Global Haptic Internet Infrastructure Market Size, Share, Industry Analysis Report By Component (Hardware, Software, Services), By Application (Healthcare & Tele-surgery, Industrial Automation & Remote Control, Automotive & In-Car Experience, Gaming, Entertainment & the Metaverse, Education & Training, Retail & E-commerce, Others), By End-User (Enterprises (B2B), Consumers (B2C), Government & Defense), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct 2025

- Report ID: 162660

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

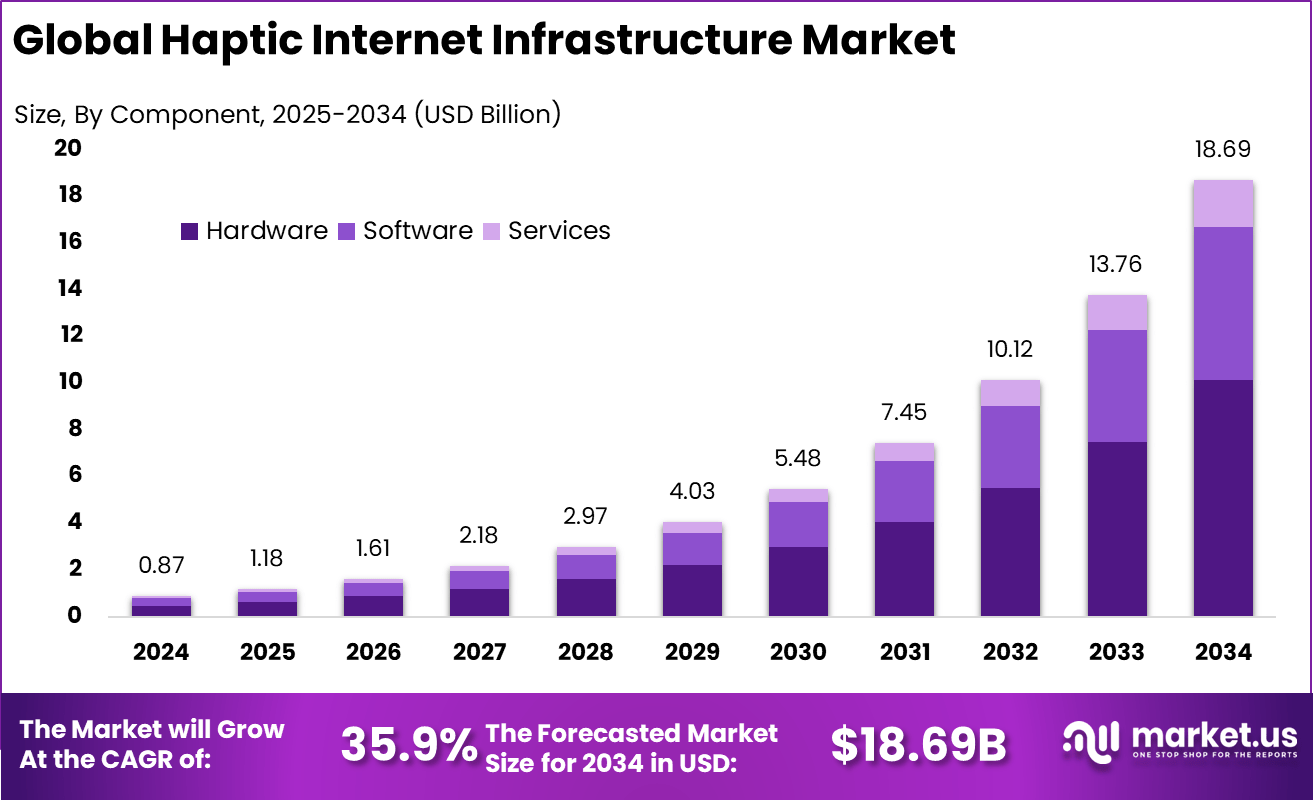

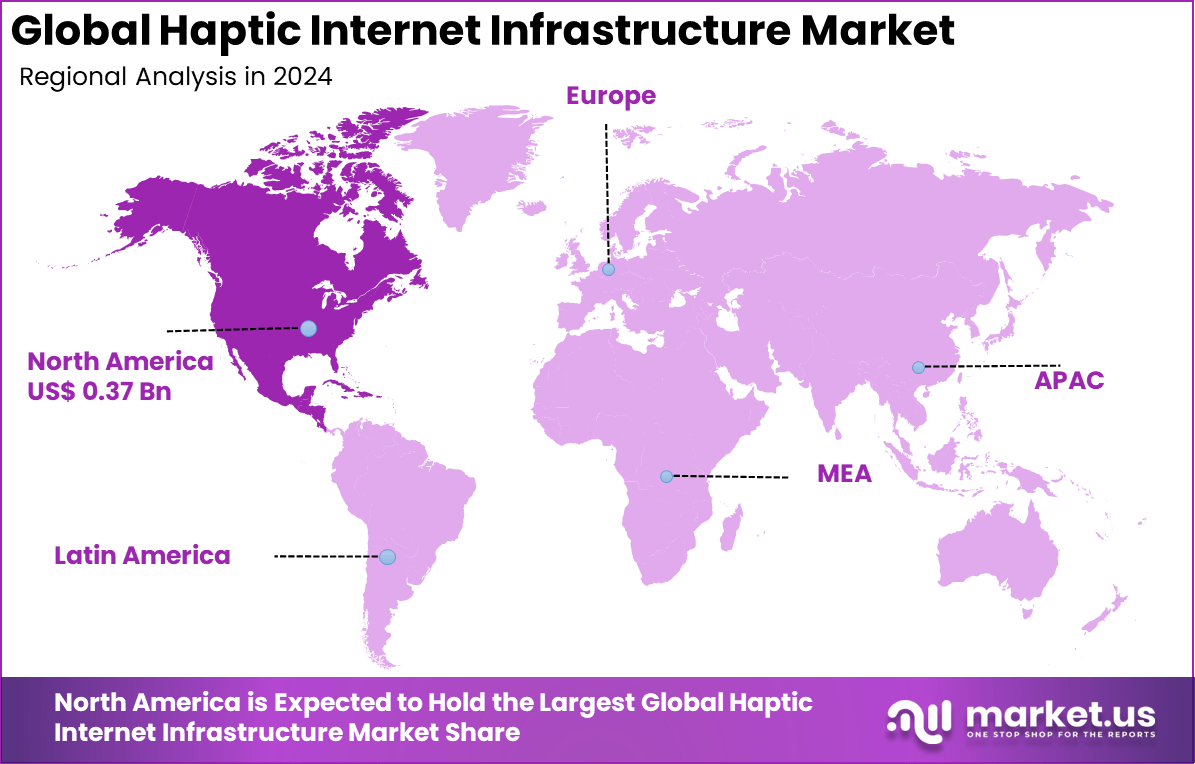

The Global Haptic Internet Infrastructure Market size is expected to be worth around USD 18.69 billion by 2034, from USD 0.87 billion in 2024, growing at a CAGR of 35.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 43.5% share, holding USD 0.37 billion in revenue.

The Haptic Internet Infrastructure Market is an emerging segment within the broader landscape of tactile communication and immersive technology, focused on enabling high-fidelity, low-latency touch interactions across digital platforms. This market involves the deployment of advanced networks and devices that facilitate real-time haptic feedback, which is essential for applications like remote surgery, virtual reality, industrial automation, and telemedicine.

The growth is being driven by technological advancements that support seamless tactile experiences and the increasing demand for immersive remote interactions across various industries. The primary drivers include the rising need for ultra-low latency communication to support real-time tactile feedback, and the expanding adoption of remote operation technologies such as telemedicine and industrial robotics.

The development of 5G and upcoming 6G networks plays a crucial role by providing the necessary bandwidth and reliability to transmit high-volume haptic data efficiently. Moreover, the surge in investments in cloud infrastructure and edge computing is facilitating the deployment of scalable, responsive haptic systems that can operate across diverse environments.

