Global Hair-Care Surfactants Market Size, Share, Growth Analysis By Surfactant Class (Anionic [sulfates, sulfonates], Amphoteric and Zwitterionic, Nonionic, Cationic), By Product Format (Liquid Concentrates, Pastes, Powders and Flakes, Pre-Blends and Systems), By Application (Shampoo, Conditioner and 2-in-1, Scalp Care & Anti-Dandruff, Co-Wash and Cleansing Conditioner), By Positioning and Claim (Sulfate-Free Systems, Mild and Sensitive Scalp, Bio-Based and Naturally Derived, High-Foam and Sensory), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171630

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

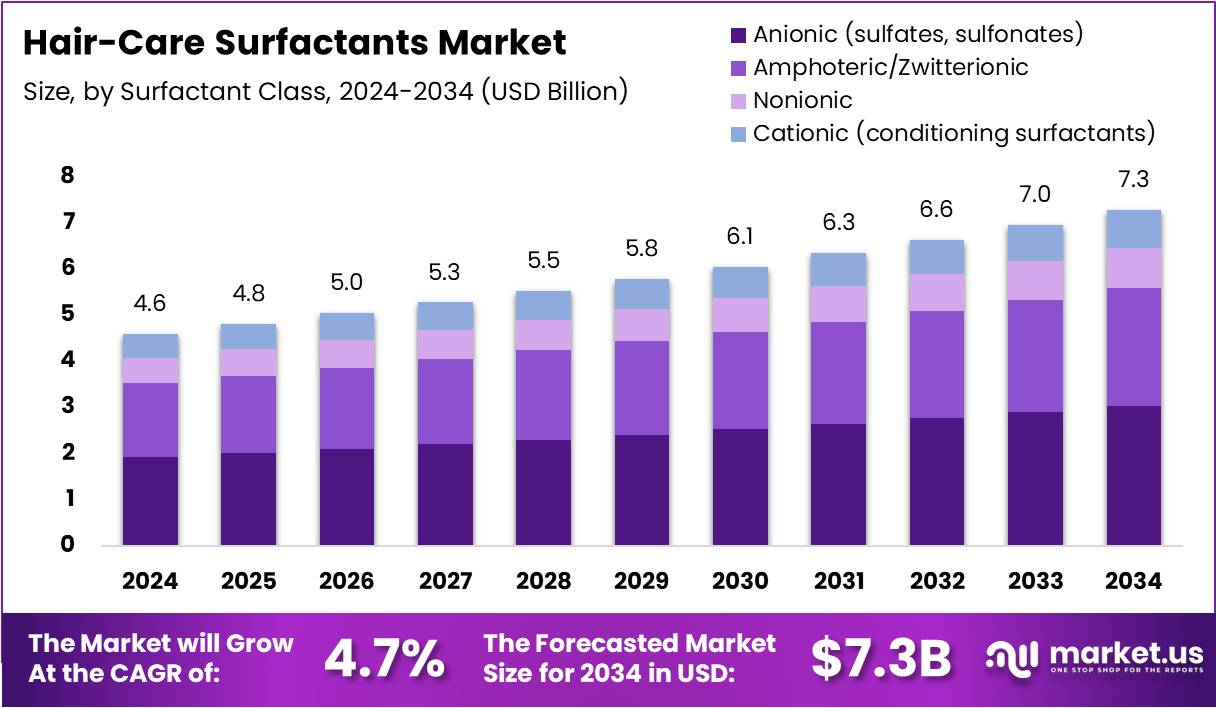

The Global Hair-Care Surfactants Market size is expected to be worth around USD 7.3 Billion by 2034, from USD 4.6 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034.

The Hair-Care Surfactants Market encompasses essential cleansing agents utilized in shampoos, conditioners, and treatment products. These surface-active compounds effectively remove dirt, oil, and impurities from hair and scalp. Surfactants form the foundational chemistry of hair-care formulations, determining product performance, foam quality, and consumer satisfaction across diverse demographics.

Market dynamics reveal substantial growth opportunities driven by evolving consumer preferences toward gentler formulations. Manufacturers increasingly prioritize natural surfactants over synthetic alternatives, responding to heightened ingredient awareness. This transition creates significant innovation pathways for botanical extracts, amino acid-based cleansers, and biodegradable surfactant technologies that align with sustainability demands.

