Global Tertiary Amines Market Size, Share, And Business Benefits By Product Type (C-8 TA, C-10 TA, C-12 TA, C-14 TA, C-16 TA, Others), By Production Process (Ammonolysis, Reductive Amination, Alkylation), By Application (Surfactants, Biocides, Others), By End Use (Cosmetics and Personal Care, Water Treatment, Pharmaceuticals, Cleaning Products and Disinfectants, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155517

- Number of Pages: 293

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

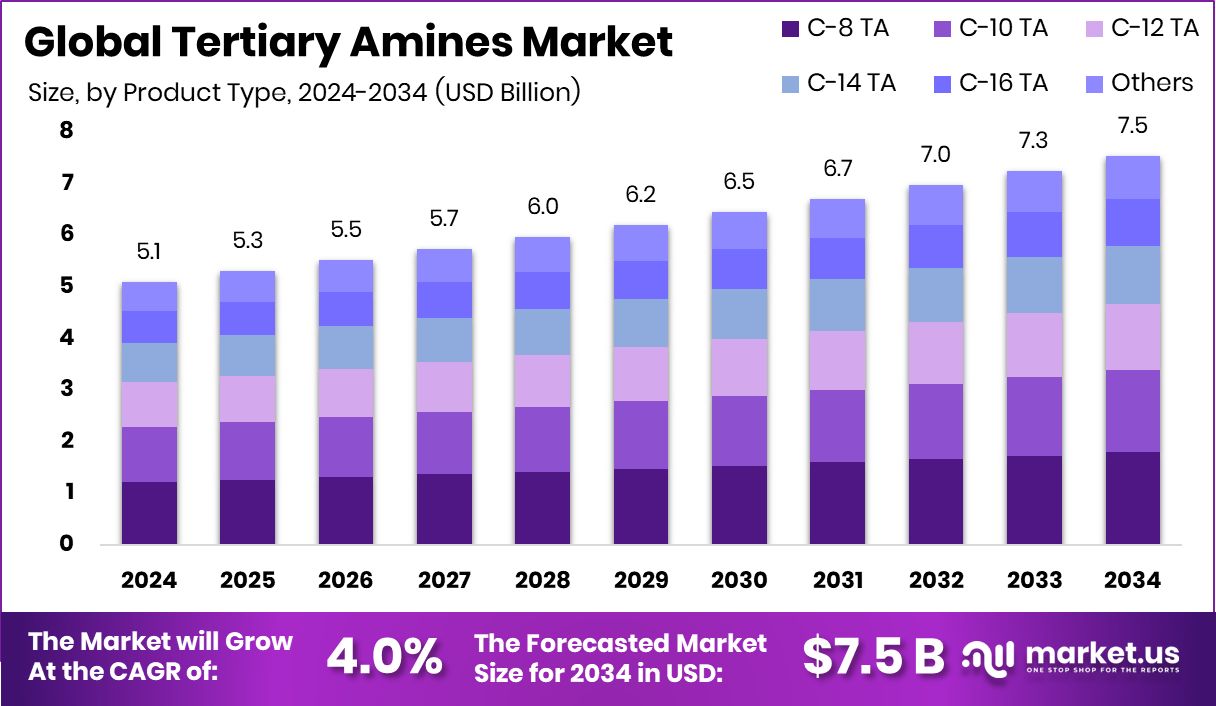

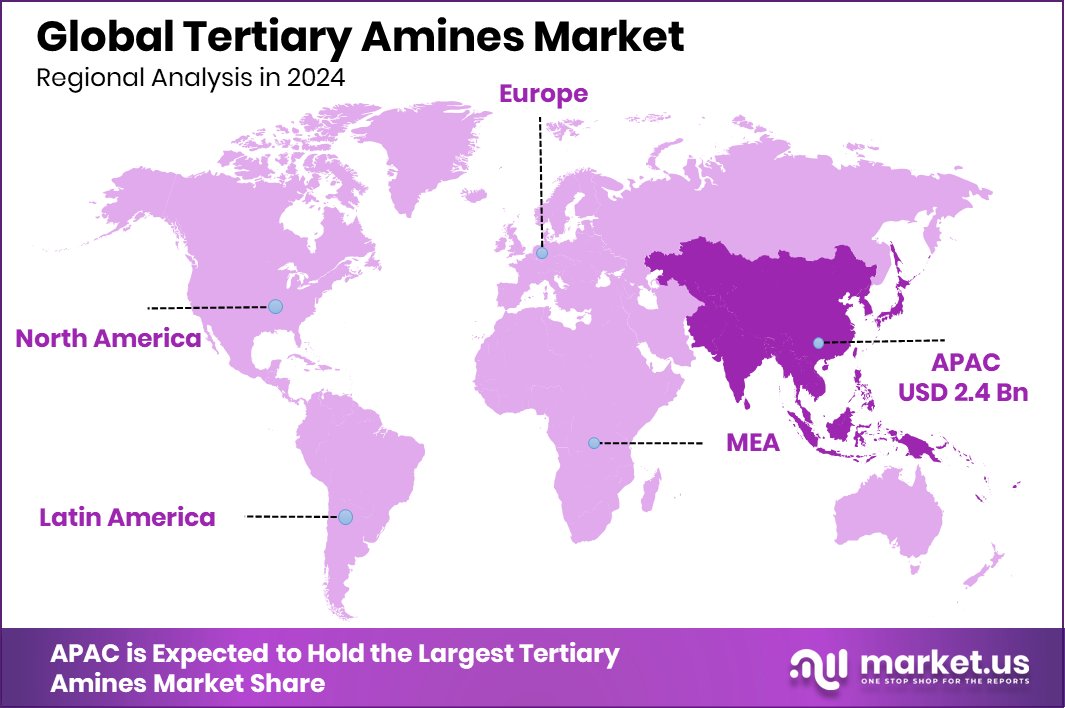

The Global Tertiary Amines Market is expected to be worth around USD 7.5 billion by 2034, up from USD 5.1 billion in 2024, and is projected to grow at a CAGR of 4.0% from 2025 to 2034. Expanding personal care sector boosts Asia Pacific Tertiary Amines market to USD 2.4 Bn.

Tertiary amines are organic compounds where the nitrogen atom is bonded to three carbon atoms, usually through alkyl or aryl groups. They do not have any hydrogen atom directly attached to the nitrogen, making them less reactive than primary or secondary amines in certain reactions. These compounds are widely used as intermediates in the production of surfactants, pharmaceuticals, agrochemicals, and corrosion inhibitors due to their stability and ability to participate in various chemical processes.

