Global Vanadium Liquid Battery Market Size, Share, And Business Benefit By Type (Redox Flow Battery, Hybrid Flow Battery), By Storage Capacity (Small Scale, Large Scale), By End-User (Energy and Power, Automotive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165728

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

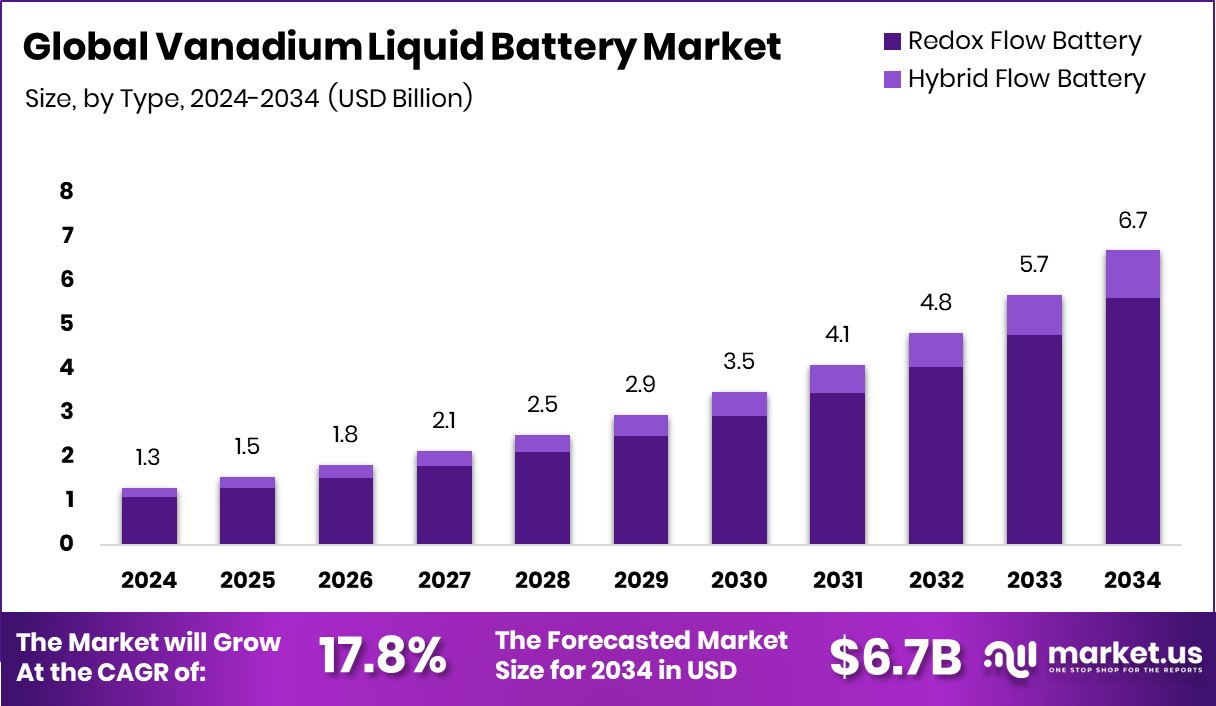

The Global Vanadium Liquid Battery Market is expected to be worth around USD 6.7 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 17.8% from 2025 to 2034. North America’s 45.2% share maintains steady growth as demand for advanced energy storage rises.

A vanadium liquid battery, also known as a vanadium redox flow battery, is an energy-storage system that uses liquid electrolytes containing vanadium ions. These electrolytes are stored in external tanks and pumped through cell stacks during charging and discharging. Because both electrolytes use the same element, the system avoids cross-contamination and lasts for thousands of cycles. Its long life, deep-discharge capability, and ability to scale by simply enlarging tanks make it suitable for renewable-energy storage and grid-balancing applications.

The vanadium liquid battery market revolves around developing, manufacturing, and deploying long-duration energy-storage systems for utility-scale renewable integration, microgrids, and industrial power backup. Demand continues to grow as grids add more solar and wind power, requiring solutions that store large amounts of energy for many hours without performance loss.

