Global UAV Battery Market Size, Share Analysis Report By UAV Type (Medium Altitude Long Endurance (MALE), High Altitude Long Endurance (HALE), Tactical UAVs and Small UAVs (Micro And Mini), By Component, Cells, Battery Management Systems, Enclosures, Connectors), By Technology (Lithium-based, Nickel-based, Fuel Cell, Sodium-ion), By Platform (Consumer, Commercial, Government And Law Enforcement, Military), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171956

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

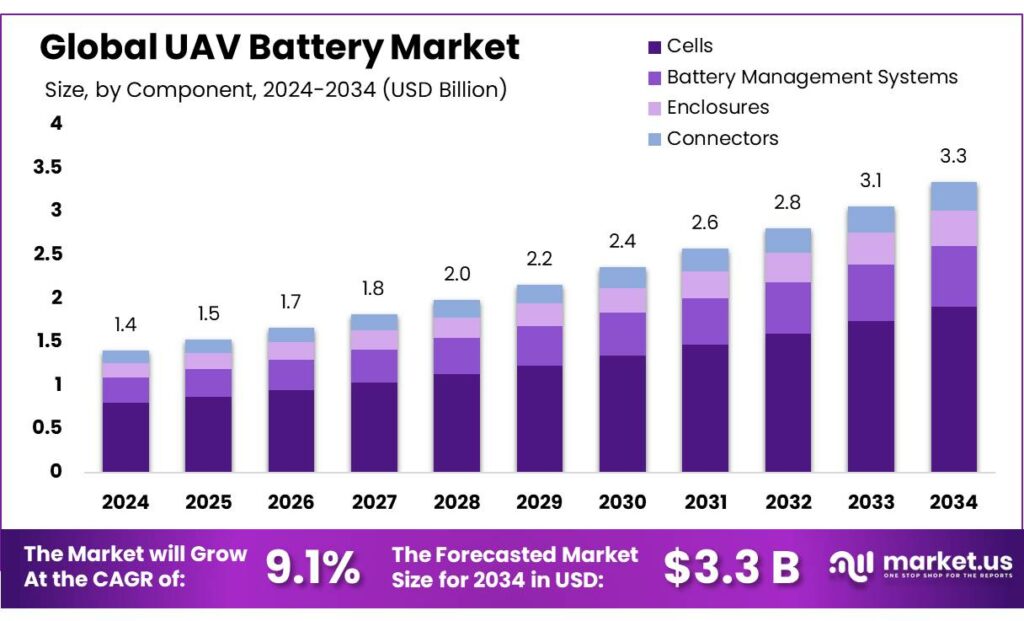

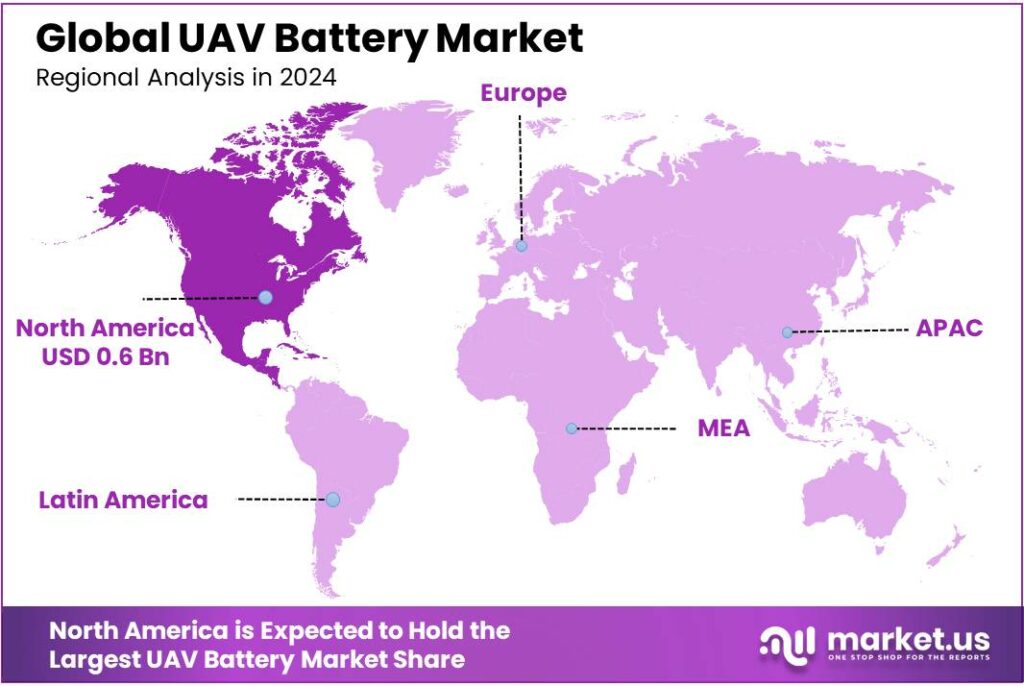

The Global UAV Battery Market size is expected to be worth around USD 3.3 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 9.1% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 43.9% share, holding USD 0.6 Billion in revenue.

UAV batteries sit at the center of drone reliability, payload capability, and mission economics because they directly set flight time, power delivery, and safety margins. Aerospace R&D is pushing the ceiling upward: NASA has documented Li-ion battery pack targets around 250 Wh/kg, and cell demonstrations reaching 340 Wh/kg for aerospace-oriented designs, which signals where “next-gen” UAV endurance platforms are headed as these designs industrialize.

The industrial scenario is being shaped by rapid expansion in the regulated drone ecosystem. In the U.S., the FAA reported 837,513 total drones registered as of November 2025, including 453,635 commercial registrations, alongside 481,760 certificated remote pilots—an installed base that steadily increases recurring demand for replacement packs and higher-performance upgrades. In Europe, EASA states there are 1.6 million+ registered drone operators under a single EU ruleset, supporting a large addressable market for compliant, traceable batteries used in routine operations.

