Global Thin Film Lithium-Ion Battery Market Size, Share, And Enhanced Productivity By Battery Type (Disposable, Rechargeable), By Voltage (Below 1.5 V, 1.5 V to 3V, Above 3 V), By Application (Wearables, Medical, Consumer Electronics, Smart Cards, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December

- Report ID: 168765

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

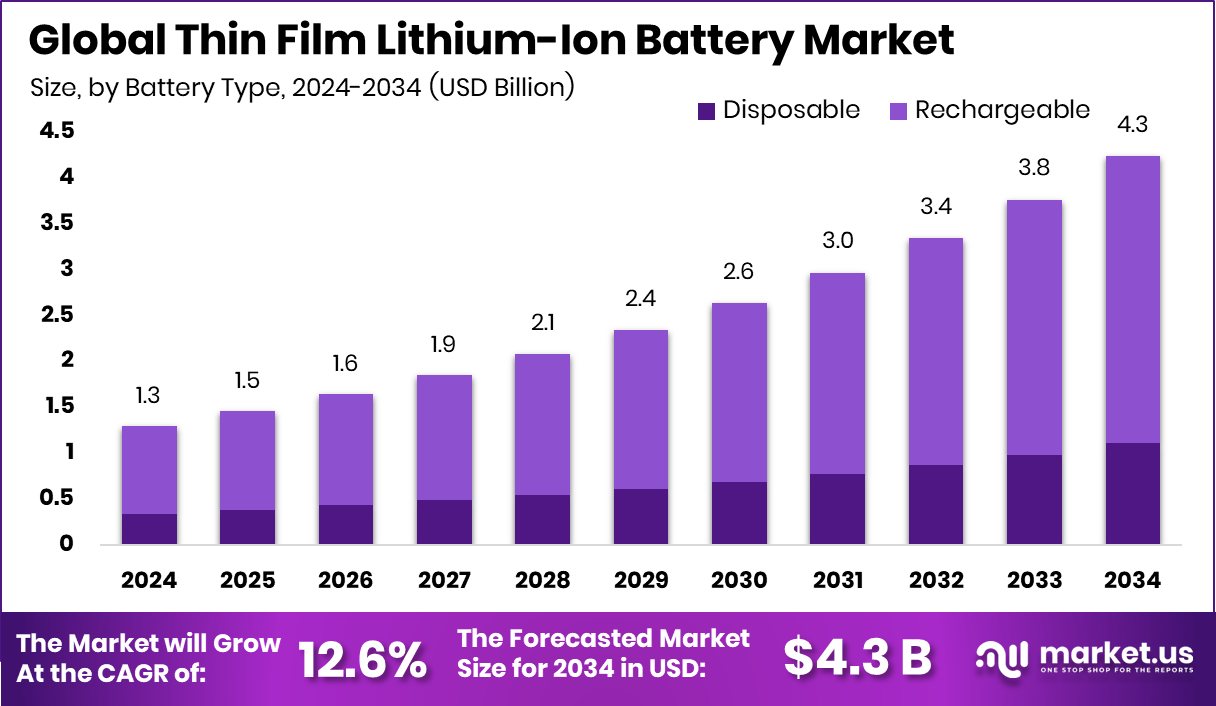

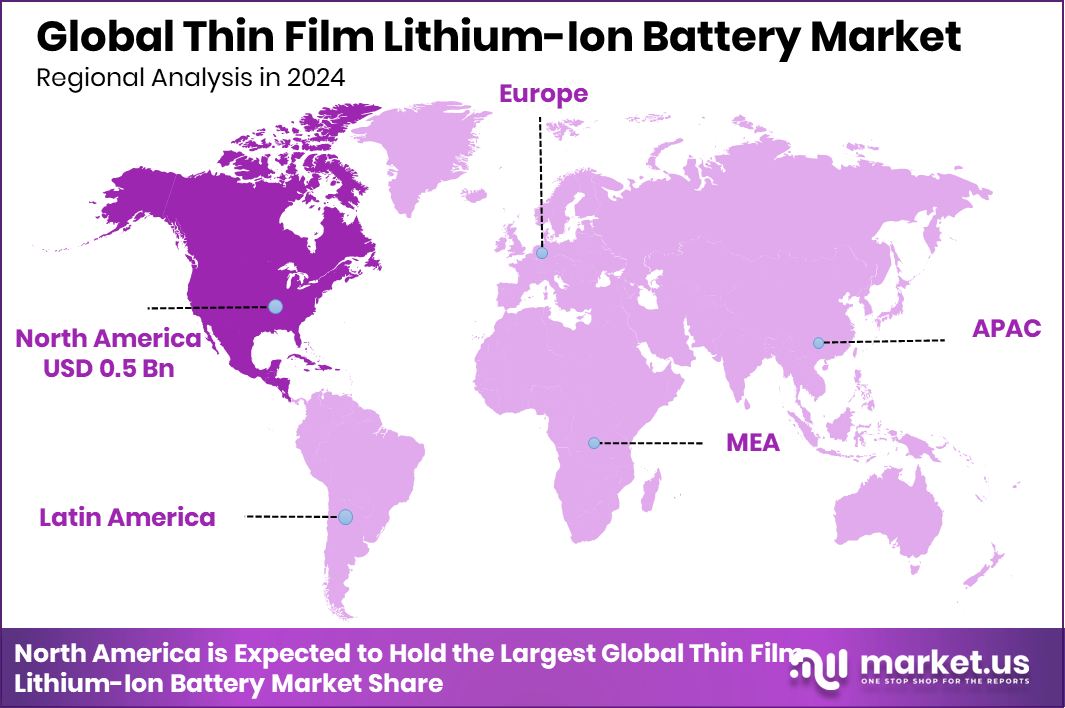

The Global Thin Film Lithium-Ion Battery Market is expected to be worth around USD 4.3 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 12.6% from 2025 to 2034. North America represents the Thin Film Lithium-Ion Battery Market at 42.6% USD 0.5 Bn.

A Thin Film Lithium-Ion Battery is a compact energy storage device made by depositing ultra-thin layers of battery materials onto a solid surface. This design allows high precision, fast charging, long cycle life, and safe operation for small electronic systems.

The Thin Film Lithium-Ion Battery Market focuses on miniaturised power solutions used in medical devices, sensors, smart cards, wearables, and industrial electronics. Demand rises as devices become smaller, maintenance-free, and require consistent power over long operating periods.

Growth is driven by strong manufacturing investments and government-backed scale-up plans. TACC secured ₹1,230 crore from SBI to build a lithium-ion battery anode plant, while Waaree Energies invested ₹300 crore in advanced lithium-ion ACC manufacturing, strengthening domestic supply capacity.

Market demand is also shaped by innovation beyond conventional lithium use. India’s Offgrid raised $15 million to develop lithium-optional storage solutions, signalling interest in flexible battery chemistries that reduce material dependency while keeping performance reliable.

Opportunities remain significant as funding and policy align for localisation. Green Li-ion secured $20.5 million to scale sustainable battery materials, and India requires US$4.5 billion in investment to meet its domestic lithium-ion manufacturing targets, opening long-term growth avenues.

Key Takeaways

- The Global Thin Film Lithium-Ion Battery Market is expected to be worth around USD 4.3 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 12.6% from 2025 to 2034.

- In the Thin Film Lithium-Ion Battery Market, rechargeable batteries lead with a 73.5% share due to long lifecycle benefits.

