Global Technical Insulation Market Size, Share, And Business Benefit By Type (Hot Insulation, Cold-Flexible Insulation, Cold-Rigid Insulation), By Application (Heating and Plumbing, HVAC, Acoustic, Refrigeration), By End-use (Industrial and OEM, Energy, Commercial Buildings), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 166233

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

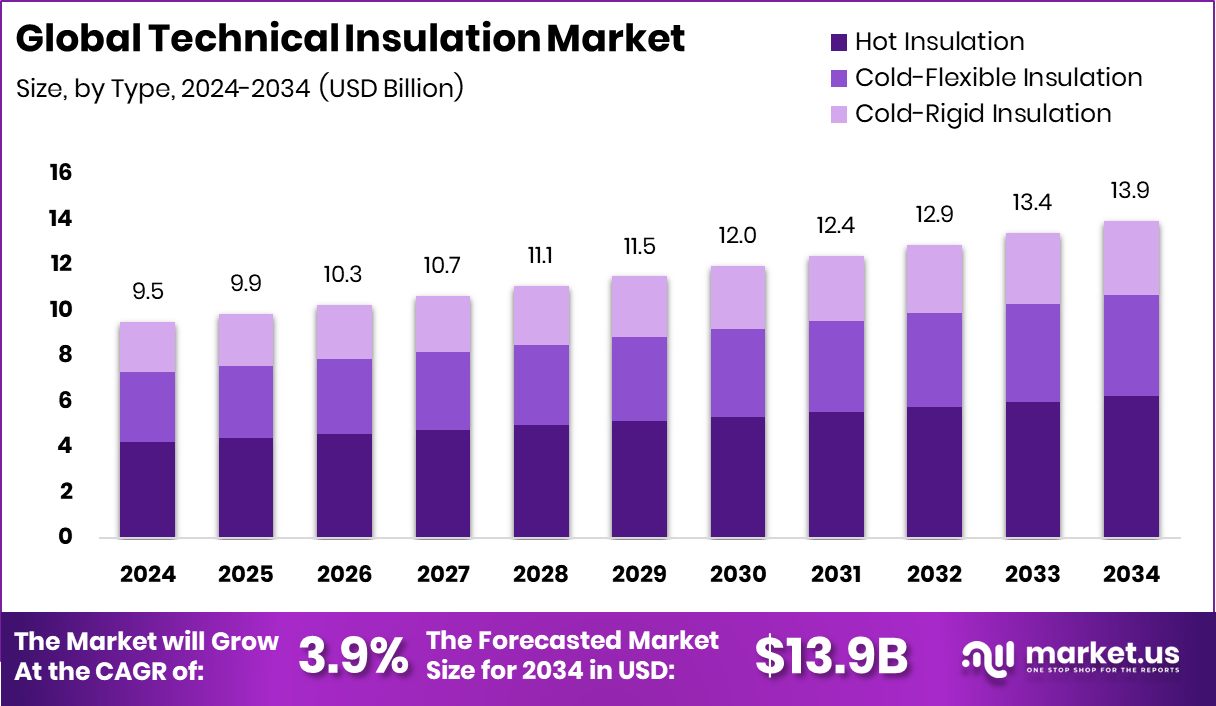

The Global Technical Insulation Market is expected to be worth around USD 13.9 billion by 2034, up from USD 9.5 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034. Asia Pacific 37.4% momentum reflects energy efficiency push and infrastructure upgrades demand continuing strongly.

Technical insulation refers to the specialized insulation materials and systems used to control heat, sound, fire, and energy loss in industrial, commercial, and infrastructure environments. It is applied to pipes, HVAC systems, boilers, turbines, vessels, storage tanks, and district heating networks to maintain process efficiency, prevent condensation, reduce energy waste, and enhance worker and structural safety. It plays a much deeper role than basic residential insulation because it protects both equipment and human health in demanding temperature and operational conditions.

The technical insulation market represents all products, services, and applications linked to these industrial and commercial insulation needs across sectors like oil & gas, chemicals, energy, marine, district heating, cold chain, food processing, and construction. The market is growing as global energy efficiency rules, carbon reduction targets, and heat-loss prevention strategies become mandatory across countries and large enterprises.

