Global Tungsten Carbide Powder Market Size, Share, And Enhanced Productivity By Grade (Rotary Drilling and Mining, Metal Forming, Wear, Submicron, Others), By Application (Machine Tools, Cutting Tools, Dies and Punches, Others), By End-Use (Building and Construction, Oil and Gas, Automotive, Mining, Aerospace and Defense, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 176174

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

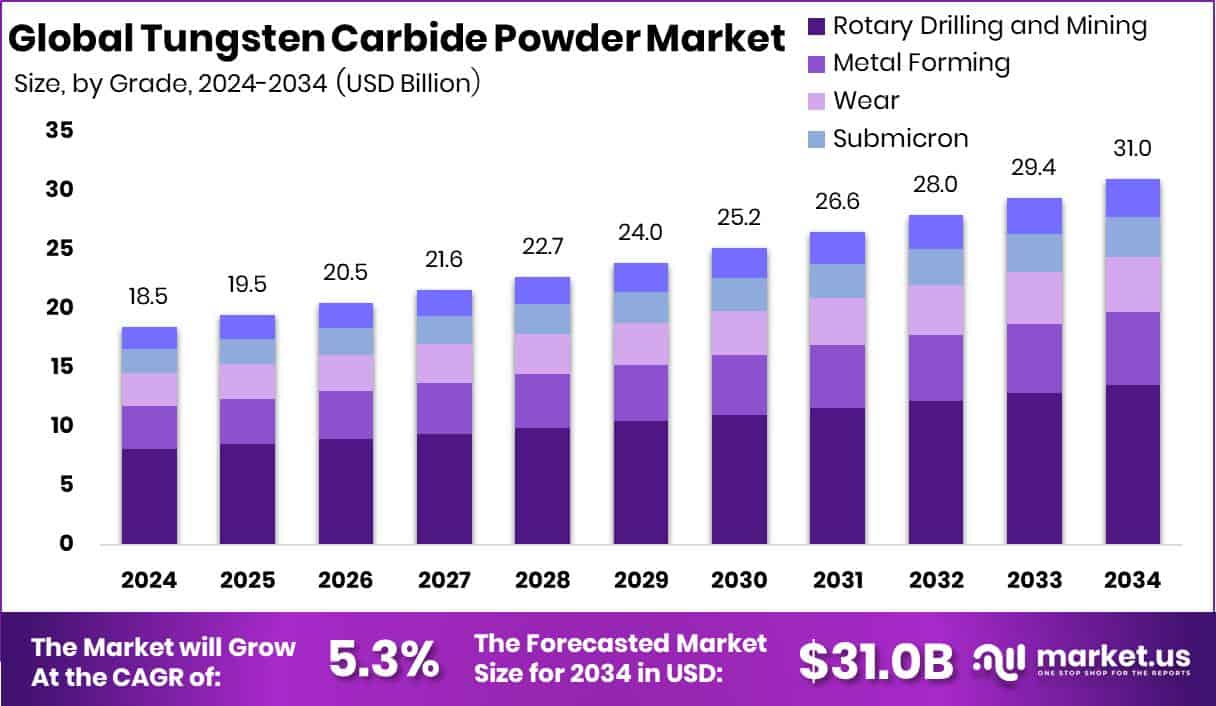

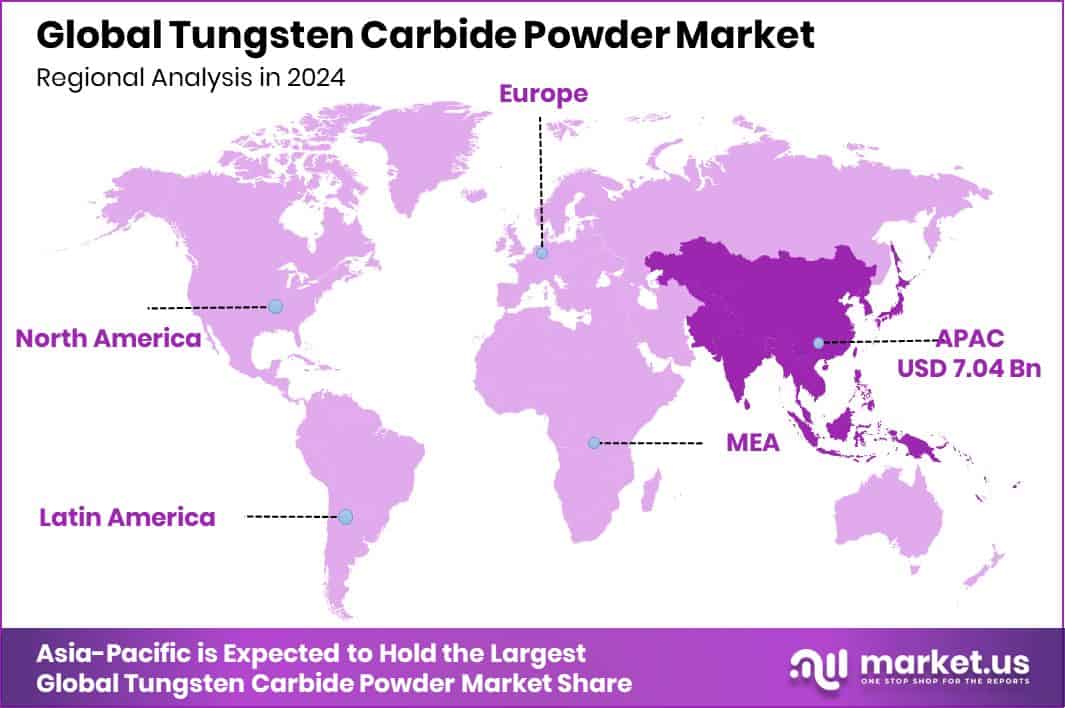

The Global Tungsten Carbide Powder Market is expected to be worth around USD 31.0 billion by 2034, up from USD 18.5 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034. The Tungsten Carbide Powder Market in the Asia Pacific achieved 38.1%, valued at USD 7.04 Bn.

Tungsten carbide powder is a hard, dense, and extremely wear-resistant material produced by combining tungsten and carbon at high temperatures. It is widely used to manufacture cutting tools, drilling components, wear parts, and industrial machinery because it maintains strength even under extreme pressure and heat. Its durability makes it essential for applications that demand long service life, precision, and resistance to abrasion, especially in heavy industries.

The Tungsten Carbide Powder Market represents the global demand for this powder across sectors such as drilling, metal forming, machine tools, construction equipment, automotive parts, and aerospace components. Growth is influenced by industrial expansion, stronger manufacturing output, and increasing use of high-performance materials. The market evolves with new applications that require tougher and more reliable components.

Growth is supported by rising global drilling and mining activity, especially as countries focus on securing critical minerals. Industry momentum is reinforced by initiatives such as AMERMIN’s $11.5 million grant to scale new materials technology and Northstar Gold Corp.’s $4 million co-investment to advance precision mining. These activities increase the need for carbide-based tools in drilling and material extraction.

Demand continues to rise as advanced equipment becomes more automated and high-precision. The announcement of a $350 million autonomous equipment sale, the largest in Epiroc’s history, reflects how automation boosts the requirement for long-lasting carbide components used in machine tools and wear parts.

Opportunity is expanding due to global investment in drilling campaigns and industrial projects. Supportive moves such as the WA Government’s $175k grant for exploration and Sandvik’s $21 million rotary drill order in Mongolia highlight increasing reliance on durable tungsten carbide materials across exploration, construction, and heavy engineering sectors.

Key Takeaways

- The Global Tungsten Carbide Powder Market is expected to be worth around USD 31.0 billion by 2034, up from USD 18.5 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

- The Tungsten Carbide Powder Market sees Rotary Drilling and Mining dominate with a strong 43.7% share.

