Global Synthetic Resin Market Size, Share Analysis Report By Form (Solid, Liquid, Emulsion, Dispersion), By Product Type (Thermosetting Resin, Thermoplastic Resin), By Application (Packaging, Printing Inks, Pipes and Hoses, Sheets and Films, Paints and Coatings, Adhesives and Sealants, Electronic Fabrications, Transportation Components, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161314

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

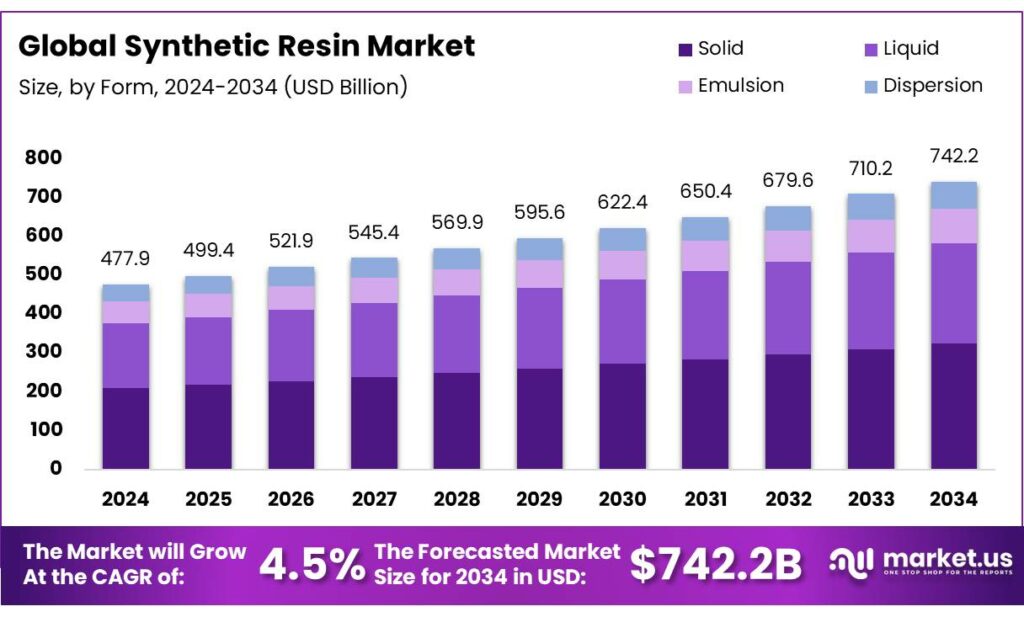

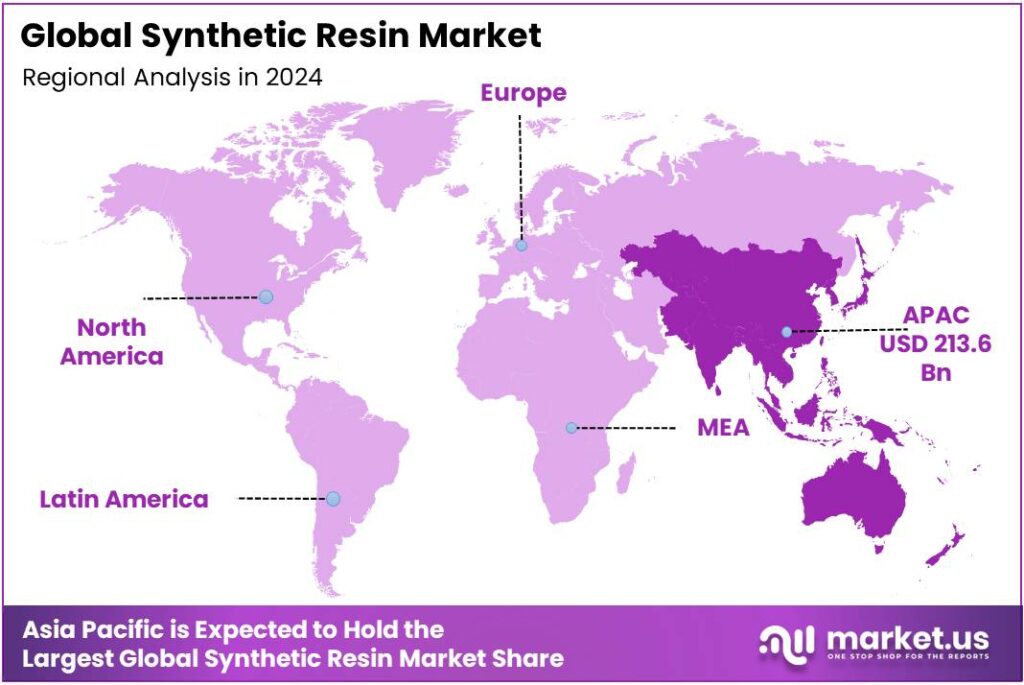

The Global Synthetic Resin Market size is expected to be worth around USD 742.2 Billion by 2034, from USD 477.9 Billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 46.8% share, holding USD 0.8 Billion in revenue.

