Global Surgical Scissors Market Analysis By Product Type (Disposable, Reusable), By Material (Stainless steel, Titanium, Tungsten-carbide, Others), By Surgical Specialty (General surgery, Plastic surgery & reconstructive, Ophthalmic/Microsurgery, Minimally invasive/Laparoscopic procedures, Others), By End-User (Hospitals, Ambulatory surgical centres, Specialty clinics, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167092

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

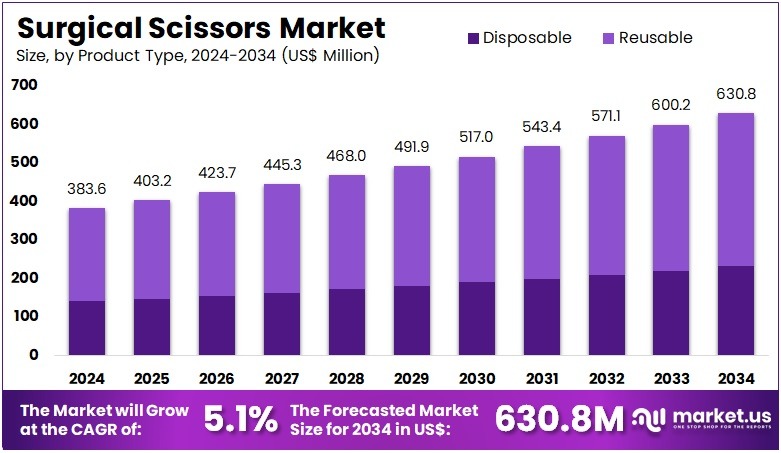

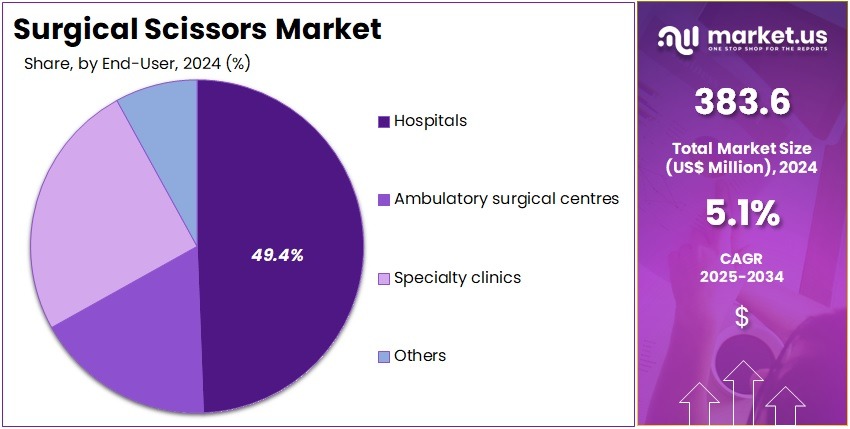

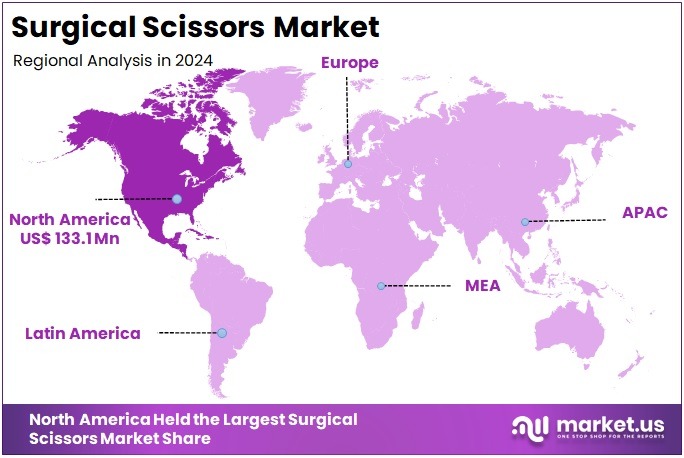

The Global Surgical Scissors Market size is expected to be worth around US$ 630.8 Million by 2034, from US$ 383.6 Million in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 34.4% share and holds US$ 133.1 Million market value for the year.

Surgical scissors are used across a wide range of medical procedures. Their precision cutting ability supports safe handling of tissues and sutures. These instruments are made from stainless steel or titanium to enhance durability and corrosion resistance. According to product studies, this material selection improves handling performance and supports efficient sterilization for repeated use.