Growth comes from rising energy-efficiency projects and heat-network upgrades, supported by public funding such as £13.9 million awarded to improve heat networks and a £1 billion insulation scheme planned to help families save hundreds. Demand is also shaped by new energy infrastructure, where Bedrock Energy secured $12m to expand geothermal-linked business activities supporting heat efficiency.

Opportunity emerges as industrial and HVAC contractors seek new solutions following installation failures, like a homeowner case costing £3k for correction, while digital payments and contractor efficiency improve through Mura, raising $4.5M, and Conry Tech securing $3M. Social and political funding decisions, including the $42 million pulled from Michigan schools, also influence adoption timelines across public-facility upgrades.

Key Takeaways

- The Global Technical Insulation Market is expected to be worth around USD 13.9 billion by 2034, up from USD 9.5 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034.

- Hot insulation leads with a 44.8% share within the growing Technical Insulation Market globally in 2024.

- HVAC dominates applications at 37.9% inside the expanding technical insulation market across energy-heavy projects.

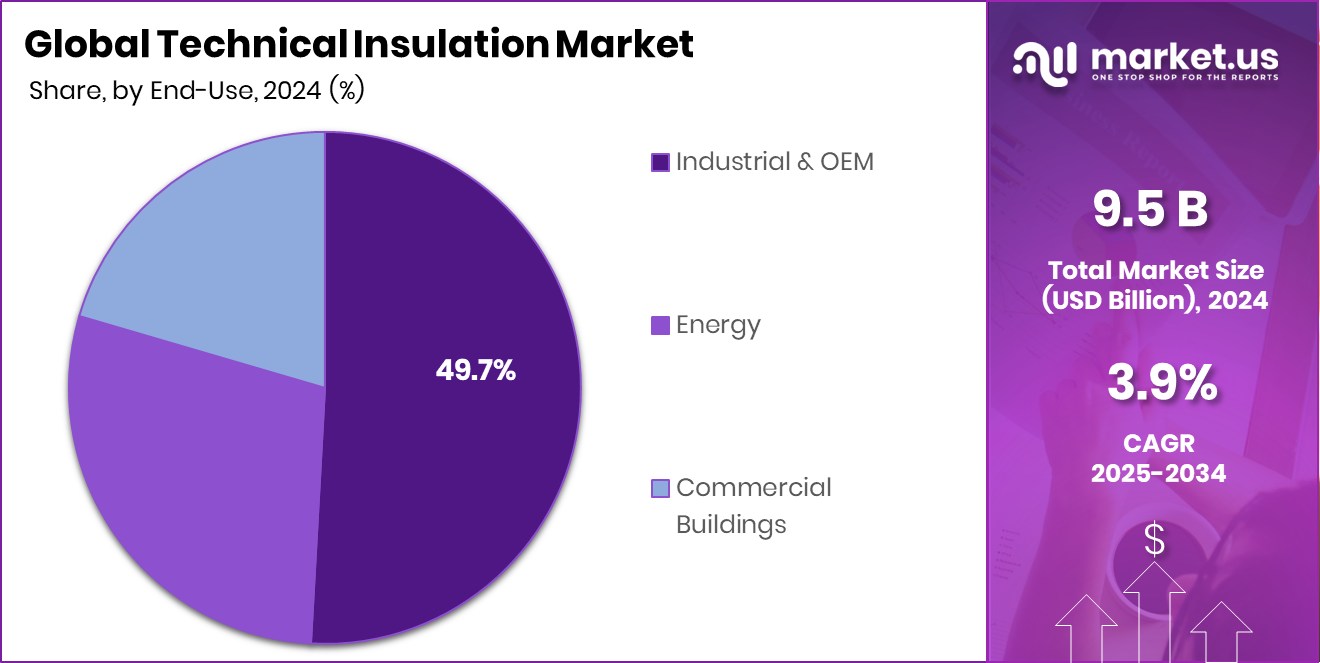

- Industrial and OEM hold a 49.7% share, powering the Technical Insulation Market for process efficiency improvements.

