Global Water Tube Food Processing Boiler Market Size, Share, And Enhanced Productivity By Fuel (Natural gas, Oil, Coal, Others), By Capacity (10 MMBtu/hr, 10-25 MMBtu/hr, 25-50 MMBtu/hr, 50-75 MMBtu/hr, 75-100 MMBtu/hr, 100-175 MMBtu/hr, 175-250 MMBtu/hr, Greater Than 250 MMBtu/hr), By Technology (Condensing, Non-condensing), By Application (Steam Generation, Heating, Drying, Evaporating, Others), By End User (Dairy Industry, Beverage Industry, Food Processing Industry, Pharmaceutical Industry, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177942

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

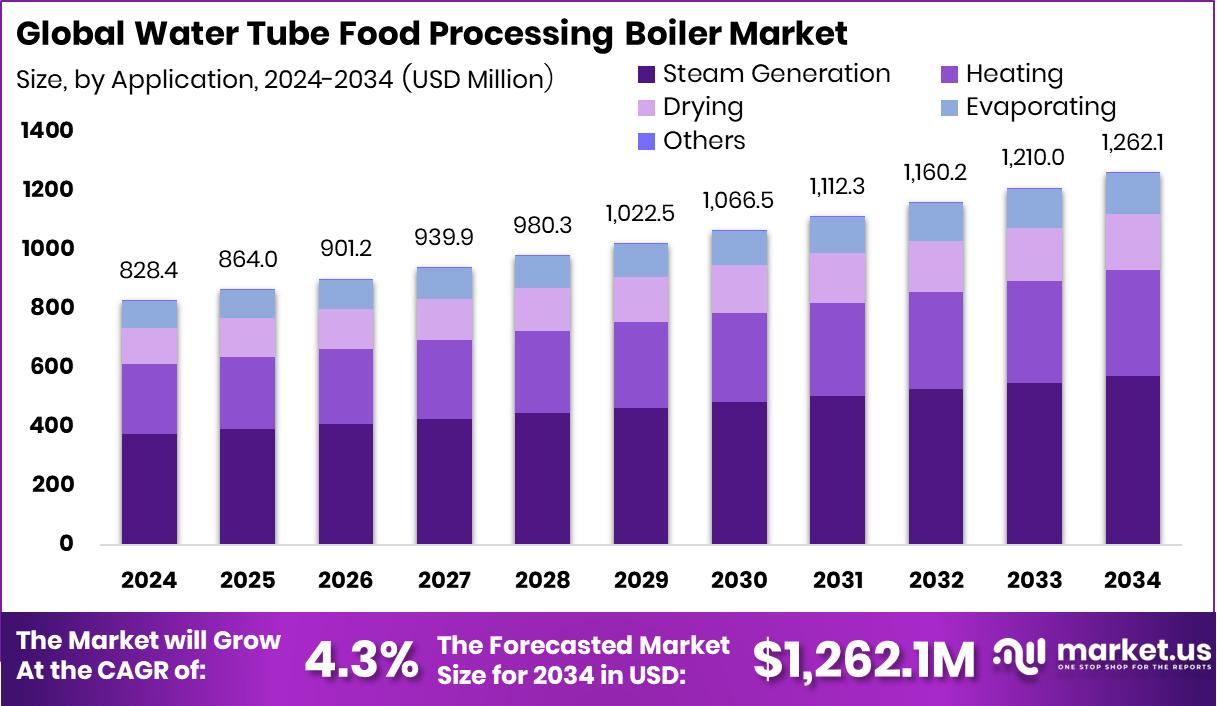

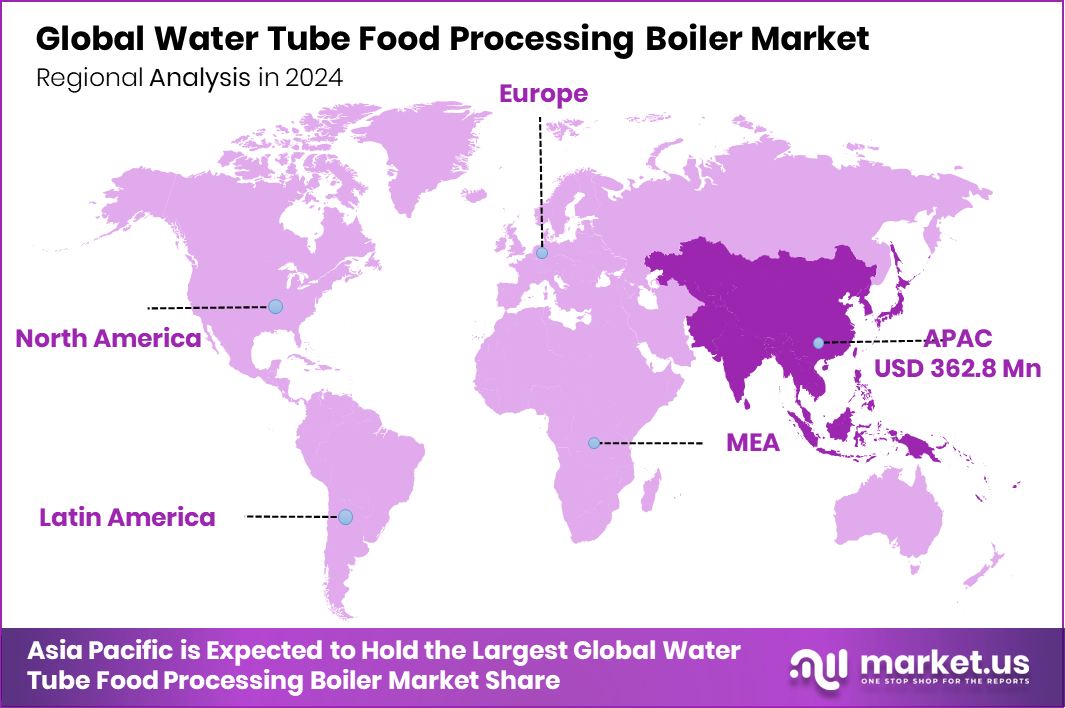

The Global Water Tube Food Processing Boiler Market is expected to be worth around USD 1,262.1 million by 2034, up from USD 828.4 million in 2024, and is projected to grow at a CAGR of 4.3% from 2025 to 2034. Strong food processing growth supported Asia Pacific 43.8% share, USD 362.8 Mn.

A water tube food processing boiler is a high-pressure steam-generating system where water flows inside tubes and hot combustion gases circulate outside them. This design allows faster heat transfer, higher efficiency, and safer operation under heavy industrial loads. In food and beverage plants, these boilers are widely used for steam generation, heating, drying, and evaporating processes that support cooking, sterilization, pasteurization, and cleaning. Their ability to handle varied fuels such as natural gas, oil, and coal makes them suitable for small dairy units as well as large food processing and pharmaceutical facilities.

