Global Gravy Mixes Market By Origin (Organic, Conventional), By Product Type (Vegan, Non-vegan), By Packaging Type (Rigid Packaging, Flexible Packaging), By End Use (Households, Commercial), By Distribution Channel (Modern Grocery Retail, Hypermarkets And Supermarkets, Departmental Stores, Convenience Store, Traditional Grocery Retail, Specialty Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172114

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

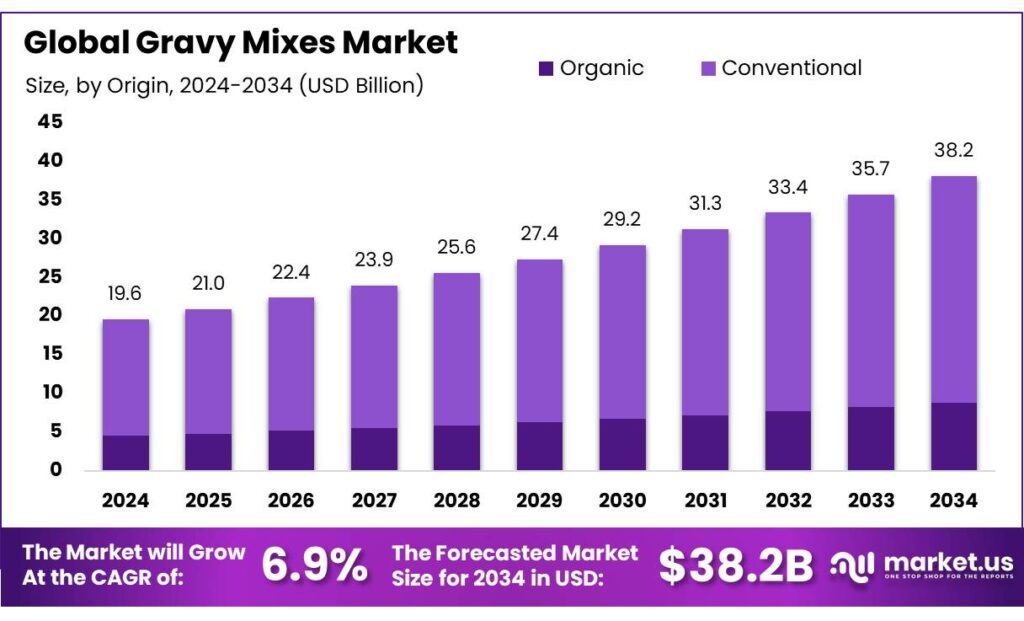

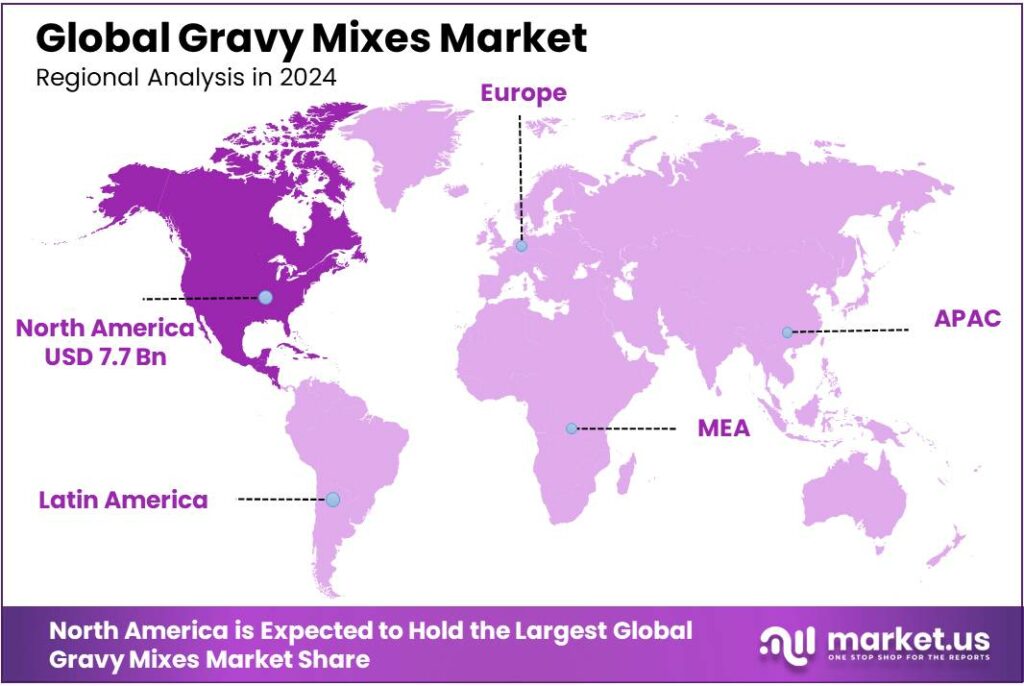

The Global Gravy Mixes Market size is expected to be worth around USD 38.2 Billion by 2034, from USD 19.6 Billion in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 39.4% share, holding USD 7.7 Billion in revenue.

The gravy mixes industry forms an integral segment of the broader convenience and meal‑solution food products market, providing dehydrated or ready‑to‑use bases to prepare savory gravies that complement a wide array of dishes. Globally, this category spans powdered, liquid, and versatile instant formats, catering to both household kitchens and commercial foodservice operators. Gravy mixes simplify flavor creation, reduce preparation time and provide consistent quality, aligning with modern consumer expectations for convenience without sacrificing taste.

In the current industrial scenario, the market’s demand is propelled by a combination of demographic drivers and evolving consumption patterns. Modern retail channels such as supermarkets, hypermarkets, and e‑commerce platforms now account for a significant share of distribution, with supermarkets alone driving approximately 57% of sales in certain markets and e‑retail channels rapidly growing their footprint.

