Global Golf Simulator Market Size, Share Analysis By Offering (Hardware, Software, Services), By Type (Built-in, Portable, Free Standing), By Simulator Type (Full Swing Simulator, Virtual Reality (VR) Simulator), By Installation Type (Indoor, Outdoor), By End-Use (Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154864

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

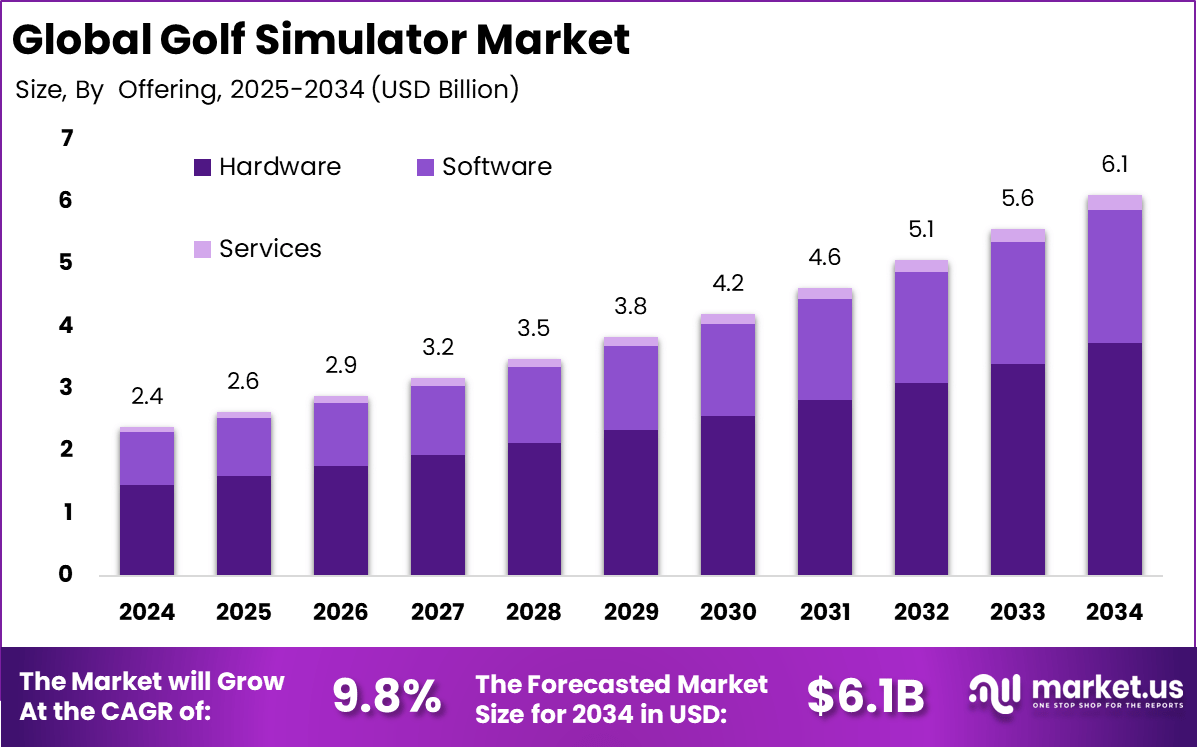

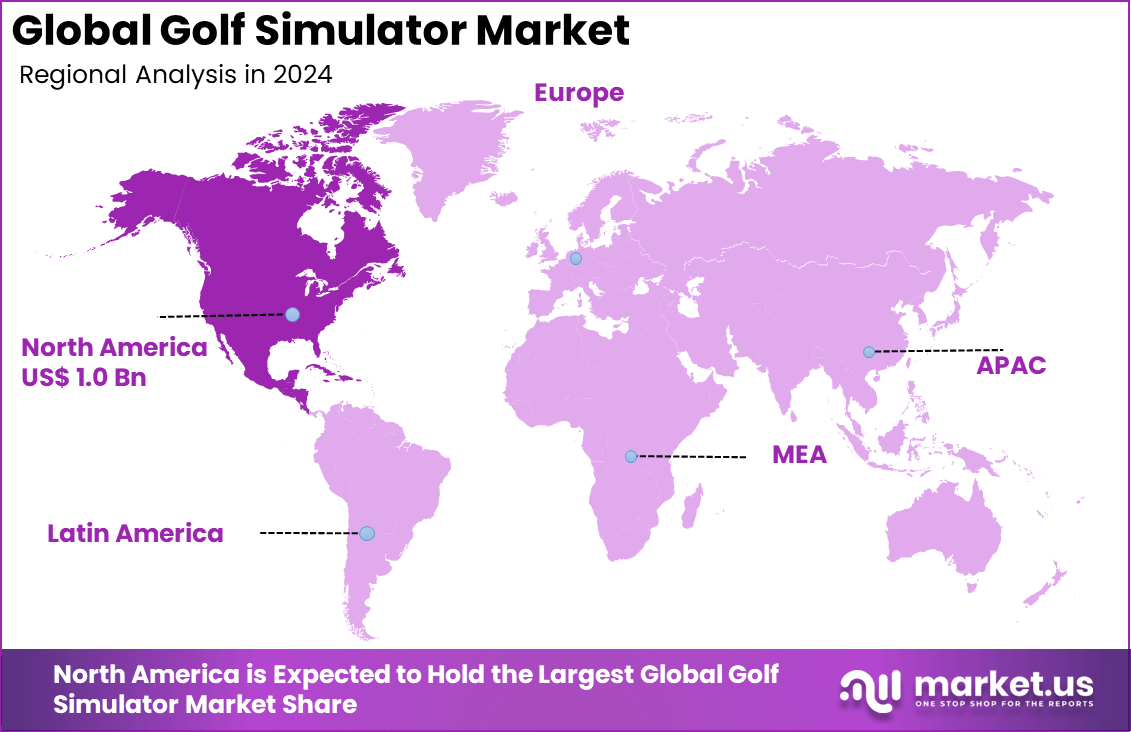

The Global Golf Simulator Market size is expected to be worth around USD 6.1 billion by 2034, from USD 2.4 billion in 2024, growing at a CAGR of 9.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 41.8% share, holding USD 1.0 billion in revenue.

The Golf Simulator Market is characterized by structured segments featuring hardware, software, portable and enclosed systems tailored for residential and commercial applications. It is defined by increasing realism in digital golf experiences and by systems capable of tracking detailed swing and ball metrics via sensors, cameras, radar and advanced software platforms.

Top Driving Factors are grounded in greater convenience and accessibility. The elimination of weather dependency and travel, combined with the appeal of indoor play, underpin sustained interest. The emergence of cost‑effective portable models and rising consumer desire for immersive home experiences also contribute significantly.

For instance, in May 2025, Virginia State University (VSU) received a new golf simulator from the PGA, enhancing its sports facilities and offering students access to advanced golfing technology. This donation underscores the growing integration of golf simulators in educational institutions, allowing students to train and practice in a year-round, controlled environment.

