Global Tomato Ketchup Market Size, Share Report By Type (Regular, Flavored), By Application (Household, Commercial, Others), By Distribution channel (Supermarkets, Online Stores, Departmental Stores, Convenience Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154286

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

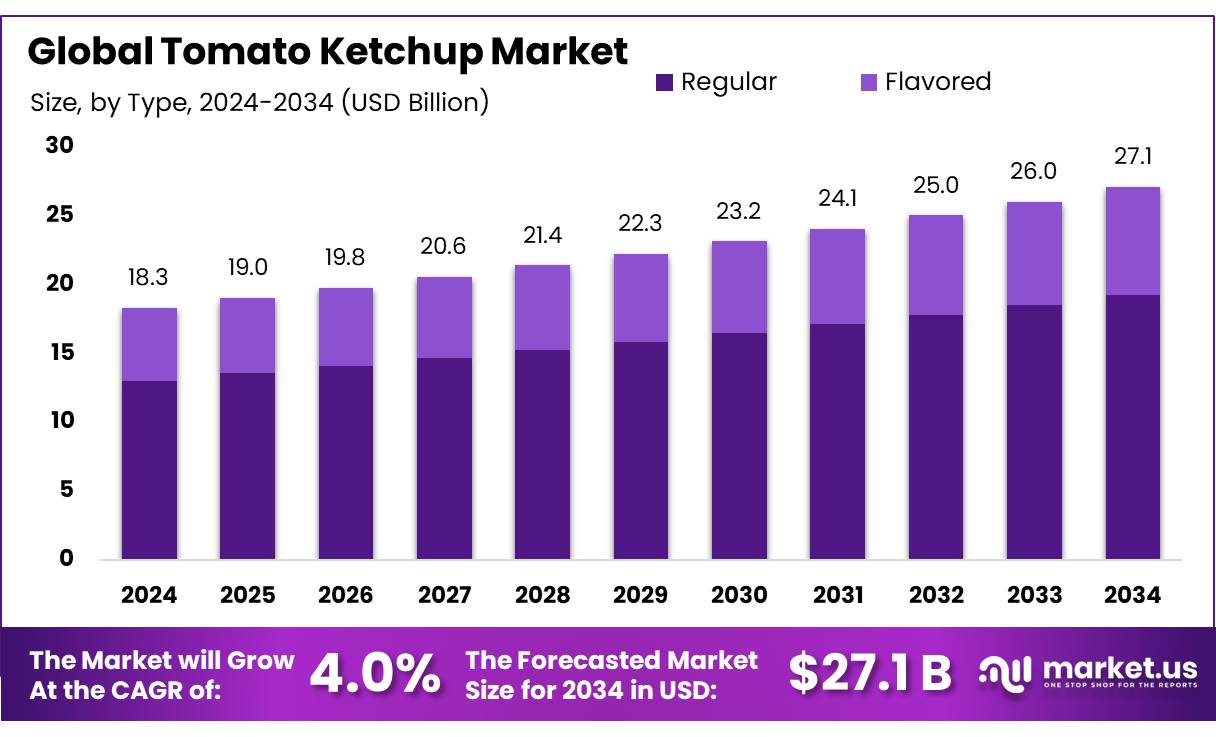

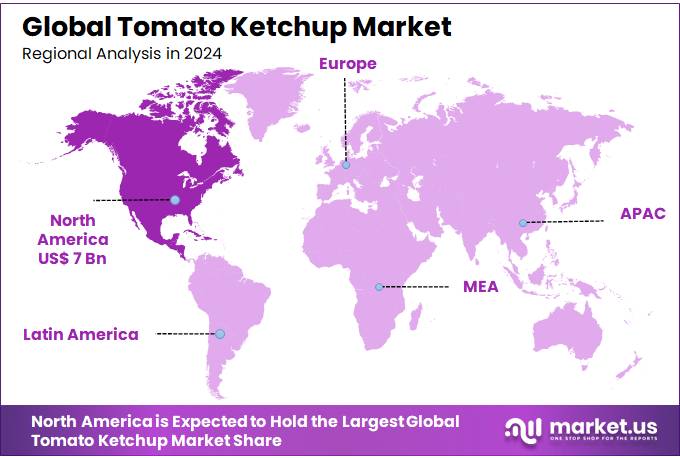

The Global Tomato Ketchup Market size is expected to be worth around USD 27.1 Billion by 2034, from USD 18.3 Billion in 2024, growing at a CAGR of 4.0% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.4% share, holding USD 7.0 Billion in revenue.