The Water Tube Food Processing Boiler Market represents the global demand and supply of these systems across fuel types, capacity ranges, technologies, and end users. Growth is supported by expanding food manufacturing output and the modernization of processing plants. Investments linked to energy infrastructure, such as $500M state financial guarantees for natural gas pipelines in North Dakota and the DOE’s $625M support for coal and gas projects, reflect broader fuel security trends that indirectly strengthen boiler demand.

Demand is rising as food producers seek reliable steam systems with better fuel efficiency and compliance standards. Funding activities, including $300 million raised for natural gas turbine expansion and $15 million strategic investments in natural gas assets, indicate confidence in gas-based energy systems widely used in industrial boilers.

Opportunities are emerging through capacity expansion projects and financing initiatives, such as a N7.5bn Series 4 commercial paper issuance and competing $500M pipeline backstop proposals. These developments highlight expanding fuel infrastructure, creating favorable conditions for advanced water tube boiler installations across growing food processing industries.

Key Takeaways

- The Global Water Tube Food Processing Boiler Market is expected to be worth around USD 1,262.1 million by 2034, up from USD 828.4 million in 2024, and is projected to grow at a CAGR of 4.3% from 2025 to 2034.

- Natural gas dominates the Water Tube Food Processing Boiler Market with a 52.8% share.

- The 25–50 MMBtu/hr segment 31.4% leads capacity demand in the Water Tube Food Processing Boiler Market.

- Condensing technology accounts for 67.2% of the Water Tube Food Processing Boiler Market.

- Steam generation represents 45.5% application share in the Water Tube Food Processing Boiler Market.