Market Size and Growth

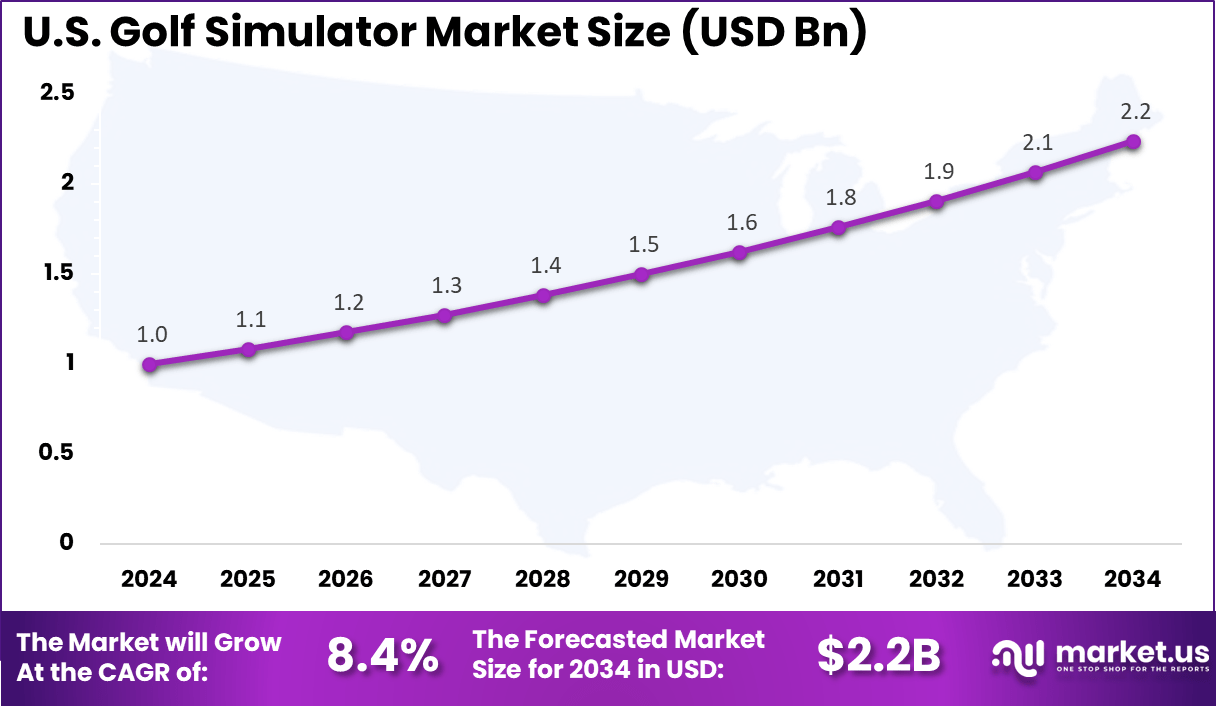

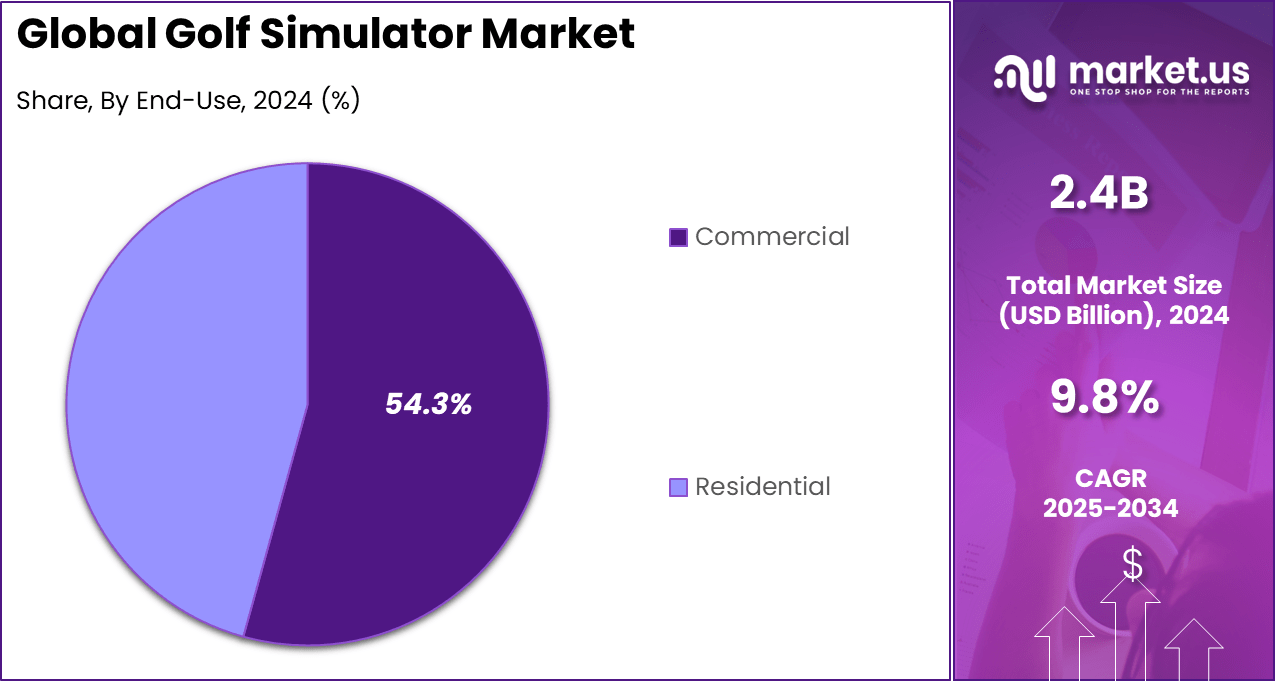

Metric Statistic / Value Market Value (2024) USD 2.4 Bn Forecast Revenue (2034) USD 6.1 Bn CAGR(2025-2034) 9.8% Leading Segment Full Swing Simulator: 84.5% Region with Largest Share North America [41.8% Market Share] Largest Country U.S. [USD 1.0 bn Market Revenue], CAGR: 8.4% Key Takeaway

- The market is projected to grow from USD 2.4 billion in 2024 to approximately USD 6.1 billion by 2034, expanding at a CAGR of 9.8%, driven by the rising popularity of virtual sports experiences and year-round indoor golfing.

- North America led the global market with a 41.8% share, generating USD 1.0 billion in revenue, supported by strong recreational spending and widespread adoption in clubs, lounges, and training centers.

- The U.S. market alone contributed USD 1.0 billion in 2024 and is expected to grow at a CAGR of 8.4%, driven by high-income demographics and growing interest in tech-enabled golf training.

- Hardware offerings held the largest share at 61.2%, reflecting the demand for screens, sensors, launch monitors, and immersive hardware systems.

- Built-in simulators accounted for 38.7%, favored for permanent installations in commercial golf centers and luxury residences.

- The Full Swing Simulator type dominated with an overwhelming 84.5% share, known for its high realism, motion tracking, and professional-grade accuracy.

- Indoor installations led with a 78.6% share, as space-saving and climate-controlled environments make indoor setups highly practical and popular.

- The Commercial segment accounted for 54.3%, driven by entertainment venues, golf academies, and sports bars seeking to enhance customer engagement and revenue streams.

Role of AI

