Global Water-soluble Polymer Market Size, Share, And Enhanced Productivity By Type (Polyacrylamide and Copolymers, Guar Gum and Derivatives, Casein, Polyvinyl Alcohol, Gelatin, Polyacrylic Acid, Others), By Raw Material (Synthetic, Semi-Synthetic, Natural), By Function (Coagulating, Flocculating, Thickening, Gelling, Rheology Modification and Control, Stabilization, Others), By Application (Wastewater Treatment, Personal Care Products, Construction Materials, Household Detergents, Paint, Textiles, Oil and Gas, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177786

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

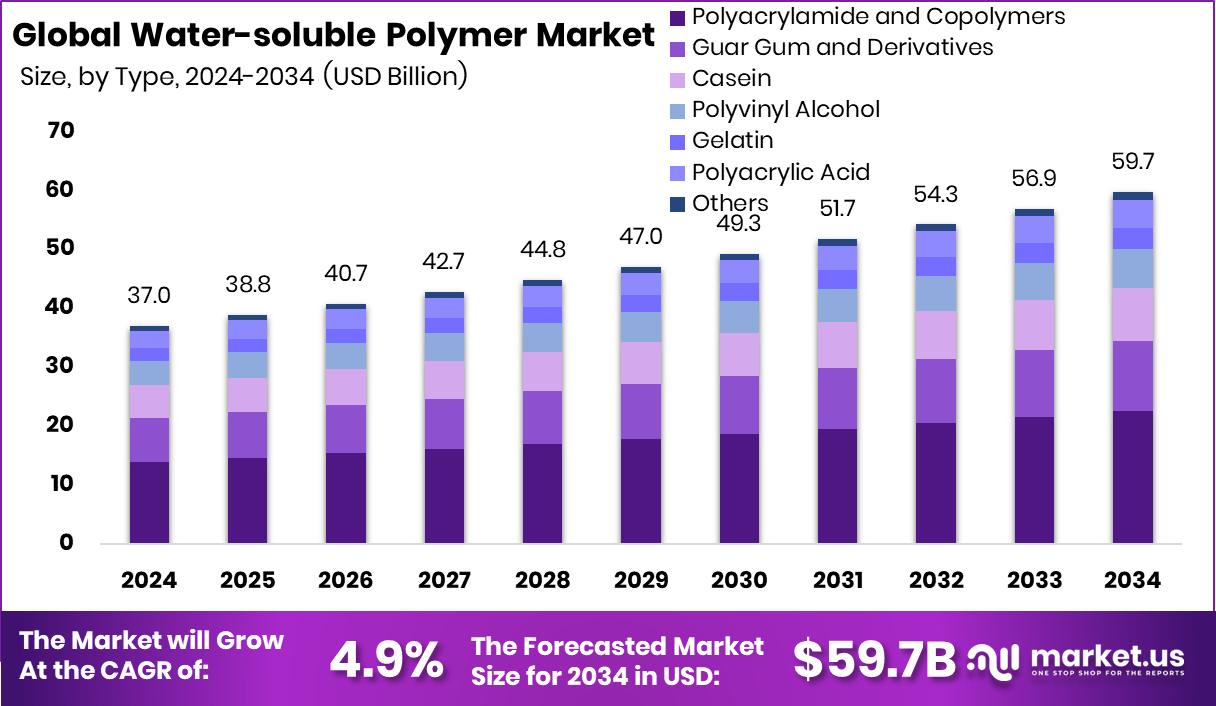

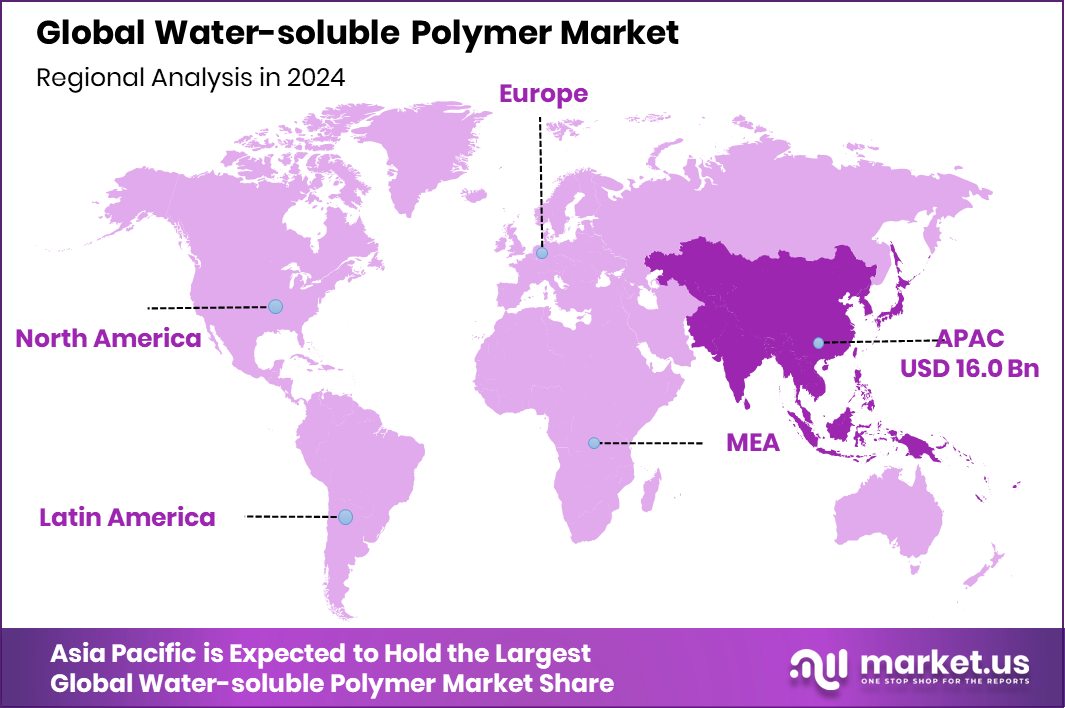

The Global Water-soluble Polymer Market is expected to be worth around USD 59.7 billion by 2034, up from USD 37.0 billion in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034. Asia Pacific accounted for 43.4%, totaling USD 16.0 Bn.

Water-soluble polymers are materials that dissolve, disperse, or swell in water to form stable solutions. They are produced from synthetic, semi-synthetic, or natural raw materials and are designed to perform specific functions such as thickening, gelling, stabilizing, coagulating, and flocculating. Common types include polyacrylamide and its copolymers, guar gum derivatives, casein, polyvinyl alcohol, gelatin, and polyacrylic acid. These polymers are widely used because they improve processing efficiency, enhance product stability, and support water treatment performance across multiple industries.

