Global Grid-scale Battery Storage Market Size, Share Analysis Report By Type (Lead-Acid, Lithium-Based, Others), By Application (Renewable Integration, Ancillary Services, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164527

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

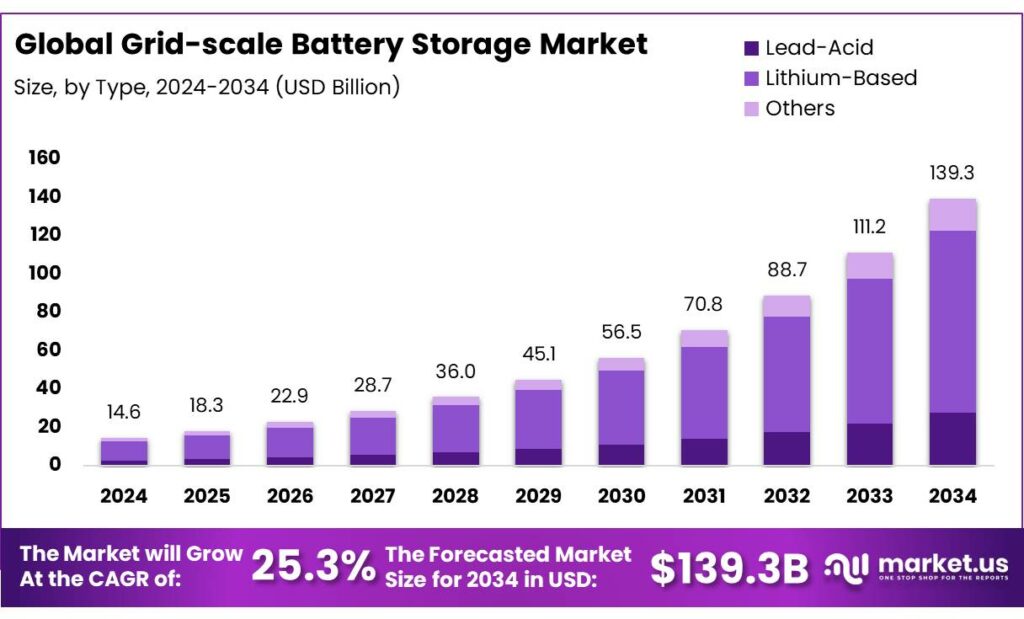

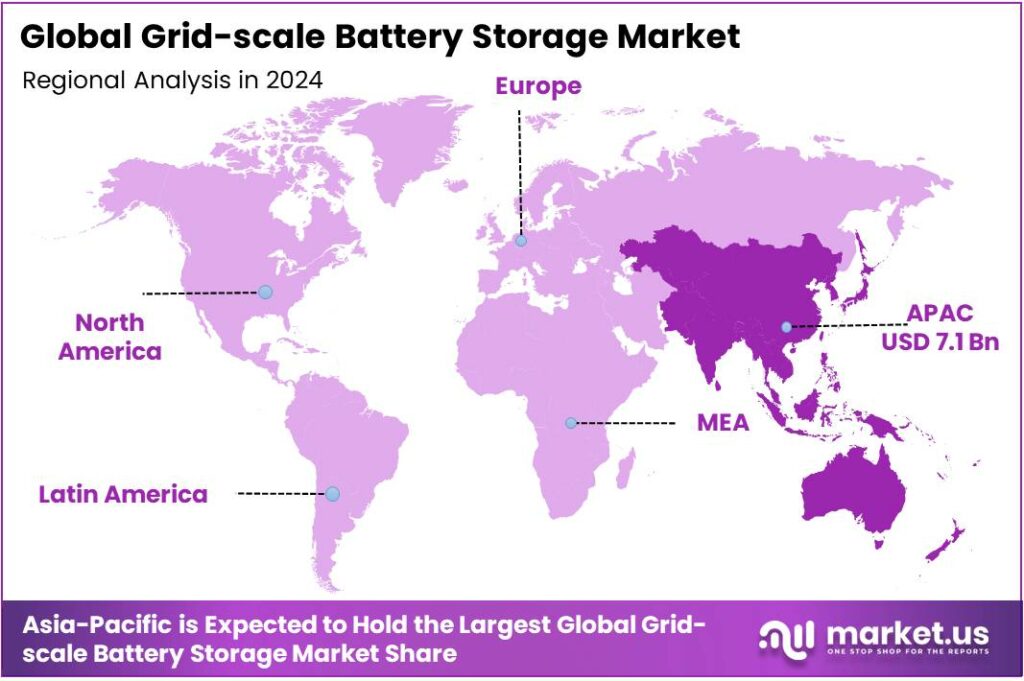

The Global Grid-scale Battery Storage Market size is expected to be worth around USD 139.3 Billion by 2034, from USD 14.6 Billion in 2024, growing at a CAGR of 25.3% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 44.8% share, holding USD 3.6 Billion in revenue.

Grid-scale battery storage has moved from pilot to pillar in power systems as utilities integrate high shares of wind and solar. The International Energy Agency estimates that, to align with a net-zero pathway, installed grid-scale battery capacity must expand 35-fold between 2022 and 2030, reaching nearly 970 GW and adding around 170 GW in 2030 alone. This pace—averaging close to 120 GW of new capacity each year through 2030—reflects storage’s growing role in balancing variability, firming renewables, and enhancing system resilience.

In the U.S., cumulative utility-scale battery capacity surpassed 26 GW in 2024, with 10.4 GW added that year; the U.S. Energy Information Administration expects another 18.2 GW to be added in 2025, underscoring batteries’ prominence alongside solar in new capacity builds. Even so, batteries were only about 2% of total U.S. utility-scale generation capacity in 2024, leaving large headroom for growth. In China, government data show nationwide new energy storage reached 73.76 GW / 168 GWh by end-2024, more than 130% higher than 2023, with average storage duration rising to 2.3 hours—evidence of both scale and improving system design.

