Global Triethylamine Market Size, Share, And Business Benefit By Grade (Industrial Grade, Pharmaceutical Grade, Electronic Grade), By Application (Agrochemicals, Pharmaceuticals, Textiles, Paints and Coatings, Rubber Processing, Others), By End-User (Chemical, Pharmaceutical, Agriculture, Textile, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 164113

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

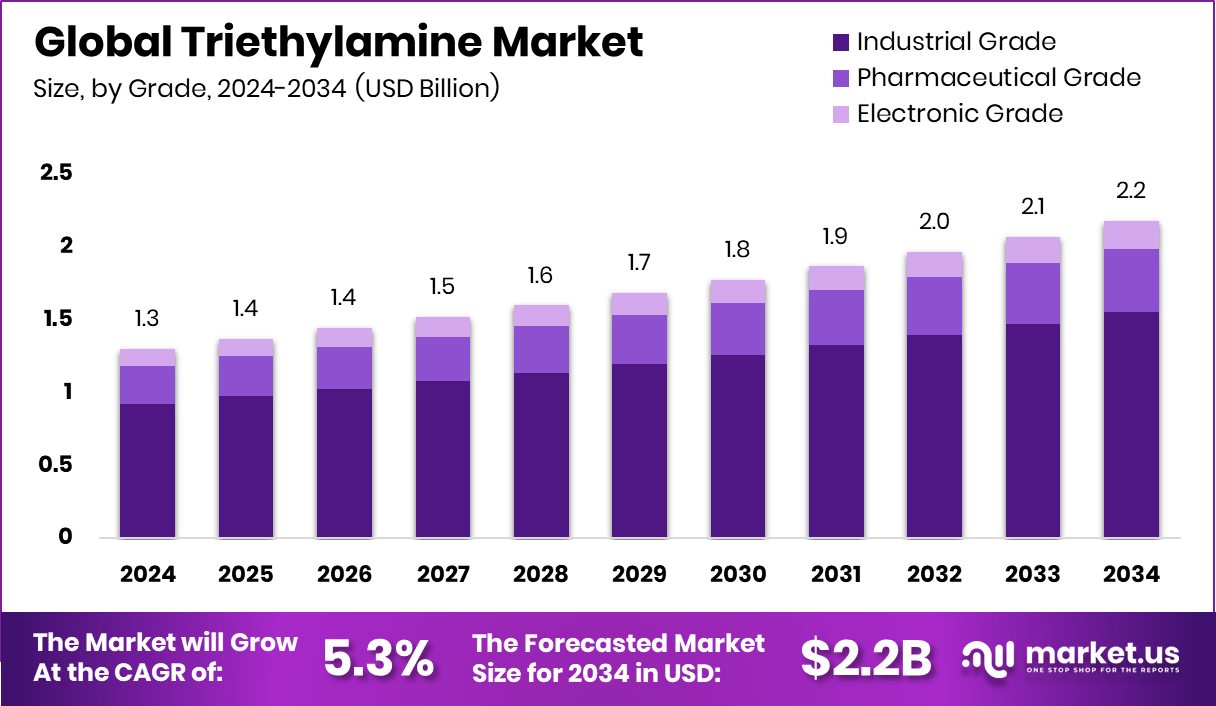

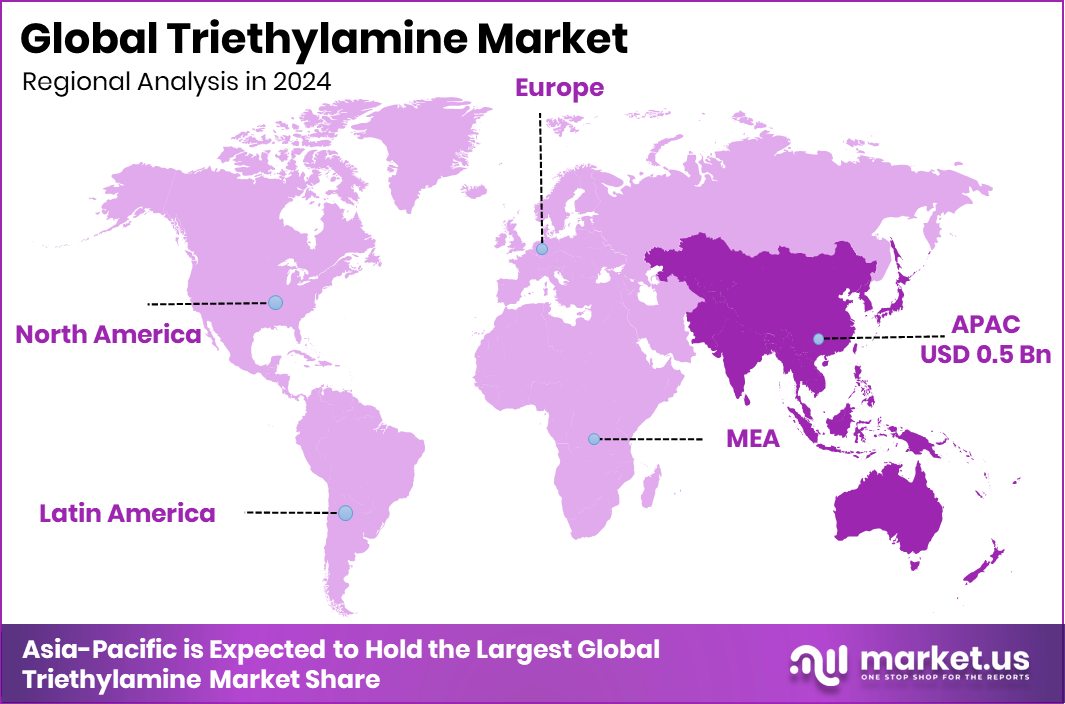

The Global Triethylamine Market is expected to be worth around USD 2.2 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034. Expanding chemical industries and regional investments strengthened the Asia Pacific’s 43.30% share, reaching USD 0.5 billion.

Triethylamine is a colorless, flammable liquid with a strong ammonia-like odor. It acts as an organic base and a catalyst in chemical synthesis. It is widely used in producing agrochemicals, pharmaceuticals, resins, and rubber processing aids. Due to its versatility, it plays an essential role in neutralizing acids and stabilizing intermediates across various industrial processes.

The triethylamine market revolves around its growing consumption in agriculture, pharmaceuticals, and chemical manufacturing. Its demand is steadily increasing as industries focus on efficiency, cleaner reactions, and scalable production. The compound’s adaptability makes it a key ingredient in the expanding specialty chemicals sector, particularly in developing regions with strong manufacturing growth.