The Water-soluble Polymer Market refers to the global trade and consumption of these polymers across applications such as wastewater treatment, personal care products, construction materials, household detergents, paints, textiles, and oil and gas. Demand is strongly linked to water management needs and industrial growth.

Large-scale investments such as Arkansas advancing $154M in water and wastewater projects, Kent County securing $6.2M for a new treatment plant, and $1.4 million in federal funding for Shamokin–Coal Township upgrades reflect sustained infrastructure activity. The first phase of Winnipeg’s $3.2B sewage treatment upgrade further highlights long-term treatment demand.

Growth is driven by environmental compliance, industrial expansion, and sustainability initiatives. Impact Recycling raised €3.8 million for water-based density separation technology, showing innovation in water processing. Ecoat secured €21M for low-carbon coatings, increasing polymer demand in paints. France’s Lactips raised €16M to scale bio-based water-soluble alternatives, signaling an opportunity in sustainable materials. These developments indicate steady demand expansion and long-term opportunity across both industrial and eco-friendly applications.

Key Takeaways

- The Global Water-soluble Polymer Market is expected to be worth around USD 59.7 billion by 2034, up from USD 37.0 billion in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034.

- Polyacrylamide and copolymers dominate the Water-soluble Polymer Market with 37.8% share.

- Synthetic raw materials lead the Water-soluble Polymer Market, accounting for 56.7% share.

