Global Wall Decor Market Size, Share, Growth Analysis By Product Type (Wall Art, Wallpapers & Wall Coverings, Wall Stickers & Decals, Clocks, Mirrors, Others), By Material Type (Wood, Metal, Plastic, Fabric, Glass, Others), By Sales Channel (Specialty Stores, Supermarkets/Hypermarkets, Online, Departmental Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166975

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

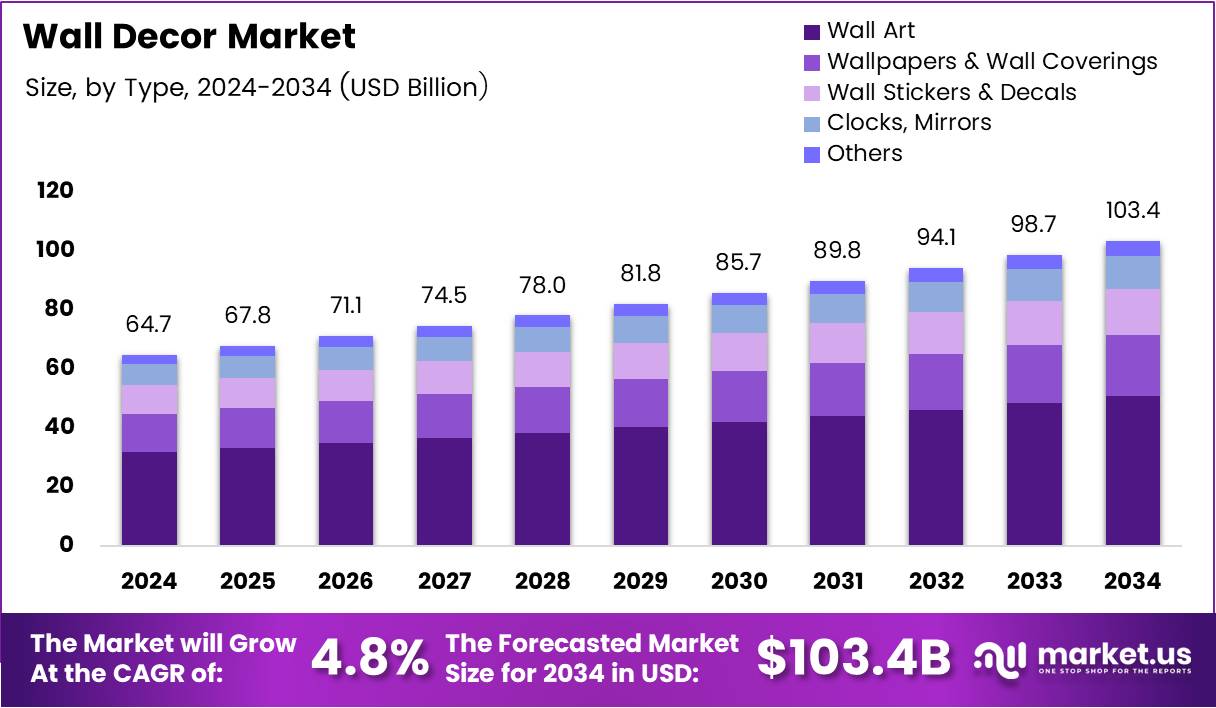

The Global Wall Decor Market size is expected to be worth around USD 103.4 Billion by 2034, from USD 64.7 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034.

The wall décor market represents a broad consumer category that includes artwork, murals, wallpapers, mirrors, and decorative panels designed to elevate interior spaces. It supports residential and commercial environments by enhancing visual appeal and reinforcing style preferences. This market continues expanding as homeowners and businesses seek affordable and expressive interior design solutions.

Additionally, the market grows as consumers increasingly adopt personalized décor, driven by rising urbanization and lifestyle upgrades. Demand strengthens as buyers pursue minimalistic, modern, or nature-inspired themes. Vendors benefit from diversified materials such as canvas, metal, wood, and vinyl, enabling flexible offerings that support evolving aesthetic trends across global regions.