The tertiary amines market refers to the global trade, production, and consumption of these nitrogen-containing chemicals across industries such as personal care, pharmaceuticals, agriculture, water treatment, and oil & gas. Market growth is supported by their versatile applications, including as catalysts, neutralizing agents, and corrosion prevention additives. Demand trends are influenced by industrial output, end-user sector growth, and innovations in chemical formulations.

Rising demand for personal care products, pharmaceuticals, and specialty chemicals is pushing manufacturers to increase tertiary amine production. Their role as intermediates in high-value applications like emulsifiers and fabric softeners is also contributing to steady market expansion. Additionally, the growth of the global chemical sector and the development of customized amine derivatives are boosting usage. According to an industry report, AmphiStar Secures €12.5M EIC Funding to Boost Bio-Based Surfactant Commercialization

The increasing consumption of agrochemicals to improve crop yields is a major driver, as tertiary amines are used in herbicide and pesticide formulations. Expanding pharmaceutical manufacturing, particularly in developing regions, also contributes to higher consumption, while industrial uses in coatings, lubricants, and oilfield chemicals continue to strengthen demand. According to an industry report, Dispersa Gains $5.8M to Expand Biosurfactant Production Using Food Waste.

Key Takeaways

- The Global Tertiary Amines Market is expected to be worth around USD 7.5 billion by 2034, up from USD 5.1 billion in 2024, and is projected to grow at a CAGR of 4.0% from 2025 to 2034.