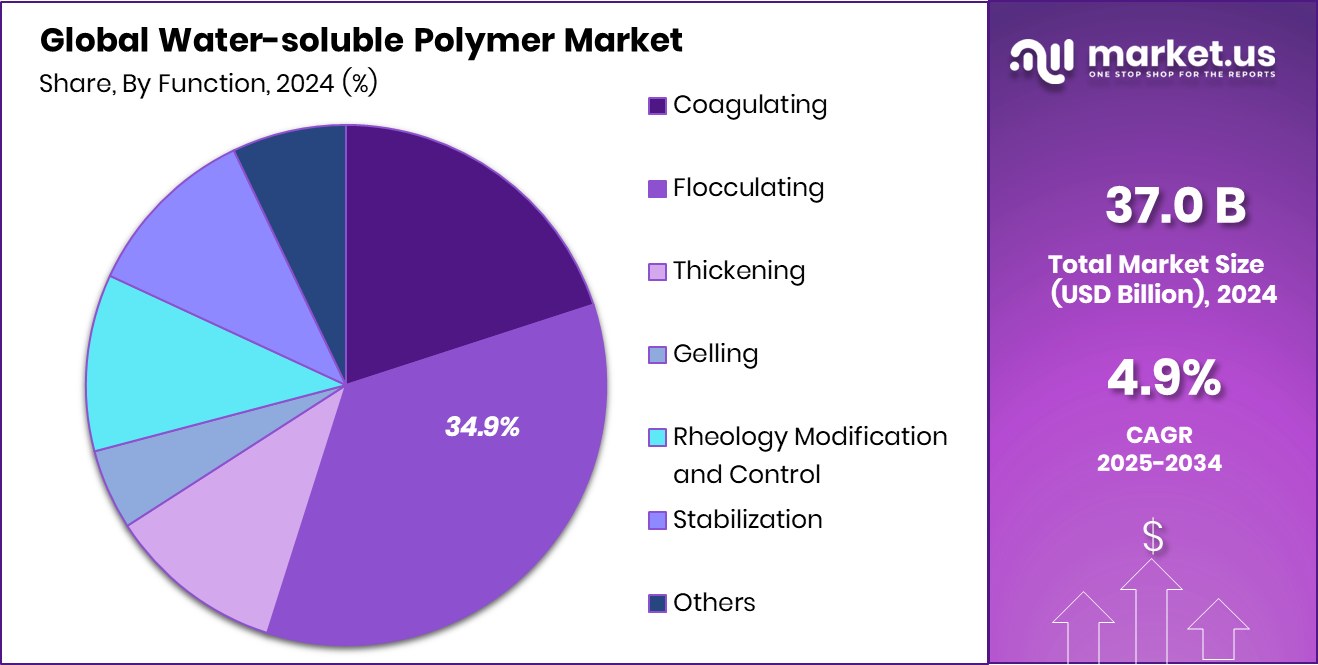

- Flocculating function represents 34.9% of the Water-soluble Polymer Market demand globally.

- Wastewater treatment applications hold 39.1% in the Water-soluble Polymer Market.

- The Asia Pacific market reached USD 16.0 Bn in 2024.

By Type Analysis

Polyacrylamide and copolymers dominate the Water-soluble Polymer Market with 37.8% share globally.

In 2024, the Polyacrylamide and Copolymers segment accounted for 37.8% of the global Water-soluble Polymer Market, positioning it as the leading product type. This dominance reflects the material’s strong performance in solid–liquid separation, sludge dewatering, and enhanced oil recovery processes. Polyacrylamide-based polymers are widely adopted across municipal utilities, mining operations, and oilfield service providers due to their high molecular weight and superior flocculation efficiency.

Demand is further reinforced by infrastructure investments in water treatment facilities and stricter environmental compliance standards. Industrial users prefer copolymer formulations for tailored charge density and improved stability in varying pH conditions. As wastewater discharge regulations tighten globally, polyacrylamide continues to serve as a cost-effective and scalable solution, strengthening its commercial share across developed and emerging markets.

By Raw Material Analysis

Synthetic raw materials lead the Water-soluble Polymer Market, accounting for a significant 56.7% share.

In 2024, synthetic raw materials represented 56.7% of the Water-soluble Polymer Market, reflecting their broad industrial acceptance and reliable production scalability. Synthetic polymers, including polyacrylamide, polyethylene oxide, and polyvinyl alcohol, are preferred for their consistent quality, controlled molecular structure, and performance stability under diverse operational environments. Large-scale chemical manufacturers benefit from established petrochemical supply chains, enabling cost competitiveness and high-volume output.

The dominance of synthetic feedstocks also stems from their adaptability in customizing viscosity, charge characteristics, and thermal resistance for sector-specific needs. While bio-based alternatives are gaining traction, synthetic polymers remain integral in applications requiring high durability and predictable behavior, particularly in heavy industrial processing and municipal infrastructure projects where performance reliability is critical.

By Function Analysis

The flocculating function segment holds 34.9% in the Water-soluble Polymer Market applications.

In 2024, flocculating polymers captured 34.9% of the Water-soluble Polymer Market by function, highlighting their essential role in solid-liquid separation processes. Flocculants are extensively used to aggregate suspended particles in water treatment, mining tailings management, and paper manufacturing operations. Their efficiency in accelerating sedimentation reduces operational costs and enhances treatment capacity.