Tomato ketchup concentrate, often known as tomato sauce concentrate, is produced by evaporating water from tomato pulp to create a dense paste that is reconstituted by food manufacturers to produce ketchup, sauces, ready meals, soups and snacks. Globally, tomato production reached approximately 186 million metric tonnes in 2022, with China contributing nearly 37% and India around 11%, making India the world’s second‑largest tomato producer.

However, only a small fraction of fresh tomatoes—around 1% of India’s 20.6 million tonnes annual output—is processed into ketchup, paste or juice products. In India, total tomato processing—including ketchup concentrate—is valued at approximately INR 1,000 crore, growing at roughly 20% year‑on‑year as of past.

In India, the tomato ketchup concentrate market is influenced by both domestic production and governmental support. The Ministry of Food Processing Industries (MoFPI) has implemented various schemes to bolster the sector. Notably, the Production Linked Incentive Scheme for Food Processing Industry (PLISFPI) aims to enhance the competitiveness of the food processing industry by providing incentives to eligible entities. Additionally, the Government of India introduced Operation Greens with an allocation of Rs 500 crores to stabilize the supply of tomato, onion, and potato crops (TOP crops) and ensure their availability year-round without price volatility .

The domestic market for tomato ketchup and sauces is estimated at approximately INR 1,000 crore, experiencing a robust annual growth rate of around 20%. This growth is propelled by the increasing consumption of fast food, the proliferation of quick-service restaurants (QSRs), and the rising demand for ready-to-eat meals. Additionally, the convenience offered by ketchup as a versatile condiment has further fueled its popularity among urban consumers.

The Tomato Grand Challenge, initiated by the Department of Consumer Affairs in collaboration with the Ministry of Education, exemplifies the government’s commitment to fostering innovation in the tomato value chain. Launched in June 2023, the challenge received 1,376 ideas, leading to the funding of 28 projects aimed at addressing issues such as post-harvest losses, processing inefficiencies, and supply chain disruptions.

Key Takeaways

- The global tomato ketchup market is projected to reach USD 27.1 billion by 2034, rising from USD 18.3 billion in 2024, growing at a CAGR of 4.0% over the forecast period.

- In 2024, the Regular type segment dominated the market, accounting for over 71.2% of the global share.

