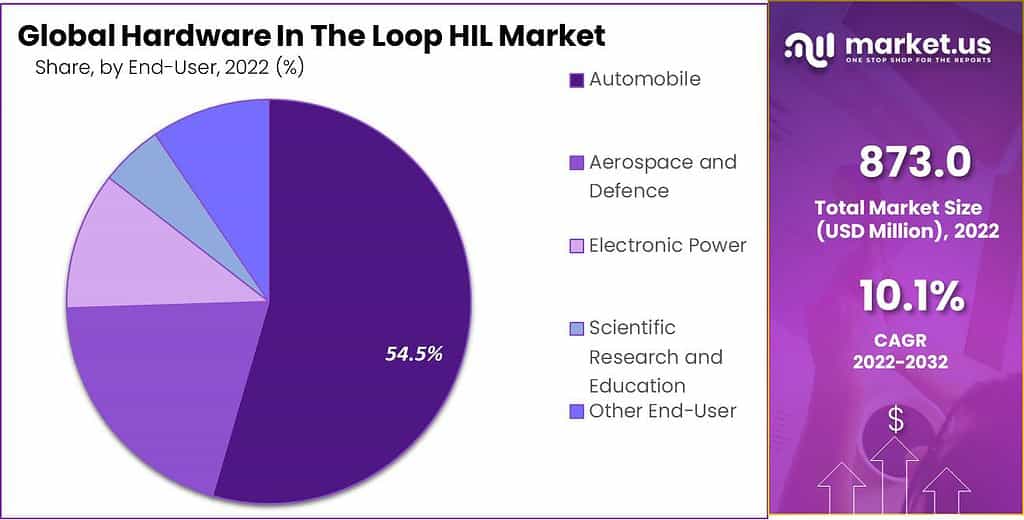

- End-User Analysis: The automotive sector dominates with a 54.5% market share, driven by the integration of HIL technology to advance Electronic Control Units (ECUs) and ensure conformity with industry mandates. Aerospace and defense segments are also witnessing significant growth.

- Drivers: The integration of hardware-oriented testing in the automotive industry, especially for autonomous driving, collision avoidance, and other advanced features, is fueling market growth.

- Restraints: Implementing HIL methodology is complex and costly due to the intricate nature of mathematical models and the need for robust hardware capable of processing substantial data volumes.

- Opportunities: HIL testing is finding applications in new sectors like power electronics and industrial robotics, driven by the need to meet industry safety standards and validate complex controllers.

- Trends: The latest trend in HIL technology involves the development of the 4th generation framework, catering to advanced applications in motor drive systems, power electronics, and automotive testing.

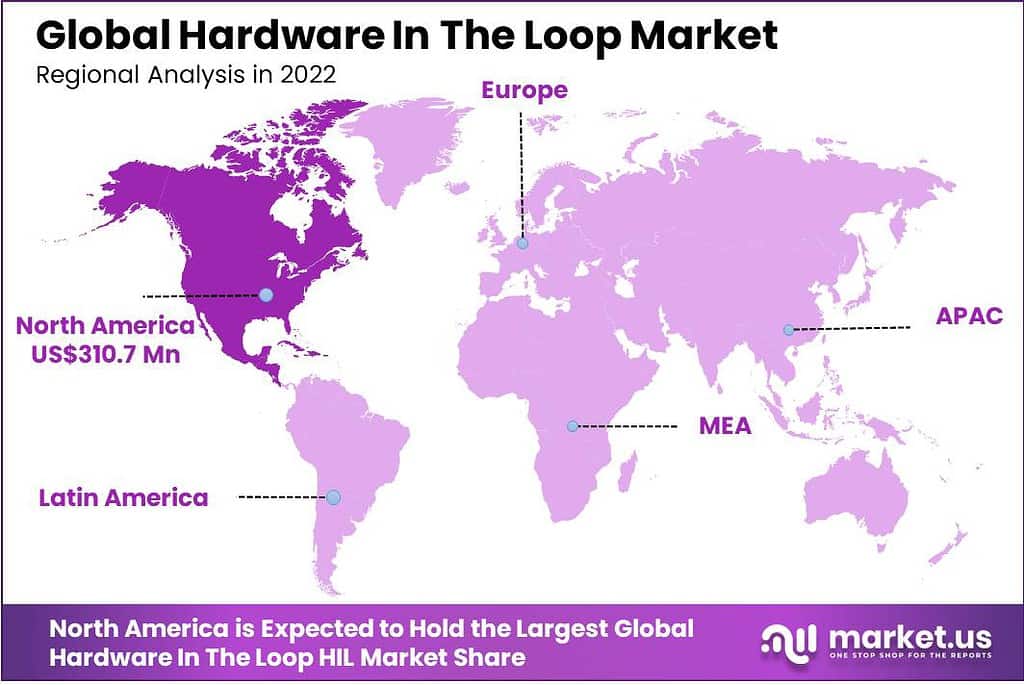

- Regional Analysis: North America holds the largest market share, followed by Europe. The US and Canada are significant contributors, driven by robust automotive and aerospace sectors.

