Global Textile Machinery Market Size, Share, Growth Analysis By Type (Weaving Machines, Spinning Machines, Knitting Machines, Finishing Machines, Others), By Plasma Treatment Method (Atmospheric Pressure Plasma, Low Pressure Plasma), By Raw Materials (Cotton, Wool, Nylon, Polyester, Acrylic, Silk, Others), By Application (Garments and Apparel, Household and Home Textiles, Technical Textiles, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176677

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

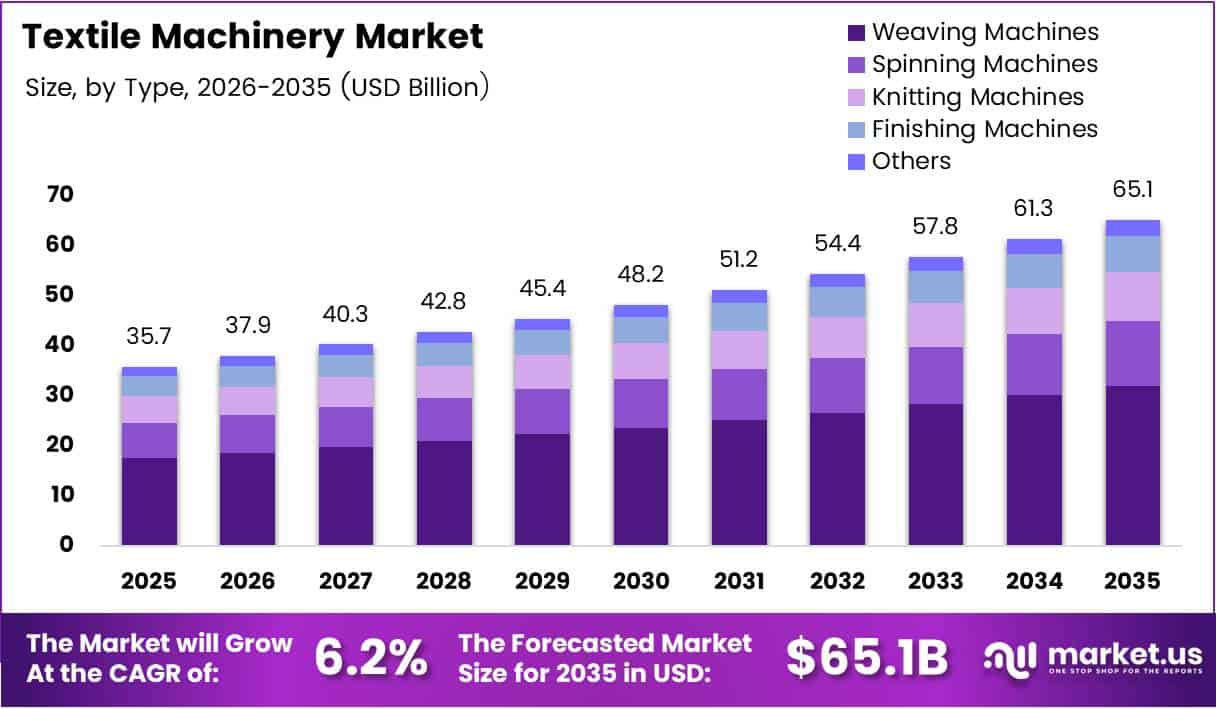

Global Textile Machinery Market size is expected to be worth around USD 65.1 Billion by 2035 from USD 35.7 Billion in 2025, growing at a CAGR of 6.2% during the forecast period 2026 to 2035.

Textile machinery encompasses equipment used to manufacture fabrics, garments, and technical textiles. These systems include spinning machines, weaving looms, knitting equipment, and finishing units. Manufacturers deploy this machinery across cotton, wool, synthetic fiber, and blended material production lines.

The market experiences robust expansion driven by capacity additions in emerging economies. Asian manufacturers invest heavily in automated production lines to meet growing export demand. Additionally, replacement cycles accelerate as mills upgrade obsolete equipment with energy-efficient alternatives.

