Global Underground Mining Equipment Market Size, Share, And Enhanced Productivity By Product Type (Mining Loaders, Mining Trucks, Mining Drills and Bolters, Continuous Miners, Mining Shearers, Mining Excavators),By Technology (Conventional Equipment, Electric Equipment, Autonomous Equipment), By Application (Hard Rock Mining, Coal Mining, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 172935

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

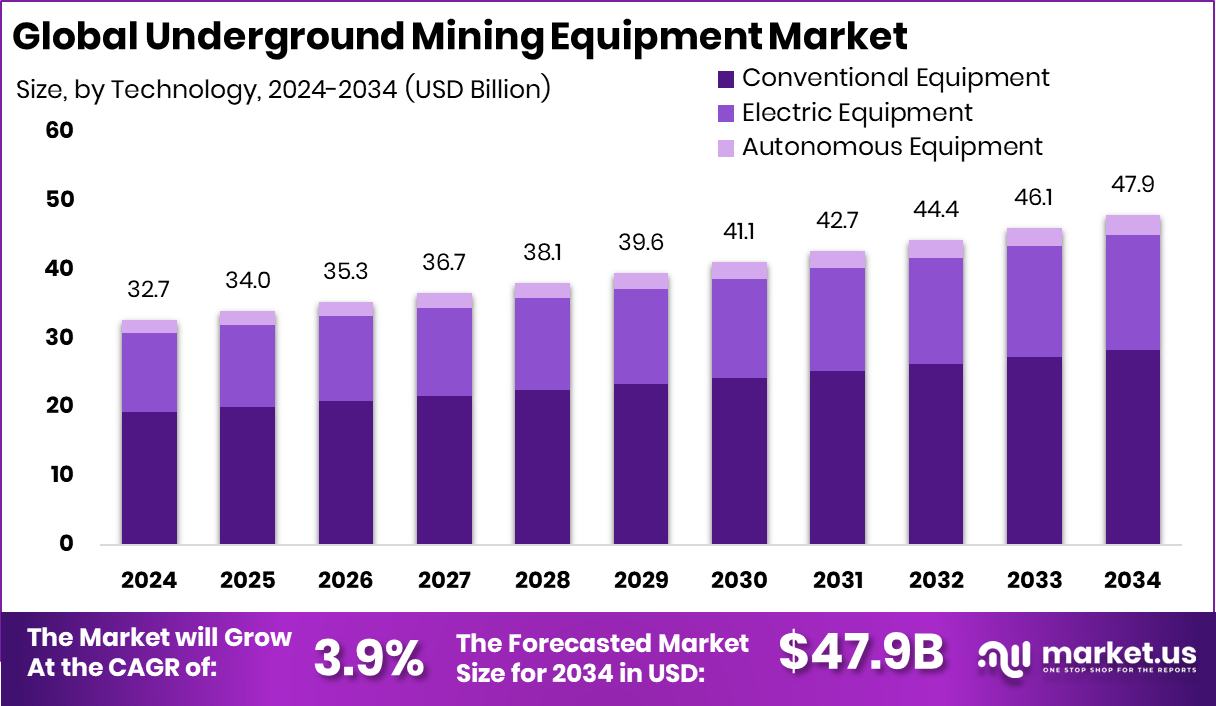

The Global Underground Mining Equipment Market is expected to be worth around USD 47.9 billion by 2034, up from USD 32.7 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034. Asia Pacific dominates the Underground Mining Equipment Market at 45.20%, generating USD 14.7 Bn.Underground mining equipment refers to the machines and tools used to extract minerals and ores from beneath the earth’s surface. This includes equipment for drilling, blasting, loading, hauling, and supporting underground tunnels and shafts. Because underground spaces are confined and challenging, these machines must be strong, safe, and able to work in tight areas. Typical underground mining equipment includes loaders, haul trucks, drilling rigs, roof bolters, and conveyors that help move material efficiently. Without this specialized equipment, it would be difficult to access deep mineral deposits or carry out safe and productive mining operations in rock formations below ground.

The Underground Mining Equipment Market describes the overall demand and supply of these machines, services, and technologies across mining operations worldwide. It covers the production, distribution, and use of underground mining machinery in coal, metal, and non-metal mines. This market exists because mining companies need reliable equipment to ensure steady production and operational safety. Growing focus on reclaiming land and environmental sustainability also influences how equipment is chosen and used in mining projects.