Government regulations substantially influence formulation development and market expansion trajectories. Regulatory bodies worldwide mandate comprehensive safety assessments for surfactant ingredients, particularly regarding environmental impact and human health considerations. Compliance requirements drive research investments, encouraging manufacturers to develop safer, eco-friendly alternatives that meet stringent international standards while maintaining product efficacy.

Investment opportunities emerge particularly within clean beauty and premium hair-care segments. Brands developing sulfate-free, silicone-free, and microbiome-friendly surfactant systems capture growing market shares. Additionally, government-backed initiatives supporting green chemistry research facilitate technological advancements in sustainable surfactant production, creating favorable conditions for market participants pursuing innovation-led growth strategies.

Consumer behavior patterns underscore critical market trends shaping purchasing decisions. According to research, 25% of consumers prefer sulfate-free products while 36% actively seek paraben-free formulations over traditional alternatives.

Furthermore, brand loyalty remains remarkably strong, with 45% of adults consistently purchasing identical shampoo brands, demonstrating slightly higher preference among men (48%) compared to women (43%). Most significantly, 97% of consumers actively seek specific functional benefits when selecting shampoo and conditioner products, emphasizing targeted solution demand.

Key Takeaways

- Global Hair-Care Surfactants Market is projected to grow from USD 4.6 Billion in 2024 to USD 7.3 Billion by 2034, at a 4.7% CAGR.

- By surfactant class, Anionic surfactants lead with a 39.4% market share in 2024, reflecting dominance in core cleansing formulations.

- By product format, Liquid Concentrates account for the largest share at 49.1% in 2024, driven by widespread use in manufacturing.

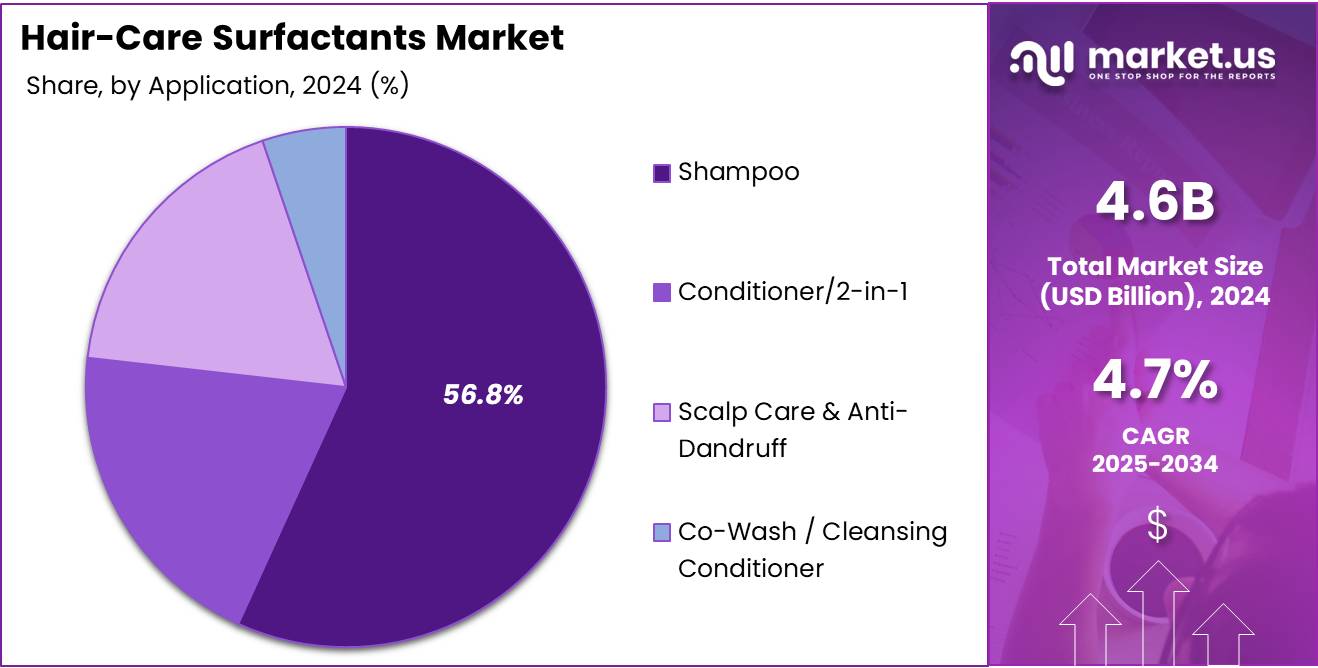

- By application, Shampoo remains the largest segment with a 56.8% share in 2024, indicating its primary role in surfactant consumption.

