Global Stump Cutter/Grinder Market Size, Share, And Enhanced Productivity By Product Type (Stand Alone Equipment, Grinder Attachment), By Type (Walk Behind Stump Grinders, Towable Stump Grinders, Compact Stump Grinders, Self-Propelled Stump Grinders), By Tooth Length (Up to 2.5 Inches, 2.5 to 3 Inches, Above 3 Inches), By Engine Type (Gasoline Engine, Diesel Engine, Electric Engine), By Cutting Mechanism (Horizontal Cutting, Vertical Cutting, Disc Cutting), By End-Use (Forest Areas, Agricultural Lands, Public and Private Parks, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 178165

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Type Analysis

- By Type Analysis

- By Tooth Length Analysis

- By Engine Type Analysis

- By Cutting Mechanism Analysis

- By End-Use Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

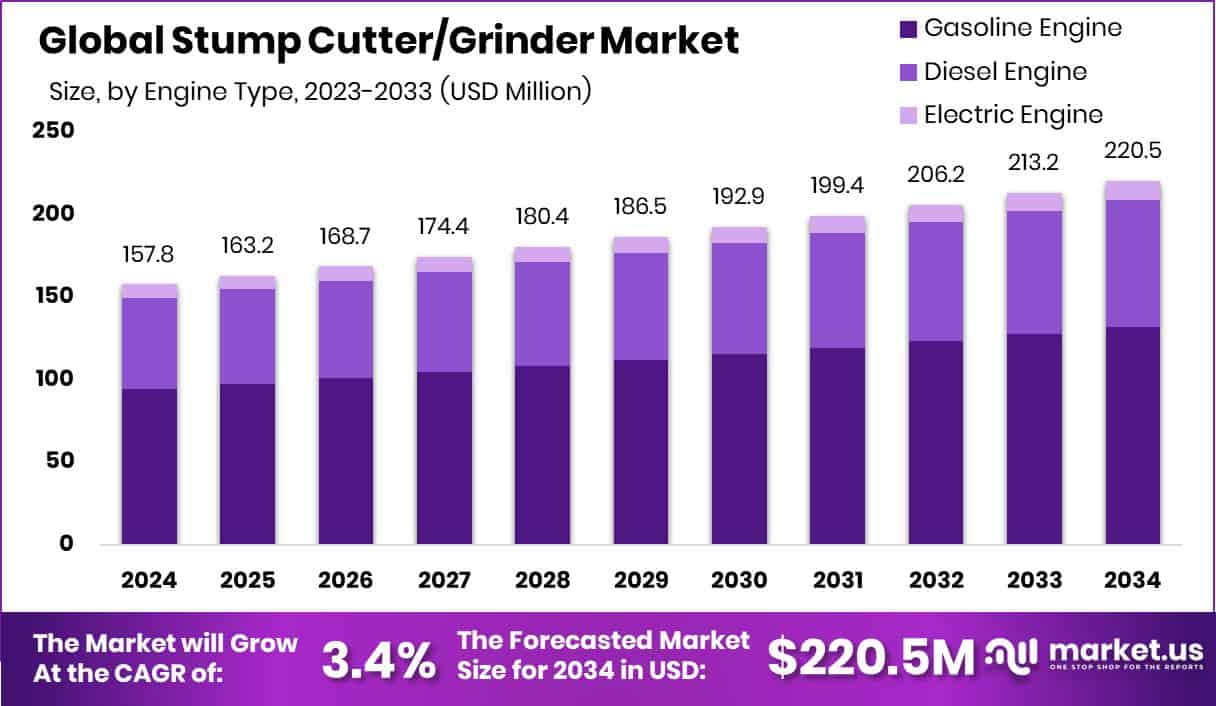

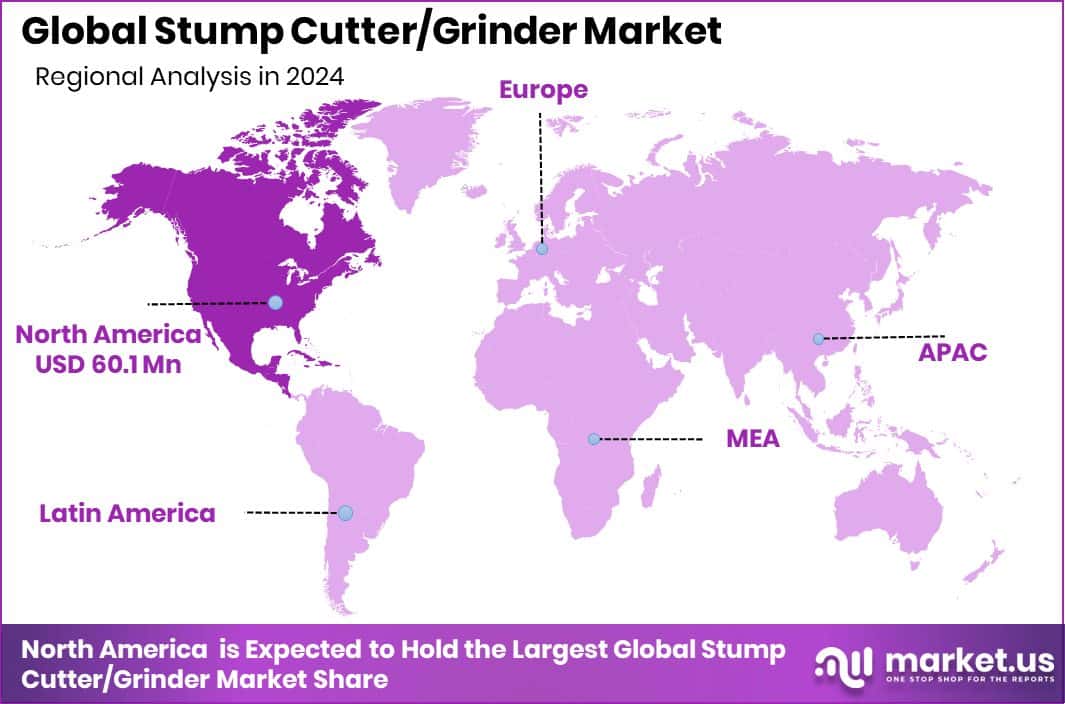

The Global Stump Cutter/Grinder Market is expected to be worth around USD 220.5 million by 2034, up from USD 157.8 million in 2024, and is projected to grow at a CAGR of 3.4% from 2025 to 2034. With 38.1% share, North America generated USD 60.1 Mn in revenue.

A stump cutter or stump grinder is a mechanical machine used to remove tree stumps by grinding them into small wood chips. It typically uses a rotating cutting wheel fitted with sharp teeth to chip away wood in a controlled manner. These machines are widely used in landscaping, forestry maintenance, agriculture, and municipal ground management. The Stump Cutter/Grinder Market refers to the global industry involved in manufacturing, distributing, and servicing these machines across various product types, engine configurations, cutting mechanisms, and end-use sectors.

Market growth is supported by rising investments in land development and public infrastructure maintenance. For example, a $1.3M plow truck and park vehicle plan highlights increasing municipal equipment budgets. Similarly, Texas is finalizing $1.8B to build solar, battery, and gas-powered microgrids, which reflects broader infrastructure expansion, indirectly driving land clearing and site preparation activities where stump grinders are essential.

Demand is influenced by landscaping upgrades, urban park management, and compliance with environmental standards. Ottawa’s $25-million funding to support EV chargers and natural gas-powered trucks signals modernization in municipal fleets, encouraging equipment renewal cycles. At the same time, CARB’s $5.6 million settlement related to gasoline engine regulations indicates tightening emission norms, shaping engine preferences within this market.

Opportunities are emerging from technological integration and energy sector expansion. Boom Supersonic is adding $300 million in new funding, and an AI-powered oil and gas startup is securing $15 million demonstrate capital flowing into infrastructure and industrial development. Such expansion increases land clearing needs, creating sustained opportunity for stump cutters and grinder equipment across global markets.

Key Takeaways

- The Global Stump Cutter/Grinder Market is expected to be worth around USD 220.5 million by 2034, up from USD 157.8 million in 2024, and is projected to grow at a CAGR of 3.4% from 2025 to 2034.

