Global Vertical Wind Turbine Market Size, Share, And Enhanced Productivity By Type (Straight-Bladed Vertical Axis Wind Turbine, Curved-Bladed Vertical Axis Wind Turbine), By Power Outlook (Less than 1 MW, 1-5 MW, 5 MW and Above), By Rotor Configuration (H-Type, V-Type), By End User (Residential, Commercial and Industrial, Utilities), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174595

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

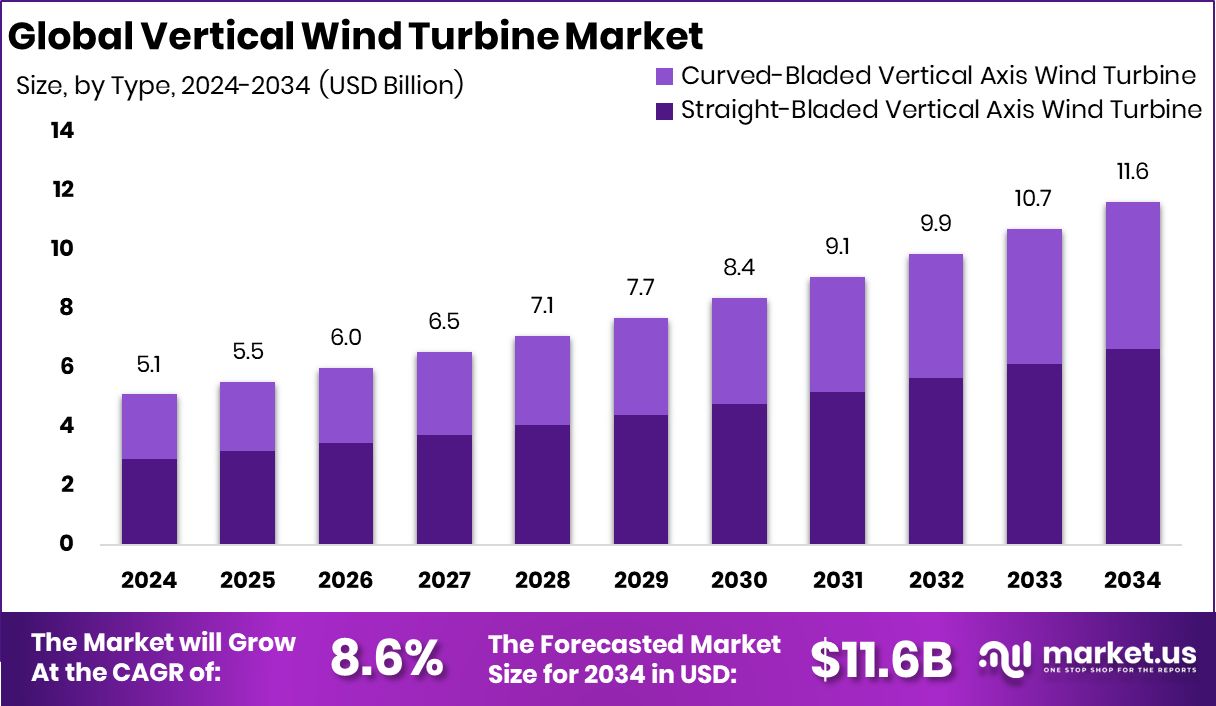

The Global Vertical Wind Turbine Market is expected to be worth around USD 11.6 billion by 2034, up from USD 5.1 billion in 2024, and is projected to grow at a CAGR of 8.6% from 2025 to 2034. Asia Pacific maintained leadership at 42.5%, supported by investments totaling USD 2.1 Bn.

A vertical wind turbine is a wind-energy system where the blades rotate around a vertical axis instead of the traditional horizontal design. Because it can capture wind from any direction, it performs well in cities, coastal areas, and locations with turbulent wind patterns. These turbines are often smaller, quieter, and easier to install, making them suitable for homes, buildings, community sites, and hybrid renewable systems. Their simple structure allows steady operation even in low-wind environments, which makes them an accessible clean-energy option.

The Vertical Wind Turbine Market represents the global demand, manufacturing, installation, and technological development of these turbines across residential, commercial, and industrial applications. This market grows as communities seek cleaner power sources and compact solutions that fit urban spaces. The sector also benefits from rising awareness of local energy generation and supportive clean-energy policies in many regions. Improving turbine materials and better efficiency at low wind speeds continue to make vertical designs more attractive.

