Global Vacation Rental Software Market By Software (Property Management Software (PMS), Channel Management Software, Booking Engine Software, Others), By Deployment (Cloud-based, On-premise), By Application (Residential Vacation Rentals, Commercial Vacation Rentals,Others), By End-User (Property Management Companies, Vacation Rental Agencies,Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 168343

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

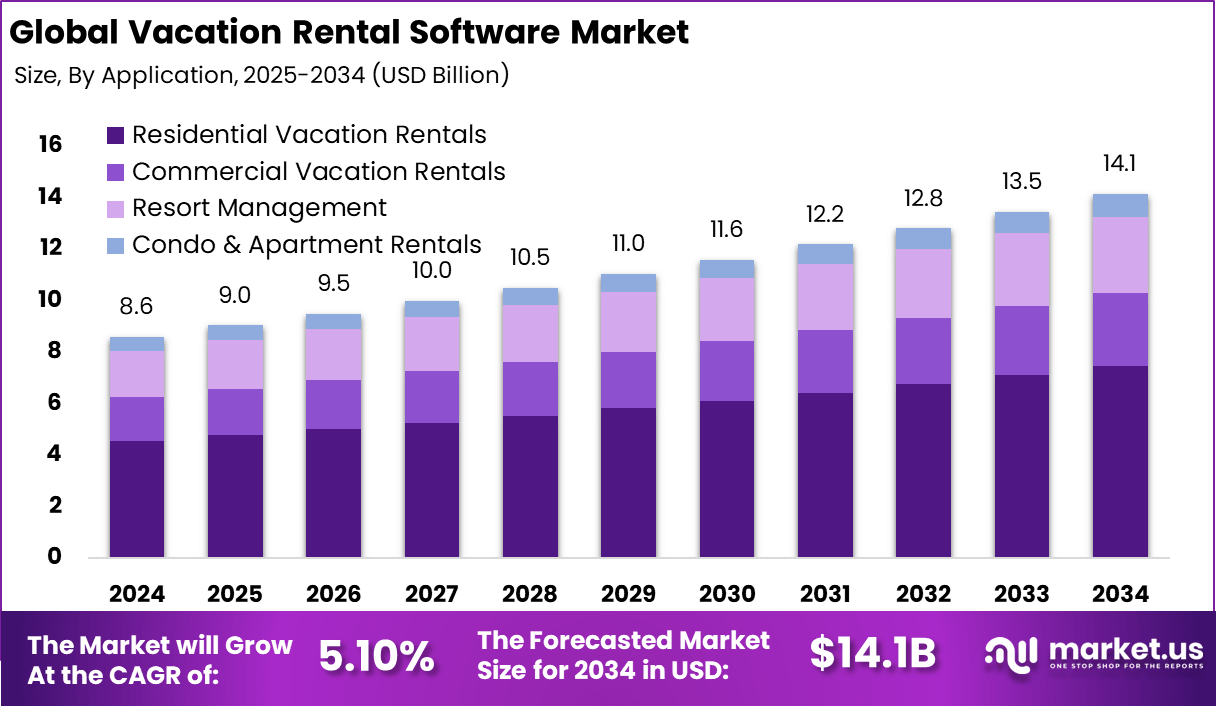

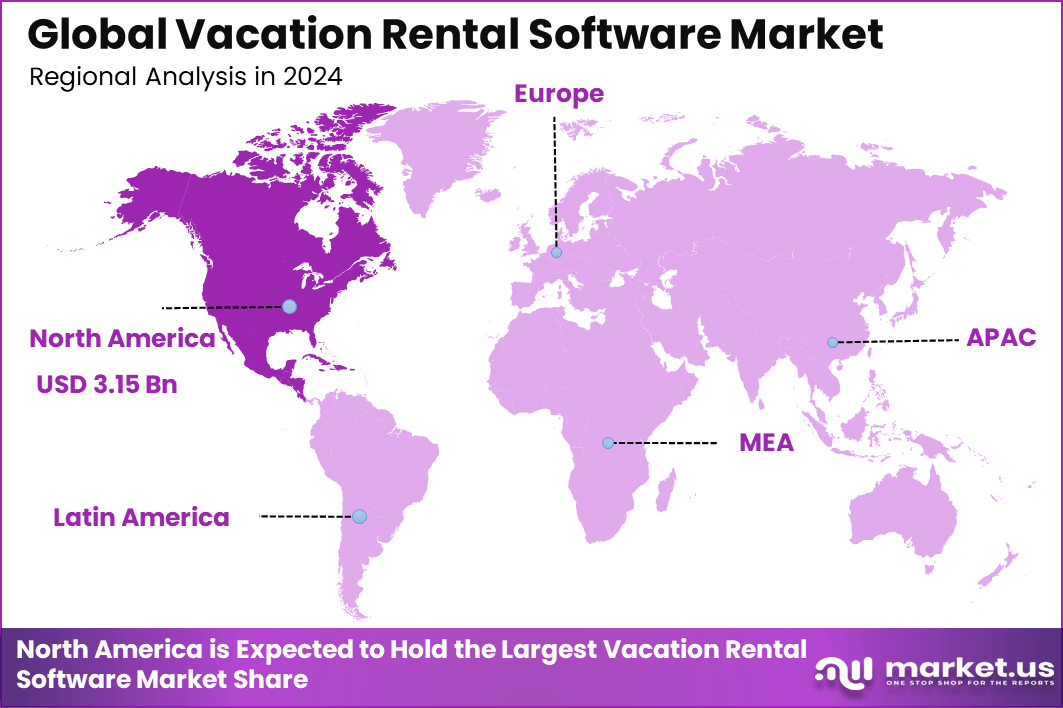

The Global Vacation Rental Software Market generated USD 8.6 billion in 2024 and is predicted to register growth from USD 9.0 billion in 2025 to about USD 14.1 billion by 2034, recording a CAGR of 5.10% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 36.7% share, holding USD 3.15 Billion revenue.

The vacation rental software market has expanded as property owners, managers and hospitality operators adopt digital platforms to automate bookings, pricing, guest communication and property maintenance. Growth reflects the rapid shift toward short stay accommodations, wider acceptance of alternative lodging and the need for centralised tools that manage multiple properties across different channels. Software systems now support listing distribution, reservation management and operational workflows in a unified interface.

Top driving factors include increasing global travel and tourism, growing adoption of online booking platforms, and expanding property portfolios. Strong government support for digital transformation and evolving regulations around rental safety and data security further boost demand. Technological advancements like AI-driven dynamic pricing, predictive maintenance, and IoT integration leading to smart property management are also key growth drivers.

Investment opportunities are seen in scalable cloud platforms offering end-to-end management, AI capabilities for personalized guest experiences, and cybersecurity enhancements. Emerging markets offer untapped potential with localized, multilingual software. Strategic partnerships between vendors and rental platforms, as well as niche focuses like luxury or eco-friendly rentals, provide avenues for expansion.

Business benefits of vacation rental software include automation of repetitive tasks, reduced risk of double bookings, enhanced guest communication, and optimized pricing strategies. These tools improve operational efficiency, increase revenue potential, and support portfolio scaling while delivering superior customer experiences. Property owners benefit from integrated reporting and streamlined accounting, making management simpler and more effective.

Top Market Takeaways

- By software type, property management software (PMS) leads with 48.3% share, offering integrated tools for reservations, channel management, pricing optimization, and maintenance scheduling critical for vacation rental operations.

- By deployment, cloud-based solutions dominate with 72.6% share, preferred for remote access, real-time synchronization across platforms like Airbnb and Vrbo, scalability, and reduced IT overhead.

- By application, residential vacation rentals hold 52.8% of the market, driven by demand for short-term stays, urban apartments, and family homes listed on multiple OTAs requiring automated calendars and guest communication.