- The stump cutter/grinder market is dominated by standalone equipment, capturing 69.2% overall share.

- In the Stump Cutter/Grinder Market, walk-behind stump grinders account for 31.6% demand.

- Stump Cutter/Grinder Market shows 46.8% preference for tooth length up to 2.5 inches.

- Gasoline engines lead the Stump Cutter/Grinder Market with a significant 59.9% share.

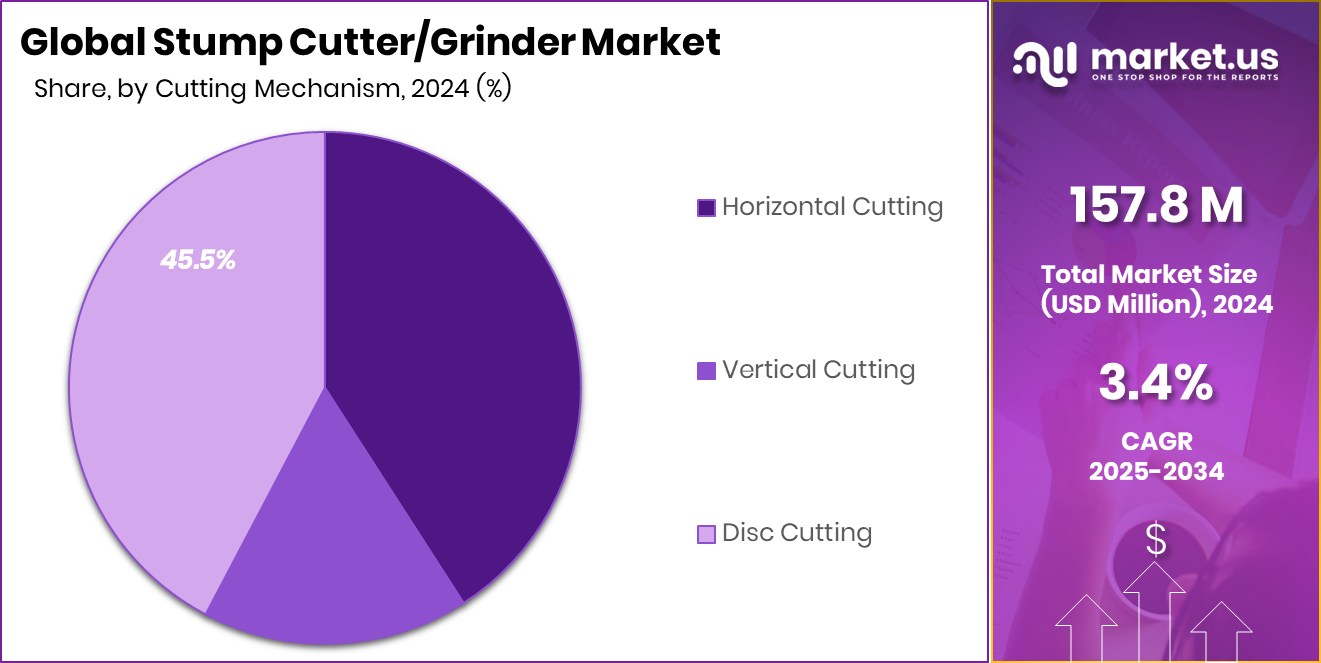

- Disc cutting mechanism holds 45.5% share in the Stump Cutter/Grinder Market.

- Public and private parks represent 33.7% end-use share in the Stump Cutter/Grinder Market.

- Stump Cutter/Grinder Market in North America reached USD 60.1 Mn, holding 38.1%.

By Product Type Analysis

Stump Cutter/Grinder Market sees Stand Alone Equipment dominating with 69.2% share.

In 2024, the Stump Cutter/Grinder Market witnessed a strong preference for standalone equipment, which accounted for 69.2% of the overall market share. This dominance reflects growing demand from professional landscaping contractors, arborists, and municipal maintenance teams seeking high-performance and independent operational units. Standalone equipment offers better mobility, higher cutting capacity, and improved operational safety compared to attachment-based systems.