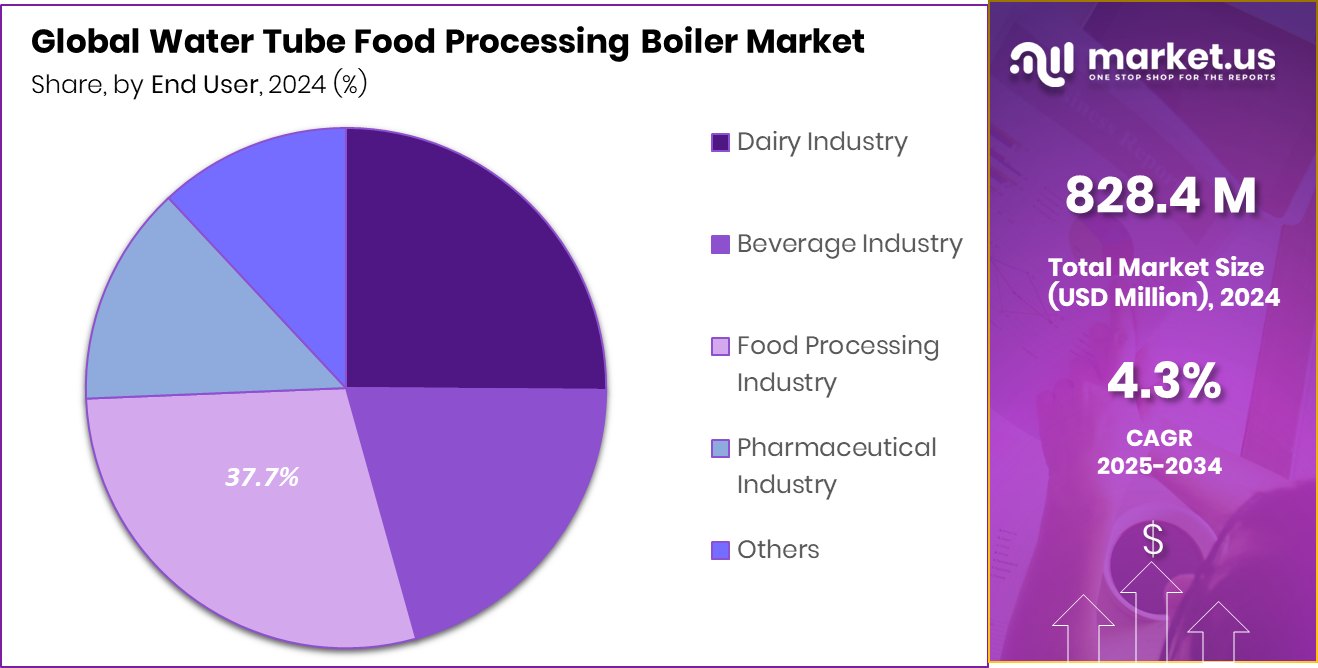

- Food processing industry holds a 37.7% end-user share in the water tube food processing boiler market.

- Asia Pacific market reached USD 362.8 Mn in 2024 regionally.

By Fuel Analysis

Natural gas dominated Water Tube Food Processing Boiler Market with 52.8% share.

In 2024, natural gas accounted for a 52.8% share and dominated the Water Tube Food Processing Boiler Market by fuel type. The strong presence of natural gas is mainly driven by its cost efficiency, cleaner combustion profile, and wide pipeline infrastructure across key industrial regions. Food processing facilities prefer natural gas-fired water tube boilers due to their ability to deliver consistent heat output while maintaining lower emission levels compared to coal and oil alternatives.

Regulatory pressure to reduce carbon emissions has further accelerated the shift toward gas-based systems. In addition, natural gas supports precise temperature control, which is essential for food safety and quality standards. As energy prices remain volatile, food processors continue prioritizing reliable and comparatively stable fuel options, reinforcing natural gas dominance in this segment.

By Capacity Analysis

25-50 MMBtu/hr capacity dominated the market, holding 31.4% total share.

In 2024, the 25–50 MMBtu/hr capacity segment held a 31.4% share and dominated the Water Tube Food Processing Boiler Market by capacity. This range is particularly suitable for medium to large-scale food processing plants that require steady steam output for cooking, sterilization, pasteurization, and cleaning processes. Boilers within this capacity range offer an optimal balance between operational efficiency and capital investment, making them highly attractive for expanding food manufacturing facilities.

Many processing units prefer this capacity as it supports production scalability without significant overcapacity. Additionally, modernization of existing plants has encouraged the replacement of smaller or outdated systems with mid-range water tube boilers. The dominance of the 25–50 MMBtu/hr category reflects growing industrial-scale food production and the need for reliable, high-pressure steam systems.

By Technology Analysis

Condensing technology dominated Water Tube Food Processing Boiler Market with 67.2% share.

In 2024, condensing technology secured a 67.2% share and dominated the Water Tube Food Processing Boiler Market by technology. The increasing focus on energy efficiency and emission reduction has significantly contributed to the widespread adoption of condensing water tube boilers. These systems recover latent heat from flue gases, enhancing overall thermal efficiency and lowering fuel consumption. For food processors operating under tight cost margins, energy savings directly impact profitability.

