Global Whipping Cream Powder Market Size, Share, And Enhanced Productivity By Source (Dairy, Non-dairy), By Type (Sweetened Whipping Cream Powder, Unsweetened Whipping Cream Powder), By Application (Bakery and Confectionery, Icecream and frozen desserts, Beverages, Others), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173823

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

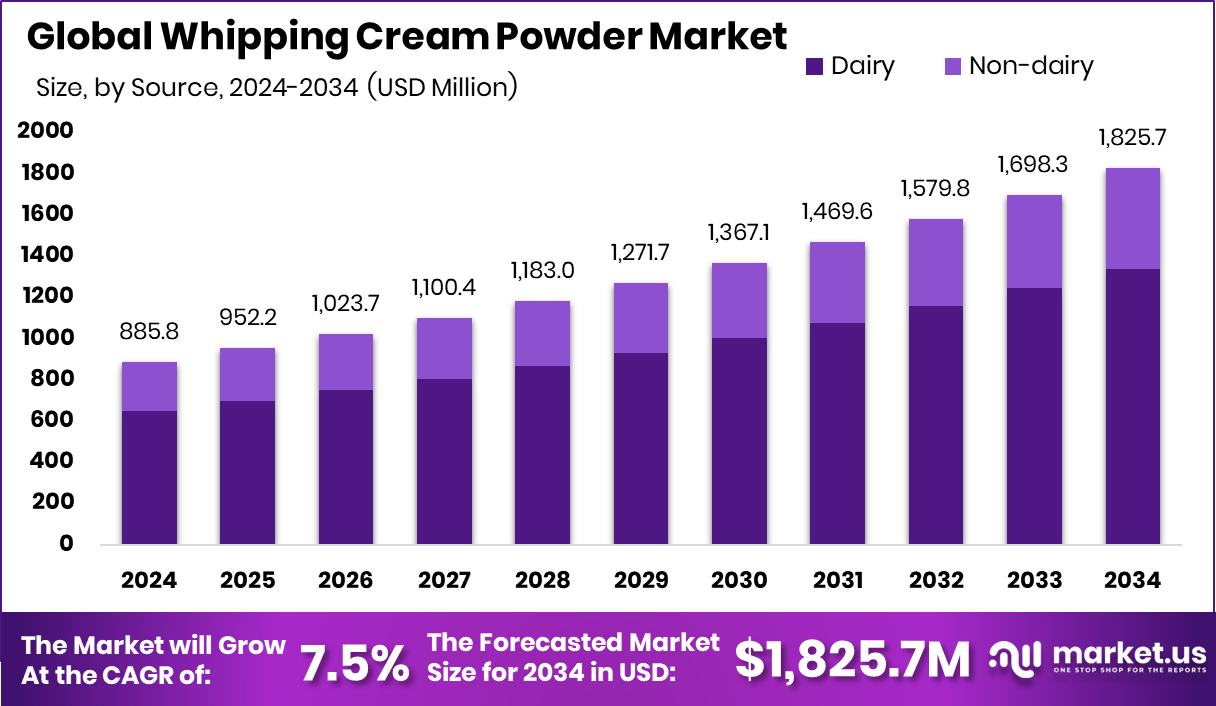

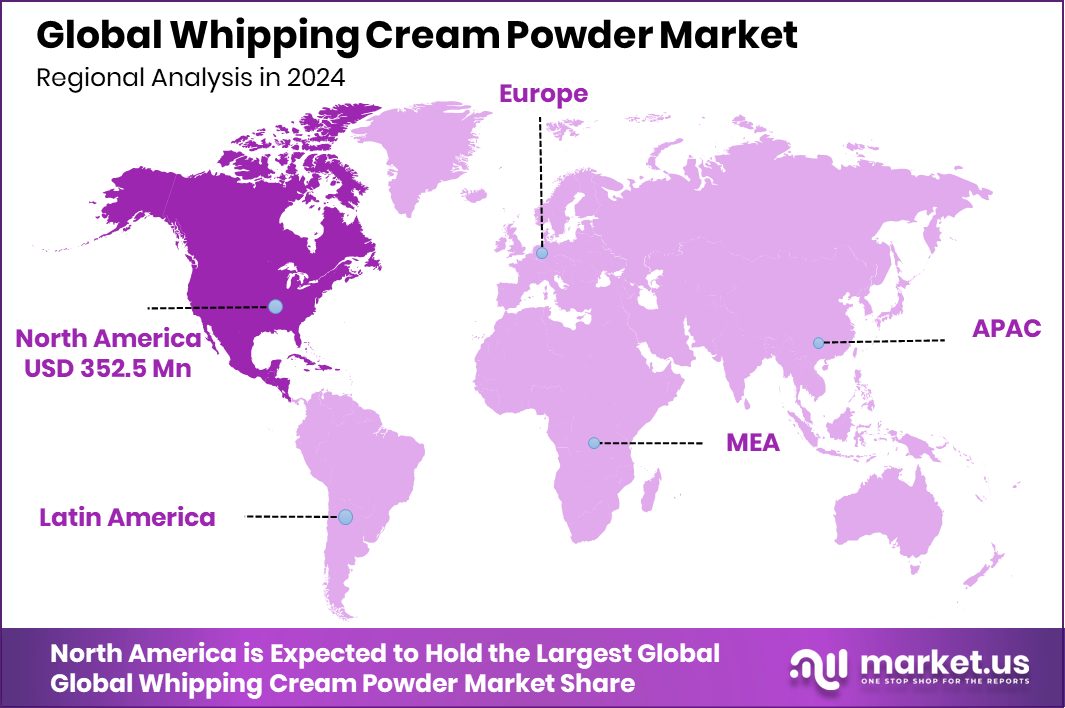

The Global Whipping Cream Powder Market is expected to be worth around USD 1,825.7 million by 2034, up from USD 885.8 million in 2024, and is projected to grow at a CAGR of 7.5% from 2025 to 2034. North America accounts for 39.8% Whipping Cream Powder Market, worth USD 352.5 Mn.

Whipping cream powder is a dehydrated cream product designed to deliver the taste, texture, and whipping performance of fresh cream with a longer shelf life. It is easy to store, quick to reconstitute, and widely used in desserts, cakes, beverages, and fillings. Powdered format reduces spoilage risk and offers consistent results, making it suitable for both professional kitchens and home use.

The whipping cream powder market represents the commercial ecosystem around producing, distributing, and using this ingredient across foodservice, bakery, confectionery, and packaged food applications. Growth is supported by convenience-focused food preparation and rising preference for stable dairy and dairy-free alternatives that simplify logistics and production planning.