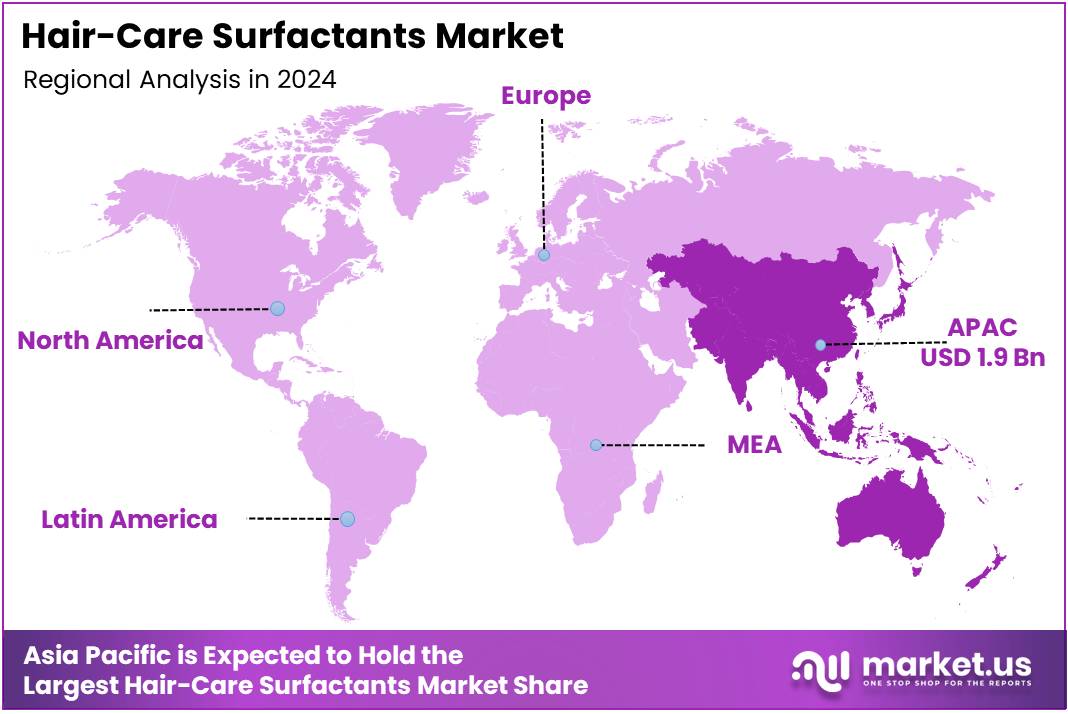

- By region, Asia Pacific dominates with 42.8% market share, valued at USD 1.9 Billion, making it the leading regional market.

Surfactant Class Analysis

Anionic surfactants dominate with 39.4% due to their superior cleansing efficiency and cost-effectiveness in formulations.

In 2024, Anionic (sulfates, sulfonates) held a dominant market position in the By Surfactant Class Analysis segment of Hair-Care Surfactants Market, with a 39.4% share. These surfactants remain the backbone of hair-care formulations owing to their exceptional foaming properties and dirt-removal capabilities.

Sulfates like sodium lauryl sulfate and sodium laureth sulfate deliver robust cleansing performance at economical price points, making them indispensable for mass-market shampoos. Their ability to create rich lather enhances consumer perception of product efficacy, driving continued adoption across diverse product lines.

Amphoteric/Zwitterionic surfactants are gaining momentum as mildness becomes a priority in modern formulations. These gentle cleansers reduce irritation while maintaining adequate cleansing power, making them ideal for sensitive scalp products. Their compatibility with other surfactant classes enables formulators to create balanced systems that deliver both performance and skin-friendliness. Additionally, their pH-responsive behavior allows them to function effectively across varying formulation conditions.