Contractors prefer these machines for large-scale commercial projects and heavy-duty stump removal tasks in urban and semi-urban areas. The rise in infrastructure development, road expansion, and residential landscaping projects further strengthened demand. Equipment rental companies also expanded their fleets with standalone models to cater to increasing short-term project requirements, reinforcing this segment’s leading contribution to overall market revenue.

By Type Analysis

Stump Cutter/Grinder Market records Walk Behind Stump Grinders holding a 31.6% share.

In 2024, walk behind stump grinders captured a 31.6% share in the Stump Cutter/Grinder Market under the type category. This segment gained traction due to its compact design, cost-effectiveness, and suitability for small to medium-scale stump removal tasks. Walk-behind machines are widely used by local landscaping businesses, tree care service providers, and property maintenance teams. Their ease of transportation and maneuverability in tight residential spaces make them particularly attractive for urban applications.

Growing residential property upgrades and garden renovation projects have supported demand for this category. Additionally, small contractors entering the tree service industry prefer walk-behind grinders because of their lower investment cost compared to larger self-propelled units, allowing them to maintain competitive pricing while ensuring efficient stump removal operations.

By Tooth Length Analysis

Stump Cutter/Grinder Market shows up to 2.5 Inches tooth length, leading 46.8%.

In 2024, stump cutters equipped with tooth lengths up to 2.5 inches held 46.8% share in the Stump Cutter/Grinder Market. This segment’s dominance is linked to its balanced performance in both residential and light commercial applications. Shorter tooth lengths provide smoother grinding, controlled cutting depth, and reduced machine vibration, which enhances operator safety and precision.

Contractors often select this configuration for routine landscaping jobs where surface-level stump removal is required without excessive ground disturbance. The segment also benefits from easier tooth replacement and lower maintenance costs. Growing emphasis on maintaining aesthetic green spaces in housing societies, parks, and commercial properties has driven demand for efficient yet precise grinding solutions, positioning this tooth length category as the preferred option in many service operations.

By Engine Type Analysis

Stump Cutter/Grinder Market highlights the Gasoline Engine segment capturing 59.9% share.

In 2024, gasoline engine models accounted for 59.9% of the Stump Cutter/Grinder Market by engine type, making it the leading power source segment. Gasoline engines remain popular due to their strong power output, operational flexibility, and widespread fuel availability. Contractors operating in remote or outdoor environments prefer gasoline-powered machines as they do not require direct electrical connections and offer consistent performance across varying terrains.

The segment also benefits from lower upfront costs compared to advanced hybrid or electric alternatives. Many small and mid-sized landscaping businesses continue to rely on gasoline engines for reliability and ease of maintenance. While environmental considerations are gradually influencing purchasing decisions, gasoline-powered stump grinders still dominate due to their proven efficiency in demanding field operations.

By Cutting Mechanism Analysis

Stump Cutter/Grinder Market indicates the disc cutting mechanism accounting for 45.5%.

In 2024, disc cutting emerged as the leading cutting mechanism in the Stump Cutter/Grinder Market, securing 45.5% share. Disc cutting systems are widely favored for their durability, high rotational speed, and ability to deliver uniform grinding performance. The mechanism allows operators to remove stumps efficiently with controlled lateral movement, improving productivity on job sites.

Disc-based systems are commonly integrated into both walk-behind and stand-alone equipment, contributing to their broad adoption. Their compatibility with various tooth configurations enhances operational flexibility across different wood densities and stump sizes. Contractors value disc cutting technology for minimizing downtime and ensuring smoother operation, particularly in commercial landscaping projects where time efficiency and consistent output are critical performance factors.

By End-Use Analysis

Stump Cutter/Grinder Market notes: Public and private parks contribute a 33.7% share.

In 2024, public and private parks represented 33.7% share of the Stump Cutter/Grinder Market by end-use segment. Municipal authorities and private park management companies increasingly invest in stump removal equipment to maintain safe and visually appealing outdoor spaces. Regular tree maintenance, storm damage clean-up, and landscape redesign projects have fueled equipment demand in this segment.

Public parks require consistent upkeep to ensure visitor safety, while private recreational facilities focus on aesthetic landscaping standards. Budget allocations for urban green space development and park modernization initiatives have further supported the procurement of stump grinding solutions. As cities prioritize environmental management and outdoor infrastructure improvement, the parks segment continues to play a significant role in overall market growth and equipment utilization rates.