- Key Market Players: Leading companies in the HIL market include DSpace GmbH, National Instruments, Vector Informatik, ETAS, Ipg Automotive GmbH, and others, with a focus on product launches and strategic partnerships.

Loop Type Analysis

Closed Loop HIL Accounted for The Largest Market Share

The global hardware in the loop HIL market is segmented based on Loop type into open-loop HIL and closed-loop HIL. Among these, closed-loop HIL held the majority of revenue share. In 2022, closed-loop HIL accounted for a market share of 53.0%, among other loop types. Closed-loop feedback loops on universal testing machines transmit data continuously from closed-loop controllers to the motor and from the motor to closed-loop controllers.

For example, load rate and stress rates can remain constant during testing because of this continuous input. A closed-loop system is more precise because it can react quickly to changes. Since closed-loop systems have a feedback loop, they can filter out noise and other external factors influencing system performance. Due to their feedback mechanisms, closed-loop systems provide greater reliability and stability in detecting and correcting errors. These advantages of the closed-loop HIL system are stimulating segment growth.

Likewise, the open-loop Hardware-in-the-Loop (HIL) system is poised for substantial advancement during the projected timeframe. Open-loop methodologies involve replicating scenario data (or recorded scenario data) generated by the model onto a test device, devoid of any feedback signals from the Device Under Test (DUT), thereby governing the device’s behavior within the specified scenario.

To illustrate, this application could pertain to the functional validation of temporal or positional attributes in onboard units. Notably, an open-loop control system, characterized by its simplicity in design and construction, emerges as a cost-effective alternative when juxtaposed with closed-loop control systems.

Its practicality is particularly accentuated when gauging production output encounters challenges or is not feasible. Open-loop control systems find apt utility in manufacturing processes that demonstrate output stability, are economically viable, and lack mechanisms for output measurement. This framework also boasts a propensity for minimal susceptibility to operational hiccups during the manufacturing process.

End-User Analysis

Automobile is the leading segment.

Based on end-users, the market is further divided into automobile, aerospace and defense, electronic power, scientific research and education, oil and gas, industrial equipment, and other end-users. Among these end-users, automobiles accounted for the largest market share of 54.5% in 2022.

This substantial upsurge can be attributed to the escalating integration of hardware-intelligent-loop (HIL) technology within automobiles. This integration facilitates the advancement of enhanced Electronic Control Units (ECUs), hastens the product development timeline, and ensures conformity with diverse industry mandates. Consequently, the market’s propulsion emanates from the escalating requisition for HIL technology in the automotive and electronics sectors.

HIL technology facilitates comprehensive evaluations encompassing vehicles, apparatus, and electronic components. By emulating an exhaustive array of plausible scenarios, it meticulously assesses the efficacy of controllers and devices.

This approach significantly economizes resources that would otherwise be expended on real-time testing endeavors for the devices above. Anticipated developments in the market are anticipated to be propelled by the assimilation of emerging technologies, such as Advanced Driver Assistance Systems (ADAS) and Artificial Intelligence (AI) within the domains of automobiles, Unmanned Aerial Vehicles (UAVs), and defense apparatus.

Furthermore, noteworthy growth has been observed within the aerospace and defense segment of the hardware-in-the-loop market, a trend anticipated to persist in the coming years. The aerospace domain, encompassing both aerospace vehicles and defense equipment, is experiencing swift expansion owing to escalating requisites for more intricate and advanced aerospace vehicles. Consequently, manufacturers of aerospace vehicles, alongside Original Equipment Manufacturers (OEMs), are increasingly embracing the utilization of the hardware-in-the-loop methodology.

This strategic adoption aims to curtail the duration of the developmental phase and mitigate superfluous financial outlays associated with the development process. Projections indicate a substantial, exponential surge in the demand for Aerospace Hardware-in-the-Loop (HIL) systems within the coming years. This heightened demand is largely attributed to the accelerated pace of technological advancements within the aerospace sector. The progression of Aerospace HIL technology is continually enhancing, thereby rendering it an alluring investment opportunity characterized by sustained growth prospects.

Key Market Segments

By Loop Type

- Open Loop HIL

- Closed Loop HIL

By End-User

- Automobile

- Aerospace and Defense

- Electronic Power

- Scientific Research and Education

- Other End-User

Drivers

Technological developments in autonomous and electric vehicles.