Role/Function Description Real-Time Swing Analysis AI analyzes swing mechanics, ball trajectory, club speed, spin, launch angle, and shot dispersion for personalized coaching Performance Optimization Machine learning provides customized feedback, helping golfers refine skills with precise data Enhanced Visualization AI aids in rendering 4K graphics, immersive virtual courses, and real-time data overlays for more realistic simulation Personalized Experience AI adapts game difficulty, recommends courses, and tailors challenges to player skill levels Integration with VR/AR AI supports augmented and virtual reality enhancements for immersive and interactive golfing sessions Automation & Maintenance AI improves simulator reliability through automated performance monitoring and error detection U.S. Market Size

The market for Golf Simulator within the U.S. is growing tremendously and is currently valued at USD 1.0 billion, the market has a projected CAGR of 8.4%. The growth of indoor golf centers and entertainment venues like Five Iron Golf, X-Golf, and Topgolf Swing Suites is making golf simulators more mainstream, appealing to both serious golfers and casual players.

Technological innovations, such as AI-driven swing analysis, 4K graphics, and real-time feedback, have enhanced the golfing experience, attracting a wider audience. Additionally, the increasing demand for indoor fitness and recreation, along with the social nature of these venues, is driving market expansion. These factors, along with rising consumer interest and commercial investments, fuel the U.S. golf simulator market’s growth.

For instance, in September 2025, X-Golf America announced the grand opening of X-Golf National Park, further strengthening the U.S.’s dominance in the golf simulator market. The new venue is set to provide state-of-the-art indoor golf experiences, featuring advanced simulators and interactive gameplay, appealing to both casual and serious golfers.