Key driving factors are coming from both demand pull and supply-side economics. Defense procurement has become a major accelerator for high-volume small UAVs; for example, the U.S. DoD’s Replicator effort has been described as securing about $500 million for FY2024, with discussion of similar scale for FY2025—signals that push manufacturers toward scalable, ruggedized battery supply chains.

The International Energy Agency notes lithium-ion battery pack prices fell 20% in 2024, while global battery manufacturing capacity reached 3 TWh in 2024, improving availability of cells and enabling more specialized UAV pack formats. The IEA also highlights lithium prices dropping more than 85% from their 2022 peak, which can reduce upstream pressure on battery inputs over time.

Government initiatives play a crucial role in stimulating UAV and battery market growth, particularly in key regions. In India, the government has streamlined drone policies under Drone Rules 2021 and supportive platforms like DigitalSky to simplify registrations and permissions, fostering adoption across sectors such as agriculture and logistics. Additionally, GST on drones was lowered to a uniform 5% in 2025 to reduce cost barriers and support ‘Make in India’ manufacturing and component production.

Adoption is still early in many farm systems, which creates runway for UAV battery volumes as usage broadens. USDA ERS reports aerial imagery (aircraft/drones/satellites) was used on 7.0% of U.S. corn acres (2016) and 9.8% of soybean acres (2018), with lower rates such as 3.5% on winter wheat (2017) and 2.8% on cotton (2019). As imagery and automation move from “trial” to “routine,” battery demand shifts from sporadic purchases to fleet-level replacement cycles and standardized pack programs.

Key Takeaways

- UAV Battery Market size is expected to be worth around USD 3.3 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 9.1%.

- Medium Altitude Long Endurance (MALE) held a dominant market position, capturing more than a 51.4% share.

- Cells held a dominant market position, capturing more than a 57.8% share.

- Lithium-based held a dominant market position, capturing more than a 69.9% share.

