Global Granulated Ground Blast Furnace Slag Market Size, Share, And Business Benefits By Type (Alkalinity Blast-Furnace Slag, Acidic Blast-Furnace Slag), By Cover (Specific Surface Area ≥ 300m2/Kg, Specific Surface Area ≥ 400m2/Kg, Specific Surface Area ≥ 500m2/Kg), By Application (Cement Production, Concrete Aggregate, Roadbed Material), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 163236

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

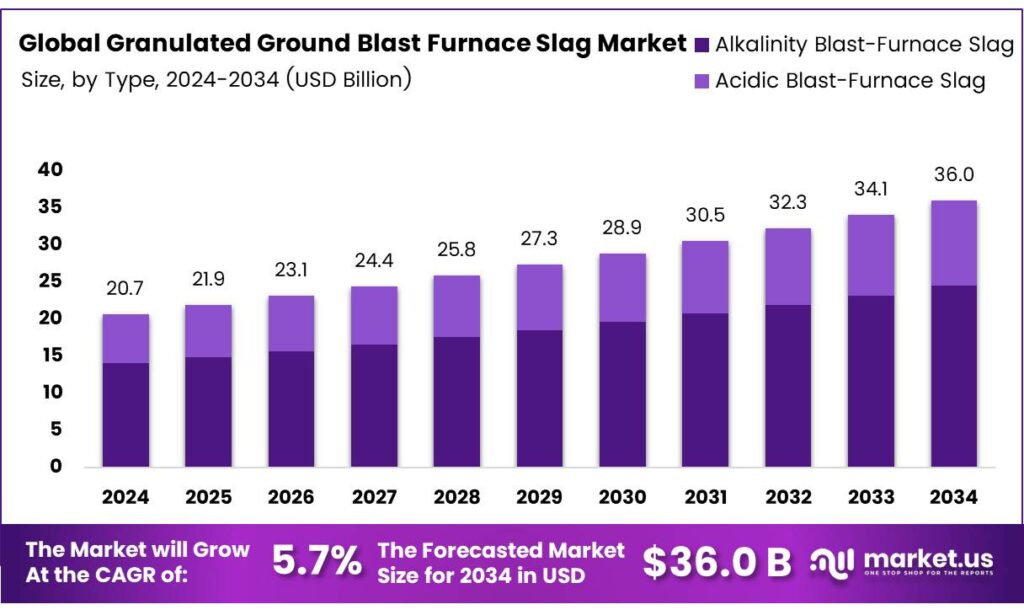

The Global Granulated Ground Blast Furnace Slag Market size is expected to be worth around USD 36.0 Billion by 2034, from USD 20.7 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034.

Ground granulated blast furnace slag (GGBFS), commonly known as GGBS, is a glassy granular material produced by rapidly cooling molten slag through water quenching. This process yields sand-sized particles with cementitious properties, making it an effective partial replacement for or additive to Portland cement. The physical structure and gradation of GGBS depend on the slag’s chemical composition and the specific production method employed.

In Europe, nearly 18 million tonnes of GGBS are utilized annually in the cement and concrete industries, representing their primary application. It serves as a direct substitute for cement, offering multiple benefits such as extending concrete’s lifecycle, enhancing durability, and reducing the carbon and energy footprint of production. Blended cements combining GGBS with ordinary Portland cement exhibit superior resistance to sulphates and improved chloride binding capacity.

- The grade of GGBS is determined by its activity index, calculated as the ratio of compressive strength in a mortar cube with a 50% GGBS-cement blend to that of a reference cement cube. Grade 80 GGBS should generally be avoided unless required for special circumstances, such as controlling the heat of hydration in mass concrete. Substituting grade 120 GGBS for up to 50% of cement typically achieves compressive strength at 7 days and beyond that equals or exceeds concrete made without GGBS.

Although rates up to 70% have been applied, optimal 28-day strength is usually achieved at around 50% of total cementitious material, varying with GGBS grade. Research indicates that scaling resistance diminishes with substitution rates above 25%. GGBS must be stored in separate, watertight silos similar to those for cement and clearly labeled to prevent mix-ups. During batching, Portland cement should be weighed first, followed by GGBS.