- C-8 TA holds a 23.8% share in the Tertiary Amines Market, driven by diverse industrial applications.

- The ammonolysis process leads with a 49.2% share in the tertiary amines market, ensuring high production efficiency.

- Surfactants dominate the tertiary amines market with a 59.4% share, supported by rising cleaning and personal care demand.

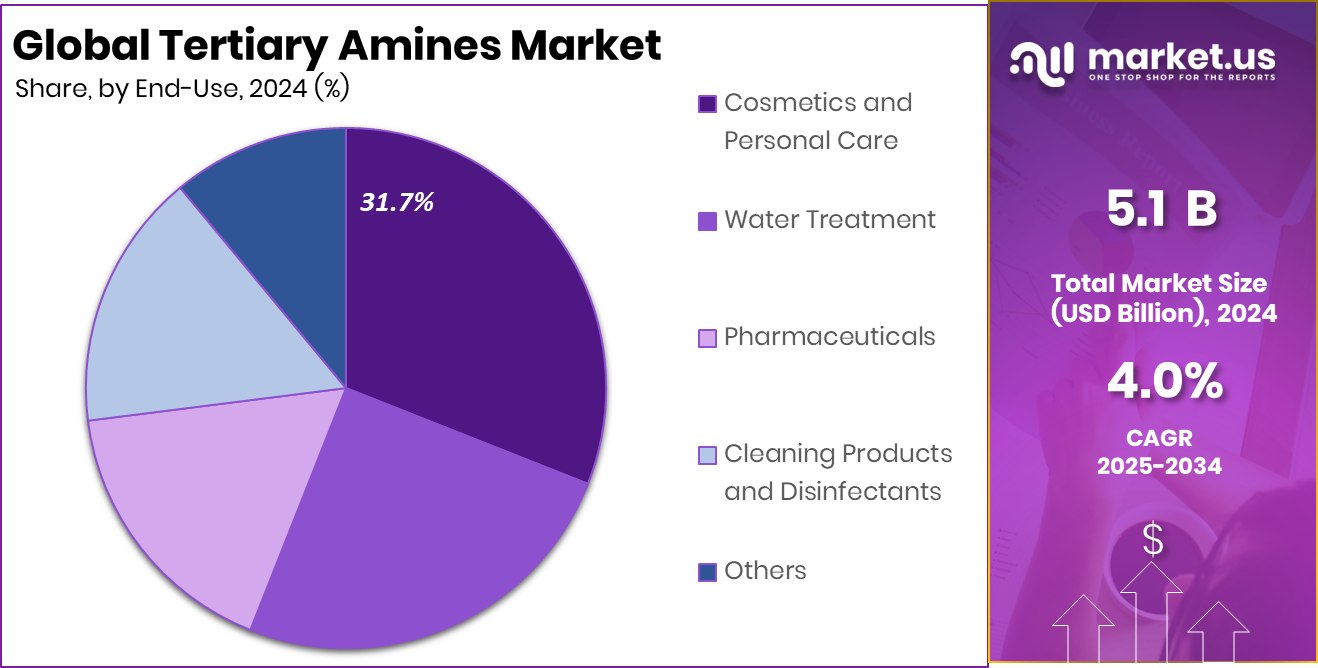

- Cosmetics and personal care account for 31.7% of the tertiary amines market, fueled by beauty product growth.

- Strong industrial growth in the Asia Pacific, 48.90% drives Tertiary Amines demand significantly upward.

By Product Type Analysis

Tertiary Amines Market: C-8 TA holds 23.8% share, driven by industrial applications.

In 2024, C-8 TA held a dominant market position in the By Product Type segment of the Tertiary Amines Market, with a 23.8% share. This strong presence is primarily attributed to its wide use in manufacturing surfactants, emulsifiers, and chemical intermediates for industries such as personal care, cleaning, and agrochemicals.

C-8 TA is favored for its balanced performance profile, offering effective solubility, stability, and compatibility with a variety of formulations. Its demand is further supported by the growth in household cleaning products and personal care items, where it serves as a key raw material for fabric softeners, shampoos, and detergents.