One key growth factor for underground mining equipment is increased investment in reclaiming and improving mining lands. For example, the Interior announced over $119 million to reclaim abandoned coal mines, and later nearly $725 million more to further reclaim these lands. These funds boost underground equipment needs for cleanup, safety work, and redevelopment of old mines, creating greater demand for machines that can support reclamation and remediation efforts.

The demand for underground mining equipment is strengthened by new mining financing. For instance, Vitol and Breakwall financing $150 million to support a metallurgical coal mine drives the requirement for modern, heavy-duty equipment to safely extract coal. As mining financing grows, so does the need for reliable underground mining gear that meets production and safety expectations.

A key opportunity lies in regional funding for environmental and economic development tied to mining. Southwest Virginia securing an $11 million boost to reclaim abandoned coal mines highlights how local programs can fund equipment deployment for mine restoration and community revitalization. These opportunities encourage equipment manufacturers and mining operators to partner on projects that both support mining activity and improve land conditions, expanding the role of underground mining equipment in broader economic and environmental outcomes.

Key Takeaways

- The Global Underground Mining Equipment Market is expected to be worth around USD 47.9 billion by 2034, up from USD 32.7 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034.

- In the Underground Mining Equipment Market, mining loaders held 28.5% share due to high material handling demand.

- The underground mining equipment market saw conventional equipment dominate with 59.1% share across operations.

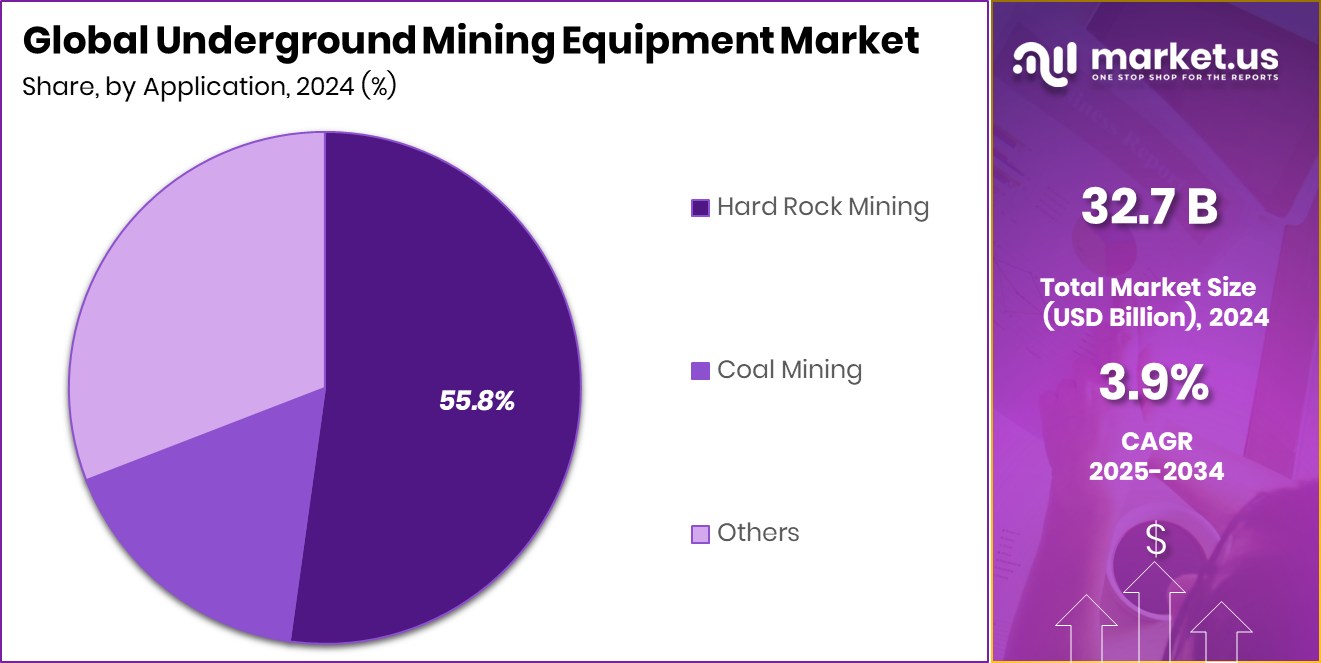

- In the Underground Mining Equipment Market, hard rock mining led applications, accounting for 55.8% demand.

