Global Golf Cart Battery Market Size, Share, Growth Analysis By Battery Type (Lead-acid, Lithium-ion), By Voltage (12V, 6V, 8V, Others), By End User (Golf Courses, Commercial Services), By Sales Channel (Original Equipment Manufacturer (OEM), Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155083

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

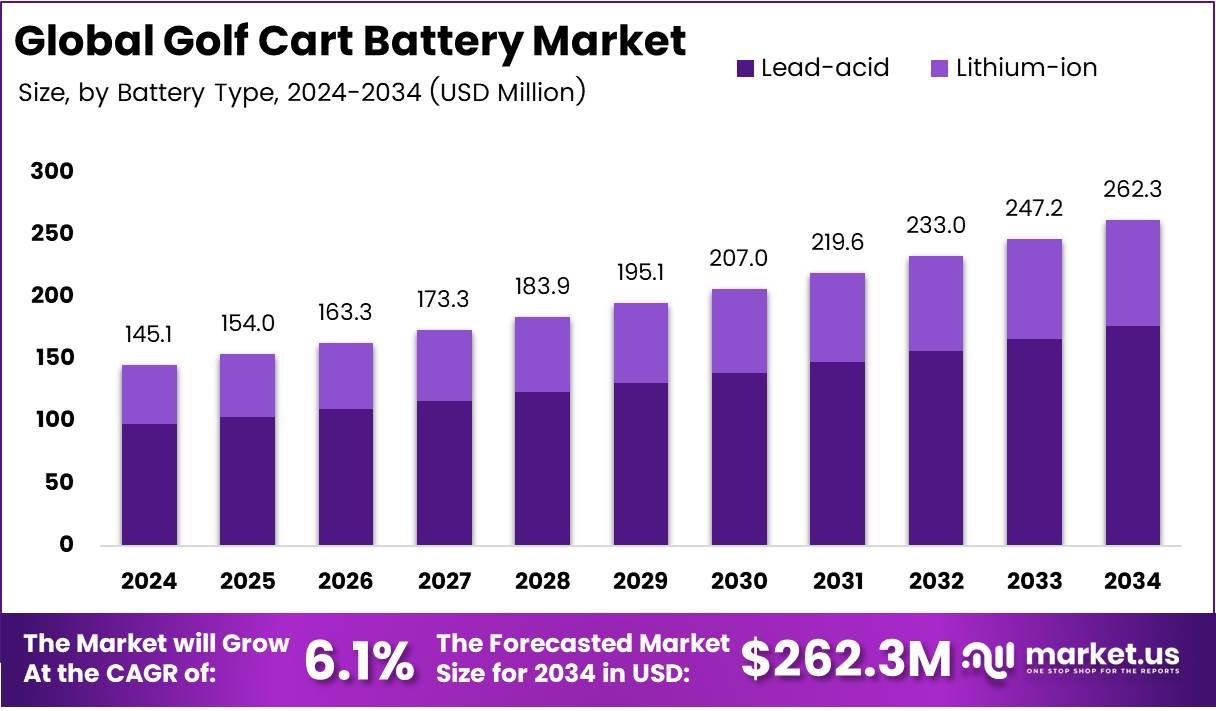

The Global Golf Cart Battery Market size is expected to be worth around USD 262.3 Million by 2034, from USD 145.1 Million in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

The golf cart battery market serves as a niche yet critical segment within the broader electric mobility landscape. It primarily caters to powering golf carts across courses, resorts, gated communities, and commercial spaces. Businesses view it as a dependable revenue channel, driven by recurring replacement cycles and performance upgrades.

Over the years, advancements in lithium-ion and sealed lead-acid technologies have improved battery efficiency, lifespan, and charging speed. Manufacturers leverage these improvements to meet growing customer expectations for low-maintenance, eco-friendly solutions. This transition from conventional lead-acid to advanced chemistries is reshaping purchase decisions and fueling competitive product innovation.

Rising golf tourism and community-based mobility needs create steady market opportunities. Premium courses and high-end resorts increasingly upgrade fleets to electric carts with enhanced battery capacity. This shift aligns with broader sustainability goals, while also reducing operational costs over time—appealing to both commercial operators and facility managers.

