Global Strontium Market Size, Share, And Enhanced Productivity By Product (Strontium Carbonate, Strontium Nitrate, Strontium Sulphate, Others), By Application (Ceramic Ferrite Magnets, Pyrotechnics and Signals, Medical, Personal Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173098

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

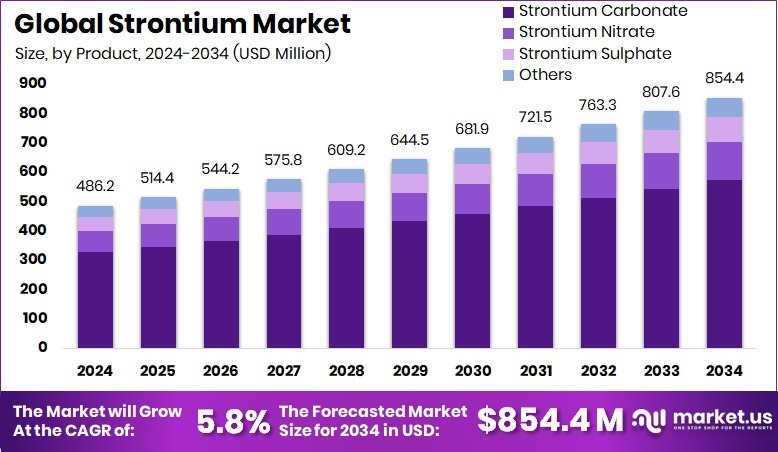

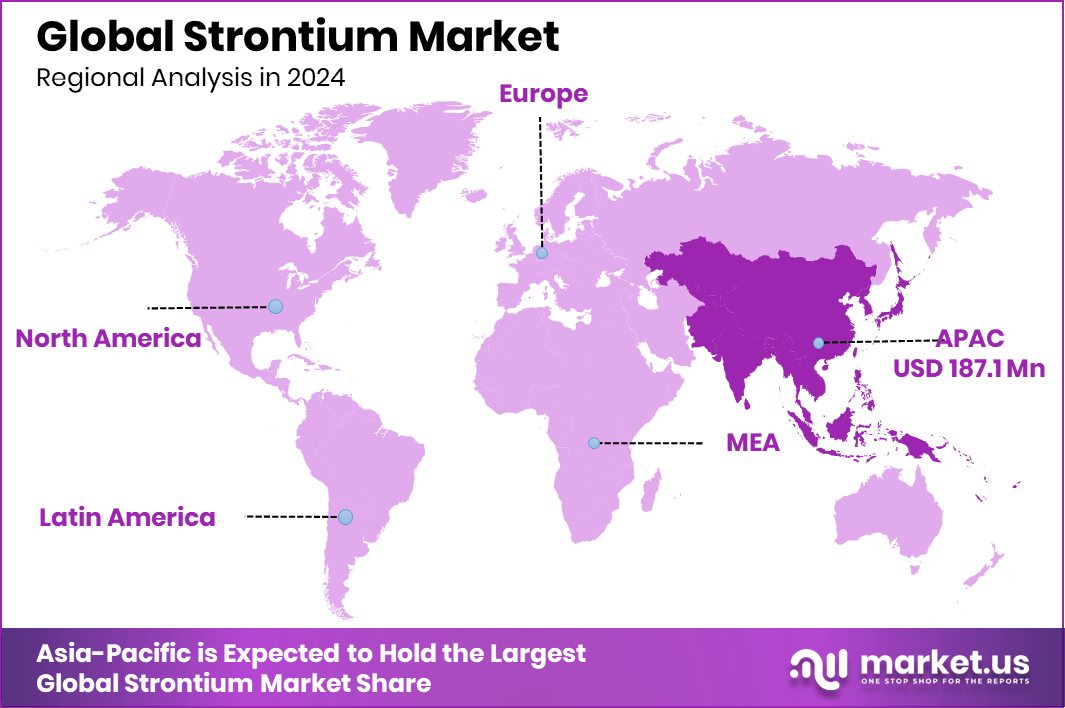

The Global Strontium Market is expected to be worth around USD 854.4 million by 2034, up from USD 486.2 million in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034. Rising industrial output and infrastructure growth sustained Asia Pacific’s USD 187.1 Mn strontium demand.

Strontium is a naturally occurring alkaline-earth metal known for its reactive nature and stable performance in compounds. It is commonly used in ceramics, specialty glass, electronics, pigments, and energy-related applications. Its chemical behavior makes it useful where durability, heat resistance, and consistent output are required.