Synthetic resin is a category of man-made polymers that are primarily used as a binder, adhesive, or coating material in various industrial applications. They are typically derived from petroleum-based or natural gas sources through chemical processes and are characterized by their durability, versatility, and ability to be molded into a wide range of shapes and forms. Synthetic resins are crucial in industries such as automotive, construction, electronics, packaging, and consumer goods, due to their ability to provide high performance in areas like strength, chemical resistance, and heat stability.

Petrochemical feedstocks remain a significant driver of oil demand — petrochemical use accounted for roughly 12% of global oil demand in prior IEA assessments — and the chemicals segment has been reported to grow at approximately 3.0% annually over the last decade for high-value chemicals, underscoring the structural linkage between energy markets and resin output. Production concentration is notable: China, the United States and the Middle East together account for an estimated 57% of global chemical production, which translates into supply-side advantages for resin outputs in those regions.

Public policy and industry initiatives are influencing future trajectories. The European Union has implemented plastics and packaging directives with targets that aim for all packaging to be recyclable by 2030 and specific packaging-waste reduction targets, thereby increasing demand for recyclable resin solutions and alternative material systems. At the same time, the climate impact of primary plastic production has been highlighted — primary plastics production was estimated to have generated ~2.24 GtCO₂e in 2019 — motivating decarbonisation and material-efficiency measures across the value chain.

Future growth opportunities will be concentrated in specialty and recycled resins, higher-value formulations for EVs and electronics, and investments in chemical recycling and bio-refining. Planned chemical recycling investment in Europe is reported to increase from EUR 2.6 billion in 2025 to EUR 8 billion by 2030, supplying an estimated 2.8 Mt of recycled plastics by 2030 and creating feedstock that will be integrated into resin manufacture.

Energy-chemical players are repositioning capital accordingly — for example, investments of the order of €2 billion by a leading energy conglomerate have been announced to pivot chemical operations toward bio-refining and advanced recycling. These trends imply that resin producers with technology for recycled content, low-carbon feedstocks, and high-performance specialties will capture disproportionate value as markets are restructured by policy and end-user requirements.

Key Takeaways

- Synthetic Resin Market size is expected to be worth around USD 742.2 Billion by 2034, from USD 477.9 Billion in 2024, growing at a CAGR of 4.5%.

- Solid held a dominant market position, capturing more than a 43.7% share in the global synthetic resin market.

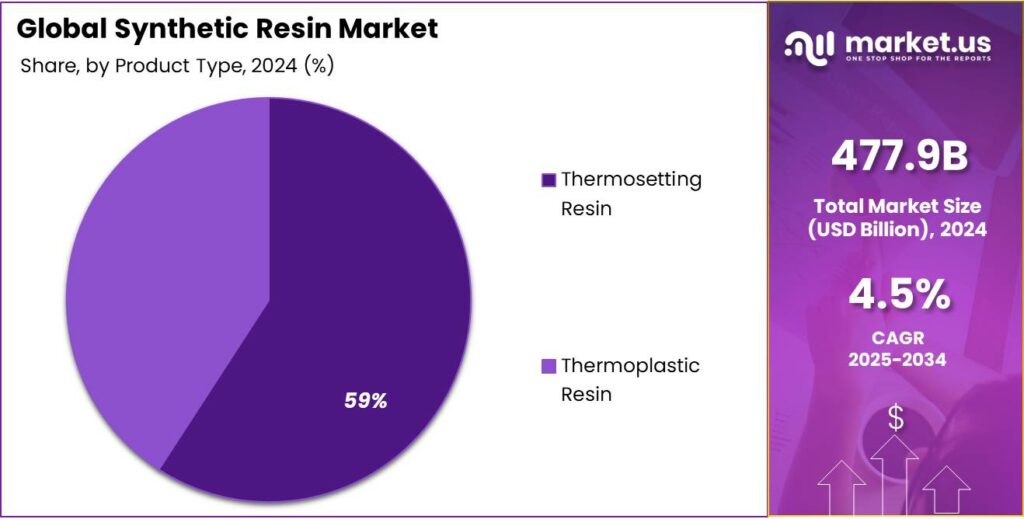

- Thermosetting Resin held a dominant market position, capturing more than a 59.4% share of the global synthetic resin market.