Key Takeaways

- The Global GGBFS Market is projected to grow from USD 20.7 billion in 2024 to USD 36.0 billion by 2034 at a 5.7% CAGR.

- Alkalinity Blast-Furnace Slag dominated in 2024 with a 67.9% share due to stronger cement bonds and lower emissions.

- Specific Surface Area ≥ 400m²/kg led with 48.6% share in 2024 for rapid reactivity and cost-effective durability.

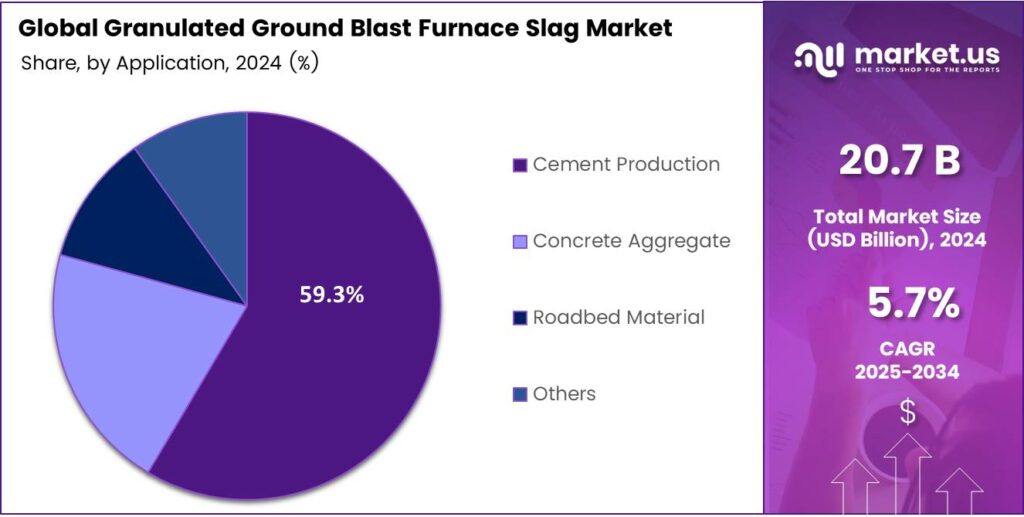

- Cement Production held a 59.3% share in 2024 applications, driven by clinker replacement and CO2 reduction.