Municipal utilities increasingly rely on advanced flocculating agents to improve sludge handling and meet stricter discharge standards. Industrial sectors favor these polymers for their ability to function effectively at low dosages while maintaining high clarification efficiency. Technological advancements in high-performance flocculants, including improved charge density optimization, continue to support growth in this segment as environmental monitoring becomes more rigorous across global markets.

By Application Analysis

Wastewater treatment dominates the Water-soluble Polymer Market applications with 39.1% share.

In 2024, wastewater treatment emerged as the leading application segment, accounting for 39.1% of the Water-soluble Polymer Market. Rapid urbanization, industrial expansion, and heightened environmental awareness are driving large-scale investments in water purification infrastructure. Governments and regulatory bodies worldwide are mandating improved effluent quality standards, compelling municipalities and industries to adopt advanced polymer-based treatment solutions.

Water-soluble polymers enhance coagulation, flocculation, and sludge dewatering efficiency, significantly improving plant productivity. Growing freshwater scarcity concerns are also encouraging water reuse and recycling initiatives, further expanding polymer demand. Industrial sectors such as food processing, textiles, and chemicals rely heavily on polymer-supported treatment systems to ensure compliance, reinforcing wastewater treatment as the market’s primary revenue contributor.

Key Market Segments

By Type

- Polyacrylamide and Copolymers

- Guar Gum and Derivatives

- Casein

- Polyvinyl Alcohol

- Gelatin

- Polyacrylic Acid

- Others

By Raw Material

- Synthetic

- Semi-Synthetic

- Natural

By Function

- Coagulating

- Flocculating

- Thickening

- Gelling

- Rheology Modification and Control

- Stabilization

- Others

By Application

- Wastewater Treatment

- Personal Care Products

- Construction Materials

- Household Detergents

- Paint

- Textiles

- Oil and Gas

- Others

Driving Factors

Rising global wastewater treatment infrastructure

The Water-soluble Polymer Market continues to gain strength as governments and municipalities invest heavily in wastewater treatment expansion and modernization. Growing urban populations and stricter discharge standards are pushing utilities to upgrade filtration, sludge dewatering, and clarification systems, all of which rely on water-soluble polymers for efficient solid-liquid separation.

At the same time, innovation in construction materials is reinforcing polymer demand. Co-reactive securing €6.5 million in seed funding for its CO₂-negative construction materials technology reflects how sustainable infrastructure solutions are gaining financial backing. As water-intensive construction and environmental projects scale up globally, polymers used in water management and advanced building materials are expected to see consistent consumption growth, directly supporting overall market momentum.

Restraining Factors

Volatile raw material price fluctuations

The Water-soluble Polymer Market faces pressure from fluctuating feedstock prices, particularly for synthetic raw materials derived from petrochemicals. Price swings impact production costs, margins, and long-term supply contracts. Market uncertainty is further highlighted by shifts in capital allocation across construction and materials sectors. Finland’s Carbonaide raised €3.7 million to convert building materials into carbon sinks, signaling a move toward alternative material technologies.

Additionally, QXO’s war chest expanded with another $1.8B in new funding, reflecting consolidation and strategic repositioning within the broader materials space. Such financial movements illustrate competitive dynamics that may influence pricing stability and procurement strategies for polymer manufacturers and end users alike.

Growth Opportunity

Expansion of bio-based polymer development

Sustainability trends are creating strong opportunities for bio-based and lower-carbon water-soluble polymers. As industries seek environmentally responsible alternatives, research into renewable raw materials and biodegradable formulations is accelerating. Investment in technology-driven construction and procurement platforms is also reshaping supply chains.

An AI-powered construction procurement startup landing $20M in Series A funding demonstrates how digital tools are optimizing sourcing and material selection processes. This modernization supports the integration of innovative polymer solutions into infrastructure and industrial projects. With sustainability targets tightening globally, bio-based polymer development presents a significant avenue for differentiation, regulatory alignment, and long-term revenue expansion within the market.

Latest Trends

Shift toward sustainable water-soluble formulations

A clear trend within the Water-soluble Polymer Market is the transition toward sustainable and performance-enhanced formulations. Industries are prioritizing reduced carbon footprints, improved recyclability, and lower environmental impact without compromising efficiency. Funding activity underscores this shift. Parspec raising $20 million in Series A financing reflects growing investor interest in digital construction technologies that streamline material selection and compliance tracking.