Growth is supported by rapid investment in large renewable-energy projects. Recent funding, such as ReNew’s financing for its 837 MW hybrid renewable project and Hero Future Energies securing ₹1,000 crore for hybrid expansion, boosts demand for long-duration storage systems capable of stabilizing intermittent power. These large renewable additions naturally push utilities to explore durable storage solutions like vanadium batteries.

Demand rises as countries seek stable grid storage for solar- and wind-heavy regions. Funding toward charging and storage ecosystems—such as ACS Energy’s ₹1.1 crore pre-seed round for EV-charging networks and Oriana Power’s ₹212 crore BESS project in Karnataka—creates an environment where reliable long-duration batteries become essential for balancing energy peaks and enabling smooth electrification.

Major infrastructure funds entering the space, including Nuveen’s $1.3 billion raise and Core Energy Systems’ ₹200 crore funding, signal strong confidence in next-generation storage technologies. This opens opportunities for vanadium liquid batteries to serve grid-scale storage, hybrid renewable projects, and future nuclear-linked energy systems that require robust, long-cycle storage capabilities.

Key Takeaways

- The Global Vanadium Liquid Battery Market is expected to be worth around USD 6.7 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 17.8% from 2025 to 2034.

- The Vanadium Liquid Battery Market is dominated by redox flow batteries, holding 84.6% share.

- Large-scale systems lead the Vanadium Liquid Battery Market with a 65.3% share worldwide.

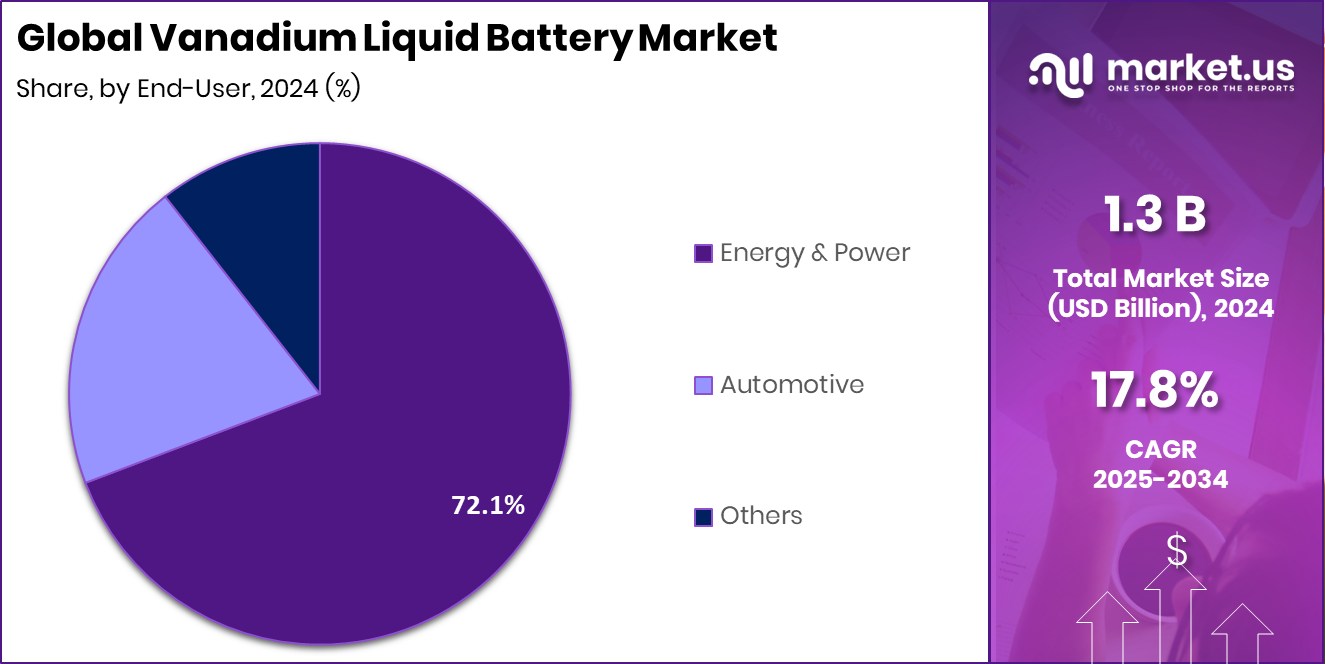

- The energy and power sector drives the Vanadium Liquid Battery Market with a 72.1% share today.