The product also benefits from its role in producing corrosion inhibitors and flotation agents, making it valuable for applications in water treatment and mining. The steady expansion of agricultural chemical production, especially in herbicide formulations, continues to boost its market presence.

Manufacturers are leveraging their versatility to cater to diverse end-user needs while optimizing cost efficiency in large-scale production. With industrial growth in emerging economies and a rise in specialty chemical consumption, C-8 TA is expected to maintain its lead in the segment through 2025, supported by both traditional applications and emerging high-performance chemical uses.

By Production Process Analysis

Tertiary Amines Market: Ammonolysis process dominates with 49.2% share in global output.

In 2024, ammonolysis held a dominant market position in the By Production Process segment of the Tertiary Amines Market, with a 49.2% share. This method remains the most widely adopted due to its efficiency, scalability, and cost-effectiveness in producing a broad range of tertiary amines.

Ammonolysis involves the catalytic reaction of alcohols with ammonia, allowing manufacturers to achieve high yields and consistent product quality. Its flexibility in processing various feedstocks enables the production of tailored amine grades suitable for diverse applications, including surfactants, corrosion inhibitors, and emulsifiers.

The dominance of ammonolysis is also supported by its adaptability to large-scale industrial operations, which is crucial for meeting the growing global demand from sectors such as personal care, cleaning products, and agrochemicals. Continuous improvements in catalyst technology and process optimization have further enhanced its energy efficiency and environmental performance, making it a preferred choice among producers.

Additionally, the method’s capability to produce high-purity tertiary amines with minimal by-products strengthens its competitiveness. As demand for specialty chemicals continues to rise in emerging and developed markets, ammonolysis is expected to retain its leading share in 2025, driven by both established applications and the development of new formulations requiring reliable, high-quality amine inputs.

By Application Analysis

Tertiary Amines Market: Surfactants lead applications, capturing 59.4% due to cleaning demand.

In 2024, Surfactants held a dominant market position in the By Application segment of the Tertiary Amines Market, with a 59.4% share. This leadership is driven by the extensive use of tertiary amines as key intermediates in producing a wide range of surfactants used in personal care, household cleaning, and industrial formulations.

Their role in manufacturing cationic, non-ionic, and amphoteric surfactants makes them indispensable for products such as fabric softeners, shampoos, conditioners, dishwashing liquids, and surface cleaners. The demand is further amplified by rising hygiene awareness and the growing consumption of personal and home care products in both developed and emerging markets.

Surfactants derived from tertiary amines are valued for their excellent emulsifying, foaming, and wetting properties, which improve the performance and stability of end products. They are also widely used in oilfield chemicals, agricultural formulations, and textile processing, adding to their market strength.

The growth of e-commerce-driven FMCG sales and the shift toward high-performance, multifunctional cleaning and personal care products have further reinforced their dominance. With continuous innovation in eco-friendly and biodegradable surfactant formulations, along with steady industrial expansion, the application of tertiary amines in surfactant production is expected to remain strong in 2025, maintaining its significant market share advantage.

By End Use Analysis

Tertiary Amines Market: The Cosmetics and personal care segment holds 31.7% share worldwide.

In 2024, Cosmetics and Personal Care held a dominant market position in the By End Use segment of the Tertiary Amines Market, with a 31.7% share. This strong position is attributed to the extensive use of tertiary amines in manufacturing conditioning agents, emulsifiers, and surfactants that enhance the texture, stability, and performance of personal care products.

They play a vital role in formulations for shampoos, conditioners, skin creams, lotions, deodorants, and hair dyes, providing smooth application, improved spreadability, and long-lasting effects. The steady rise in consumer spending on premium personal care products, coupled with growing awareness of grooming and hygiene, has further strengthened their demand.