Growth in this market is supported by expanding investment across the wind sector. Funding such as INR 30 Crore secured by Wind O&M Specialist GreenTech, €135 million lined up by Encavis for Spanish renewable assets, and the $500K awarded by the NSF to WindSTAR helps advance innovation, project development, and maintenance capabilities that indirectly strengthen vertical wind technologies. These investments reflect broader confidence in wind-based solutions.

Demand for vertical turbines rises as households, businesses, and communities look for reliable and space-efficient renewable systems. The fact that wind power has saved UK consumers over £100 billion since 2010 shows how wind energy reduces long-term electricity costs, encouraging more small-scale and distributed turbine adoption. Users increasingly prefer solutions that cut bills, require minimal land, and offer clean power closer to the point of use.

Opportunities are expanding as governments and investors show interest in wind assets. Discussions like Ørsted exploring the sale of a stake in an £8.5 billion UK wind project to Apollo highlight the high value placed on wind infrastructure. For vertical turbines, this creates room for new hybrid installations, urban pilot programs, and integration with local grids, opening pathways for growth in both developed and emerging markets.

Key Takeaways

- The Global Vertical Wind Turbine Market is expected to be worth around USD 11.6 billion by 2034, up from USD 5.1 billion in 2024, and is projected to grow at a CAGR of 8.6% from 2025 to 2034.

- The vertical wind turbine market shows strong dominance as straight-bladed designs capture 57.2% of global preference.

- In the vertical wind turbine market, systems under 1 MW hold a leading 52.4% share worldwide.

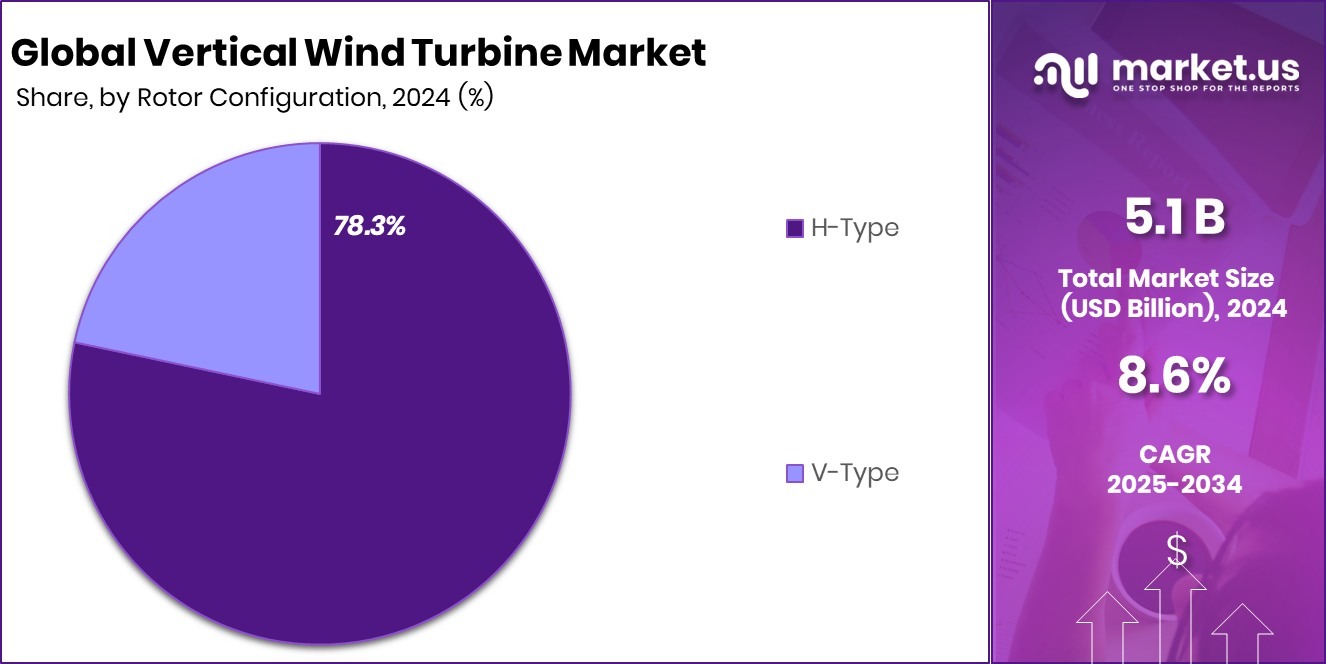

- The vertical wind turbine market benefits from the popularity of H-Type rotor configurations, commanding a 78.3% share.