- Packaging held a dominant market position, capturing more than a 23.8% share in the global synthetic resin market.

- Asia Pacific held a dominant position in the global synthetic resin market, capturing approximately 44.7% of the total market share, valued at around USD 213.6 billion.

By Form Analysis

Solid Form Dominates the Market with 43.7% Share in 2024 Owing to Its Superior Versatility and Cost Efficiency

In 2024, Solid held a dominant market position, capturing more than a 43.7% share in the global synthetic resin market. The segment’s strong performance can be attributed to its high adaptability across diverse industries such as packaging, construction, and automotive manufacturing. Solid synthetic resins are preferred due to their excellent mechanical strength, durability, and ease of processing, which make them ideal for producing films, molded parts, and coatings.

The industrial preference for solid resins in 2024 was driven by the growing need for lightweight yet robust materials that ensure long product life and reduced maintenance costs. Industries focusing on cost optimization have increasingly shifted toward solid resins as they offer superior yield and recyclability compared to liquid counterparts. Additionally, their stable form allows easier storage and transportation, reducing logistical challenges for manufacturers and distributors.

By Product Type Analysis

Thermosetting Resin Leads the Market with 59.4% Share Driven by Its High Strength and Heat Resistance

In 2024, Thermosetting Resin held a dominant market position, capturing more than a 59.4% share of the global synthetic resin market. This dominance can be attributed to its exceptional mechanical strength, heat resistance, and structural stability, which make it a preferred material in industries such as automotive, construction, and electronics. Thermosetting resins, once cured, do not soften upon heating, which gives them a distinct advantage over thermoplastics in applications requiring durability and dimensional stability. Their widespread use in coatings, adhesives, and composite materials further reinforced their strong market presence during the year.

Looking ahead to 2025, the demand for thermosetting resins is projected to remain robust due to the expanding infrastructure and transportation sectors. Growing investments in lightweight automotive components and high-performance electrical systems are expected to further drive adoption. Additionally, advancements in resin formulations that improve sustainability and recyclability are enhancing their market acceptance. The segment’s continued growth reflects an industry-wide preference for materials that combine strength, reliability, and resistance to extreme conditions, securing thermosetting resin’s leading role in the global synthetic resin landscape.

By Application Analysis

Packaging Dominates the Market with 23.8% Share Owing to Rising Demand for Lightweight and Durable Materials

In 2024, Packaging held a dominant market position, capturing more than a 23.8% share in the global synthetic resin market. The segment’s strong performance was primarily driven by the increasing use of synthetic resins in flexible and rigid packaging solutions for food, beverages, pharmaceuticals, and consumer goods. The material’s excellent strength, moisture resistance, and formability have made it a preferred choice for manufacturers aiming to enhance product safety and shelf life. Growing consumer demand for convenient, lightweight, and cost-efficient packaging has further accelerated the use of synthetic resins across both developed and emerging markets.

By 2025, the packaging segment is expected to continue expanding, supported by the growth of e-commerce, urbanization, and the global shift toward sustainable packaging materials. The development of recyclable and bio-based resins is also gaining momentum, as companies respond to stricter environmental regulations and changing consumer preferences. Additionally, innovations in high-barrier films and resin-based coatings are improving product protection and reducing material waste. As a result, the packaging segment is likely to maintain its leadership position, playing a vital role in driving overall growth in the synthetic resin market over the coming years.

Key Market Segments

By Form

- Solid

- Liquid

- Emulsion

- Dispersion

By Product Type

- Thermosetting Resin

- Epoxy Resins

- Phenolic Resins

- Polyurethane Resins

- Polyester Resins

- Others

- Thermoplastic Resin

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Polycarbonate

- Polyethylene Terephthalate

- Nylon

- Others

By Application

- Packaging

- Printing Inks

- Pipes & Hoses

- Sheets & Films

- Paints & Coatings

- Adhesives & Sealants

- Electronic Fabrications

- Transportation Components

- Others

Emerging Trends

Adoption of Sustainable and Bio-Based Synthetic Resins

The synthetic resin industry in India is experiencing a significant transformation, with a growing emphasis on sustainability and the adoption of bio-based materials. This shift is driven by increasing environmental awareness, regulatory pressures, and consumer demand for eco-friendly products.