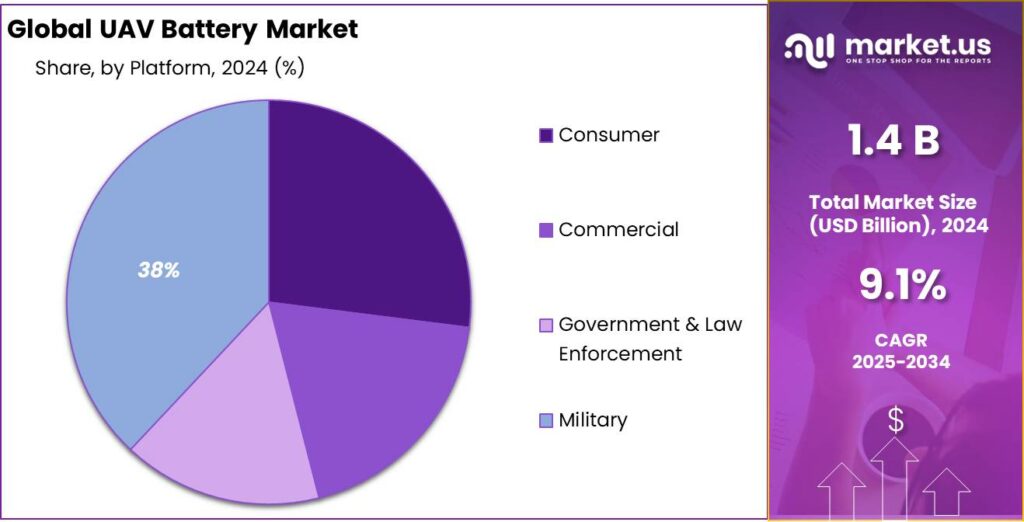

- Military held a dominant market position, capturing more than a 38.1% share.

- North America remained the dominating region in the UAV battery market, holding a leading share of 43.90% and reaching a market value of approximately USD 0.6 billion.

By UAV Type Analysis

Medium Altitude Long Endurance (MALE) UAV leads the UAV battery market with a 51.4% share due to extended mission needs and high operational demand

In 2024, Medium Altitude Long Endurance (MALE) held a dominant market position, capturing more than a 51.4% share, as this UAV type continued to be widely used for long-duration surveillance, border monitoring, and intelligence missions. The demand for reliable and high-capacity batteries was driven by the need for longer flight endurance, stable power supply, and consistent performance at medium altitudes.

MALE platforms were increasingly preferred by defense and security operators because they balance payload capacity and endurance without the complexity of higher-altitude systems. In 2025, growth remained steady as fleet upgrades and new UAV deployments supported battery replacement and efficiency improvement programs. Battery selection in this segment was mainly influenced by endurance requirements, safety, and lifecycle reliability, making MALE UAVs a key contributor to overall market demand during this period.

By Component Analysis

Cells dominate the UAV battery market with a 57.8% share due to their direct role in energy storage and performance

In 2024, Cells held a dominant market position, capturing more than a 57.8% share, as they formed the core of UAV battery systems and directly influenced flight time, payload capacity, and safety. Demand was mainly driven by the need for higher energy density and consistent power output, especially for surveillance and long-endurance UAV operations.

Manufacturers focused on improving cell chemistry and durability to support repeated charge cycles and harsh operating conditions. In 2025, the segment continued to show stable growth as UAV deployments increased and battery upgrades became more frequent to meet longer mission requirements. The strong share of cells reflected their essential role in determining overall battery efficiency and operational reliability across UAV platforms.

By Technology Analysis

Lithium-based technology leads the UAV battery market with a 69.9% share due to its high energy efficiency and lightweight nature

In 2024, Lithium-based held a dominant market position, capturing more than a 69.9% share, as it remained the preferred battery technology for most UAV platforms. This dominance was mainly supported by its high energy density, low weight, and ability to deliver stable power over long flight durations. Lithium-based batteries were widely adopted in both tactical and commercial UAVs where endurance and payload efficiency are critical.

In 2025, demand stayed strong as UAV operators continued to favor proven and reliable battery technologies to reduce operational risks and maintenance needs. The large market share reflected the continued trust in lithium-based systems to meet evolving UAV performance and mission requirements.

By Platform Analysis

Military platform leads the UAV battery market with a 38.1% share due to rising defense surveillance and mission intensity

In 2024, Military held a dominant market position, capturing more than a 38.1% share, as defense forces continued to rely heavily on UAVs for intelligence, surveillance, reconnaissance, and tactical missions. Battery demand in this segment was driven by the need for long endurance, high reliability, and stable performance under extreme operating conditions.