Growth factors include innovation in alternative fats and cream systems. Startups such as Whipnotic, which raised $2.5M for whipped cream innovation, and a dairy-free cream startup securing $2.7 million in seed funding, show strong investor confidence in next-generation whipping solutions. These investments reflect demand for improved texture, clean labels, and plant-based functionality.

Demand is rising as consumers seek variety beyond traditional dairy. An Israeli startup raised $8M to develop zero-waste, butter-like vegan fat, while Gavan raised $8M to introduce clean-label butter alternatives in Europe, indirectly supporting whipping cream powder applications.

Opportunities extend into broader food innovation ecosystems. Capital inflows such as $8.6M invested by Kea into plant-based milk, alongside unrelated but confidence-boosting raises like $95M for Apex and $6M Series A for Vacation, signal strong cross-sector appetite for scalable, branded consumer products—creating a favorable climate for whipping cream powder innovation.

Key Takeaways

- The Global Whipping Cream Powder Market is expected to be worth around USD 1,825.7 million by 2034, up from USD 885.8 million in 2024, and is projected to grow at a CAGR of 7.5% from 2025 to 2034.

- Whipping Cream Powder Market is led by dairy sources, holding 73.2% share globally today worldwide.

- Sweetened whipping cream powder dominates the Whipping Cream Powder Market by type, with 66.7% share overall.

- Bakery and confectionery applications drive the Whipping Cream Powder Market demand, accounting for 46.9% share usage.