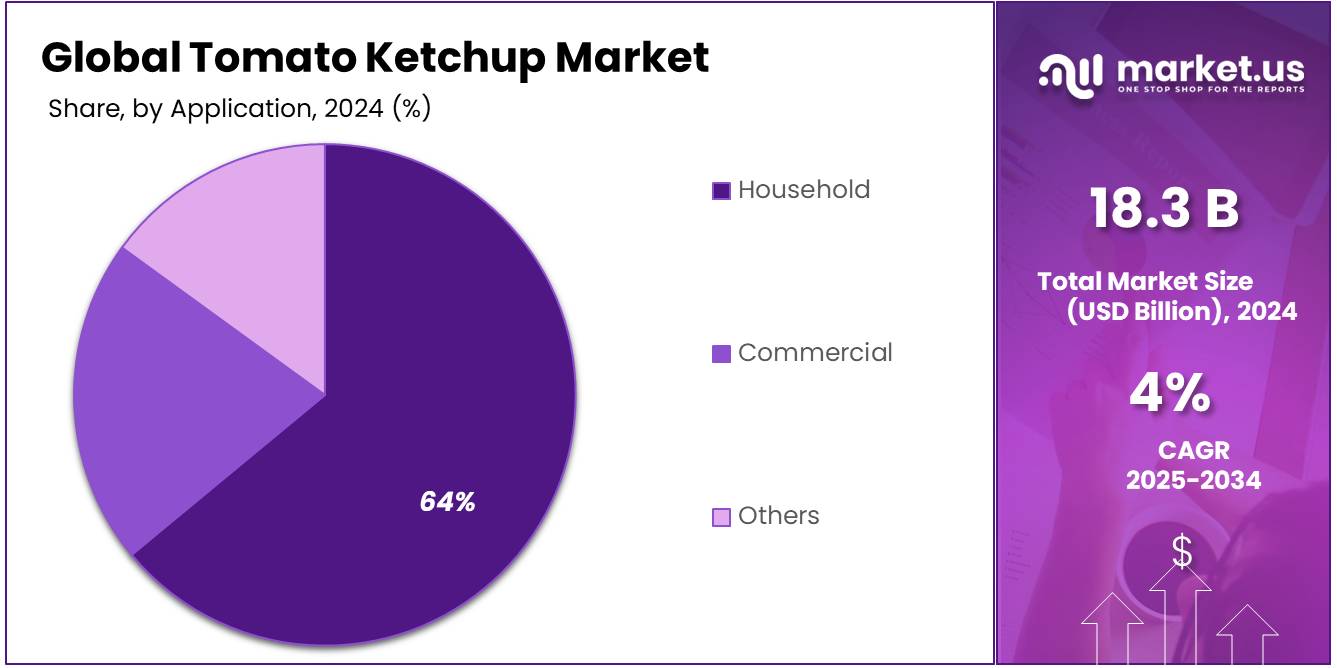

- The Household application segment led the market in 2024, capturing more than 64.7% of the total market share.

- Supermarkets emerged as the leading distribution channel in 2024, holding over 44.1% of the market share globally.

- North America maintained a strong position in the global tomato ketchup market in 2024, representing approximately 38.4% share, valued at around USD 7.0 billion.

By Type Analysis

Regular Tomato Ketchup dominates with 71.2% due to its wide acceptance and classic flavor profile.

In 2024, Regular held a dominant market position, capturing more than a 71.2% share in the global tomato ketchup market. This strong performance can be credited to its traditional taste, affordability, and wide usage across households, restaurants, and fast-food chains. Consumers across all age groups prefer regular ketchup as a versatile condiment that complements a variety of foods such as fries, sandwiches, burgers, and snacks.

Its long-standing popularity and familiarity have made it a staple in kitchens worldwide. By 2025, this segment is expected to maintain its lead, driven by steady demand and high product availability across retail formats. The regular variant also benefits from efficient mass production and lower price points, which contribute to its continued dominance over specialty or premium varieties.

By Application Analysis

Household segment leads with 64.7% due to everyday usage and strong retail availability.

In 2024, Household held a dominant market position, capturing more than a 64.7% share in the global tomato ketchup market. This leadership is mainly due to the everyday use of ketchup in homes as a preferred condiment for regular meals and snacks. Families widely use it with items like sandwiches, pakoras, burgers, and fries, making it a kitchen essential.

The convenience of bottled packaging, extended shelf life, and availability in multiple sizes further boosts its demand in retail stores and online platforms. In 2025, the household segment is expected to continue its strong presence, supported by consistent consumption patterns, growing urban populations, and increased home cooking trends. Bulk buying, family packs, and attractive pricing schemes also contribute to higher sales in this segment.

By Distribution Channel Analysis

Supermarkets dominate with 44.1% thanks to easy access and wide product variety.

In 2024, Supermarkets held a dominant market position, capturing more than a 44.1% share in the global tomato ketchup market. This leadership is driven by their ability to offer a broad range of ketchup brands, pack sizes, and flavors all under one roof. Shoppers prefer supermarkets for their convenience, organized shelves, and promotional discounts that make ketchup more accessible to a wide customer base.

The rise of urban supermarkets and modern retail infrastructure has further strengthened this channel’s reach. In 2025, supermarket sales are expected to remain strong due to growing consumer footfall, especially in metro cities, and continued partnerships between ketchup brands and large retail chains.

Key Market Segments

By Type

- Regular

- Flavored

- Curry Powder

- Sriracha

- Balsamic Vinegar

- Mole

- Hoisin sauce

- Sweet and Sour

- Basil

- Mango Chutney

- Others

By Application

- Household

- Commercial

- Others

By Distribution channel

- Supermarkets

- Online Stores

- Departmental Stores

- Convenience Stores

- Others

Emerging Trends

Climate-Resilient Tomato Varieties for Sustainable Ketchup Production

A significant trend shaping the tomato ketchup industry is the development of climate-resilient tomato varieties. As climate change leads to unpredictable weather patterns, including droughts and extreme temperatures, traditional tomato farming faces challenges. For instance, in California, a major tomato-growing region, the acreage of tomato crops has been shrinking due to prolonged droughts and water shortages.

To address these challenges, agricultural scientists and seed breeders are focusing on creating tomato varieties that can withstand harsh climatic conditions. Companies like Bayer are employing both traditional breeding techniques and advanced gene-editing methods to develop drought-resistant tomatoes. These innovations aim to ensure a stable supply of tomatoes for ketchup production, even in the face of climate uncertainties.

The importance of this development is underscored by the substantial global revenue from tomato-based products. The global revenue for tomato ketchup alone amounts to nearly $37.7 billion. This highlights the critical need for sustainable farming practices to meet the growing demand for ketchup and other tomato-based products.