Key Market Segments

By Product Type

- Stand Alone Equipment

- Grinder Attachment

By Type

- Walk Behind Stump Grinders

- Towable Stump Grinders

- Compact Stump Grinders

- Self-Propelled Stump Grinders

By Tooth Length

- Up to 2.5 Inches

- 2.5 to 3 Inches

- Above 3 Inches

By Engine Type

- Gasoline Engine

- Diesel Engine

- Electric Engine

By Cutting Mechanism

- Horizontal Cutting

- Vertical Cutting

- Disc Cutting

By End-Use

- Forest Areas

- Agricultural Lands

- Public and Private Parks

- Others

Driving Factors

Rising demand for natural sweeteners globally

Rising urban landscaping maintenance activities continue to support steady growth in the Stump Cutter/Grinder Market, particularly across cities investing in green space improvement and roadside vegetation management. Municipal bodies are allocating higher budgets for tree removal, park upgrades, and storm damage cleanup, which directly increases equipment utilization. In parallel, Ecology’s $25 million “Rails, Keels, and Wheels” grant program aimed at funding zero-emission vehicles reflects broader public sector investment in cleaner fleet infrastructure.

Such initiatives encourage contractors and municipalities to modernize their equipment base, indirectly supporting demand for newer and more efficient stump grinders. As urban areas expand and sustainability targets strengthen, routine vegetation control and stump removal remain essential components of city planning and environmental maintenance strategies.

Restraining Factors

Limited sourcing of premium date varieties

High equipment purchase and maintenance costs remain a notable restraint in the Stump Cutter/Grinder Market, particularly for small contractors and independent landscaping operators. Stand-alone and self-propelled machines require significant upfront capital, along with ongoing expenses for fuel, replacement teeth, servicing, and transportation. Financial pressure becomes more evident when environmental compliance costs are added.

For instance, the DNR’s announcement of $385,000 in funding to reduce diesel engine emissions highlights the regulatory push toward cleaner engines. While beneficial for environmental outcomes, such measures can increase upgrade requirements and compliance investments for equipment owners. Smaller operators may delay purchases or rely on rental fleets, which can limit direct sales growth and slow replacement cycles within the market.

Growth Opportunity

Expanding use in functional food formulations

Increasing municipal park modernization projects present meaningful opportunities for the Stump Cutter/Grinder Market as governments continue revitalizing public recreational spaces. Urban redevelopment plans often include tree removal, landscape redesign, and infrastructure upgrades, all requiring efficient stump grinding solutions. At the same time, capital inflows into energy and fuel innovation create indirect expansion prospects.

The announcement of a $30M investment in an ethanol-diesel technology company reflects continued development in alternative fuel systems. Such advancements may influence future stump grinder engine designs, enabling more cost-efficient and environmentally adaptable equipment. As municipalities prioritize sustainability while expanding green areas, equipment manufacturers have opportunities to align product development with evolving fuel technologies and long-term environmental planning goals.

Latest Trends

Increasing shift toward instant date powder

A noticeable trend in the Stump Cutter/Grinder Market is the gradual shift toward electric powered grinders, particularly in noise-sensitive urban zones and emission-regulated regions. Electric models offer reduced operational noise and lower exhaust emissions, making them suitable for residential and municipal environments. However, market dynamics remain mixed.

A major car brand recently redirected £222m in electric vehicle funding toward a £659m petrol and diesel investment boost, signaling the continued relevance of conventional engine technologies. This dual movement highlights a transitional phase where electric and traditional engine platforms coexist. Equipment manufacturers are therefore balancing innovation in electric drivetrains with improvements in gasoline and diesel efficiency to meet diverse customer requirements across global markets.

Regional Analysis

North America dominates Stump Cutter/Grinder Market with 38.1% share valued at USD 60.1 Mn.

The Stump Cutter/Grinder Market demonstrates varied regional performance across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America stands as the dominating region, accounting for 38.1% of the global market and generating USD 60.1 Mn in revenue. The region’s leadership position is supported by established landscaping industries, advanced mechanized tree care practices, and consistent demand from municipal and commercial end users. Europe represents a steady market driven by urban green space management and professional arboriculture services.

