Global Handwheels Market Size, Share, Growth Analysis By Product Type (Spoked Handwheel, Offset Handwheel, Flat Handwheel, Handlebar Handwheel, Others), By Grip Type (Fixed Grip, Folding Grip, Revolving Grip, Others), By Material (Aluminum, Plastic, Stainless Steel, Cast Iron, Others), By Type of Assembly (Plain Hole, Keyway Hole, Others), By End Use (Manufacturing, Automotive, Oil & Gas, Food & Beverage, Construction, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157788

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

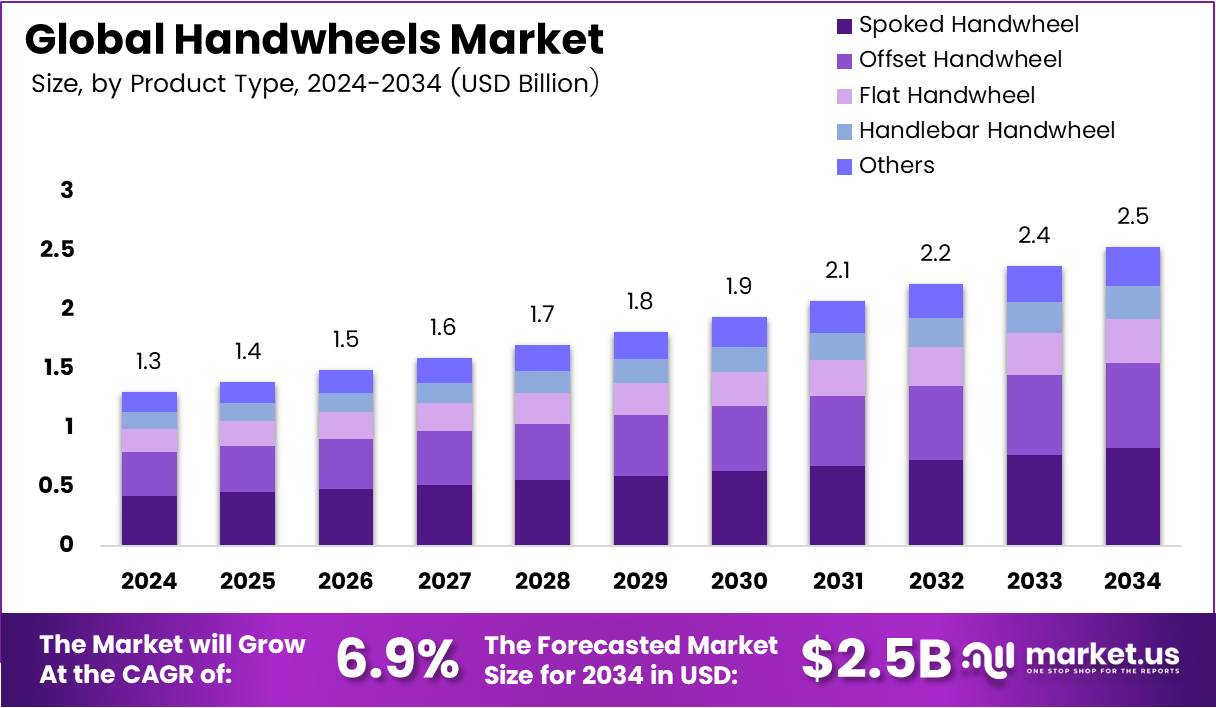

The Global Handwheels Market size is expected to be worth around USD 2.5 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034.

The Handwheels Market refers to the demand and supply dynamics for hand-operated mechanical devices used to control machinery and equipment. These wheels are primarily used for precise mechanical adjustments in various industrial applications, including manufacturing, aerospace, automotive, and machinery sectors. The market is growing due to its vital role in ensuring operational efficiency and safety.

In recent years, the Handwheels Market has experienced steady growth, driven by advancements in industrial automation. The demand for manual control devices, such as handwheels, has surged as industries prioritize precision in operations. As automation technology evolves, industries are focusing on integrating manual control systems for finer adjustments, which further boosts handwheels’ market presence.

Furthermore, the rising investments in manufacturing industries have created significant growth opportunities for handwheels. As sectors such as automotive, aerospace, and robotics evolve, the need for handwheels in these high-precision industries has increased. With expanding production lines and growing mechanization, handwheels are essential for maintaining equipment and ensuring quality control processes.