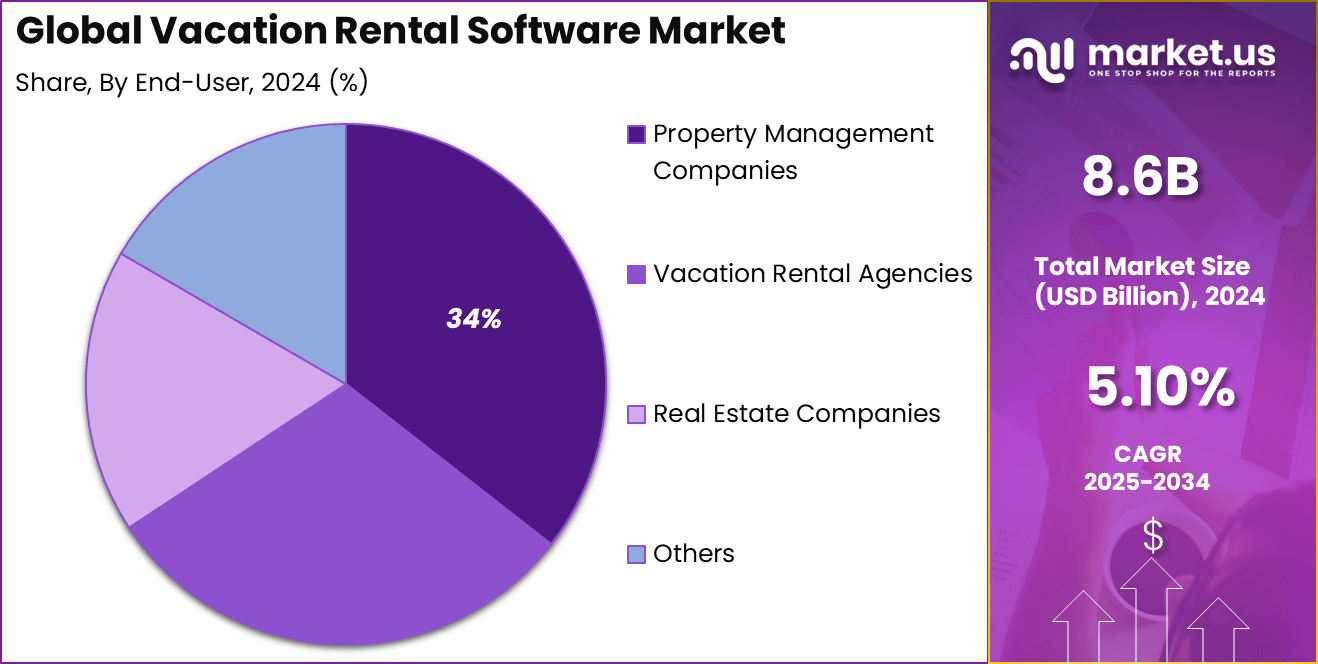

- By end-user, property management companies account for 34.2%, utilizing comprehensive platforms to handle multi-property portfolios, compliance, and revenue management efficiently.

- Regionally, North America commands about 36.7% market share.

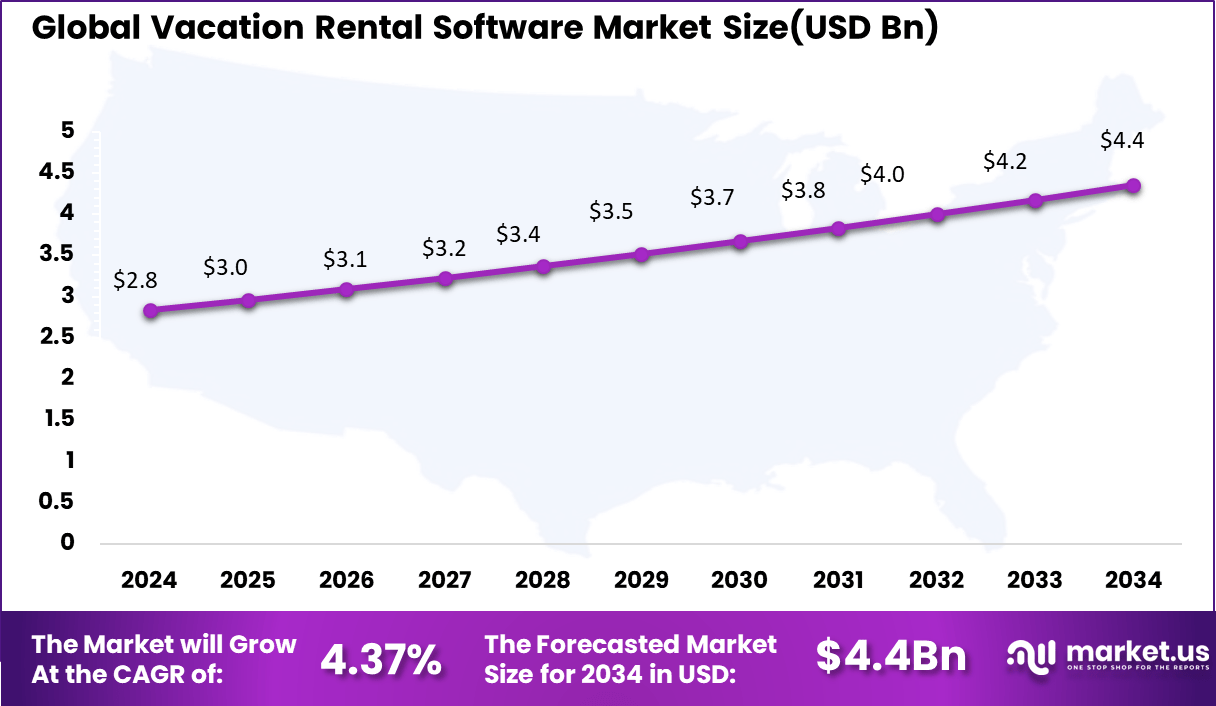

- The U.S. market size is valued at approximately USD 2.84 billion in 2025.