Asia Pacific is witnessing expanding adoption due to growing infrastructure development and increasing landscaping activities in emerging economies. Meanwhile, the Middle East & Africa region shows gradual growth supported by urban development projects and public space maintenance initiatives.

Latin America reflects developing market potential, influenced by expanding commercial landscaping and municipal ground maintenance activities. Overall, regional performance highlights North America’s clear dominance in both revenue contribution and market share within the global landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Caterpillar continues to demonstrate strong positioning in the global Stump Cutter/Grinder Market through its reputation for heavy-duty machinery and durable equipment platforms. The company’s engineering strength, global dealer network, and established brand credibility provide it with a competitive advantage, particularly in large-scale land clearing and infrastructure-related applications. Its ability to integrate stump grinding capabilities within broader construction and earthmoving equipment portfolios enhances cross-selling opportunities. Caterpillar’s focus on performance reliability and after-sales service support strengthens customer retention among contractors and municipal buyers seeking long-term operational efficiency and minimal downtime.

MORBARK, LLC maintains a specialized presence in the stump cutter and grinder segment, leveraging its expertise in forestry and wood processing equipment. The company’s focus on purpose-built grinding solutions positions it strongly within professional tree care and land management industries. MORBARK’s product development strategy centers on durability, cutting efficiency, and operator-focused design, which resonates with commercial service providers. Its specialization enables it to address demanding forestry and vegetation management requirements while maintaining strong relationships with contractors requiring high-capacity grinding systems.

Vermeer Corporation remains a key competitor in 2024, recognized for its dedicated tree care and environmental equipment portfolio. The company’s stump grinder offerings are widely adopted by landscaping professionals and arborists due to their operational ease and maneuverability. Vermeer’s consistent emphasis on innovation, safety features, and productivity optimization enhances its appeal across both residential and commercial applications. Its established distribution channels and customer training support further reinforce brand loyalty and long-term equipment adoption.

Top Key Players in the Market

- Caterpillar

- MORBARK, LLC

- Vermeer Corporation

- Tracmaster Ltd.

- Wacker Neuson SE

- Green Manufacturing, Inc

- J.P. Carlton Company

- The Toro Company

Recent Developments

- In October 2025, Caterpillar announced an agreement to acquire Australian-based mining software company RPMGlobal, expanding its digital solutions and equipment support capabilities. The acquisition, expected to close in early 2026, enhances Caterpillar’s technology offerings for machine asset and fleet management. While this is not directly a stump cutter/grinder product launch, such digital expansion supports all equipment operations and efficiency improvements.

- In January 2024, MORBARK, LLC announced Kirby-Smith Machinery, Inc. as a new authorized dealer for all of its product lines, including stump cutters, grinders, and tree care machines. This development expands MORBARK’s service and sales reach in the U.S., making its equipment more accessible to customers through an extended dealer network.

Report Scope

Report Features Description Market Value (2024) USD 157.8 Million Forecast Revenue (2034) USD 220.5 Million CAGR (2025-2034) 3.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Stand Alone Equipment, Grinder Attachment), By Type (Walk Behind Stump Grinders, Towable Stump Grinders, Compact Stump Grinders, Self-Propelled Stump Grinders), By Tooth Length (Up to 2.5 Inches, 2.5 to 3 Inches, Above 3 Inches), By Engine Type (Gasoline Engine, Diesel Engine, Electric Engine), By Cutting Mechanism (Horizontal Cutting, Vertical Cutting, Disc Cutting), By End-Use (Forest Areas, Agricultural Lands, Public and Private Parks, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Caterpillar, MORBARK, LLC, Vermeer Corporation, Tracmaster Ltd., Wacker Neuson SE, Green Manufacturing, Inc, J.P. Carlton Company, The Toro Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Stump Cutter/Grinder MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Stump Cutter/Grinder MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Caterpillar

- MORBARK, LLC

- Vermeer Corporation

- Tracmaster Ltd.

- Wacker Neuson SE

- Green Manufacturing, Inc

- J.P. Carlton Company

- The Toro Company