Technical textile applications create substantial growth opportunities beyond traditional apparel manufacturing. Automotive interiors, medical fabrics, and construction materials require specialized machinery with precise controls. Consequently, equipment suppliers develop advanced systems tailored to these high-value segments.

Government initiatives supporting domestic textile manufacturing stimulate machinery procurement. Trade policies encourage local production over imports, prompting mill operators to modernize facilities. Moreover, sustainability regulations push manufacturers toward low-waste, resource-efficient production technologies.

Digital transformation reshapes equipment capabilities and operational models. In February 2026, Rieter completed the acquisition of Barmag, fully integrating it into its group as a dedicated Man-Made Fiber Division. This consolidation strengthens advanced filament spinning technology portfolios across synthetic fiber production.

According to Texpertise Network, networking 58 textile machines with IoT sensors increased operational efficiency by 19% and halved manual inspection time. These connectivity gains demonstrate measurable productivity improvements through real-time monitoring systems.

According to Global Textile Times, predictive maintenance using IoT can reduce unplanned downtime by up to 65% when fully implemented in textile operations. This dramatic reduction transforms maintenance strategies from reactive to proactive approaches, minimizing production disruptions and extending equipment lifespan.

Key Takeaways

- Global Textile Machinery Market valued at USD 35.7 Billion in 2025, projected to reach USD 65.1 Billion by 2035