Rapid cost declines are a core driver. IRENA reports fully installed battery storage project costs fell 93% between 2010 and 2024, with additional year-over-year declines in 2024 for 2-hour and 4-hour systems. These trends, together with maturing supply chains and the ascendance of LFP chemistries in stationary storage, continue to compress levelized costs and broaden use cases from frequency regulation to multi-hour energy shifting.

Policy is a decisive catalyst. The US Inflation Reduction Act extends a 30% investment tax credit to stand-alone storage, accelerating project pipelines. In Europe, the Net-Zero Industry Act targets building domestic clean-tech manufacturing so that at least 40% of annual deployment needs are met by EU capacity by 2030, strengthening supply-chain resilience for batteries and related components.

- Meanwhile, renewable build-out continues at pace—IEA projects annual additions rising from 666 GW in 2024 to almost 935 GW by 2030—expanding the system-level need for storage to integrate solar and wind efficiently.

- In the U.S., the Department of Energy’s Loan Programs Office highlighted more than USD 2 billion in loans and commitments to unlock ~850 MW of batteries for Puerto Rico’s grid resilience in 2025, underscoring the use of federal credit programs to de-risk large storage pipelines.

Grid-scale storage’s core drivers include falling lithium-ion costs, higher renewable curtailment incentives, and market designs that reward capacity, fast frequency response and congestion relief. National tenders and auctions are unlocking bankable revenue stacks—India alone has run tenders totaling 171 GWh of energy-storage capacity since 2018, including >55 GWh in the first half of 2025, underscoring demand growth in Asia’s largest emerging markets. In the US, batteries increasingly shift energy from low-price to high-price periods, with 10,487 MW primarily used for price arbitrage as of end-2023, while also bolstering reliability.

Key Takeaways

- Grid-scale Battery Storage Market size is expected to be worth around USD 139.3 Billion by 2034, from USD 14.6 Billion in 2024, growing at a CAGR of 25.3%.