Drivers

Growing Consumer Demand for Convenience Foods

The demand for convenience foods is one of the key driving factors behind the growth of the tomato ketchup concentrate market. With busy lifestyles becoming the norm, more people are turning to ready-to-use and easy-to-prepare food products. Tomato ketchup, being a staple in many households and restaurants, fits perfectly into this trend. In fact, as per the National Restaurant Association, over 40% of meals consumed away from home in the United States are considered “convenience” foods, highlighting a growing preference for fast, easy, and ready-to-serve products. Tomato ketchup is widely used in various cuisines, from fast food to home-cooked meals, making it an indispensable item in most kitchens.

Additionally, the rise in fast-food chains and quick-service restaurants (QSRs) has been a significant factor contributing to the increased consumption of tomato ketchup. According to the Ministry of Food Processing Industries, the Indian food processing sector alone, which includes sauces and condiments like ketchup, is expected to grow at a rate of 9-10% annually over the next few years. This growth reflects a global shift in eating habits where people are opting for quick, ready-to-eat meals, with ketchup playing a crucial role in enhancing the taste and convenience.

Furthermore, government initiatives like the Pradhan Mantri Kisan Sampada Yojana (PMKSY) have bolstered the supply chain and infrastructure of the food processing industry. The scheme’s budget allocation of ₹4,099.76 crore aims to enhance food processing infrastructure, which benefits sectors such as tomato ketchup production, by improving supply chain efficiency and reducing post-harvest losses. These efforts are expected to help the ketchup concentrate market expand even further, catering to the growing consumer demand for ready-to-eat foods.

Restraints

High Raw Material Costs and Supply Chain Challenges

One of the major restraining factors for the tomato ketchup concentrate market is the fluctuating cost of raw materials, particularly tomatoes. Tomatoes are highly sensitive to environmental conditions, and changes in weather patterns such as droughts, excessive rainfall, or temperature variations can significantly impact yields. This, in turn, leads to price volatility. For example, in India, where the tomato industry is a key player, tomato prices saw a sharp rise of nearly 60% in 2021 due to poor harvests caused by unseasonal rainfall, affecting both local supply and global exports.

Additionally, the tomato ketchup industry relies heavily on tomatoes, and any disruption in the supply of this key ingredient leads to production delays and cost increases. The Government of India has launched several initiatives, like the Pradhan Mantri Kisan Sampada Yojana (PMKSY), to strengthen food processing and support agriculture. However, despite these efforts, the price of tomatoes remains unpredictable. This is largely due to challenges in the supply chain, ranging from inefficient storage and transportation systems to limited access to cold storage facilities, leading to high levels of post-harvest loss.

For example, an estimated 40% of India’s tomato production is lost annually due to inadequate infrastructure for storage and transportation. This results in lower availability of tomatoes for ketchup production, forcing manufacturers to rely on higher-cost imports during off-season periods. These supply chain inefficiencies continue to be a challenge for ketchup manufacturers, keeping costs high and limiting profit margins.

Opportunity

Expansion of Health-Conscious Product Lines

One of the most significant growth opportunities for the tomato ketchup market lies in the rising demand for healthier, more natural products. With consumers becoming increasingly health-conscious, there has been a noticeable shift towards products that are lower in sugar, sodium, and preservatives. As a result, ketchup manufacturers are responding to these preferences by introducing organic, no-sugar-added, and reduced-sodium variants.

- In 2024, a survey conducted by the U.S. Department of Agriculture (USDA) found that 63% of American households are prioritizing healthier food options, including condiments, which has led to the growth of organic food sales, which reached US$62 billion, a 9% increase from the previous year.

The increasing awareness about the negative health impacts of excessive sugar and sodium consumption has further propelled the demand for alternatives. Ketchup brands are capitalizing on this trend by introducing healthier versions of their products, which are free from artificial additives and preservatives. The U.S. Food and Drug Administration (FDA) has supported these efforts by setting guidelines for food labeling that highlight “low sodium” and “sugar-free” claims, thus helping consumers make informed choices.

The expansion of health-conscious ketchup options aligns with broader market trends in the food industry. The organic ketchup segment, for example, has witnessed a steady growth of around 6% annually. In addition, a report by the National Restaurant Association (NRA) in 2023 highlighted that restaurants are increasingly offering healthier menu options, including ketchup made from organic tomatoes or alternatives like tomato-less sauces. This shift reflects the growing demand for more wholesome and transparent food choices, presenting an opportunity for brands to innovate and attract a more health-aware consumer base.