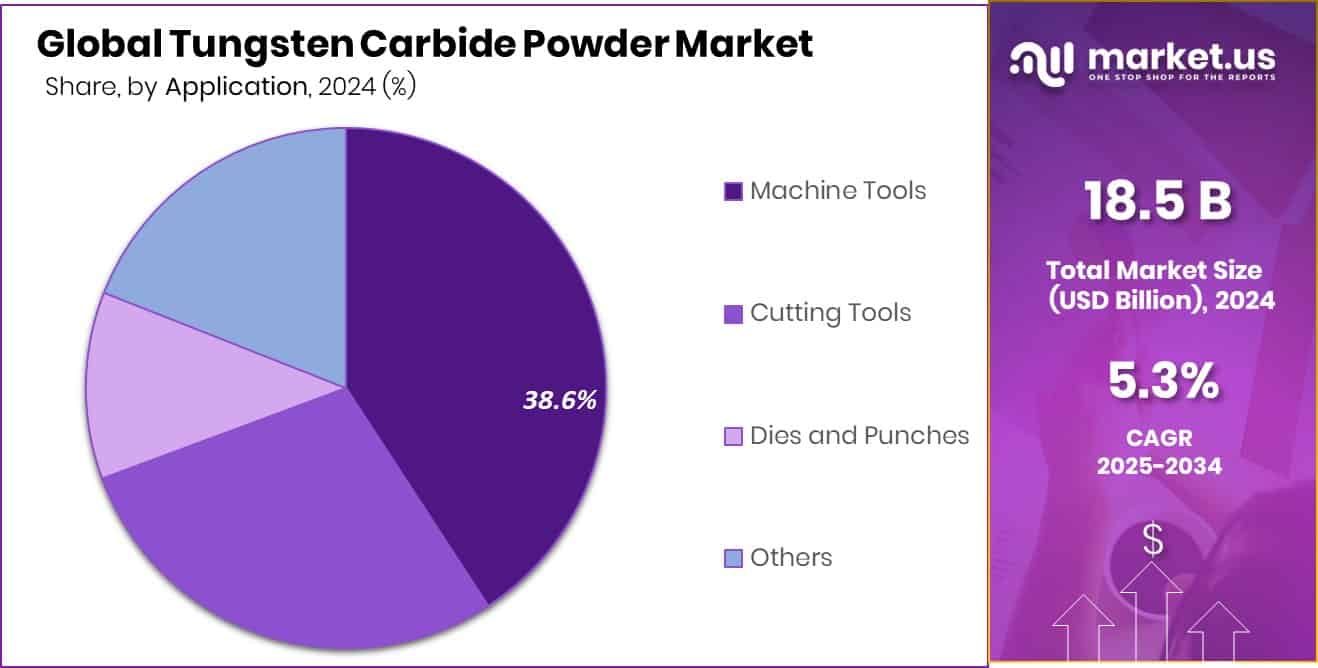

- In the Tungsten Carbide Powder Market, Machine Tools applications account for a notable 38.6% contribution.

- Mining remains the top end-use segment in the Tungsten Carbide Powder Market with 41.2% share.

- In 2024, the Asia Pacific maintained a strong 38.1% share worth USD 7.04 Bn.

By Grade Analysis

Tungsten Carbide Powder Market was dominated by Rotary Drilling & Mining with 43.7% share.

In 2024, Rotary Drilling & Mining dominated the Tungsten Carbide Powder Market with a strong 43.7% share. This leadership comes from the sector’s heavy reliance on highly durable cutting and drilling materials that can endure extreme pressure and abrasive environments. Tungsten carbide powder enables superior hardness, making it essential for drill bits, cutters, and downhole tools used in deep mining and large-scale excavation projects.

As global mineral extraction increases, especially for critical metals used in electronics and renewable energy systems, demand for carbide-based tools continues to rise. The reliability, longer tool life, and reduced maintenance offered by tungsten carbide ensure its sustained preference in the drilling and mining ecosystem, reinforcing this segment’s market dominance.

By Application Analysis

Tungsten Carbide Powder Market applications were dominated by Machine Tools holding 38.6% share.

In 2024, Machine Tools held a dominant 38.6% share in the Tungsten Carbide Powder Market, driven by its vital role across precision manufacturing, automotive part production, and heavy industrial machining. Machine tools require materials that retain sharpness, resist deformation, and maintain consistency under high-speed cutting conditions—qualities that tungsten carbide powder delivers exceptionally well.

Its use in inserts, milling tools, cutting tips, and wear-resistant components enhances productivity and reduces downtime for manufacturers. The growing shift toward automated machining and CNC technologies further amplifies the need for high-performance carbide-based tools. As industries push for tighter tolerances, faster output, and longer tool cycles, the machine tools segment continues to anchor its market leadership.