For instance, in July 2025, Tata Communications and Amazon Web Services announced a strategic collaboration to build an advanced AI-ready network in India, connecting key AWS data centers. This network aims to provide high-bandwidth and low-latency services necessary for scalable AI and haptic applications across multiple industries.

Key Takeaway

- The Hardware segment led the market with 54.2%, driven by rising deployment of advanced sensors, actuators, and tactile interface systems that enable real-time haptic feedback.

- The Industrial Automation & Remote Control segment accounted for 28.7%, reflecting increasing use of haptic-enabled systems for precision operations, tele-robotics, and manufacturing control.

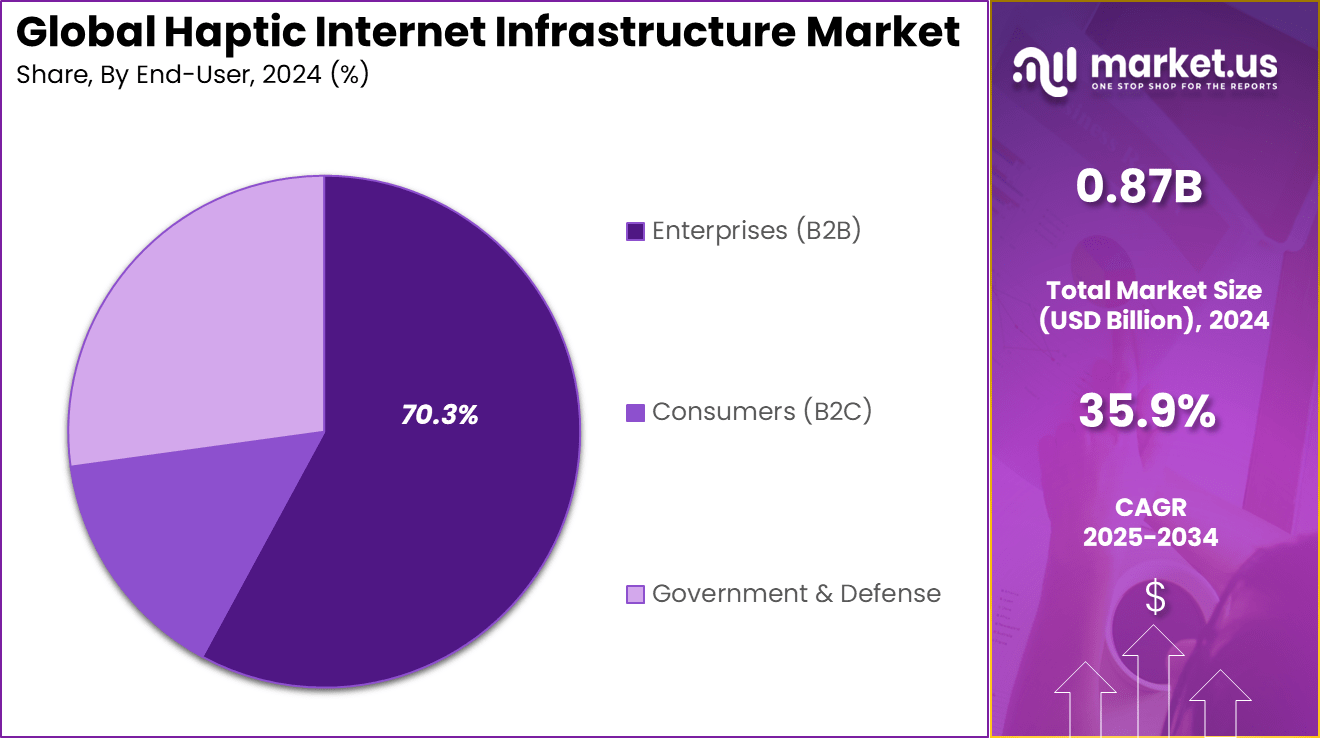

- The Enterprises (B2B) segment dominated with 70.3%, highlighting strong adoption among corporations investing in immersive technologies for remote collaboration and machine interaction.