The strontium market covers the production, processing, and use of strontium-based minerals and compounds across industrial and advanced technology sectors. Demand is shaped by applications in electronics, coatings, energy systems, and defense-linked materials, where long life and reliability are essential.

Growth is supported by rising investment in advanced energy and science programs. A recent USD 50 million funding round for a U.S. nuclear battery startup highlights growing interest in long-life power sources where strontium isotopes are relevant. Similarly, the MAGIS-100 quantum experiment at Fermilab, backed by U.K. support, reflects expanding research activity that indirectly boosts demand for high-purity materials.

Demand is increasing from defense and strategic manufacturing. The Pentagon has committed USD 192.5 million toward strengthening domestic defense chemical production, supporting materials like strontium used in specialized electronics, optics, and protective systems. This focus on supply security directly lifts consumption.

Opportunities are emerging in sustainable coatings and advanced materials. Ecoat’s €21 million funding to reinvent paint technologies signals growing use of strontium compounds in eco-friendly pigments and corrosion-resistant coatings. As industries seek durable and low-impact solutions, strontium-based formulations gain wider adoption.

Key Takeaways

- The Global Strontium Market is expected to be worth around USD 854.4 million by 2034, up from USD 486.2 million in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034.

- In the Strontium Market, Strontium Carbonate leads by product, holding 67.2% share due to widespread industrial usage.

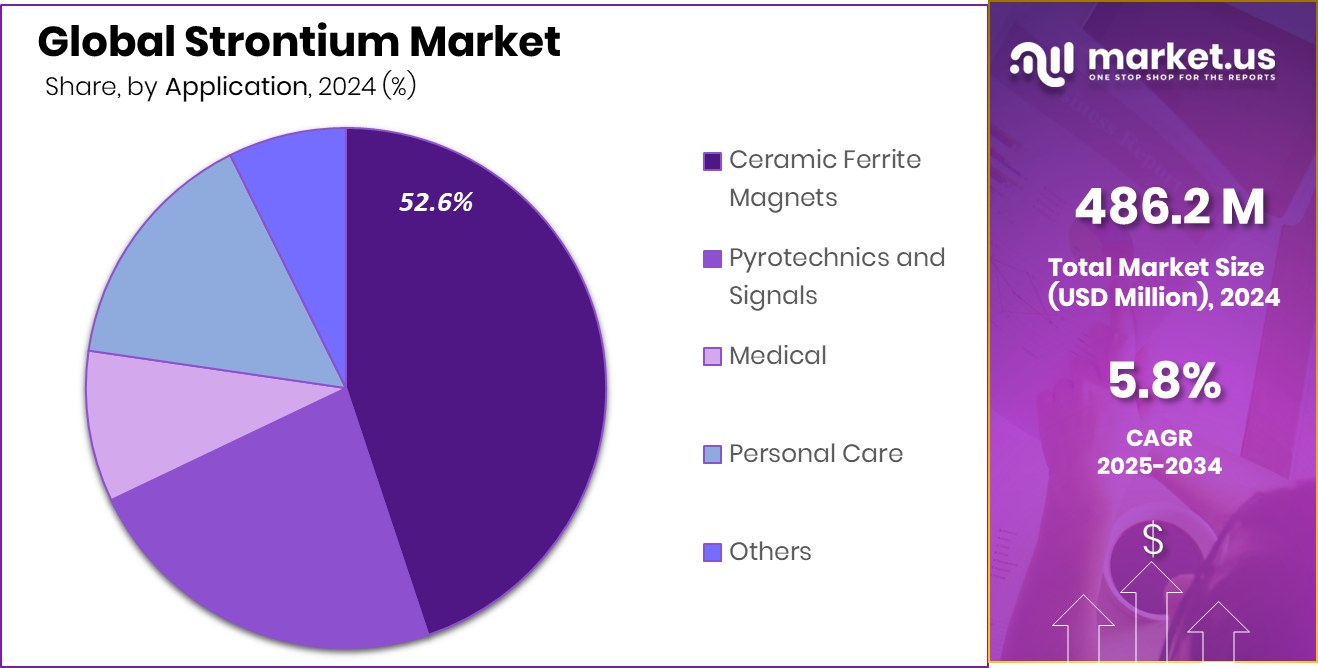

- Within the Strontium Market, Ceramic Ferrite Magnets dominate applications with 52.6% share driven by electronics demand.

- Strong ceramics, electronics, and magnet manufacturing made the Asia Pacific USD 187.1 Mn the largest regional market.

