Global Vegan Steak Market Size, Share, And Business Benefit , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034By Source (Soy, Almond, Wheat, Others), By End User (Packaged Food Industries, Hotels and Restaurants, Retail Food Shops, Domestic Consumers, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Platforms, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 163447

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

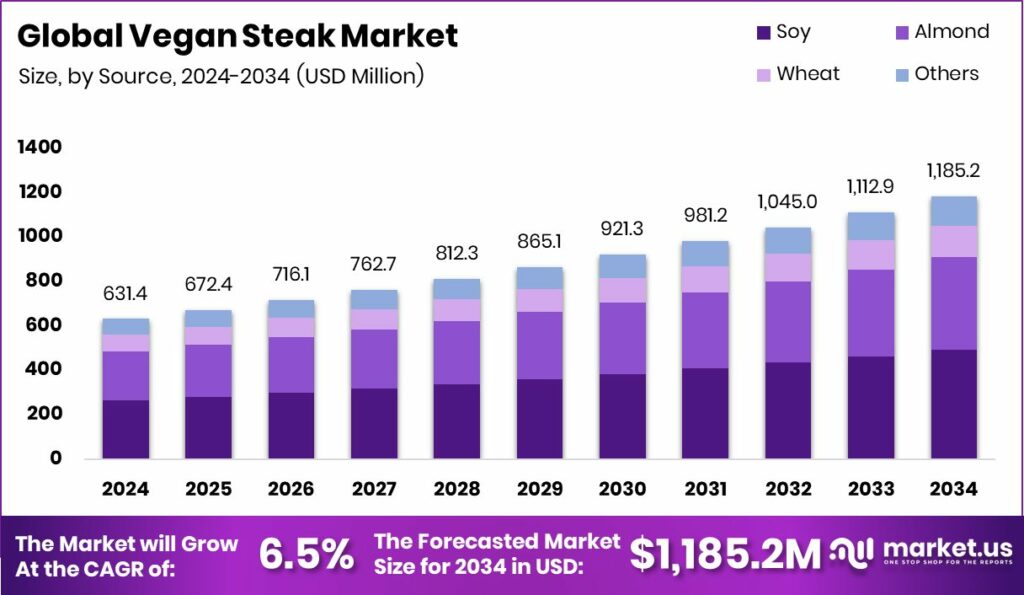

The Global Vegan Steak Market is expected to be worth around USD 1,185.2 million by 2034, up from USD 631.4 million in 2024, and is projected to grow at a CAGR of 6.5% from 2025 to 2034. Growing health awareness and sustainable diets continue to strengthen North America’s 46.80% market leadership.

Vegan steak refers to a plant-based food product designed to mimic the look, texture, and taste of traditional animal-based steak but using entirely non-animal ingredients such as soy, wheat gluten, legumes, or mushrooms. It’s formulated to appeal to consumers who seek the steak experience without meat and often highlights attributes such as “high in plant protein,” “free from cholesterol,” “cruelty-free,” and “environmentally friendly”.

The vegan steak market represents the global commercial segment for these plant-based steak analogues across retail, food service, and domestic channels. It covers production, distribution, marketing, and consumption of vegan steak products, driven by shifting dietary habits, sustainability awareness, and food technology innovation.

One major growth factor is changing consumer behavior: as more people adopt flexitarian, vegetarian, or vegan diets, demand for meat-free alternatives capable of delivering familiar steak-style experiences is rising. The increased health consciousness around red and processed meats and the rising interest in sustainable diets are also driving the shift.

Significant opportunity lies in technology-led product innovation (texture, flavor, and ingredient sourcing) and geographic expansion, especially in markets where plant-based alternatives are nascent. Also, strategic upstream investments and alternative protein feedstocks create room for differentiation.

Funding examples: Sironix, which turns soybeans into cleaning ingredients, raises $3.5 M to fund manufacturing; the rail board sends $12.6 million to the Mitchell area to support a $500 million soy processing plant; Nitricity bags $50M to meet surging demand for organic fertilizer from upcycled almond shells; CarbonZero.Eco secures $3.5M in seed funding and $7M in biochar agreements with almond farmers; Almond FinTech secures $7M in funding to transform global financial transactions; and Nitricity raises $10M for an organic fertilizer plant in California and pivots to new tech.

Key Takeaways

- The Global Vegan Steak Market is expected to be worth around USD 1,185.2 million by 2034, up from USD 631.4 million in 2024, and is projected to grow at a CAGR of 6.5% from 2025 to 2034.

- In 2024, the Vegan Steak Market saw soy dominate with a 48.9% share, ensuring superior protein content.