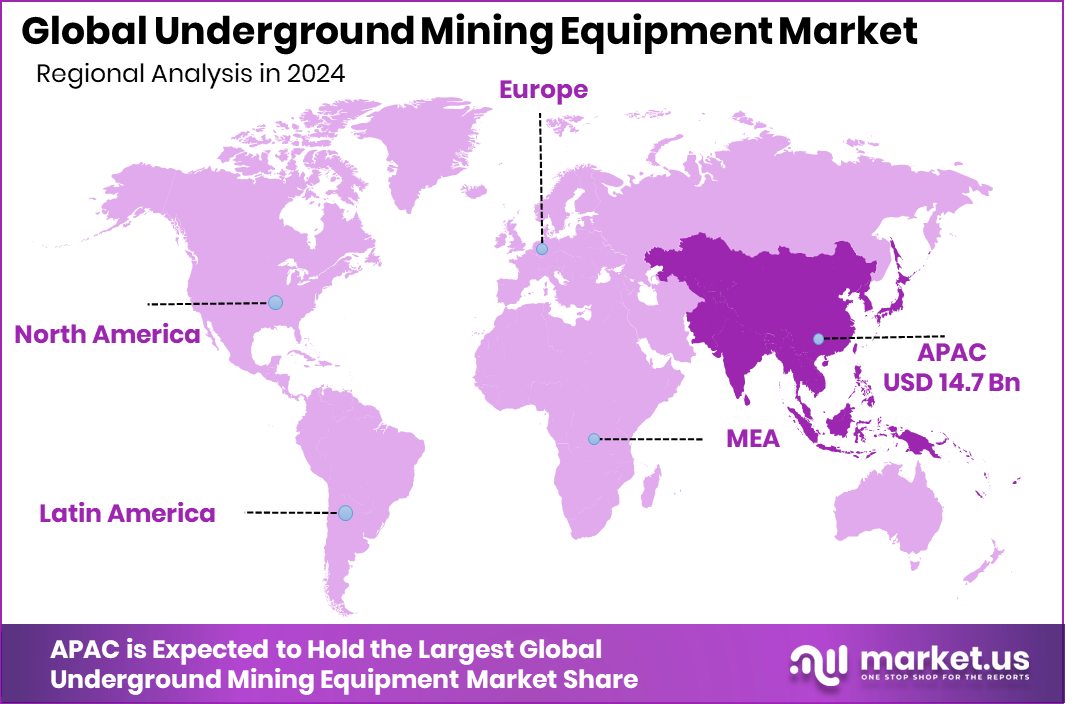

- Asia Pacific accounts for 45.20% of the Underground Mining Equipment Market, reaching USD 14.7 Bn.

By Product Type Analysis

In the Underground Mining Equipment Market, mining loaders held 28.5% share due to high productivity.

In 2024, the Underground Mining Equipment Market by product type was led by mining loaders, which accounted for 28.5% of total demand. Mining loaders play a critical role in underground operations by handling material loading, hauling, and transfer in confined mining environments. Their strong adoption is linked to ongoing underground mine development and the need for efficient ore handling in narrow tunnels.

Operators value loaders for their durability, maneuverability, and ability to operate under high-load conditions. In the Underground Mining Equipment Market, manufacturers continue to focus on improving payload capacity, operator safety, and machine reliability.

The consistent use of mining loaders across coal and metal mining operations supports their steady demand, especially in mature underground mining regions where productivity and operational continuity remain priorities.

By Technology Analysis

In the Underground Mining Equipment Market, conventional equipment dominated with 59.1% adoption globally.

In 2024, the Underground Mining Equipment Market by technology was dominated by conventional equipment, holding a 59.1% share. Conventional underground mining machines remain widely used due to their proven performance, lower upfront costs, and ease of maintenance. Many mining operators continue to rely on conventional equipment because it fits well with existing infrastructure and skilled labor availability.

In the Underground Mining Equipment Market, conventional systems are preferred in regions where automation adoption is gradual or limited by cost constraints. These machines offer reliable operation in challenging underground conditions and are easier to repair in remote mining locations.

Despite emerging advanced technologies, conventional equipment continues to form the backbone of underground mining operations, ensuring stable production levels and predictable operational performance across diverse mining environments.

