Global Wood-Based Panel Market Size, Share, And Industry Analysis Report By Product (Plywood, MDF, HDF, PB, OSB, Softboard, Hardboard), By Thickness (Up to 10 mm, 10 mm to 50 mm, Above 50 mm), By Application (Furniture, Residential, Commercial, Construction, Floor and Roof, Wall, Door, Others, Packaging, Others), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 176595

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

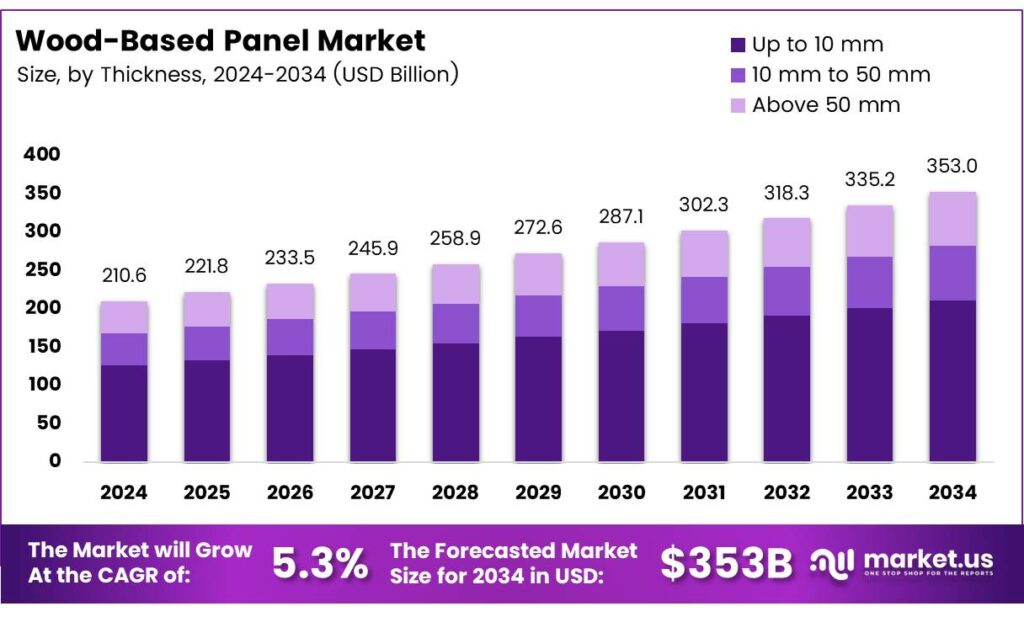

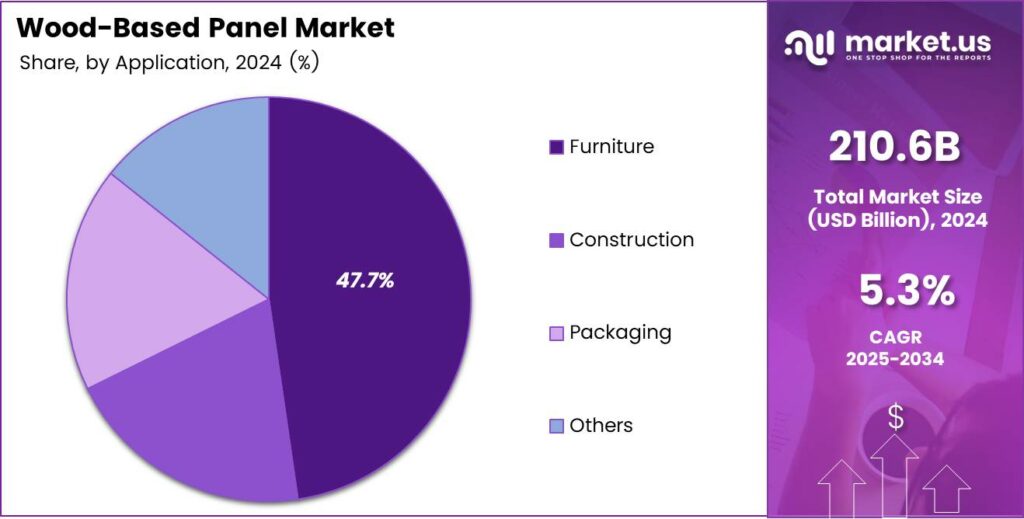

The Global Wood-Based Panel Market size is expected to be worth around USD 353.0 billion by 2034, from USD 210.6 billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034.