Furthermore, opportunities emerge from digital printing, customizable wall art, and eco-friendly décor products. Sellers gain advantages by offering on-demand prints and sustainable materials, responding to rising environmental awareness. Market players continue leveraging online retail channels, improving accessibility and allowing customers to visualize products before purchasing, thereby accelerating conversion rates.

Moreover, government investments in housing, smart city projects, and commercial infrastructure stimulate long-term demand for wall décor. Regulatory emphasis on indoor air quality encourages low-VOC paints and safe decorative materials. These initiatives support product innovation and push manufacturers to adopt compliant production methods that strengthen consumer trust and long-term market stability.

The wall décor category benefits from strong emotional and functional value. Consumers increasingly link décor with lifestyle improvement, driving steady purchase behavior. With rising renovation activities, digital commerce expansion, and design-driven spending, sellers gain sustained growth momentum across residential, office, hospitality, and institutional segments.

According to a Houzz decorating survey, 91% of homeowners planned to cover walls with paint, while 22% preferred art prints, 17% original art, and 16% family photos, reinforcing strong interest in decorative finishes. Additionally, a Houzz survey of over 6,000 respondents noted that 87% said design affects happiness, and 74% felt happier after redecorating—directly linking wall décor with wellbeing and purchase motivation.

Key Takeaways

- Global Wall Decor Market valued at USD 64.7 Billion (2024) and projected to reach USD 103.4 Billion by 2034 with a 4.8% CAGR (2025–2034).

- Wall Art leads by product type with a 37.1% market share in 2024.

- Wood dominates material type with a 34.3% share in 2024.

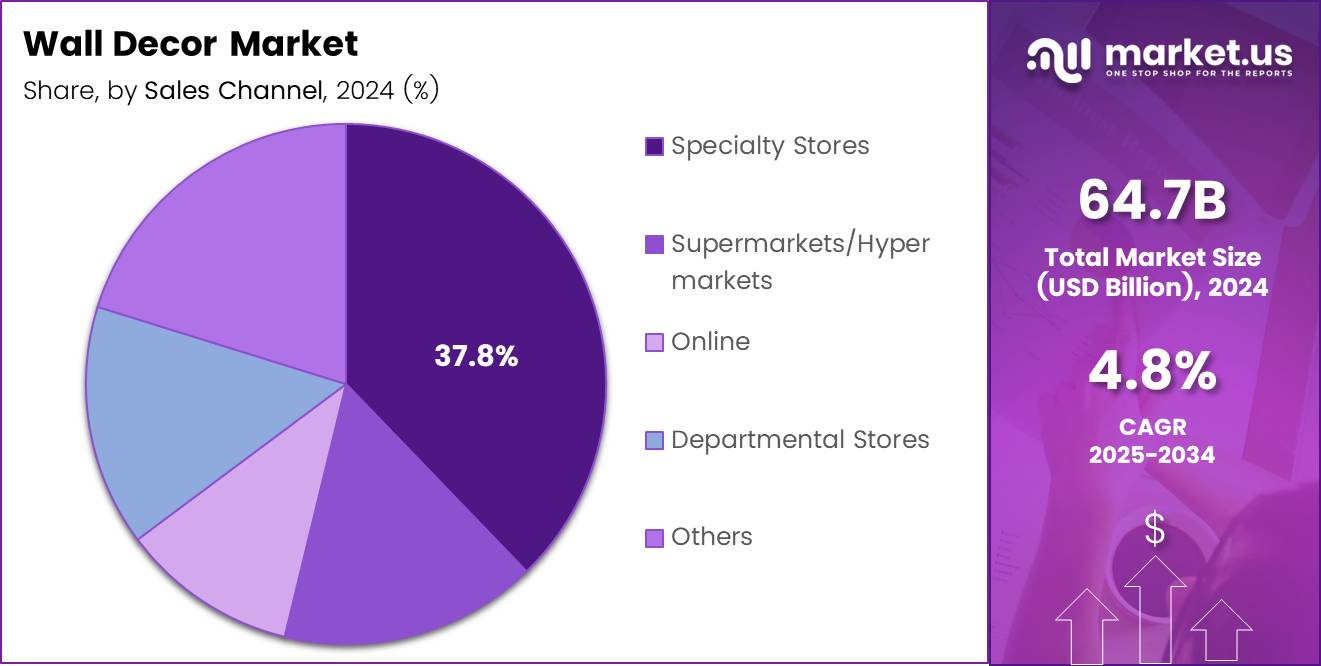

- Specialty Stores account for the highest sales channel share at 37.8% in 2024.