By Application Analysis

In the Underground Mining Equipment Market, hard rock mining applications accounted for 55.8% demand.

In 2024, the Underground Mining Equipment Market by application was largely driven by hard rock mining, which represented 55.8% of overall usage. Hard rock mining operations require robust and high-performance equipment to extract minerals from dense and abrasive rock formations. This segment relies heavily on specialized underground machinery capable of withstanding extreme pressure, vibration, and continuous operation.

In the Underground Mining Equipment Market, demand from hard rock mining is supported by the ongoing extraction of metals such as gold, copper, and nickel. Operators prioritize equipment strength, safety features, and long service life to minimize downtime. The scale and technical complexity of hard rock mining continue to make it a key application area, sustaining strong equipment demand worldwide.

Key Market Segments

By Product Type

- Mining Loaders

- Mining Trucks

- Mining Drills and Bolters

- Continuous Miners

- Mining Shearers

- Mining Excavators

By Technology

- Conventional Equipment

- Electric Equipment

- Autonomous Equipment

By Application

- Hard Rock Mining

- Coal Mining

- Others

Driving Factors

Government Funding Spurs Underground Mining Demand

A major driving factor for the Underground Mining Equipment Market is government funding that revitalizes mining communities and supports energy transition projects. When public funds are directed toward mining areas, operators and local authorities invest in equipment to make underground work safer and more efficient. For instance, the Interior Department disbursed over $13 million to revitalize coal communities, helping restore infrastructure and support jobs in regions that once depended heavily on coal mining. This kind of funding often leads to renewed investment in underground mining equipment, because machines are needed to clean up old sites, strengthen tunnels, and support ongoing extraction work.

In addition, EUR 36.5 million in funding for geothermal research at a coal plant site in Weisweiler highlights how energy transition programs can also boost equipment demand. Even though this project focuses on geothermal energy, it still involves deep drilling and underground construction tools similar to mining equipment. Such investments help broaden use cases for underground machines beyond traditional mineral extraction, making the market more dynamic and resilient. These funding streams create sustained opportunities for equipment suppliers and mining operators to modernize fleets and support both reclamation and new energy initiatives.

Restraining Factors

Limited Heritage Funding Diverts Resources from Equipment

A key restraining factor for the Underground Mining Equipment Market is the way targeted heritage and cultural funding can draw attention and resources away from direct mining investment. For example, £87,000 funding was awarded to help the National Coal Mining Museum uncover and preserve hidden stories of the industrial past. While this funding supports important historical work and community engagement, it represents a shift in focus away from investments in modern mining operations and equipment upgrades.

When limited public or private funds are allocated to heritage projects rather than to operational needs, mining companies and local authorities may face tighter budgets for purchasing or replacing underground mining machines. This can delay plant modernization, slow the adoption of newer safety technologies, and reduce demand for new loaders, drills, or haulage systems.

Growth Opportunity

Funding for Electrification Expands Equipment Opportunities

A major growth opportunity for the Underground Mining Equipment Market lies in electrification and clean energy solutions, as funding and investor interest shift toward electric machines that reduce emissions and operating costs. A clear example is Lumina’s plan to raise $20–40 million in Series A funding to develop and scale electric construction equipment. Although this funding is focused on construction, it highlights a broader trend that presents opportunities for underground mining equipment as well.

Mining operations are increasingly interested in electric loaders, drills, and haulage systems because they produce fewer emissions underground, improve air quality for workers, and cut fuel expenses over time. As startups and manufacturers secure capital to innovate electric platforms, underground mine operators can adopt cleaner, more efficient machines that meet future energy and environmental goals.

Latest Trends

Electric Underground Machines Becoming Industry Standard

One of the latest trends in the Underground Mining Equipment Market is the fast rise of electric-powered mining machines, driven by strong investment and shifting energy goals. A clear signal of this trend is Harbinger’s electric vehicle production expected to rise after $100M funds, showing how capital is flowing into electric systems that reduce emissions and operating costs. While this specific funding is for electric vehicles, it reflects a broader shift toward electrification across heavy equipment sectors, including underground mining.

Underground mines are especially suited to electric machines because they reduce harmful diesel exhaust, improve air quality for workers, and cut fuel expenses. As more companies secure large funding rounds for electric technologies, suppliers and operators are encouraged to develop and adopt battery-powered loaders, drills, and transport vehicles. This trend also aligns with global environmental goals and stricter emissions standards in mining regions.