Demand for surgical scissors has grown steadily due to increasing global surgical activity. Surgical procedures form a critical part of modern healthcare delivery. The rise in chronic diseases and improved access to care increases the overall surgical load. According to the World Health Organization, nearly 234 million surgeries take place every year. A study by the Lancet Commission earlier estimated around 313 million procedures annually.

Operating-room efficiency improvements also influence market expansion. Health systems are adopting less invasive approaches and faster recovery models. These advancements support higher patient turnover and more frequent use of surgical tools. For example, OECD data indicate rising surgery rates per 100,000 population and substantial growth in same-day procedures as hospitals adopt minimally invasive methods.

Ageing populations further reinforce long-term demand for surgical instruments. Older adults face higher incidence of conditions such as cataracts, osteoarthritis, and cardiovascular disease. These conditions often require surgical intervention, increasing reliance on scissors. A study projected that surgical workloads could increase by 14–47% as populations age, creating sustained demand across specialties.

Evolving Trends and Long-Term Demand Outlook

Expanding access to surgery in low- and middle-income countries creates new market opportunities. Many regions still face substantial gaps in healthcare infrastructure. As investment increases, more operating rooms and trained teams are being added. According to global health assessments, many LMICs perform only 877 operations per 100,000 people, compared with the 5,000 benchmark set by the Lancet Commission.

Minimally invasive and robotic procedures are also reshaping demand patterns. Hospitals are shifting toward techniques that reduce recovery time and improve outcomes. These methods require specialised instruments with long shafts and high precision. For instance, historical reviews show MIS has grown “exponentially” since the 1980s, increasing adoption of advanced laparoscopic scissors and robotic end-effectors.

Infection-control requirements significantly affect purchasing decisions. Healthcare providers must meet strict sterilization standards to prevent complications. Scissors used in sterile fields must maintain sharpness and structural integrity after repeated sterilization. According to WHO, surgical site infections reach 11% in some settings, prompting facilities to invest in high-quality, corrosion-resistant instruments.

Rising health expenditure also strengthens the market outlook. Many countries are increasing investment in hospitals and surgical services. This financial growth enables continuous upgrades of essential instruments, including scissors. According to WHO, global health spending reached US$9.8 trillion in 2021, equal to 10.3% of GDP. For example, US national health expenditure rose to US$4.9 trillion in 2023, supporting ongoing equipment replacement and modernization.

Key Takeaways

- The global surgical scissors market was projected to reach US$ 630.8 million by 2034, rising from US$ 383.6 million in 2024 at a 5.1% CAGR.

- The reusable category was noted as the leading product type in 2024, accounting for over 63.3% of total market share.

- Stainless steel material was highlighted as the strongest contributor in 2024, representing more than 32.1% of the overall market distribution.

- General surgery applications were recognized as the leading specialty segment in 2024, securing a share exceeding 26.8% of the market.

- Hospitals remained the primary end-user group in 2024, capturing over 49.4% of the demand for surgical scissors.

- North America maintained its leading regional position in 2024, holding more than 34.4% share valued at approximately US$ 133.1 million.

Product Type Analysis

In 2024, the Reusable held a dominant market position in the Product Type Segment of the Surgical Scissors Market, and captured more than a 63.3% share. This leadership was supported by strong durability and high precision. Reusable designs allowed repeated sterilization. Their use aligned with strict surgical protocols. Hospitals favored these tools for long-term cost efficiency. Demand was also reinforced by stable supply chains and improved material quality. This trend continued across major regions.

The growth of the reusable category was encouraged by advancements in stainless-steel grades and refined manufacturing processes. These improvements increased cutting accuracy and enhanced mechanical strength. Healthcare facilities adopted reusable scissors to ensure consistent performance during complex procedures. Standardized sterilization practices supported safer handling. Cost benefits accumulated over time, which further strengthened hospital preference. This segment also benefited from regulatory focus on quality assurance, which created a stable environment for sustained adoption.

The disposable segment maintained steady demand due to its role in infection prevention. Single-use designs reduced contamination risks. Outpatient centers and emergency units favored disposable scissors for fast patient turnover. Their low initial cost encouraged wider usage in resource-limited settings. Improved packaging solutions supported easier storage. Consistent availability ensured reliable supply during peak demand periods. Both product types continued to shape the market, driven by operational needs, safety standards, and cost-related considerations.

Material Analysis

In 2024, the ‘Stainless steel’ held a dominant market position in the Material Segment of the Surgical Scissors Market, and captured more than a 32.1% share. Its use was supported by strong durability and reliable corrosion resistance. The material helped maintain sharp edges. It improved precision in routine and complex procedures. Its cost efficiency encouraged broad adoption across hospitals and surgical centers. A wide range of stainless steel grades also strengthened its presence.