Nonionic surfactants serve as excellent secondary cleansers and conditioning agents in hair-care products. Their neutral charge prevents interactions that could compromise formulation stability, while offering supplementary foam stabilization. These surfactants are particularly valuable in sulfate-free and natural formulations where gentleness is paramount. Furthermore, their low skin irritation potential makes them preferred choices for baby shampoos and dermatologically-tested products.

Cationic (conditioning surfactants) play a specialized role in hair conditioning and detangling applications. Their positive charge enables substantivity to negatively charged hair fibers, delivering smoothness and manageability. These surfactants are essential components in conditioners and 2-in-1 products where softening benefits are required. Moreover, they provide antistatic properties that reduce flyaway and improve hair combability in humid conditions.

Product Format Analysis

Liquid Concentrates dominate with 49.1% due to their ease of handling and versatile formulation capabilities.

In 2024, Liquid Concentrates held a dominant market position in the By Product Format Analysis segment of Hair-Care Surfactants Market, with a 49.1% share. This format offers unparalleled convenience in manufacturing processes, enabling precise dosing and seamless integration into final formulations.

Liquid concentrates eliminate the need for complex dissolution steps, reducing production time and minimizing equipment requirements. Their ready-to-use nature appeals to both large-scale manufacturers and smaller contract producers, facilitating faster time-to-market for new product launches while maintaining consistent quality standards.

Pastes provide a concentrated alternative for formulators seeking higher active content in compact formats. These semi-solid forms offer excellent stability during storage and transportation, reducing shipping costs through decreased volume. Paste formats are particularly favored in regions where cold-processing capabilities exist, allowing manufacturers to incorporate these surfactants without extensive heating.

Powders/Flakes represent the most concentrated surfactant format, delivering maximum active content with minimal water. These dry forms offer extended shelf life and reduced freight expenses, making them economically attractive for international supply chains. Powder surfactants require proper dissolution equipment but provide flexibility in creating custom surfactant blends tailored to specific product requirements.

Pre-Blends/Systems are gaining traction as turnkey solutions for simplified formulation development. These ready-made surfactant combinations eliminate the complexity of balancing multiple raw materials, enabling faster product development cycles. Pre-blended systems often incorporate performance-enhancing additives that optimize foam quality, viscosity, and mildness in finished products.

Application Analysis

Shampoo dominates with 56.8% due to its essential role in daily hair-cleansing routines worldwide.

In 2024, Shampoo held a dominant market position in the By Application Analysis segment of Hair-Care Surfactants Market, with a 56.8% share. Shampoos represent the primary hair-cleansing category, consuming the largest volume of surfactants globally.

The universality of shampooing across demographics and geographies ensures consistent demand for surfactant ingredients. From value-priced everyday products to premium salon formulations, shampoos require surfactant systems that deliver thorough cleansing while meeting increasingly sophisticated consumer expectations for mildness, sensory experience, and hair health benefits.

Conditioner/2-in-1 products utilize specialized surfactant combinations that balance cleansing with conditioning benefits. These formulations incorporate cationic surfactants alongside traditional cleansers to deliver smoothness and detangling properties. The growing popularity of 2-in-1 formats among time-conscious consumers drives innovation in surfactant systems that can simultaneously clean and condition without compromising either function.

Scalp Care & Anti-Dandruff applications demand surfactants compatible with active ingredients like zinc pyrithione and selenium sulfide. These specialized formulations require gentle surfactant systems that effectively remove scalp buildup without irritating sensitive or compromised skin. The rising awareness of scalp health as fundamental to hair wellness continues expanding this category’s surfactant requirements.

Co-Wash/Cleansing Conditioner represents an emerging application leveraging ultra-mild surfactant technologies. These products cater to textured and curly hair types requiring moisture retention during cleansing. Co-wash formulations rely on conditioning surfactants and low-foaming cleansers that refresh hair without stripping natural oils, addressing a growing niche market segment.

Positioning/Claim Analysis

Sulfate-Free Systems dominate with 38.9% due to increasing consumer preference for gentler, scalp-friendly formulations.