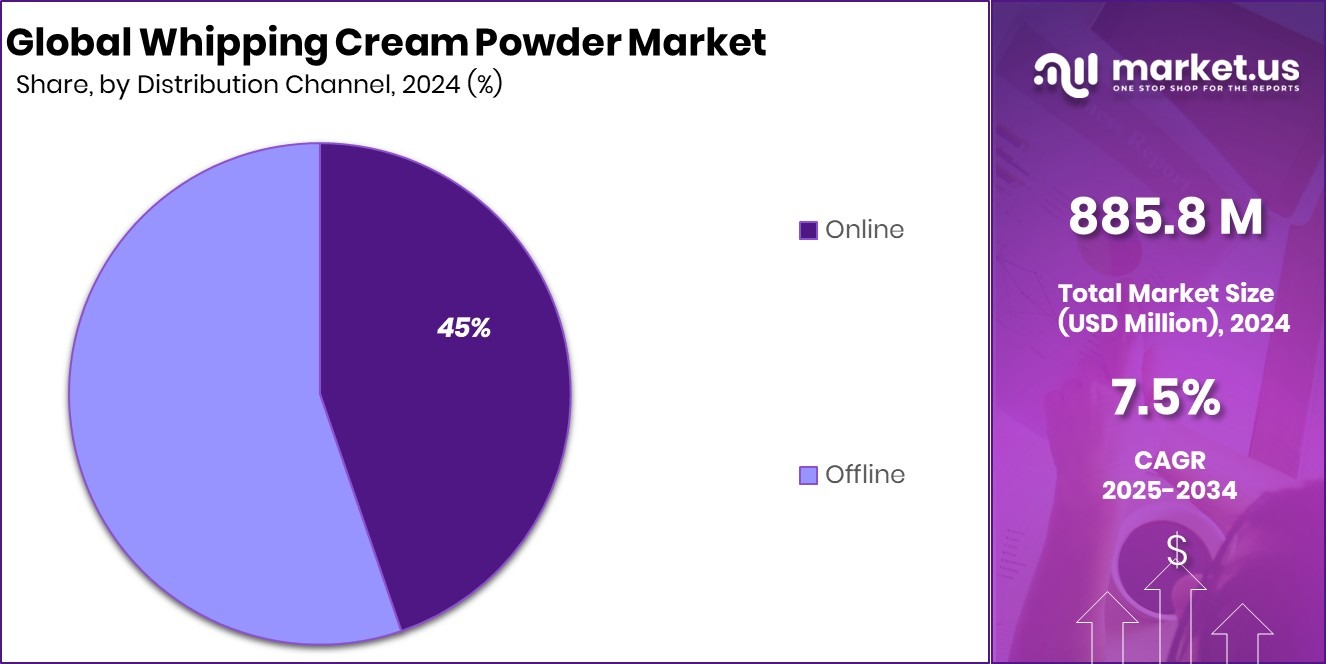

- Offline channels remain crucial in Whipping Cream Powder Market distribution, contributing 68.3% sales volume globally.

- Whipping Cream Powder Market in North America reached 39.8% share, totaling USD 352.5 Mn.

By Source Analysis

In Whipping Cream Powder Market, dairy sources dominate with a 73.2% share.

In 2024, the Whipping Cream Powder Market saw dairy-based sources take a commanding lead, accounting for 73.2% of overall demand. This dominance reflects strong industry trust in dairy inputs for delivering authentic cream taste, superior mouthfeel, and reliable whipping performance. Food manufacturers continue to prefer dairy sources because they ensure consistent aeration, stable foam structure, and clean flavor release in finished products.

Dairy-based whipping cream powders also align well with traditional recipes used by commercial bakeries, confectioners, and foodservice operators. Their compatibility with existing production equipment and predictable shelf-life behavior further supports adoption. Despite rising interest in plant-based alternatives, dairy sources remain the benchmark for quality, functionality, and consumer familiarity within the global whipping cream powder landscape.

By Type Analysis

In Whipping Cream Powder Market, sweetened whipping cream powder leads with 66.7%.

In 2024, the Whipping Cream Powder Market was largely shaped by product preference, with sweetened whipping cream powder capturing a 66.7% share. Sweetened variants reduce formulation complexity for manufacturers by eliminating the need for additional sugar blending, saving both time and processing costs. This convenience is especially valuable in high-volume bakery and dessert production, where consistency is critical.

Sweetened whipping cream powder also delivers balanced sweetness and stable whipping performance, making it ideal for cakes, pastries, mousses, and ready-to-use dessert mixes. Its longer shelf life and easy reconstitution support efficient inventory management. These functional and operational advantages continue to drive strong demand for sweetened formats across both industrial and artisanal food production settings.

By Application Analysis

In Whipping Cream Powder Market, bakery and confectionery applications hold 46.9% demand.