- Lithium-Based batteries held a dominant market position, capturing more than a 72.4% share in the global grid-scale battery storage market.

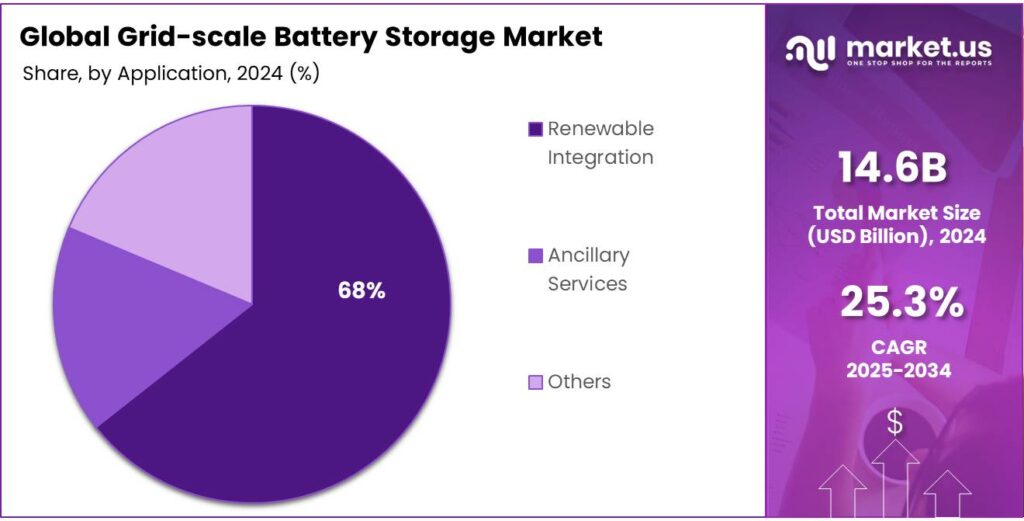

- Renewable Integration held a dominant market position, capturing more than a 68.9% share of the global grid-scale battery storage market.

- Asia Pacific region emerged as the dominant market for grid-scale battery storage, accounting for 48.9% of the global share, valued at approximately USD 7.1 billion.

By Type Analysis

Lithium-Based Batteries dominate with 72.4% share due to high energy efficiency and cost competitiveness

In 2024, Lithium-Based batteries held a dominant market position, capturing more than a 72.4% share in the global grid-scale battery storage market. This leadership was driven by their high energy density, long cycle life, and rapidly declining production costs. The increasing deployment of renewable energy projects, particularly solar and wind, has significantly boosted demand for lithium-based storage systems, which are preferred for their fast response time and modular design.

During 2025, the adoption of lithium-based grid storage systems is expected to grow steadily, supported by expanding manufacturing capacities and stable supply chains in key regions such as Asia-Pacific and North America. Several national grid operators and utility providers are investing in multi-gigawatt battery projects utilizing lithium technology to stabilize fluctuating renewable power generation. The continuous fall in lithium-ion battery prices, coupled with increasing government incentives for energy storage integration, is expected to sustain this segment’s leadership position in the near term.

By Application Analysis

Renewable Integration dominates with 68.9% share due to rising solar and wind power adoption

In 2024, Renewable Integration held a dominant market position, capturing more than a 68.9% share of the global grid-scale battery storage market. This dominance was largely driven by the accelerating shift toward clean energy systems and the growing need to balance variable power generation from solar and wind sources. Governments and utilities across major economies invested heavily in large-scale storage systems to ensure grid stability and energy reliability during peak demand hours.

The Renewable Integration segment is expected to maintain its leading position as renewable energy capacity continues to expand worldwide. Nations such as the United States, China, and India are deploying grid-scale batteries alongside massive renewable installations to reduce curtailment rates and optimize power delivery. Supportive policy measures and national energy transition plans are expected to further accelerate the deployment of storage systems for renewable integration.