- Market grows at CAGR of 6.2% during forecast period 2026-2035

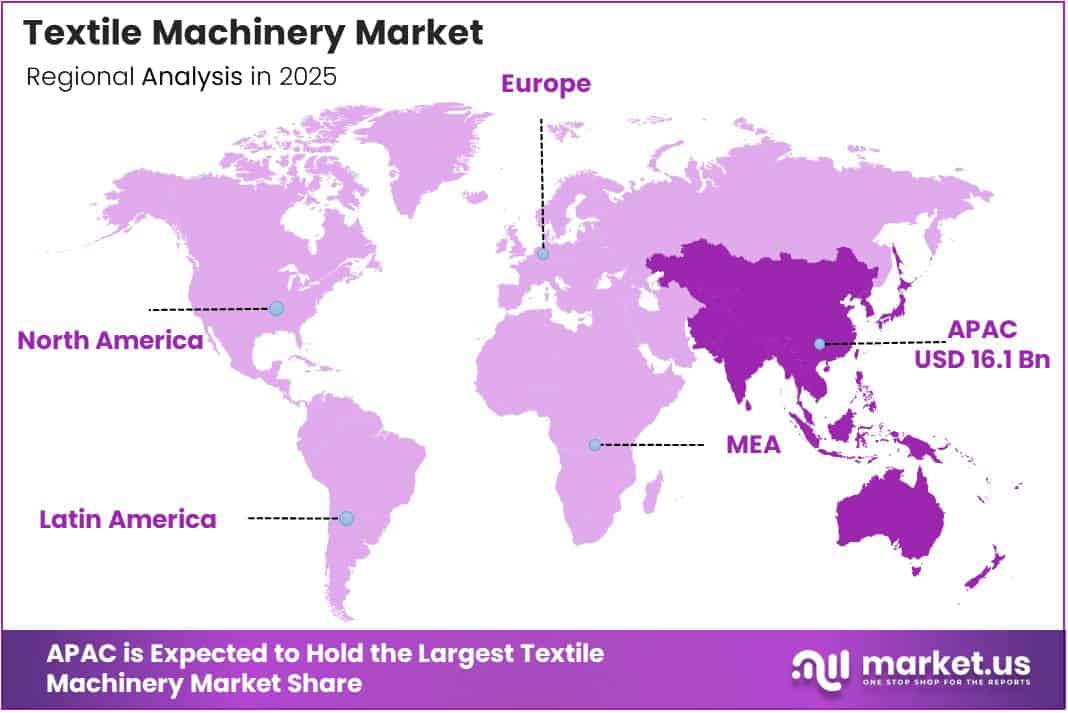

- Asia Pacific dominates with 45.2% market share, valued at USD 16.1 Billion

- Weaving Machines segment leads By Type category with 28.3% share

- Atmospheric Pressure Plasma treatment method holds 64.2% market share

- Cotton raw material segment captures 34.6% of total market

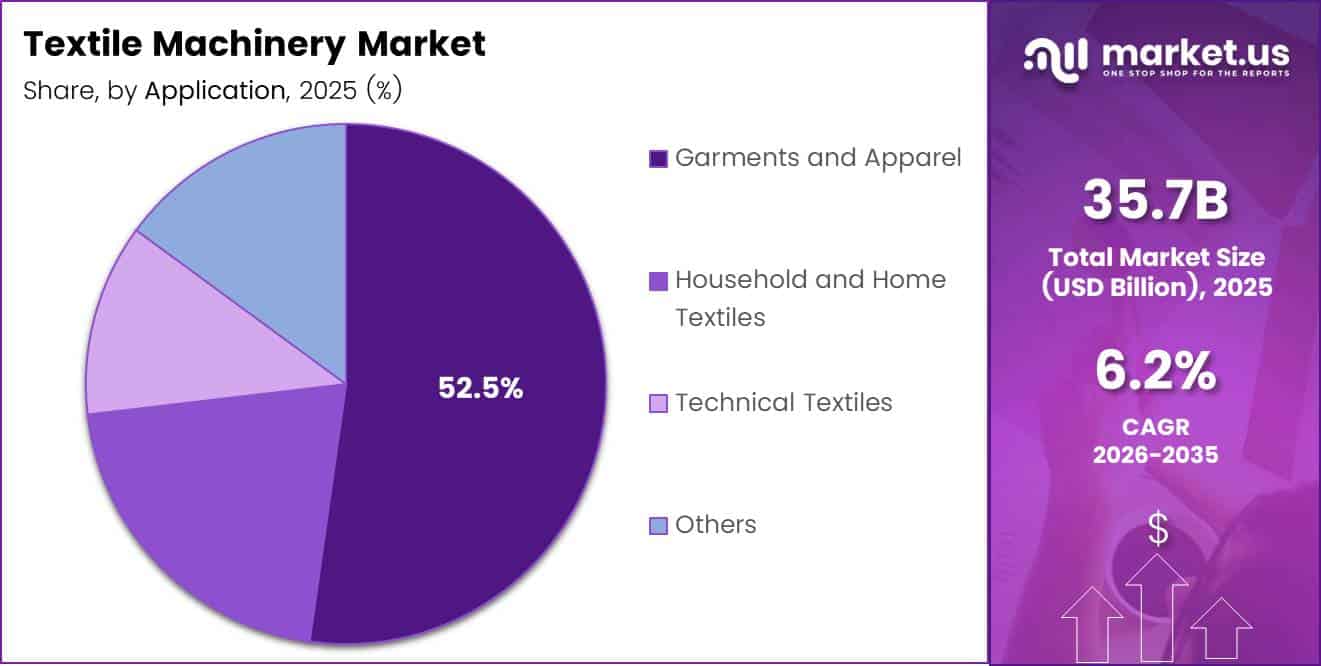

- Garments and Apparel application dominates with 52.5% market share

Type Analysis

Weaving Machines dominates with 28.3% due to widespread adoption in fabric production facilities.

In 2025, Weaving Machines held a dominant market position in the By Type segment of Textile Machinery Market, with a 28.3% share. These systems produce woven fabrics for apparel, home textiles, and industrial applications. Modern air-jet and rapier looms offer high-speed operation with minimal defects. Therefore, manufacturers prefer weaving equipment for versatile fabric construction across multiple end-uses.

Spinning Machines convert raw fibers into continuous yarns through mechanical processes. Ring spinning, rotor spinning, and air-jet spinning technologies serve different quality and speed requirements. Moreover, integrated spinning-weaving facilities invest in coordinated equipment lines. Consequently, spinning machinery remains essential for vertical production strategies.