Military UAVs often require frequent missions and extended flight hours, which increased the demand for durable and high-capacity battery systems. In 2025, growth remained steady as modernization programs and fleet expansions supported continued battery upgrades and replacements. The strong share of the military platform highlighted its consistent investment in UAV capabilities and energy storage performance.

Key Market Segments

By UAV Type

- Medium Altitude Long Endurance (MALE)

- High Altitude Long Endurance (HALE)

- Tactical UAVs and Small UAVs (Micro & Mini)

By Component

- Cells

- Battery Management Systems

- Enclosures

- Connectors

By Technology

- Lithium-based

- Nickel-based

- Fuel Cell

- Sodium-ion

By Platform

- Consumer

- Commercial

- Government & Law Enforcement

- Military

Emerging Trends

Ultra-Fast Charging and “Field Power” Setups Are Becoming the New Standard for UAV Batteries

One major latest trend in UAV batteries is the shift from “longer flight time only” to faster turnaround in the field. In farming and food-supply operations, drones don’t fly once and stop—they fly in repeated sorties. That means the real performance metric is how quickly a team can get a drained pack safely back to usable charge, again and again, without overheating or shortening battery life. This is pushing battery makers and drone OEMs to design high-rate charging ecosystems—battery, charger, cooling, and power source working as one.

A clear example is in agriculture drones, where manufacturers are openly marketing single-digit-minute recharge as a productivity feature. DJI’s official Agras T50/T25 battery system notes an “impressively quick” 9 minutes to reach a stable, high-energy charge with its rapid charging approach (published April 2024). DJI’s Agras T30 charger specs also describe charging a battery in 9 to 12 minutes and list a rated power of 7,200 W with 120 A charging current.

This trend matters directly for food production because timing affects yield protection and waste reduction. FAO highlights that an estimated 13.2% of food—about 1.25 billion tonnes—is lost after harvest and before reaching retail. Drones are increasingly used to act fast: spot stress early, treat outbreaks sooner, and cover more area per day. Faster battery turnaround supports that “act fast” model, because the drone can keep moving instead of being parked beside a slow charger.

Alongside fast charging, another part of the same trend is portable, site-ready energy—basically “bring the charging station to the field.” Media coverage of DJI’s Power 2000 portable power station describes a capacity of 2048 Wh using LiFePO₄ cells, aimed at powering/charging drone batteries and other gear on location. Even if operators don’t use this exact product, the direction is clear: field teams want compact, reliable power so they can charge safely in remote areas, not only at a base facility.

Drivers

Growing Food Demand Drives UAV Battery Growth Through Precision Agriculture

One major driving factor for the UAV battery market is the rising global demand for food and the corresponding need to improve agricultural productivity sustainably, which has strengthened the adoption of UAVs across farming systems and, in turn, increased the need for advanced UAV batteries. The world’s population continues to grow rapidly, placing pressure on agriculture to produce more food on existing farmland.

- According to the Food and Agriculture Organization (FAO), global production of primary crops reached 9.9 billion tonnes in 2023, reflecting a 3% increase over 2022 and a 27% increase since 2010 as food systems responded to ongoing demand pressures.

By 2050, it is estimated that food production will need to increase by a further 70% to meet the nutritional needs of an expected 9.7 billion people, a challenge that conventional farming methods alone cannot sustainably achieve. UAVs have increasingly been applied in precision agriculture to help bridge this gap by improving crop monitoring, resource use efficiency, and pest and disease management. These aircraft are equipped with sensors and imaging systems that allow farmers to assess field conditions in real time, leading to targeted irrigation, fertilizer application, and reduced chemical use.

The adoption of UAVs in agricultural practices directly influences battery demand. Longer flight times and more energy-intensive sensors require high-performance batteries, driving innovation and demand in the UAV battery segment. The adoption of UAVs also reflects broader precision agriculture trends where technological tools replace or supplement traditional labour-intensive tasks, increasing overall farm productivity while reducing costs and environmental impact. Government policies and support schemes in countries such as India have extended financial incentives to agricultural institutions and growers for drone purchases, which enhances UAV use and associated battery requirements.