Key Market Segments

By Type

- Lead-Acid

- Lithium-Based

- Others

By Application

- Renewable Integration

- Ancillary Services

- Others

Emerging Trends

Hybrid solar-plus-storage and longer durations go mainstream

A defining trend in grid-scale storage is the rapid shift to hybrid projects—pairing batteries with solar—and a clear move toward longer discharge durations. This is visible first in the United States, where the Energy Information Administration (EIA) reports that batteries are now a leading share of new capacity: developers added 10.4 GW in 2024, lifting cumulative utility-scale battery capacity above 26 GW, and plan another 18.2 GW in 2025—making storage one of the top growth pillars alongside solar.

- China’s buildout underscores the same trend at global scale. The National Energy Administration’s data (via CNESA) show “new energy storage” (non-pumped hydro) reached ~74 GW / 168 GWh by end-2024, up about 130% year-on-year, with 42.37 GW / 101 GWh added in 2024 alone. Critically, average duration rose to 2.3 hours, signaling a shift from short-duration frequency response to multi-hour energy shifting that supports solar and wind integration.

Policy is aligning with the hybrid trend. In the U.S., FERC Order No. 2023 retools interconnection to a “first-ready, first-served” cluster study process, aiming to cut queue delays that have held back renewable-plus-storage projects. Expedited studies, standardized procedures, and clear cost allocation should help hybrids move from study to steel in the ground faster. States with strong solar growth illustrate the outcome: Texas alone was on track to add 6.5 GW of batteries in 2024—often sited with solar—to reach roughly 10 GW total, supported by federal tax credits and wider revenue stacks.

Technology choices are also converging to support this trend. The U.S. National Renewable Energy Laboratory’s 2024 cost book confirms LFP has become the primary lithium-ion chemistry for stationary storage (since 2022), favored in hybrids for its cost, safety profile, and cycle life. System configurations are standardizing at 2–4 hours today, with growing activity at 6–10 hours for deeper evening peaks and reduced curtailment.

Hybrids unlock stranded midday solar and deliver it in the evening when people actually need power. The EIA showed that solar and batteries together accounted for 81% of planned new U.S. capacity in 2024, an indicator of how developers design projects now: one interconnection, one site, multiple value streams. Meanwhile, China’s storage duration rising to 2.3 hours hints at a broader global push toward longer-duration assets that can shift more renewable energy and stabilize grids during evening peaks.

Drivers

Rapid Decline in Battery Storage Costs

One of the most powerful drivers behind the growth of grid-scale battery storage is the dramatic drop in costs for battery systems, which makes them increasingly viable for large-scale electricity networks. Back in 2010, utility-scale battery energy storage systems (BESS) were extraordinarily expensive; by 2024, the cost had fallen by about 93%, reaching USD 192 per kilowatt-hour (kWh) for utility-scale applications.

- For example, the International Renewable Energy Agency (IRENA) projects that total installed costs for stationary battery-storage systems could fall a further 50-60% by 2030 as manufacturing ramps, materials usage improves and production processes are optimised.

What this means in practice is that for many grids, a battery can now compete or even beat other technologies for certain functions such as short-term storage (say 2 to 4 hours), frequency regulation or managing evening solar ramps. The International Energy Agency (IEA) notes that as batteries become cost-competitive with open cycle gas turbines in places like India, their role shifts from niche to mainstream.

In regions where renewables penetration is high, the intermittent nature of wind and solar generation means power supply must be managed carefully. Cheaper batteries mean one doesn’t have to over-invest in fossil-fired “backup” capacity or oversized transmission infrastructure; instead, grid-scale batteries can smooth out peaks, absorb excess solar midday, shift that energy to evening hours, and in some cases offer “black start” or resilience services.

On a human-scale, this cost decline has made battery storage a practical tool rather than a “nice to have”. A younger engineer in a regional utility planning group might once have been told “storage is too expensive unless you have a special case”—now they may be told “yes, factor battery storage into your plan”. Once costs cross that psychological threshold, investment decisions change, the supply chain expands, projects proliferate, and learning curves steepen further.

