Global Uht Milk Market Size, Share, And Business Benefits By Product (Flavored, Unflavored), By Fat Content (Whole, Semi Skimmed, Skimmed), By Form (Powder, Liquid), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154216

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

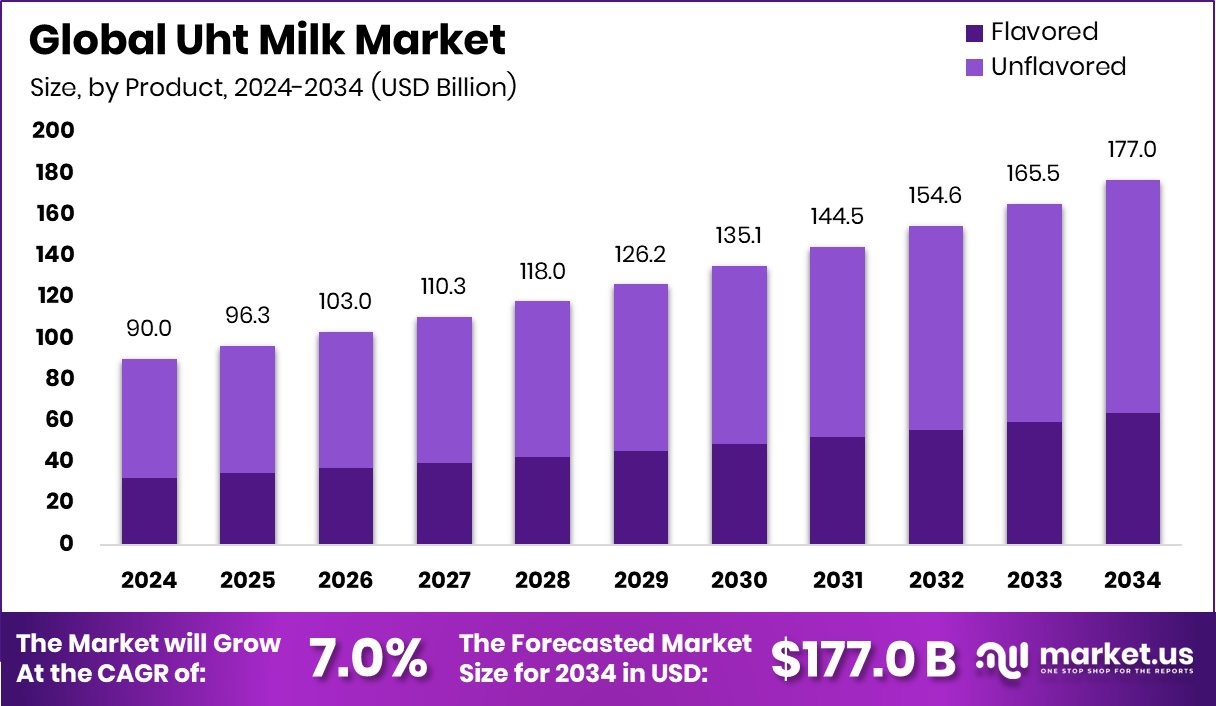

The Global Uht Milk Market is expected to be worth around USD 177.0 billion by 2034, up from USD 90.0 billion in 2024, and is projected to grow at a CAGR of 7.0% from 2025 to 2034. Strong retail networks in Europe supported UHT milk growth at USD 39.5 Bn.

UHT (Ultra-High Temperature) milk is a type of milk that undergoes a special heat treatment process to extend its shelf life without the need for refrigeration until opened. In this process, milk is heated to a temperature of around 135–150°C for a few seconds and then packed in sterile, airtight containers. This method kills harmful bacteria while preserving nutrients, taste, and texture. UHT milk is popular in regions where cold storage facilities are limited or where consumers prefer long-lasting dairy products for convenience.

The UHT milk market refers to the global trade and consumption of ultra-high temperature processed milk. It encompasses production, packaging, distribution, and sales across various regions. The market has gained traction due to the growing demand for shelf-stable food and beverage items. It caters to both retail and institutional segments, including households, schools, hospitals, and remote areas. The market includes full cream, semi-skimmed, and skimmed milk variants, addressing a wide range of consumer preferences.

The growth of the UHT milk market is mainly driven by rising urbanization, busier lifestyles, and increasing demand for convenience food products. Its long shelf life eliminates the need for refrigeration, which is especially valuable in developing countries with inconsistent electricity access. Additionally, population growth and a rising middle class have led to greater consumption of dairy products in packaged form.