In 2024, North America held a dominant market position in the Global Golf Simulator Market, capturing more than a 41.8% share, holding USD 1.0 billion in revenue. This dominance is due to the strong golf culture, high per capita income, and well-established distribution networks of leading simulator brands. Urban areas in North America have seen growing commercial adoption, with simulation-based golf bars and private clubs offering year-round play.

Advancements in simulation technology and increasing demand for immersive experiences further support this growth. Additionally, advancements in technology, coupled with increasing consumer interest in fitness and golf, have boosted the adoption of simulators. Commercial investments and a strong golf culture further solidify North America’s leadership in this market.

For instance, in January 2025, Golf VX entered the North American franchising market with its first venue, marking a significant step in expanding its presence in the region. This move underscores North America’s dominance in the golf simulator market, where demand for indoor golfing experiences continues to rise.

Offering Analysis

In 2024, The Hardware segment held a dominant market position, capturing a 61.2% share of the Global Golf Simulator Market. This dominance is due to the essential role that high-quality hardware, such as sensors, projectors, screens, and tracking systems, plays in delivering an accurate and immersive golfing experience.

The demand for high-quality equipment keeps growing as more customers aspire to lifelike simulations and improved features. Increasing use of simulators and technological advancements contributes to the hardware’s continued dominance in the market.

For Instance, in January 2024, Uneekor made significant announcements at the PGA Show, showcasing new products and features designed to enhance the golf simulator experience. These innovations included advanced technologies such as AI-driven swing analysis and new hardware additions aimed at providing more accurate and immersive simulations. Uneekor’s continued focus on precision and user experience.

Type Analysis

In 2024, the Built-in segment held a dominant market position, capturing a 38.7% share of the Global Golf Simulator Market. The demand for built-in golf simulators has been driven by the increasing preference for integrated, space-saving solutions that offer easy installation and a smooth user experience.

These systems, commonly found in high-end commercial venues and luxury homes, offer permanent, high-quality setups with advanced features like accurate ball tracking and immersive graphics. They provide year-round golfing in controlled indoor environments, making them especially appealing in regions with harsh weather or limited outdoor golf options. It makes built-in systems attractive to both serious golfers and businesses.

For instance, in November 2024, Garmin launched the Approach R50 Launch Monitor, a new built-in golf simulator system. This monitor features advanced features such as precise shot tracking, real-time performance data, and integration with Garmin’s ecosystem, making it an excellent option for golfers looking to improve their game indoors.

Simulator Type Analysis

In 2024, the Full Swing Simulator segment held a dominant market position, capturing an 84.5% share of the Global Golf Simulator Market. This dominance is due to its precise ball tracking, realistic gameplay, and professional-grade performance, making it highly popular among golfers, commercial venues, and sports professionals.

Celebrity endorsements and partnerships with pro golfers have further boosted its credibility and appeal. The segment’s leadership is reinforced by its adoption in luxury residences, training centers, and entertainment venues, where demand for immersive full-room simulations with advanced features like dual tracking and 4K graphics continues to grow.

For Instance, in March 2024, Full Swing Golf announced the integration of its Full Swing KIT launch monitor with the Onform mobile video coaching platform. This collaboration enhances the user experience by allowing golfers to analyze their swings alongside video footage, providing real-time insights and improving training effectiveness.

Installation Type Analysis

In 2024, the Indoor segment held a dominant market position, capturing a 78.6% share of the Global Golf Simulator Market. This dominance is due to the growing demand for year-round, weather-independent golfing experiences.

Indoor golf simulators provide immersive, high-tech features like AI-powered swing analysis, 4K graphics, and realistic motion tracking, appealing to both residential users and commercial venues, including sports clubs, entertainment centers, and corporate spaces.