Government regulations and investments play a crucial role in the expansion of the Handwheels Market. In countries such as the US and Germany, regulatory bodies enforce strict quality standards for mechanical components used in industrial machinery. This drives manufacturers to produce high-quality, durable handwheels, thereby expanding the market’s potential. Government initiatives to promote industrial growth and manufacturing technologies further contribute to market growth.

Another opportunity arises from the increasing focus on sustainability. As industries become more eco-conscious, manufacturers are incorporating sustainable materials in handwheels, which is expected to drive innovation. The shift towards lightweight and durable materials, like aluminum and high-strength plastics, caters to industries focused on reducing their carbon footprint.

With the expected growth in sectors like energy, automotive, and aerospace, the demand for high-performance handwheels is anticipated to continue. The growing need for more reliable, durable, and efficient components will likely shape the future of the market. Manufacturers will need to align their product offerings with these emerging industry trends to maintain competitive advantage.

The market’s prospects are also influenced by emerging technological developments in machine design. Innovations such as digital handwheels for more intuitive controls are expected to reshape how industries use manual control systems. As industries embrace these digital solutions, handwheels’ role in enhancing operational safety and precision will become even more pivotal.

Key Takeaways

- The Global Handwheels Market is projected to reach USD 2.5 Billion by 2034, growing at a CAGR of 6.9% from 2025 to 2034.

- Spoked Handwheel held a dominant market position in 2024, capturing 32.6% of the By Product Type segment.

- Fixed Grip led the By Grip Type segment in 2024, accounting for 37.5% of the market share.

- Aluminum dominated the By Material segment in 2024, holding a 28.9% share.

- Plain Hole was the dominant assembly type in 2024, commanding 45.8% of the By Type of Assembly segment.

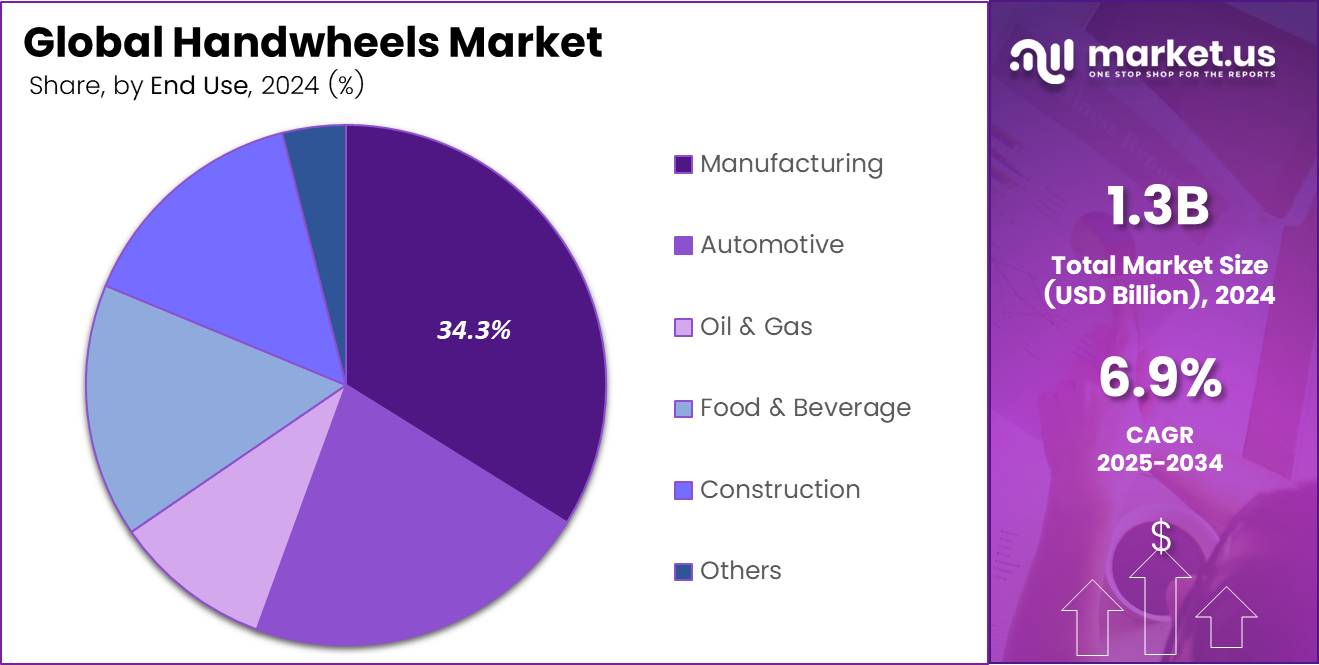

- Manufacturing accounted for 34.3% of the By End Use segment in 2024, reflecting its large-scale demand for manual control solutions.