Government investment and supportive regulations further accelerate market growth. Policies promoting electric vehicle adoption indirectly benefit golf cart battery demand. Tax incentives, sustainability mandates, and local air-quality regulations encourage course operators to replace older combustion-based carts with electric models, thereby boosting the aftermarket for battery replacement.

Emerging markets show significant growth potential as golf gains traction in Asia-Pacific and Latin America. Infrastructure expansion, rising disposable incomes, and new course development contribute to higher demand for battery-powered fleets. Players in the market are increasingly targeting these regions with cost-effective, durable battery solutions.

Seasonal maintenance and replacement cycles ensure a stable aftermarket revenue stream for suppliers. Fleet managers prioritize reliability and operational readiness, creating ongoing demand for high-performance batteries with minimal downtime. Manufacturers that offer flexible service plans and rapid delivery options gain a competitive advantage in these high-utilization environments.

According to the R&A, global on-course golfers reached 43.3M in affiliated markets in 2024, up from 42.7M in 2023, highlighting sustained facility demand. According to the NGF, U.S. rounds hit a record 545M in 2024, maintaining over 500M annually for five consecutive years, directly expanding fleet battery cycling and charging requirements.

Moreover, according to the Battery Council, U.S. lead batteries maintain an impressive ~99% recycling rate, the highest of any consumer product. This high recycling performance strengthens the market’s eco-positioning, enhancing its appeal to environmentally conscious buyers and aligning with global sustainability trends in the golf cart battery market.

Key Takeaways

- Global Golf Cart Battery Market projected to reach USD 262.3 Million by 2034 from USD 145.1 Million in 2024, at a CAGR of 6.1% (2025–2034).

- Lead-acid batteries dominate By Battery Type with 67.3% share in 2024, due to low cost, reliability, and compatibility.

- 12V batteries lead By Voltage with 38.7% share in 2024, offering versatility, availability, and affordability.

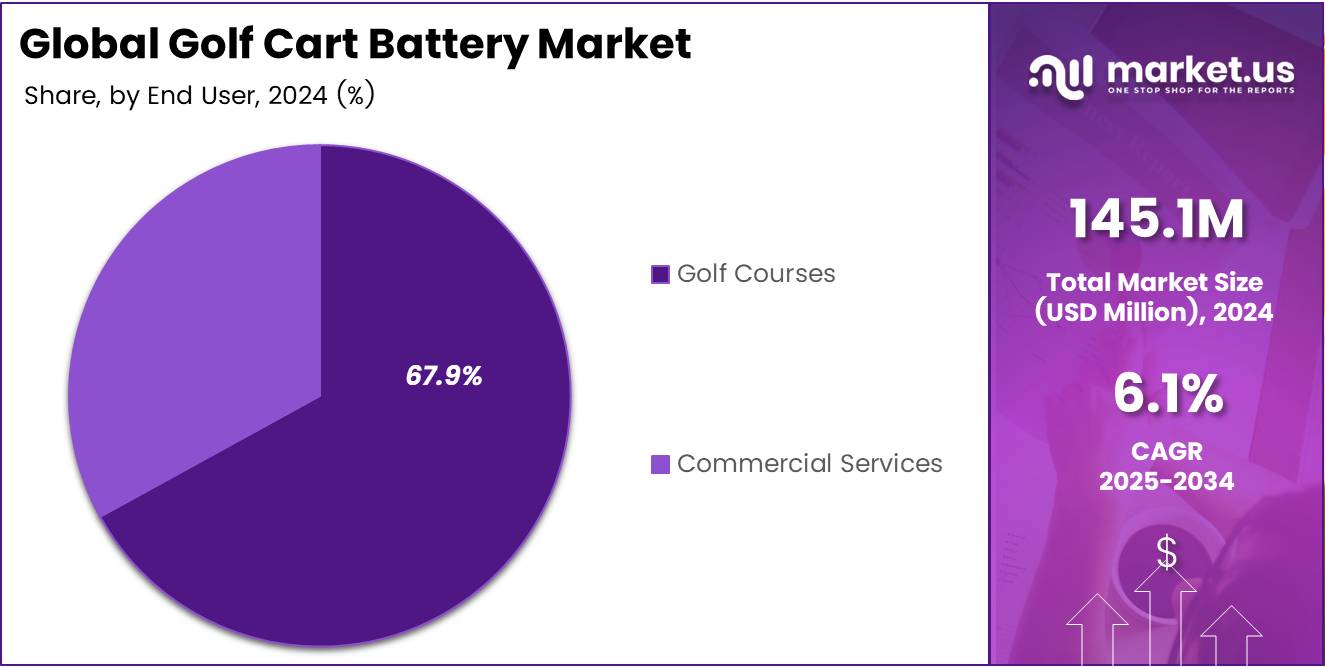

- Golf Courses dominate By End User with 67.9% share in 2024, driven by large fleet operational needs.