Tertiary amines are also preferred for their versatility in producing mild, skin-friendly formulations that meet the needs of sensitive skin products. Their compatibility with both oil- and water-based systems makes them essential in a wide range of cosmetic applications. The market is additionally supported by rapid urbanization, rising disposable incomes, and the influence of beauty and lifestyle trends, especially in emerging economies.

With the ongoing development of eco-friendly and sustainable cosmetic formulations, alongside increasing demand for high-performance personal care products, tertiary amines in the cosmetics and personal care segment are expected to maintain a strong growth trajectory into 2025.

Key Market Segments

By Product Type

- C-8 TA

- C-10 TA

- C-12 TA

- C-14 TA

- C-16 TA

- Others

By Production Process

- Ammonolysis

- Reductive Amination

- Alkylation

By Application

- Surfactants

- Biocides

- Others

By End Use

- Cosmetics and Personal Care

- Water Treatment

- Pharmaceuticals

- Cleaning Products and Disinfectants

- Others

Driving Factors

Rising Demand from Personal Care and Cleaning Industries

One of the key driving factors for the Tertiary Amines Market is the increasing demand from the personal care and cleaning product industries. Tertiary amines are essential ingredients in making surfactants, which are widely used in shampoos, conditioners, skin creams, fabric softeners, and household cleaning products. As people across the world become more conscious about hygiene, skincare, and grooming, the consumption of these products is growing steadily.

This trend is particularly strong in emerging economies, where rising incomes and urban lifestyles are boosting demand for premium and everyday personal care items. Additionally, the surge in cleaning product usage after global health concerns has further strengthened market growth, making this sector a consistent and strong consumer of tertiary amines.

Restraining Factors

Environmental Concerns and Stringent Regulatory Compliance Issues

A major restraining factor for the Tertiary Amines Market is the increasing environmental concerns and strict regulatory requirements related to their production and usage. Tertiary amines, while highly useful in many applications, can pose environmental risks if not handled and disposed of properly. Regulatory authorities in various regions have imposed strict guidelines on emissions, waste management, and permissible limits of chemical residues in end products.

Compliance with these regulations often requires additional investment in cleaner production technologies, waste treatment systems, and safety measures, which can raise manufacturing costs. Moreover, delays in regulatory approvals for certain formulations can slow market expansion. These environmental and compliance challenges create hurdles for producers, especially smaller manufacturers with limited resources.

Growth Opportunity

Expanding Applications in Eco-Friendly Surfactant Formulations

A key growth opportunity for the Tertiary Amines Market lies in the rising demand for eco-friendly and biodegradable surfactant formulations. With increasing consumer preference for sustainable products and stricter environmental regulations, manufacturers are focusing on developing greener solutions using renewable or bio-based feedstocks for tertiary amine production.

These eco-friendly surfactants are gaining traction in personal care, household cleaning, and industrial applications, as they offer performance benefits while reducing environmental impact. Companies investing in research and innovation to create high-performance, plant-derived tertiary amines can tap into this growing segment.

This shift toward sustainable chemistry not only supports environmental goals but also opens new market avenues, particularly in regions actively promoting green manufacturing and environmentally responsible consumer goods.

Latest Trends

Shift Towards Bio-Based and Renewable Raw Materials

One of the latest trends in the Tertiary Amines Market is the growing shift towards bio-based and renewable raw materials for production. As industries move towards sustainable practices, manufacturers are exploring plant-derived alcohols and other renewable feedstocks to produce tertiary amines, reducing reliance on petroleum-based sources. This trend is driven by rising environmental awareness, consumer demand for greener products, and stricter government regulations on chemical manufacturing.

Bio-based tertiary amines are particularly attractive for applications in personal care, cleaning products, and agrochemicals, where eco-friendly claims add strong market value. Advancements in biotechnology and green chemistry are making these alternatives more cost-competitive, encouraging wider adoption and signaling a long-term transformation in the production landscape of tertiary amines.

Regional Analysis

In 2024, the Asia Pacific held a 48.90% share, worth USD 2.4 Bn.