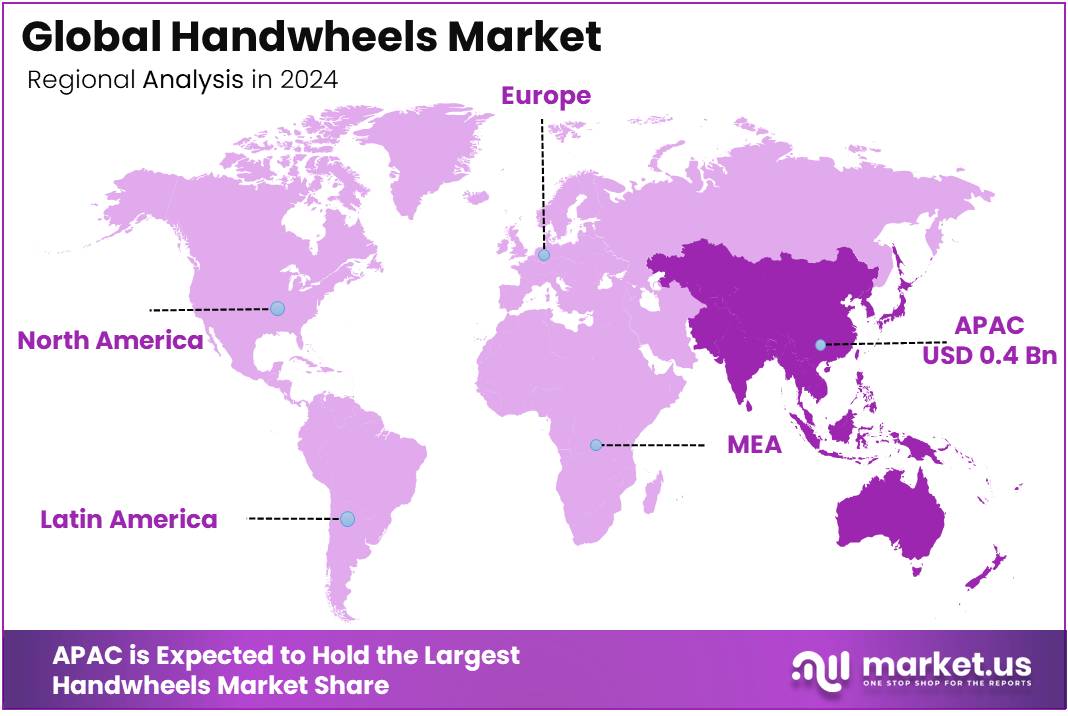

- Asia Pacific led the Handwheels market in 2024 with a 34.8% share, valued at USD 0.4 Billion, driven by industrial manufacturing growth in China and India.

Product Type Analysis

Spoked Handwheel dominates with 32.6% due to its superior grip control and traditional reliability in industrial applications.

In 2024, Spoked Handwheel held a dominant market position in By Product Type Analysis segment of Handwheels Market, with a 32.6% share. This leadership position stems from the segment’s exceptional functionality and widespread acceptance across various industrial sectors.

Offset Handwheel secured the second position with a substantial market presence, offering enhanced accessibility in tight spaces and ergonomic advantages for operators. The segment’s growth reflects increasing demand for user-friendly mechanical control solutions.

Flat Handwheel maintained steady market penetration, particularly favored in applications requiring compact design and smooth operation. Its streamlined profile makes it ideal for space-constrained installations and modern machinery designs.

Handlebar Handwheel captured a notable portion of the market, especially in specialized equipment where directional control and operator comfort are paramount. This segment continues to evolve with ergonomic improvements and enhanced grip technologies.

The Others category encompasses various specialized handwheel designs, including custom configurations and niche applications. While smaller in market share, this segment demonstrates the industry’s adaptability to specific operational requirements and emerging technological needs.