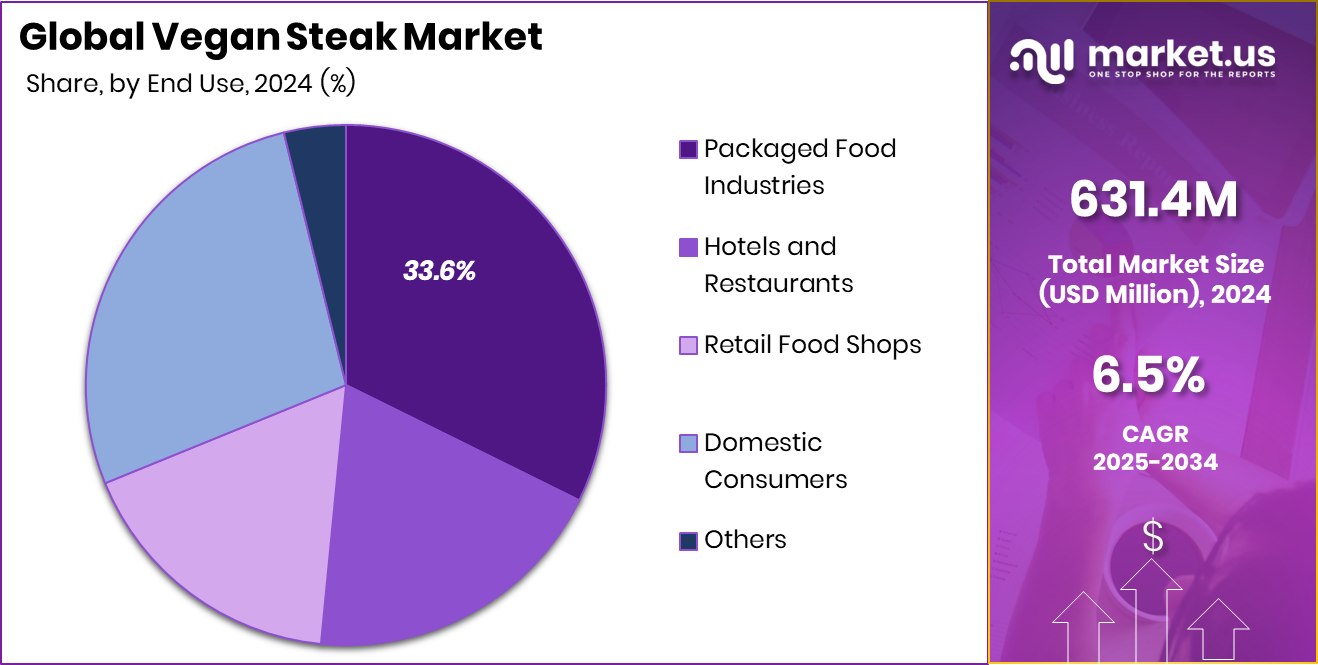

- The Vegan Steak Market observed a 33.6% share from packaged food industries, driven by retail-ready

- Supermarkets and hypermarkets captured 38.5% of the vegan steak market share, dominating distribution access globally.

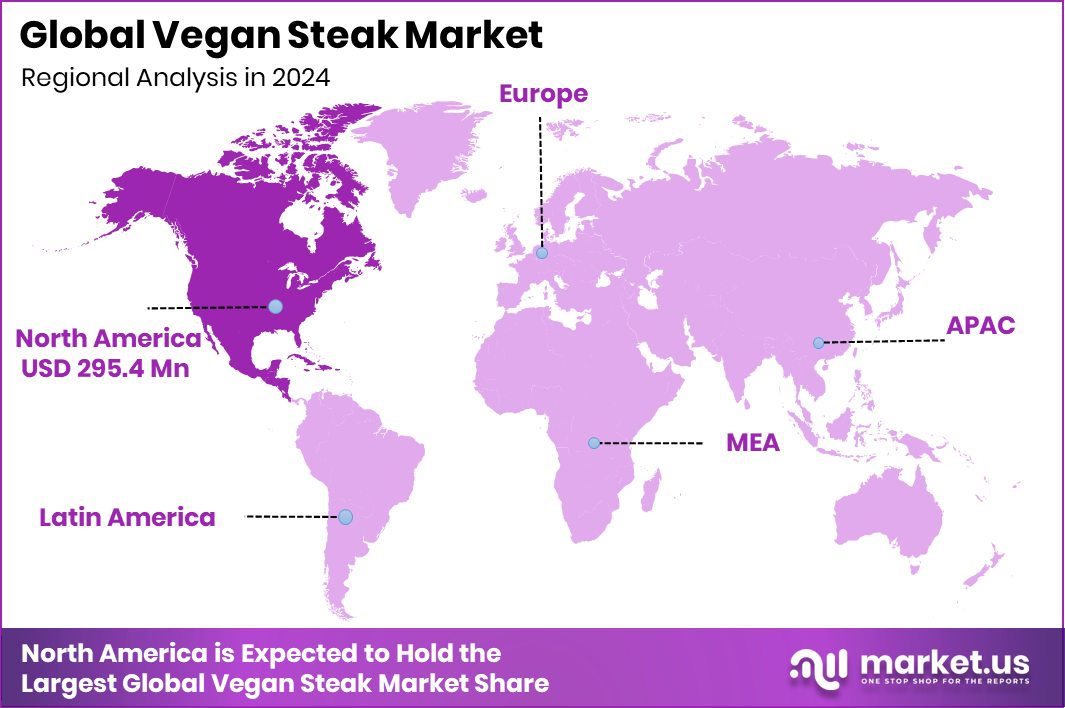

- The North American market value reached approximately USD 295.4 million, driven by rising vegan consumption.