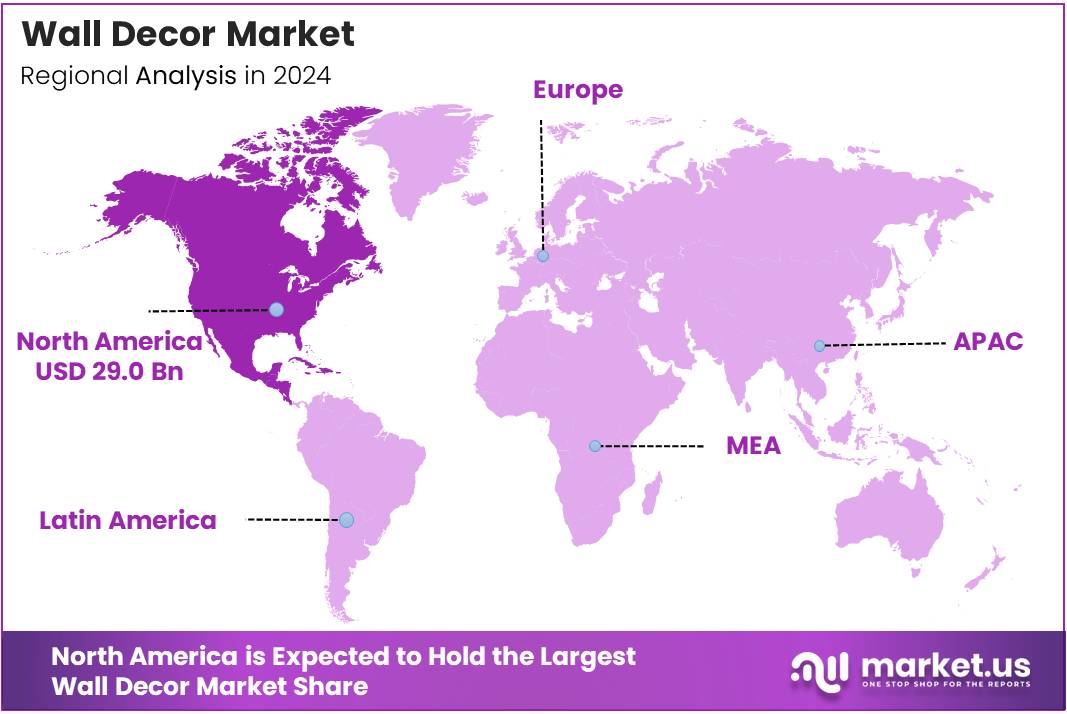

- North America holds the largest regional share at 44.9%, valued at USD 29.0 Billion in 2024.

By Product Type Analysis

Wall Art dominates with 37.1% due to its strong aesthetic appeal and versatility.

In 2024, Wall Art held a dominant market position in the By Product Type segment of the Wall Decor Market, with a 37.1% share. It enhances interiors effortlessly and continues to attract consumers seeking expressive, elegant, and customizable décor solutions across residential and commercial environments.

In 2024, Wallpapers & Wall Coverings gained strong traction as consumers increasingly preferred durable and design-rich wall enhancement options. Their wide pattern variety and ability to transform spaces quickly continued to drive adoption across modern homes and offices.

In 2024, Wall Stickers & Decals expanded steadily as cost-effective and easily removable décor solutions. Their adaptability for themed décor, children’s rooms, and rented spaces boosted demand, allowing users to personalize walls without long-term commitment or professional installation.

In 2024, Clocks, Mirrors maintained consistent demand, offering both functional and decorative benefits. Their ability to enhance spatial aesthetics, create depth, and introduce practical utility contributed to their rising preference in contemporary interior design trends.