Titanium held a notable share due to its light weight and strong biocompatibility. The material reduced surgeon fatigue. It also resisted rust and chemical damage. These traits supported its use in microsurgeries. Tungsten-carbide showed high hardness and long edge retention. It improved cutting efficiency in dense tissues. Its inserts increased instrument life. These benefits supported adoption in orthopedic, cardiovascular, and reconstructive procedures. Demand for both materials continued to rise in advanced surgical settings.

The ‘Others’ segment included polymer materials and hybrid metal designs. These options addressed specific surgical needs. Their use was supported by flexible design features. Improved ergonomics enhanced handling. Adoption remained limited but steady. Product development encouraged gradual acceptance. These materials were used in specialized procedures. Their growth was influenced by rising interest in customized instruments. Continued innovation was expected to expand their role in advanced surgical practices. Future demand is projected to rise with ongoing advancements.

Surgical Specialty Analysis

In 2024, the ‘General surgery’ held a dominant market position in the Surgical Specialty Segment of the Surgical Scissors Market, and captured more than a 26.8% share. This lead was driven by high procedure volume and broad clinical use. Demand increased due to rising abdominal and trauma surgeries. Hospitals preferred precise cutting tools to support consistent surgical outcomes. Growth was also supported by better access to surgery in developing regions. These factors strengthened the position of general surgery in the global market.

Plastic and reconstructive surgery formed the next major segment. Growth was supported by a steady rise in cosmetic and restorative procedures. Surgeons required fine and sharp scissors to achieve accurate soft-tissue work. This need increased product demand. Ophthalmic and microsurgery also expanded. Growth in cataract and retinal cases supported the use of ultra-fine scissors. Advancements in microscopes and microsurgical tools improved accuracy. These improvements increased adoption across eye care centers and specialty clinics.

Minimally invasive and laparoscopic procedures continued to gain traction. Surgeons preferred long-shaft and precision-engineered scissors for controlled cutting. Patient preference for faster recovery supported the rise of these procedures. Technological progress in endoscopic tools improved reliability. Other specialties, including orthopedic, cardiovascular, and neurological surgery, added steady demand. These fields relied on specialty scissors designed for delicate tissue handling. Overall, demand across surgical specialties was driven by procedural volume, accuracy needs, and continuous improvements in surgical instrument design.

End-User Analysis

In 2024, the ‘Hospitals’ held a dominant market position in the End-User Segment of the Surgical Scissors Market, and captured more than a 49.4% share. Hospitals recorded the highest usage due to a large volume of surgical procedures. Strong investments in surgical tools supported demand. The focus on patient safety increased the use of high-quality scissors. Adoption of reusable and disposable types grew steadily. Hospitals continued to drive overall market revenue through broad procedure coverage and consistent equipment upgrades.

Ambulatory surgical centres showed firm growth. The rise in outpatient surgeries supported higher consumption of precise cutting tools. These centres used surgical scissors to improve procedure speed and reduce turnaround time. Demand increased due to a shift toward minimally invasive surgeries. ASCs preferred durable, easy-to-sterilize instruments. Their focus on efficiency strengthened product adoption. Growing patient preference for same-day care also contributed to the expansion of this segment in many regions.

Specialty clinics recorded moderate but rising demand. Clinics offering dermatology, ophthalmology, orthopedics, and plastic surgery relied on specialized scissors. The segment grew due to increasing demand for targeted procedures. Clinics selected premium materials to ensure accuracy and clean incisions. The expansion of clinic networks supported steady adoption. Research units and training centres also contributed through routine practice and educational procedures. The combined effect of specialized care, training programs, and clinic expansion maintained growth across this segment.

Key Market Segments

By Product Type

- Disposable

- Reusable

By Material

- Stainless steel

- Titanium

- Tungsten-carbide

- Others

By Surgical Specialty

- General surgery

- Plastic surgery & reconstructive

- Ophthalmic/Microsurgery

- Minimally invasive/Laparoscopic procedures

- Others

By End-User

- Hospitals

- Ambulatory surgical centres

- Specialty clinics

- Others

Drivers

Greater Surgical Procedure Volumes Worldwide

The growing volume of surgical procedures worldwide has been driving steady demand for precision-based surgical scissors. The rise in chronic illnesses, trauma cases, and age-related disorders has increased the number of patients requiring operative care. As more surgeries are performed across hospitals and ambulatory centers, the routine use of scissors in tissue cutting, dissection, and wound management becomes more frequent. The growth of the market can be attributed to this expanding surgical workload, which supports consistent baseline consumption of reusable and disposable scissors.