Knitting Machines create loop-based fabrics for garments, hosiery, and technical textiles. Circular knitting and flat knitting systems address distinct product categories and production volumes. Additionally, electronic jacquard controls enable complex pattern generation. These capabilities support fashion customization and small-batch specialty production.

Finishing Machines apply treatments such as dyeing, printing, coating, and heat-setting to enhance fabric properties. Chemical application systems, stenters, and calendering equipment ensure consistent quality standards. Furthermore, eco-friendly finishing technologies reduce water and chemical consumption. This segment grows as sustainability regulations tighten across textile markets.

Plasma Treatment Method Analysis

Atmospheric Pressure Plasma dominates with 64.2% due to cost-effectiveness and easier integration into existing production lines.

In 2025, Atmospheric Pressure Plasma held a dominant market position in the By Plasma Treatment Method segment of Textile Machinery Market, with a 64.2% share. This technology modifies fabric surfaces without vacuum chambers, reducing equipment costs and operational complexity. Manufacturers apply atmospheric plasma for cleaning, activation, and coating preparation. Therefore, mills adopt this method for scalable surface treatment applications.

Low Pressure Plasma operates in vacuum environments, delivering precise surface modifications for specialized applications. This approach achieves deeper material penetration and more controlled chemical reactions. However, higher equipment costs and batch processing limitations restrict adoption. Consequently, low pressure systems serve niche technical textile and high-value product segments.

Raw Materials Analysis

Cotton dominates with 34.6% due to natural fiber preference in apparel and home textiles.

In 2025, Cotton held a dominant market position in the By Raw Materials segment of Textile Machinery Market, with a 34.6% share. Natural cotton fibers require specific spinning, weaving, and finishing machinery configurations. Established cotton supply chains support large-scale production infrastructure across Asia and Americas. Moreover, consumer demand for breathable, comfortable fabrics sustains cotton processing volumes.

Wool processing requires specialized machinery for cleaning, carding, and spinning coarser fibers. Temperature and moisture controls prevent fiber damage during mechanical handling. Additionally, wool finishing equipment applies treatments like felting and shrink-resistance. These systems primarily serve premium apparel and luxury textile manufacturers.

Nylon production utilizes synthetic filament spinning and texturizing equipment for continuous polymer fibers. High-speed winding and precise tension controls ensure uniform yarn properties. Furthermore, nylon’s durability drives demand in hosiery, carpets, and industrial fabrics. Consequently, dedicated nylon processing lines expand in technical textile facilities.

Polyester machinery processes the largest-volume synthetic fiber through melt spinning and draw-texturizing systems. Automated production lines achieve high throughput with consistent quality standards. Moreover, polyester blending equipment combines synthetic fibers with natural materials. This versatility supports diverse applications from fast fashion to automotive textiles.

Acrylic fiber processing employs wet spinning or dry spinning technologies for wool-like synthetic yarns. Specialized drying and crimping equipment creates bulk and softness in acrylic products. Additionally, acrylic machinery serves niche markets in sweaters, blankets, and outdoor textiles. However, environmental concerns limit acrylic production growth.

Silk processing uses gentle handling machinery to preserve delicate natural protein fibers. Reeling, throwing, and weaving equipment operate at lower speeds than cotton or synthetic systems. Furthermore, silk finishing applies minimal chemical treatments to maintain luster and texture. These specialized machines support luxury textile and high-end fashion markets.

Application Analysis

Garments and Apparel dominates with 52.5% due to massive global clothing consumption and fast fashion production.

In 2025, Garments and Apparel held a dominant market position in the By Application segment of Textile Machinery Market, with a 52.5% share. Clothing manufacturers operate integrated production lines combining spinning, weaving, knitting, and cutting equipment. Fast fashion business models demand rapid style changes and flexible machinery configurations. Therefore, apparel producers invest continuously in versatile, high-speed equipment to meet seasonal collection cycles.