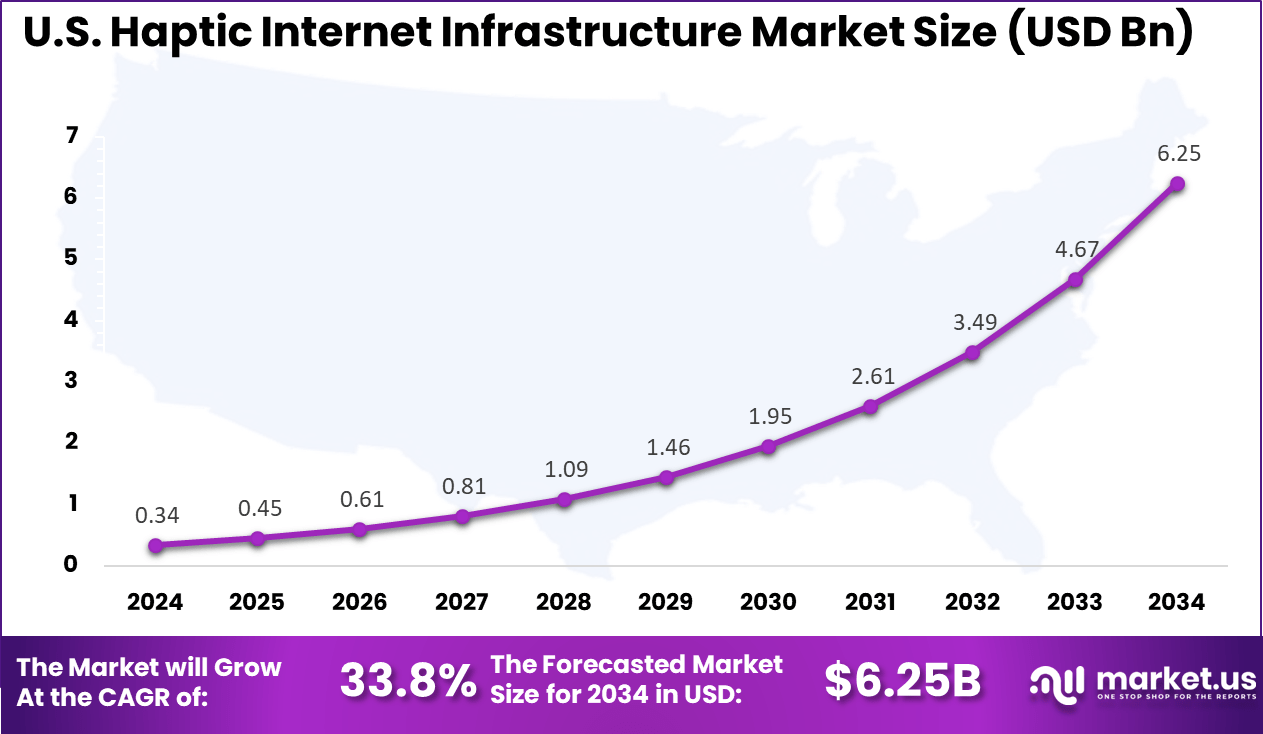

- The US market reached USD 0.34 Billion in 2024, registering an impressive 33.8% CAGR, supported by growth in 5G networks, edge computing, and tactile communication research.

- North America held a leading 43.5% share of the global market, underpinned by strong R&D activity, early adoption of next-generation connectivity, and industrial digitalization initiatives.

Analysts’ Viewpoint

The market for Haptic Internet Infrastructure is driven by the rapid advancement of 5G and edge computing technologies, which enable ultra-low latency and high bandwidth necessary for real-time tactile communication. These innovations make it possible to deliver precise touch feedback over long distances, opening new applications in healthcare, gaming, and remote industrial control.

As connectivity improves, businesses invest in infrastructure to support immersive, interactive experiences that rely on accurate and instant haptic feedback. Demand for haptic internet infrastructure is escalating due to the growing requirement for immersive experiences in healthcare, gaming, training, and manufacturing.