The Wood-Based Panel Market represents a broad category of engineered materials such as MDF, particleboard, plywood, and oriented strand board, widely used in construction, interiors, and furniture. It continues gaining traction as industries shift toward sustainable building materials that ensure durability, design flexibility, and cost-efficient manufacturing.

Demand increases steadily as residential construction, modular furniture, and commercial renovation projects expand globally. Manufacturers focus on efficiency, using advanced pressing systems and resin technologies that reduce emissions while improving mechanical performance. This encourages buyers in construction and décor to shift from solid wood to engineered wood solutions.

- Blending wood fibres with 10–50% pine cone flour can notably cut formaldehyde emissions in MDF, though levels above 10% may reduce water resistance and flexural strength. Linen husk panels using bio-adhesives show strong, furniture-grade performance, while particleboards made with hemp husks or maize seeds are about 30% lighter than conventional boards, offering clear logistical advantages.

Furthermore, opportunities arise from the rising need for cost-effective and eco-friendly furniture materials. Lightweight panels help reduce logistics costs and energy consumption during processing. Interior design brands increasingly prefer wood-based composite panels that provide uniform texture, stability, and compatibility with laminates and veneers across residential and office environments.

Sustainability regulations encourage producers to explore low-formaldehyde board formulations. Consumer awareness regarding indoor air quality has accelerated innovation in bio-based adhesives and alternative fibre compositions. Markets in Asia-Pacific and Europe show significant adoption as construction norms emphasize renewable raw materials and reduced carbon footprints.

Key Takeaways

- The Global Wood-Based Panel Market is projected to reach USD 353.0 billion by 2034, growing from USD 210.6 billion in 2024 at a 5.3% CAGR.

- Plywood leads the By Product segment with a 33.1% market share in 2025.

- The 10 mm to 50 mm thickness segment dominates the By Thickness category with a 59.5% share.

- Furniture remains the largest application segment, accounting for 47.7% of the market in 2025.

- Offline distribution channels hold a strong lead with 72.9% share in 2025.

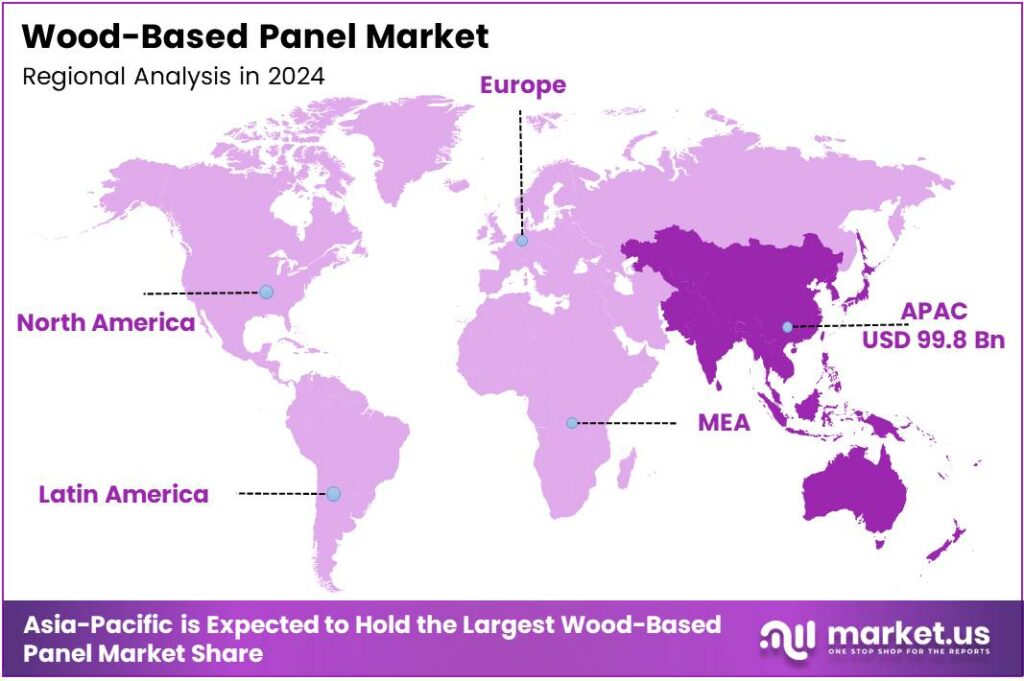

- Asia Pacific is the leading regional market with a 47.4% share valued at USD 99.8 billion.