Restraints

High Costs and Infrastructure Gaps Restrain UAV Battery Adoption Despite Agricultural Needs

One major restraining factor for the UAV battery market is the high cost of battery systems and the lack of supporting infrastructure, which slows adoption even in sectors such as agriculture that could benefit significantly from drone technology. While drones offer the potential to improve crop monitoring, spraying, and yield prediction, many farmers—especially smallholders—face financial barriers that make it difficult to invest in advanced UAVs and the high-performance batteries they require.

The price of a high-capacity UAV battery can represent a significant portion of the total cost of a drone. For example, advanced lithium-based batteries designed for long flight times and harsh environmental conditions often cost several hundred dollars per unit. When combined with the price of the UAV itself, maintenance, and required ground support equipment, total investment can exceed the annual income of many small and medium farms in developing regions. This cost dynamic becomes more pronounced when farmers must replace batteries frequently due to intensive field use, which adds to operating expenses.

- According to the Food and Agriculture Organization (FAO), global production of primary crops reached 9.9 billion tonnes in 2023, up by 3% over the previous year, reflecting efforts to meet rising food demand. However, achieving the estimated 70% increase in food production by 2050 needed to feed a growing population places immense pressure on farmers to adopt efficient technologies. These technologies include UAVs, but the upfront costs remain daunting for many.

Government initiatives aimed at supporting UAV use in agriculture have been introduced in some countries. Subsidies or grants may be available to help offset the cost of drone purchases, training, and infrastructure development. However, these programs are often limited in scope or unevenly distributed, leaving many smaller agricultural producers without meaningful support. In regions where subsidies exist, uptake improves, but gaps in service networks and technical assistance continue to be major hurdles.

Opportunity

Subsidised Agri-Drone Programs Create a Big Opportunity for High-Cycle, Fast-Swap UAV Batteries

One of the best growth opportunities for UAV batteries is the rapid expansion of drones in farming and food supply chains—because agriculture work is not “one flight a day.” Spraying, seeding support, crop scouting, and mapping happen in repeated sorties across large areas. That operating pattern creates a clear battery need: packs that can deliver steady power under load, survive frequent charge cycles, and get back into the air quickly. When a drone becomes a daily tool for a village service provider or a custom-hiring centre, batteries turn into the main consumable—and the main bottleneck to scale.

This opportunity is strengthened by the fact that food systems still lose a huge amount of output before it even reaches people. FAO notes that 13.2% of food is lost in the supply chain after harvest and before retail, and it also highlights a scale figure of about 1.25 billion tonnes lost after harvest (2021 estimate). While batteries don’t fix every cause of loss, they directly support faster, better-timed farm operations—like precise spraying and quicker response to pest outbreaks. If drones help farms protect yield and reduce waste, demand rises for reliable battery systems that can work in heat, dust, and long field days without frequent failures.

- India is a strong example of how government support can turn this into a real, bankable battery market. The Ministry of Agriculture & Farmers Welfare’s mechanization page lists direct financial assistance for drone adoption: 75% of drone cost up to Rs. 7.5 lakh for FPOs (and similar institutional users), 50% up to Rs. 5 lakh for SC/ST, small/marginal, women, and NE state farmers, and 40% up to Rs. 4 lakh for other individual farmers. Separately, the SMAM guidelines also include operating support for hiring drones—showing financial assistance of Rs. 2000/ha for small and marginal farmers in low-mechanized regions, up to 2 ha per year.

There is also a scale signal in the number of platforms entering the field. In a parliamentary-reply-based count reported around the DGCA Digital Sky ecosystem, India had 10,208 type-certified commercial drones registered up to September 2024, and DGCA had issued 96 type certificates, with 65 agriculture-based models. More certified ag models generally means more buyers with similar operational needs—spraying missions, payload lift, and quick turnaround—which again points straight to battery demand.

Regional Insights

North America dominates the UAV battery market with strong defense spending and advanced UAV deployment

North America remained the dominating region in the UAV battery market, holding a leading share of 43.90% and reaching a market value of approximately USD 0.6 billion. This strong regional position was primarily supported by high UAV adoption across military, homeland security, and commercial applications. In 2024, the region benefited from continuous investments in unmanned systems for surveillance, border security, intelligence gathering, and tactical missions, which directly increased demand for high-performance and long-endurance battery systems. The presence of a well-established aerospace and defense ecosystem further supported consistent battery procurement and replacement cycles.