Industries realize that tactile feedback enhances user engagement, safety, and operational precision, particularly in remote or hazardous settings. As user expectations increase for realistic and interactive digital experiences, the adoption of these networks is becoming more widespread. Remote surgeries, virtual reality training, and tactile-enabled robotic systems are increasingly mainstream, fueling demand in both consumer and enterprise segments.

Investment and Business Benefits

Investment opportunities are abundant, especially in developing scalable network solutions, creating cost-effective sensors and actuators, and designing user-centric haptic devices. Startups and established technology firms are focusing on innovating low-power, compact, and high-performance components for integration into a wide range of applications.

Growing interest in digital twins, AR/VR, and telehealth further broadens investment prospects as these sectors seek to enhance tactile interactivity. Businesses adopting haptic internet infrastructure can expect to gain competitive advantages through improved service quality, increased operational precision, and expanded market reach.

It enables companies to offer advanced remote services, streamline manufacturing processes, and provide more engaging customer experiences. Over time, these benefits translate into higher customer satisfaction, reduced operational costs, and new revenue streams driven by innovations in tactile communication.

U.S. Market Size

The market for Haptic Internet Infrastructure within the U.S. is growing tremendously and is currently valued at USD 0.34 billion, the market has a projected CAGR of 33.8%. Advancements in 5G, edge computing, and ultra-low latency networks are enabling real-time tactile communication critical for industries like healthcare and manufacturing.

Increasing applications in remote surgery, telemedicine, and industrial automation are driving adoption, powered by innovations in sensor and actuator technologies that enhance the realism and responsiveness of haptic feedback. Additionally, strong technology infrastructure and partnerships between technology firms and institutions are accelerating market expansion.

For instance, in March 2025, Qualcomm, a key U.S. player, showcased its latest 5G innovations at Mobile World Congress, unveiling the powerful X85 5G modem-RF and Dragonwing platforms designed for advanced industrial IoT and cellular infrastructure. These technologies deliver ultra-fast speeds up to 12.5 Gbps with AI-powered connectivity improvements, essential for supporting the ultra-low latency and high reliability required by haptic internet applications.

In 2024, North America held a dominant market position in the Global Haptic Internet Infrastructure Market, capturing more than a 43.5% share, holding USD 0.37 billion in revenue. This dominance is due to early adoption of advanced 5G and edge computing technologies that support real-time tactile communication.

The region’s strong industrial base, extensive R&D investments, and government support for innovation further fuel demand. Key industries such as healthcare, manufacturing, and defense leverage haptic infrastructure to enhance remote operations and automation, solidifying North America’s market dominance.

For instance, in October 2025, Amazon Web Services (AWS) reinforced its massive cloud footprint across North America, despite a temporary U.S.-EAST-1 network disruption. Its continued reinvestment in edge network optimization and data resilience highlights AWS’s pivotal role in supporting haptic-dependent industries like telemedicine, AR/VR, and gaming.

Component Analysis

In 2024, The Hardware segment held a dominant market position, capturing a 54.2% share of the Global Haptic Internet Infrastructure Market. The precision of haptic experiences depends greatly on physical components such as micro-actuators, sensors, and transducers that translate digital signals into tactile sensations.

As industries demand stronger interaction between humans and machines, hardware solutions are evolving to support smoother, low-latency feedback. This shift is most visible in robotics, wearable use cases, and teleoperation systems, where performance reliability determines success. Rapid advances in tactile display materials and miniature motion actuators are further improving realism in haptic applications.

Manufacturers are increasingly exploring modular designs that allow developers to integrate tactile interfaces into diverse platforms like healthcare simulators and automotive cockpits. Sustainable materials and power-efficient designs are also emerging trends, helping hardware providers align with corporate responsibility goals while meeting growing enterprise demand for tactile precision.

For Instance, in October 2025, Intel Corporation announced a new data center GPU code-named Crescent Island designed to optimize AI inference workloads with energy-efficient, high-memory hardware suitable for real-time tactile internet demands. This hardware innovation supports scalable and efficient tactile data processing, crucial for haptic internet infrastructure.