- OEM sales channel leads By Sales Channel with 67.2% share in 2024, ensuring compatibility and performance via direct manufacturer supply.

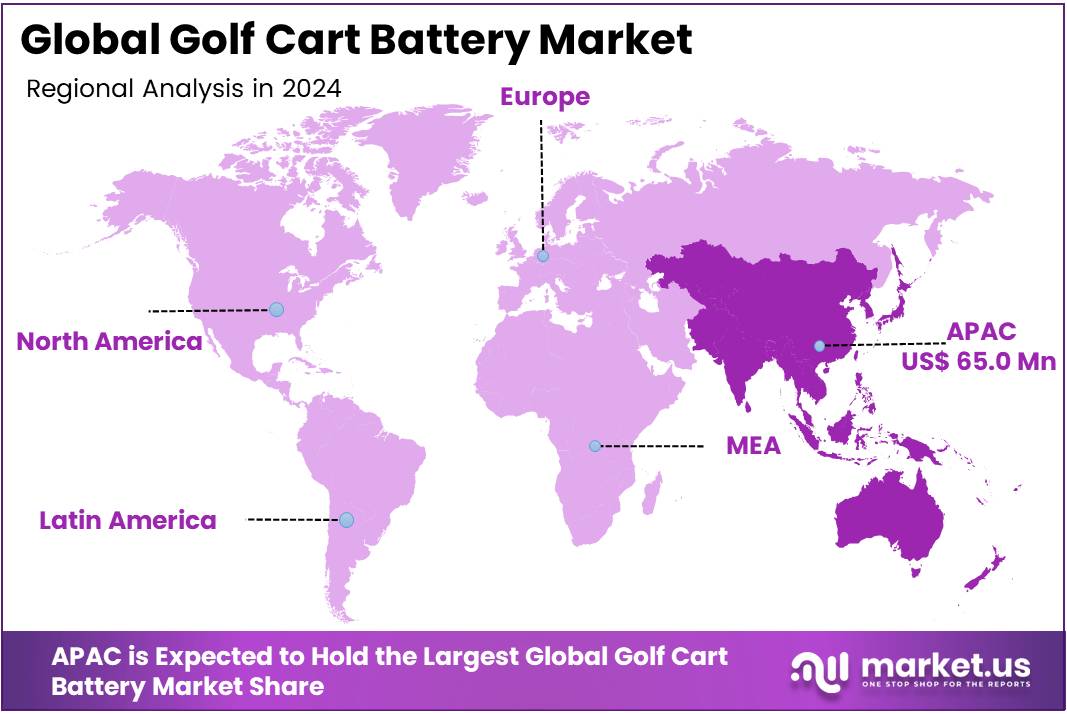

- Asia Pacific holds the largest regional share at 44.8% (USD 65.0 Million in 2024), fueled by urbanization, tourism, and sustainable transport initiatives.

Battery Type Analysis

Lead-acid dominates with 67.3% due to its affordability and established market presence.

In 2024, Lead-acid held a dominant market position in the By Battery Type Analysis segment of the Golf Cart Battery Market, with a 67.3% share. The dominance of lead-acid batteries is primarily attributed to their low upfront cost, proven performance reliability, and ease of maintenance. Golf course operators and commercial service providers continue to rely on lead-acid technology for its compatibility with existing charging infrastructure and cost-effectiveness in fleet management.

Despite their heavier weight and shorter lifecycle compared to newer technologies, lead-acid batteries remain a preferred choice for budget-conscious buyers and those with moderate daily usage needs. Their recycling infrastructure is also well-established, contributing to continued adoption in mature markets.