The automobile industry is actively incorporating autonomous driving, collision avoidance, and various other technological advancements to enhance the safety and comfort aspects of vehicles. In the context of in-the-loop testing, hardware components are employed to evaluate not only Electronic Control Units (ECUs) and algorithms but also the underlying software systems.

This comprehensive testing process extends to scrutinizing sensor-generated data to ensure its precision. Substantial capital investments underline the commitment to this field. For instance, Continental has channeled a significant $76.5 million toward developing Advanced Driver Assistance Systems (ADAS) and other technologies pertinent to autonomous driving.

A collaborative initiative between Hyundai and Aptiv has also emerged in the United States, focusing on creating self-driving systems tailored for commercial utilization. Furthermore, Minus Zero, operating from Bangalore, India, has secured a noteworthy financial injection of $1.7 million. This financial influx is intended to establish a robust infrastructure for research and development aimed at realizing economically viable autonomous vehicles.

As many automotive manufacturers adopt these progressive functionalities, the envisaged trajectory portends a notable upswing in the demand for hardware-oriented in-the-loop testing. This heightened demand aligns with the gradual proliferation of these advanced features across the automotive sector, marking a distinctive trend in the forecasted period.

Restraints

High cost of ownership and technical complexity in implementation

Implementing hardware-in-the-loop (HIL) methodology is a notably intricate endeavor, primarily attributed to the intricate nature of devising mathematical models, which becomes compounded based on the variables and function blocks integrated into the loop system. Intricate systems such as microgrids, aircraft simulations, and automotive environment generation necessitate robust hardware capable of processing substantial volumes of data.

The endeavor mandates a substantial investment in procuring a high-end real-time simulator and a robust rack computer to execute the simulation model effectively. Establishing the hardware infrastructure for a loop test system presents a considerable financial outlay, as acquiring a new system proves financially demanding, further compounded by the intricate programming requisites to configure the simulation model. The escalating intricacy in the architecture of embedded controllers has precipitated a commensurate escalation in the demand for compatible hardware that aligns with the requisites of the loop system, thereby addressing the imperatives of the testing prerequisites.

Opportunity

Adoption in new application areas such as power electronics and industrial robotics

Hardware in the-loop testing is mainly used in the automotive and aerospace industries. With the increasing functionality of modern vehicles, there is a growing need for hardware in-loop testing solutions that can meet these new requirements. In the aviation industry, loop system hardware is mainly used to verify and validate aerospace control systems. Physical testing in this industry can be very dangerous for real plants and human life, so hardware in the loop is preferred for most testing requirements.

In the last few years, there has been an increase in the demand for hardware in loop testing techniques within the power electronics industry, particularly in electrical grid operation, stability, and fault tolerance testing. In the robotics sector, hardware in loop testing is being used to test complex controllers used by robots. The increasing need to meet industry safety standards amongst manufacturers is also driving market growth.

Trends

Modernizing vehicles equipped with advanced features.

The latest iteration of Hardware-in-the-Loop (HIL) technology, known as the 4th generation, has been strategically designed to cater to the most cutting-edge applications in motor drive systems. Notably, industries such as automotive and aerospace have already embraced model-based HIL testing, whereas the power electronics sector is presently catching up to this trend.

The 4th generation HIL framework introduces an unprecedented level of precision in modeling, particularly tailored to address the demands of intricate motor drive systems and power electronics applications in the automotive realm. This advancement directly responds to the emergence of high switching frequency converters (HFCs), novel wide-bandgap semiconductors (WBS), and innovative circuit topologies, collectively propelling the evolution of next-generation controllers.

These advanced controllers necessitate HIL testing that accommodates increasingly shorter simulation time increments, swifter gate drive sampling intervals, minimal loop-back latency, and heightened model precision. This enhanced model accuracy encompasses intricate attributes such as nonlinear behaviors and spatial harmonics. Ultimately, this technological progress holds the potential to facilitate the development of modernized vehicles endowed with sophisticated features.

Regional Analysis

North America Holds Region Accounted Significant Share of the Market

North America held the largest market share, with 35.6% in the Global Hardware in The Loop HIL Market in 2022. The prominent status of North America can be attributed to the robust requisites of the automotive and aerospace sectors for the global implementation of the hardware-in-the-loop technique.

The United States ranks among the foremost global manufacturers within the automotive and aerospace domains. It is primarily the prevailing market trends that underlie the expansion observed in this geographical region. The trajectory of this segment’s progression stands to receive additional impetus from heightened endeavors directed toward the establishment of manufacturing facilities and industrial plants within the North American territory.

Within revenue distribution, Europe stands as the second-largest market region. The surge in market dynamics originates from several contributing factors, one notable factor being the amplification of the Information and Communication Technology (ICT) sector. The profound sway wielded by this sector on worldwide Gross Domestic Product (GDP) expansion, labor productivity enhancements, allocations toward research and development, and other vital economic benchmarks has, in turn, triggered an effect poised to nurture the market’s progression in the impending timespan.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Strong Focus On Product Launches Through Various Strategies.