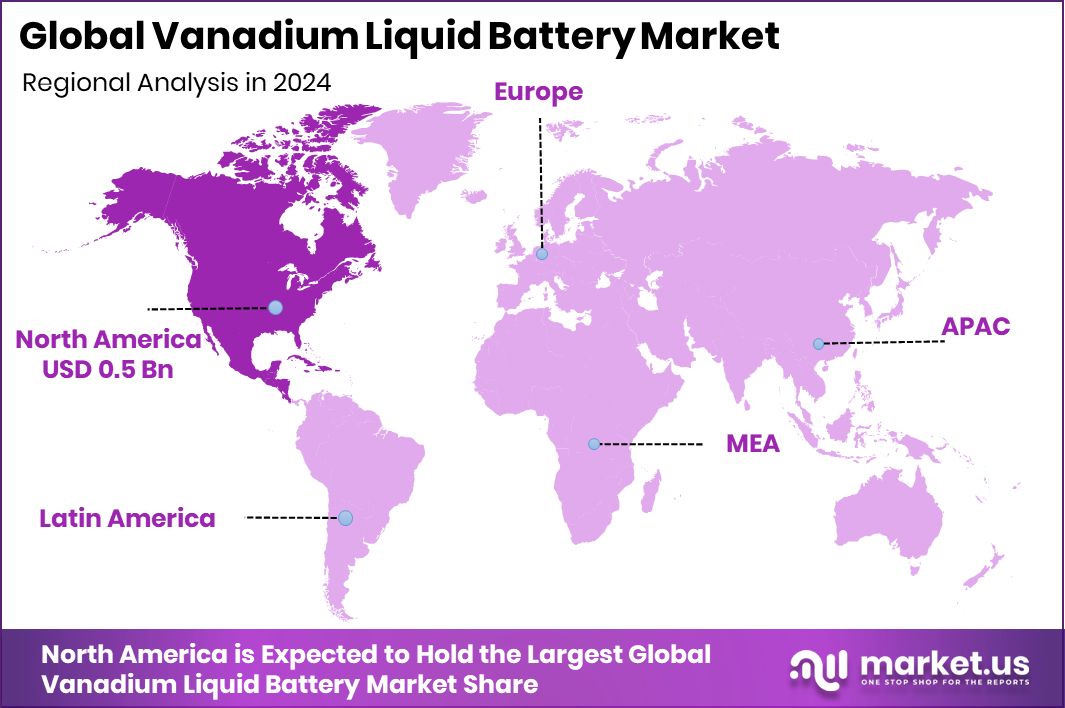

- North America records a strong market valuation of USD 0.5 Bn today.

By Type Analysis

The vanadium liquid battery market is dominated by redox flow technology at 84.6%.

In 2024, Redox Flow Battery held a dominant market position in the By Type segment of the Vanadium Liquid Battery Market, with an 84.6% share. This strong lead reflects its reliable design, long cycle life, and suitability for large-scale energy-storage needs. Redox flow systems allow easy scalability by expanding electrolyte tanks, making them preferred for utility projects and long-duration storage applications. Their ability to operate safely under deep-discharge conditions also strengthens user confidence.

The dominance of this segment highlights growing interest in stable storage technologies that support renewable integration and grid balancing. With consistent performance and flexible capacity expansion, Redox Flow Batteries maintain a clear advantage in meeting modern energy-storage demands.

By Storage Capacity Analysis

Vanadium Liquid Battery Market relies on large-scale systems, holding a 65.3% share.

In 2024, Large Scale held a dominant market position in the By Storage Capacity segment of the Vanadium Liquid Battery Market, with a 65.3% share. This leadership reflects the growing demand for high-capacity systems that can support utility operations, renewable-energy integration, and long-duration grid balancing.