The acceleration in surgical activity has been further supported by the rapid expansion of global healthcare access. More countries have strengthened surgical care capacity, which has raised the number of operations conducted each year. As procedural volumes rise, procurement cycles for surgical instruments become more regular. This has created sustained demand across high-volume specialties such as general surgery, orthopedics, and cardiovascular procedures. The trend indicates that rising procedure frequency continues to reinforce the essential role of surgical scissors in modern operating environments.

According to the World Health Organization, many millions of surgical treatments are performed each year, and surgical interventions account for nearly 13% of total disability-adjusted life years. This statistic demonstrates the scale at which surgery contributes to global health needs. For example, the widespread reliance on operative care directly raises demand for core instruments. The use of scissors increases proportionally with procedure numbers, which strengthens consumption trends across healthcare systems. The market is therefore supported by both rising clinical requirements and growing adoption of standardized surgical practices.

A study by The Lancet in 2025 estimated that the unmet need for surgery has reached nearly 160 million procedures annually, highlighting significant gaps yet also indicating future volume growth. For instance, reporting reviewed by World Bank Blogs showed that 123 countries, representing about 56.9% of all nations, had published surgical volume data by 2023, up roughly 70.8% since 2016. According to these assessments, expanding reporting and rising procedure counts signal an expanding demand base for surgical scissors as essential operative tools.

Restraints

Variability And Limitations In Surgical Systems & Procedure Volumes In Low-Income Settings

The global adoption of advanced surgical scissors continues to face restraints in low-income environments where surgical system capacity remains limited. Restricted access to reliable operating theatres, sterilisation units and skilled staff reduces the overall demand for high-end reusable instruments. The growth of the market can be affected by lower procedure throughput, as hospitals in under-resourced regions often prioritise basic surgical tools. These structural gaps create a constrained environment in which premium scissor types are not routinely procured, despite rising global interest in safer and more efficient instruments.

The limitation is further reinforced by significant variability in annual surgical procedure volumes. Study by Annals of Global Health shows that many low- and middle-income countries perform fewer surgeries than the 5,000 procedures per 100,000 population benchmark set for 2030. This gap demonstrates that procedure capacity remains insufficient. Reduced surgical activity restricts routine instrument usage. As a result, investment in higher-grade surgical scissors becomes less feasible. Procurement decisions tend to favour low-cost options because utilisation rates are not high enough to justify premium tools.

Safety concerns also contribute to market restraint in these regions. According to the World Health Organization, mortality linked solely to general anaesthesia can reach one in 150 in some lower-income settings. This figure indicates that surgical systems may lack the safety infrastructure and personnel training necessary for complex procedures. For instance, facilities with elevated perioperative risk often avoid expanding surgical services. Lower procedure frequency subsequently reduces the demand for advanced scissor designs that are typically used in specialised or high-precision operations.

Operational limitations further compound this restraint. For example, restricted sterilisation capacity and inconsistent equipment maintenance increase reliance on basic or disposable instruments rather than durable premium scissors. These systemic conditions limit adoption even when clinical benefits are recognised. Study by several global health groups highlights that hospitals in underserved regions often defer investment in advanced instruments due to budget constraints and inadequate workflow infrastructure. Consequently, market penetration of high-quality surgical scissors remains significantly lower than in well-resourced healthcare systems.

Opportunities

Integration Of Instrument-Tracking And Ai-Assisted Surgical Systems

The opportunity for surgical scissors is expanding as operating rooms adopt digital, automated and data-driven systems. Demand is rising for instruments that not only cut but also support workflow optimization, traceability and safety. The growth of smart-surgery ecosystems indicates that scissors with embedded tracking or data-ready features can deliver operational value. Hospitals aiming to reduce manual counting errors and improve asset visibility are expected to show stronger interest in instruments that integrate seamlessly with their surgical data platforms.

Integration of advanced technologies allows manufacturers to reposition surgical scissors as intelligent assets. Smart designs equipped with RFID, sensors or AI-readiness can support predictive maintenance and structured data collection. This shift aligns with procurement preferences that prioritize efficiency and compliance. For instance, digitally enabled scissors can strengthen sterilization tracking, improve inventory control and reduce time spent on manual verification. The opportunity is therefore rooted in offering added functionality that extends beyond a traditional mechanical instrument.