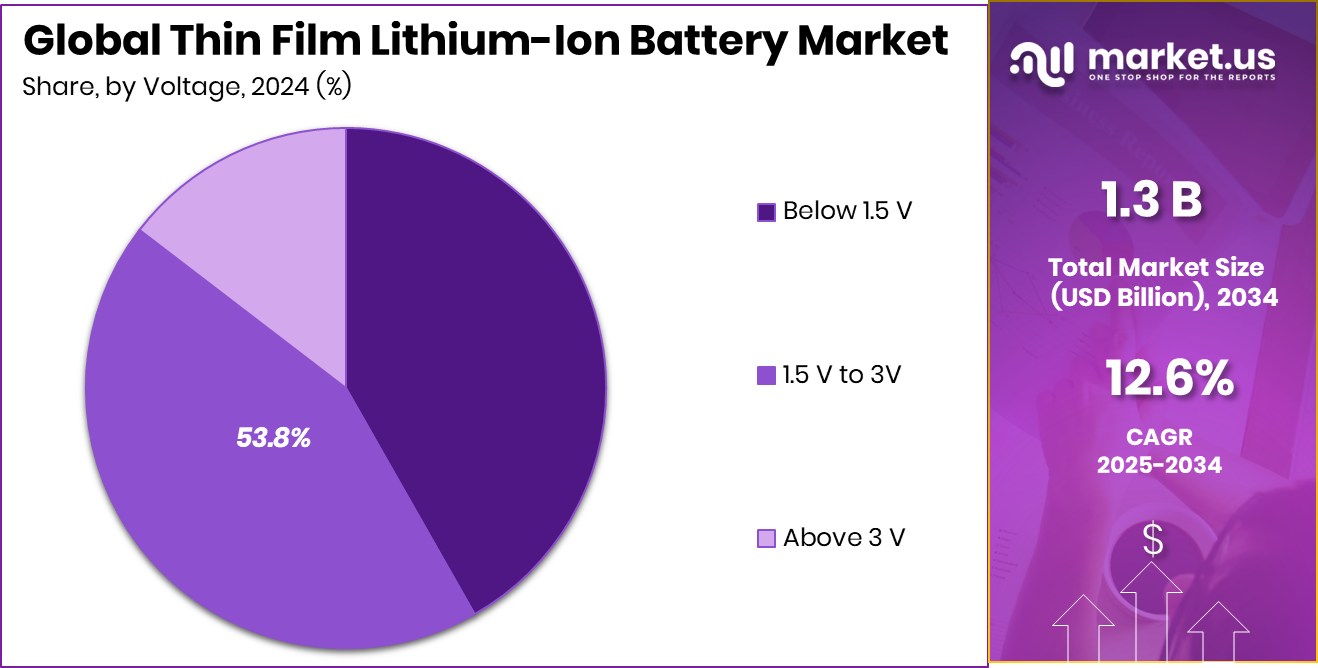

- Thin Film Lithium-Ion Battery Market sees 1.5 V to 3V dominate at 53.8%, supporting compact and low-power electronic designs.

- Consumer electronics account for 39.2% of the Thin Film Lithium-Ion Battery Market, driven by demand for miniature, reliable power sources.

- North America holds Thin Film Lithium-Ion Battery Market at 42.6% USD 0.5 Bn.

By Battery Type Analysis

Rechargeable batteries dominate Thin Film Lithium-Ion Battery Market with a 73.5% share globally.

In 2024, Rechargeable held a dominant market position in the By Battery Type segment of the Thin Film Lithium-Ion Battery Market, with a 73.5% share. This leadership reflects the strong preference for long-life, reuse-focused energy storage in compact electronic applications.

Rechargeable thin film batteries support repeated charge cycles without significant performance loss, making them suitable for devices that require stable power over extended periods. Their ability to deliver consistent energy in small form factors improves product reliability and lowers replacement frequency.

Manufacturers favour rechargeable configurations to align with efficiency goals and long-term usage economics. The 73.5% share highlights how end users increasingly prioritise durability, operational continuity, and dependable energy output.

As device miniaturisation continues, rechargeable thin-film lithium-ion batteries remain the backbone of this segment, securing their dominant role through proven performance, functional flexibility, and alignment with modern electronic design needs.

By Voltage Analysis

1.5 V to 3V range leads the Thin Film Lithium-Ion Battery Market 53.8%.

In 2024, 1.5 V to 3 V held a dominant market position in the By Voltage segment of the Thin Film Lithium-Ion Battery Market, with a 53.8% share. This voltage range remained widely adopted due to its compatibility with compact and low-power electronic devices.

Products operating within this range benefit from stable energy delivery while maintaining safety and efficiency in thin form factors. The segment’s 53.8% share demonstrates its importance in supporting reliable operation where space constraints and controlled power output are critical.

Device designers continue to favour this voltage level as it balances performance with longevity, enabling smooth integration into modern electronics. As usage expands across small-scale applications, the 1.5 V to 3 V range sustains its dominance through consistent operational reliability and practical design advantages.