Restraints

Cycle and Calendar Life Limitations

One of the biggest hurdles facing grid-scale battery storage systems is how the batteries degrade over time — both through repeated charge/discharge cycles (cycle life) and simply by aging. According to the Pacific Northwest National Laboratory (PNNL) in its Energy Storage Grand Challenge: Cost and Performance Assessment 2022, for lithium-ion (Li-ion) batteries used in grid applications the typical calendar life is only 13 years for nickel-manganese-cobalt (NMC) chemistry and 16 years for lithium-iron-phosphate (LFP) chemistry. Meanwhile, at 80% depth-of-discharge (DOD) the estimated cycle life of LFP systems is around 2,640 cycles, and for NMC around 1,672 cycles.

Putting this into everyday terms: if a battery bank is regularly used once per day (for example storing excess solar in the afternoon and dispatching in the evening) that corresponds to roughly one full cycle each day. At 2,640 cycles, a battery would reach its rated cycle life in about 7.2 years. Even if you operate more conservatively (less than full DOD), the calendar life cap of 13-16 years remains. So after around a decade, operators are faced with declining performance, capacity fade, and replacement or major refurbishment cost.

This makes long-duration economics trickier. Even if upfront costs are low and performance is good early on, the asset’s useful life is limited by chemistry degradation. Public-sector and utility planners must factor in these end-of-life risks: what happens when capacity falls below useful levels, how to replace modules, how to recycle or repurpose. According to PNNL, lifecycle cost modelling assumes battery “augmentation or replacement” when available energy drops to ~60% of rated energy.

Another human dimension: for a grid operator deploying a large battery installation, the promise is “install once, use for 20-plus years” alongside solar or wind farms. But if the battery chemistry only realistically supports ~13–16 years or 2,600 cycles, then the operator must plan for mid-life overhaul or early retirement — which can undermine the value proposition. This creates uncertainty, which slows down financing, increases risk margins, and can deter investment in the first place.

Opportunity

Renewable-Plus-Storage Integration

As renewables like solar and wind expand, the opportunity for grid-scale battery storage to partner with them has never been stronger. For instance, the International Energy Agency (IEA) reports that global grid-scale battery capacity must expand to nearly 970 GW by 2030 under its Net-Zero scenario — up from about 28 GW at the end of 2022. This gap between today’s capacity and future need spells a huge growth potential for batteries, especially when paired directly with renewable generation assets.

Solar and wind power are fantastic because they’re clean, but their power output fluctuates: midday sun, windy nights, calm mornings. The battery becomes the “storage locker” for that energy until the grid needs it. In India, for example, the Central Electricity Authority (CEA) estimates that by 2030 the country may need around 41.65 GW of battery storage capacity amounting to 208 GWh to support its renewable goals. When you think of “208 GWh” — that’s enough stored energy to deliver 1 GWh every day for about 208 days — it becomes vivid how big the role could be.

Governments are already moving. In India, the modernisation of grid infrastructure includes smart meter rolls and storage-ready systems. The IEA notes that India launched a INR 3.03 trillion (approx. USD 36.8 billion) scheme in 2022 to modernise distribution infrastructure, which supports storage integration. That means it’s not just about building batteries: it’s about rewiring, rethinking policy, making storage a practical piece of how electricity is delivered.

The numbers reflect the scale. If global additions of battery storage rise to roughly 120 GW per year through the mid-2020s to meet the IEA target, that’s more than ten times the annual build of just a few years ago. In emerging economies especially, co-locating storage with renewables in areas where the grid is weaker unlocks major value: less wasted energy, fewer outages, more local asset control.