In 2024, Sulfate-Free Systems held a dominant market position in the By Positioning/Claim Analysis segment of Hair-Care Surfactants Market, with a 38.9% share. The sulfate-free movement has transformed hair-care formulation strategies, driven by consumer concerns about ingredient harshness and scalp irritation.

Alternative surfactant systems utilizing ingredients like coco-glucoside, decyl glucoside, and sodium cocoyl isethionate deliver effective cleansing without traditional sulfates. This positioning resonates strongly with health-conscious consumers, color-treated hair segments, and those with sensitive scalps seeking milder cleansing experiences.

Mild/Sensitive Scalp formulations emphasize surfactant gentleness through pH optimization and irritation-reducing technologies. These products incorporate amphoteric buffers and ultra-mild cleansers that minimize disruption to the scalp’s natural barrier. The growing incidence of scalp sensitivity issues drives demand for surfactant systems validated through dermatological testing and hypoallergenic claims.

Bio-Based/Naturally Derived surfactants align with sustainability trends and clean beauty movements. Ingredients sourced from coconut, corn, and other renewable feedstocks appeal to environmentally conscious consumers. These naturally derived surfactants maintain performance standards while offering improved biodegradability and reduced environmental impact, supporting brands’ sustainability commitments.

High-Foam/Sensory positioning leverages surfactant technologies that maximize lather density and foam stability. Rich, luxurious foam enhances perceived product efficacy and delivers satisfying sensory experiences during application. Advanced surfactant blends optimize bubble structure, foam creaminess, and rinsing characteristics, creating premium product experiences that justify higher price points.

Key Market Segments

By Surfactant Class

- Anionic (sulfates, sulfonates)

- Amphoteric/Zwitterionic

- Nonionic

- Cationic (conditioning surfactants)

By Product Format

- Liquid Concentrates

- Pastes

- Powders / Flakes

- Pre-Blends/Systems

By Application

- Shampoo

- Conditioner/2-in-1

- Scalp Care & Anti-Dandruff

- Co-Wash / Cleansing Conditioner

By Positioning / Claim

- Sulfate-Free Systems

- Mild / Sensitive Scalp

- Bio-Based / Naturally Derived

- High-Foam/Sensory

Drivers

Rising Global Hair-Care Product Consumption Among Millennials and Gen Z Drives Market Growth

Younger consumers, particularly Millennials and Gen Z, are increasingly investing in personal grooming and hair-care products. This demographic shows a strong preference for premium shampoos, conditioners, and styling products that contain effective surfactants. Their willingness to experiment with diverse hair-care solutions has significantly expanded market demand for surfactants globally.

Growing awareness about hair and scalp care is pushing consumers toward specialized products. People now understand that healthy hair starts with a healthy scalp, leading to increased demand for surfactants designed for specific concerns like dandruff, dryness, or oiliness. This shift toward targeted solutions is encouraging manufacturers to develop surfactants that address particular hair and scalp conditions effectively.

Technological innovations in surfactant chemistry have led to the development of mild and high-efficiency formulations. Modern surfactants provide better cleansing performance while being gentler on hair and scalp. These advancements allow manufacturers to create products that deliver superior results without causing damage or irritation, meeting consumer expectations for both effectiveness and safety in hair-care applications.

Restraints

Rising Consumer Awareness About Potential Skin and Scalp Irritation from Synthetic Surfactants Limits Market Growth

Consumers are becoming increasingly educated about the potential side effects of synthetic surfactants in hair-care products. Many traditional surfactants, such as sulfates, are known to cause scalp irritation, dryness, and allergic reactions in sensitive individuals. This growing awareness has led to consumer reluctance toward products containing harsh chemical surfactants, negatively impacting market growth for conventional surfactant formulations.

Social media and online forums have amplified discussions about ingredient safety, making consumers more cautious about what they apply to their hair and scalp. Many now actively read product labels and avoid surfactants linked to potential health concerns. This behavioral shift is forcing manufacturers to reformulate products or risk losing market share to competitors offering gentler alternatives.

Regulatory bodies worldwide are implementing stricter guidelines on chemical additives in personal care products. Governments and regulatory agencies are setting limits on certain surfactant types and requiring extensive safety testing before approval. These stringent regulations increase compliance costs for manufacturers and may delay product launches. Additionally, varying regulations across different regions create challenges for companies operating in multiple markets, constraining overall market expansion.