In 2024, Others continued to support the market with niche décor items that complement evolving interior styles. These products attracted consumers seeking unique, artisanal, or trend-driven pieces to complete their wall décor arrangements.

By Material Type Analysis

Wood dominates with 34.3% owing to its natural aesthetics and durability.

In 2024, Wood held a dominant market position in the By Material Type segment of the Wall Decor Market, with a 34.3% share. Its timeless look, sustainability appeal, and compatibility with diverse décor themes strengthened its widespread consumer acceptance.

In 2024, Metal décor products advanced steadily, appealing to modern and industrial design preferences. Their durability, sleek finishes, and ability to create bold visual statements supported rising adoption in both residential and commercial interiors.

In 2024, Plastic materials captured interest due to affordability and design flexibility. Their lightweight nature and broad color options made them suitable for consumers seeking budget-friendly yet aesthetically pleasing décor solutions.

In 2024, Fabric wall décor items grew steadily as soft, textured elements gained popularity in interior styling. Their warmth and ability to add depth to spaces increased their preference among homeowners seeking cozy and artistic wall enhancements.

In 2024, Glass décor options sustained market presence with elegant, reflective qualities. Their capability to brighten rooms and complement minimalist themes continued to attract design-conscious consumers seeking sophisticated décor pieces.

In 2024, Others contributed to material diversity by offering distinct and innovative décor options. These materials appealed to niche consumer segments looking for unconventional and artistic wall décor choices.

By Sales Channel Analysis

Specialty Stores dominate with 37.8% due to curated selections and expert guidance.

In 2024, Specialty Stores held a dominant market position in the By Sales Channel segment of the Wall Decor Market, with a 37.8% share. Their curated collections and personalized assistance continued to attract consumers seeking high-quality, design-specific décor items.

In 2024, Supermarkets/Hypermarkets maintained stable growth by providing convenient access to affordable décor products. Their wide presence and competitive pricing enabled consumers to explore diverse wall décor solutions during routine shopping visits.

In 2024, Online channels strengthened their market presence as digital shopping became increasingly preferred. Extensive product variety, user reviews, and quick delivery options supported rising consumer reliance on e-commerce platforms for décor purchases.

In 2024, Departmental Stores continued to serve customers seeking mid-range décor offerings. Their balanced product assortment and accessible store layouts helped consumers compare styles and make informed purchasing decisions.

In 2024, Others including local décor shops and boutique outlets offered unique and artisanal pieces. Their niche appeal attracted consumers seeking customized or handcrafted wall décor products to enhance personalized interior themes.

Key Market Segments

By Product Type

- Wall Art

- Wallpapers & Wall Coverings

- Wall Stickers & Decals

- Clocks, Mirrors

- Others

By Material Type

- Wood

- Metal

- Plastic

- Fabric

- Glass

- Others

By Sales Channel

- Specialty Stores

- Supermarkets/Hypermarkets

- Online

- Departmental Stores

- Others

Drivers

Rising Consumer Preference for Personalized and Customizable Wall Art Drives Market Growth

The wall décor market is growing steadily as more consumers look for unique and personalized art to match their home style. People want wall pieces that reflect their personality, and this rising demand for customization is pushing brands to offer made-to-order prints, name-based art, and tailored designs. This shift is giving companies new ways to stand out and develop stronger connections with buyers.

Another major driver is the rapid increase in home renovation and interior styling activities. As homeowners spend more time improving their living spaces, decorative wall products such as framed art, wallpapers, murals, and decals are becoming essential elements of interior upgrades.

The fast expansion of e-commerce also supports market growth. Online platforms now offer wide collections, easy comparison, and global access to trending designs, encouraging customers to explore and purchase more frequently.

Social media platforms and lifestyle influencers are playing an increasingly important role as well. Home décor trends spread quickly through Instagram, Pinterest, and YouTube, inspiring consumers to recreate stylish interiors. This influence is directly boosting demand for modern, visually appealing wall décor options.