Meanwhile, Lithium-ion batteries are steadily gaining traction in the golf cart sector. They offer longer lifespan, faster charging, and lower long-term maintenance costs. However, higher initial investment requirements have limited their adoption in certain price-sensitive markets.

Over the forecast period, the market is expected to see gradual growth in lithium-ion adoption, especially among premium golf courses and commercial operators seeking operational efficiency. Nonetheless, the entrenched position of lead-acid technology is expected to maintain its dominance in the short term.

Voltage Analysis

12V dominates with 38.7% due to its compatibility and widespread usage in standard golf cart systems.

In 2024, 12V held a dominant market position in the By Voltage Analysis segment of the Golf Cart Battery Market, with a 38.7% share. The popularity of 12V batteries stems from their versatility, availability, and compatibility with a wide range of golf cart models. They are often favored for their balance between power output, maintenance convenience, and affordability.

The 6V segment follows closely, primarily used in configurations that require multiple batteries to achieve desired voltage and range. They are valued for their deep-cycle performance, particularly in courses with extended operating hours.

8V batteries serve as a middle ground, offering more power than 6V while reducing the total number of batteries needed in a setup. This makes them appealing for fleets seeking efficiency in both cost and space management.

The Others category, which includes less common voltage types, holds a niche share, typically catering to specialized golf cart models or customized applications.

Over time, while advanced battery chemistries might influence the voltage mix, the well-established infrastructure and proven utility of the 12V segment are likely to sustain its market leadership.

End User Analysis

Golf Courses dominate with 67.9% due to their consistent demand for fleet battery replacements.

In 2024, Golf Courses held a dominant market position in the By End User Analysis segment of the Golf Cart Battery Market, with a 67.9% share. The sustained demand from golf courses is driven by their need to maintain large fleets for daily operations. Battery reliability, capacity, and durability are critical in ensuring smooth transportation of players and equipment across expansive golf course layouts.

Many golf courses opt for periodic bulk battery replacements to ensure consistent performance and avoid downtime during peak seasons. Their procurement decisions often prioritize proven battery types that balance cost and performance, making them a key revenue contributor for battery suppliers.

Commercial Services, including resorts, gated communities, and industrial facilities, also represent a significant segment. Their adoption of golf carts for transportation and utility purposes is increasing, especially in locations emphasizing sustainable mobility. However, their purchasing volumes are typically smaller compared to golf courses.

While commercial services may adopt newer battery technologies faster due to diverse operational needs, the dominant share of golf courses is expected to remain intact, supported by the stable nature of the golfing industry and the essential role carts play in the sport.

Sales Channel Analysis

Original Equipment Manufacturer (OEM) dominates with 67.2% due to direct integration and quality assurance.

In 2024, Original Equipment Manufacturer (OEM) held a dominant market position in the By Sales Channel Analysis segment of the Golf Cart Battery Market, with a 67.2% share. OEM channels benefit from direct supply agreements with golf cart manufacturers, ensuring that batteries are specifically designed and tested for compatibility and performance. This integration minimizes installation issues and enhances overall customer satisfaction.

OEM-supplied batteries often come with comprehensive warranties and after-sales support, further boosting their appeal to buyers seeking reliability and long-term service assurance. Fleet operators, particularly in golf courses and commercial facilities, frequently prefer OEM-sourced batteries to reduce the risk of operational disruptions.

The Aftermarket segment caters to replacement demand, often offering competitive pricing and a wider range of options, including upgraded battery technologies. While aftermarket sales provide flexibility for end users to select from various brands, concerns over compatibility and warranty coverage can limit their penetration in certain markets.

Over the coming years, the OEM segment is projected to maintain its leadership position, supported by the trust factor, direct manufacturer relationships, and the continued growth of the global golf cart market.

Key Market Segments

By Battery Type

- Lead-acid

- Lithium-ion

By Voltage

- 12V

- 6V

- 8V

- Others

By End User

- Golf Courses

- Commercial Services

By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

Drivers

Rising Adoption of Lithium-Ion Batteries for Enhanced Performance and Longevity

The golf cart battery market is witnessing a steady shift from traditional lead-acid batteries to advanced lithium-ion technology. Lithium-ion batteries offer longer lifespan, faster charging times, and consistent performance, making them increasingly attractive for golf course operators and individual users.