- Residential users significantly shape the vertical wind turbine market, contributing a substantial 39.8% segment share.

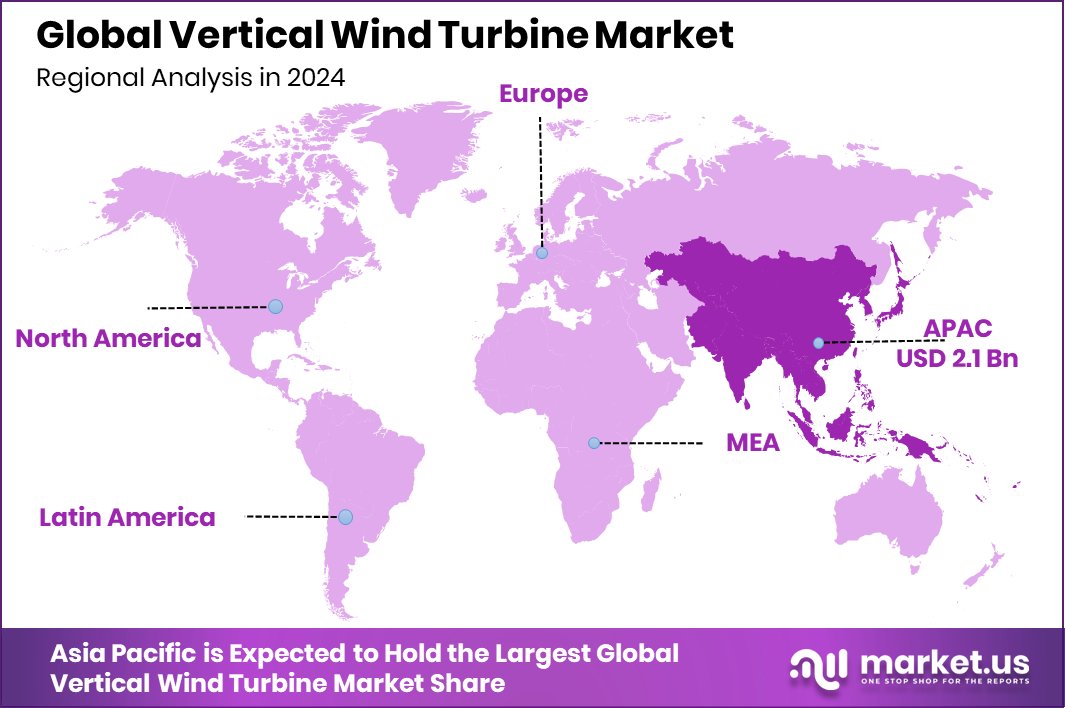

- The Asia Pacific’s 42.5% share reflects strong clean-energy adoption worth USD 2.1 Bn.

By Type Analysis

Straight-bladed vertical axis wind turbines dominate the market with 57.2% share.

In 2024, the Straight-Bladed Vertical Axis Wind Turbine segment dominated the Vertical Wind Turbine Market with a strong 57.2% share, reflecting its simplicity, durability, and better performance in turbulent urban wind conditions. This design works efficiently regardless of wind direction, making it ideal for cities and off-grid setups. Manufacturers increasingly prefer straight-bladed systems due to easier maintenance, lower production costs, and reliable startup speeds.

Growing investments in distributed renewable energy and supportive government incentives have strengthened adoption. The segment continues to expand as end users demand quiet, compact, and efficient turbine options suitable for rooftops, community microgrids, and hybrid energy systems, solidifying its leadership in the overall market landscape.

By Power Outlook Analysis

Systems under one megawatt lead the power outlook, capturing a strong 52.4% share.

In 2024, the Less Than 1 MW category led the Vertical Wind Turbine Market with a commanding 52.4% share, driven by rising demand for small-scale renewable systems across residential, commercial, and small industrial facilities. This segment is favored for its low installation cost, easier permitting, and suitability for decentralized clean-energy needs. Small turbines align well with backup power, hybrid solar-wind systems, and remote area electrification.

Governments’ focus on boosting household-level renewable energy adoption further accelerates growth. Technology advancements improving efficiency, blade materials, and low-wind performance also support this segment. As the urban energy transition strengthens, sub-1 MW turbines remain crucial in supporting distributed, reliable, and cost-effective wind power generation.

By Rotor Configuration Analysis

H-type rotor configurations remain preferred, holding an impressive 78.3% market share.