Restraints

High Price Volatility of Raw Materials Used in Premium Wall Décor Limits Market Stability

One of the major restraints affecting the wall décor market is the unpredictable cost of raw materials such as wood, metal, and high-quality canvas. These fluctuations make it difficult for manufacturers to maintain stable pricing, often leading to higher product costs. As a result, premium wall décor becomes less affordable for price-sensitive consumers, which slows down overall market growth.

Market saturation is another key challenge. With many brands, online sellers, and local artisans entering the space, competition has intensified. This saturation reduces profit margins, as companies often lower prices or increase promotional discounts to attract buyers.

The crowded marketplace also makes it harder for new entrants to establish a strong presence. Consumers are frequently overwhelmed by choices, which can delay purchasing decisions and increase brand switching. This competitive pressure forces companies to invest more in innovation, marketing, and customer engagement, raising operational costs.

Furthermore, maintaining product differentiation in a saturated environment becomes difficult as many offerings look similar. This weakens brand loyalty and creates pricing wars, which puts additional strain on smaller businesses.

Growth Factors

Adoption of Sustainable and Eco-Friendly Wall Décor Materials Creates New Market Opportunities

The shift toward eco-friendly living is opening strong growth opportunities within the wall décor market. Consumers are increasingly interested in products made from recycled, biodegradable, or responsibly sourced materials. This trend is pushing brands to innovate with sustainable wallpapers, natural fiber frames, and environmentally safe paints.

Smart and interactive digital wall art is also emerging as a promising segment. Digital frames, LED art panels, and app-controlled displays are attracting tech-savvy homeowners seeking modern décor options. This creates room for collaborations between décor manufacturers and technology companies.

Another major opportunity lies in emerging residential and hospitality markets. Growing construction activities in developing regions are increasing demand for stylish wall décor in hotels, apartments, and shared living spaces. This offers companies a chance to expand their global presence.

Additionally, subscription-based décor rotation services are gaining attention. These services allow customers to refresh their wall décor regularly without buying new items each time. This model supports sustainability, reduces waste, and appeals to consumers who enjoy frequent interior changes.

Emerging Trends

Surge in Minimalist and Nature-Inspired Wall Design Themes Shapes Market Trends

Minimalist and nature-inspired themes are becoming highly popular, driven by the desire for calm and aesthetically pleasing interiors. Soft colors, botanical prints, and clean designs are influencing buying decisions, especially among younger homeowners.

Another growing trend is the interest in 3D and textured wall décor installations. Products such as carved panels, raised geometric patterns, and layered artworks add depth to walls and are increasingly used in modern homes and offices. This trend is encouraging designers to experiment with new materials and techniques.

Culturally inspired and handcrafted art pieces are also gaining traction. Consumers value unique, artisan-made décor that showcases local craftsmanship and heritage. This trend supports small creators and promotes cultural diversity in décor choices.

AI-generated custom wall art is becoming a significant trend as well. Advanced algorithms now allow users to create personalized designs instantly, while on-demand printing makes production faster and more affordable. This combination is reshaping how consumers shop for unique and creative wall décor.

Regional Analysis

North America Dominates the Wall Decor Market with a Market Share of 44.9%, Valued at USD 29.0 Billion

The North America wall decor market leads the global landscape, holding a significant 44.9% share and reaching a valuation of USD 29.0 Billion. Growth in this region is strongly supported by high consumer spending on home improvement and interior aesthetics. Additionally, the rise of premium home décor trends and increased adoption of modern wall-art solutions further strengthen the region’s dominance.

Europe Wall Decor Market Trends

Europe represents a mature and design-conscious market for wall decor, driven by strong cultural appreciation for art and interior styling. The region benefits from steady demand across both residential and commercial spaces. Increasing preference for sustainable and minimalist décor also plays a significant role in shaping product trends across European markets.

Asia Pacific Wall Decor Market Trends

The Asia Pacific region is experiencing rapid expansion, supported by growing urbanization and increasing disposable incomes. Rising homeownership among younger demographics is fueling demand for modern and customizable wall décor solutions. Additionally, the expansion of organized retail and e-commerce channels is making decorative products more accessible across emerging markets.