Government initiatives and broader food processing sector support frameworks also contribute to an enabling environment for gravy mixes production, particularly in emerging economies such as India. The Indian food processing sector, which encompasses processed food products including convenience mixes, reached a market size of approximately Rs. 30,49,800 crore (US $ 354.5 billion) in 2024 and is forecasted to grow to Rs. 65,24,480 crore (US $ 758.4 billion) by 2028, reflecting a strong growth incentive for related product categories.

From a policy and government initiative perspective, the gravy mixes sector benefits indirectly through broader support for the processed food and food processing industries. For example, the Government of India’s Production Linked Incentive Scheme for Food Processing Industry (PLISFPI) carries an outlay of Rs. 10,900 crore to stimulate investment, manufacturing competitiveness, and export readiness in processed food production. Likewise, schemes such as the Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) with a total outlay of Rs. 10,000 crore aim to formalize and upscale small food enterprises, potentially including niche or regional gravy mix producers.

Key Takeaways

- Gravy Mixes Market size is expected to be worth around USD 38.2 Billion by 2034, from USD 19.6 Billion in 2024, growing at a CAGR of 6.9%.

- Conventional held a dominant market position, capturing more than a 76.9% share of the global gravy mixes market.

- Non-vegan held a dominant market position, capturing more than a 64.2% share of the global gravy mixes market.

- Flexible Packaging held a dominant market position, capturing more than a 69.3% share of the global gravy mixes market.