- The market grows at a CAGR of 4.37%, supported by short-term rental expansion, smart home integrations, AI pricing tools, and regulatory adaptations for vacation properties.

By Software

Property Management Software (PMS) commands a leading 48.3% share in the vacation rental software market. PMS serves as the central hub for owners and managers, handling reservations, guest communications, pricing strategies, and maintenance scheduling all in one place.

Its comprehensive features help streamline daily operations, from automated check-in instructions to dynamic pricing adjustments based on demand patterns. Property managers rely on PMS to maximize occupancy rates and minimize vacancy periods through real-time analytics and reporting tools that provide clear insights into performance trends.

The growing complexity of managing multiple listings across different platforms drives PMS adoption, as it eliminates manual tracking and reduces errors. Integration with online travel agencies and payment processors further enhances efficiency, allowing hosts to focus on guest satisfaction rather than administrative tasks, which ultimately boosts revenue and repeat business.

By Deployment

Cloud-based deployment holds a dominant 72.6% share, favored for its accessibility and scalability in the vacation rental sector. Cloud solutions allow property managers to access systems from any device, anywhere, making it ideal for handling last-minute bookings or maintenance issues while traveling.

Automatic backups, software updates, and robust security features reduce downtime and protect sensitive guest data without requiring expensive on-site servers. This model supports rapid scaling during peak seasons when rental demand surges.

Small hosts and large portfolios alike embrace cloud deployment for its cost-effectiveness and ease of integration with marketing tools and review platforms. The shift reflects broader digital trends where flexibility trumps traditional setups, enabling managers to respond quickly to market changes and guest needs.

By Application

Residential vacation rentals account for 52.8% of the market application, reflecting the popularity of home-like stays among travelers seeking authentic experiences. These properties, from beach houses to city apartments, demand software that handles unique features like flexible check-in times, local amenity guides, and personalized guest communications.

Software tailored for residential rentals optimizes pricing based on local events, seasonality, and competitor rates, helping owners compete effectively in saturated markets. The appeal of residential options continues to grow with remote work trends and family travel preferences, pushing software developers to enhance features like virtual tours and smart home integrations. This segment thrives on tools that balance guest comfort with operational simplicity, fostering higher reviews and bookings.

By End-User

Property Management Companies represent 34% of end-users, leveraging vacation rental software to oversee extensive portfolios efficiently. These companies manage diverse properties across locations, requiring centralized dashboards for inventory tracking, revenue reporting, and team coordination. Software enables them to standardize processes, automate routine tasks, and analyze performance metrics to allocate resources effectively across their holdings.

Professional managers prioritize solutions with multi-property views, advanced reporting, and channel management to synchronize listings across platforms seamlessly. Their scale drives innovation in software capabilities, benefiting the entire market by raising standards for reliability and guest experience delivery.

Key Reasons for Adoption

- Automation of routine tasks: Takes over calendars, payments, and messaging, freeing up hours spent on manual work.

- Multi-channel syncing: Connects listings across platforms to avoid double bookings and maximize visibility.

- Guest experience boost: Streamlines check-ins, communications, and reviews for happier visitors who come back.

- Scalability for growth: Manages more properties without adding staff, perfect for expanding operations.

- Real-time insights: Tracks occupancy and rates to make smart pricing decisions on the fly.

Benefits

- Time savings: Cuts admin work dramatically, letting owners handle more listings or relax a bit.

- Higher occupancy: Smart tools fill gaps in calendars and optimize rates for steady bookings.

- Direct booking gains: Builds personal websites to capture reservations without hefty platform fees.

- Better revenue: Automated upselling and dynamic pricing squeeze more income from each stay.

- Stronger reviews: Seamless guest interactions lead to positive feedback that draws more business.