Middle East & Africa Wall Decor Market Trends

The Middle East & Africa wall decor market is gradually expanding, propelled by rising construction activities and growth in luxury residential and hospitality projects. Consumers in this region are increasingly embracing contemporary and culturally inspired décor elements. Economic diversification initiatives in several countries are also contributing to the upliftment of the interior decoration industry.

Latin America Wall Decor Market Trends

Latin America shows steady growth in the wall decor market, driven by increasing interest in home enhancement and aesthetic interior upgrades. Urban population growth and improving retail distribution channels support market penetration. The region also displays a growing inclination toward vibrant and handcrafted décor elements influenced by local artistic traditions.

U.S. Wall Decor Market Trends

The U.S. market plays a dominant role within North America, supported by strong consumer inclination toward premium and personalized wall décor. Rising investments in home remodeling and DIY culture continue to boost product demand. The widespread availability of diverse design options across online and offline platforms further accelerates market growth in the country.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Wall Decor Company Insights

The global Wall Décor Market in 2024 reflects strong consumer interest in personalization, multifunctional interiors, and digitally enabled shopping journeys. Within this landscape, four leading retailers continue to reinforce their competitive advantage through scale, assortment depth, and increasingly sophisticated omnichannel strategies.

IKEA remains a dominant force, leveraging its global footprint and Scandinavian design philosophy to influence mainstream décor preferences. Its affordable pricing and rapid rollout of new collections help the brand stay aligned with shifting consumer tastes, particularly among budget-conscious and younger shoppers seeking minimalist wall accents.

Home Depot continues to benefit from the ongoing DIY culture, using its robust in-store guidance and online project tools to drive wall décor sales. The retailer’s focus on seasonal trends and easy-install products positions it well among homeowners looking to refresh interiors without professional assistance.

Lowe’s enhances its market position through curated décor assortments designed to complement its broader home-improvement ecosystem. Its investment in online visualization tools and coordinated style collections appeals to consumers wanting cohesive room designs supported by reliable brand trust.

Wayfair leverages its data-driven online marketplace to capture a growing share of digital décor spending. With extensive product variety and AI-based personalization, the platform excels at connecting shoppers with niche wall décor items and emerging micro-trends at scale.

Together, these four players underscore how accessibility, digital enablement, and adaptable assortments are shaping competitive dynamics in 2024. Their combined influence continues to set benchmarks for product innovation, online experience, and consumer-centric retail strategies across the global wall décor sector.

Top Key Players in the Market

- IKEA

- Home Depot

- Lowe’s

- Wayfair

- Williams-Sonoma

- Etsy Minted

- Society6 & Redbubble

- Urban Outfitters & Anthropologie

Recent Developments

- In September 2025, Johnson Paint | A Ring’s End Brand acquired Home Décor Group Stratham, strengthening its regional presence and expanding its portfolio in the home improvement and décor market.

- In January 2025, Consortium Brand Partners acquired the iconic home décor company Jonathan Adler®, aiming to accelerate its growth and extend the brand’s reach across new consumer and retail channels.

- In January 2025, the renowned design brand Jonathan Adler was purchased by a leading consumer investment firm, marking a strategic move to support its continued innovation and expansion in the life

Report Scope

Report Features Description Market Value (2024) USD 64.7 Billion Forecast Revenue (2034) USD 103.4 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Wall Art, Wallpapers & Wall Coverings, Wall Stickers & Decals, Clocks, Mirrors, Others), By Material Type (Wood, Metal, Plastic, Fabric, Glass, Others), By Sales Channel (Specialty Stores, Supermarkets/Hypermarkets, Online, Departmental Stores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape IKEA, Home Depot, Lowe’s, Wayfair, Williams-Sonoma, Etsy Minted, Society6 & Redbubble, Urban Outfitters & Anthropologie Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- IKEA

- Home Depot

- Lowe's

- Wayfair

- Williams-Sonoma

- Etsy Minted

- Society6 & Redbubble

- Urban Outfitters & Anthropologie