Application Analysis

In 2024, the Industrial Automation & Remote Control segment held a dominant market position, capturing a 28.7% share of the Global Haptic Internet Infrastructure Market. Haptic feedback in automated environments allows operators to “feel” system responses even from remote locations, making critical processes safer and more accurate.

The technology enhances precision in assembly lines, improves fault detection, and increases flexibility across smart manufacturing setups. Industries like aerospace and oil refining particularly benefit from such systems, as they empower engineers to interact virtually with infrastructure that may be situated miles away. The ongoing digital transformation of industrial sectors is strengthening the role of haptic-enabled remote control platforms.

Combined with 5G and edge computing, tactile internet systems are reducing latency barriers to almost imperceptible levels. This enables industrial facilities to deploy robotic equipment that can react instantly to operator inputs, minimizing operational risk and downtime. Continuous R&D in industrial haptics signals a clear move toward deeper connectivity between real and virtual industrial control networks.

For instance, in March 2025, Nokia Corporation launched six new Industry 4.0 applications integrated into its MX Industrial Edge platform to improve automation, safety, and operational efficiency in industrial enterprises. These include advanced AI and connectivity tools that enhance industrial control systems with improved tactile feedback and remote monitoring capabilities.

End-User Analysis

In 2024, the Enterprises (B2B) segment held a dominant market position, capturing a 70.3% share of the Global Haptic Internet Infrastructure Market. Organizations in healthcare, manufacturing, and logistics are embracing haptic infrastructure to enable real-time collaboration and training in simulated environments.

Remote maintenance is another major driver, as haptic tools now enable field experts to guide or perform delicate operations without being physically present. The integration of haptic systems into enterprise workflows is reshaping how companies approach skill development, productivity enhancement, and risk management.

B2B adoption continues to rise due to the expanding ecosystem that supports haptic connectivity through cloud and edge infrastructures. As these systems mature, more enterprises are relying on haptic solutions to bridge the gap between human intuition and machine execution. This growing synergy between tactile innovation and enterprise digitalization positions the segment as a key driver of the market’s next stage of expansion.

For Instance, in October 2025, Huawei Technologies Co. Ltd. Introduced Enterprise Network Integration Service 6.0 at GITEX GLOBAL 2025, focused on building resilient, secure networks for enterprise sectors like finance and transportation. This service promotes reliable tactile internet infrastructure adaptable to verticals requiring high availability and intelligent network management.

Emerging trends

Emerging trends in haptic internet infrastructure point to widespread adoption of ultra-low latency networks combined with edge computing and 5G/6G connectivity. By 2025, 5G will already cover about 65% of the global population, facilitating the haptic internet’s core requirement of sub-millisecond responsiveness to tactile inputs.

This trend drives enhanced user experiences in augmented and virtual reality applications, remote surgery, and live training simulations. Notably, sensor technology improvements, such as high-resolution tactile sensors, support more precise touch sensations, increasing reliability and immersion.

Additionally, integration of network slicing on 5G allows dedicated virtual connections tailored to latency-sensitive haptic applications, including healthcare wearables and industrial robotics. Industry reports indicate a 50% growth in the adoption of these network capabilities for haptics from 2023 to 2025, reflecting the critical role emerging network technologies play in supporting the tactile internet’s expansion.

Growth Factors

Growth in haptic internet infrastructure is propelled by rising demand in healthcare, entertainment, industrial automation, and remote work applications. With telemedicine and remote surgery gaining ground, networks must support high-resolution tactile feedback with end-to-end latency measured in milliseconds.

Actuator and sensor technologies, such as piezoelectric and electroactive polymers, have become more affordable and power-efficient, allowing broader integration into consumer and industrial devices. Recent statistics show that the adoption of wearable technology combined with AR/VR is fuelling over 30% year-on-year growth in devices relying on haptic feedback.