Growth Factors

Expansion of Natural and Bio-Based Surfactant Formulations for Premium Hair-Care Products Creates Market Opportunities

The premium hair-care segment is witnessing rapid growth in natural and bio-based surfactant formulations. Consumers are willing to pay higher prices for products made from plant-derived ingredients that are perceived as safer and more environmentally friendly. This trend presents significant opportunities for surfactant manufacturers to develop innovative, sustainable alternatives that meet the demands of eco-conscious consumers seeking premium hair-care solutions.

Multi-benefit hair products are gaining popularity as consumers seek convenience and value. Products combining cleansing, conditioning, and treatment benefits in one formulation require advanced surfactant solutions. Manufacturers developing integrated surfactant systems that deliver multiple benefits simultaneously can capture this growing market segment. These products appeal to busy consumers looking for simplified hair-care routines without compromising on effectiveness.

E-commerce platforms are revolutionizing how consumers purchase hair-care products. Direct-to-consumer brands leveraging online channels can introduce specialized surfactant-based formulations without traditional retail limitations. This distribution model allows smaller brands to compete effectively while providing consumers with access to niche products tailored to specific hair types and concerns, expanding overall market reach and consumer choice.

Emerging Trends

Surge in Demand for Eco-Friendly and Biodegradable Surfactants in Hair-Care Products Shapes Market Trends

Environmental sustainability has become a major priority for hair-care consumers. The demand for eco-friendly and biodegradable surfactants is surging as people become more conscious about their environmental impact. Consumers actively seek products that won’t harm aquatic ecosystems when washed down the drain. This trend is pushing manufacturers to invest in green chemistry and develop surfactants derived from renewable resources that decompose naturally.

Personalization is transforming the hair-care industry, with consumers increasingly interested in customizable formulations. Brands offering products with specific surfactant blends tailored to individual hair types, textures, and concerns are gaining popularity. This trend allows consumers to create personalized hair-care routines that address their unique needs, driving innovation in surfactant technology and formulation flexibility.

Sustainable packaging has emerged as a critical factor influencing purchase decisions. Consumers now evaluate both the product formulation and its packaging when making choices. Brands combining effective surfactant-based shampoos and conditioners with eco-friendly packaging materials like recycled plastics, biodegradable containers, or refillable systems are resonating strongly with environmentally conscious consumers. This integrated approach to sustainability is becoming essential for brand differentiation and market success.

Regional Analysis

Asia Pacific Dominates the Hair-Care Surfactants Market with a Market Share of 42.8%, Valued at USD 1.9 Billion

Asia Pacific emerges as the dominant region in the global hair-care surfactants market, commanding a substantial market share of 42.8% and valued at USD 1.9 billion. This leadership position is driven by the region’s massive population base, rapidly growing middle-class segment, and increasing consumer awareness regarding personal grooming. The expanding urban population, coupled with rising disposable incomes in emerging economies such as China and India, has significantly boosted demand for premium hair-care products. The region’s well-established manufacturing infrastructure and growing influence of social media and e-commerce platforms have further accelerated market growth.

North America Hair-Care Surfactants Market Trends

North America represents a mature market for hair-care surfactants, characterized by high consumer spending on premium personal care products. The region exhibits a pronounced shift toward natural, organic, and sulfate-free surfactant formulations, driven by increasing health consciousness and ingredient transparency awareness. Innovation in mild and eco-friendly surfactants remains a key trend, supported by the presence of major cosmetic brands and robust research and development activities.

Europe Hair-Care Surfactants Market Trends

Europe maintains a significant position in the hair-care surfactants market, distinguished by stringent regulatory frameworks and high consumer emphasis on product safety and sustainability. The region demonstrates strong demand for biodegradable and naturally-derived surfactants, reflecting growing preference for green chemistry and eco-conscious formulations. European consumers exhibit sophisticated purchasing behavior with willingness to invest in premium, dermatologically-tested products that align with ethical and environmental values.

Latin America Hair-Care Surfactants Market Trends

Latin America presents a dynamic market for hair-care surfactants, propelled by expanding urbanization and growing beauty consciousness. The region’s diverse climate conditions and varied hair types create demand for specialized surfactant formulations. Brazil and Mexico emerge as key growth drivers, supported by their large population bases and rising middle-class consumption. The market benefits from growing retail infrastructure and increasing influence of international beauty trends, though price sensitivity remains a significant purchasing factor.