By Source Analysis

In 2024, the vegan steak market was dominated by soy, holding 48.9%.

In 2024, Soy held a dominant market position in the By Source segment of the Vegan Steak Market, with a 48.9% share. The dominance of soy-based vegan steak is mainly due to its rich protein content, versatility, and ability to closely replicate the texture and flavor of animal meat. Soy provides a complete amino acid profile, making it a preferred ingredient among consumers seeking nutritious meat alternatives.

Manufacturers are increasingly using soy to develop products that offer authentic taste and enhanced mouthfeel. The steady supply of soybeans and growing adoption of plant-based proteins in mainstream diets have strengthened soy’s leadership in this segment, maintaining its competitive edge across retail, food service, and packaged meal applications.

By End Use Analysis

The vegan steak market saw packaged food industries accounting for a 33.6% share.

In 2024, Packaged Food Industries held a dominant market position in the By End Use segment of the Vegan Steak Market, with a 33.6% share. The strong position of this segment is driven by the rising demand for convenient, ready-to-cook vegan meals that align with modern lifestyles.

Packaged food manufacturers are increasingly incorporating vegan steak into frozen, chilled, and ready-to-eat product lines to cater to health-conscious and sustainability-focused consumers.

The growth of retail chains and online grocery platforms has further supported the widespread availability of these products. Additionally, the long shelf life and consistent quality of packaged vegan steaks have enhanced their adoption, making them a preferred choice across both domestic and commercial consumption channels.

By Distribution Channel Analysis

Supermarkets and hypermarkets led the vegan steak market with a 38.5% distribution share.

In 2024, supermarkets/hypermarkets held a dominant market position in the By Distribution Channel segment of the Vegan Steak Market, with a 38.5% share. The dominance of this channel is primarily due to its extensive product visibility, wide consumer reach, and the availability of diverse vegan steak brands under one roof.

Consumers prefer supermarkets and hypermarkets for their convenience, product variety, and promotional offers, which boost sales volume. The ability to physically inspect packaging, ingredients, and freshness adds to consumer confidence.

Moreover, the rising focus of retail chains on plant-based product sections and in-store marketing campaigns has strengthened their position, making supermarkets and hypermarkets the leading sales points for vegan steak products worldwide.

Key Market Segments

By Source

- Soy

- Almond

- Wheat

- Others

By End User

- Packaged Food Industries

- Hotels and Restaurants

- Retail Food Shops

- Domestic Consumers

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Platforms

- Others

Driving Factors

Rising Shift Toward Sustainable Protein Alternatives

One of the key driving factors for the vegan steak market is the rising global shift toward sustainable and ethical protein alternatives. Consumers are increasingly adopting plant-based diets to reduce environmental impact and improve personal health. The vegan steak market benefits from this shift as it offers a meat-like experience without animal products.

Governments and industries are also supporting sustainability transitions with strategic funding. The UK’s $4 million allocation to support Ukraine’s wheat supply to Syria highlights the focus on global food security. Similarly, innovations in soy and organic fertilizers demonstrate sustainable production expansion, creating favorable conditions for vegan protein industries. These combined efforts are encouraging large-scale adoption of vegan steak across retail and food service sectors.

Restraining Factors

Limited Consumer Acceptance and Taste Perception Challenges

A major restraining factor for the vegan steak market is limited consumer acceptance due to taste and texture perception. Many consumers still feel that plant-based steaks do not completely replicate the flavor and juiciness of traditional meat. This sensory gap affects repeat purchases and slows overall adoption. Additionally, some consumers associate vegan products with being overly processed or lacking authentic nutritional balance.

Despite technological advances, achieving the same satisfaction level as animal-based steak remains a challenge. Price sensitivity also influences purchasing decisions, as vegan steak products are often more expensive than conventional meat. These combined issues restrict market growth and highlight the need for continued innovation to improve flavor authenticity and affordability.

Growth Opportunity

Expanding Government Support for Plant-Based Agriculture

A key growth opportunity for the vegan steak market lies in expanding government support for plant-based agriculture and sustainable food systems. Increasing investments in crop diversification and eco-friendly farming strengthen the availability of high-quality raw materials like soy and wheat, essential for vegan steak production.

