Global Hangover Rehydration Supplements Market By Product Type (Solution & Powder, and Tablet/Capsule) By Application (Residential and Commercial) By Distribution Channel (Offline and Online), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept 2025

- Report ID: 156783

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

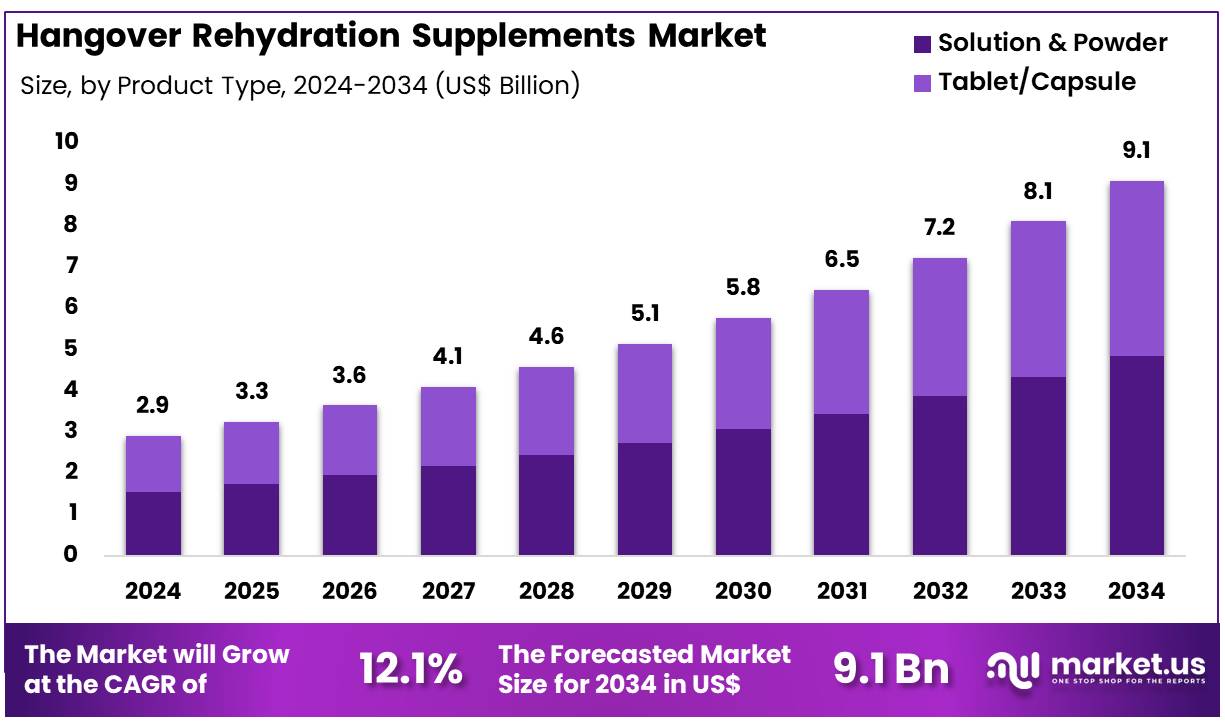

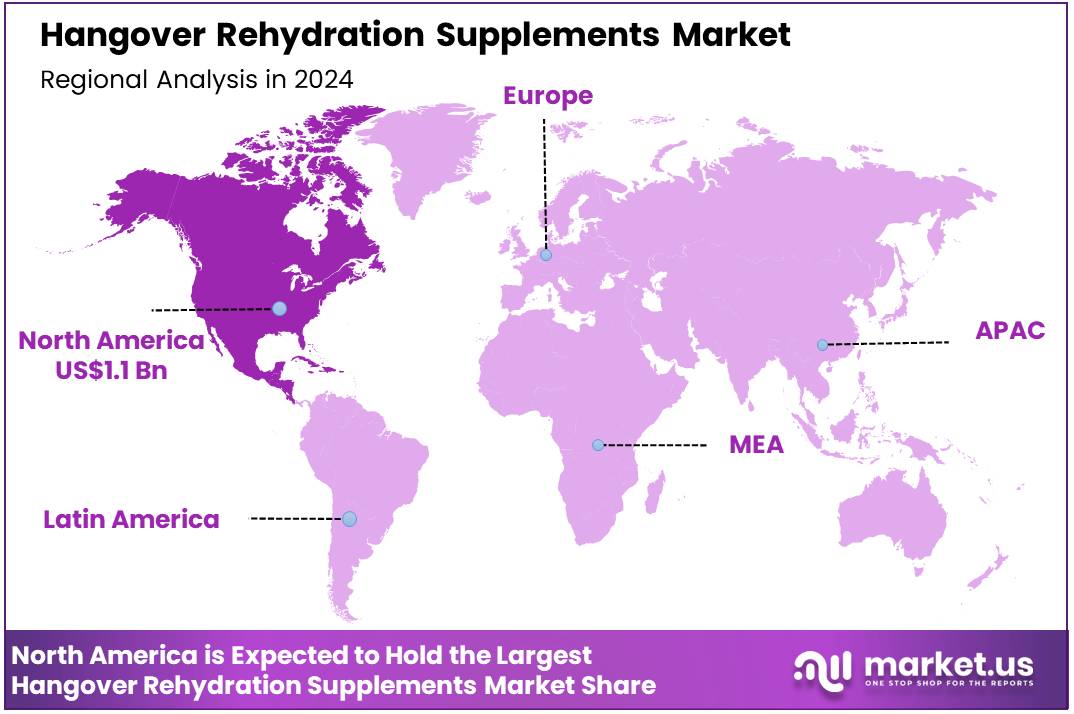

Global Hangover Rehydration Supplements Market size is expected to be worth around US$ 9.1 Billion by 2034 from US$ 2.9 Billion in 2024, growing at a CAGR of 12.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.5% share with a revenue of US$ 1.1 Billion.

Rising social alcohol consumption and a heightened focus on personal wellness are the primary drivers of the hangover rehydration supplements market. Consumers are increasingly seeking proactive solutions to mitigate the adverse effects of alcohol, such as dehydration, headaches, and fatigue, without disrupting their daily routines. This trend is particularly prevalent among younger demographics who are highly engaged in social activities and value productivity. As a result, the market is seeing a surge in demand for convenient, scientifically formulated products that can be consumed before, during, or after drinking.

Growing product innovation and a shift towards more effective delivery methods are shaping the market’s trajectory. Companies are investing heavily in research and development to create advanced formulations that offer rapid absorption and enhanced efficacy. A prime example of this trend is C.L. Pharm’s introduction of its hangover relief solutions in the form of orally dissolving films to the Singapore and Malaysia markets in May 2025. Leveraging its Dr.FiLL Bio SorbFilm technology, these products are designed for quicker absorption, catering to the consumer’s need for fast and effective results. This strategic move highlights the industry’s focus on convenience and rapid action.

Increasing scientific validation and a rise in government support for research are creating significant opportunities for market expansion and consumer trust. While many hangover remedies lack rigorous clinical backing, there is a growing trend toward evidence-based product development. In April 2025, Dongsung Bio Pharm received KRW 570 million in government funding to support the development of products based on Hwangchil and Dangyuja. The company is set to begin human trials to evaluate the efficacy of these traditional ingredients, which is a critical step in building consumer confidence and gaining a competitive edge. This focus on clinical trials and government-backed research is essential for moving the market forward and legitimizing these products in the broader wellness industry.

Key Takeaways

- In 2024, the market for hangover rehydration supplements generated a revenue of US$ 2.9 Billion, with a CAGR of 12.1%, and is expected to reach US$ 9.1 Billion by the year 2034.

- The product type segment is divided into solution & powder and tablet/capsule, with solution & powder taking the lead in 2023 with a market share of 53. 4%.