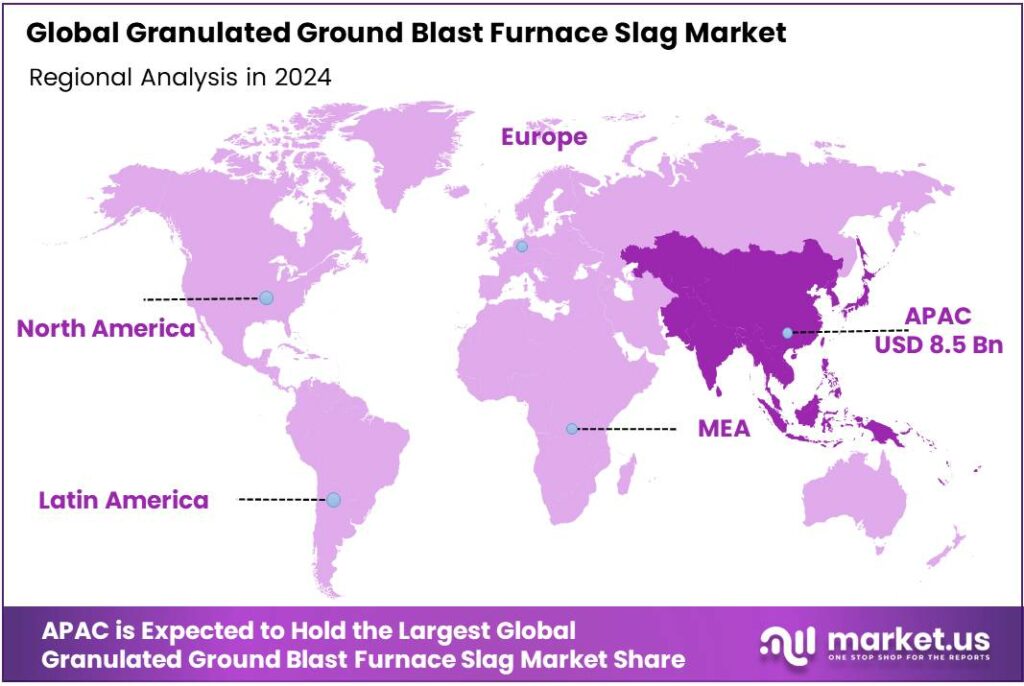

- Asia-Pacific commanded 41.2% of the global market in 2024, valued at USD 8.5 billion.

By Type

Alkalinity Blast-Furnace Slag dominates with 67.9%

In 2024, Alkalinity Blast-Furnace Slag held a dominant market position with a 67.9% share. This type excels because it forms stronger bonds in cement blends. Producers favor it for reducing clinker needs, thus lowering emissions. Its alkaline nature boosts long-term strength, making it ideal for sustainable builds. Demand surges in infrastructure projects worldwide.

Acidic Blast-Furnace Slag, while less prevalent, offers unique benefits in specialized mixes. It provides better flowability during pouring. This type suits applications needing quick setting times. However, its lower reactivity limits widespread use. Still, it gains traction in niche areas like precast elements. Transitioning to this slag helps optimize costs in certain formulations.

By Cover

Specific Surface Area ≥ 400m2/Kg dominates with 48.6%

In 2024, Specific Surface Area ≥ 400m2/Kg held a dominant market position with a 48.6% share. This fineness level ensures rapid reaction with activators, improving early-age performance. It balances grinding costs and efficacy, appealing to manufacturers. Bridges and high-rises increasingly adopt it for enhanced durability. This segment drives market growth through versatile applications.

Specific Surface Area ≥ 300m2/Kg serves as a cost-effective option for basic uses. It achieves adequate strength over time, suiting mass concrete pours. Though coarser, it reduces energy in production. Users select it where budget constraints prevail. This variant maintains reliability in standard road works, bridging gaps in accessibility.

Specific Surface Area ≥ 500m2/Kg targets premium, high-performance needs. Its ultra-fine particles accelerate hydration, yielding superior sulfate resistance. Premium projects embrace it for longevity. However, higher processing costs temper adoption. Innovators leverage this for eco-friendly, dense concretes, pushing boundaries in advanced engineering.

By Application

Cement Production dominates with 59.3% owing to its role in blending for greener

In 2024, Cement Production held a dominant market position in the By Application Analysis segment of the Granulated Ground Blast Furnace Slag Market, with a 59.3% share. It replaces clinker effectively, cutting CO2 emissions significantly. Blends gain popularity for their reduced heat and improved workability. Global cement firms integrate it to meet sustainability goals.

This application fuels expansion in urban developments. Concrete Aggregate enhances mix designs with added toughness. It improves impermeability, resisting chemical attacks. Builders choose it for durable structures like dams. This use extends slag’s value beyond cement, optimizing material efficiency.

Transitions to aggregate applications boost overall project resilience. Roadbed Material stabilizes bases under heavy traffic. It compacts well, minimizing settlement issues. Infrastructure upgrades favor it for longevity and cost savings. This segment supports rapid construction timelines. Adopting roadbed uses expands slag’s reach in transportation networks.

Key Market Segments

By Type

- Alkalinity Blast-Furnace Slag

- Acidic Blast-Furnace Slag

By Cover

- Specific Surface Area ≥ 300m2/Kg

- Specific Surface Area ≥ 400m2/Kg

- Specific Surface Area ≥ 500m2/Kg

By Application

- Cement Production

- Concrete Aggregate

- Roadbed Material

- Others

Emerging Trends

Surge in Low-Clinker / Slag-Rich Cement Adoption

A major emerging trend in the granulated ground blast furnace slag (GGBFS) space is the growing use of slag-rich cementitious blends driven by carbon-reduction mandates and circular-economy strategies. The global steel industry. The production of one tonne of steel results in 200 kg (EAF) to 400 kg (BF/BOF) of co-products, including slag, dust, and sludge.