In terms of market geography, the rise in health-conscious eating habits is particularly notable in North America and Europe. Both regions have experienced significant increases in sales of organic and reduced-sugar condiments. For instance, in 2023, organic ketchup sales in the European Union grew by 12%, with the demand mainly driven by younger, environmentally aware consumers.

Regional Insights

North America leads the global tomato ketchup market with 38.4% share, contributing approximately USD 7.0 billion in revenue.

In 2024, North America held a commanding position in the global tomato ketchup industry, accounting for an estimated 38.4% share, equivalent to around USD 7.0 billion in market revenue. This regional leadership reflects strong consumer preference for ketchup as a staple condiment, particularly in the United States and Canada, where fast-food and home dining habits significantly support high per capita consumption.

In addition to mature domestic markets, North America influences global ketchup trends through large exporter foodservice chains, diverse consumer demographics, and strong innovation pipelines. The U.S. remains the largest sub‑market within North America, supported by significant fast‑food usage and entrenched retail habits. Canada and Mexico also contribute meaningfully, especially through niche segments such as organic, low‑sugar, or ethnic flavor introductions.

The region’s market dominance in 2024 is underpinned by well established distribution networks, including supermarkets, convenience stores, and growing online retail channels. In the U.S., household consumption averages several bottles of ketchup per capita annually, contributing substantially to regional volume and value. Meanwhile, major brands maintain high levels of brand loyalty, and product innovations in reduced‑sugar, organic, and flavor‑enhanced variants further sustain consumer interest.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Kraft Heinz, Inc. is one of the world’s leading producers of tomato ketchup, with its flagship “Heinz” brand recognized globally. The company dominates the ketchup category in North America and holds a significant share in Europe and Asia. It emphasizes innovation with sugar-free and organic variants and continues expanding into new packaging formats for convenience. With widespread supermarket distribution and strategic partnerships, Kraft Heinz reported global net sales of USD 26.6 billion in 2024, reinforcing its market strength.

Waitrose, a premium supermarket chain in the United Kingdom, markets its own label of tomato ketchup known for its high-quality ingredients and clean-label positioning. The retailer emphasizes sustainability and British-sourced tomatoes, appealing to health-conscious and environmentally aware customers. As a private-label player, Waitrose ketchup competes by offering additive-free, rich-flavor products. Its strong in-store merchandising and loyalty programs help drive consistent ketchup sales across its network of over 330 stores in the UK.

Wm. Morrison Supermarkets, one of the UK’s largest grocery retailers, offers private-label tomato ketchup products tailored to price-sensitive consumers. Its ketchup lines cater to both value and premium segments under Morrison’s brand, enabling wide market reach. Known for in-house food manufacturing capabilities, Morrison ensures quality control and cost-efficiency. With over 490 stores across the UK, the company leverages scale and convenience to maintain strong sales in its ketchup offerings through effective promotions and availability.

Top Key Players Outlook

- JBS S.A

- Kraft Heinz, Inc

- Hormel Foods

- Waitrose

- Wm. Morrison Supermarkets

- General Mills Inc

- Conagra Brands

- Nestlé

- Unilever

- Kellogg Co

- McCain Foods Ltd

Recent Industry Developments

In 2024, JBS S.A. reported USD 77.2 billion in total revenue and USD 2.6 billion net income, positioning it as a global leader in food processing with operations spanning meat, plant‑based foods, and packaging.

In 2024, Waitrose generated £7.7 billion in annual revenue and £1.1 billion in operating income, operating through 329 stores across Great Britain and exporting to 52 countries.

Report Scope

Report Features Description Market Value (2024) USD 18.3 Bn Forecast Revenue (2034) USD 27.1 Bn CAGR (2025-2034) 4.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Regular, Flavored), By Application (Household, Commercial, Others0, By Distribution channel (Supermarkets, Online Stores, Departmental Stores, Convenience Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape JBS S.A, Kraft Heinz, Inc, Hormel Foods, Waitrose, Wm. Morrison Supermarkets, General Mills Inc, Conagra Brands, Nestlé, Unilever, Kellogg Co, McCain Foods Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- JBS S.A

- Kraft Heinz, Inc

- Hormel Foods

- Waitrose

- Wm. Morrison Supermarkets

- General Mills Inc

- Conagra Brands

- Nestlé

- Unilever

- Kellogg Co

- McCain Foods Ltd