The market growth is driven by the increasing use of triethylamine in pesticide and pharmaceutical production. Rising agricultural activities and expansion in drug formulation have boosted its industrial consumption. New investments such as Arbuda Agrochemicals’ ₹120 crore NSE Emerge IPO and Kotak’s ₹375 crore infusion into Cropnosys underline rising confidence in agrochemical infrastructure, indirectly supporting triethylamine demand.

Demand for triethylamine is fueled by the continuous rise in agrochemical and pharmaceutical production. With companies like Bhaskar Agrochemicals redeeming preference shares and Scimplify securing $9.5 million for specialty chemical innovation, production capacities are expanding. Triethylamine’s role as a catalyst and neutralizing agent keeps it essential in synthesis processes across these sectors.

There is a strong opportunity in sustainable chemical manufacturing and eco-friendly product development. VitalFluid’s €5 million funding for sustainable AgTech reflects the market’s shift toward greener solutions. As industries transition to renewable and bio-based chemicals, triethylamine producers focusing on cleaner technologies and localized manufacturing can capitalize on rising global sustainability initiatives.

Key Takeaways

- The Global Triethylamine Market is expected to be worth around USD 2.2 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

- In 2024, industrial-grade triethylamine dominated the Triethylamine Market, capturing 71.2% share due to extensive industrial applications.

- The agrochemical segment led the Triethylamine Market by application, accounting for a 32.8% share in 2024.