The expansion of golf tourism is also fueling demand for high-performance batteries. With more golf courses being developed globally, especially in Asia-Pacific and the Middle East, the need for reliable and efficient golf carts is growing. This trend directly supports the adoption of advanced battery technologies to meet high usage demands.

Another key driver is the increasing integration of smart battery management systems (BMS) in golf carts. These systems help monitor battery health, optimize charging cycles, and extend operational life. By preventing overcharging and deep discharging, smart BMS ensures that golf carts maintain optimal performance throughout the day, improving efficiency for golf course operations.

Restraints

High Initial Cost of Advanced Battery Technologies Limiting Adoption in Budget-Sensitive Markets

One of the major challenges facing the golf cart battery market is the high upfront cost of advanced lithium-ion batteries. While these batteries offer long-term savings through lower maintenance and extended life, budget-sensitive buyers, especially smaller golf courses, often opt for cheaper lead-acid options.

Additionally, limited charging infrastructure in remote golf destinations restricts the use of modern battery technologies. Many developing regions lack fast-charging facilities, making it difficult to adopt advanced batteries that require specialized charging equipment.

This combination of cost barriers and infrastructure gaps slows market penetration, especially in emerging economies where golf is still developing. Without supportive financing options or infrastructure investment, the transition to high-performance battery systems may remain limited in these regions.

Growth Factors

Development of Solar-Powered Charging Solutions for Golf Carts

The golf cart battery market is seeing promising growth opportunities in renewable energy solutions. Solar-powered charging systems can reduce dependence on grid electricity, lower operational costs, and support eco-friendly initiatives in golf courses.

Expanding into non-golf sectors such as industrial warehouses, resorts, and hospitality venues presents another growth avenue. In these environments, golf carts are increasingly used for transport and logistics, boosting battery demand beyond traditional applications.

Strategic partnerships between battery manufacturers and golf cart OEMs are expected to accelerate innovation. Collaborative efforts can result in customized solutions, better performance integration, and improved after-sales services.

Furthermore, the introduction of swappable battery systems offers operational efficiency by reducing downtime. This technology allows quick battery changes, ensuring uninterrupted service in high-demand environments.

Emerging Trends

Increasing Demand for Eco-Friendly and Recyclable Battery Materials

Environmental concerns are driving demand for eco-friendly golf cart batteries. Manufacturers are focusing on recyclable materials and reducing harmful chemicals, aligning with sustainability goals of modern golf courses.

Premium golf carts are also shifting toward maintenance-free battery technologies, eliminating the need for regular water refills or servicing. This trend enhances user convenience and reduces operational interruptions.

Additionally, the growing popularity of lightweight, high-efficiency battery designs is influencing purchasing decisions. Lighter batteries improve cart performance, extend range, and reduce strain on the motor, making them ideal for both leisure and commercial use.

Regional Analysis

Asia Pacific Dominates the Golf Cart Battery Market with a Market Share of 44.8%, Valued at USD 65.0 Million

The Asia Pacific region holds the 44.8% market share, Valued at USD 65.0 Million, driven by rapid urbanization, growing tourism, and expanding golf courses across countries like China, Japan, and India. The adoption of electric-powered carts is further supported by government initiatives promoting sustainable transportation. Increasing recreational activities and the expansion of luxury resorts also contribute to the region’s strong market presence.

North America Golf Cart Battery Market Trends

North America is a significant market for golf cart batteries, supported by the presence of a large number of golf courses and country clubs. High consumer spending on leisure activities and the rising demand for electric vehicles in residential communities drive market growth. Technological advancements in battery efficiency also enhance adoption in this region.

Europe Golf Cart Battery Market Trends

The European market benefits from a growing emphasis on eco-friendly mobility solutions and the expansion of golf tourism. Countries such as the UK, Germany, and France are seeing steady demand due to rising interest in golf and sustainable transportation within resorts and recreational facilities. Regulations promoting reduced emissions are further boosting the transition toward electric carts.

Middle East and Africa Golf Cart Battery Market Trends

In the Middle East and Africa, the market is expanding due to the development of luxury resorts, golf courses, and gated communities. The adoption of electric golf carts is encouraged by rising tourism in countries like the UAE and South Africa. Investments in infrastructure and high-end hospitality projects are fostering greater demand for advanced battery solutions.