Household and Home Textiles include bedding, towels, curtains, and upholstery fabrics requiring durable, washable constructions. Wide-width weaving looms and specialized finishing equipment serve this segment with high-volume standardized production. Moreover, home textile manufacturers prioritize color consistency and fabric stability. Consequently, quality control systems integrate throughout production workflows.

Technical Textiles encompass automotive fabrics, medical textiles, geotextiles, and protective materials with engineered performance properties. Specialized coating, laminating, and bonding machinery creates composite structures with specific strength, barrier, or conductivity characteristics. Additionally, technical textile applications demand certified quality standards and traceability. This segment grows rapidly as industrial sectors adopt advanced fabric solutions.

Key Market Segments

By Type

- Weaving Machines

- Spinning Machines

- Knitting Machines

- Finishing Machines

- Others

By Plasma Treatment Method

- Atmospheric Pressure Plasma

- Low Pressure Plasma

By Raw Materials

- Cotton

- Wool

- Nylon

- Polyester

- Acrylic

- Silk

- Others

By Application

- Garments and Apparel

- Household and Home Textiles

- Technical Textiles

- Others

Drivers

Rapid Capacity Expansion and Automation Adoption Drive Textile Machinery Demand

Asia-Pacific manufacturers expand production capacity to capture growing global apparel exports. New integrated textile parks combine spinning, weaving, and finishing facilities within coordinated infrastructure. Moreover, government incentives reduce capital costs for modern equipment installations. Consequently, machinery suppliers experience sustained order volumes from greenfield and brownfield projects.

High-speed automated equipment replaces manual and semi-automatic systems across established textile hubs. Weaving and knitting machines with electronic controls reduce labor requirements while increasing output rates. Additionally, automated material handling systems connect individual machines into continuous production flows. Therefore, mills achieve higher productivity with fewer operational staff.

According to Global Textile Times, predictive maintenance implementations can cut maintenance costs by as much as 40% through IoT-based monitoring and analytics. Energy-efficient production systems lower operating expenses while meeting environmental compliance requirements. Manufacturers adopt servo motors, variable frequency drives, and heat recovery systems to reduce power consumption. Furthermore, waste minimization technologies decrease raw material losses and disposal costs.

Restraints

High Capital Investment and Skills Shortage Limit Market Adoption

Advanced textile machinery requires substantial upfront capital expenditure ranging from hundreds of thousands to millions of dollars per unit. Small and medium-sized mills struggle to finance equipment purchases without favorable lending terms. Moreover, long payback periods extend beyond three to five years depending on capacity utilization. Therefore, financial constraints delay modernization cycles in price-sensitive markets.

Modern computerized equipment demands technically skilled operators proficient in programming, troubleshooting, and preventive maintenance. Educational institutions produce insufficient graduates with specialized textile machinery training across developing regions. Additionally, experienced technicians migrate to higher-paying manufacturing sectors. Consequently, mills face recruitment challenges and increased training costs.

Rapid technological evolution creates uncertainty about optimal equipment investment timing. Manufacturers hesitate between purchasing current-generation systems or waiting for next-generation innovations. Furthermore, compatibility concerns arise when integrating new machines with existing production infrastructure. This hesitation extends decision-making cycles and postpones capital allocation.

Growth Factors

Technical Textiles Demand and Smart Manufacturing Integration Accelerate Market Expansion

Automotive, medical, construction, and protective equipment sectors increase consumption of engineered fabrics with specific performance characteristics. Technical textiles require specialized machinery for coating, laminating, and composite material production. Moreover, higher profit margins justify premium equipment investments compared to commodity apparel fabrics. Therefore, machinery suppliers develop dedicated product lines for technical textile applications.

Obsolete equipment in mature textile markets reaches end-of-life cycles requiring complete replacement rather than incremental upgrades. European and North American mills invest in state-of-the-art systems to maintain quality competitiveness against low-cost imports. According to research on smart manufacturing, IoT-enabled production systems showed an 18% reduction in energy consumption alongside a 22% decrease in machine downtime. Additionally, government modernization subsidies offset replacement costs in domestic textile industries.