Demand for UHT milk is fueled by changing dietary habits and increased awareness of food safety and hygiene. Consumers are leaning toward packaged milk due to concerns over contamination and storage of raw milk. School milk programs and government support for safe milk distribution further enhance demand, particularly in rural and semi-urban areas.

Key Takeaways

- The Global Uht Milk Market is expected to be worth around USD 177.0 billion by 2034, up from USD 90.0 billion in 2024, and is projected to grow at a CAGR of 7.0% from 2025 to 2034.

- In the UHT Milk Market, unflavored milk dominates with a 64.2% share due to daily consumption.

- Whole milk leads by fat content in the UHT Milk Market, holding a strong 48.3% share.

- Liquid form accounts for 74.8% in the UHT Milk Market, preferred for ease and convenience.

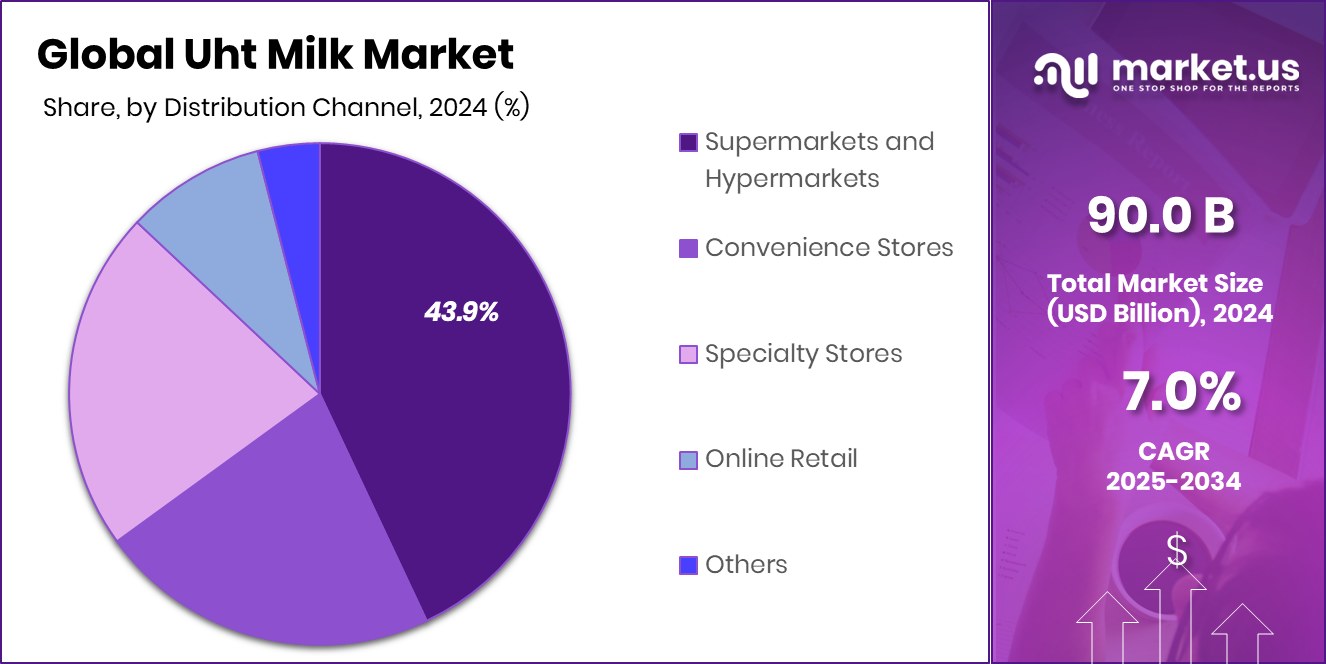

- Supermarkets and hypermarkets drive sales in the UHT Milk Market, capturing a 43.9% distribution share.