Regional Analysis

Asia Pacific leads the Underground Mining Equipment Market with 45.20% share, valued at USD 14.7 Bn.

The Underground Mining Equipment Market shows varied regional dynamics across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, shaped by mining intensity, resource profiles, and operational maturity. Asia Pacific dominates the market, holding 45.20% share and reaching a value of USD 14.7 Bn, reflecting its large concentration of underground mining activities and sustained demand for loaders, haulage systems, and core production equipment. The region’s dominance is supported by extensive hard rock mining operations and continuous equipment utilization across established and developing mining corridors.

North America represents a stable and technically mature market, where underground equipment demand is linked to productivity improvement and long-life mine operations. Europe maintains a steady demand driven by regulated mining practices and a focus on operational efficiency in underground environments.

The Middle East & Africa region reflects selective demand tied to mineral-rich zones where underground mining supports long-term extraction strategies. Latin America continues to show consistent equipment usage, supported by underground metal mining operations that rely on durable and proven machinery.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Caterpillar Inc. remains a cornerstone player in the global Underground Mining Equipment Market in 2024 due to its broad equipment portfolio and strong engineering depth. The company is widely recognized for delivering reliable underground loaders, haul trucks, and support equipment designed for demanding mining environments. Its strength lies in long equipment life, global service reach, and consistent focus on operator safety and machine durability. Caterpillar’s approach supports large-scale underground operations that value uptime, standardized fleets, and dependable performance over long mine lifecycles.

Sandvik AB is viewed as a technology-driven player with deep specialization in underground mining systems. Analysts note Sandvik’s strong positioning in drilling, loading, and hauling solutions tailored for hard rock applications. The company’s emphasis on precision, equipment efficiency, and integrated mining workflows supports productivity-focused underground operations. In 2024, Sandvik continues to align closely with mines seeking optimized production cycles and consistent operational control.

Epiroc AB is recognized for its focused underground mining expertise and application-specific equipment design. Analysts highlight Epiroc’s strength in developing machines that balance performance with ease of operation and maintenance. Its solutions are well-suited for mines prioritizing safety, adaptability, and long-term operational stability in complex underground conditions.

Top Key Players in the Market

- Caterpillar Inc.

- Sandvik AB

- Epiroc AB

- Komatsu Ltd.

- Volvo Construction Equipment

- Hitachi Construction Machinery Co., Ltd.

- Liebherr Group

- Atlas Copco

- Komatsu Mining Corp. (Joy Global)

- RDH Mining Equipment

Recent Developments

- In December 2024, Atlas Copco’s portable air compressors were used in Turkey for reliable drilling performance in mining and exploration projects. These compressors support underground ventilation and drilling power needs, showing how the company’s technology assists actual mining operations

- In September 2024, Caterpillar introduced a Dynamic Energy Transfer (DET) solution designed to help both battery-electric and diesel-electric mining equipment manage power more efficiently around mine sites. This system improves how energy is shared and used by machines while they operate, aiming to boost productivity and reduce downtime at underground mines.

- In August 2024, Liebherr-Australia delivered an R 9400 E electric excavator to BHP’s Yandi mine in Western Australia. This machine is the first electric excavator in BHP’s fleet, offering zero local emissions and improved cable management for safer underground and surface mining operations.

Report Scope

Report Features Description Market Value (2024) USD 32.7 Billion Forecast Revenue (2034) USD 47.9 Billion CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Mining Loaders, Mining Trucks, Mining Drills and Bolters, Continuous Miners, Mining Shearers, Mining Excavators), By Technology (Conventional Equipment, Electric Equipment, Autonomous Equipment), By Application (Hard Rock Mining, Coal Mining, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Caterpillar Inc., Sandvik AB, Epiroc AB, Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery Co., Ltd., Liebherr Group, Atlas Copco, Komatsu Mining Corp. (Joy Global), RDH Mining Equipment Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Underground Mining Equipment MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Underground Mining Equipment MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Caterpillar Inc.

- Sandvik AB

- Epiroc AB

- Komatsu Ltd.

- Volvo Construction Equipment

- Hitachi Construction Machinery Co., Ltd.

- Liebherr Group

- Atlas Copco

- Komatsu Mining Corp. (Joy Global)

- RDH Mining Equipment