In 2024, the Whipping Cream Powder Market experienced strong traction in bakery and confectionery applications, which together accounted for 46.9% of total consumption. These segments rely heavily on whipping cream powder for its ability to deliver uniform texture, smooth mouthfeel, and consistent volume across batches. Bakeries value the ease of storage compared to liquid cream, while confectioners benefit from precise portion control and reduced spoilage risks.

The ingredient supports a wide range of products, including cakes, fillings, chocolates, frostings, and decorative toppings. Growing demand for premium baked goods and indulgent desserts has further strengthened usage. As urban lifestyles and packaged bakery consumption expand, this application segment continues to anchor market growth.

By Distribution Channel Analysis

In the Whipping Cream Powder Market, offline distribution channels account for 68.3% sales.

In 2024, the Whipping Cream Powder Market remained strongly influenced by offline distribution channels, which accounted for 68.3% of total sales. Physical channels such as wholesalers, food ingredient distributors, specialty baking stores, and cash-and-carry outlets continue to dominate due to established procurement practices among commercial buyers.

Many bakeries and food manufacturers prefer offline purchasing for bulk buying, immediate product inspection, and reliable supply relationships. Offline channels also provide technical guidance and formulation support, which is critical for professional users. Despite steady growth in digital sourcing, offline networks retain an edge in trust, logistics efficiency, and after-sales service, making them the primary route to market for whipping cream powder globally.

Key Market Segments

By Source

- Dairy

- Non-dairy

By Type

- Sweetened Whipping Cream Powder

- Unsweetened Whipping Cream Powder

By Application

- Bakery and Confectionery

- Icecream and frozen desserts

- Beverages

- Others

By Distribution Channel

- Online

- Offline

Driving Factors

Expanding Premium Confectionery Fuels Whipping Cream Powder Demand

The Whipping Cream Powder Market is strongly driven by the fast growth of premium confectionery and dessert brands that demand stable, easy-to-use cream ingredients. Whipping cream powder helps confectioners maintain consistent texture, volume, and shelf life across chocolates, fillings, and toppings. This trend is reinforced by fresh capital entering the confectionery space.

In 2024, Oroos Confectionery secured INR 20 Cr in funding led by Fireside Ventures, highlighting rising confidence in scalable dessert brands. As premium sweets move from artisanal to organized retail, manufacturers increasingly rely on whipping cream powder for uniform quality and production efficiency. This shift toward branded, premium confectionery continues to push steady demand for functional cream powder solutions.

Restraining Factors

Fresh Cream Preference Limits Powdered Cream Adoption

A key restraint in the Whipping Cream Powder Market is the continued preference for fresh and chilled cream in indulgent dessert categories. Some consumers and bakers perceive liquid cream as more natural, especially in premium cookies and baked goods. This mindset shapes product development choices among dessert brands.

For example, Doughlicious raised $5 million to expand its dessert range, which often emphasizes fresh ingredients and indulgent textures. Such funding supports products where liquid cream remains central, limiting faster substitution by powdered formats. While whipping cream powder offers storage and consistency advantages, overcoming taste perception and traditional baking habits remains a challenge in select high-end dessert segments.

Growth Opportunity

Chocolate Innovation Creates New Application Opportunities

Growing innovation in chocolate and snack products presents a strong growth opportunity for the Whipping Cream Powder Market. Chocolate brands increasingly experiment with whipped fillings, layered textures, and creamy coatings that benefit from stable powdered cream inputs.

In 2024, Awake Chocolate from Canada celebrated raising $8 million in funding, reflecting investor interest in differentiated chocolate products. As such brands scale production, whipping cream powder becomes attractive due to its consistency, ease of handling, and reduced spoilage risk. This opens new application areas in filled chocolates, whipped inclusions, and hybrid dessert snacks, supporting long-term market expansion.

Latest Trends

Rapid Ice Cream Brand Scaling Shapes Ingredient Trends

One of the latest trends influencing the Whipping Cream Powder Market is the rapid scaling of ice cream and frozen dessert brands. Large-scale expansion requires ingredients that perform consistently across batches and locations.

In this context, Hocco raised INR 115 Cr at a Rs 2,000 Cr valuation, with funding led by Sauce.vc. Such growth highlights rising demand for reliable cream systems in frozen desserts. Whipping cream powder supports this trend by offering uniform whipping behavior, easier storage, and operational efficiency, making it increasingly relevant for fast-growing ice cream brands.