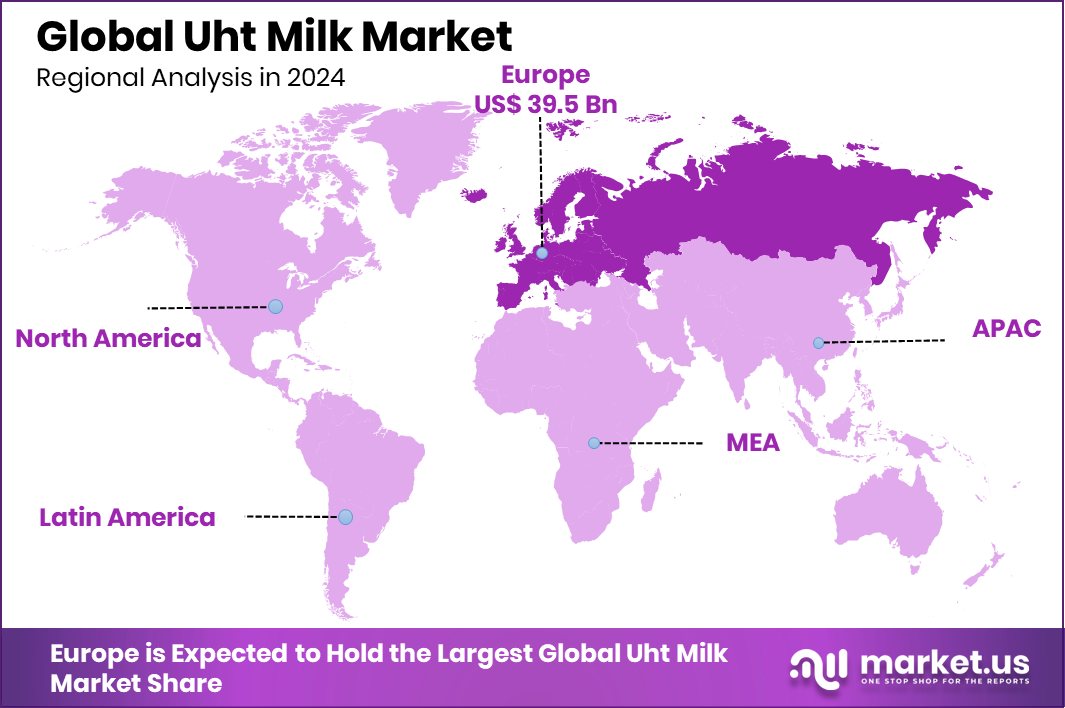

- Europe’s UHT milk sales reached USD 39.5 billion, driven by high consumption.

By Product Analysis

Unflavored UHT milk leads with 64.2% market share globally.

In 2024, Unflavored held a dominant market position in the By Product segment of the UHT Milk Market, with a 64.2% share. This notable share is largely attributed to the strong consumer preference for natural-tasting dairy products without added ingredients or sweeteners. Unflavored UHT milk continues to be widely accepted across diverse demographics, as it aligns with daily household usage such as drinking, cooking, baking, and making tea or coffee. Its neutrality in taste makes it a versatile option for various culinary applications, contributing to its higher demand.

Moreover, unflavored UHT milk appeals to health-conscious consumers who prefer minimal processing and clean-label products. Parents also tend to choose unflavored milk for children to avoid excess sugar and additives. Its longer shelf life, without the need for refrigeration until opened, makes it ideal for regions with unreliable cold storage or consumers seeking convenient stocking solutions.

The dominance of this segment also reflects cultural preferences in many countries where milk is traditionally consumed in its purest form. As a result, manufacturers continue to prioritize unflavored variants to cater to mainstream consumption patterns. The strong trust in the taste, quality, and utility of unflavored UHT milk remains a key driver behind its continued leadership in the product category.

By Fat Content Analysis

Whole UHT milk captures 48.3% and is preferred for a fuller taste.

In 2024, Whole held a dominant market position in the By Fat Content segment of the UHT Milk Market, with a 48.3% share. This leading position can be attributed to the widespread consumer preference for richer taste, creamier texture, and higher nutritional content found in whole milk. Whole UHT milk, retaining its natural fat content, is commonly favored by families with children, as it supports growth and development through essential nutrients like calcium and vitamin D.

The dominance of this segment also reflects traditional dietary habits in many regions where full-fat milk is perceived as more wholesome and satisfying. Whole UHT milk continues to be used not just for drinking but also in cooking and baking, where the fat content plays a crucial role in enhancing flavor and consistency. Its long shelf life, combined with the nutritive value of whole milk, makes it a convenient and desirable choice for daily consumption.

Additionally, the preference for unprocessed or minimally altered dairy products has reinforced demand for whole UHT milk among health-focused consumers. This steady demand has enabled the segment to secure a significant market share, making it a cornerstone of the UHT milk category in both urban and rural retail landscapes.

By Form Analysis

Liquid form dominates the UHT milk market with a 74.8% share.

In 2024, Liquid held a dominant market position in the By Form segment of the UHT Milk Market, with a 74.8% share. This commanding share highlights the strong preference for ready-to-consume dairy formats that offer both convenience and familiarity. Liquid UHT milk closely resembles fresh milk in taste and appearance, making it a practical substitute for consumers seeking long shelf life without compromising on daily usage patterns.