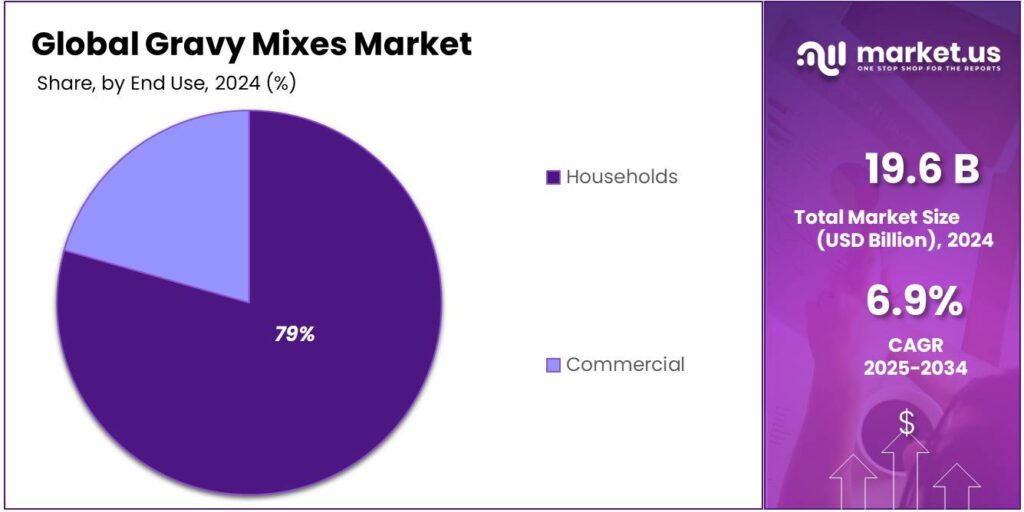

- Households held a dominant market position, capturing more than a 79.4% share of the global gravy mixes market.

- Hypermarkets & Supermarkets held a dominant market position, capturing more than a 35.7% share of the global gravy mixes market.

- North America emerged as the dominant regional market for gravy mixes, capturing a 39.40% share of global revenue and contributing approximately USD 7.7 billion.

By Origin Analysis

Conventional origin dominates with 76.9% due to its wide acceptance and cost efficiency

In 2024, Conventional held a dominant market position, capturing more than a 76.9% share of the global gravy mixes market, supported by its strong presence across household and foodservice consumption. Conventional gravy mixes continue to be preferred due to their consistent taste, longer shelf life, and easy availability across supermarkets, convenience stores, and institutional supply chains.

In 2024, demand remained stable as consumers prioritized familiar flavors and affordable meal solutions for daily cooking. Manufacturers focused on improving texture, flavor depth, and packaging convenience while maintaining traditional formulations, which helped sustain high adoption. Moving into 2025, the conventional segment is expected to retain leadership as price-sensitive consumers and large-scale foodservice operators continue to rely on these products for volume cooking and menu standardization.

By Product Type Analysis

Non-vegan gravy mixes lead with 64.2% driven by traditional taste preference and wider usage

In 2024, Non-vegan held a dominant market position, capturing more than a 64.2% share of the global gravy mixes market, largely due to strong consumer preference for meat-based flavors such as chicken, beef, and seafood gravies. These products are deeply rooted in traditional cooking habits and are widely used in both home kitchens and foodservice settings, especially for main meals and festive dishes.

During 2024, demand was supported by the continued popularity of comfort foods and the need for rich, authentic taste profiles that non-vegan gravies deliver more easily. Restaurants, catering services, and quick-service outlets also favored non-vegan gravy mixes for their ability to provide consistent flavor at scale. Looking ahead to 2025, the segment is expected to maintain its leading position as meat-based gravies remain a staple in many regional cuisines.

By Packaging Type Analysis

Flexible packaging leads with 69.3% due to convenience, easy storage, and lower cost

In 2024, Flexible Packaging held a dominant market position, capturing more than a 69.3% share of the global gravy mixes market, mainly because it offers practicality and cost advantages for both manufacturers and consumers. Pouches and sachets are lightweight, easy to store, and simple to use, making them suitable for daily household cooking as well as bulk foodservice operations. During 2024, flexible packs supported better shelf life protection while reducing transportation and storage costs, which helped brands keep products affordable in price-sensitive markets. Consumers also preferred this packaging format because it allows controlled portion use and minimizes product wastage.