Real-time monitoring sensors, predictive analytics, and automated quality control systems transform traditional machinery into connected production platforms. In January 2026, Epson launched the SureColor G9000 high-production Direct-To-Film printer with enhanced speed, reliability and efficiency for textile transfer printing. Furthermore, digital twin simulations optimize machine parameters before physical implementation. This technological integration attracts capital from mills seeking competitive advantages through Industry 4.0 adoption.

Emerging Trends

Digital Controls and Sustainable Fiber Compatibility Reshape Textile Machinery Landscape

Artificial intelligence algorithms optimize production parameters based on real-time quality feedback and predictive failure analysis. Digital control systems replace mechanical linkages with programmable logic controllers and touchscreen interfaces. According to research on energy-efficient AI frameworks, an ensemble deep transfer learning method enhanced prediction accuracy in textile manufacturing by 5.66% and improved model robustness by 3.96% with limited data availability. Therefore, mills reduce setup times and minimize defective output.

Manufacturers demand smaller, modular equipment configurations that enable rapid product changeovers and space-efficient layouts. Flexible machinery handles multiple yarn counts, fabric widths, and material types without extensive retooling. Moreover, compact designs suit urban manufacturing facilities with limited floor space. Consequently, equipment suppliers redesign traditional large-format machines into adaptable production cells.

Recycled cotton, regenerated polyester, and novel bio-based fibers require modified processing parameters compared to conventional materials. Machinery manufacturers develop adjustable systems accommodating varying fiber lengths, strengths, and thermal properties. Additionally, chemical-free finishing equipment supports sustainable production certifications. This compatibility expands as circular economy principles gain prominence across textile supply chains.

Regional Analysis

Asia Pacific Dominates the Textile Machinery Market with a Market Share of 45.2%, Valued at USD 16.1 Billion

Asia Pacific leads global textile machinery consumption driven by massive apparel manufacturing capacity in China, India, Bangladesh, and Vietnam. The region holds a 45.2% market share valued at USD 16.1 Billion, reflecting concentrated production infrastructure and ongoing modernization investments. Government initiatives supporting domestic textile industries accelerate equipment procurement across Southeast Asian nations. Moreover, proximity to raw material sources and export markets sustains regional machinery demand.

North America Textile Machinery Market Trends

North America focuses on specialized technical textiles and high-value apparel production requiring advanced automation and quality control systems. Mills invest in replacement equipment emphasizing energy efficiency and labor productivity over capacity expansion. Additionally, nearshoring trends bring selective apparel manufacturing back from overseas locations. Therefore, machinery suppliers target premium, flexible production systems for North American customers.

Europe Textile Machinery Market Trends

Europe maintains machinery demand through technological leadership in specialized equipment and replacement cycles in established mills. German and Italian manufacturers export advanced weaving, knitting, and finishing systems globally while upgrading domestic installations. Moreover, sustainability regulations drive adoption of resource-efficient and low-emission production technologies. Consequently, European machinery emphasizes quality, precision, and environmental compliance.

Latin America Textile Machinery Market Trends

Latin America experiences moderate machinery investment concentrated in Brazil, Mexico, and Central American garment assembly operations. Regional manufacturers balance local consumption with export-oriented production requiring competitive cost structures. Additionally, trade agreements influence equipment sourcing decisions between domestic, regional, and international suppliers. Therefore, machinery demand follows cyclical patterns aligned with economic growth and currency stability.

Middle East & Africa Textile Machinery Market Trends

Middle East and Africa show emerging machinery demand as countries diversify economies beyond resource extraction toward manufacturing sectors. Turkish textile industry maintains established equipment base while African nations develop nascent production capabilities. Moreover, free trade zones attract foreign investment in textile manufacturing infrastructure. Consequently, machinery sales target both modernization projects and greenfield facility installations.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Rieter maintains a leading position in spinning machinery through comprehensive product portfolios covering short-staple fiber processing from opening to winding. The Swiss manufacturer combines mechanical engineering expertise with digital monitoring systems for integrated production solutions. Moreover, strategic acquisitions expand capabilities into man-made fiber equipment segments. Consequently, Rieter serves both traditional cotton spinning and synthetic filament production markets.