The United States accounted for the majority of regional demand, driven by large-scale UAV fleets and frequent mission operations requiring reliable and energy-dense battery solutions. Battery performance requirements in North America remained focused on endurance, safety, and operational reliability, especially for medium and large UAV platforms. In 2025, market growth continued at a steady pace as defense modernization programs and increased use of UAVs in disaster management, infrastructure inspection, and logistics supported battery upgrades and efficiency improvements.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ballard Power Systems: Ballard Power Systems Inc., established in 1979 and headquartered in Burnaby, Canada, specializes in proton exchange membrane (PEM) fuel cell products that extend to UAV energy systems under development. The company reported a total revenue of USD 17.8 million in Q2 2025, with growth in heavy-duty mobility segments, reflecting diversification in clean energy solutions that may influence future zero-emission aerial platforms.

Amprius Technologies: Amprius Technologies secured a $35 million purchase order in 2025 from a leading unmanned aerial systems manufacturer for its high-energy silicon-anode battery cells, highlighting adoption momentum in UAV applications. The company supports over 1.8 GWh of secured manufacturing capacity globally and its SiCore® batteries deliver up to 450 Wh/kg energy density with commercial deployments underway.

Denchi Group Ltd: Denchi Group Ltd, based in the UK, delivers specialist battery solutions for commercial and military UAVs with over 20 years of experience in rugged lithium-ion systems. Its portfolio includes custom power packs such as the Sparrowhawk UAV battery, designed for high power and extended flight operations, earning the trust of defence primes like BAE Systems and Lockheed Martin.

Top Key Players Outlook

- AMIT industries L.T.D

- Amprius Technologies.

- Ballard Power Systems

- Denchi Group Ltd

- DJI

- EaglePicher Technologies

- Epsilor-Electric Fuel Ltd.

- H3 Dynamics Holdings Pte. Ltd.

- Kokam, OXIS Energy Ltd.

- RRC Power Solutions GmbH

- Shenzhen Grepow Battery Co., Ltd.

- Sion Power Corporation

- Tadiran Batteries

Recent Industry Developments

In 2024, Amprius Technologies, Inc. expanded its product portfolio with the SiCore™ platform, offering cells with energy densities up to 400 Wh/kg and balanced power required for longer UAV flight times and heavier payloads. These silicon-based cells significantly outperform traditional graphite batteries, providing up to double the specific energy and energy density of conventional cells and enabling rapid charging in under six minutes for 80 % state of charge.

In 2024, Ballard faced broader fuel cell market challenges, reporting full-year revenue of USD 69.7 million, down 32 % from the prior year, though it achieved a record order backlog of USD 173.5 million and delivered over 660 fuel cell engines (~56 MW total) to customers.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Bn Forecast Revenue (2034) USD 3.3 Bn CAGR (2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By UAV Type (Medium Altitude Long Endurance (MALE), High Altitude Long Endurance (HALE), Tactical UAVs and Small UAVs (Micro And Mini), By Component, Cells, Battery Management Systems, Enclosures, Connectors), By Technology (Lithium-based, Nickel-based, Fuel Cell, Sodium-ion), By Platform (Consumer, Commercial, Government And Law Enforcement, Military) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AMIT industries L.T.D, Amprius Technologies., Ballard Power Systems, Denchi Group Ltd, DJI, EaglePicher Technologies, Epsilor-Electric Fuel Ltd., H3 Dynamics Holdings Pte. Ltd., Kokam, OXIS Energy Ltd., RRC Power Solutions GmbH, Shenzhen Grepow Battery Co., Ltd., Sion Power Corporation, Tadiran Batteries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AMIT industries L.T.D

- Amprius Technologies.

- Ballard Power Systems

- Denchi Group Ltd

- DJI

- EaglePicher Technologies

- Epsilor-Electric Fuel Ltd.

- H3 Dynamics Holdings Pte. Ltd.

- Kokam, OXIS Energy Ltd.

- RRC Power Solutions GmbH

- Shenzhen Grepow Battery Co., Ltd.

- Sion Power Corporation

- Tadiran Batteries