Large-scale installations benefit from the technology’s ability to deliver steady performance, deep-discharge tolerance, and long operational life, making them suitable for managing fluctuations in solar and wind output. Their scalable tank-based design also makes capacity expansion straightforward, which further strengthens their preference among energy developers. With rising emphasis on grid stability and reliable storage, the Large-Scale segment continues to anchor the market’s overall growth.

By End-User Analysis

The vanadium liquid battery market is led by energy and power at 72.1%.

In 2024, Energy and Power held a dominant market position in the By End-User segment of the Vanadium Liquid Battery Market, with a 72.1% share. This strong lead reflects the sector’s need for dependable long-duration storage to manage variable renewable output and maintain grid stability. Utilities and power developers rely on the steady performance and long cycle life of vanadium-based systems, especially for balancing large solar and wind capacities.

The segment’s dominance also highlights the growing focus on strengthening transmission networks and ensuring uninterrupted supply during peak demand. With increasing adoption of renewable projects and wider acceptance of large-scale energy storage, the Energy and Power segment remains the core driver of market uptake.

Key Market Segments

By Type

- Redox Flow Battery

- Hybrid Flow Battery

By Storage Capacity

- Small Scale

- Large Scale

By End-User

- Energy and Power

- Automotive

- Others

Driving Factors

Growing Need for Long-Duration Renewable Storage Solutions

A major driving factor for the Vanadium Liquid Battery Market is the rising need for long-duration energy storage to support expanding renewable power. As more solar and wind projects come online, grids require storage systems that can manage long hours of fluctuating energy.

Vanadium liquid batteries are valued for their long life, stable output, and ability to store large amounts of energy without performance loss. This demand strengthens as innovators secure new investments, such as a Swiss membrane-free redox flow battery company receiving $17 million in early-stage funding.

Such funding highlights confidence in advanced storage technologies and encourages wider adoption of vanadium-based solutions for grid stability, peak management, and renewable integration.

Restraining Factors

High Initial System Costs Limit Adoption

One key restraining factor for the Vanadium Liquid Battery Market is the high upfront cost of building and installing these systems. Vanadium electrolyte, large storage tanks, and specialized pumping setups make the initial investment higher than many other storage technologies. This slows adoption, especially for smaller developers and projects with limited budgets.

Even though long life and low degradation offer savings over time, the starting expense remains a challenge for wider usage. Recent activity, such as Unbound Potential securing 14 million euros in pre-seed funding for innovative redox flow technology, shows growing interest in reducing technical and cost barriers. However, until manufacturing and material costs drop further, upfront expenses will continue to restrain broader market expansion.

Growth Opportunity

Rising Demand for Grid-Scale Renewable Storage

A major growth opportunity for the Vanadium Liquid Battery Market comes from the increasing need for large, stable energy-storage systems that can support national grids as renewable energy expands. Countries adding more solar and wind power require storage that can deliver long-duration capacity without losing performance over time.

Vanadium liquid batteries fit this need well because their electrolyte tanks can be scaled easily for bigger storage requirements. This opportunity becomes stronger as new funding flows into advanced redox flow technologies, such as the €14 million boost for Unbound’s redox flow battery tech. Such investments encourage innovation, improve system efficiency, and open new pathways for widespread grid-scale adoption of vanadium-based storage solutions.

Latest Trends

Growing Shift Toward Utility-Scale Flow Storage Projects

A key trend in the Vanadium Liquid Battery Market is the rising focus on large utility-scale flow battery installations designed to support renewable-heavy grids. Energy developers and governments are increasingly turning to long-duration storage to handle the variability of wind and solar plants.

Vanadium liquid batteries stand out because they maintain performance over thousands of cycles and can scale easily by enlarging electrolyte tanks. This trend is strengthened by new deployments, such as Invinity moving ahead with a part government-funded 20.7MWh flow battery project in the UK.

Such real-world installations show how grid operators are adopting advanced flow storage to improve reliability, support clean-energy growth, and achieve long-term grid stability.

Regional Analysis

North America leads the Vanadium Liquid Battery Market with 45.2% share dominance.

In North America, the Vanadium Liquid Battery Market shows a clear lead, holding a 45.2% share and reaching USD 0.5 Bn in value. This dominance reflects the region’s strong push for stable long-duration storage to support growing renewable power and maintain grid reliability. North America’s early adoption of flow battery systems and focus on dependable large-scale storage further strengthen its leadership in this market.