This trend is evident in the packaging sector, which led the synthetic resin market with a 42.6% revenue share in 2024. The demand for sustainable packaging solutions is escalating due to the rise of e-commerce and increasing consumer preference for eco-friendly products. Flexible films and rigid containers made from resins like polyethylene terephthalate (PET) and biaxially oriented polypropylene (BOPP) offer excellent barrier properties, extending shelf life and reducing food waste. In North America, the rising adoption of mono-material packaging to meet recycling targets has increased demand for high-purity resin grades

Government initiatives play a pivotal role in promoting the adoption of sustainable synthetic resins. In India, the Plastic Waste Management Rules incentivize investment in biodegradable and recyclable resin technologies. These regulations encourage manufacturers to develop and adopt resins that are not only efficient but also environmentally friendly. Additionally, the government’s focus on infrastructure development and urbanization is driving the demand for synthetic resins in construction and automotive applications, further accelerating the shift towards sustainable materials

The automotive industry is also contributing to this trend by adopting lightweight thermoplastics like polyamide and polycarbonate blends to reduce vehicle weight and meet stringent fuel-efficiency targets. These materials offer excellent mechanical strength, heat resistance, and electrical insulation properties, making them ideal for battery enclosures, structural components, and interior parts. This shift not only enhances vehicle performance but also aligns with global sustainability goals

Drivers

Advancements in Resin Technology: A Catalyst for Industry Growth

The synthetic resin industry has witnessed remarkable growth, largely propelled by continuous advancements in resin technology. These innovations have significantly enhanced the performance, efficiency, and sustainability of synthetic resins, making them indispensable across various sectors.

One of the most notable developments is the improvement in the thermal stability and chemical resistance of synthetic resins. For instance, epoxy resins have evolved to offer superior adhesion and resistance to environmental factors, making them ideal for demanding applications in industries such as automotive, aerospace, and electronics. These advancements ensure that products maintain their integrity and performance over extended periods, even under harsh conditions.

Moreover, the push towards sustainability has led to the creation of bio-based and recyclable resins. Manufacturers are increasingly focusing on reducing the environmental impact of synthetic resins by developing materials derived from renewable resources and improving recycling processes. This shift not only aligns with global environmental goals but also meets the growing consumer demand for eco-friendly products.

Technological innovations have also streamlined the manufacturing processes of synthetic resins. Advanced polymerization techniques have enhanced the efficiency of resin production, leading to cost reductions and increased scalability. These improvements enable manufacturers to meet the rising demand across various industries without compromising on quality or performance.

Restraints

Environmental Impact and Recycling Challenges of Synthetic Resins

One of the most pressing challenges facing the synthetic resin industry today is its significant environmental impact, particularly concerning plastic pollution and the limitations of recycling systems. Synthetic resins, such as polyethylene, polypropylene, and polystyrene, are widely used across various sectors, including packaging, automotive, and construction. However, their widespread use has led to substantial environmental concerns.

Globally, plastic production has escalated dramatically, with over 400 million metric tons produced annually as of 2023. Despite this high production rate, the recycling of plastic materials remains inefficient. Studies indicate that only about 9% of plastic waste is recycled, while approximately 79% accumulates in landfills or the natural environment, contributing to long-term pollution.

The challenges in recycling synthetic resins are multifaceted. One significant issue is the contamination of plastic waste with food residues, adhesives, and other materials, which complicates the recycling process. Additionally, the presence of various additives in synthetic resins, such as plasticizers and flame retardants, can hinder the recycling process and may pose health risks.

The infrastructure for plastic recycling is often inadequate. In the United States, for example, only 53% of the population has access to curbside recycling programs, and multifamily households have even less access, at just 37%. This limited access to recycling facilities exacerbates the problem of plastic waste accumulation.

Addressing these challenges requires a concerted effort from both the industry and governments. Governments can play a pivotal role by implementing policies that promote recycling, such as providing incentives for the use of recycled materials and investing in recycling infrastructure. For instance, the U.S. Environmental Protection Agency has set a national recycling goal to increase the recycling rate to 50% by 2030

Opportunity

Government Initiatives and Sustainable Growth in Synthetic Resin

One of the most promising growth opportunities for the synthetic resin industry lies in the increasing emphasis on sustainability and the adoption of eco-friendly materials. Governments worldwide are implementing policies and initiatives that encourage the development and use of sustainable resins, providing a significant boost to the industry.

In the United States, the Environmental Protection Agency (EPA) has introduced several programs aimed at reducing plastic waste and promoting recycling. For instance, the EPA’s Sustainable Materials Management (SMM) program focuses on reducing the environmental impact of materials, including synthetic resins, throughout their lifecycle. This initiative encourages manufacturers to design products with longer lifespans and easier recyclability, thereby reducing waste and conserving resources.