In 2024, the H-Type Rotor Configuration segment emerged as the clear leader in the Vertical Wind Turbine Market with an impressive 78.3% share, making it the most preferred design among VAWT technologies. Its aerodynamic stability, high torque output, and efficient operation in low and variable wind speeds make it suitable for both urban and rural installations. H-type turbines offer reduced noise, minimal vibration, and better mechanical balance, supporting long-term durability.

The configuration is widely adopted in building-mounted systems, small wind farms, and hybrid microgrids. Continuous innovation in composite blades, magnetic levitation systems, and lightweight materials further enhances performance. This dominance is expected to continue as demand grows for compact, reliable, clean-energy solutions worldwide.

By End User Analysis

Residential users increasingly adopt vertical turbines, accounting for 39.8% total share.

In 2024, the Residential segment accounted for a significant 39.8% share of the Vertical Wind Turbine Market, highlighting the growing shift toward household-level renewable power generation. Homeowners increasingly prefer VAWTs because they operate quietly, require minimal space, and perform well in turbulent urban wind flows compared to horizontal turbines. Rising electricity costs and sustainability awareness are motivating residents to adopt personal clean-energy systems.

Government incentives, rooftop wind pilot programs, and hybrid solar-wind installations further support segment expansion. Residential users value easy installation, low maintenance, and the ability to supplement grid power. As cities promote decentralized energy, vertical turbines are becoming an accessible choice for clean, affordable home electricity.

Key Market Segments

By Type

- Straight-Bladed Vertical Axis Wind Turbine

- Curved-Bladed Vertical Axis Wind Turbine

By Power Outlook

- Less than 1 MW

- 1-5 MW

- 5 MW and Above

By Rotor Configuration

- H-Type

- V-Type

By End User

- Residential

- Commercial and Industrial

- Utilities

Driving Factors

Strong Investments Drive Vertical Wind Turbine Expansion

Growing financial support for wind-based innovations remains a major driving factor for the Vertical Wind Turbine Market. The sector benefits when funding flows into advanced projects, because it encourages better designs, stronger materials, and new installation possibilities. A clear example is Gazelle securing new funding for its 2 MW floating wind demonstration project, which highlights rising confidence in wind technologies of all scales.

Although this project is focused on floating systems, such funding strengthens the broader ecosystem by improving engineering knowledge, supply chains, and operational skills that directly support vertical wind solutions as well. As investors continue backing creative wind concepts, vertical turbines gain from improved awareness, technical expertise, and cross-sector innovation.

Restraining Factors

Infrastructure Delays Restrict Vertical Wind Deployment

A key restraint for the Vertical Wind Turbine Market is delays in infrastructure decisions related to wind projects. When governments pause or reconsider funding, it slows overall momentum for renewable capacity expansion. A recent case is the nearly £2.3 million funding opportunity for a Californian harbour’s transformation into an offshore wind terminal being put on hold.

Although this project is offshore-focused, such delays create uncertainty in the wider wind ecosystem. They slow permitting, stall supply chain upgrades, and push back supporting facilities that also help vertical wind installations scale faster. These interruptions reduce investor confidence and make it harder for small and urban wind systems to secure smooth pathways for adoption.

Growth Opportunity

Supply Chain Expansion Creates New Market Openings

One of the biggest opportunities for the Vertical Wind Turbine Market comes from ongoing efforts to strengthen the wind-energy supply chain. Enhancing local manufacturing, skills, and innovation supports easier adoption of compact and urban-friendly turbines. A recent boost came from the Offshore Wind Growth Partnership (OWGP) allocating £2.4 million to nine UK supply-chain companies to help them scale capabilities.

Even though the funding targets offshore operations, improvements in materials, design standards, and engineering processes benefit vertical turbines as well. These advancements open doors for new pilot projects, hybrid installations, and community-level energy programs. With stronger supply networks, vertical turbines can reach more markets with reliable costs and better long-term performance.

Latest Trends

Rising Focus on Large Wind Projects Shapes Trends

A major trend influencing the Vertical Wind Turbine Market is the global push toward large-scale wind development, which lifts awareness and investment across all wind technologies. Regions are strengthening wind commitments through major financing rounds, such as Welsh offshore wind farms securing funding with up to 7,000 jobs projected, showing how strongly governments view wind’s long-term value.