Latin America Golf Cart Battery Market Trends

Latin America’s market growth is supported by the rising popularity of golf and leisure tourism in countries such as Brazil and Mexico. The region is witnessing gradual adoption of electric golf carts as resorts and golf courses modernize their fleets. Economic development and increasing tourism infrastructure are creating opportunities for further expansion of the market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Golf Cart Battery Company Insights

The global golf cart battery market in 2024 is shaped by a mix of established battery manufacturers leveraging advanced technologies to enhance performance, sustainability, and cost efficiency.

C&D Technologies, Inc. continues to focus on innovative lead-acid and AGM battery solutions, offering dependable performance for golf carts in both recreational and commercial applications. Their expertise in industrial energy storage positions them as a consistent and reliable supplier in the market.

Clarios LLC leverages its large-scale manufacturing capabilities and advanced battery technologies to serve a wide range of electric mobility applications, including golf carts. With a focus on sustainability and efficiency, the company emphasizes extended battery life and reduced maintenance needs, appealing to both OEMs and end-users.

Crown Battery stands out for its emphasis on durable, deep-cycle battery designs tailored to demanding golf cart applications. Their strong reputation for quality and service support, combined with a focus on performance under extreme conditions, keeps them competitive in diverse market environments.

DURACELL INC. brings strong brand recognition and consumer trust into the golf cart battery space. Known for reliability in consumer batteries, the company applies its quality standards to larger-scale energy solutions, ensuring consistent performance and a low-maintenance experience for users.

Overall, the competitive landscape in 2024 is marked by technological improvements, brand strength, and supply chain capabilities. These key players maintain market relevance through a balance of innovation, product longevity, and responsiveness to shifting customer expectations for sustainable and efficient golf cart power solutions.

Top Key Players in the Market

- C&D TECHNOLOGIES, INC.

- Clarios LLC

- Crown Battery

- DURACELL INC.

- East Penn Manufacturing Co., Inc.

- EnerSys

- Exide Technologies

- GS YUASA INTERNATIONAL LTD.

- INTERSTATE BATTERIES

- Leoch International Technology Limited

Recent Developments

- In Aug 2024, EV battery manufacturer Neuron Energy successfully raised ₹200 million in funding to expand production capabilities and enhance its R&D for next-generation electric vehicle batteries. This investment aims to strengthen its market position and meet the growing demand for sustainable mobility solutions.

- In Mar 2025, Yamaha previewed its latest line of electric golf carts powered by an in-house-developed LFP battery technology, promising longer life cycles and improved safety. The innovation reflects Yamaha’s push into sustainable recreational transport solutions.

- In Oct 2024, Khon Kaen University (KKU) unveiled revolutionary sodium-ion battery-powered golf carts at Srinagarind Hospital, marking a significant leap in eco-friendly hospital transportation. The sodium-ion technology offers a cost-effective and sustainable alternative to conventional lithium batteries.

- In Jan 2025, Motive Energy acquired Deep Cycle Battery San Diego to strengthen its service network and expand its presence in Southern California. This strategic acquisition is expected to enhance customer reach and offer improved local battery solutions.

- In Jul 2025, Bolt Energy USA launched a high-performance 48V 60Ah lithium battery targeting electric vehicle and energy storage markets. The new product offers improved energy density, longer runtime, and better durability for commercial and recreational applications.

Report Scope

Report Features Description Market Value (2024) USD 145.1 Million Forecast Revenue (2034) USD 262.3 Million CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Battery Type (Lead-acid, Lithium-ion), By Voltage (12V, 6V, 8V, Others), By End User (Golf Courses, Commercial Services), By Sales Channel (Original Equipment Manufacturer (OEM), Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape C&D TECHNOLOGIES, INC., Clarios LLC, Crown Battery, DURACELL INC., East Penn Manufacturing Co., Inc., EnerSys, Exide Technologies, GS YUASA INTERNATIONAL LTD., INTERSTATE BATTERIES, Leoch International Technology Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- C&D TECHNOLOGIES, INC.

- Clarios LLC

- Crown Battery

- DURACELL INC.

- East Penn Manufacturing Co., Inc.

- EnerSys

- Exide Technologies

- GS YUASA INTERNATIONAL LTD.

- INTERSTATE BATTERIES

- Leoch International Technology Limited