For Instance, in August 2025, Clubhouse Hawaii elevated indoor golf in Honolulu by introducing TrackMan simulators, offering premium club fittings, and year-round events. This expansion into high-quality golf simulators positions the venue as a leader in providing top-tier golfing experiences, combining cutting-edge technology with tailored services to attract both serious golfers and enthusiasts.

End-Use Analysis

In 2024, The Commercial segment held a dominant market position, capturing a 54.3% share of the Global Golf Simulator Market. This dominance is driven by the growing adoption of golf simulators in commercial spaces such as sports clubs, entertainment venues, and corporate facilities, offering unique, year-round experiences that appeal to diverse customers.

The rise of golf lounges, simulation-based bars, and entertainment centers, along with increasing demand for interactive and social golfing, has boosted the segment. Technological advancements like AI-driven analytics, real-time tracking, and multiplayer features enhance engagement, while rising disposable incomes and strategic partnerships further fuel the market’s growth in the commercial sector.

For Instance, In November 2024, Cerca Homes introduced a new range of prefab golf simulator studios tailored for backyard and commercial spaces. These ready-to-install units emphasize ease of use, durability, and space efficiency, offering a practical solution for delivering high-quality indoor golf experiences to both enthusiasts and businesses.

Top 5 Growth Factors

Key Factors Description Rising Popularity of Indoor Sports Increased demand for year-round, convenient indoor golfing recreational experiences Technological Advancements Improved realism, motion tracking, high-definition visuals, and AI-driven analytics Expansion of Indoor Golf Centers Growth of commercial venues like Five Iron Golf, X-Golf, and Topgolf Swing Suites driving adoption Increasing Golf Participation Golf’s growing popularity globally, especially in urban areas with limited outdoor space Use in Training and Entertainment Wide adoption by amateurs and professionals for practice and leisure, including corporate and social Key Market Segments

By Offering

- Hardware

- Launch Monitors (radar-based, camera-based)

- Projectors

- Golf Mats & Screens

- Enclosures/Cages

- Ball Tracking Systems

- Others

- Software

- Services

- Installation & Integration

- Maintenance & Support

- Subscription-based Content & Software Updates

By Type

- Built-in

- Portable

- Free Standing

By Simulator Type

- Full Swing Simulator

- Virtual Reality (VR) Simulator

By Installation Type

- Indoor

- Outdoor

By End-Use

- Residential

- Commercial

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Increasing Popularity of Indoor and Virtual Golf

With the growing interest in indoor sports and virtual activities, golf simulators are becoming a more popular option than traditional playing. These simulators are designed to enable players to play golf at any time of the year, regardless of their location or weather conditions.

This makes them an excellent choice for those seeking to practice or play golf frequently. The availability of these simulators and advancements in technology has made golf a more desirable activity, particularly in urban areas or regions with limited outdoor golf courses.

For instance, in May 2025, BenQ and other leading projector brands contributed to the increasing popularity of indoor and virtual golf by powering the latest golf simulators. These projectors enhance the realism and immersive experience of virtual golf, making it more accessible and enjoyable for both casual and serious players.

Restraint

High Initial Costs

While golf simulators offer advanced technological features, the high initial costs remain a significant barrier for many potential buyers. High-end models with realistic simulations require substantial investment in both the simulator itself and additional equipment such as sensors, projectors, and screens.

Furthermore, space requirements for proper installation can add to the financial burden, making it difficult for individual consumers and small businesses to justify the upfront costs. This financial hurdle limits wider market penetration.

For instance, in January 2025, according to a report by Carlofet, the high cost of golf simulators remains a significant factor limiting their widespread adoption. While entry-level models may start at lower prices, high-end systems with advanced features like realistic ball tracking, 4K graphics, and immersive environments can cost several thousand dollars.

Opportunities

Technological Advancements

The golf simulator industry is experiencing significant growth due to the development of virtual reality, augmented reality, and motion tracking technology. Compared to previous versions, the golfing experience is becoming more authentic and thrilling.

The demand for top-notch simulators is rising due to advancements in graphics, sensors, and data analysis that enable more accurate simulations. With technological progress, the potential to produce more efficient, cost-effective, and user-friendly products arises, resulting in increased market opportunities.