The approval of the Rs 15 billion wheat support fund by Maryam Nawaz, along with the announced relief for Punjab’s farmers, highlights a growing policy push toward resilient, sustainable agriculture.

Such initiatives enhance supply stability, lower production costs, and encourage local sourcing for plant-based protein industries. As more governments prioritize food security and sustainable consumption, vegan steak producers can benefit from improved ingredient access, regional partnerships, and stronger integration into global food supply chains.

Latest Trends

Advancing Crop Resilience to Support Plant-Based Growth

One of the latest trends in the vegan steak market is the focus on strengthening crop resilience and sustainable ingredient sourcing. As plant-based production depends heavily on agricultural stability, improving crop protection and post-harvest management has become a major priority. The Henan government’s 200 million yuan emergency funding for wheat drying amid the rainy season reflects growing global attention toward safeguarding essential crops used in plant-based foods.

This funding ensures consistent wheat quality and availability, directly benefiting producers of vegan steak and other plant-based proteins. Such proactive agricultural measures reduce supply chain disruptions, maintain ingredient integrity, and encourage long-term investments in sustainable food innovation, reinforcing the vegan steak market’s steady and secure growth outlook.

Regional Analysis

In 2024, North America dominated the Vegan Steak Market with a 46.80% share.

In 2024, North America held a dominant position in the global Vegan Steak Market, capturing 46.80% share valued at USD 295.4 million. The region’s leadership is driven by strong consumer preference for plant-based diets, rising health awareness, and increasing vegan product launches across major retail chains. The U.S. and Canada have witnessed the rapid adoption of meat alternatives, supported by favorable labeling regulations and expanding product innovation.

Europe follows closely with steady growth, influenced by strict sustainability policies and the expansion of plant-based protein processing facilities. Asia Pacific is experiencing notable demand growth due to urbanization and the growing middle-class preference for sustainable protein options.

Meanwhile, Latin America and the Middle East & Africa are emerging markets showing early-stage awareness of vegan lifestyles, supported by expanding retail availability and shifting dietary habits. North America’s mature retail infrastructure and advanced food technology continue to reinforce its dominance across the global landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Danone S.A. demonstrated strong progress in the vegan steak market through its expanding plant-based portfolio. The company’s focus on sustainable food innovation and nutrition-driven product development continues to align with the global shift toward alternative proteins. Danone is leveraging its expertise in plant-based dairy to create texture-rich, nutrient-balanced meat substitutes catering to health-conscious consumers.

The Archer Daniels Midland Company (ADM) maintained its leadership by strengthening its plant protein ingredient base, which supports a wide range of vegan and meat-alternative formulations. Its advanced processing capabilities and R&D initiatives help improve taste, mouthfeel, and nutritional consistency in vegan steak production. ADM’s robust supply chain ensures high-quality, traceable raw materials essential for product reliability.

Daiya Foods Inc. continued to enhance its position through innovation in allergen-free, vegan-friendly food solutions. The company’s focus on clean-label, plant-based offerings resonates with growing consumer demand for ethical and sustainable choices. Daiya’s product diversification into plant-based meals, including meat alternatives, positions it as a trusted brand in the evolving vegan food segment.

Top Key Players in the Market

- Danone S.A.

- The Archer Daniels Midland Company

- Daiya Foods Inc.

- Impossible Foods Inc.

- Beyond Meat, Inc.

- Amy’s Kitchen

- Tofutti Brands Inc.

- Earth’s Own Food Company Inc.

Recent Developments

- In September 2024, Danone announced the expansion of its “Partner for Growth (P4G)” programme, signing multiple new strategic agreements and joint business development plans across ingredients, manufacturing, agriculture, and innovation — underpinning broader commitments including plant-based and alternative protein value chains.

- In September 2024, ADM announced an investment of roughly US $300 million at its Decatur, Illinois, facility to ramp up production of alternative proteins by increasing soy protein concentrate capacity and nearly doubling extrusion capacity.

Report Scope

Report Features Description Market Value (2024) USD 631.4 Million Forecast Revenue (2034) USD 1,185.2 Million CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Soy, Almond, Wheat, Others), By End User (Packaged Food Industries, Hotels and Restaurants, Retail Food Shops, Domestic Consumers, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Platforms, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Danone S.A., The Archer Daniels Midland Company, Daiya Foods Inc., Impossible Foods Inc., Beyond Meat, Inc., Amy’s Kitchen, Tofutti Brands Inc., Earth’s Own Food Company Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Danone S.A.

- The Archer Daniels Midland Company

- Daiya Foods Inc.

- Impossible Foods Inc.

- Beyond Meat, Inc.

- Amy's Kitchen

- Tofutti Brands Inc.

- Earth's Own Food Company Inc.