Moreover, stricter environmental regulations across developed and emerging economies have pushed companies to adopt advanced, low-emission technologies. Condensing boilers also support improved operational performance and reduced maintenance frequency. The strong dominance of this segment highlights the industry’s transition toward sustainable and high-efficiency boiler systems tailored to modern food processing requirements.

By Application Analysis

Steam generation application dominated the market, capturing 45.5% overall share.

In 2024, steam generation captured a 45.5% share and dominated the Water Tube Food Processing Boiler Market by application. Steam remains a critical utility in food processing operations, used extensively for cooking, drying, blanching, sterilizing, and cleaning-in-place systems. Water tube boilers are particularly suitable for high-pressure steam production, ensuring rapid response and stable output for continuous production lines.

The dominance of steam generation reflects the essential role of thermal processing in maintaining food safety standards and extending product shelf life. Additionally, the growth of packaged and processed food consumption has increased reliance on efficient steam systems. As production volumes rise and automation expands, demand for reliable steam generation solutions continues to strengthen this segment’s leading position in the market.

By End User Analysis

Food processing industry dominated end user segment with 37.7% share.

In 2024, the food processing industry accounted for a 37.7% share and dominated the Water Tube Food Processing Boiler Market by end user. Rising global demand for processed, packaged, and ready-to-eat foods has driven the expansion of food manufacturing facilities, directly boosting boiler installations. Water tube boilers are widely adopted in this industry due to their ability to handle high pressure and large steam loads efficiently.

Hygiene standards and regulatory compliance requirements further necessitate reliable and consistent steam systems. Investment in plant modernization and automation has also supported demand for advanced boiler technologies. The sector’s dominant share reflects its central role in sustaining boiler demand, as continuous production cycles and strict quality standards require dependable and energy-efficient thermal systems.

Key Market Segments

By Fuel

- Natural gas

- Oil

- Coal

- Others

By Capacity

- 10 MMBtu/hr

- 10-25 MMBtu/hr

- 25-50 MMBtu/hr

- 50-75 MMBtu/hr

- 75-100 MMBtu/hr

- 100-175 MMBtu/hr

- 175-250 MMBtu/hr

- > 250 MMBtu/hr

By Technology

- Condensing

- Non-condensing

By Application

- Steam Generation

- Heating

- Drying

- Evaporating

- Others

By End User

- Dairy Industry

- Beverage Industry

- Food Processing Industry

- Pharmaceutical Industry

- Others

Driving Factors

Rising global processed food demand

Rising global processed food demand continues to strengthen the Water Tube Food Processing Boiler Market, as food manufacturers expand production capacities to meet growing consumption of packaged and ready-to-eat products. Higher output requires dependable steam generation systems for cooking, sterilization, and cleaning operations. At the same time, broader energy sector investments are reinforcing industrial confidence.

Nuclear Power Group Alva Energy’s launch with $33 million in funding signals renewed capital flow into power and energy infrastructure, indirectly supporting large-scale thermal equipment demand. As energy security and industrial reliability gain attention worldwide, food processors are increasingly prioritizing high-performance water tube boilers that can operate efficiently under continuous production cycles while ensuring a consistent steam supply across processing lines.

Restraining Factors

High initial boiler installation costs

High initial boiler installation costs remain a key restraint in the Water Tube Food Processing Boiler Market, particularly for small and mid-sized food manufacturers. Water tube systems require significant capital for equipment, engineering, installation, and safety compliance, which can delay purchasing decisions. Financing conditions in the broader energy sector also influence industrial investment sentiment.

For instance, the Olkiluoto nuclear plant securing a €90 million loan for upgrades just two years after commissioning highlights how even large-scale energy assets require additional funding to maintain performance and compliance. Such capital intensity underscores the financial burden associated with advanced thermal systems, making cost considerations a critical factor for food processing facilities evaluating boiler upgrades or replacements.

Growth Opportunity

Adoption of energy-efficient systems

Adoption of energy-efficient systems presents a strong growth opportunity for the Water Tube Food Processing Boiler Market. Food manufacturers are actively seeking technologies that reduce fuel consumption and operating expenses while meeting environmental standards. Improved heat recovery systems, optimized combustion controls, and advanced steam management solutions are gaining traction across processing plants. Wider investor interest in next-generation energy technologies further supports this transition.

TAE Technologies’ raising $150 million in its latest funding round reflects strong financial backing for innovative energy solutions, signaling broader confidence in efficiency-driven technologies. As sustainability becomes central to industrial strategies, food processors are expected to accelerate investment in high-efficiency water tube boilers that deliver measurable energy savings and long-term operational value.