As procurement platforms and project developers increasingly favor environmentally responsible inputs, polymer producers are adapting formulations to meet green building standards and stricter environmental benchmarks. This movement toward sustainable chemistry and smarter sourcing continues to shape product innovation and purchasing decisions across multiple application sectors.

Regional Analysis

Asia Pacific dominated the water-soluble polymer market with 43.4% share.

The Water-soluble Polymer Market demonstrates varied regional performance across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, reflecting differences in industrial development and water infrastructure demand.

Asia Pacific emerged as the dominating region, accounting for 43.4% of the global market, valued at USD 16.0 Bn. The region’s leadership is supported by strong demand from wastewater treatment facilities, expanding manufacturing activities, and large-scale municipal water management programs. Rapid urbanization and industrial expansion across major economies continue to drive consistent polymer consumption.

North America maintains a stable market presence, supported by established wastewater treatment infrastructure and stringent environmental regulations governing industrial discharge. Europe follows with steady demand driven by regulatory compliance standards and sustainability-focused water reuse initiatives.

Meanwhile, the Middle East & Africa and Latin America represent developing markets, where gradual investments in water treatment infrastructure and industrial processing sectors are supporting moderate but consistent growth within the overall Water-soluble Polymer Market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Arkema S.A. continues to strengthen its presence through advanced specialty materials and performance polymers, leveraging its integrated production capabilities and global manufacturing footprint to serve water treatment, coatings, and industrial processing applications. The company’s focus on high-value specialty chemistries enables it to address customized polymer requirements across multiple end-use industries.

Ashland Inc. maintains a strong position through its specialty additives and functional polymer solutions, particularly in water treatment and performance materials. Its emphasis on application-driven innovation and customer-specific formulations supports stable demand across municipal and industrial segments. Ashland’s operational agility and specialty focus allow it to respond effectively to evolving environmental standards and technical specifications.

BASF SE, with its broad chemical portfolio and global production network, remains a key participant in water-soluble polymers. Its strong research capabilities, integrated supply chain, and large-scale manufacturing infrastructure support consistent product availability and technical development, reinforcing its competitive standing in 2024.

Top Key Players in the Market

- Arkema S.A.

- Ashland Inc.

- BASF SE

- Dow Inc.

- DuPont de Nemours Inc.

- J.M. Huber Corporation

- Kemira Oyj

- Kuraray Co. Ltd.

- Mitsubishi Chemical Holdings Corporation

- SNF

- Sumitomo Seika Chemicals Company Ltd.

Recent Developments

- In June 2025, Ashland announced the launch of additional viatel™ bioresorbable polymer grades that offer higher molecular weights and improved performance for medical device and controlled-release drug formulations. These new grades support broader use in healthcare and polymer applications.

- In May 2024, Arkema agreed to acquire Dow’s flexible packaging laminating adhesives business to expand its adhesive solutions portfolio. This acquisition adds well-recognized adhesive technologies and production sites across Europe, North America, and Mexico, strengthening Arkema’s presence in industrial and packaging markets.

Report Scope

Report Features Description Market Value (2024) USD 37.0 Billion Forecast Revenue (2034) USD 59.7 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Polyacrylamide and Copolymers, Guar Gum and Derivatives, Casein, Polyvinyl Alcohol, Gelatin, Polyacrylic Acid, Others), By Raw Material (Synthetic, Semi-Synthetic, Natural), By Function (Coagulating, Flocculating, Thickening, Gelling, Rheology Modification and Control, Stabilization, Others), By Application (Wastewater Treatment, Personal Care Products, Construction Materials, Household Detergents, Paint, Textiles, Oil and Gas, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arkema S.A., Ashland Inc., BASF SE, Dow Inc., DuPont de Nemours Inc., J.M. Huber Corporation, Kemira Oyj, Kuraray Co. Ltd., Mitsubishi Chemical Holdings Corporation, SNF, Sumitomo Seika Chemicals Company Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Water-soluble Polymer MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Water-soluble Polymer MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Arkema S.A.

- Ashland Inc.

- BASF SE

- Dow Inc.

- DuPont de Nemours Inc.

- J.M. Huber Corporation

- Kemira Oyj

- Kuraray Co. Ltd.

- Mitsubishi Chemical Holdings Corporation

- SNF

- Sumitomo Seika Chemicals Company Ltd.