Grip Type Analysis

Fixed Grip dominates with 37.5% due to its proven durability and consistent performance in demanding industrial environments.

In 2024, Fixed Grip held a dominant market position in By Grip Type Analysis segment of Handwheels Market, with a 37.5% share. This commanding position reflects the segment’s reliability and cost-effectiveness in standard industrial applications.

Folding Grip established a significant market presence, particularly valued in applications where space optimization and storage efficiency are critical. This segment appeals to manufacturers seeking versatile solutions that can adapt to varying operational conditions and space constraints.

Revolving Grip captured considerable market attention with its enhanced operator comfort and reduced fatigue during extended use. The segment’s growth indicates increasing focus on ergonomic design and worker safety in industrial environments.

The Others category includes specialized grip configurations designed for specific applications and unique operational requirements. While maintaining a smaller market share, this segment represents innovation opportunities and customized solutions for niche industrial needs.

The grip type segmentation demonstrates the market’s evolution toward user-centric designs, balancing traditional reliability with modern ergonomic requirements and operational efficiency considerations.

Material Analysis

Aluminum dominates with 28.9% due to its optimal balance of strength, lightweight properties, and corrosion resistance.

In 2024, Aluminum held a dominant market position in By Material Analysis segment of Handwheels Market, with a 28.9% share. This leadership position reflects aluminum’s superior performance characteristics and widespread industrial acceptance.

Plastic secured substantial market penetration, offering cost-effective solutions with excellent chemical resistance and design flexibility. This segment continues to grow as manufacturers develop advanced polymer formulations that meet demanding industrial requirements.

Stainless steel maintained a strong market presence, particularly in applications requiring exceptional corrosion resistance and hygiene standards. The segment’s stability reflects its critical role in food processing, pharmaceutical, and marine applications.

Cast iron captured a notable market portion, especially valued for its durability and cost-effectiveness in heavy-duty industrial applications. This traditional material continues to serve essential roles in manufacturing and construction sectors.

The Others category encompasses specialized materials including brass, bronze, and composite materials designed for specific environmental conditions and performance requirements. While smaller in overall share, this segment represents technological advancement and material innovation opportunities.

Type of Assembly Analysis

Plain Hole dominates with 45.8% due to its simplicity, cost-effectiveness, and universal compatibility with standard shaft configurations.

In 2024, Plain Hole held a dominant market position in By Type of Assembly Analysis segment of Handwheels Market, with a 45.8% share. This commanding position demonstrates the segment’s fundamental importance in standard mechanical assemblies and widespread industrial adoption.

Keyway Hole established a significant market presence, offering enhanced torque transmission and secure shaft connection in demanding applications. This segment serves critical roles where precise positioning and high torque capacity are essential operational requirements.

The Others category includes specialized assembly configurations such as set screw attachments, clamp-on designs, and custom mounting solutions. While maintaining a smaller market share, this segment addresses specific installation challenges and unique mechanical requirements across diverse industrial applications.

End Use Analysis

Manufacturing dominates with 34.3% due to extensive automation requirements and diverse mechanical control applications across production facilities.

In 2024, Manufacturing held a dominant market position in By End Use Analysis segment of Handwheels Market, with a 34.3% share. This leadership reflects the sector’s massive scale and continuous demand for reliable manual control solutions in automated and semi-automated production environments.

Automotive secured substantial market presence, driven by assembly line requirements and quality control applications. The segment’s growth correlates with global vehicle production trends and increasing emphasis on precision manufacturing processes.

Oil & Gas maintained significant market penetration, particularly for valve control and equipment operation in harsh environments. This segment demands robust, reliable handwheels capable of withstanding extreme conditions and providing precise control.

Food & Beverage captured notable market share, emphasizing hygiene standards and corrosion resistance requirements. The segment’s growth reflects expanding food processing capabilities and stringent regulatory compliance needs.

Construction established steady market presence through equipment operation and infrastructure development projects. The segment requires durable, weather-resistant solutions for outdoor applications and heavy-duty machinery operation.

The Others category encompasses diverse applications including marine, pharmaceutical, and utility sectors, each with specific performance requirements and operational challenges.