Evidence from current research supports this direction. According to a 2024 study by BioMed Central, instrument-classification models achieved high accuracy, with surgical scissors reaching a precision of 99.2% and recall of 99.6%. This demonstrates that AI systems can reliably distinguish and track scissors within complex surgical workflows. Such performance levels indicate strong compatibility between existing algorithms and enhanced instrument designs, reinforcing the feasibility of integrating scissors into automated recognition environments used in data-driven operating rooms.

Further momentum is reflected in broader developments in machine learning and surgical data science. Studies emphasise increased use of datasets and algorithms for instrument recognition, tracking and tray optimization. For example, research on surgical-workflow analytics shows that instrument-level data improves efficiency, reduces misplacements and enhances procedural planning. Manufacturers of surgical scissors can leverage these trends by developing AI-compatible models that support real-time identification. This opportunity positions scissors as contributors to smarter, safer and more integrated surgical ecosystems.

Trends

Growth Of Minimally Invasive And Microsurgical Instrumentation Demand

A major trend is emerging in the surgical scissors market. The demand for minimally invasive and microsurgical procedures continues to rise. This shift has led to strong interest in finer and more ergonomic scissor designs. The growth of these procedures has increased expectations for instruments that offer better precision and improved control. As clinical workflows adopt less-invasive approaches, the need for lightweight tools with strong material performance has become more pronounced. This transition is reshaping design priorities within the surgical instrument ecosystem.

The adoption of endoscopic, laparoscopic, and microsurgical techniques has accelerated the requirement for scissors that reduce hand fatigue and enhance accuracy. According to industry observations, surgeons prefer instruments that maintain stability during delicate procedures. Finer blades and optimized handle geometry are now being engineered to meet these expectations. For example, microsurgical platforms are using scissors with enhanced strength-to-weight ratios to achieve consistent performance. The result is a notable movement toward products that support precise tissue handling in restricted anatomical spaces.

A study by global health authorities indicated that the burden of trauma, cardiovascular diseases, and cancer has increased worldwide. These conditions often require surgical intervention, and less-invasive methods are now favored for patient recovery and cost efficiency. According to the World Health Organization, surgical care has become essential for addressing these rising health challenges. For instance, the broader adoption of minimally invasive surgery has created sustained demand for scissor designs compatible with advanced visualization and narrow-access techniques.

As minimally invasive surgery and microsurgery expand across medical specialties, the market demand for high-precision scissors is expected to grow. For example, robotic-assisted procedures require instruments with refined tip geometry and consistent cutting performance. According to various clinical technology assessments, such platforms rely on micro-engineered tools to maintain accuracy during complex movements. This shift suggests that innovation in scissor design will continue to align with the evolution of surgical methods. The trend reflects a long-term transition toward precision-focused instrumentation.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 34.4% share and holds US$ 133.1 Million market value for the year. This lead was supported by strong healthcare infrastructure and steady adoption of advanced surgical tools. Hospitals in the region used high-precision scissors for a wide range of procedures. Demand increased as surgical volumes grew. Strict quality standards also encouraged the use of reliable instruments. These factors together strengthened the region’s overall position.

High usage of surgical services contributed to the region’s market strength. Elective and emergency procedures were performed at a higher rate compared to other regions. This created constant demand for sharp and durable surgical scissors. Short replacement cycles were driven by strict sterilization rules. Clinical practices favored instruments that ensured accuracy and safety. These conditions supported steady procurement across hospitals and surgical centers. As a result, North America remained a key consumer of high-quality scissors.

Innovation played a role in reinforcing the region’s dominance. Facilities adopted premium stainless steel and tungsten carbide scissors at a faster pace. Specialized scissors for cardiovascular, orthopedic, and neurosurgical procedures gained traction. Higher healthcare spending also supported purchasing decisions. Insurance coverage improved access to surgical care. Strong distribution networks ensured consistent product availability. These combined factors created a stable outlook. North America is expected to maintain its lead as demand for advanced surgical scissors continues to rise.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape of the surgical scissors market is shaped by global premium manufacturers and cost-efficient suppliers. German companies such as RUDOLF Medical, KLS Martin Group and B. Braun Melsungen AG strengthen the high-end reusable segment through precision engineering and broad surgical portfolios. Their instruments are valued for sharpness retention and durability. These companies also support specialty-specific requirements, which increases their presence in advanced operating rooms and drives steady adoption of premium surgical scissors across major healthcare facilities.