Regional Analysis

North America leads the Whipping Cream Powder Market at 39.8% share, USD 352.5 Mn.

North America remains the dominating region in the Whipping Cream Powder Market, holding a 39.8% share and valued at USD 352.5 Mn, driven by its mature bakery industry, high consumption of packaged desserts, and strong demand from foodservice operators seeking shelf-stable dairy ingredients. Europe follows as a well-established market, supported by deep-rooted bakery and confectionery traditions where whipping cream powder is widely used for consistency and operational efficiency.

Asia Pacific represents an expanding regional landscape, fueled by urbanization, growing café culture, and rising adoption of Western-style baked goods across commercial and artisanal bakeries. The Middle East & Africa market shows steady demand, largely linked to the growth of hospitality, premium desserts, and centralized bakery operations that favor long-shelf-life ingredients.

Latin America continues to develop as a consumption market, supported by increasing availability of processed bakery products and gradual modernization of food manufacturing practices. Across regions, whipping cream powder benefits from advantages such as ease of storage, reduced wastage, and formulation flexibility, making it a preferred alternative to liquid cream. Regional demand patterns are closely tied to bakery scale, foodservice expansion, and preference for consistent dairy functionality.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Kraft Heinz brings scale, brand discipline, and operational consistency to the whipping cream powder space. Its strength lies in standardized formulations, robust quality controls, and deep integration with bakery and dessert ecosystems. Kraft Heinz benefits from strong relationships with commercial food manufacturers and foodservice buyers that value reliability, shelf stability, and uniform performance. The company’s focus on efficiency and brand trust supports steady adoption of whipping cream powder across industrial and professional use cases, particularly where consistency and volume matter most.

Wilton Brands LLC plays a distinct role by addressing the premium and specialty baking segment. Its influence is rooted in product usability, small-batch reliability, and alignment with creative baking needs. Wilton’s whipping cream powder offerings appeal strongly to home bakers, specialty cake makers, and boutique bakeries seeking ease of use and predictable results. The brand’s close connection with the baking community allows it to shape product formats that prioritize convenience, visual appeal, and performance in decorative applications.

Weikfield stands out for its strong regional understanding and mass-market accessibility. The company effectively serves emerging bakery and confectionery businesses by offering dependable whipping cream powder suited to local production practices. Its emphasis on affordability, familiarity, and functional performance supports wide adoption among small and mid-sized food operators, reinforcing its relevance in fast-growing consumption markets.

Top Key Players in the Market

- Kraft Heinz

- Wilton Brands LLC

- Weikfield

- Betty Crocker

- AussieBlends

- Dr. Oetker

- Well & Good

- Hoosier Hill Farm

- Swiss Bake Ingredients Pvt.

Recent Developments

- In January 2025, Betty Crocker introduced Bridgerton-inspired tea-themed baking kits priced around $6.99 at select retailers like Walmart. These kits tie into pop culture and broaden the brand’s seasonal and themed baking portfolio.

- In July 2024, Dr. Oetker launched new My Little Bites baking mixes with varieties like cinnamon rolls, salted caramel cookie cups, and brookies to tap into snack-style desserts and baking trends. These items broaden the company’s dessert portfolio and appeal to consumers seeking easy, sweet snacks made at home. These launches complement their broader baking and dessert mix offerings.

Report Scope

Report Features Description Market Value (2024) USD 885.8 Million Forecast Revenue (2034) USD 1,825.7 Million CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Dairy, Non-dairy), By Type (Sweetened Whipping Cream Powder, Unsweetened Whipping Cream Powder), By Application (Bakery and Confectionery, Icecream and frozen desserts, Beverages, Others), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kraft Heinz, Wilton Brands LLC, Weikfield, Betty Crocker, AussieBlends, Dr. Oetker, Well & Good, Hoosier Hill Farm, Swiss Bake Ingredients Pvt. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Whipping Cream Powder MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Whipping Cream Powder MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Kraft Heinz

- Wilton Brands LLC

- Weikfield

- Betty Crocker

- AussieBlends

- Dr. Oetker

- Well & Good

- Hoosier Hill Farm

- Swiss Bake Ingredients Pvt.