Murata Machinery specializes in automated winding, twisting, and yarn preparation systems with advanced electronic controls and quality monitoring. Japanese engineering precision delivers consistent performance in high-speed textile operations requiring minimal manual intervention. In January 2026, ANDRITZ commissioned three advanced neXline spunlace nonwoven lines at the Alar Silk Road New Materials facility in China, expanding nonwoven production capacity. Additionally, Murata integrates IoT connectivity for predictive maintenance and remote diagnostics across installed equipment bases.

Itema Group produces weaving machinery including rapier, air-jet, and projectile looms serving diverse fabric constructions and production requirements. Italian design emphasizes reliability, energy efficiency, and ease of maintenance across global customer installations. Furthermore, Itema develops specialized solutions for technical textiles demanding precise control over complex weave patterns. Therefore, the company maintains strong positions in both commodity and specialized weaving applications.

Toyota Industries Corporation leverages automotive manufacturing expertise to produce high-precision air-jet looms and spinning machinery with advanced automation. Japanese quality standards ensure consistent performance in demanding production environments requiring minimal downtime. Moreover, Toyota integrates sensor technologies and data analytics developed for automotive applications into textile equipment platforms. Consequently, customers benefit from cross-industry innovation improving productivity and operational efficiency.

Key players

- A.T.E. Private Limited

- Murata Machinery

- Rieter

- Itema Group

- Qingdao Jingtian Textile Machinery Co., Ltd

- OC Oerlikon

- Trützschler Group

- Savio Macchine Tessili S.p.A

- Toyota Industries Corporation

- SHIMA SEIKI MFG., LTD

Recent Developments

- May 2025 – Rieter signed a definitive agreement to acquire Barmag, a leading filament spinning and nonwoven equipment producer, for an upfront equity purchase price of CHF 713 million. This strategic acquisition strengthens Rieter’s position in man-made fiber processing technology and expands its product portfolio into synthetic filament production systems.

- January 2025 – MMI Textiles Inc. acquired Jason Mills, LLC, expanding its product offerings in high-performance knit textiles and components. The acquisition enhances MMI’s capabilities in technical textile applications and broadens its customer base across industrial and specialty fabric markets.

- August 2025 – Navis TubeTex entered a strategic partnership with Mascoe Systems to manufacture and sell an expanded line of advanced coating machinery technologies. This collaboration combines Navis TubeTex’s process expertise with Mascoe’s equipment engineering to deliver innovative coating solutions for technical textile applications.

Report Scope

Report Features Description Market Value (2025) USD 35.7 Billion Forecast Revenue (2035) USD 65.1 Billion CAGR (2026-2035) 6.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Weaving Machines, Spinning Machines, Knitting Machines, Finishing Machines, Others), By Plasma Treatment Method (Atmospheric Pressure Plasma, Low Pressure Plasma), By Raw Materials (Cotton, Wool, Nylon, Polyester, Acrylic, Silk, Others), By Application (Garments and Apparel, Household and Home Textiles, Technical Textiles, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape A.T.E. Private Limited, Murata Machinery, Rieter, Itema Group, Qingdao Jingtian Textile Machinery Co., Ltd, OC Oerlikon, Trützschler Group, Savio Macchine Tessili S.p.A, Toyota Industries Corporation, SHIMA SEIKI MFG., LTD Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- A.T.E. Private Limited

- Murata Machinery

- Rieter

- Itema Group

- Qingdao Jingtian Textile Machinery Co., Ltd

- OC Oerlikon

- Trützschler Group

- Savio Macchine Tessili S.p.A

- Toyota Industries Corporation

- SHIMA SEIKI MFG., LTD