By End Use Analysis

Households dominate with 79.4% as home cooking and convenience drive daily demand

In 2024, Households held a dominant market position, capturing more than a 79.4% share of the global gravy mixes market, reflecting the strong role of home cooking in everyday meal preparation. Gravy mixes are widely used in households to save cooking time while maintaining familiar taste, especially for regular meals and family gatherings. During 2024, demand from this segment was supported by rising preference for easy-to-prepare foods and the growing habit of cooking at home due to cost awareness and lifestyle changes. These products also offer flexibility, allowing consumers to adjust flavor strength and portion size based on personal preference.

By Distribution Channel Analysis

Hypermarkets & supermarkets lead with 35.7% due to strong visibility and one-stop shopping

In 2024, Hypermarkets & Supermarkets held a dominant market position, capturing more than a 35.7% share of the global gravy mixes market, supported by their wide product assortment and high consumer footfall. These stores offer multiple brands, pack sizes, and flavor options in one place, making them a preferred choice for routine grocery shopping. During 2024, consumers continued to rely on physical retail for food purchases, especially for staple cooking products like gravy mixes where brand familiarity and price comparison matter. Promotional pricing, in-store discounts, and attractive shelf placement further encouraged impulse and repeat purchases.

Key Market Segments

By Origin

- Organic

- Conventional

By Product Type

- Vegan

- Non-vegan

By Packaging Type

- Rigid Packaging

- Flexible Packaging

By End Use

- Households

- Commercial

By Distribution Channel

- Modern Grocery Retail

- Hypermarkets & Supermarkets

- Departmental Stores

- Convenience Store

- Traditional Grocery Retail

- Specialty Stores

- Others

Emerging Trends

Global Flavour Innovation and Cultural Exploration in Gravy Mixes

One of the most exciting and human trends shaping the world of gravy mixes today is the growing consumer appetite for bold, global flavours and cultural taste experiences. People no longer want the same old salt‑and‑pepper gravy they grew up with — they want layers of taste that remind them of travel, heritage, or dishes they’ve enjoyed at friends’ homes or restaurants. This trend is part of a broader shift in sauces, seasonings, and condiments that reflects how food now connects us emotionally, culturally, and socially.

Across kitchen tables worldwide, younger generations — especially Millennials and Gen Z — are at the heart of this shift. They are more adventurous with taste and eager to bring global cuisine into everyday meals. The Specialty Food Association found that seasonings and spices — which are closely tied to gravy flavours — experienced an 11.4 % year‑over‑year increase in sales and a 49 % rise in unit sales in recent seasons, even amid inflationary pressures. These numbers show that consumers really want new flavours, not just familiar ones — and they’re buying them.

What makes this trend so meaningful at a human level is how it reflects shifting attitudes toward food and culture. People see cooking as a form of expression and connection. Trying a new flavour isn’t just a choice — it’s a way to remember a trip, honour a cultural tradition, or simply share something new with loved ones at dinner. This emotional element makes global flavour exploration deeply personal. Many home cooks say that discovering a new sauce or spice blend reminds them of family meals, celebrations, or the joy of creating something that feels uniquely their own.

Government nutrition guidelines in several countries — such as the Dietary Guidelines for Americans — now encourage people to broaden their culinary horizons and include a rich variety of herbs, spices, and vegetables in place of excess salt and fat. These guidelines emphasize the importance of a balanced diet that minimises processed ingredients and highlights real, whole foods. While gravy mixes are a processed product, innovators are responding to this guidance by integrating natural herbs and spice blends, reducing sodium, and enhancing nutritional profiles.

Drivers

Rising Demand for Convenience Foods

One of the most important reasons why gravy mixes are finding a permanent place in kitchen pantries around the world is the rising demand for convenience in everyday cooking — not because people don’t want to cook, but because life has simply become busier for many families and individuals. In today’s world, most households juggle work, studies, family care, and social life, which often leaves limited time for traditional cooking that requires lengthy preparation and attention. This change in daily life patterns has led many consumers to seek solutions that help them prepare tasty meals quickly without sacrificing flavor or quality.