- The Asia Pacific records a USD 3.5 Bn market size across diverse users’ industrial expansion.

By Type Analysis

Hot insulation leads the Technical Insulation Market with 44.8%, a global efficiency upgrade.

In 2024, Hot Insulation held a dominant market position in the By Type segment of the Technical Insulation Market, with a 44.8% share. This preference reflects its strong use across industrial heating systems, process pipelines, boilers, and heat-network infrastructure, where energy loss prevention and equipment stability are critical.

Hot insulation appealed to asset owners who aimed to minimise operational heat leakage, maintain temperature stability, and support long-term safety performance in high-temperature environments.

Its rising share also aligned with increased upgrading of thermal network systems and improved adoption of government-supported insulation initiatives focused on reducing household and industrial energy cost burdens. The market positioning remained stable due to its broad applicability and strong alignment with the long-term energy-efficiency direction.

By Application Analysis

HVAC dominates the Technical Insulation Market with a 37.9% share, driving adoption.

In 2024, HVAC held a dominant market position in the By Application segment of the Technical Insulation Market, with a 37.9% share. This leadership reflects its broad usage across commercial buildings, industrial facilities, transport hubs, and public infrastructure, where temperature stability, air-quality control, and energy-efficiency compliance are considered essential.

The share aligns with growing retrofitting programs and the push to reduce power consumption in heating and cooling networks, especially as users seek safer, quieter, and more efficient climate-control systems.

HVAC applications benefited from rising awareness of operational cost savings, better moisture and condensation management, and the focus on preventing energy loss across ducts, chillers, air-handling units, and ventilation pipelines without compromising system performance or reliability.

By End-use Analysis

Industrial and OEM top the Technical Insulation Market at 49.7%, in leadership.

In 2024, Industrial and OEM held a dominant market position in the by-end-use segment of the Technical Insulation Market, with a 49.7% share. This strong position reflects large-scale energy-dependent operations, continuous process systems, and the need for reliable temperature control across manufacturing plants, machinery, and engineering assemblies.

Industrial and OEM demand was also driven by safety standards, heat-loss prevention requirements, and the growing importance of equipment protection to maintain productivity and reduce downtime.

The share was further supported by the use of insulation in factories, machinery housings, and engineered components, where thermal stability, condensation control, and efficiency improvement are considered essential for long-term operational performance and compliance.

Key Market Segments

By Type

- Hot Insulation

- Cold-Flexible Insulation

- Cold-Rigid Insulation

By Application

- Heating & Plumbing

- HVAC

- Acoustic

- Refrigeration

By End-use

- Industrial & OEM

- Energy

- Commercial Buildings

Driving Factors

Energy-Efficient Buildings and Infrastructure Investments Rise

A major driving factor for the Technical Insulation Market is the continuous global push toward energy-efficient buildings, industrial facilities, and commercial spaces, supported by both private and institutional capital. Technical insulation helps reduce heat loss, lower electricity bills, increase safety, and improve temperature control in HVAC pipes, ducts, boilers, and industrial machinery.

Investor confidence toward energy-efficient construction and premium commercial real estate also plays a role, highlighted by the world’s largest sovereign wealth fund investing $543 million in a Manhattan office building, signalling strong demand for modern, well-insulated, and high-performance structures.

This kind of investment creates long-term momentum for advanced insulation upgrades in mechanical systems, heating networks, and smart buildings that aim to meet efficiency and sustainability requirements.

Restraining Factors

High Installation Costs and Skilled Labour Challenges

A key restraining factor for the Technical Insulation Market is the higher upfront installation cost, along with the need for trained professionals who understand industrial insulation standards. Many facility owners delay upgrades because improper installation can cause energy leaks, moisture damage, corrosion, or fire risk, increasing long-term expenses.

Small and medium businesses often choose temporary fixes instead of full insulation work due to cash-flow limits, maintenance downtime, or uncertainty about payback time. Even though supportive programs are emerging, some buyers still perceive insulation as a cost rather than an efficiency asset.

At the same time, financial aid exists, including Commerce awarding $55.5 million to help building owners meet Clean Building Performance Standards, but adoption hesitation persists among cost-sensitive users.