Furthermore, the increasing use of generative AI contributes to adaptive haptic interaction models, improving user satisfaction and expanding use cases. The expansion of immersive gaming and training simulators further supports infrastructure demand. Investments in software development kits and research into low-power haptic technologies suggest an innovation cycle focused on robustness, energy efficiency, and scalability.

Key Market Segments

By Component

- Hardware

- Haptic Actuators & Devices

- Sensors

- Interfaces & COntrollers

- Others

- Software

- Haptic Rendering Engines

- Haptic Codecs & Data Compression

- Others

- Services

- Integration Services

- Maintenance & Support

By Application

- Healthcare & Tele-surgery

- Industrial Automation & Remote Control

- Automotive & In-Car Experience

- Gaming, Entertainment & the Metaverse

- Education & Training

- Retail & E-commerce

- Others

By End-User

- Enterprises (B2B)

- Consumers (B2C)

- Government & Defense

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Drivers

Advances in 5G and Edge Computing

The rapid development of 5G and edge computing technologies is a key driver for Haptic Internet Infrastructure. These advancements allow for the ultra-low latency and high data transfer speeds needed to transmit tactile feedback effectively over long distances.

As more regions deploy 5G networks, industries such as healthcare, manufacturing, and entertainment are increasingly able to explore new applications that require real-time touch sensations. These network improvements provide the backbone for immersive remote experiences like virtual surgeries or remote robotic control.

The enhanced connectivity and reduced response times make it feasible to deliver high-fidelity tactile interactions, which were previously impossible with slower networks. Advancements in network technology are expected to accelerate adoption and broaden the scope of haptic applications across various sectors.

For instance, in March 2025, Nokia Bell Labs collaborated with the Technical University of Munich to improve the transmission of tactile data over 5G networks. The project focused on reducing delay between touch and response time in haptic systems, reinforcing how advances in network technology serve as the foundation for the Haptic Internet Infrastructure’s growth.

Restraint

High Infrastructure Costs and Complexity

Despite its promise, haptic internet infrastructure faces significant hurdles due to the high costs associated with deploying the necessary network and hardware components. Establishing ultra-low latency networks demands advanced technologies and significant upgrades to existing communication systems, which require large capital investments. This financial barrier slows adoption, especially in regions or sectors with limited resources.

Additionally, the complexity of integrating diverse components such as specialized sensors, actuators, and software platforms adds to the challenges. Compatibility issues and the need for standardized protocols further complicate the deployment process, limiting widespread scalability. Organizations may delay investment while assessing the return on these costly upgrades.

For instance, in October 2025, Ericsson partnered with Hewlett Packard Enterprise to establish a joint validation lab for cloud-native, dual-mode 5G core networks. This collaboration emphasized how costly and complex it is to deploy multi-vendor, cloud-based infrastructure to support mission-critical services like haptic communications.

Opportunities

Healthcare and Remote Industrial Applications

Haptic internet infrastructure presents substantial opportunities in healthcare, where it can revolutionize remote surgery, rehabilitation, and telemedicine. The ability to transmit precise touch feedback allows doctors to perform surgeries or guide therapy sessions from remote locations, increasing access to specialized care and reducing patient risk. This capability promises to transform medical services by making them more efficient and accessible.

Beyond healthcare, industries like manufacturing and robotics see opportunities to use haptic technology for remote control, training, and quality inspections. Workers can manipulate robotic tools with tactile feedback, enabling safer and more accurate operations in hazardous or distant environments. These applications can lead to cost reductions, improved safety, and expanded service possibilities, driving market demand.

For instance, in September 2025, Huawei highlighted applications of its Net5.5G Intelligent IP Network at the UBBF Summit in Paris, showing how AI-powered networks can support real-time control in healthcare and industrial automation. This indicates strong potential for tactile-enabled remote surgeries and medical training, enhancing healthcare accessibility around the world.

Challenges

Network Reliability and Standardization

One of the foremost challenges in haptic internet infrastructure is maintaining stable network conditions required for consistent tactile feedback. Packet loss, jitter, and latency fluctuations can degrade the quality of haptic communication, resulting in disrupted or unrealistic touch experiences. Ensuring high reliability and seamless performance across diverse and complex network environments remains difficult.