Within this market landscape, the foremost contenders are deploying a spectrum of strategies encompassing collaborative ventures, introducing novel products, augmentations in the breadth of product portfolios through investments, mergers and acquisitions, and cooperative initiatives. As delineated by the Cardinal Matrix Analysis, the leading triumvirate of entities within the hardware-in-loops sector comprises Elektrotechnik GmbH (Continental AG), Robert Bosch, and dSPACE GmbH (National Instruments Corporation). These entities center their endeavors primarily around forging partnerships, engaging in collaborative efforts, and formalizing agreements.

Market Key Players

With the presence of several key players across the globe, the global hardware-in-loop HIL Market is fragmented. Companies are seeking to penetrate the market through a variety of strategies, including mergers and acquisitions, expansion, investment, and the introduction of new services, partnerships, and agreements. Players are expanding into new geographic areas by expanding and developing emerging technologies and investments to gain a competitive edge through synergies.

The following are some of the major players in the industry

- DSpace GmbH

- National Instruments

- Vector Informatik

- ETAS

- Ipg Automotive GmbH

- MicroNova AG

- HiRain Technologies

- Opal-RT Technologies

- Shanghai KeLiang InformationTechnology Co., Ltd.

- EON

- Other Key Players

Recent Developments

- April 2022: IPG Automotive introduced SensInject, an innovative offering designed to facilitate integrating data from camera, radar, and lidar sensors into automotive testing systems. This release signifies a noteworthy augmentation of IPG Automotive’s hardware lineup within the automotive test system domain.

- February 2022: dSPACE announced the launch of its latest sensor simulation solution, AureLION. AURELION offers high-quality visualization for autonomous driving testing and validation. Operating in cloud or on-premise, the solution creates photorealistic real-time images for camera simulation and, with ray tracing, provides a precise environment for radar simulation and lidar. Developers can validate algorithms for self-driving vehicles by simulating them in virtual test drives before a prototype ever hits the road.

Report Scope

Report Features Description Market Value (2023) US$ 961.2 Mn Forecast Revenue (2032) US$ 2,230.7 Mn CAGR (2023-2032) 10.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Loop Type (Open Loop HIL and Closed Loop HIL), By End-User (Automobile, Aerospace and Defense, Electronic Power, Scientific Research and Education, and Other End-User) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape DSpace GmbH, National Instruments, Vector Informatik, ETAS, Ipg Automotive GmbH, MicroNova AG, HiRain Technologies, Opal-RT Technologies, Shanghai KeLiang InformationTechnology Co., Ltd., EON, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is HIL?Hardware-in-the-loop (HIL) is a testing methodology that allows engineers to test electronic control systems (ECUs) in a simulated environment. The ECU is connected to a real-time simulator, which provides the ECU with input signals that mimic the real-world environment. This allows engineers to test the ECU's performance under a variety of conditions, without having to build a physical prototype.

What are the benefits of HIL testing?HIL testing offers a number of benefits over traditional testing methods, such as:

- Reduced costs: HIL testing can significantly reduce the cost of testing, as it eliminates the need to build physical prototypes.

- Increased speed: HIL testing can be much faster than traditional testing methods, as it allows engineers to test the ECU in a simulated environment.

- Improved accuracy: HIL testing can provide more accurate results than traditional testing methods, as it allows engineers to test the ECU under a wider range of conditions.

- Earlier detection of defects: HIL testing can help engineers to detect defects earlier in the development process, which can save time and money.

What are the major drivers and opportunities in the HIL market?The major drivers for the growth of the HIL market include:

- Increasing complexity of electronic systems: Electronic systems are becoming increasingly complex, which makes it more difficult to test them using traditional methods. HIL testing provides a more effective way to test these complex systems.

- Growing demand for safety-critical systems: Many electronic systems are safety-critical, such as those used in cars and airplanes. HIL testing can help to ensure the safety of these systems.

- Advances in simulation technology: Advances in simulation technology are making HIL testing more affordable and accessible.

What is the future of the HIL market?The HIL market is expected to continue to grow in the coming years, driven by the factors mentioned above. The market is also expected to benefit from the increasing adoption of HIL testing in emerging markets.

Hardware in The Loop (HIL) MarketPublished date: Jan. 2024add_shopping_cartBuy Now get_appDownload Sample

Hardware in The Loop (HIL) MarketPublished date: Jan. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- DSpace GmbH

- National Instruments

- Vector Informatik

- ETAS

- Ipg Automotive GmbH

- MicroNova AG

- HiRain Technologies

- Opal-RT Technologies

- Shanghai KeLiang InformationTechnology Co., Ltd.

- EON

- Other Key Players