Growth Opportunity

Expansion Through New Public Infrastructure and Retrofits

A major growth opportunity for the Technical Insulation Market is the expansion of large public and institutional buildings, along with the rising need for retrofitting old facilities to improve energy performance and lower running costs.

Many hospitals, universities, airports, research buildings, and commercial campuses are preparing to update mechanical systems, heating and cooling pipelines, and indoor climate equipment to meet modern efficiency and safety expectations.

However, delays and funding gaps in some institutions highlight the importance of cost-efficient insulation solutions and phased upgrades, as seen when UNC paused a $228M facility amid funding woes. This situation opens doors for technical insulation suppliers to offer modular, faster-install, and maintenance-friendly options that support long-term utility savings and reduce operational risks.

Latest Trends

Smart, Sustainable and Retrofit-Ready Insulation Solutions

A key latest trend in the Technical Insulation Market is the shift toward smart, sustainable, and retrofit-ready insulation systems designed for old and new buildings, without long shutdown times. Users are moving toward materials that deliver stronger thermal control, easy installation, lower maintenance, and longer life under commercial and industrial load conditions.

Digital-enabled inspection, moisture-resistant designs, and fire-safe formulations are becoming central to new purchasing decisions. Urban renewal and downtown redevelopment plans are also supporting insulation demand, especially where older structures must meet modern energy standards.

This aligns with financial support, such as Commerce offering $1.5M in HEAL grants to revitalize downtown buildings, encouraging better building performance, comfort, and long-term operating savings while preserving existing infrastructure.

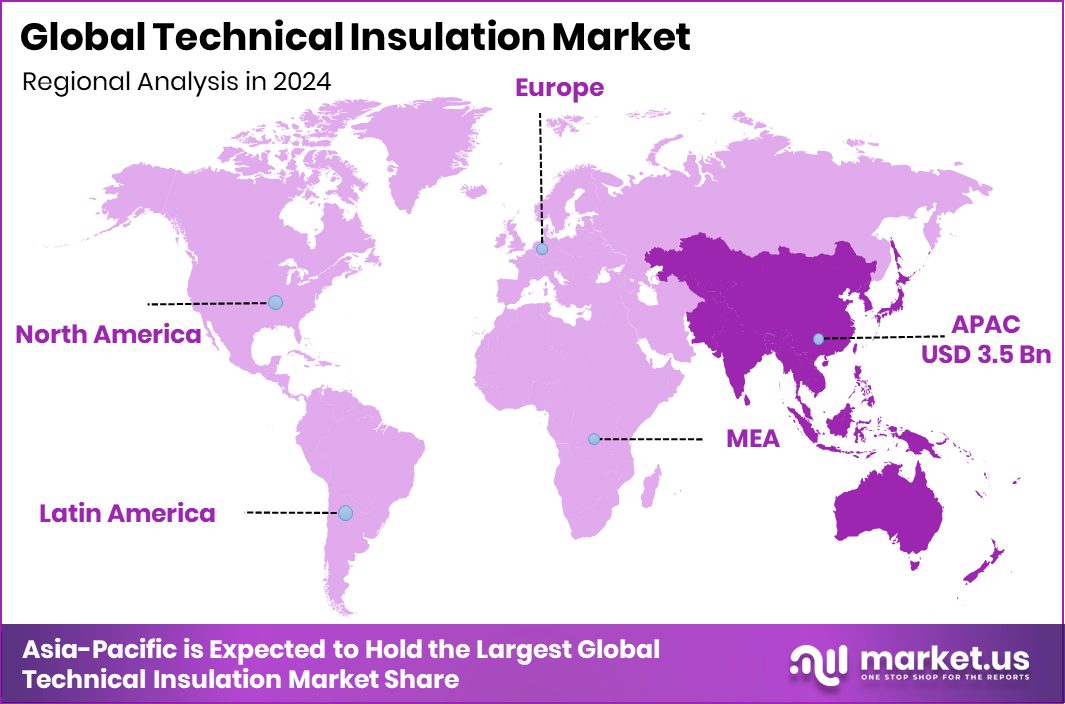

Regional Analysis

Asia Pacific leads the Technical Insulation Market with 37.4% dominant value globally today.