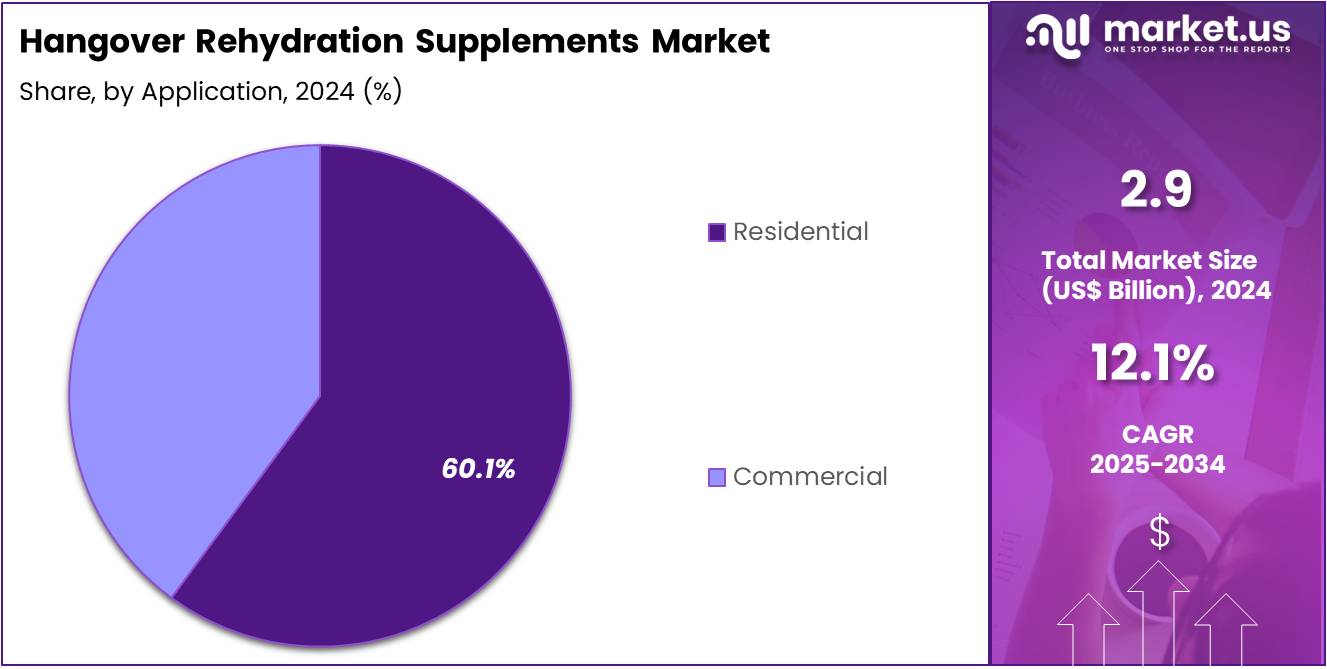

- Considering application, the market is divided into residential and commercial. Among these, residential held a significant share of 60.1%.

- Furthermore, concerning the distribution channel segment, the market is segregated into offline and online. The offline sector stands out as the dominant player, holding the largest revenue share of 70.3% in the hangover rehydration supplements market.

- North America led the market by securing a market share of 38.5% in 2023.

Product Type Analysis

Solution & powder-based hangover rehydration supplements account for 53.4% of the product type segment in the market. This growth is expected to continue as consumers increasingly prefer liquid and powdered forms for their faster absorption and convenience. Solutions and powders are known for their ability to rapidly rehydrate the body and replenish electrolytes, which is essential for alleviating the symptoms of a hangover. The increasing awareness of hangover recovery products, especially in regions with high alcohol consumption, is likely to drive the demand for these types of supplements.

The flexibility of solution and powder formats also contributes to their popularity, as they can be easily mixed with water for on-the-go consumption. Innovations in flavor, ease of use, and enhanced absorption rates are anticipated to further fuel the demand for these products. As health and wellness trends continue to grow, solutions and powders that offer quick relief from dehydration and fatigue will likely remain a dominant choice for consumers looking for fast and effective hangover remedies.

Application Analysis

Residential applications account for 60.1% of the market share in the hangover rehydration supplements market. This segment’s growth is projected to continue as more individuals seek at-home solutions for hangover recovery. With the rise in alcohol consumption and social drinking, especially among young adults and urban dwellers, the demand for convenient, effective hangover remedies is likely to grow in residential settings. Consumers prefer products that are easy to use at home without needing to visit a clinic or pharmacy.