Europe continues to explore vanadium-based solutions as part of its broader clean-energy transition, with utilities prioritizing safe, long-cycle technologies for managing wind and solar output. The region’s regulatory focus on reducing carbon emissions supports steady uptake of advanced storage.

The Asia Pacific region shows rising interest as countries expand renewable capacity and seek storage options capable of handling long-duration requirements. Growing grid investments and clean-energy programs keep vanadium systems relevant for future projects.

In the Middle East & Africa, energy diversification efforts are creating opportunities for long-duration technologies, especially in areas integrating solar power at scale.

Latin America is gradually recognizing the value of vanadium liquid batteries as nations strengthen renewable infrastructure, particularly in regions facing grid intermittency. Across all regions, interest builds around durable, scalable, and long-life storage solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Sumitomo Electric Industries Ltd. remains a notable contributor through its long-standing involvement in vanadium-based systems. The company’s focus on reliability, multi-hour storage, and scalable installations strengthens confidence in flow battery technology, especially for utilities seeking stable operations. Its experience in deploying commercial systems helps demonstrate the practical value of long-life electrolyte-based storage.

Dalian Rongke Power Co., Ltd. plays an important role in shaping market growth with its emphasis on large-scale flow battery projects. The company’s work highlights how vanadium systems can handle grid-level requirements such as renewable integration, peak shifting, and long-duration backup. By focusing on multi-megawatt installations, it demonstrates how the technology can operate at a meaningful scale, supporting broader acceptance across energy markets.

Invinity Energy Systems adds momentum through its commitment to modular and flexible vanadium battery solutions. The company’s projects emphasize dependable cycle life and suitability for commercial, industrial, and utility environments. Its approach helps broaden the technology’s appeal, showing how flow batteries can support both long-duration performance and operational stability.

Top Key Players in the Market

- Sumitomo Electric Industries Ltd.

- Dalian Rongke Power Co. Ltd.

- Invinity Energy Systems

- Bushveld Energy Ltd.

- CellCube Energy Storage Systems Inc.

- VRB Energy Inc.

- Big Pawer Electrical Technology Xiangyang Inc. Co.

- Australian Vanadium Limited

- StorEn Technologies Inc.

- Primus Power Corporation

- Vanadis Power GmbH

- Schmid Group

Recent Developments

- In December 2024, Sumitomo Electric completed installation of a 1 MW × 8-hour VRFB system for the municipal utility Kashiwazaki IR Energy in Kashiwazaki City, Japan, and secured a follow-on order for another system of the same size. With this deployment, the company’s cumulative VRFB capacity reached 50 MW and 176 MWh.

- In December 2024, Rongke Power announced the completion of a 175 MW / 700 MWh vanadium flow battery project in Ushi, China. The installation is reported as the world’s largest vanadium-flow battery system to date, capable of grid-forming, peak-shaving, frequency regulation, and renewable integration.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 6.7 Billion CAGR (2025-2034) 17.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Redox Flow Battery, Hybrid Flow Battery), By Storage Capacity (Small Scale, Large Scale), By End-User (Energy and Power, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Sumitomo Electric Industries Ltd., Dalian Rongke Power Co. Ltd., Invinity Energy Systems, Bushveld Energy Ltd., CellCube Energy Storage Systems Inc., VRB Energy Inc., Big Pawer Electrical Technology Xiangyang Inc. Co., Australian Vanadium Limited, StorEn Technologies Inc., Primus Power Corporation, Vanadis Power GmbH, Schmid Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Vanadium Liquid Battery MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Vanadium Liquid Battery MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sumitomo Electric Industries Ltd.

- Dalian Rongke Power Co. Ltd.

- Invinity Energy Systems

- Bushveld Energy Ltd.

- CellCube Energy Storage Systems Inc.

- VRB Energy Inc.

- Big Pawer Electrical Technology Xiangyang Inc. Co.

- Australian Vanadium Limited

- StorEn Technologies Inc.

- Primus Power Corporation

- Vanadis Power GmbH

- Schmid Group