By End-Use Analysis

Tungsten Carbide Powder Market end-use segment was dominated by Mining, capturing 41.2% share.

In 2024, Mining dominated the Tungsten Carbide Powder Market by end-use with a 41.2% share, reflecting the sector’s dependence on robust materials capable of handling intense geological challenges. Mining operations demand equipment that can withstand continuous impact, friction, and thermal stress, making tungsten carbide indispensable for blasting tools, drilling components, tunnelling machinery, and wear-resistant parts.

The rise in global exploration for lithium, copper, rare earth elements, and other strategic minerals fuels consistent consumption of carbide-enhanced tools. With mining companies prioritising efficiency, reduced operational delays, and longer equipment life, tungsten carbide powder remains central to achieving these goals. Its unmatched durability solidifies mining’s leading position within the overall market.

Key Market Segments

By Grade

- Rotary Drilling and Mining

- Metal Forming

- Wear

- Submicron

- Others

By Application

- Machine Tools

- Cutting Tools

- Dies and Punches

- Others

By End-Use

- Building and Construction

- Oil and Gas

- Automotive

- Mining

- Aerospace and Defense

- Others

Driving Factors

Rising demand for advanced machining materials

Rising demand for advanced machining materials continues to shape the Tungsten Carbide Powder Market, especially as industries push for better durability and precision in cutting, drilling, and forming applications. This demand grows further with stronger support for manufacturing innovation, such as the announcement that an Abu Dhabi fund will invest up to $35 million in the Machina Labs project, boosting robotics-driven metal processing.

Such investments strengthen the need for tougher, wear-resistant materials like tungsten carbide powder, which performs reliably under high heat and pressure. As industries scale automation and intelligent manufacturing, the role of carbide-based components grows even more central, reinforcing this factor as a key driver of future market expansion.

Restraining Factors

High production costs reduce adoption

High production costs reduce the adoption of tungsten carbide powder, especially for companies operating with limited budgets or in regions where material costs already strain manufacturing margins. These cost pressures become more pronounced as advanced processes require tighter tolerances and purer carbide formulations.

Adding to this challenge, Machina Labs raised $32 million to expand robotic sheet metal forming, highlighting how emerging technologies, though promising, often come with premium costs. While innovation attracts attention, many industries still hesitate due to expensive inputs, making affordability a persistent restraint that slows broader market penetration.

Growth Opportunity

Expanding mining projects increase needs

Expanding mining projects increase needs for durable drilling and wear-resistant materials, creating strong opportunities for tungsten carbide powder. Mining operations depend on components capable of handling impact, abrasion, and continuous heavy loads, making carbide essential for tools and equipment. New investment activity reinforces this opening, such as American Axle seeking $2.3 billion to fund the Dowlais takeover, signalling industrial expansion that could elevate carbide demand.

Additionally, Wayne State University received a $3.1 million grant to explore alternative rare earth sources highlights growing research momentum, potentially widening material development and future applications where tungsten carbide plays a key performance role.

Latest Trends

Shift toward ultra-fine carbide powders

A major trend shaping the market is the shift toward ultra-fine carbide powders, which offer improved hardness, precision, and wear resistance for high-performance tooling. This trend aligns with rising innovation across the energy and manufacturing sectors. A notable example is Form Energy raising $405 million for its 100-hour iron-air batteries, contributing to its total of $1.2 billion raised, as the company expands its West Virginia facility and prepares for first deployments.

Such large-scale energy and infrastructure projects typically increase the need for carbide-based components used in machinery, battery production equipment, and industrial systems, reinforcing the market’s movement toward finer, more advanced powder grades.

Regional Analysis

Asia Pacific dominated the Tungsten Carbide Powder Market with 38.1%, reaching USD 7.04 Bn.

In 2024, Asia Pacific dominated the Tungsten Carbide Powder Market with a commanding 38.1% share, valued at USD 7.04 Bn, supported by strong industrial manufacturing, expanding mining operations, and heavy investment in machine tools across China, India, and Southeast Asia. The region’s leadership is reinforced by high consumption of wear-resistant materials in automotive components, electronics, tooling, and large-scale drilling activities.