A clear indication of this shift comes from consumer behavior studies in larger food markets. For example, a survey reported that 77 % of U.S. consumers consider convenience — meaning speed, ease of preparation, and accessibility — as a key factor when choosing food products. This high percentage shows that convenience is now a priority for more than three‑quarters of consumers when making food choices that fit their busy routines.

Gravy mixes specifically fit into this growing convenience food category because they allow consumers to create flavorful gravies — something that otherwise requires both time and culinary skill — with minimal effort. Instead of spending 15–30 minutes stirring roux, measuring ingredients, and watching a pot on the stove, many households can prepare a rich gravy in a fraction of that time just by adding hot water to a mix.¹ This kind of time‑saving simplicity appeals particularly to working professionals, dual‑income households, students, and young families who want home‑style meals without long preparation times.

Government and public health organizations also observe and respond to these changing patterns. For instance, the U.S. Department of Agriculture (USDA) has studied how time constraints from employment influence food choices toward convenience foods. USDA research points out that households with all adults employed tend to buy more ready‑to‑eat and convenience foods — a pattern that underlines how modern work and lifestyle pressures shape food purchasing decisions.

Restraints

Health Concerns Around Processed and Ultra‑Processed Foods

One of the biggest challenges facing the gravy mixes industry — and convenience food products more broadly — stems from growing health concerns tied to processed foods. People are becoming more aware of what they eat, and many are worried about how certain packaged and industrially prepared foods affect long‑term wellbeing. This isn’t just a vague feeling — major health organizations and research show that diets high in ultra‑processed foods are linked with real health risks, and this perception influences how consumers think about products like gravy mixes (which are generally categorized under processed food when dry seasoning and additives are involved).

A key issue is excessive sodium (salt) content. The World Health Organization (WHO) estimates that the global average sodium intake is about 4,310 mg per day, which is more than twice the recommended limit of less than 2,000 mg per day for adults. High sodium intake is a well‑established driver of raised blood pressure, increasing the risk of cardiovascular diseases like heart attacks and strokes — which together contribute to millions of deaths worldwide.¹ For many consumers, seeing such figures from reputable public health bodies prompts caution about products perceived as high in salt, including packaged sauces, seasonings, and gravy mixes.

Closely related to sodium concerns are broader anxieties about “ultra‑processed foods,” a category that includes many convenience products. Recent data from the U.S. Centers for Disease Control and Prevention (CDC) shows that ultra‑processed foods make up about 55 % of the average American’s daily calorie intake, with even higher percentages among younger people.² This tells us that these highly convenient foods — often rich in salt, sugar, unhealthy fats, and additives — dominate diets in developed markets, and that balance is being questioned by health professionals and consumers alike.

Governments are responding too. For example, the U.S. Food and Drug Administration (FDA) has introduced voluntary initiatives to significantly reduce sodium in processed foods by about 20 % over the coming years as part of a public health strategy to prevent chronic disease.⁴ This kind of regulatory direction further reinforces health concerns in the public mindset and pushes manufacturers to reformulate products to meet tougher nutritional expectations — sometimes at higher cost.

Opportunity

Expansion Through Clean‑Label and Health‑Conscious Products

One of the clearest and most meaningful growth opportunities for gravy mixes today lies in meeting rising consumer demand for healthier and cleaner‑label food products. This shift is not just a marketing trend — it reflects how people around the world are thinking about food with their hearts and bodies, not just convenience. Families, young professionals, and home cooks increasingly want ingredients they understand, can trust, and can feel good about serving to loved ones. That’s a powerful human force shaping the future of gravy mixes.

In the last few years, there has been a noticeable shift in what shoppers look for on grocery shelves. Many consumers no longer want products filled with long lists of unpronounceable ingredients or artificial additives. Instead, they want more transparency — ingredients that sound like real food — and healthier versions of familiar favorites. In the broader sauces, seasonings, and gravy category, data shows that around 52 % of new product launches globally between 2023‑2025 featured clean‑label traits such as organic, vegan, gluten‑free, or low‑sodium formulations. This isn’t a small niche; it’s more than half of all new entries, telling us there’s real demand for products that feel wholesome and modern.