By Application Analysis

Consumer Electronics drives Thin Film Lithium-Ion Battery Market with 39.2% application share.

In 2024, Consumer Electronics held a dominant market position in the By Application segment of the Thin Film Lithium-Ion Battery Market, with a 53.8% share. This dominance reflects the rising integration of thin, lightweight power sources in everyday electronic devices.

Consumer electronics increasingly rely on compact batteries that support sleek designs, stable energy output, and long operating life. The 53.8% share highlights how manufacturers prioritise thin-film lithium-ion batteries to enhance device portability and user convenience.

These batteries fit well into space-limited designs while offering dependable performance for continuous use. As demand for smart, connected, and wearable electronics grows, consumer electronics continue to lead adoption, reinforcing its position as the primary application area driving market uptake.

Key Market Segments

By Battery Type

- Disposable

- Rechargeable

By Voltage

- Below 1.5 V

- 1.5 V to 3V

- Above 3 V

By Application

- Wearables

- Medical

- Consumer Electronics

- Smart Cards

- Others

Driving Factors

Rising Fast-Charging Demand for Compact Electronics

One major driving factor for the Thin Film Lithium-Ion Battery Market is the growing need for fast-charging, space-saving power solutions. Modern electronics such as wearables, smart sensors, medical devices, and portable tools require batteries that charge quickly while fitting into very thin designs. Thin film lithium-ion batteries meet this need by offering short charging times, stable performance, and long usage life in compact formats.

Industry funding activity supports this trend. Maxvolt Energy secured $1.5 million to roll out fast-charging lithium-ion batteries, highlighting strong investor confidence in faster energy storage technologies. This push toward rapid charging improves user convenience and device uptime, making thin-film batteries more attractive to manufacturers. As charging speed becomes a key buying factor, fast-charging capability continues to drive adoption across multiple electronic applications.

Restraining Factors

High Development Costs Limit Large-Scale Adoption

A key restraining factor for the Thin Film Lithium-Ion Battery Market is the high cost of development and production. Manufacturing thin film batteries requires advanced deposition techniques, precise material control, and specialised equipment, which raises overall costs. These expenses can slow adoption, especially for applications that rely on cost-sensitive components.

Even technology-focused funding highlights this challenge. Lionvolt securing €4 million to fund solid-state lithium-ion battery development shows that significant capital is still needed to mature and scale advanced battery technologies.

While such funding supports innovation, it also reflects the financial barriers companies face before reaching commercial efficiency. Until production costs decline and manufacturing scales improve, high initial investment requirements will continue to restrain faster market expansion.

Growth Opportunity

Expanding Material Innovation Enables New Battery Applications

A major growth opportunity for the Thin Film Lithium-Ion Battery Market lies in advanced battery material development. Improving electrode and electrolyte materials can enhance energy density, charging speed, and lifespan while keeping batteries extremely thin. This opens new uses across compact electronics where traditional batteries cannot fit.

Funding activity supports this direction. NEU Battery Materials concluded an oversubscribed US$3.7 million seed funding round, showing strong investor interest in next-generation battery materials.

Such investments help accelerate research and scaling of improved materials that directly support thin-film battery performance. As material quality improves, manufacturers can design more powerful and durable thin film batteries, creating broader application opportunities and supporting long-term market growth.

Latest Trends

Shift Toward Next-Generation Battery Material Systems

One of the latest trends in the Thin Film Lithium-Ion Battery Market is the move toward next-generation battery material systems that improve performance while reducing size and weight. Developers are focusing on new chemistries and advanced thin-layer designs to achieve higher energy density and longer life without increasing battery thickness. This trend is strongly supported by recent funding activity.

Germany-based Theion secured €15 million in Series A funding to advance next-generation battery technology, highlighting Europe’s role in driving innovation. Such investments encourage the shift from conventional material approaches to newer systems suited for ultra-thin battery architectures.

Regional Analysis

North America dominates Thin Film Lithium-Ion Battery Market with 42.6% USD 0.5 Bn.