Moreover, the industry lacks universally accepted standards, causing difficulties in achieving interoperability between different devices and platforms. Without unified protocols, the integration of various hardware and software components becomes cumbersome, limiting market growth and user adoption. Addressing these challenges requires coordinated efforts in research and international collaboration to develop robust standards and optimize network performance.

For instance, in May 2025, Amazon Web Services expanded its edge computing ecosystem through services like AWS Wavelength and CloudFront, aiming to improve local responsiveness for distributed applications. Despite this progress, achieving global standardization across multi-vendor systems and maintaining stable tactile responsiveness across networks remains a complex challenge.

Key Players Analysis

The Haptic Internet Infrastructure Market is led by global technology and network innovators such as Ericsson AB, Nokia Corporation, Huawei Technologies Co. Ltd., and Cisco Systems Inc. These companies are developing ultra-low-latency communication networks and 5G/6G-enabled infrastructure essential for real-time haptic feedback transmission.

Cloud and computing leaders including Microsoft Corporation, Amazon Web Services Inc., Intel Corporation, Qualcomm Incorporated, and Samsung Electronics Co. Ltd. are driving the integration of artificial intelligence, cloud orchestration, and high-performance processors to support haptic signal processing and synchronization.

Specialized haptic technology providers such as Tanvas Inc., 3D Systems Corporation, Haption S.A., and Force Dimension, along with other emerging players, are focusing on precision haptic interfaces and actuator design. Their innovations in tactile rendering, motion simulation, and feedback control systems are accelerating the commercialization of haptic-enabled internet ecosystems, bridging the gap between digital communication and physical sensation.

Top Key Players in the Market

- Ericsson AB

- Nokia Corporation

- Huawei Technologies Co. Ltd.

- Cisco Systems Inc.

- Microsoft Corporation

- Amazon Web Services Inc.

- Intel Corporation

- Qualcomm Incorporated

- Samsung Electronics Co. Ltd.

- Tanvas Inc.

- 3D Systems Corporation

- Haption S.A.

- Force Dimension

- Others

Recent Developments

- In March 2025, Qualcomm revealed several advancements at Mobile World Congress, including its X85 5G modem-RF and Dragonwing platforms for cellular infrastructure, enabling faster and more efficient 5G connectivity crucial for haptic applications. The company is also working on AI-powered enhancements that improve latency and bandwidth efficiency.

- In September 2025, Huawei unveiled its upgraded Xinghe Intelligent Network solutions focused on Wi-Fi 7 advanced technologies and high-performance Ethernet connectivity optimized for AI and HPC workloads. These developments aim to enhance tactile internet infrastructure by delivering reliable, low-latency networking capable of supporting immersive AI applications.

Report Scope

Report Features Description Market Value (2024) USD 0.87 Bn Forecast Revenue (2034) USD 18.69 Bn CAGR(2025-2034) 35.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Application (Healthcare & Tele-surgery, Industrial Automation & Remote Control, Automotive & In-Car Experience, Gaming, Entertainment & the Metaverse, Education & Training, Retail & E-commerce, Others), By End-User (Enterprises (B2B), Consumers (B2C), Government & Defense) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ericsson AB, Nokia Corporation, Huawei Technologies Co. Ltd., Cisco Systems Inc., Microsoft Corporation, Amazon Web Services Inc., Intel Corporation, Qualcomm Incorporated, Samsung Electronics Co. Ltd., Tanvas Inc., 3D Systems Corporation, Haption S.A., Force Dimension, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)  Haptic Internet Infrastructure MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Haptic Internet Infrastructure MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ericsson AB

- Nokia Corporation

- Huawei Technologies Co. Ltd.

- Cisco Systems Inc.

- Microsoft Corporation

- Amazon Web Services Inc.

- Intel Corporation

- Qualcomm Incorporated

- Samsung Electronics Co. Ltd.

- Tanvas Inc.

- 3D Systems Corporation

- Haption S.A.

- Force Dimension

- Others