Latest Trends

Shift toward condensing boiler technology

The shift toward condensing boiler technology is emerging as a significant trend in the Water Tube Food Processing Boiler Market. Condensing systems enhance thermal efficiency by capturing additional heat from exhaust gases, lowering fuel usage and emissions. However, evolving policy dynamics are influencing the broader energy landscape.

The U.S. Department of Energy’s decision to scrap $3.7 billion in OECD projects, disrupting carbon capture progress at power plants, reflects changing regulatory and funding priorities in energy transition initiatives. Such developments may reshape investment flows in emission-control technologies. Within the food processing sector, this reinforces interest in proven, high-efficiency boiler technologies that balance performance, compliance, and operational reliability amid shifting energy policy environments.

Regional Analysis

Asia Pacific dominated with 43.8% share in the Water Tube Food Processing Boiler Market.

The Water Tube Food Processing Boiler Market demonstrates varied regional performance across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, reflecting differences in industrial maturity and food manufacturing expansion. Among these regions, Asia Pacific emerged as the dominating region, accounting for 43.8% of the global market and reaching a value of USD 362.8 Mn. The region’s leadership position is supported by the strong presence of large-scale food processing facilities and expanding packaged food consumption.

North America and Europe represent established markets, characterized by steady demand from organized food manufacturing sectors and ongoing equipment modernization. Meanwhile, the Middle East & Africa and Latin America are witnessing the gradual adoption of water tube boilers, supported by industrial development and growth in food processing activities. However, Asia Pacific continues to lead both in percentage share and market value, reinforcing its dominant role in the global Water Tube Food Processing Boiler Market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Alfa Laval continues to leverage its expertise in heat transfer and thermal solutions to strengthen its relevance in food processing applications. The company’s focus on energy efficiency, hygienic design standards, and advanced steam handling systems aligns well with the operational needs of modern food manufacturers.

Babcock and Wilcox remains a technically established player with deep capabilities in high-performance boiler engineering. Its long-standing experience in water tube boiler systems and emphasis on reliability, emissions control, and large-scale steam generation support its position in food processing environments that require stable and continuous output. The company’s engineering depth provides a competitive advantage in complex industrial installations.

Babcock Wanson demonstrates strong specialization in industrial boiler solutions tailored to process industries. Its focus on compact, efficient, and regulation-compliant systems enhances its attractiveness among food processing operators seeking operational flexibility and optimized fuel usage. Collectively, these companies shape the market through technical innovation and performance-driven product strategies.

Top Key Players in the Market

- Alfa Laval

- Babcock and Wilcox

- Babcock Wanson

- Bosch Thermotechnology

- Clayton Industries

- Cleaver-Brooks

- Forbes Marshall

- Fulton

- Hoval

- Hurst Boiler

Recent Developments

- In July 2025, Alfa Laval completed the acquisition of the cryogenic business unit from Fives, a French industrial group. This business specializes in cryogenic heat transfer and pump technologies. The acquisition strengthens Alfa Laval’s technological capabilities in efficient heat and gas handling systems, which support industrial steam and thermal applications broadly.

- In April 2024, Babcock and Wilcox’s Thermal segment won contracts worth about US$24 million to design, manufacture, and supply three industrial boilers and related equipment for petrochemical facilities in the Middle East and Central Asia. This deal highlights continued demand for boiler systems in industrial sectors.

Report Scope

Report Features Description Market Value (2024) USD 828.4 Million Forecast Revenue (2034) USD 1,262.1 Million CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fuel (Natural gas, Oil, Coal, Others), By Capacity (10 MMBtu/hr, 10-25 MMBtu/hr, 25-50 MMBtu/hr, 50-75 MMBtu/hr, 75-100 MMBtu/hr, 100-175 MMBtu/hr, 175-250 MMBtu/hr, > 250 MMBtu/hr), By Technology (Condensing, Non-condensing), By Application (Steam Generation, Heating, Drying, Evaporating, Others), By End User (Dairy Industry, Beverage Industry, Food Processing Industry, Pharmaceutical Industry, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alfa Laval, Babcock and Wilcox, Babcock Wanson, Bosch Thermotechnology, Clayton Industries, Cleaver-Brooks, Forbes Marshall, Fulton, Hoval, Hurst Boiler Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Water Tube Food Processing Boiler MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Water Tube Food Processing Boiler MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Alfa Laval

- Babcock and Wilcox

- Babcock Wanson

- Bosch Thermotechnology

- Clayton Industries

- Cleaver-Brooks

- Forbes Marshall

- Fulton

- Hoval

- Hurst Boiler