That means hundreds of millions of tonnes of slag are generated each year, making GGBFS a readily available supplementary cementitious material (SCM) with strong sustainability credentials. At the same time, the International Energy Agency (IEA) emphasises that substituting conventional clinker in cement with alternative materials (including slags) is a key route to reducing process CO₂ emissions.

- As governments around the world roll out stricter embodied-carbon regulations for construction and infrastructure, end-users are increasingly specifying higher slag-content cements. For example, in some markets, up to 80% of the cement contains granulated blast furnace slag. One industry fact-sheet notes that replacing Portland cement with slag cement can save up to 59% of embodied CO₂ emissions.

Drivers

Large-Scale CO₂-Emission Reduction via Slag Utilisation

One of the strongest drivers for the uptake of granulated ground blast-furnace slag (GGBFS) in cement and concrete is its potential to significantly cut CO₂ emissions in the construction materials value chain. For every tonne of clinker or Portland cement replaced by slag-rich blends or other supplementary cementitious materials (SCMs), the CO₂ savings can reach around 0.8 tonnes of CO₂.

Behind this number lies a clear logic: production of conventional clinker—the core ingredient in Portland cement—releases massive amounts of CO₂, not just from the fuel used to heat kilns but from the chemical decomposition (calcination) of limestone itself.

Substituting part of that clinker with GGBFS, which is a by-product of steelmaking and requires much less additional calcination, means fewer raw virgin materials, lower energy input, and hence lower carbon output. For example, industry documentation highlights that using slag cement can reduce embodied CO₂ emissions by up to 59% compared with ordinary cement.

Restraints

Slower Early-Strength Development and Technical Constraints

One significant restraint facing the utilization of Ground Granulated Blast Furnace Slag (GGBFS) is its slower early strength development in concrete mixes, which affects construction scheduling and project cost. Concrete containing GGBFS experiences delayed strength gain compared to ordinary Portland cement, especially when the slag content exceeds about According to the (FHWA) guidelines 25% of the total cementitious material.

In cold weather or during projects demanding rapid form removal, the extended setting time of slag-based materials poses a significant practical obstacle, hindering adoption on time-sensitive schedules. Additionally, variability in slag chemistry and processing further constrains its use.

- The United States Geological Survey (USGS), approximately 16 million tons of ferrous slag were sold in the U.S. market, with blast furnace slag comprising about 54% of the tonnage yet accounting for 90% of the total value, primarily in granulated form. This tonnage value disparity highlights that not all slag is suitable or economically feasible to process into ground granulated blast furnace slag (GGBFS), resulting in limited availability of consistently high-quality material.

Opportunity

Rising Demand from Infrastructure & Sustainable Construction

One meaningful growth factor driving the use of granulated ground blast-furnace slag (GGBFS) is the surge in infrastructure projects combined with rising demand for sustainable construction materials. According to the Global Cement & Concrete Association (GCCA)-India roadmap published in 2025, increased use of supplementary cementitious materials (SCMs) such as GGBFS accounts for 16.2% of the CO₂-reduction potential in India’s cement sector.

This indicates that policymakers and industry players are actively looking at slag-rich cements as a lever for both volume demand and decarbonisation. In addition, data from the World Steel Association indicates that the built-environment sectors are collaborating with the steel and cement industries to use steel slag in concrete. This means that more GGBFS-type materials are being up-cycled into cementitious blends rather than being landfilled.

From a human-perspective, construction teams in growing economies are under pressure to deliver infrastructure — roads, bridges, housing — but also meet environmental goals. Using GGBFS helps them check both boxes: they get a high-performing material and tick the sustainability requirement. In Europe, cement standards are being reviewed under the Construction Products Regulation to allow higher levels of clinker substitution and thus greater inclusion of SCMs such as GGBFS.