North America follows with steady demand driven by mining activities, precision machining, and strong adoption of advanced cutting technologies across the U.S. and Canada. Europe shows consistent growth as Germany, Italy, and France rely heavily on carbide tools for automotive engineering and metalworking applications.

The Middle East & Africa market benefits from drilling operations and infrastructure expansion, increasing the requirement for durable carbide-based components. Latin America contributes through mining-intensive economies, where tungsten carbide powder plays a crucial role in drilling efficiency and equipment longevity.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Ceratizit S.A. continued to strengthen its position in the global Tungsten Carbide Powder Market by focusing on high-performance carbide materials widely used in tooling, machining, and wear-resistant applications. The company’s long-standing expertise in powder metallurgy supports consistent product quality, enabling it to meet the growing industrial demand for precise, durable, and thermally stable carbide solutions. Ceratizit’s ability to serve diverse sectors such as automotive components, metal cutting, and mining equipment reinforces its role as a key influencer shaping product innovation and technical standards in the tungsten carbide domain.

China Tungsten Online (Xiamen) Manu. & Sales Corp. plays a crucial role due to its strong presence in China’s tungsten value chain, offering a wide portfolio of carbide powders used in cutting tools, drill bits, molds, and wear parts. The company benefits from China’s extensive tungsten resources and mature processing infrastructure, allowing it to support both domestic and international demand with competitive efficiency. Its technical capabilities in producing fine-grade and specialized powders enable it to supply industries that require stable performance in high-stress machining environments.

Chongyi ZhangYuan Tungsten Co., Ltd remains another important market participant, recognized for its vertically integrated operations that span mining, refining, and powder production. Its controlled supply chain enhances material purity and consistency, which is essential for downstream manufacturers of hardmetals, inserts, and industrial tools. The company’s scale and production depth allow it to address large-volume requirements, especially for industries that rely on durable and wear-resistant carbide-based components.

Top Key Players in the Market

- Ceratizit S.A.

- China Tungsten Online (Xiamen) Manu. & Sales Corp.

- Chongyi ZhangYuan Tungsten Co., Ltd

- Extramet

- Federal Carbide Company

- Guangdong Xianglu Tungsten Co., Ltd.

- H.C. Starck GmbH

- Japan New Metal Co., Ltd

- Kennametal Inc.

- Nanchang Cemented Carbide Co., Ltd

- Reade International Corp.

Recent Developments

- In September 2025, Swiss carbide maker EXTRAMET AG was acquired by ADMETOS GmbH, an industrial investment firm. This acquisition supports a planned ownership change as the longtime owner retired, and it aims to strengthen Extramet’s market position and operational capacity in high-precision carbide products for milling and drilling blanks in automotive, aerospace, and other industries.

- In May 2024, Masan High-Tech Materials Group signed an agreement to sell H.C. Starck Holding GmbH to Mitsubishi Materials Corporation Group. This deal covers H.C. Starck’s business of producing and selling tungsten and tungsten carbide powders, and integration into MMC’s global metals operations was planned, subject to regulatory approvals.

Report Scope

Report Features Description Market Value (2024) USD 18.5 Billion Forecast Revenue (2034) USD 31.0 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Rotary Drilling and Mining, Metal Forming, Wear, Submicron, Others), By Application (Machine Tools, Cutting Tools, Dies and Punches, Others), By End-Use (Building and Construction, Oil and Gas, Automotive, Mining, Aerospace and Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ceratizit S.A., China Tungsten Online (Xiamen) Manu. & Sales Corp., Chongyi ZhangYuan Tungsten Co., Ltd, Extramet, Federal Carbide Company, Guangdong Xianglu Tungsten Co., Ltd., H.C. Starck GmbH, Japan New Metal Co., Ltd, Kennametal Inc., Nanchang Cemented Carbide Co., Ltd, Reade International Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Tungsten Carbide Powder MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Tungsten Carbide Powder MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Ceratizit S.A.

- China Tungsten Online (Xiamen) Manu. & Sales Corp.

- Chongyi ZhangYuan Tungsten Co., Ltd

- Extramet

- Federal Carbide Company

- Guangdong Xianglu Tungsten Co., Ltd.

- H.C. Starck GmbH

- Japan New Metal Co., Ltd

- Kennametal Inc.

- Nanchang Cemented Carbide Co., Ltd

- Reade International Corp.