Asia Pacific dominated the Technical Insulation Market with a strong 37.4% share and an estimated value of USD 3.5 Bn, reflecting large industrial use across power, manufacturing, and commercial building systems. The region benefited from strong installation activity across HVAC, process pipelines, and heat-controlled industrial assets, supported by continuous infrastructure upgrades. This leadership also aligns with high construction and energy-efficiency adoption across expanding urban and industrial hubs, giving the Asia Pacific a clear leading position among global regions.

North America showed stable interest driven by commercial retrofitting, industrial maintenance cycles, and building comfort upgrades in heating and cooling systems. Demand was also shaped by professional installation standards and replacement requirements within old equipment, which encouraged insulation use across operational facilities. Europe focused more on thermal control in buildings, district energy systems, and regulated safety frameworks, supporting the use of insulation in controlled temperature environments.

The Middle East & Africa adopted insulation mainly in energy-intensive environments, industrial facilities, and temperature-sensitive structures where heat exposure is common, resulting in focused but steady demand. Latin America experienced gradual installation activity through industrial and commercial upgrades, influenced by maintenance priorities and the gradual adoption of insulation for cost-efficiency, overall equipment protection, and long-term operating performance.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Zotefoams Plc maintains its market relevance through its expertise in advanced polymer foam technologies, where lightweight, durable, and controlled-cell structures are used to improve thermal stability and energy efficiency. Its technical material approach aligns with insulation needs for industrial, transportation, and controlled-temperature systems. The company’s focus on performance-driven solutions keeps it competitive in technical insulation environments that demand consistency and precision.

Owens Corning brings a strong portfolio reputation in high-performance insulation materials built around thermal protection, energy management, and equipment efficiency. The company’s strength lies in engineered material knowledge combined with a long-term focus on improving heat resistance, durability, and installation ease. Its positioning aligns well with large-volume industrial, HVAC, and infrastructure-driven insulation requirements.

Kingspan Group Plc demonstrates strong strategic alignment through its focus on high-performance insulation and building envelope solutions. The company’s role is visible in delivering thermally efficient and safety-oriented materials, targeting energy-efficient environments across large commercial and industrial facilities. Its strategic positioning supports long-term insulation value where sustainability, design reliability, and operational durability matter.

Top Key Players in the Market

- Zotefoams Plc

- Owens Corning

- Kingspan Group Plc

- Rockwool International A/S

- Recticel NV/SA

- Morgan Advanced Materials plc

- Armacell International S.A.

- Aspen Aerogels, Inc.

- Knauf Insulation

- Saint-Gobain

- Palziv Inc.

Recent Developments

- In September 2025, Zotefoams unveiled an innovation plan, committing £6.8 million over three years to establish three innovation hubs (including a global hub at Croydon and a footwear hub in South Korea) to accelerate product development in insulation and foam technologies.

- In September 2024, Owens Corning showcased its insulation innovations at Gastech 2024 in Houston, introducing new cryogenic piping insulation systems for LNG and very low-temperature industrial use.

Report Scope

Report Features Description Market Value (2024) USD 9.5 Billion Forecast Revenue (2034) USD 13.9 Billion CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hot Insulation, Cold-Flexible Insulation, Cold-Rigid Insulation), By Application (Heating and Plumbing, HVAC, Acoustic, Refrigeration), By End-use (Industrial and OEM, Energy, Commercial Buildings) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Zotefoams Plc, Owens Corning, Kingspan Group Plc, Rockwool International A/S, Recticel NV/SA, Morgan Advanced Materials plc, Armacell International S.A., Aspen Aerogels, Inc., Knauf Insulation, Saint-Gobain, Palziv Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Technical Insulation MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Technical Insulation MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zotefoams Plc

- Owens Corning

- Kingspan Group Plc

- Rockwool International A/S

- Recticel NV/SA

- Morgan Advanced Materials plc

- Armacell International S.A.

- Aspen Aerogels, Inc.

- Knauf Insulation

- Saint-Gobain

- Palziv Inc.