The increasing availability of hangover rehydration supplements in convenient formats, such as powder packets and ready-to-drink solutions, is anticipated to further drive demand. The growing focus on self-care and preventive health, as well as the expansion of wellness products in mainstream retail channels, will likely support the growth of the residential segment. As people become more aware of the long-term benefits of hydration and recovery after drinking, the residential demand for hangover rehydration supplements is expected to continue expanding.

Distribution Channel Analysis

Offline distribution channels represent 70.3% of the market share in the hangover rehydration supplements market. This growth is expected to continue as traditional brick-and-mortar stores remain the primary point of purchase for many consumers. In-store shopping provides customers with immediate access to products, making it particularly convenient for those in need of a quick hangover remedy after a night out. Retail outlets such as pharmacies, supermarkets, and convenience stores are expected to continue to be the go-to places for purchasing hangover rehydration supplements.

Additionally, the opportunity to speak with in-store staff and receive recommendations may further enhance consumer confidence in the product. The accessibility of these supplements in various locations, along with increasing product availability in global markets, is projected to keep driving growth. Although online shopping continues to rise, the offline segment is likely to remain dominant in regions with limited access to digital platforms and where face-to-face interactions are preferred for purchasing health and wellness products.

Key Market Segments

By Product Type

- Solution & Powder

- Tablet/Capsule

By Application

- Residential

- Commercial

By Distribution Channel

- Offline

- Online

Drivers

Rising alcohol consumption and public awareness of its physiological effects are driving the market.

The market for hangover rehydration supplements is experiencing significant growth, primarily driven by a global culture of social drinking and the associated physiological consequences. A growing number of consumers, particularly younger adults, are seeking proactive solutions to mitigate the negative effects of alcohol consumption, such as dehydration and nutrient depletion. Binge drinking, in particular, has become a key behavior leading to demand.

According to data from the 2023 National Survey on Drug Use and Health (NSDUH) conducted by the Substance Abuse and Mental Health Services Administration (SAMHSA), 28.7% of young adults aged 18 to 25 reported past-month binge alcohol use. This substantial segment of the population is actively looking for products that promise to alleviate morning-after discomfort. The increasing public awareness of dehydration’s role in hangovers, fueled by social media and health-focused content, is also converting more consumers from traditional remedies to scientifically formulated products containing electrolytes, vitamins, and minerals.

Restraints

The lack of scientific validation and regulatory oversight is restraining the market.

A significant restraint on the market is the lack of robust scientific evidence and the limited regulatory oversight of the claims made by many products. Because these products are categorized as dietary supplements, they are not subject to the same stringent pre-market approval process as pharmaceuticals. This has led to a market filled with products making unproven claims about their efficacy.

In 2023, the US Food and Drug Administration (FDA) issued multiple warning letters to companies marketing dietary supplements with unproven claims, including products that falsely claim to treat or prevent diseases. This regulatory environment creates consumer skepticism and hesitation, as individuals find it difficult to distinguish between credible, effective products and those with questionable ingredients or exaggerated marketing. The absence of a universally accepted standard for what constitutes a “hangover cure” or “prevention” tool undermines consumer trust and can limit a brand’s ability to build a loyal customer base.

Opportunities

The growing consumer focus on proactive wellness and self-care is creating growth opportunities.

The market is presented with significant opportunities from a broader cultural shift towards proactive wellness and self-care. Consumers are no longer waiting for symptoms to appear; they are actively seeking products that help them prepare for and recover from various lifestyle choices. The market for these products is expanding as they are reframed not just as a reactive solution but as a proactive part of a wellness routine.

According to the Council for Responsible Nutrition’s 2024 Consumer Survey, three-quarters of Americans continue to use dietary supplements, with a majority affirming their importance to maintaining their health. This high rate of supplement usage provides a fertile ground for the market to grow, as consumers are already accustomed to integrating these types of products into their daily lives. The opportunity lies in positioning these products within this broader wellness narrative, emphasizing their role in replenishing essential nutrients and supporting the body’s natural recovery processes.