This growth opportunity also coincides with larger trends in how people eat and live. According to several trusted food and nutrition research sources, convenience food patterns are rising globally — more than three in five consumers use convenience foods at least once a week. What’s important here is that convenience and health are no longer opposites for many people. Instead, consumers want options that deliver both — easy to prepare and better for their families. Gravy mixes that are clean‑label, lower in sodium, and free from artificial ingredients speak directly to this dual desire.

Regional Insights

North America leads with 39.40% share and USD 7.7 billion value backed by strong demand for convenience foods

In 2024, North America emerged as the dominant regional market for gravy mixes, capturing a 39.40 % share of global revenue and contributing approximately USD 7.7 billion to the total market value, underscoring the region’s entrenched consumption culture and developed food retail ecosystem. This leadership reflects strong consumer preference for quick and convenient cooking solutions that fit busy lifestyles, supported by widespread retail availability across supermarkets, hypermarkets, and e-commerce platforms.

Canada’s market behaviour parallels the U.S., with similar adoption patterns for ready-to-use mixes that offer ease of preparation and consistent quality. Retail infrastructure maturity contributes to high product penetration, and promotional activities by major brands have reinforced consumer awareness year over year. The region’s dominance is also tied to higher disposable incomes and strong distribution networks which facilitate a broad assortment of flavours and formats, further enhancing consumer choice.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Bob’s Red Mill is a U.S.-based producer of natural, whole-grain, organic, and gluten-free food products, established in 1978 and headquartered in Milwaukie, Oregon. The company offers over 400 products, including baking and gravy mixes, flours, grains, and specialty items, distributed across more than 70 countries through natural food distributors and online channels. Bob’s Red Mill emphasises high-quality, minimally processed ingredients and certified gluten-free options, aligning with rising consumer demand for clean-label foods. The firm has maintained strong brand recognition in natural foods, supported by employee-ownership structures and transparent sourcing practices.

Hodgson Mill is a family-owned milling company based in Illinois, producing whole-grain foods including flours, pastas, breakfast cereals, and baking mixes. Since its incorporation in 1969, Hodgson Mill has emphasised natural, organic, and gluten-free products, appealing to health-conscious consumers seeking minimally processed options. Its product range supports both retail household and specialty ingredient markets.

Top Key Players Outlook

- Bobs Red Mill

- Namaste Foods

- King Arthur Flour

- Hodgson Mill

- Martha White

- Namaste Foods

- Megabite Foods

- Bakers Spring

Recent Industry Developments

In 2024, Hodgson Mill was estimated to have annual revenue of around USD 15.3 million and employed approximately 63 people, reflecting its status as a modest but stable operation focused on quality food products.

Namaste Foods, founded in 2000, is a small U.S. food manufacturer based in Coeur d’Alene, Idaho, with 10–50 employees and estimated annual revenue of USD 2.5 million in 2024 (reflecting its status as a niche provider of allergen-free products).

Report Scope

Report Features Description Market Value (2024) USD 19.6 Bn Forecast Revenue (2034) USD 38.2 Bn CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Origin (Organic, Conventional), By Product Type (Vegan, Non-vegan), By Packaging Type (Rigid Packaging, Flexible Packaging), By End Use (Households, Commercial), By Distribution Channel (Modern Grocery Retail, Hypermarkets And Supermarkets, Departmental Stores, Convenience Store, Traditional Grocery Retail, Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bobs Red Mill, Namaste Foods, King Arthur Flour, Hodgson Mill, Martha White, Namaste Foods, Megabite Foods, Bakers Spring Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bobs Red Mill

- Namaste Foods

- King Arthur Flour

- Hodgson Mill

- Martha White

- Namaste Foods

- Megabite Foods

- Bakers Spring