Key Market Segments

By Product Type

- Spoked Handwheel

- Offset Handwheel

- Flat Handwheel

- Handlebar Handwheel

- Others

By Grip Type

- Fixed Grip

- Folding Grip

- Revolving Grip

- Others

By Material

- Aluminum

- Plastic

- Stainless Steel

- Cast Iron

- Others

By Type of Assembly

- Plain Hole

- Keyway Hole

- Others

By End Use

- Manufacturing

- Automotive

- Oil & Gas

- Food & Beverage

- Construction

- Others

Drivers

Increasing Automation in Manufacturing Processes Drives Market Growth

The handwheels market is experiencing significant growth as manufacturing facilities worldwide embrace automation technologies. Modern automated systems require precise control mechanisms, making handwheels essential components for manual override functions and fine-tuning operations.

The rising demand for precision and control in industrial equipment further strengthens market prospects. Manufacturing processes today require extremely accurate positioning and movement control, where handwheels provide operators with the tactile feedback and precise control necessary for quality production outcomes.

Advancements in material science have revolutionized handwheel manufacturing, enabling the production of more durable and reliable products. New materials offer better resistance to wear, corrosion, and extreme temperatures, extending product lifecycles and reducing maintenance costs for industrial users.

The growth of industrial equipment in emerging economies presents substantial market opportunities. Countries like India, China, and Brazil are rapidly expanding their manufacturing capabilities, creating increased demand for quality control components including handwheels across various industrial sectors.

Restraints

Availability of Alternative Control Mechanisms Limits Market Expansion

The handwheels market faces challenges from the increasing availability of alternative control mechanisms. Digital control systems, servo motors, and automated positioning systems offer advanced functionality that can replace traditional handwheel applications in many industrial settings.

Limited awareness in low-scale industrial applications constrains market growth potential. Smaller manufacturing facilities and emerging market players often lack knowledge about the benefits of quality handwheels, leading to reduced adoption rates and preference for cheaper alternatives.

Regulatory challenges and compliance requirements create additional market barriers. Industries like aerospace, automotive, and medical equipment manufacturing must adhere to strict quality standards and certifications, which can increase costs and complexity for handwheel manufacturers and limit market accessibility for some suppliers.

Growth Factors

Adoption of Handwheels in Smart Manufacturing Solutions Creates New Market Potential

The integration of handwheels in smart manufacturing solutions presents significant growth opportunities. As Industry 4.0 concepts gain traction, handwheels with embedded sensors and connectivity features enable better data collection and process optimization in manufacturing environments.

Rising demand for ergonomically designed handwheels opens new market segments. Manufacturers are increasingly focusing on operator comfort and safety, driving demand for handwheels with improved grip designs, reduced operator fatigue features, and enhanced user experience.

Integration of IoT technology in industrial equipment creates opportunities for smart handwheels with real-time monitoring capabilities. These connected devices can provide valuable data on usage patterns, maintenance needs, and operational efficiency, adding significant value for industrial users.

The expansion of aerospace and automotive industries globally drives specialized handwheel demand. These sectors require high-precision, lightweight, and durable handwheels that meet stringent performance and safety standards, creating premium market opportunities for specialized manufacturers.

Emerging Trends

Increasing Focus on Energy Efficiency in Industrial Operations Shapes Market Direction

The handwheels market is being shaped by the increasing focus on energy efficiency in industrial operations. Manufacturers are developing handwheels that require less force to operate, reducing operator fatigue and contributing to overall energy savings in manufacturing processes.

There is a growing preference for lightweight and compact handwheel designs that offer the same functionality while reducing equipment weight and space requirements. This trend is particularly important in aerospace and mobile equipment applications where weight reduction is critical.

The incorporation of ergonomics for operator comfort and safety has become a key market trend. Modern handwheels feature improved grip surfaces, optimal sizing for human hands, and designs that reduce repetitive strain injuries, making them more attractive to safety-conscious manufacturers.

Rising demand for customizable handwheels for specialized equipment creates opportunities for manufacturers to offer tailored solutions. Custom colors, sizes, materials, and mounting configurations help meet specific industry requirements and differentiate products in competitive markets.

Regional Analysis

Asia Pacific Dominates the Handwheels Market with a Market Share of 34.8%, Valued at USD 0.4 Billion

In 2024, Asia Pacific held a dominant market share of 34.8%, valued at USD 0.4 Billion in the Handwheels market. This region’s strong position is driven by growing industrial manufacturing activities and the rising demand for automation across key sectors, particularly in China and India. The high volume of manufacturing and assembly plants in this region supports the widespread adoption of handwheels.