Regional Analysis

Asia-Pacific leads with a 41.2% share and a USD 8.5 Billion market value.

In 2024, Asia-Pacific dominated the Granulated Ground Blast Furnace Slag (GGBFS) market, accounting for 41.2% of the global share, valued at approximately USD 8.5 billion. The region’s dominance is attributed to massive infrastructure development, rapid urbanization, and government-driven sustainable construction initiatives across China, India, Japan, and South Korea.

China remains the largest producer and consumer, driven by extensive use of GGBFS in cement and concrete to reduce carbon emissions. The growing use of GGBFS as a substitute for Portland cement supports low-carbon building practices and aligns with the Asia-Pacific’s net-zero targets.

The increasing preference for eco-friendly building materials is stimulating demand among the public and private construction sectors. Additionally, rising investments in transportation networks, smart cities, and renewable energy infrastructure enhance slag utilization.

Asia-Pacific’s proactive environmental policies, abundant steel manufacturing base, and strong construction sector fundamentals ensure its continued leadership in the GGBFS market through 2034, consolidating its position as the global growth hub for sustainable cementitious materials.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nippon Steel leverages its extensive in-house blast furnace operations to produce a consistent and high-quality granulated slag. The company emphasizes advanced processing technologies to ensure product purity and performance for cement and concrete applications. Its strong focus on technical customer support and R&D allows it to offer tailored solutions, particularly in the demanding Asian construction market.

Arcelor Mittal’s steel production makes it one of the largest volume suppliers of granulated blast furnace slag worldwide. This massive output provides a significant and reliable supply chain for the international construction industry. The company capitalizes on its extensive distribution network to serve diverse markets, ensuring product availability. Promoting the use of its slag as a green building material that reduces the carbon footprint of concrete.

JFE Steel Corporation ensures its granulated slag is a premium, eco-friendly construction material. The company invests heavily in stringent quality control throughout the granulation process, resulting in a product known for its consistency and ability to enhance the durability and chemical resistance of concrete. JFE focuses on the high-value construction sector, marketing its slag as a key component for producing sustainable.

Top Key Players in the Market

- Nippon Steel Corporation

- ArcelorMittal S.A.

- JFE Steel Corporation

- Hunan Valin Xiangtan Iron and Steel Co., Ltd

- TATA Steel

- POSCO

- Ansteel Group

Recent Developments

- In 2025, Nippon Steel received the 2025 Commendation for Science and Technology by the Minister of Education, Culture, Sports, Science and Technology in Japan for its development of technology to create sea forests by using steel slag. While this is not strictly GGBFS for cement, it shows a novel utilisation of steel slag in environmental applications.

- In 2024, JFE Steel announced a long-term agreement with U.S.-based Zeynel Advisory Group Americas LLC (ZAG) for the supply of granulated blast-furnace slag (GBFS) as raw material for cement. It further indicates that JFE will provide a stable, long-term supply globally and enhance the value of GBFS internationally.

Report Scope

Report Features Description Market Value (2024) USD 20.7 Billion Forecast Revenue (2034) USD 36.0 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Alkalinity Blast-Furnace Slag, Acidic Blast-Furnace Slag), By Cover (Specific Surface Area ≥ 300m2/Kg, Specific Surface Area ≥ 400m2/Kg, Specific Surface Area ≥ 500m2/Kg), By Application (Cement Production, Concrete Aggregate, Roadbed Material, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nippon Steel Corporation, ArcelorMittal S.A., JFE Steel Corporation, Hunan Valin Xiangtan Iron and Steel Co., Ltd, TATA Steel, POSCO, Ansteel Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Granulated Ground Blast Furnace Slag MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Granulated Ground Blast Furnace Slag MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nippon Steel Corporation

- ArcelorMittal S.A.

- JFE Steel Corporation

- Hunan Valin Xiangtan Iron and Steel Co., Ltd

- TATA Steel

- POSCO

- Ansteel Group