Usage

- Syncing calendars across booking sites

- Automating guest messages and check-ins

- Managing cleaning schedules and payments

- Tracking owner reports and commissions

- Building direct booking websites

Emerging Trends

Key Trends Description AI-Driven Dynamic Pricing Machine learning algorithms optimizing rates based on demand, seasonality, and competitor pricing in real-time. Cloud-Based Multi-Channel Management Integration with multiple OTAs (Airbnb, Vrbo, Booking.com) for seamless calendar synchronization and bookings. Guest Experience Automation Automated messaging, digital check-ins, smart home integration, and personalized recommendations. Mobile-First Property Management Apps enabling on-the-go operations for owners/managers including remote monitoring and instant notifications. Sustainability and ESG Analytics Tools tracking energy usage, waste management, and eco-certifications to attract environmentally conscious guests. Growth Factors

Key Factors Description Surge in Short-Term Rental Demand Growing preference for vacation rentals over hotels driving need for efficient management platforms. Digital Transformation of Hospitality Shift to online booking platforms and tech-savvy travelers necessitating advanced software solutions. Expansion of Sharing Economy Platforms Platforms like Airbnb and Vrbo creating ecosystem requiring integrated property management tools. Remote Work and Bleisure Travel Trends Increased demand for longer stays and work-friendly rentals boosting software adoption. Emerging Market Penetration Rapid growth in Asia-Pacific and Latin America due to rising internet access and tourism infrastructure. Key Market Segments

By Software

- Property Management Software (PMS)

- Channel Management Software

- Booking Engine Software

- Pricing & Revenue Management Software

- Others

By Deployment

- Cloud-based

- On-premise

By Application

- Residential Vacation Rentals

- Commercial Vacation Rentals

- Resort Management

- Condo & Apartment Rentals

By End-User

- Property Management Companies

- Vacation Rental Agencies

- Real Estate Companies

- Others

Regional Analysis

North America led the vacation rental software market with a 36.7% global share, propelled by a booming short-term rental sector and high digital adoption among property managers and hosts. The region’s mature tourism infrastructure, widespread use of platforms like Airbnb and Vrbo, and growing demand for automated booking, pricing, and guest management tools drive expansion.

Advanced cloud-based solutions dominate, enabling real-time analytics, dynamic pricing, and seamless integrations with payment gateways to optimize occupancy and revenue. North America’s tech-savvy consumers and regulatory support for digital hospitality further solidify its position as the primary market for vacation rental software innovation.

The U.S. anchors North America’s dominance, valued at USD 2.84 billion in 2024 with a steady CAGR of 4.37%. This growth reflects extensive vacation property portfolios in popular destinations like Florida, California, and Colorado, where managers leverage software for multi-channel distribution and operational efficiency.

Leading providers offer AI-enhanced features for demand forecasting and compliance with local regulations, catering to both individual hosts and professional management firms. The shift toward remote work and experiential travel sustains demand, positioning the U.S. as the core engine for North American vacation rental software advancement.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Professionalization and Efficiency Needs

The major driver of this market is the steady professionalization of short-term rental operations. Managers who handle multiple properties are moving from manual spreadsheets toward centralized platforms that combine calendars, bookings, payments, and housekeeping tasks. As travel demand rises, the pressure to maintain accuracy and quick response times pushes operators toward software-based workflows.

This driver is reinforced by the need to scale operations without increasing labour costs. Cloud-based systems allow managers to access real-time data, adjust pricing, and coordinate teams from any location. The shift toward efficiency also ensures that occupancy rates, average daily rates, and guest communication remain consistent, even as portfolios grow.

Restraint

Integration Complexity and Cost Sensitivity

A key restraint is the complexity involved in integrating multiple tools into a unified workflow. Many managers rely on separate systems for pricing, cleaning, accounting, and messaging, which creates technical burdens. Smaller hosts often hesitate to implement full software stacks because the setup process can feel overwhelming, limiting overall adoption.

Cost sensitivity further strengthens this restraint. Some tools charge revenue-based fees, add-on costs, or require paid integrations, which can reduce profit margins for small operators. This financial pressure makes many hosts prefer partial digital solutions rather than committing to fully integrated systems, slowing the modernization process.

Opportunity

Direct Booking and End-to-End Platforms

The strongest opportunity lies in supporting direct bookings through all-in-one software platforms. Operators are increasingly interested in reducing dependence on online travel agencies by building their own websites, running email campaigns, and attracting repeat guests. Vacation rental software that includes website builders, CRM tools, and automated marketing can help managers strengthen their brand identity.