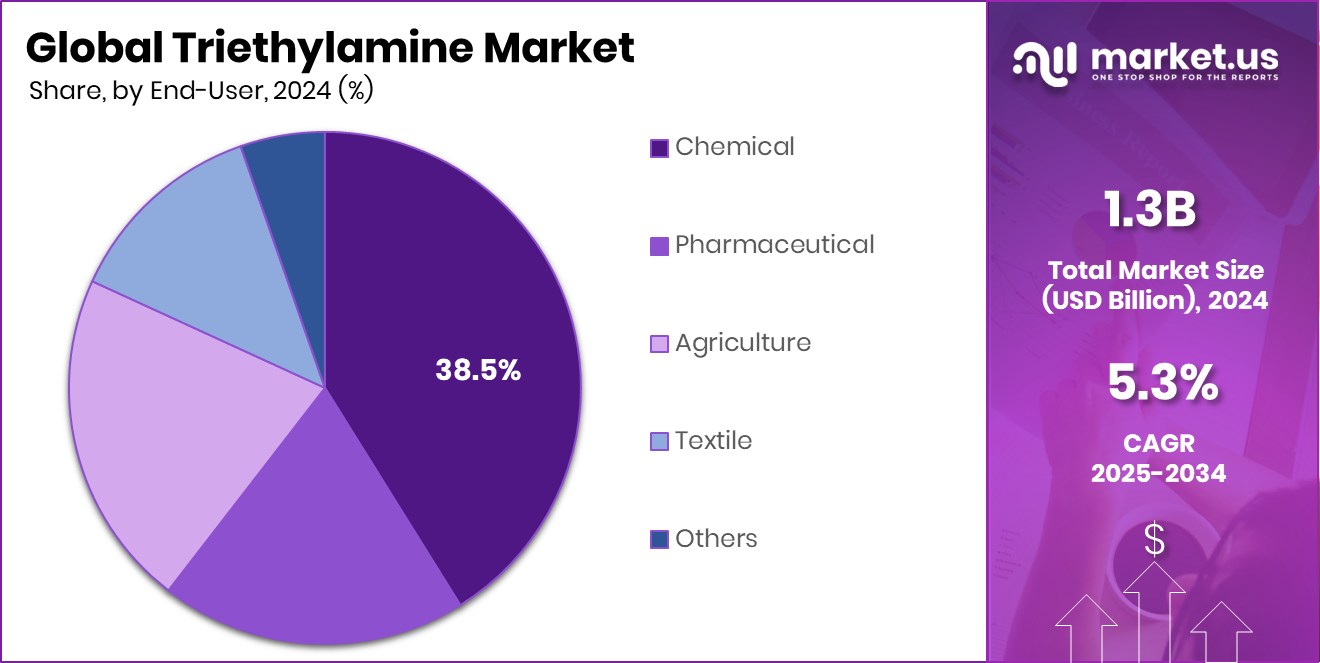

- The chemical sector emerged as the leading end-user, capturing 38.5% share of the Triethylamine Market.

- Strong manufacturing growth and rising agrochemical production boosted the Asia Pacific’s dominance, valued at USD 0.5 billion.

By Grade Analysis

In 2024, industrial-grade triethylamine dominated the market with 71.2%.

In 2024, Industrial Grade held a dominant market position in the By Grade segment of the Triethylamine Market, capturing a 71.2% share. This dominance reflects its extensive use across agrochemicals, pharmaceuticals, and chemical processing industries, where triethylamine serves as a key catalyst, neutralizing agent, and intermediate. The industrial-grade variant is preferred for large-scale applications due to its cost-effectiveness, high purity, and compatibility with diverse formulations.

Its demand continues to rise in manufacturing pesticides, resins, and coatings, supported by expanding agricultural production and industrial growth worldwide. Furthermore, ongoing investments in chemical and agrochemical infrastructure have strengthened the adoption of industrial-grade triethylamine, reinforcing its leadership within the market’s grade-based segmentation.

By Application Analysis

The agrochemicals segment accounted for 32.8% of the triethylamine market.

In 2024, Agrochemicals held a dominant market position in the By Application segment of the Triethylamine Market, accounting for a 32.8% share. This strong position is driven by its extensive use in the synthesis of herbicides, fungicides, and insecticides that support modern agricultural practices. Triethylamine serves as a critical intermediate and catalyst in producing active agrochemical compounds, enabling efficient and stable formulations.