The popularity of liquid UHT milk is driven by its direct usability—requiring no dilution or reconstitution—making it ideal for drinking, preparing beverages, and cooking. It is especially favored by households, educational institutions, and food service operators due to its ease of storage, extended shelf life, and minimal wastage. The packaging of liquid UHT milk in sealed, sterilized cartons or bottles further enhances hygiene and portability, meeting growing consumer expectations for safe and convenient dairy options.

Moreover, the increasing demand for dairy products in urban areas, where fast-paced lifestyles demand ready-to-use products, continues to boost this segment. The consistent availability of liquid UHT milk across retail chains, supermarkets, and online platforms has also contributed to its widespread adoption. This strong market presence affirms liquid UHT milk’s status as the most accessible and trusted form in the category.

By Distribution Channel Analysis

Supermarkets and hypermarkets sell 43.9% of UHT milk volume.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of the UHT Milk Market, with a 43.9% share. This significant share reflects the growing consumer reliance on large-format retail outlets for purchasing daily essentials, including dairy products. These stores offer a wide selection of UHT milk brands and packaging sizes under one roof, making them a convenient one-stop destination for consumers seeking variety and value.

The preference for supermarkets and hypermarkets is also driven by their established cold chain infrastructure, efficient inventory management, and consistent product availability. These outlets often offer promotional pricing, discounts, and loyalty programs that attract repeat customers. Additionally, the visibility of UHT milk on well-organized shelves and dedicated dairy sections plays a crucial role in influencing purchase decisions.

Consumers trust supermarkets and hypermarkets for the quality, safety, and authenticity of packaged food items. The spacious layout, hygiene standards, and ease of access further enhance the shopping experience. Urban households, in particular, favor these outlets for their routine grocery needs, contributing to the sustained dominance of this segment.

Key Market Segments

By Product

- Flavored

- Unflavored

By Fat Content

- Whole

- Semi Skimmed

- Skimmed

By Form

- Powder

- Liquid

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Driving Factors

Growing Demand for Long Shelf-Life Dairy Products

One of the main driving factors for the UHT milk market is the increasing consumer need for dairy products with extended shelf life. UHT milk can stay fresh for several months without refrigeration until it is opened. This feature makes it ideal for households, especially in regions where cold storage is limited or unreliable. Busy lifestyles have also led many people to choose products that are easy to store and use, without frequent grocery trips.

Parents and working individuals often prefer UHT milk as a convenient and safe option. Its longer shelf life reduces spoilage and food waste, making it cost-effective. As more consumers seek practical and reliable food choices, the demand for UHT milk continues to rise steadily.

Restraining Factors

Consumer Preference for Fresh Milk Limits Growth

A key restraining factor in the UHT milk market is the strong consumer preference for fresh, refrigerated milk in many regions. Fresh milk is often seen as more natural, tastier, and healthier compared to UHT milk, especially in countries with well-established cold supply chains. This perception creates resistance among consumers who associate UHT milk with heavy processing or loss of nutrients.

In rural and semi-urban areas where traditional milk delivery systems are common, people tend to favor milk that comes directly from local sources. This loyalty to fresh milk can slow down the adoption of UHT milk, particularly among older consumers or those who are less open to packaged dairy alternatives, thereby limiting the overall market growth.

Growth Opportunity

Expanding Reach in Rural and Remote Areas

One of the biggest growth opportunities for the UHT milk market lies in expanding distribution across rural and remote regions. These areas often lack proper refrigeration and cold chain facilities, making traditional fresh milk harder to store and transport. UHT milk, with its long shelf life and no need for refrigeration before opening, is a perfect solution for such locations.

Governments and private players are increasingly focusing on improving access to packaged food in these regions, creating new sales channels for UHT milk. As awareness about food safety, hygiene, and convenience grows, rural consumers are becoming more open to packaged milk. This shift presents a strong opportunity for companies to grow their presence and reach untapped consumer bases.

Latest Trends

Rise of Plant-Based UHT Milk Alternatives

There is a growing trend toward plant-based UHT milk alternatives such as almond, oat, soy, and rice options. More consumers are choosing these variants because they are perceived as healthier, lactose-free, or environmentally friendly. Plant-based UHT milk mirrors the long shelf life and convenience of traditional UHT dairy milk, making it a practical substitute for those with dietary restrictions or ethical preferences.