Middle East and Africa Hair-Care Surfactants Market Trends

The Middle East and Africa region exhibits promising growth potential in the hair-care surfactants market, driven by improving economic conditions and rising urbanization rates. The region’s unique climatic challenges create specific demand for surfactants offering deep cleansing and oil control properties. Increasing adoption of Western beauty standards, expanding retail presence of international brands, and growth of the hospitality sector contribute to market expansion, though economic disparities and varying regulatory landscapes present ongoing challenges.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Hair-Care Surfactants Company Insights

The global Hair-Care Surfactants Market in 2024 is characterized by intense competition among established chemical manufacturers who continue to innovate and expand their product portfolios to meet evolving consumer demands for sustainable and high-performance hair care solutions.

BASF maintains its position as a market leader through its extensive range of mild surfactants and commitment to developing biodegradable formulations that align with the growing consumer preference for environmentally conscious personal care products. The company’s strong research and development capabilities enable it to introduce innovative surfactant technologies that enhance product performance while addressing safety and sustainability concerns.

Kao Corporation leverages its deep expertise in surfactant chemistry and strong presence in Asian markets to deliver specialized solutions for diverse hair types and regional preferences. The company’s focus on creating gentle, skin-friendly surfactants has strengthened its competitive position in the premium hair care segment.

Evonik differentiates itself through its specialty chemicals portfolio, offering high-value surfactants that provide superior conditioning and foam characteristics for premium hair care formulations. The company’s strategic investments in sustainable production processes and bio-based raw materials position it well for future market growth.

Stepan continues to expand its market share by providing cost-effective surfactant solutions without compromising on quality, making it a preferred partner for both established brands and emerging hair care manufacturers. The company’s focus on sulfate-free and naturally derived surfactants addresses the increasing consumer demand for cleaner label products in the hair care industry.

Top Key Players in the Market

- BASF

- Kao Corporation

- Evonik

- Stepan

- Nouryon

- Croda

- Clariant

- Solvay

- Dow

- Galaxy Surfactants

Recent Developments

- In July 2025, Croda announced the registration of a new non-animal keratin repair ingredient aimed at strengthening damaged hair fibers.This launch reflects the growing shift toward bio-based and ethical alternatives in advanced hair-care surfactant systems.

- In May 2025, BASF showcased sustainable surfactant prototypes, including Lamesoft OP Plus and Verdessence Maize, at NYSCC Suppliers’ Day.These innovations emphasize plant-derived, biodegradable cleansing and conditioning solutions for modern hair-care formulations.

- In May 2024, Evonik inaugurated a first-of-its-kind industrial-scale rhamnolipid facility in Slovakia.The facility supports large-scale production of fermentation-based, bio-surfactants as alternatives to petroleum-derived ingredients.

- In April 2024, Clariant completed the acquisition of Lucas Meyer Cosmetics, strengthening its personal care ingredient portfolio.This move enhances Clariant’s capabilities in functional and naturally derived cosmetic ingredients for premium hair-care formulations.

Report Scope

Report Features Description Market Value (2024) USD 4.6 Billion Forecast Revenue (2034) USD 7.3 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Surfactant Class (Anionic [sulfates, sulfonates], Amphoteric/Zwitterionic, Nonionic, Cationic [conditioning surfactants]), By Product Format (Liquid Concentrates, Pastes, Powders/Flakes, Pre-Blends/Systems), By Application (Shampoo, Conditioner/2-in-1, Scalp Care & Anti-Dandruff, Co-Wash/Cleansing Conditioner), By Positioning/Claim (Sulfate-Free Systems, Mild/Sensitive Scalp, Bio-Based/Naturally Derived, High-Foam/Sensory) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BASF, Kao Corporation, Evonik, Stepan, Nouryon, Croda, Clariant, Solvay, Dow, Galaxy Surfactants Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hair-Care Surfactants MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Hair-Care Surfactants MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF

- Kao Corporation

- Evonik

- Stepan

- Nouryon

- Croda

- Clariant

- Solvay

- Dow

- Galaxy Surfactants