By Product Analysis

In the strontium market, strontium carbonate holds 67.2% share due to wide ceramic use.

In 2024, Strontium Carbonate held a dominant position in the Strontium Market by product, accounting for 67.2% of total demand. This strong share is mainly linked to its wide use in ceramics, glass manufacturing, electronics, and specialty chemicals. Strontium carbonate is valued for its ability to improve brightness, heat resistance, and structural strength in finished products. Many manufacturers prefer it because it offers consistent quality and is easier to process compared to other strontium compounds.

Growing production of ceramic tiles, display glass, and electronic components has supported steady consumption. In addition, its role as a key raw material for downstream strontium compounds keeps demand stable. As industries focus on performance and long product life, strontium carbonate continues to remain the most commercially important form in the market.

By Application Analysis

Ceramic ferrite magnets dominate the strontium market applications with 52.6% share globally.

In 2024, Ceramic Ferrite Magnets emerged as the leading application in the Strontium Market, capturing 52.6% of overall usage. These magnets are widely used in electric motors, household appliances, automotive components, and industrial machinery due to their cost efficiency and reliable magnetic properties. Strontium-based ferrite magnets are especially favored in applications where durability and stable performance matter more than high magnetic strength. Rising production of electric fans, washing machines, power tools, and small motors has directly increased demand.

Growth in energy-efficient appliances and expanding manufacturing activity in emerging economies further support this segment. As industries continue to seek affordable and dependable magnetic materials, ceramic ferrite magnets remain the largest application driving strontium consumption.

Key Market Segments

By Product

- Strontium Carbonate

- Strontium Nitrate

- Strontium Sulphate

- Others

By Application

- Ceramic Ferrite Magnets

- Pyrotechnics and Signals

- Medical

- Personal Care

- Others

Driving Factors

Industrial Expansion And Capital Inflows Boost Demand

Strong capital inflows into industrial and technology sectors are a key driving factor for the strontium market. When large industrial groups expand their coatings, materials, and manufacturing portfolios, the need for specialty minerals like strontium rises steadily. Recently, JSW secured a ₹9,300-crore financing package to acquire Akzo Nobel operations, highlighting fresh investment flowing into paints and surface-protection activities. These segments often rely on strontium compounds for durability, color stability, and performance.

At the same time, innovation-led financing also supports demand. Fireworks AI discussing a USD 4 billion valuation in new financing reflects broader confidence in advanced technologies, electronics, and data infrastructure. Such expansion indirectly increases consumption of high-purity materials used in electronics, ceramics, and energy systems, making steady investment a clear driver for strontium demand.

Restraining Factors

Capital Intensity And Uneven Investment Focus Limit Growth

One major restraining factor for the strontium market is high capital intensity combined with uneven investment priorities across industries. Large funding rounds often flow into finished products, branding, or digital technology rather than raw material supply chains. For example, JSW Paints secured INR 3,300 crore in financing for the acquisition of AkzoNobel India, showing a strong focus on downstream paints and coatings.

While this supports end products, it does not always translate into direct investment in mineral extraction or processing. At the same time, technology-led funding also shifts attention away from materials. Fireworks AI reaching a USD 4 billion valuation in a funding round reflects how capital is drawn toward software and computing. This imbalance can slow capacity expansion, price stability, and long-term supply development for strontium.

Growth Opportunity

Specialty Chemicals And Coatings Transition Create Demand

A major growth opportunity for the strontium market is emerging from the expansion of specialty chemicals and changes in the global coatings landscape. Specialty chemical producers increasingly focus on high-performance minerals that improve durability, stability, and functionality. This trend is reflected in fresh funding, such as a specialty chemicals startup securing USD 7.7 million in Series A funding, showing strong investor interest in advanced material solutions.

At the same time, strategic restructuring by large material suppliers is opening space for new sourcing models. BASF’s initiation of the sale of its coatings business at an estimated USD 6.8 billion valuation signals a shift in ownership and supply chains. Such transitions create opportunities for strontium-based inputs to gain wider adoption in reformulated coatings, ceramics, and performance materials as new players scale production and innovate.

Latest Trends

Coatings Expansion And Industry Consolidation Shape Usage

A key latest trend in the strontium market is the strong push toward coatings expansion combined with global consolidation in the paints industry. Large manufacturers are increasing capacity to meet demand for durable and long-lasting coatings, where strontium compounds are often used for performance and stability. This is visible as Asian Paints boosts capital expenditure to Rs 3,250 crore for its Gujarat facility, signaling higher production of advanced coatings and related materials.