The sector’s growth is further supported by rising global food demand and the need for higher crop productivity. Expanding investments in the agrochemical industry and sustainable agricultural technologies have also reinforced the role of triethylamine in enhancing production efficiency, solidifying the dominance of the agrochemical segment within the overall market.

By End-User Analysis

The chemical sector captured 38.5% of the total triethylamine market.

In 2024, Chemical held a dominant market position in the By End-User segment of the Triethylamine Market, capturing a 38.5% share. This leadership is attributed to the compound’s broad utilization in chemical manufacturing, where it functions as a key intermediate, catalyst, and pH regulator. Triethylamine is essential in producing resins, coatings, and specialty intermediates used across diverse industrial applications.

The chemical sector’s steady expansion, coupled with advancements in synthesis processes and product innovation, has amplified the consumption of triethylamine. Moreover, the increasing focus on high-performance materials and efficient production routes has further strengthened its demand, cementing the chemical segment’s prominent role in driving overall market growth during the year.

Key Market Segments

By Grade

- Industrial Grade

- Pharmaceutical Grade

- Electronic Grade

By Application

- Agrochemicals

- Pharmaceuticals

- Textiles

- Paints and Coatings

- Rubber Processing

- Others

By End-User

- Chemical

- Pharmaceutical

- Agriculture

- Textile

- Others

Driving Factors

Rising Industrial Demand from Sustainable Chemical Production

One of the major driving factors for the Triethylamine Market is the increasing industrial shift toward sustainable and high-performance chemical production. Triethylamine plays a crucial role as a catalyst and neutralizing agent in various manufacturing processes, especially in paints, coatings, agrochemicals, and pharmaceuticals. The growing focus on green chemistry and eco-friendly formulations has elevated its demand, as industries aim to reduce environmental footprints while maintaining efficiency.

The sector’s momentum is further strengthened by recent funding initiatives supporting innovation in sustainable chemicals. For example, Ecoat secured €21 million to reinvent the future of paint sustainably, underscoring the industry’s movement toward greener formulations where intermediates like triethylamine remain essential for achieving desired performance and quality outcomes.

Restraining Factors

Health and Environmental Concerns Limiting Market Expansion

A major restraining factor for the Triethylamine Market is the growing concern over its environmental and health impacts. Triethylamine is a volatile organic compound with strong fumes that can cause respiratory irritation and environmental pollution if not handled properly.

Strict safety norms and emission regulations imposed by authorities often increase compliance costs for manufacturers, limiting wider adoption in certain regions. These challenges push companies to explore safer alternatives and adopt advanced waste management practices.

Despite this, the specialty chemical sector continues to attract innovation funding. For instance, specialty chemicals startup Distil secured $7.7 million in Series A funding, showing ongoing efforts to develop safer, more sustainable chemical solutions that could reshape the use of compounds like triethylamine.

Growth Opportunity

Expanding Applications Across Emerging Chemical Industries Globally

A key growth opportunity for the Triethylamine Market lies in its expanding role across emerging chemical industries. As developing economies invest heavily in industrial growth and infrastructure, the demand for triethylamine as a catalyst, neutralizer, and processing agent is increasing rapidly.

Its versatility makes it essential in producing coatings, adhesives, and intermediates that support the automotive, construction, and agriculture sectors. The recent financial movement within the chemical industry highlights this potential.

For instance, JSW promoters plan to pledge stake to fund the Rs 9,000 crore AkzoNobel India deal, reflecting rising investor confidence in specialty and performance chemicals. Such large-scale investments signal stronger production capacities and create new opportunities for triethylamine suppliers to cater to evolving industrial needs worldwide.

Latest Trends

Shift Toward Green and High-Purity Chemical Manufacturing

One of the latest trends shaping the Triethylamine Market is the transition toward sustainable and high-purity chemical manufacturing. Industries are increasingly adopting eco-friendly production methods to minimize emissions and enhance process safety.