For instance, in March 2025, Roblox launched the Ultimate Golf Simulator, partnering with PING and First Tee to bring a more immersive virtual golf experience to the gaming world. This collaboration highlights the technological advancements in golf simulation, combining PING’s expertise in golf equipment with Roblox’s gaming platform to create a dynamic, interactive experience.

Challenges

Competition from Traditional Golf

The popularity of traditional outdoor golf persists, despite its seasonal restrictions. Golf simulators face stiff competition from this well-established and widely accepted form of the sport. To encourage players to switch to simulators, companies must demonstrate that it is a straightforward process, cost-effective, and allows for consistent playing and practice throughout the year.

For instance, In March 2025, LIV Golf partnered with YouTube to launch a new duel series in Miami, featuring popular personalities like Grant Horvat. This move highlights the shift toward innovative golf formats that blend entertainment, online streaming, and virtual elements. As younger, tech-savvy audiences gravitate toward these dynamic experiences, traditional golf faces rising competition from modern, digitally integrated alternatives.

Key Players Analysis

TrackMan and Foresight Sports have remained two of the most influential players in the golf simulator market. TrackMan’s advanced radar and video tracking systems are widely used for professional training and analysis, while Foresight Sports has gained popularity for its high-performance indoor launch monitors. Both companies have developed ecosystems of connected tools and software, enabling seamless user experiences.

Golfzon, Full Swing Golf, and SkyTrak have contributed significantly to the market’s expansion across recreational and home-use segments. Golfzon’s AI-powered simulators are known for immersive experiences, while Full Swing Golf benefits from its partnerships with top-tier athletes. SkyTrak has found strong traction among budget-conscious consumers due to its accessible pricing and mobile integration.

Uneekor, HD Golf, AboutGolf, and OptiShot Golf continue to differentiate through product features and user personalization. Uneekor has gained attention for its ceiling-mounted camera systems, while HD Golf offers photo-realistic environments. AboutGolf and OptiShot focus on modular design and flexible software, making them attractive to indoor facility operators and home users.

Top Key Players in the Market

- TrackMan

- Foresight Sports

- Golfzon

- Full Swing Golf

- SkyTrak

- Uneekor

- HD Golf

- AboutGolf

- OptiShot Golf

- Rapsodo

- BenQ

- Bushnell Golf

- Ernest Sports, Inc.

- Others

Recent Developments

- In August 2025, Corpus Christi opened its first indoor golf simulation venue in the Bay Area. This new facility brings the benefits of virtual golf to the region, offering residents and visitors year-round access to a high-quality golfing experience regardless of weather conditions.

- In February 2025, BenQ unveiled the AK700ST, the most advanced model in its ACE Series of golf simulator projectors. Equipped with a 4,000-lumen 4K laser light source, the AK700ST delivers lifelike visuals, vibrant colors, and rich textures. Engineered for easy installation and minimal ambient light interference, it offers a highly immersive golf simulation experience.

- In January 2024, SkyTrak unveiled its new all-in-one golf simulator studios at the PGA Merchandise Show. These innovative studios combine advanced simulation technology with comprehensive training features, providing users with a complete and immersive golfing experience.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (Hardware, Software, Services), By Type (Built-in, Portable, Free Standing), By Simulator Type (Full Swing Simulator, Virtual Reality (VR) Simulator), By Installation Type (Indoor, Outdoor), By End-Use (Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape TrackMan, Foresight Sports, Golfzon, Full Swing Golf, SkyTrak, Uneekor, HD Golf, AboutGolf, OptiShot Golf, Rapsodo, BenQ, Bushnell Golf, Ernest, Sports, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- TrackMan

- Foresight Sports

- Golfzon

- Full Swing Golf

- SkyTrak

- Uneekor

- HD Golf

- AboutGolf

- OptiShot Golf

- Rapsodo

- BenQ

- Bushnell Golf

- Ernest Sports, Inc.

- Others