Impact of Macroeconomic / Geopolitical Factors

The market for these products is navigating a complex macroeconomic and geopolitical landscape, which affects both manufacturing costs and end-user purchasing power. Global inflationary pressures have continued to increase the cost of essential raw ingredients, particularly the various vitamins, minerals, and herbal extracts used in formulations. According to the US Bureau of Labor Statistics, the price index for imported materials saw a 0.9% increase for the year ending in July 2024, reflecting continued volatility in global supply chains.

Furthermore, geopolitical tensions have introduced an additional layer of risk, with trade route disruptions and export restrictions creating volatility in the global supply of crucial components. A 2024 report on the botanical supply chain highlighted how regional conflicts and extreme weather events have led to significant delays and price spikes for key herbal extracts.

However, the industry demonstrates resilience by proactively adapting to these conditions. Many companies are strategically diversifying their supplier base and exploring partnerships with local and regional growers to ensure a more secure and stable supply for their customers.

Current US tariff policies are fundamentally reshaping the global supply chain, creating both fiscal challenges and new strategic opportunities. The imposition of duties on imported dietary supplements or their raw ingredients has increased the final cost of these products for US-based consumers. The US International Trade Commission’s data for 2023 showed that dietary supplements imported from certain regions faced a variety of duties, with some exceeding 5%. This directly impacts the consumer’s budget, as they are often viewed as discretionary purchases, and can influence their willingness to pay a premium.

However, this same dynamic is also creating a powerful incentive for domestic manufacturing. Many companies are now accelerating plans to establish or expand production facilities within the United States to bypass these import duties. A recent report from a government-sponsored trade initiative noted a significant increase in capital expenditure for the localization of critical medical and wellness supply manufacturing. This strategic shift is fostering a resurgence of domestic production, thereby strengthening the US manufacturing base and creating a more secure and resilient supply chain.

Latest Trends

The trend toward natural, plant-based, and clean-label ingredients is a recent trend.

A significant trend in 2024 is the shift toward natural, plant-based, and clean-label formulations. Consumers are increasingly scrutinizing product labels and demanding transparency, favoring products with ingredients they can easily recognize and trust. In a 2023 consumer survey, a strong preference for plant-based ingredients and clean-label products was evident, with consumers seeking natural and sustainable wellness solutions over synthetic alternatives. This has prompted manufacturers to replace synthetic vitamins and chemicals with botanical extracts, amino acids, and naturally sourced electrolytes.

For example, ingredients like milk thistle extract, ginger root, and turmeric have become increasingly popular for their traditional use in supporting liver function and reducing inflammation. This trend is not just about ingredients; it also extends to product packaging and sourcing. The focus on transparent, sustainably sourced products that align with the values of health-conscious consumers is revolutionizing the market’s product development and marketing strategies.

Regional Analysis

North America is leading the Hangover Rehydration Supplements Market

The North American market for hangover rehydration supplements has grown considerably in 2024. This expansion is a direct result of the region’s prominent social drinking culture, an increasing consumer focus on health and wellness, and a robust e-commerce and retail infrastructure. A key driver is the consumer shift toward preventive health measures, as individuals seek products to mitigate the negative effects of alcohol consumption.

According to the Centers for Disease Control and Prevention’s (CDC) latest available data from the 2022 Behavioral Risk Factor Surveillance System, nearly 1 in 6 adults in the US reported binge drinking, defined as consuming four or more drinks for women or five or more for men on one occasion. This substantial rate of alcohol consumption directly fuels demand for products that can alleviate associated negative symptoms. The market is also propelled by significant investments and product innovations from companies.

For example, in February 2024, Unilever invested US$80 million into a US facility to boost the production capacity for the Liquid I.V. brand, demonstrating strong corporate confidence in the market and supporting the development of new products with advanced ingredients. The focus on convenience and novel delivery formats, such as effervescent tablets and ready-to-drink shots, further contributes to market expansion by catering to the fast-paced North American lifestyle.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific market for hangover rehydration supplements is anticipated to experience the fastest growth during the forecast period. This is largely a result of rapidly changing lifestyles, increasing disposable incomes, and the growing urbanization of the region, which is leading to a more prevalent social drinking culture.