Triethylamine is being refined for use in cleaner formulations, particularly in coatings, agrochemicals, and pharmaceuticals, where environmental compliance and quality are key priorities. Companies are investing in advanced purification systems and renewable feedstocks to support this trend.

Adding momentum to this movement, Distil raised $7.7 million in Series A funding to strengthen its specialty chemicals platform, reflecting a strong industry focus on innovation, sustainability, and efficiency. This shift toward greener chemistry is redefining production standards and shaping the future direction of the triethylamine market.

Regional Analysis

In 2024, Asia Pacific held a 43.30% share, valued at USD 0.5 billion, leading the Triethylamine Market.

In 2024, the Asia Pacific emerged as the dominant region in the Triethylamine Market, holding a 43.30% share, valued at approximately USD 0.5 billion. This strong position is supported by rapid industrialization, expanding agrochemical manufacturing, and a growing pharmaceutical base across countries such as China, India, and Japan. The increasing demand for triethylamine as a catalyst and neutralizing agent in large-scale chemical synthesis has further reinforced the region’s leadership.

North America and Europe follow closely, driven by their mature chemical industries, robust R&D activities, and sustainable production initiatives. Meanwhile, Latin America is witnessing gradual growth owing to rising agricultural chemical use, while the Middle East & Africa region is progressing through industrial diversification and expanding manufacturing capabilities.

Overall, the Asia Pacific region continues to lead the global triethylamine market due to its strong manufacturing base, cost-efficient production, and significant consumption across the agrochemical and pharmaceutical sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE continues to focus on sustainable and high-efficiency production processes, emphasizing environmentally responsible chemical manufacturing. The company’s integrated production system and global distribution network allow it to efficiently serve demand across pharmaceuticals, coatings, and agrochemical intermediates, ensuring consistent product availability and quality.

Dow Chemical Company plays a crucial role through its advanced chemical synthesis technologies and commitment to innovation in amine derivatives. Its wide application reach, particularly in solvents, catalysts, and specialty intermediates, positions it as a key contributor to the triethylamine value chain. Dow’s ongoing efforts to enhance process safety and reduce environmental footprint align well with current sustainability trends.

Meanwhile, Eastman Chemical Company demonstrates a strategic approach focused on efficiency and application-specific development. Its expertise in specialty chemicals and intermediates supports tailored triethylamine solutions for industrial customers. The company’s emphasis on customer-centric product design and operational excellence continues to strengthen its position.

Top Key Players in the Market

- BASF SE

- Dow Chemical Company

- Eastman Chemical Company

- INEOS Group Holdings S.A.

- Huntsman Corporation

- SABIC

- Mitsubishi Gas Chemical Company, Inc.

- Linde plc

- Alkyl Amines Chemicals Ltd.

- Balaji Amines Ltd.

- Daicel Corporation

Recent Developments

- In December 2024, BASF signed a binding agreement to sell its Food & Health Performance Ingredients business to Louis Dreyfus Company (LDC). The transaction includes a production site in Illertissen, Germany, and three application labs outside Germany. This divestment supports BASF’s strategy to sharpen its core business focus.

- In July 2024, Dow launched the DOWSIL CC-8000 Series UV and dual moisture-cure conformal coatings, which are solventless silicone coatings for electronic components that offer faster cure times and improved sustainability in manufacturing.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.2 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Industrial Grade, Pharmaceutical Grade, Electronic Grade), By Application (Agrochemicals, Pharmaceuticals, Textiles, Paints and Coatings, Rubber Processing, Others), By End-User (Chemical, Pharmaceutical, Agriculture, Textile, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Dow Chemical Company, Eastman Chemical Company, INEOS Group Holdings S.A., Huntsman Corporation, SABIC, Mitsubishi Gas Chemical Company, Inc., Linde plc, Alkyl Amines Chemicals Ltd., Balaji Amines Ltd., Daicel Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Dow Chemical Company

- Eastman Chemical Company

- INEOS Group Holdings S.A.

- Huntsman Corporation

- SABIC

- Mitsubishi Gas Chemical Company, Inc.

- Linde plc

- Alkyl Amines Chemicals Ltd.

- Balaji Amines Ltd.

- Daicel Corporation