Likewise, Ørsted securing a €2.6 billion multi-ECA finance package for a Taiwan wind project demonstrates expanding global appetite for wind infrastructure. While these projects are utility-scale, they create broader momentum, attract research attention, and improve supply-chain maturity. This rising interest indirectly supports vertical turbines by encouraging the adoption of diverse, space-efficient wind systems in cities and communities.

Regional Analysis

Asia Pacific dominated the Vertical Wind Turbine Market with 42.5%, reaching USD 2.1 Bn.

Asia Pacific led the Vertical Wind Turbine Market with a solid 42.5% share, valued at USD 2.1 Bn, reflecting the region’s strong focus on small-scale renewable installations and rapid adoption across urban and semi-urban areas. The market benefits from rising demand for distributed clean energy and growing suitability of vertical turbines for dense city landscapes.

In North America, adoption continues to expand steadily as residential and commercial users integrate compact wind systems to support local power generation, especially in areas with variable wind patterns. Europe shows consistent growth driven by community-level energy projects and interest in low-noise, space-efficient wind solutions.

Meanwhile, the Middle East & Africa region demonstrates gradual uptake as hybrid solar-wind applications gain relevance in remote locations, supporting small power needs. Latin America maintains a developing presence, with installations increasing in regions seeking cost-effective renewable alternatives for rural and peri-urban energy requirements.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, ArborWind stands out for its strong engineering-driven approach to vertical wind turbine development. The company focuses on robust turbine structures designed for consistent performance in challenging wind conditions. ArborWind’s emphasis on durability, simplified mechanics, and long operating life makes its solutions suitable for decentralized power generation. Its technology direction reflects a practical understanding of real-world installation environments, particularly where space constraints and variable winds are common. This positions the company as a steady innovator rather than a volume-driven supplier.

Aeolos Wind Energy demonstrates a balanced focus on design efficiency and system reliability. The company has built credibility through vertical wind solutions that prioritize ease of installation and operational stability. Aeolos’ product philosophy aligns well with users seeking scalable, low-maintenance renewable systems. Its engineering choices indicate a clear intention to serve both on-grid and off-grid applications. From an analyst perspective, Aeolos benefits from its adaptable turbine platforms and a clear understanding of small-to-medium energy demand profiles.

Meanwhile, HI-VAWT Technology is recognized for its technical specialization in vertical-axis wind systems. The company’s focus on aerodynamic efficiency and structural balance highlights a research-oriented mindset. HI-VAWT Technology concentrates on improving performance under low and unstable wind conditions, which are critical for urban and built environments. This technical depth gives the company a niche advantage in precision-driven vertical wind applications.

Top Key Players in the Market

- ArborWind

- Aeolos Wind Energy

- HI-VAWT Technology

- Flower Turbines

- Ryse Energy

- SeaTwirl

- Urban Green Energy

- Whirlwind Wind Turbines

- Wind Harvest International

- Windside Production

- Windspire Energy

Recent Developments

- In September 2025, Ryse Energy confirmed a pilot use of rGF textiles for wind blade materials at its facility in Spain. This development focuses on improving blade strength and durability without changing current manufacturing processes, supporting future performance improvements for wind turbines.

- In August 2025, Flower Turbines launched Project Series 1, a new model of their small vertical wind turbines, and began a crowdfunding campaign to fund its rollout. This initiative is aimed at expanding product reach and engaging community investors to support production. The campaign highlights the company’s focus on sleek, efficient wind solutions suitable for urban and off-grid use.

Report Scope

Report Features Description Market Value (2024) USD 5.1 Billion Forecast Revenue (2034) USD 11.6 Billion CAGR (2025-2034) 8.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Straight-Bladed Vertical Axis Wind Turbine, Curved-Bladed Vertical Axis Wind Turbine), By Power Outlook (Less than 1 MW, 1-5 MW, 5 MW and Above), By Rotor Configuration (H-Type, V-Type), By End User (Residential, Commercial and Industrial, Utilities) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ArborWind, Aeolos Wind Energy, HI-VAWT Technology, Flower Turbines, Ryse Energy, SeaTwirl, Urban Green Energy, Whirlwind Wind Turbines, Wind Harvest International, Windside Production, Windspire Energy Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Vertical Wind Turbine MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Vertical Wind Turbine MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- ArborWind

- Aeolos Wind Energy

- HI-VAWT Technology

- Flower Turbines

- Ryse Energy

- SeaTwirl

- Urban Green Energy

- Whirlwind Wind Turbines

- Wind Harvest International

- Windside Production

- Windspire Energy