There is also room to expand into emerging regional markets where digital adoption is still early. Many small and mid-sized agencies in developing tourism destinations are beginning to explore advanced pricing tools and automation. Solutions that offer simple onboarding and affordable pricing can capture these new segments and broaden global reach.

Challenge

Data Quality and Regulatory Fragmentation

One of the major challenges is maintaining accurate, high-quality data across multiple booking channels. Dynamic pricing and forecasting depend on live data, and any delay or inaccuracy can lead to poor decisions. Managers often face mismatched calendars, incorrect availability, or inconsistencies in local demand signals, making software reliability a critical concern.

Regulatory fragmentation adds another layer of difficulty. Short-term rental rules vary widely across cities and countries, affecting taxes, licensing, and reporting requirements. Software providers must constantly update compliance features to help managers avoid penalties. Balancing automation with transparent control remains essential for building trust among operators.

Competitive Analysis

Guesty, Hostfully, OwnerRez, and Lodgify lead the vacation rental software market with strong platforms that help property managers automate bookings, manage calendars, and streamline guest communication. Their tools support multi-channel distribution, dynamic pricing, and integrated payment processing. These companies focus on ease of use, scalability, and centralized workflow management.

Streamline, MyVR, TurnKey, Hostaway, Smoobu, and Uplisting strengthen the competitive landscape with advanced property-management features, housekeeping coordination, and real-time availability syncing. Their systems help hosts improve occupancy rates, reduce manual work, and deliver consistent guest experiences. These providers emphasize automation, analytics, and seamless integration with major OTAs.

LiveRez, Bookerville, Rentals United, Sync, Tokeet, and other players expand the market with flexible solutions designed for smaller hosts, boutique operators, and regional agencies. Their platforms offer channel management, automated messaging, and intuitive reservation tools. These companies prioritize affordability, simple onboarding, and customizable workflows.

Top Key Players in the Market

- Guesty

- Hostfully

- OwnerRez

- Lodgify

- Streamline

- MyVR

- TurnKey

- Hostaway

- Smoobu

- Uplisting

- LiveRez

- Bookerville

- Rentals United

- Sync

- Tokeet

- Others

Future Outlook

The vacation rental software market is poised for significant growth as short-term rentals gain popularity and property managers increasingly seek scalable solutions to enhance booking efficiency, guest experiences, and revenue management.

Cloud-based platforms dominate due to their accessibility and flexibility, while integrations with IoT and AI-driven pricing tools are shaping future trends. Adoption is growing rapidly in emerging markets, supported by rising tourism and mobile internet penetration. Regulatory compliance and data security continue to be critical focus areas driving software innovation.

Opportunities lie in

- Integration with smart home devices and IoT for enhanced guest control and security.

- Expansion in emerging regions with growing tourism infrastructure and rising middle-class disposable incomes.

- Customizable software solutions catering to niche property types and varied market requirements.

Recent Developments

- November, 2025, Guesty enhanced its property management platform integrating AI-powered automation for property syncing across 60+ channels including Airbnb, Booking.com, and Vrbo. The platform features unified inbox, dynamic pricing, guest portals, secure payment, and AI-driven fraud prevention tools.

- October, 2025, Hostfully focused on digital solutions for corporate housing rentals, offering multimedia digital guidebooks, dynamic pricing integration, automated messaging, and smart devices for easy property access.

Report Scope

Report Features Description Market Value (2024) USD 8.6 Bn Forecast Revenue (2034) USD 14.1 Bn CAGR(2025-2034) 5.10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Software (Property Management Software (PMS), Channel Management Software, Booking Engine Software, Others), By Deployment (Cloud-based, On-premise), By Application (Residential Vacation Rentals, Commercial Vacation Rentals,Others), By End-User (Property Management Companies, Vacation Rental Agencies,Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Guesty, Hostfully, OwnerRez, Lodgify, Streamline, MyVR, TurnKey, Hostaway, Smoobu, Uplisting, LiveRez, Bookerville, Rentals United, Sync, Tokeet, and others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Vacation Rental Software MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Vacation Rental Software MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Guesty

- Hostfully

- OwnerRez

- Lodgify

- Streamline

- MyVR

- TurnKey

- Hostaway

- Smoobu

- Uplisting

- LiveRez

- Bookerville

- Rentals United

- Sync

- Tokeet

- Others