At the same time, industry consolidation is reshaping supply chains. AkzoNobel, the owner of Dulux, has agreed to a USD 25 billion merger with Axalta. Such large mergers encourage standardization and higher-volume sourcing of specialty minerals, supporting wider and more consistent use of strontium across coating applications.

Regional Analysis

In 2024, the Asia Pacific led the Strontium Market with 38.50% share, valued at USD 187.1 Mn.

The Asia Pacific region dominated the Strontium Market in 2024, holding 38.50% of global demand and reaching a value of USD 187.1 Mn. This leadership is supported by strong ceramics production, large-scale magnet manufacturing, and expanding electronics output across the region. High consumption of ceramic ferrite magnets and ceramic materials keeps strontium usage consistently strong. The presence of large manufacturing clusters and export-oriented industries further reinforces the Asia Pacific’s leading position in overall market volume and value.

In North America, the strontium market shows stable demand driven by advanced manufacturing and technology-focused applications. The region benefits from the steady use of strontium compounds in electronics, specialty glass, and industrial components. Emphasis on product quality and long service life supports consistent consumption across established end-use industries.

Europe represents a mature market where strontium demand is linked to ceramics, coatings, and industrial materials. Strict quality standards and a focus on performance materials sustain usage, particularly in high-value applications requiring material reliability.

In the Middle East and Africa, strontium consumption remains moderate but steady, supported by construction-linked ceramics and basic industrial applications. Growth is gradual, reflecting developing manufacturing infrastructure.

Latin America shows emerging demand, mainly from ceramics and appliance manufacturing. Industrial development and regional production needs continue to support gradual market expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABASSCO plays a focused role in the global strontium market by supporting steady supply of strontium-based materials to downstream industrial users. Its positioning reflects strength in handling niche mineral requirements where consistency and material reliability matter more than scale alone. The company’s operations align well with demand from ceramics, magnets, and specialty material segments that require dependable quality rather than frequent product changes. In 2024, ABASSCO’s relevance comes from its ability to serve repeat industrial demand, which helps stabilize supply chains in a market that depends heavily on process continuity and material performance.

Basstech International is viewed as a technically oriented participant with emphasis on chemical processing and application-specific solutions. Its involvement in strontium-related materials supports customers who need tailored inputs for ceramics, electronics, and industrial formulations. Basstech International’s strength lies in adapting material specifications to meet end-use requirements, which is increasingly important as manufacturers demand tighter control over performance characteristics. In 2024, this application-driven approach allows the company to stay relevant despite market fluctuations.

Joyieng Chemical LTD. is recognized for its role in supplying strontium compounds to global buyers seeking cost-efficient yet reliable materials. The company benefits from manufacturing discipline and export-oriented operations, supporting demand from ceramic ferrite magnets and related applications. Its market presence is shaped by volume stability and long-term customer relationships rather than aggressive expansion.

Top Key Players in the Market

- ABASSCO

- Basstech International

- Joyieng Chemical LTD.

- ProChem

- Sakai Chemical Co., LTD.

- Solvay

- Others

Recent Developments

- In August 2024, Solvay announced a new share buy-back program to meet delivery obligations from its long-term incentive plans. Under this program, Solvay planned to acquire up to 1,025,000 shares, supporting employee stock units and financial flexibility. Solvay is a global chemical company producing specialty and base chemicals used in industrial, automotive, and consumer applications. The buy-back helps manage its capital structure as business conditions evolve.

- In April 2024, ProChem Inc. announced the expansion of its chemical manufacturing facility with a new building at its existing site. This development enhances the company’s production space and operational scale, allowing it to improve output and better serve industrial customers with a broader range of chemical products. ProChem Inc. supplies quality chemical products and engineered solutions to diverse markets, and this facility addition reflects growing business activity.

Report Scope

Report Features Description Market Value (2024) USD 486.2 Million Forecast Revenue (2034) USD 854.4 Million CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Strontium Carbonate, Strontium Nitrate, Strontium Sulphate, Others), By Application (Ceramic Ferrite Magnets, Pyrotechnics and Signals, Medical, Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABASSCO, Basstech International, Joyieng Chemical LTD., ProChem, Sakai Chemical Co., LTD., Solvay, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABASSCO

- Basstech International

- Joyieng Chemical LTD.

- ProChem

- Sakai Chemical Co., LTD.

- Solvay

- Others