The World Health Organization’s (WHO) June 2024 “Global Status Report on Alcohol and Health and Treatment of Substance Use Disorders” noted a worldwide total consumption of 5.5 litres of pure alcohol per person aged 15 years and older in 2019, highlighting that the highest spikes in consumption from 2010 to 2019 occurred in Southern Europe and Southeast Asia. This significant rate of alcohol consumption directly fuels the demand for effective hangover remedies.

Furthermore, there is a growing trend of health consciousness among consumers, especially the younger generation, who are actively seeking products that provide a quick and convenient way to recover from the aftereffects of drinking. The market’s growth is also supported by the expansion of e-commerce platforms and the increasing availability of products through online channels, making these supplements more accessible to a broader consumer base across the region. Unilever, for instance, has successfully introduced its Liquid I.V. brand to India in April 2025, expanding its presence to meet consumer needs in this high-growth market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market for hangover relief products are focusing on product innovation, expanding their distribution channels, and utilizing digital marketing to drive growth. Companies are developing a diverse range of products, including capsules, powders, and ready-to-drink options, that feature advanced formulations with electrolytes, vitamins, and herbal extracts to enhance efficacy.

Manufacturers are also increasing their product’s accessibility by expanding into both online and offline retail channels, including pharmacies and convenience stores. Furthermore, brands are leveraging strategic marketing campaigns and social media partnerships to build brand awareness and engage with a health-conscious consumer base.

DripDrop Hydration, Inc., a company based in San Francisco, California, is a producer of oral rehydration solutions. Founded in 2008 by a physician, the company’s core mission is to defeat dehydration with its patented formula, which delivers a precise balance of electrolytes and a low osmolarity to ensure rapid fluid absorption. DripDrop has a strong history of providing its products for medical relief efforts globally, a philanthropic approach that has solidified its reputation and brand identity. It continues to expand its product line with new offerings, including zero-sugar versions, and has a significant presence in e-commerce.

Top Key Players

- The IV Doc Inc

- Rally Labs LLC

- More Labs

- Himalaya Wellness

- Flyby Ventures LLC

- Drinkwel, LLC

- DOTSHOT

- Cheers Health, Inc

Recent Developments

- In July 2022, Myrkl, a Swedish brand specializing in anti-hangover supplements, introduced its innovative anti-hangover pill to the U.K. market. The pill claims to break down up to 70% of alcohol within an hour of consumption. By activating beneficial gut bacteria and incorporating vitamin B12, it helps convert alcohol into water and carbon dioxide, reducing its impact on the liver.

- In June 2022, Bayer’s Alka-Seltzer brand unveiled Alka-Seltzer Hangover Relief, a new product designed to ease hangover symptoms. The product comes in the form of an effervescent orange tablet, featuring a potent combination of aspirin and caffeine. To promote the launch, the brand partnered with renowned musician and producer, T-Pain, and made the product available in major retail outlets such as Target, CVS, and Rite Aid.

Report Scope

Report Features Description Market Value (2024) US$ 2.9 Billion Forecast Revenue (2034) US$ 9.1 Billion CAGR (2025-2034) 12.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Solution & Powder, and Tablet/Capsule) By Application (Residential and Commercial) By Distribution Channel (Offline and Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape The IV Doc Inc, Rally Labs LLC, More Labs, Himalaya Wellness, Flyby Ventures LLC, Drinkwel, LLC, DOTSHOT, Cheers Health, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hangover Rehydration Supplements MarketPublished date: Sept 2025add_shopping_cartBuy Now get_appDownload Sample

Hangover Rehydration Supplements MarketPublished date: Sept 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- The IV Doc Inc

- Rally Labs LLC

- More Labs

- Himalaya Wellness

- Flyby Ventures LLC

- Drinkwel, LLC

- DOTSHOT

- Cheers Health, Inc