By Product Analysis

Plywood dominates with 33.1% due to its strong structural reliability and wide utility.

In 2025, ‘Plywood’ held a dominant market position in the ‘By Product’ Analysis segment of the Wood-Based Panel Market, with a 33.1% share. Plywood remained widely preferred for furniture, interiors, and construction because of its durability and resistance to bending. Its stability across applications continued to support strong purchasing trends.

MDF showed consistent demand as manufacturers increasingly adopted it for decorative interiors and cabinetry. Its smooth surface and ease of shaping made it suitable for modern designs. Buyers also leaned toward MDF because it offers cost-effective performance for mass-produced furniture without compromising on finish quality.

HDF gained traction through its superior density and robustness, which supported applications requiring heavy-duty performance. Producers found it ideal for flooring substrates and high-strength furniture components. Its uniformity and mechanical strength kept it competitive despite rising material costs across engineered wood categories.

Softboard witnessed moderate demand, serving mainly insulation and sound-absorbing applications. Its lightweight composition supported wall linings and acoustic treatments. Growing awareness of energy-efficient buildings created new interest, especially in renovation projects focused on thermal performance improvements.

Hardboard maintained niche demand where dense, smooth panels are required. It was commonly used for drawer bottoms, backing panels, and decorative laminates. Despite limited usage, its strength and uniformity ensured its relevance in specific manufacturing environments, emphasizing quality finishes.

By Thickness Analysis

10 mm to 50 mm dominates with 59.5% due to its wide usability across furniture and construction needs.

In 2025, ‘10 mm to 50 mm’ held a dominant market position in the ‘By Thickness’ Analysis segment of the Wood-Based Panel Market, with a 59.5% share. This range suited most cabinetry, shelving, furniture frames, and structural needs. Its flexibility in machining and installation ensured widespread industry-wide adoption.

Up to 10 mm-thick panels mainly served applications requiring lightweight and thin-layering. These panels were preferred for drawer bottoms, cabinet backers, interior decorative finishes, and packaging elements. Their ease of handling and low material consumption supported growing demand among cost-conscious manufacturers.

Above 50 mm thickness was selected for heavy-duty applications. Their sturdy construction made them ideal for industrial furniture, specialized flooring, and architectural elements requiring enhanced load-bearing capability. Although used in limited volumes, these panels remained important for high-strength structural and customized design projects.

By Application Analysis

Furniture dominates with 47.7%, driven by rising interior décor demand and modular design trends.

In 2025, ‘Furniture’ held a dominant market position in the ‘By Application’ Analysis segment of the Wood-Based Panel Market, with a 47.7% share. Strong demand for modular, ready-to-assemble, and space-efficient furniture boosted consumption. The segment benefited from rising residential furnishing activities and urban lifestyle transitions.

Residential applications continued expanding with increased home-building and renovation. Consumers preferred engineered panels for wardrobes, kitchen cabinets, and decorative partitions. The rise of compact homes further encouraged efficient woodworking solutions, supporting consistent panel uptake across major housing markets.

Construction applications relied on wood-based panels for sheathing, flooring, roofing, and structural frameworks. Panels offered better cost efficiency compared to solid wood. Increasing adoption of prefabricated building solutions further supported stable panel demand in structural and semi-structural areas.

Packaging applications utilized lightweight engineered boards for protective casing and product transport. Furniture packaging, electronics packing, and industrial crates are increasingly adopting these materials. Their consistent strength-to-weight ratio ensured safer handling and reduced overall packaging costs.

By Distribution Channel Analysis

Offline dominates with 72.9% due to strong dealer networks and bulk procurement patterns.

In 2025, ‘Offline’ held a dominant market position in the ‘By Distribution Channel’ Analysis segment of the Wood-Based Panel Market, with a 72.9% share. Offline stores supplied builders, contractors, and furniture makers through established supply chains. Their capacity for bulk delivery and material inspection supported consistent, large-volume procurement.

Online channels grew steadily as buyers increasingly browsed specifications digitally. E-commerce platforms provided easy comparisons and convenient ordering for small-scale manufacturers and DIY users. Although online share remained smaller, growing digital awareness continued to support gradual expansion in this segment.