Similarly, the European Union has established the Circular Plastics Alliance, which aims to increase the recycling rate of plastics, including synthetic resins, to 10 million tons per year by 2025. This ambitious goal is supported by legislation that mandates higher recycling targets and promotes the use of recycled materials in new products. Such policies not only help in managing plastic waste but also create a market for recycled synthetic resins, encouraging manufacturers to invest in sustainable practices.

These government initiatives are complemented by technological advancements in resin production. Researchers are developing bio-based synthetic resins derived from renewable resources such as plant oils and agricultural waste. These bio-based resins offer comparable performance to traditional petroleum-based resins but with a lower environmental footprint.

Regional Insights

Asia Pacific Leads the Synthetic Resin Market with 44.7% Share Valued at USD 213.6 Billion

In 2024, Asia Pacific held a dominant position in the global synthetic resin market, capturing approximately 44.7% of the total market share, valued at around USD 213.6 billion. This strong regional dominance is primarily attributed to the rapid expansion of manufacturing, construction, automotive, and packaging industries across major economies such as China, India, Japan, and South Korea. The region’s industrial output has grown consistently, with China alone accounting for nearly 30% of global plastics and resin production, supported by large-scale polymer manufacturing facilities and favorable trade policies.

The market in Asia Pacific is benefiting from increasing urbanization, infrastructural development, and rising consumer spending on packaged goods and automobiles. The demand for thermosetting and solid-form resins has also increased due to their superior strength, cost-effectiveness, and compatibility with large-volume manufacturing processes.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE, headquartered in Germany, is a global leader in the chemical industry, renowned for its extensive portfolio of synthetic resins. In 2024, BASF’s strategic focus on innovation and sustainability bolstered its position in the resin market. The company emphasized the development of high-performance resins for automotive, construction, and packaging applications. BASF’s commitment to reducing carbon emissions and enhancing product recyclability aligns with the growing demand for eco-friendly materials. Through continuous research and development, BASF aims to meet the evolving needs of its global customer base while contributing to environmental sustainability.

SABIC, a Saudi Arabian multinational, is a significant player in the global synthetic resin market. In 2024, the company reported a net profit of 1.54 billion riyals, reflecting its resilience amidst market challenges. SABIC’s strategic investments focus on expanding its resin production capabilities and enhancing product offerings to meet diverse industrial requirements. The company’s emphasis on innovation and operational efficiency positions it well to capitalize on emerging market opportunities in the synthetic resin sector.

Covestro AG, based in Germany, specializes in high-performance polymers and resins. In 2024, Covestro’s commitment to sustainability and innovation in resin production was evident through its development of eco-friendly materials and advanced manufacturing processes. The company’s focus on circular economy principles and reducing carbon footprint aligns with the increasing demand for sustainable resin solutions across various industries, including automotive, electronics, and construction. Covestro’s strategic initiatives aim to strengthen its position in the global synthetic resin market.

Top Key Players Outlook

- BASF SE

- SABIC

- Covestro AG

- Mitsubishi Chemical Group Corporation

- LG Chem

- Sumitomo Chemical Co., Ltd.

- Arkema S.A.

- DSM-Firmenich

- Dow Inc.

- DuPont de Nemours, Inc.

- Westlake Chemical Corporation

Recent Industry Developments

In 2024, SABIC continued to strengthen its position in the global synthetic resin market through strategic expansions and technological advancements. The company reported a net profit of 1.54 billion riyals, reflecting its resilience amidst market challenges.

In 2024, Covestro AG, a leading global supplier of high-performance polymers, continued to strengthen its position in the synthetic resin market by focusing on innovation and strategic expansion. The company reported a revenue of €14.2 billion for the year, reflecting its commitment to delivering value through sustainable and advanced material solutions.

Report Scope

Report Features Description Market Value (2024) USD 477.9 Bn Forecast Revenue (2034) USD 742.2 Bn CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Solid, Liquid, Emulsion, Dispersion), By Product Type (Thermosetting Resin, Thermoplastic Resin), By Application (Packaging, Printing Inks, Pipes and Hoses, Sheets and Films, Paints and Coatings, Adhesives and Sealants, Electronic Fabrications, Transportation Components, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, SABIC, Covestro AG, Mitsubishi Chemical Group Corporation, LG Chem, Sumitomo Chemical Co., Ltd., Arkema S.A., DSM-Firmenich, Dow Inc., DuPont de Nemours, Inc., Westlake Chemical Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- SABIC

- Covestro AG

- Mitsubishi Chemical Group Corporation

- LG Chem

- Sumitomo Chemical Co., Ltd.

- Arkema S.A.

- DSM-Firmenich

- Dow Inc.

- DuPont de Nemours, Inc.

- Westlake Chemical Corporation