In 2024, the Asia Pacific emerged as the leading region in the Tertiary Amines Market, capturing 48.90% of the global share, valued at USD 2.4 billion. The region’s dominance is driven by strong industrial growth, expanding manufacturing capacities, and rising demand from end-use sectors such as personal care, cleaning products, and agrochemicals.

Rapid urbanization, increasing disposable incomes, and the growth of middle-class consumers in countries like China, India, and Southeast Asian nations have significantly boosted the consumption of tertiary amine-based products, particularly in household cleaning, personal grooming, and agricultural applications.

Additionally, the presence of cost-effective raw material sourcing, competitive labor markets, and large-scale chemical manufacturing facilities supports high production volumes. The agriculture sector in the Asia Pacific, which is critical for regional economies, further stimulates demand as tertiary amines are key intermediates in herbicides and other agrochemicals.

Continuous investments in chemical production infrastructure, coupled with advancements in eco-friendly formulations, are reinforcing the region’s market position. With government initiatives promoting industrial growth and export-oriented production, Asia Pacific is expected to maintain its leadership in the coming years, supported by both domestic consumption and increasing global demand for high-quality tertiary amine derivatives from the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Albemarle Corporation continues to leverage its strong chemical manufacturing expertise and global distribution network to meet rising demand across personal care, cleaning products, and agrochemical sectors. The company’s focus on process optimization and product diversification helps maintain a competitive edge in both developed and emerging markets.

Alkyl Amines Chemicals Limited has strengthened its market presence through capacity expansions and consistent quality in amine production, catering to domestic and export markets. Its integrated production facilities and emphasis on efficiency enable it to supply a wide range of tertiary amines for various end-use applications.

Arkema benefits from its broad specialty chemicals portfolio, offering innovative tertiary amine solutions tailored for surfactants, water treatment, and industrial chemicals. The company’s R&D capabilities and commitment to sustainable solutions position it well to tap into the growing demand for eco-friendly formulations.

Balaji Amines remains a significant contributor to the market, with robust manufacturing infrastructure and a strong foothold in the Asian region. Its competitive pricing, wide product range, and responsiveness to market needs make it a preferred supplier for many downstream industries.

Top Key Players in the Market

- Albemarle Corporation

- Alkyl Amines Chemicals Limited

- Arkema

- Balaji Amines

- BASF SE

- Dow Chemical

- Eastman Chemical Company

- Hexion Inc.

- Huntsman International LLC

- Indo Amines Ltd.

Recent Developments

- In August 2025, the company reported its Q1 results for the quarter ended June 2025. Revenue rose modestly by 1.4% to INR 405.5 crore, while net profit increased by 0.8% to INR 49.4 crore. However, the EBITDA declined by 3.8% to INR 76.7 crore, indicating some pressure on margins likely due to rising costs or tight pricing environments.

- In April 2024, Arkema signed an agreement to acquire nearly 78% of Proionic, a startup specializing in ionic liquids. These substances are crucial for making safer, more efficient next‑generation lithium‑ion batteries, especially solid or flexible batteries. The move strengthens Arkema’s innovation in sustainable battery materials and boosts its position in the evolving energy storage market.

Report Scope

Report Features Description Market Value (2024) USD 5.1 Billion Forecast Revenue (2034) USD 7.5 Billion CAGR (2025-2034) 4.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (C-8 TA, C-10 TA, C-12 TA, C-14 TA, C-16 TA, Others), By Production Process (Ammonolysis, Reductive Amination, Alkylation), By Application (Surfactants, Biocides, Others), By End Use (Cosmetics and Personal Care, Water Treatment, Pharmaceuticals, Cleaning Products and Disinfectants, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Albemarle Corporation, Alkyl Amines Chemicals Limited, Arkema, Balaji Amines, BASF SE, Dow Chemical, Eastman Chemical Company, Hexion Inc., Huntsman International LLC, Indo Amines Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Albemarle Corporation

- Alkyl Amines Chemicals Limited

- Arkema

- Balaji Amines

- BASF SE

- Dow Chemical

- Eastman Chemical Company

- Hexion Inc.

- Huntsman International LLC

- Indo Amines Ltd.