Key Market Segments

By Product

- Plywood

- MDF

- HDF

- PB

- OSB

- Softboard

- Hardboard

By Thickness

- Up to 10 mm

- 10 mm to 50 mm

- Above 50 mm

By Application

- Furniture

- Residential

- Commercial

- Construction

- Floor and Roof

- Wall

- Door

- Others

- Packaging

- Others

By Distribution Channel

- Online

- Offline

Emerging Trends

Rising Demand for Sustainable Building Materials Drives Market Growth

Several key trends are shaping the wood-based panel market. One of the strongest trends is the movement toward environmentally friendly and low-emission products. Consumers now prefer boards that are free from harmful chemicals, pushing manufacturers to adopt bio-based adhesives and cleaner production processes.

- In the United States, the EPA’s TSCA Title VI standards set formaldehyde emission limits for key composite wood products, including 0.09 ppm for particleboard, 0.11 ppm for MDF, and 0.13 ppm for thin MDF—numbers that directly shape how panels are formulated and certified.

Digitalization is also influencing the market. Automated cutting, advanced finishing, and digital printing technologies are making wood panels more attractive and customizable. This allows designers to create high-quality interiors with unique textures and patterns, increasing customer interest in engineered wood products.

Drivers

Rising Demand for Sustainable Building Materials Drives Market Growth

The wood-based panel market is growing mainly because builders and furniture makers are shifting toward sustainable and eco-friendly materials. As more consumers prefer renewable products, wood panels have become a natural choice in residential and commercial projects. This demand is further supported by government rules promoting green construction, which pushes manufacturers to adopt certified wood sources.

- Another major driver is the rapid rise in urban housing. With new apartments, modular kitchens, and ready-to-assemble furniture becoming common, the consumption of plywood, MDF, and particleboard keeps increasing. In the EU, the European Commission’s Renovation Wave aims to renovate 35 million buildings by 2030 and at least double the annual renovation rate.

Growth in renovation activities also supports the demand for wood-based panels. Homeowners frequently upgrade interiors, which increases the need for decorative panels, doors, flooring, and cabinetry materials. The versatility and strength of wood panels make them suitable for multiple applications across the construction sector.

Restraints

Rising Demand for Sustainable Building Materials Drives Market Growth

The wood-based panel market faces challenges mainly due to the fluctuating cost and availability of raw materials. Timber shortages in some regions make it difficult for manufacturers to maintain stable pricing. Deforestation controls, while essential for sustainability, also limit the supply of wood, increasing production costs and affecting profitability for companies.

- The U.S. Census Bureau reported privately-owned housing starts in October 2025 at a seasonally adjusted annual rate of 1,246,000 units. Even when construction slows in some months, ongoing completions and repairs still keep panels moving through distribution channels—especially particleboard and MDF used in furniture and interiors.

The strict environmental regulations related to formaldehyde emissions. Many traditional wood panels use resins that release harmful gases, and growing health concerns have forced manufacturers to modify their formulas. Meeting these standards requires expensive technology upgrades, which smaller producers may struggle to afford.

Growth Factors

Rising Demand for Sustainable Building Materials Drives Market Growth

The wood-based panel market has several promising opportunities, especially with the shift toward eco-friendly construction. As more developers adopt green building certifications, demand for low-emission and sustainably sourced panels will continue to rise. Manufacturers who invest in certified raw materials and cleaner production methods can capture a larger share of this market.

A major opportunity lies in advanced furniture manufacturing. Modular and ready-to-assemble furniture is expanding quickly across urban markets, driven by changing lifestyles and increasing rental housing. This trend creates strong demand for MDF, particleboard, and decorative panels with better aesthetics and durability.

Emerging economies present additional opportunities. Rapid urbanization in Asia-Pacific, Africa, and parts of Latin America is boosting demand for affordable housing and interior products. This creates long-term prospects for companies offering cost-effective engineered wood solutions. Innovation in water-resistant and fire-resistant panels can further expand the range of applications, helping companies reach new customer segments.

Regional Analysis

Asia Pacific Dominates the Wood-Based Panel Market with a Market Share of 47.4%, Valued at USD 99.8 Billion

Asia Pacific holds the leading position in the global wood-based panel market, capturing a substantial 47.4% share valued at USD 99.8 billion. This dominance is supported by strong construction growth, rising furniture production, and increasing residential renovation activities across China, India, and Southeast Asian nations. Rapid industrial development and easy access to raw materials further strengthen the region’s manufacturing capability, making Asia Pacific the core hub for global panel exports.