Retailers and online stores are expanding their inventory to include a wider range of these products, often featuring fortified nutrition with added vitamins and minerals. Packaging has also evolved to allow these alternatives to be stored similarly to dairy UHT milk, maintaining the same ease of storage and transport. As plant-based diets gain momentum across age groups, the demand for plant-based UHT milk continues to accelerate, reflecting broader shifts toward sustainable and inclusive food choices.

Regional Analysis

In 2024, Europe dominated the UHT Milk Market with 43.9% market share.

In 2024, Europe held a dominant position in the global UHT Milk Market by region, accounting for 43.9% of the total market share, valued at USD 39.5 billion. This leading share is primarily driven by the region’s long-established preference for shelf-stable dairy products and strong consumption patterns across both Western and Eastern Europe. UHT milk has become a staple in many European households due to its extended shelf life, convenience, and consistent availability in retail outlets.

High urbanization levels and busy consumer lifestyles further support its popularity in the region. Moreover, the widespread presence of efficient supply chains and cold storage infrastructure enhances product distribution across supermarkets and hypermarkets. Countries such as France, Germany, and Italy continue to contribute significantly to market demand, supported by a robust dairy processing industry and stable per capita milk consumption.

The demand for clean-label and minimally processed dairy products also aligns with the attributes of UHT milk, reinforcing its position in household preferences. As a result, Europe remains the largest regional market, benefiting from mature dairy consumption habits, high awareness of food safety, and strong retail penetration. This established consumer base ensures the region’s continued dominance in the global UHT milk sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Amul (GCMMF) continues to lead in the Indian dairy sector, with its strong focus on wide-scale distribution and rural accessibility. Its extensive cooperative network allows for effective milk procurement and a consistent supply of UHT milk across urban and semi-urban markets. In 2024, Amul maintained momentum by focusing on value-based pricing and expanding its UHT milk reach in tier-2 and tier-3 cities, where demand for long shelf-life milk products is on the rise.

Arla Foods amba, a prominent European dairy cooperative, capitalized on its deep-rooted presence across Europe, where UHT milk is a household staple. The company continued to invest in sustainable packaging and innovation to meet changing consumer preferences. Arla’s focus on quality assurance and nutritional transparency helped strengthen its brand value in key markets.

China Mengniu Dairy Company Limited remained a key contributor in the Asia Pacific region, supported by China’s rising urbanization and growing demand for packaged dairy. In 2024, Mengniu expanded its product availability through modern retail and e-commerce platforms, responding to increasing consumer expectations for convenience and hygiene. The brand’s appeal among middle-income groups has played a vital role in driving UHT milk sales, particularly in fast-growing cities.

Top Key Players in the Market

- Amul (GCMMF)

- Arla Foods amba

- China Mengniu Dairy Company Limited

- Dairy Farmers of America Inc.

- Dairy Group South Africa

- Dana Dairy Group

- Danone S.A.

- Dean Foods

- Fonterra Co-operative Group Limited

- FrieslandCampina

Recent Developments

- In May 2024, Arla Foods launched Milka chocolate milk drinks in Germany, Austria, and Poland in June 2024, in collaboration with Mondelēz International. While this product includes UHT-treated liquid milk, it represents a broader innovation in flavored UHT formats. Offered in three pack sizes (220 ml cup, 250 ml PET bottle, and 750 ml carton) and available in Original Chocolate, Caramel, and Noisette flavours. Production takes place at Arla’s Esbjerg Dairy in Denmark.

- In March 2024, Amul expanded into the European market by launching fresh milk in Spain and the broader European Union, in collaboration with Spain’s top dairy cooperative COVAP. The launch event took place in Madrid, and the initial rollout will cover cities such as Madrid, Barcelona, followed by planned expansion into Lisbon, Germany, Italy, and Switzerland.

Report Scope

Report Features Description Market Value (2024) USD 90.0 Billion Forecast Revenue (2034) USD 177.0 Billion CAGR (2025-2034) 7.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Flavored, Unflavored), By Fat Content (Whole, Semi Skimmed, Skimmed), By Form (Powder, Liquid), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amul (GCMMF), Arla Foods amba, China Mengniu Dairy Company Limited, Dairy Farmers of America Inc., Dairy Group South Africa, Dana Dairy Group, Danone S.A., Dean Foods, Fonterra Co-operative Group Limited, FrieslandCampina Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amul (GCMMF)

- Arla Foods amba

- China Mengniu Dairy Company Limited

- Dairy Farmers of America Inc.

- Dairy Group South Africa

- Dana Dairy Group

- Danone S.A.

- Dean Foods

- Fonterra Co-operative Group Limited

- FrieslandCampina