North America Handwheels Market Trends

North America holds a significant share in the Handwheels market, driven by strong demand from the automotive and machinery sectors. The United States, in particular, is a major contributor to this growth due to its advanced manufacturing facilities and innovation in industrial technologies. The market is expected to continue growing with a focus on automation and technological advancements in industrial tools.

Europe Handwheels Market Trends

Europe is a key player in the Handwheels market, with an increasing demand for high-precision industrial equipment. The region is known for its stringent safety and quality standards, which drive the adoption of handwheels in sectors like aerospace, automotive, and industrial machinery. Germany, as a manufacturing powerhouse, plays a pivotal role in the market’s expansion.

Latin America Handwheels Market Trends

Latin America is experiencing steady growth in the Handwheels market, fueled by a rise in industrial manufacturing activities in countries like Brazil and Mexico. The increasing need for automation in industries such as automotive and textiles is contributing to the demand for handwheels. Economic growth in the region is expected to continue driving the market forward.

Middle East and Africa Handwheels Market Trends

The Middle East and Africa region holds a smaller but growing share in the Handwheels market. The growth is driven by investments in infrastructure and industrial development, particularly in the oil and gas sectors. Countries like the UAE and Saudi Arabia are key contributors, with expanding construction and manufacturing industries supporting the demand for handwheels.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Handwheels Company Insights

In 2024, Otto Ganter is expected to maintain a strong position in the global handwheels market, owing to its reputation for producing high-quality and durable handwheels. The company’s extensive product portfolio caters to a wide range of industrial applications, supporting its market growth.

Alpha Engineering continues to be a prominent player in the handwheels market, thanks to its focus on delivering custom-engineered solutions. Their ability to meet the unique demands of various sectors, from automotive to aerospace, allows them to stay competitive in a rapidly evolving market.

Carr Lane remains a key contributor to the handwheels industry, recognized for its innovation in providing standard and specialized components. Their commitment to precision and reliability ensures a broad customer base and strengthens their market position in 2024.

Dandong Foundry is expanding its footprint in the handwheels market, with its high-strength castings offering excellent durability. Their ability to provide cost-effective solutions without compromising quality plays a vital role in capturing market share, particularly in the industrial machinery segment.

Top Key Players in the Market

- Otto Ganter

- Alpha Engineering

- Carr Lane

- Dandong Foundry

- Elesa

- Erwin Halder

- Igus

- Imao Corporation

- Jergens

- KIPP

- Norelem

Recent Developments

- In June 2025, Komatsu completed the acquisition of Core Machinery, expanding its product portfolio and strengthening its competitive position in the machinery market.

- In January 2025, Yanmar finalized its acquisition of CLAAS India, enhancing its presence in the Indian agricultural machinery sector and expanding its manufacturing capabilities.

- In June 2025, a Foxconn unit acquired machinery equipment valued at $121.3 million, boosting its production capacity and solidifying its position in the industrial equipment market.

- In December 2024, Pai Machines further strengthened its market position by acquiring L&T Construction Equipment’s facilities, positioning itself as a key player in the construction machinery segment.

- In December 2024, Pai Machines completed the acquisition of L&T Construction Equipment’s Machinery Works Division, significantly increasing its production capabilities and market share in the heavy machinery industry.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.5 Billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Spoked Handwheel, Offset Handwheel, Flat Handwheel, Handlebar Handwheel, Others), By Grip Type (Fixed Grip, Folding Grip, Revolving Grip, Others), By Material (Aluminum, Plastic, Stainless Steel, Cast Iron, Others), By Type of Assembly (Plain Hole, Keyway Hole, Others), By End Use (Manufacturing, Automotive, Oil & Gas, Food & Beverage, Construction, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Otto Ganter, Alpha Engineering, Carr Lane, Dandong Foundry, Elesa, Erwin Halder, Igus, Imao Corporation, Jergens, KIPP, Norelem Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Otto Ganter

- Alpha Engineering

- Carr Lane

- Dandong Foundry

- Elesa

- Erwin Halder

- Igus

- Imao Corporation

- Jergens

- KIPP

- Norelem