North America continues to show steady demand for wood-based panels, driven by ongoing housing developments, repair-and-remodel activities, and the expansion of engineered wood product applications. The United States accounts for the majority of the regional consumption due to its robust construction sector and high adoption of sustainable building materials. Rising emphasis on green-certified buildings is also supporting the shift toward engineered wood products.

Europe remains a mature yet innovative market for wood-based panels, backed by strong environmental regulations and advanced manufacturing technologies. Demand is shaped by the region’s well-established furniture and interior décor industries, particularly in countries such as Germany, Poland, and Italy. Increasing adoption of circular economy practices and bio-based materials continues to drive product modernization in the European market.

The Middle East and Africa region is experiencing gradual growth, supported by rising urbanization and infrastructure development projects, especially in GCC countries. Demand for wood-based panels is growing in residential and commercial construction as governments diversify investments beyond traditional sectors. Improvements in distribution networks and increased furniture manufacturing further aid market expansion across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2025, Arauco continues to look like a scale-driven leader in wood-based panels, supported by its integrated forestry base and long-term investment approach. Its advantage lies in securing a stable fiber supply while maintaining consistent product performance for both domestic and export markets. The company is also positioned well as global buyers increasingly prioritize responsibly sourced raw materials.

Boise Cascade Company remains a strong North American player with a practical competitive edge built around distribution reach and close alignment with building products demand. In 2025, its strategy focuses on staying close to contractors and jobsite needs, providing steady availability and dependable logistics—factors that become especially valuable during construction market volatility.

EGGER Group’s 2025 outlook is defined by its emphasis on value-added, design-oriented boards, including decorative surfaces and engineered interior solutions. The company typically competes through manufacturing efficiency and a wide design portfolio, which helps protect margins even when commodity panel prices fluctuate. Analysts will also monitor how it balances rising energy costs with regional production capacities.

Georgia-Pacific LLC continues to differentiate itself with broad product coverage and deep distribution channels across the building materials ecosystem. In 2025, its scale supports market reliability, and long-standing brand familiarity sustains share in segments where builders rely on proven quality. A key focus remains its ability to manage raw material cost swings while maintaining strong service levels and competitive lead times.

Top Key Players in the Market

- Arauco

- Boise Cascade Company

- EGGER Group

- Georgia-Pacific LLC

- Kronospan

- Louisiana-Pacific Corporation (LP)

- Pfleiderer Group S.A.

- Roseburg Forest Products

- Swiss Krono Group

- U.S. Lumber Group LLC

- West Fraser Timber Co. Ltd.

- Weyerhaeuser Company

Recent Developments

- In 2025, Arauco enhanced its operational capacity with increased production of Thermally Fused Laminate (TFL) panels, as highlighted in their Q2 newsletter. The company’s board approved the construction of a new MDF line in Zitácuaro, Mexico, which began operating in the second quarter.

- In 2025, EGGER acquired a minority stake in Thai wood-based material manufacturer Panel Plus Co., Ltd., to strengthen its market position in Asia. The company started production at its new wood-based materials plant in Markt Bibart, Germany, after a two-year construction period, marking its 22nd plant.

Report Scope

Report Features Description Market Value (2024) USD 210.6 Billion Forecast Revenue (2034) USD 353.0 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Plywood, MDF, HDF, PB, OSB, Softboard, Hardboard), By Thickness (Up to 10 mm, 10 mm to 50 mm, Above 50 mm), By Application (Furniture, Residential, Commercial, Construction, Floor and Roof, Wall, Door, Others, Packaging, Others), By Distribution Channel (Online, Offline) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Arauco, Boise Cascade Company, EGGER Group, Georgia-Pacific LLC, Kronospan, Louisiana-Pacific Corporation (LP), Pfleiderer Group S.A., Roseburg Forest Products, Swiss Krono Group, U.S. Lumber Group LLC, West Fraser Timber Co. Ltd., Weyerhaeuser Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Wood-Based Panel MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Wood-Based Panel MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Arauco

- Boise Cascade Company

- EGGER Group

- Georgia-Pacific LLC

- Kronospan

- Louisiana-Pacific Corporation (LP)

- Pfleiderer Group S.A.

- Roseburg Forest Products

- Swiss Krono Group

- U.S. Lumber Group LLC

- West Fraser Timber Co. Ltd.

- Weyerhaeuser Company