North America leads the Thin Film Lithium-Ion Battery Market, holding a 42.6% share valued at USD 0.5 Bn. The region benefits from strong adoption of miniaturised electronics, advanced healthcare devices, and embedded energy systems. High investment in innovation ecosystems and early deployment of next-generation battery technologies support steady market penetration. The USD 0.5 Bn valuation reflects active commercialisation across precision electronics and industrial applications, helping North America remain the dominant regional contributor.

Europe follows with steady activity driven by a strong focus on sustainable energy storage and advanced manufacturing practices. The region emphasises research-led development and integration of thin, efficient batteries into high-value electronic applications. Regulatory alignment with clean technology frameworks supports gradual but consistent market expansion.

Asia Pacific shows growing traction supported by large-scale electronics production and rising demand for compact power sources. The region’s manufacturing depth and expanding use of smart devices help strengthen the adoption of thin-film lithium-ion batteries across multiple end uses.

The Middle East & Africa region reflects early-stage adoption, primarily linked to niche industrial and medical applications. Gradual technology uptake and infrastructure development shape regional demand.

Latin America remains an emerging market, with increasing interest in compact and reliable battery solutions. Adoption grows steadily as electronic device usage expands across consumer and industrial segments.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Blue Spark Technologies continues to stand out for its focus on ultra-thin, flexible battery designs suited for low-power electronics. The company’s approach centres on printable and compact power sources that fit into space-constrained applications. Its technology emphasis aligns well with applications requiring lightweight, bendable, and maintenance-free energy storage, positioning the firm strongly in specialised thin-film use cases where form factor matters more than high capacity.

Enfucell remains a notable participant in thin-film batteries due to its specialisation in soft, flexible energy storage solutions. The company’s batteries are designed to integrate smoothly into smart labels, sensors, and disposable electronics. This application-driven strategy supports growing demand for compact power sources that deliver stable performance while remaining thin and adaptable. Enfucell’s focus on usability and integration supports steady technology adoption across embedded electronics.

STMicroelectronics brings system-level strength to the Thin Film Lithium-Ion Battery ecosystem by aligning battery functionality with semiconductor and electronic system integration. Its involvement reinforces reliability, performance consistency, and compatibility with advanced electronic architectures. This systems-oriented presence helps bridge power storage with device intelligence, supporting broader adoption of thin-film battery solutions in complex electronic environments.

Top Key Players in the Market

- Blue Spark Technologies

- Enfucell

- STMicroelectronics

- LG Chem

- LionVolt

- SAMSUNG SDI Co. Ltd.

- Ilika Plc.

- BTRY AG

- NGK Insulators, Ltd.

- The Kurt J. Lesker Company

- Ultralife Corporation

Recent Developments

- In July 2025, Enfucell reportedly released an enhanced zinc-based flexible battery variant. This update is described as improving shelf life and printability — aimed at disposable electronics, medical patches, and smart labels.

- In March 2025, LG Chem announced that it would showcase its new “Precursor-Free (LPF) cathode materials” at the trade show InterBattery 2025 in Seoul. The LPF cathode materials are a part of battery-materials innovation — aimed at making battery cells more efficient or cost-effective.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 4.3 Billion CAGR (2025-2034) 12.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Battery Type (Disposable, Rechargeable), By Voltage (Below 1.5 V, 1.5 V to 3V, Above 3 V), By Application (Wearables, Medical, Consumer Electronics, Smart Cards, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Blue Spark Technologies, Enfucell, STMicroelectronics, LG Chem, LionVolt, SAMSUNG SDI Co. Ltd., Ilika Plc., BTRY AG, NGK Insulators, Ltd., The Kurt J. Lesker Company, Ultralife Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Thin Film Lithium-Ion Battery MarketPublished date: Decemberadd_shopping_cartBuy Now get_appDownload Sample

Thin Film Lithium-Ion Battery MarketPublished date: Decemberadd_shopping_cartBuy Now get_appDownload Sample -

-

- Blue Spark Technologies

- Enfucell

- STMicroelectronics

- LG Chem

- LionVolt

- SAMSUNG SDI Co. Ltd.

- Ilika Plc.

- BTRY AG

- NGK Insulators, Ltd.

- The Kurt J. Lesker Company

- Ultralife Corporation