A group of specialized European producers also contributes to strong market depth. Firms such as SIEMA Scheren-Medizintechnik GmbH and Geister Medizintechnik GmbH focus on craftsmanship and offer extensive design variations. Their catalogs include micro scissors, tungsten-carbide options and coated blades. These manufacturers serve hospitals and distributors that prioritize performance consistency. Their long production heritage supports high reliability. This positioning helps maintain demand in cardiovascular, neurosurgery and minimally invasive procedures, where precise cutting capability and stable instrument handling are essential.

Diversified global medtech companies add further competitiveness. Players such as Becton Dickinson and Company, Stryker Corporation, Integra LifeSciences and Richard Wolf GmbH integrate surgical scissors into broad procedure-based instrument sets. These companies benefit from strong distribution networks and group purchasing contracts. Their scissors are often bundled with laparoscopic, electrosurgical or general surgery systems. This strengthens procurement efficiency for healthcare providers. Their presence ensures stable demand across large hospital networks and supports the expansion of mid- to high-tier product categories.

Specialty-focused suppliers expand innovation in niche segments of the market. Arthrex Inc. offers advanced arthroscopic scissors designed for tight joint spaces and high-strength suture materials. Scanlan International contributes premium microsurgical scissors known for long-term sharpness. Alcon Laboratories dominates the ophthalmic segment with fine intraocular scissors used in delicate eye procedures. IndoSurgical Private Limited supports value-driven markets with cost-effective stainless-steel scissors. Together, these companies broaden the market by serving diverse surgical needs and supporting both premium and budget-aligned purchasing patterns.

Market Key Players

- IndoSurgical Private Limited

- RUDOLF Medical GmbH

- KLS Martin Group

- B Braun Melsungen AG

- SIEMA Scheren‑Medizintechnik GmbH

- Becton Dickinson and Company

- Arthrex Inc.

- Integra LifeSciences Holding Corporation

- Scanlan International Inc.

- Geister Medizintechnik GmbH

- Alcon Laboratories Inc

- Richard Wolf GmbH

- Stryker Corporation

Recent Developments

- In March 2023: KLS Martin Group announced that it had increased global sales by 16.9% in 2022, reaching a new record. The press release attributes this performance to high demand across its portfolio, including surgical instruments and implants, and notes several structural developments: expansion of manufacturing sites, a new logistics centre, and the ongoing integration (and planned legal merger) of previously acquired companies into the group.

- In March 2023: (FY 2022 release) – Investment programme and demand recovery in surgical instruments: In its 2022 fiscal year press release (March 2023), B. Braun reported sales of €8.5 billion, noting that the Aesculap division’s surgical business recovered as elective surgeries resumed, with demand increasing particularly for surgical instruments and suture materials.

- In March 2024: B. Braun announced 2023 fiscal-year results under the headline “B. Braun drives innovation in health care while sales and profit improved”. Sales grew to €8.8 billion (+3.0% vs. prior year), and profit before tax increased by 15.3%. The company reports that the Aesculap division grew strongly, especially in instruments, implants, imaging systems and suture materials, and that B. Braun invested around €1.2 billion in 2023 in production capacity, R&D and new technologies such as robotics and automation.

Report Scope

Report Features Description Market Value (2024) US$ 383.6 Million Forecast Revenue (2034) US$ 630.8 Million CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Disposable, Reusable), By Material (Stainless steel, Titanium, Tungsten-carbide, Others), By Surgical Specialty (General surgery, Plastic surgery & reconstructive, Ophthalmic/Microsurgery, Minimally invasive/Laparoscopic procedures, Others), By End-User (Hospitals, Ambulatory surgical centres, Specialty clinics, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape IndoSurgical Private Limited, RUDOLF Medical GmbH, KLS Martin Group, B Braun Melsungen AG, SIEMA Scheren‑Medizintechnik GmbH, Becton Dickinson and Company, Arthrex Inc., Integra LifeSciences Holding Corporation, Scanlan International Inc., Geister Medizintechnik GmbH, Alcon Laboratories Inc, Richard Wolf GmbH, Stryker Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- IndoSurgical Private Limited

- RUDOLF Medical GmbH

- KLS Martin Group

- B Braun Melsungen AG

- SIEMA Scheren‑Medizintechnik GmbH

- Becton Dickinson and Company

- Arthrex Inc.

- Integra LifeSciences Holding Corporation

- Scanlan International Inc.

- Geister Medizintechnik GmbH

- Alcon Laboratories Inc

- Richard Wolf GmbH

- Stryker Corporation