Regional Insights

Asia Pacific leads the Grid-scale Battery Storage Market with 48.9% share valued at USD 7.1 billion

In 2024, the Asia Pacific region emerged as the dominant market for grid-scale battery storage, accounting for 48.9% of the global share, valued at approximately USD 7.1 billion. This leadership is supported by rapid renewable energy expansion, government-backed energy transition programs, and large-scale investments in battery manufacturing and storage infrastructure. China, Japan, South Korea, and India have been key contributors to this growth, driven by national targets to reduce carbon emissions and improve grid resilience.

In Japan, grid-scale battery projects are being deployed to stabilize the growing solar power network, while South Korea continues to strengthen its domestic battery production ecosystem through companies such as LG Energy Solution and Samsung SDI. India’s energy storage sector is witnessing accelerated progress under government schemes like the National Energy Storage Mission, with multiple state-level tenders promoting hybrid renewable-plus-storage solutions.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

NGK Insulators Ltd.: NGK Insulators has developed its proprietary NAS (sodium-sulfur) stationary battery technology, leveraging ceramic and high-temperature sodium-sulfur chemistry for long-duration grid storage deployments. The company reports more than 250 installations worldwide, with operational histories exceeding 20 years, addressing utility and renewable-integration applications.

BYD Co. Ltd.: BYD has rapidly scaled its energy-storage business, having delivered over 75 GWh of BESS equipment across more than 350 projects in over 110 countries. In early 2025 the firm secured a 12.5 GWh contract for grid-scale battery storage in Saudi Arabia, further establishing its utility-scale footprint.

Sumitomo Electric Industries, Ltd.: Sumitomo Electric has focused on vanadium redox flow battery (VRFB) technology for grid‐scale storage, with modular systems offering long cycle life, high safety and fully recyclable electrolytes. A notable project is an 8 000 kWh grid-scale installation in Kumamoto, Japan, selected under METI’s support programme.

General Electric Company: Through its energy segment (GE Vernova Inc.), GE has introduced modular battery-enabled energy storage systems such as the RESTORE DC Block (5 MWh capacity, 2–8 h duration) and is engaged in large-scale grid-BESS projects such as Australia’s 250 MW/1 000 MWh “Supernode” project.

Top Key Players Outlook

- NGK Insulators Ltd.

- BYD Co. Ltd.

- Sumitomo Electric Industries, Ltd.

- Samsung SDI Co. Ltd.

- General Electric

- GS Yuasa Corp.

- LG Chem Ltd.

- Mitsubishi Electric Corp.

- Panasonic Corp.

- ABB Group

- Hitachi Ltd.

Recent Industry Developments

In 2024, NGK Insulators Ltd. achieved a notable milestone when it secured an order for its NAS® (sodium-sulfur) battery system with a rated output of 18 MW and capacity of 104.4 MWh (72 container-type units) for a green hydrogen project in northern Germany.

In 2024 the BYD Co. Ltd. grid-scale battery storage business achieved several notable milestones: the company reported a cumulative delivery of 75 GWh of battery energy storage system (BESS) equipment across more than 350 projects in over 110 countries and regions.

Report Scope

Report Features Description Market Value (2024) USD 14.6 Bn Forecast Revenue (2034) USD 139.3 Bn CAGR (2025-2034) 25.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Lead-Acid, Lithium-Based, Others), By Application (Renewable Integration, Ancillary Services, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape NGK Insulators Ltd., BYD Co. Ltd., Sumitomo Electric Industries, Ltd., Samsung SDI Co. Ltd., General Electric, GS Yuasa Corp., LG Chem Ltd., Mitsubishi Electric Corp., Panasonic Corp., ABB Group, Hitachi Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Grid-scale Battery Storage MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Grid-scale Battery Storage MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- NGK Insulators Ltd.

- BYD Co. Ltd.

- Sumitomo Electric Industries, Ltd.

- Samsung SDI Co. Ltd.

- General Electric

- GS Yuasa Corp.

- LG Chem Ltd.

- Mitsubishi Electric Corp.

- Panasonic Corp.

- ABB Group

- Hitachi Ltd.